Professional Documents

Culture Documents

Etm 2012 5 14 3

Uploaded by

prajapati1983Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Etm 2012 5 14 3

Uploaded by

prajapati1983Copyright:

Available Formats

WWW.ECONOMICTIMES.

COM *

Corporate 3

In A Nutshell

Infy Top Mgmts Salary Up 50%, Crosses `50 Cr in FY12 .

NEW YORK IT giant Infosys paid its top man-

agement personnel a total remuneration of $10.7 million (around `57 crore) last fiscal, . marking an increase of about 50% from the previous year. The remuneration paid to its key management personnel, had remained almost unchanged at $7 million for FY10 and FY11, as per a filing to the US SEC. But it rose sharply in 2011-12 despite a fall in the individual pay packages of some top executives. In 2011-12, the top paid executive was Stephen R Pratt, an executive council member, with a to. tal package of about $2 million (around `10 crore. The total package of Shibulal was $162,990 in 2011-12, down by $80,000 from the previous year, while that of Gopalakrishnan fell by about $85,000 to $164,543. Compensation paid to independent chairman KV Kamath rose from $1,25,600 to $2,05,000.

Trai may Reduce Reserve Price for CDMA Spectrum

OUR BUREAU

NEW DELHI

CDMA Lobby Asks Sibal to Junk Report on Dual-tech Cos

GULVEEN AULAKH

NEW DELHI

Essar Oil Posts `515-crore . Loss in Q4 on Sales Tax Woes

MUMBAI Essar Oil reported a net loss of `515 .

crore for the March quarter, against a net profit of `321 crore in the year-ago period, despite a . 29% growth in gross revenues to `19,160 . crore. Essar Oil MD and CEO LK Gupta attributed the loss to expenditure on corporate debt restructuring as well as non-availability of sales tax benefits.

Bhushan Steel Q4 Net Rises 15% to `330 crore .

NEW DELHI Bhushan Steel reported 15% growth in net profit at `330 crore for the quar. . ter ended March 31, 2012, against `288 crore in the same quarter last fiscal. The company board, which met to approve the results, also gave a go-ahead for a fund raising plan of up to $1 billion. Meanwhile, Bhushan Steel said its total income during the quarter rose to `2,842 crore . . from `2,004 crore a year ago. The net profit of the company during the entire 2011-12 slightly increased to `1,024 crore compared to `1,005 . . in the 2010-11 fiscal. Total income increased from `7,069 crore to `9,969 crore for the year. . .

he telecom regulator on Sunday proposed to reduce the reserve price of CDMA spectrum but made no change in its price recommendation for GSM spectrum auction. The Telecom Regulatory Authority of India (Trai) suggested a cut in the reserve price of CDMA spectrum from 2 to 1.3 times the base price recommended for the 1,800 MHz band. The reduction, however, will be valid only in states where airwaves less than 5 MHz are available for auction. Trais earlier proposals to charge `3,622 crore per unit of spectrum to . GSM operators in the upcoming auction and refarm the 900 MHz and 800 MHz bands remain unchanged. This could offer some relief to CDMA spectrum-holders Reliance Communications, Tata Teleservices and Sistema Shyam. Operators, who would . have had to start bidding at `7,244 crore per MHz, can now start bidding at about `4,700 crore per unit. . Outgoing Trai chairman JS Sarma has increased the spectrum usage charge to 3%, from the earlier proposal of 1% of the telcos gross revenues, which he believes would increase savings for the telecom sector. The amount of savings on account of 1% spectrum usage charges (SUC) will be around 68% of the total amount of the renewal fees, which will be paid by the entire industry. However, if the SUC is fixed at 3% instead of 1%, this figure reduces to around 31%, which still gives a reasonable discount, he said in the recommendations and added that the move would not have any adverse effect. Hemant Joshi, partner, Deloitte Haskins & Sells, said this particular proposal could only worsen the situation for telcos. Trai has suggested increase in spectrum charge, this will put greater pressure on already cash-strapped operators. The reserve price is lowered (for CDMA operators), he said.

The regulator has also proposed to auction balance spectrum in the 1,800 MHz band this financial year, after auctioning the 800 MHz band. It had earlier indicated auctioning in the first half of 2013-14. Reiterating that auction of 5 MHz airwaves would be open to all players, Trai has, however, suggested that after auctioning the first lot of 5 MHz, a second lot of equal spectrum units in the 1,800 MHz band will be made available where the frequencies are available. However, this must be done after keeping airwaves for refarming and a block for one operator. Largely continuing with its earlier , recommendations issued on April 23, Trai has not changed many of its proposals. The regulator has maintained that its calculations on reserve price neither adversely impact profitability of operators nor the entry of new operators, while adding that the impact on call tariffs for customers would be 4 paise per minute or lower. This can be either absorbed by the service providers from the additional minutes that are generated or recovered through charges for different retail and wholesale services, the regulator said. GSM and CDMA operators have been clamouring for a lower base price for the auction, as higher base price would lead to doubling of call tariffs for consumers since they would not be able to absorb any costs. The regulator has not changed the re. serve price of `3,622 crore per unit of spectrum for GSM operators, which would mean that any telco would have . to cough up `18,111 crore for a pan-India permit, a licence for which they . had paid `1,659 crore when former telecom minister A Raja had dished out these permits in 2008, which came bundled with 6.2 MHz of spectrum. An analyst with an MNC brokerage said: Setting reserve price has become political. The government is better positioned to take that decision by keeping Trai headless.

Taxman Probes All Telcos whose 2G Licences were Scrapped by SC

NEW DELHI In fresh trouble for tele-

In a 59-page response to the department of telecom, Trai has urged it to consider installment-linked payment over a period of 12 years against paying all up-front and allowing mortgaging of spectrum to financial institutions after taking a view from ministries of law and finance. While providing reasoning for all its proposals, the regulator has maintained that refarming of 900 MHz and 800 MHz spectrum bands be done without any further delay Trai had earlier . endorsed the demands of Reliance Industries-owned Infotel Broadband and RCOM that the 900 MHz band, considered the most cost-effective for 2G services, and currently used by Bharti, BSNL and Vodafone along with Idea and Aircel in some circles, be redistributed or refarmed among all operators in the upcoming 2G auctions. It has also maintained that telcos would have to pay for liberalised use of spectrum. The regulators proposals come after the Supreme Court had ordered it to devise a method to auction 122 mobile permits which belonged to nine telecom companies it cancelled on February 2 this year. Following the recommendations, the Empowered Group of Ministers will take a final call on whether to reject, accept or modify these proposals.

com companies, the Income-Tax department has initiated a probe into the finances, investments and returns of all those 2G spectrum licence benefactors whose authorisations were scrapped by the Supreme Court recently. These 122 licences, granted during the tenure of former telecom minister A Raja, were cancelled by the apex court on the ground that they were issued in a totally arbitrary and unconstitutional manner. In its 2G probe status report, the Central Board of Direct Taxes (CBDT) last week had informed the Supreme Court that it has begun scrutinising the tax statements and multi-billion investments of these telecom firms on the directions of Central Vigilance Commission (CVC), which is vetting the investigation reports of the department along with ED and CBI, the two other agencies probing the 2G spectrum case. The CVC, during a meeting last month with a team of CBDT officials, had asked them and the I-T department to focus and probe all those telecom firms who were granted 122 licences during Raja's tenure. The CBDT, subsequently has issued formal orders to all its investigation units across the country, to begin a comprehensive financial probe of these telecom firms with retrospective effect from 2008, sources said. PTI

The industry body of CDMA operators has asked telecom minister Kapil Sibal to ignore suggestions made by JS Deepak, the government-appointed auction overseer, specific to telcos using dualtechnology spectrum. Association of Unified Telecom Service Providers of India or Auspi, that represents companies like Reliance Communications, Tata Teleservices and Sistema Shyam, has written to Sibal that targeting dual-technology operators to pay up for spectrum at a market-determined price would be illegal and contrary to the policies of the levelplaying field in a communication to the minister last week, seen by ET. Auspi said that dual-technology mobile permits were not cancelled by the Supreme Court, and thus the original price they . paid of `1,659 crore, as discovered in an airwave auction in 2001 was fair. On February 2, the Indian apex court rolled back 122 licences awarded in the controversial 2008 allocations. The lobby said the matter was sub judice since its counterpart in the GSM industry the Cellular , Operators Association of India that represents the likes of Bharti Airtel and Vodafone, had moved the Supreme Court against permits given to RCOM, Tata Tele and HFCL in 2007 that allowed them to offer services on both GSM and CDMA platforms. Last week, the apex court sought replies from these operators and the government. In his communication to the telecom department, Deepak had recommended against holding a separate auction for the 800 MHz airwave band, and charging dual technology spectrum held by telcos at market discovered price depending on participation in auction. He had also questioned the feasibility of re-farming the 800 Mhz band and auctioning this band given the negligible likelihood of any new bidder emerging. He said that dual-technology telcos be asked to participate in auction and bid for contracted spectrum of existing licences. The CDMA lobby vehemently opposed this as it has no merit and said that auction would not be able to ensure allotment of contracted spectrum to existing licensees.

Well Furnished Ready to use OFFICE PREMISES Millennium Bus iness Park , MAHAPE , Navi Mumbai 9000 sq .feetweli furnished office premises,veiy good interior layout,equippedwith proper reception area,cabins , cubicles,

located at

. 1

work stabons; conference rcom, server room etc. Suitablefor IT/lIES industry Interested parties may contact on Mobile No. 09870676765

or write in confidence to vi kymore II@gma il.com

Getting the Chemistry Right was Imperative

From Page 1

Heavyweights Spoil Show

From Page 1

Letting go of Pantaloon or even a part of it was unthinkable, say officials close to Biyani. That was the cue for Birla to make the unthinkable thinkable for Biyani. During the course of over half-adozen one-on-one meetings, Birla strengthened his equation and personal rapport with Biyani. Before attempting to clinch the deal, Birla realised that getting the chemistry right was imperative; that both promoters belong to the close-knit Maheshwari Marwari community helped. According to officials close to the development, Birla refrained from forcing his suggestions on Biyani. If there was any hint of persuasion, it was couched in humility and tenderness. I was totally amazed not only by his excellent understanding of retail but also how humbly he went about convincing Biyani. It was Kumar who closed the deal, not me, says Kampani. The sensitivity and respect he gave Biyani in his meetings with him set the ball rolling, he adds. Still, Birlas challenge was to convince a man who was in no mood to sell his flagship business to do exactly that. The only way to do that would be to reinforce that the transaction would be mutually beneficial. Whilst Birla doubtless stood to gain with an access to a solid value retailing franchise with

. sales of `1,700 crore, his focus was on making it a win-win deal and sending the message through that the 25% stake that Biyani would retain in the business would be more valuable if the two became partners. Also, as Kampani points out: . The deal takes `1,500 crore of debt off his books, which significantly lessens the strain on the group. It took two weeks of relentless discussions all which took place at the Aditya Birla group headquarters in central Mumbai before Biyani agreed, albeit with a heavy heart. There was no looking back from there. Biyani himself called a family meeting at his Nepean Sea home in south Mumbai to explain the virtues of the transaction. Every member of his family wife, brothers, cousin, daughters and nephews was present. The Aditya Birla group declined to comment on the matter as it is in a silent period until May 15 when the company will announce its results. Biyani too was reluctant to talk about the sensitive issue. Following much persuasion, he said: With every discussion, our relationship grew even on a personal level. Kumar made me feel very comfortable. We still hold 25% equity which will , become more valuable after the deal. Life hasnt changed. The deal was clinched when Biyani and Kampani flew down to Kolkata and met Birla during the celebrations of his grandfather B K Birlas wedding anniversary .

In the quarter ended September 30, 2011, revenue growth had grown in single digits. The earnings scorecard for the quarter ended March 2012 was weighed down by the poor showing of industry heavyweights such as Reliance Industries, Bharti Airtel, Sterlite Industries and Sesa Goa, all of which reported a fall in profits and mounting pressure on margins. Barring some sectors, the ETIG analysis shows, companies are unable to pass on rising expenses to end-users, a fact reflected in the continuing erosion in their operating margins before depreciation. Operating profitability shrank for the eighth consecutive quarter in March compared to a year ago. Though it was 200 basis points higher than in the December 2011 quarter, at 19% it was still lower than the over-22% registered two years ago when the economy was recovering from the 2008-09 slowdown. A major reason for the margin contraction is the rise in the price of raw materials, which means a faster increase in cost compared with the rate of growth of sales. Raw material cost, as a percentage of sales, rose to 32.4% in the March 2012 quarter from over 29% two years ago. According to Sankaran Naren, chief investment officer, ICICI Prudential Asset Management, a noticeable change is that some of the larger companies are finding it tough to grow in a meaningful way. That not many corporates are doing sizeable investment is one of the key reasons for the subdued growth, he says, adding the problem is more to do with the slowdown in the economy than at the level of individual companies. The latest data on industrial production, which showed an unexpected contraction of 3.5% in March, sluggish export growth, a weakening rupee and slowdown in capital flows point to further pressure on top line growth in the next few

quarters. The sharp 21% drop in capital goods output and slack demand, including for consumer durables and non-durables, are worrying firms and analysts alike. In a report on the factory output data, Goldman Sachs said capital goods fell back into negative zone due to a weak investment climate, and also due to a strong adverse base effect. Credit rating agency Crisil has also highlighted the slowdown in sales of commercial vehicles and slowing exports, which are considered leading indicators of industrial demand. Companies in the capital goods, real estate, textiles, telecom and power sectors continued to report lower net profits in the March 2012 quarter from a year ago. However, firms in a few sectors such as IT, pharmaceuticals, tyres, media and entertainment were able to clock higher profits. Anand Shah, chief investment officer, BNP Paribas Mutual Fund, said while retail-centric sectors have done well, the big-ticket sectors such as capital goods, infrastructure and real estate have underperformed. According to Krishna Sanghvi, head (equities), Kotak Asset Management, corporate results have been in line with expectations. Guidances have not been positive while margin pressures are visible across industries, he said. Another concern is that inflationary pressure may persist despite a softening of commodity prices globally Economists feel factors such as . changes in domestic duty rates and a weakening of the rupee will keep prices firm in the near term. Nomura Research, in its latest update on Indias inflation, notes that higher raw material costs and the 2% increase in excise duty would add to inflationary pressure. Among the companies that have reported robust profit growth so far are pharma major Ranbaxy (helped by better sales of its flagship drug Lipitor), Glenmark Pharmaceuticals, watch and jewellery major Titan Industries, tyremaker MRF, mid-tier IT players Hexaware and KPIT Cummins, and Asian Paints.

j 1 JL ( VI ,) ECONOMICS Unleashing the

winds of socio-economic change...

Admissions Open

Specialisations: InternationalTrade Development Studies Eligibility: Any graduate with exposure to Economics/Mathematics/Statistics/Physics with a minimum of 50% marks (45% for SC/Si) can apply. Students appearing for for year examinations can also apply but their admission final will besubj ectto obtaining minimum marks. Online registrations end: 15 June,2012; Programme commences: 23 July, 2012 Students can also opt for M. Sc. - Ph.D Integrated programme

Eligibility: Appearing graduates/Graduates/Post Graduates in any field! Corporates/NGO Professionals/Government Employees

[Corporate Social Responsibility I Urban Governance I Taxation For more details , visit www.sse.ac.in

Dean , Humanities & Social Sciences - SIU

Dr. Jyoti Chandiramani , Director, SSE

INTERNATIONAL UNIVE RSITY

(Established under Section 3 of UGC Act 1956 Notification No. F9-1 2/2001-U3 of the Government of India) Accredited by NAAC with AAGrade r o capitation/donation is charged for admission to any programme at any Institute of Symbiosis

SYMBIOSIS

Achieving Nasscom Targets Doubtful

From Page 1

108 Responds to a Million Calls Every Quarter

From Page 1

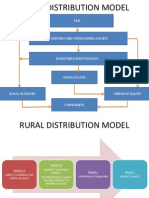

Mast er Dist ribu t or Req uired

Modi Revlon (A formidable alliance between Umesh. K. Modi Group an d the world famous Revlon of USA) is one of the leading players in the Indian cosmetics and toiletries market.

Modi Revlon wishes to appoint an

_ _ _ _

Pricing, or per-hour rates charged by IT firms, declined 1.2% the sharpest quarterly sequential decline since the last quarter of 2009 fiscal. Analysts are beginning to draw parallels with the 2008 crisis, from which the global economies still havent fully recovered. Cognizant reset its guidance from 23% to 20%, but why did the stock fall 20%? The reason is nobody believes the reset is the real reset, Moshe Katri, managing director at securities research firm Cowen & Co told ET. This is beginning to look similar to 2008. Initially it was budget delays, , then things got worse and it got a lot worse after that, Katri added. After growing at around 16% in 2011-12, Indias second-largest software exporter Infosys expects to grow by only 8-10% in the year to March 2013. This is much lower than the 11-14% growth forecast by the National Association of Software & Services Companies (Nasscom). Mumbai-based brokerage Motilal Oswal said the guidance by large IT firms challenges Nasscoms growth expectations in the year ahead. While TCS will grow above the industry, we doubt if the industry growth number will still be 11-14%, going by the developments during the quarter, analyst Ashish Chopra of Motilal Oswal wrote in his latest report on the IT sector. We would not be surprised if Nasscoms estimates for fiscal 2013 are revised

downwards. Nasscom has maintained that it expects to revisit the forecast only in October, as it said while coming out with the initial forecast earlier this year. For this year, we are sticking to the forecast of 11-14%. October will be the time that we will come up for a review, said N Chandrasekaran, the new chairperson of Nasscom, two weeks ago, at the time of taking over. Its not prudent to change the forecast based on a quarters performance of IT companies.

The unique thing about 108 is that it is a service that has a centralised state-level database, making it easier to track emergencies, unlike any other government emergency service, including 100, Sridhar said. With big states such as Andhra Pradesh, Tamil Nadu and Madhya Pradesh providing these services, the 108 ambulance service responds to a million emergencies on average every quarter. Even in states where other organisations are providing the services, efforts are on to integrate these with the 108 ambulance service. Tamil Nadu, where the service has 99% coverage, will ramp up by 45% the current fleet of 436 ambulances by June-end. While Andhra Pradesh and Karnataka have already achieved 100% coverage, states such as Kerala, Goa and Madhya Pradesh have covered more than 50% of their population. In most cases, the state governments are funding 95% of the capital and maintenance costs, while GVK is putting in the rest of the 5% and the managerial costs. On average, the state governments incur `1 lakh per ambulance per year . as maintenance and operations cost. Two non-government organisations had in 2008 contested in the Supreme Court GVK EMRIs selection in most states, but with the court ruling in its favour in 2010, GVK is looking at expanding its reach across the country. Most state governments have been routing the funds for the service through the National Rural Health Mission. With increasing coverage, however, the state governments will have to bear a bigger chunk of the operating costs that . range from `50-80 crore per year, excluding additions to the fleet.

_____

All India Master Distributor

I ,

for

marketing and distribution of their leading personal care brands in the Hair Care, Deodorants and Fragrance categories. Intereste d parties with adequate infrastructure on Pan India basis, sound financial standing & prior experience in handling FMCG products may apply in strict confidence to the Chairman , Modi-Revlon Pvt. Ltd. at the following: Email: ukmod i@rnod irevion .com

N REVLO

You might also like

- Economic Heresies Some Old Fashioned Questions in Economic Theory PDFDocument167 pagesEconomic Heresies Some Old Fashioned Questions in Economic Theory PDFWashington Quintero100% (1)

- Earnings Presentation FY24 Q3Document35 pagesEarnings Presentation FY24 Q3Zerohedge JanitorNo ratings yet

- Capital Budgeting ProcessDocument17 pagesCapital Budgeting ProcessjanineNo ratings yet

- Credit LendingDocument64 pagesCredit LendingZubair Mirza100% (2)

- Financial Performance of SbiDocument55 pagesFinancial Performance of Sbimikkijain50% (2)

- Private Placement & Venture CapitalDocument18 pagesPrivate Placement & Venture Capitalshraddha mehtaNo ratings yet

- DIEGO Vs FernandoDocument2 pagesDIEGO Vs FernandoErica ManuelNo ratings yet

- TRAI - A Woeful DownslideDocument4 pagesTRAI - A Woeful DownslideIndiamaticNo ratings yet

- Not Original 2G Spectrum Scam-Full Story, Origin, Growth (?) and Modus OperandiDocument6 pagesNot Original 2G Spectrum Scam-Full Story, Origin, Growth (?) and Modus OperandiSweta SaxenaNo ratings yet

- Where Was The Alleged Scam?Document6 pagesWhere Was The Alleged Scam?Sayudh SarkarNo ratings yet

- DoT Issues Notices to Telecom Operators for Under Reporting Revenues 2006-2008Document12 pagesDoT Issues Notices to Telecom Operators for Under Reporting Revenues 2006-2008Deepak RamNo ratings yet

- Mergers and Acquisitions (M&A)Document3 pagesMergers and Acquisitions (M&A)Arzoo AgrawalNo ratings yet

- Presentation On 2G Scam: Submitted By:-Neha Bhanot ECE/10/137Document13 pagesPresentation On 2G Scam: Submitted By:-Neha Bhanot ECE/10/137Er ROhit SinghalNo ratings yet

- The Scope and Limitations of The Inherent Powers of The Court Under Section 482 of The Criminal Procedure CodeDocument3 pagesThe Scope and Limitations of The Inherent Powers of The Court Under Section 482 of The Criminal Procedure CodeAmrita ChoudharyNo ratings yet

- 2008 Conceptual TelecomDocument4 pages2008 Conceptual Telecomabsekhar797No ratings yet

- Clamour Grows For Flat Spectrum ChargeDocument1 pageClamour Grows For Flat Spectrum ChargespmkumarNo ratings yet

- Presented By:-Priya JohnDocument12 pagesPresented By:-Priya JohnjotusethNo ratings yet

- 2008-11-7 Press Release by DoTDocument5 pages2008-11-7 Press Release by DoTFirstpostNo ratings yet

- INFRASTRUCTURE INVESTMENT MODELDocument94 pagesINFRASTRUCTURE INVESTMENT MODELRaghav RoyNo ratings yet

- Major Scams in Telecommunication Sector: A Project Submitted in The Partial Completion of The Said DegreeDocument16 pagesMajor Scams in Telecommunication Sector: A Project Submitted in The Partial Completion of The Said DegreeNavi JamesNo ratings yet

- Telecom Industry Woes and SolutionsDocument4 pagesTelecom Industry Woes and SolutionsMohd AnasNo ratings yet

- Shocked Telcos May Go For Review: BusinessDocument1 pageShocked Telcos May Go For Review: BusinessnitschemistryNo ratings yet

- Vodafone Idea & Its AGR SagaDocument9 pagesVodafone Idea & Its AGR SagaAshutosh TulsyanNo ratings yet

- Introduction To The TopicDocument16 pagesIntroduction To The TopichimanshuNo ratings yet

- Customers Have Benefited A Lot From 2G Allocation"Document13 pagesCustomers Have Benefited A Lot From 2G Allocation"arunnifriendsNo ratings yet

- 2g DivideDocument3 pages2g DivideVishal Kumar SinghNo ratings yet

- English Front PageDocument208 pagesEnglish Front PagerahulleibenNo ratings yet

- AirtelDocument8 pagesAirtelLokesh SinghNo ratings yet

- Project Report On Income Tax: Advantage & Disadvantages To Telecom Sector in IndiaDocument6 pagesProject Report On Income Tax: Advantage & Disadvantages To Telecom Sector in IndiaShalini MahawarNo ratings yet

- Monetary & Fiscal Policy of TelecomDocument15 pagesMonetary & Fiscal Policy of TelecomAnupam MishraNo ratings yet

- Entry BarierDocument4 pagesEntry BarierSaket KumarNo ratings yet

- Impact of AGR Ruling on Telecom SectorDocument4 pagesImpact of AGR Ruling on Telecom SectorRamreejhan ChaudharyNo ratings yet

- Presentation On 2G Spectrum: Click To Edit Master Subtitle Style Submitted By:-Pranjal Sahai Prachi SahaiDocument13 pagesPresentation On 2G Spectrum: Click To Edit Master Subtitle Style Submitted By:-Pranjal Sahai Prachi SahaiArpit SahaiNo ratings yet

- 2G Scam: How Raja Allegedly Robbed India: Politicians InvolvedDocument6 pages2G Scam: How Raja Allegedly Robbed India: Politicians InvolvedSiddharth BhardwajNo ratings yet

- The End Game in TelecomDocument4 pagesThe End Game in TelecommahasuryaNo ratings yet

- Economics ProjectDocument15 pagesEconomics ProjectHababNo ratings yet

- Weekly News: By: Kapil Singh PathaniaDocument16 pagesWeekly News: By: Kapil Singh PathaniaCapil Path A NiaNo ratings yet

- Presentation On 2G spectrum: Key facts on scam and charges against former ministerDocument2 pagesPresentation On 2G spectrum: Key facts on scam and charges against former ministerShilpa ShuklaNo ratings yet

- IndiaDocument3 pagesIndiasatty_adiNo ratings yet

- Supreme Court Cancels 122 2G Licenses in IndiaDocument2 pagesSupreme Court Cancels 122 2G Licenses in IndiaKamaldeep KaurNo ratings yet

- Bharti Airtel's response to TRAI's draft tariff order on STB rental plansDocument8 pagesBharti Airtel's response to TRAI's draft tariff order on STB rental plansAashish ChhajedNo ratings yet

- Project On Voda and AirtelDocument81 pagesProject On Voda and AirtelNitu SainiNo ratings yet

- Presentation On 2G SpectrumDocument13 pagesPresentation On 2G SpectrumAnushka101No ratings yet

- News Analysis - Consumers Could Pay A Price For Free National Roaming, Pan-India Licence - The HinduDocument2 pagesNews Analysis - Consumers Could Pay A Price For Free National Roaming, Pan-India Licence - The HinduNeha ChoudharyNo ratings yet

- Growth of India's Telecom SectorDocument8 pagesGrowth of India's Telecom Sectorsumit1234No ratings yet

- 2008-5-28 Brief Note For FMDocument4 pages2008-5-28 Brief Note For FMFirstpostNo ratings yet

- Robi-Airtel CorrectionDocument7 pagesRobi-Airtel CorrectionMiraz AhmedNo ratings yet

- An Information Report SahilDocument21 pagesAn Information Report SahilSahil SherasiyaNo ratings yet

- BSNL faces financial crisis amid competition and high employee costsDocument3 pagesBSNL faces financial crisis amid competition and high employee costsMayank AroraNo ratings yet

- Dot To Keep Govt'S Revenues in Mind While Setting Suc Rate: The Economic TimesDocument1 pageDot To Keep Govt'S Revenues in Mind While Setting Suc Rate: The Economic TimesspmkumarNo ratings yet

- Acquisation-Merger Telecom News.Document11 pagesAcquisation-Merger Telecom News.Ashwani KumarNo ratings yet

- 2G Spectrum ScamDocument2 pages2G Spectrum ScamDeepak MishraNo ratings yet

- Regulation Session: Vodafone Open Office Mumbai, IndiaDocument8 pagesRegulation Session: Vodafone Open Office Mumbai, IndiaSaran BaskarNo ratings yet

- Telecom Industry in IndiaDocument21 pagesTelecom Industry in IndiaVaibhav PatelNo ratings yet

- EGoM's Spectrum Levy Decision Leaves Room for Revenue ArbitrageDocument2 pagesEGoM's Spectrum Levy Decision Leaves Room for Revenue ArbitragespmkumarNo ratings yet

- Clarifies On News Item (Company Update)Document3 pagesClarifies On News Item (Company Update)Shyam SunderNo ratings yet

- Presentation On 2G Spectrum: Presented By:-Aashish U.Jikar Shrikant R. MunghateDocument14 pagesPresentation On 2G Spectrum: Presented By:-Aashish U.Jikar Shrikant R. MunghateLokesh GajbhiyeNo ratings yet

- Competition Issues Relating To Telecommunication Sector in India - A Critical AnalysisDocument8 pagesCompetition Issues Relating To Telecommunication Sector in India - A Critical AnalysisPrabhav PandeyNo ratings yet

- 2G ScamDocument4 pages2G ScamVivek AroraNo ratings yet

- TTSL To Rajeev Chandrasekhar 20101209Document6 pagesTTSL To Rajeev Chandrasekhar 20101209OutlookMagazineNo ratings yet

- Telecom Sector Analysis ReportDocument4 pagesTelecom Sector Analysis Report9036280350No ratings yet

- Key Details of the 2G Spectrum Scam in IndiaDocument9 pagesKey Details of the 2G Spectrum Scam in IndiaJagadish SajjanNo ratings yet

- Scope of Audit - Changing DimensionsDocument8 pagesScope of Audit - Changing DimensionsNehaNo ratings yet

- Open Access Volume 30 Mar April13 v3Document17 pagesOpen Access Volume 30 Mar April13 v3Shubham MishraNo ratings yet

- Papers on the field: Telecommunication Economic, Business, Regulation & PolicyFrom EverandPapers on the field: Telecommunication Economic, Business, Regulation & PolicyNo ratings yet

- Facilitating Power Trade in the Greater Mekong Subregion: Establishing and Implementing a Regional Grid CodeFrom EverandFacilitating Power Trade in the Greater Mekong Subregion: Establishing and Implementing a Regional Grid CodeNo ratings yet

- Energy Storage: Legal and Regulatory Challenges and OpportunitiesFrom EverandEnergy Storage: Legal and Regulatory Challenges and OpportunitiesNo ratings yet

- Illiteracy in India: Causes and Efforts to Increase Literacy RatesDocument11 pagesIlliteracy in India: Causes and Efforts to Increase Literacy Ratesprajapati1983No ratings yet

- UP08 Tax 01 & 02Document163 pagesUP08 Tax 01 & 02jojitusNo ratings yet

- IntelliJ IDEA Mac OS X Keymap ReferenceDocument1 pageIntelliJ IDEA Mac OS X Keymap ReferencealeshivanNo ratings yet

- Health Related Physical FitnessDocument5 pagesHealth Related Physical Fitnessprajapati1983No ratings yet

- Etm 2012 6 25 19Document1 pageEtm 2012 6 25 19prajapati1983No ratings yet

- M Solved Taxation Question PapersDocument18 pagesM Solved Taxation Question PapersMahesh KadamNo ratings yet

- The Engines of The Indian E-Commerce TrainDocument1 pageThe Engines of The Indian E-Commerce Trainprajapati1983No ratings yet

- Enviornment Managment University Question PaperDocument9 pagesEnviornment Managment University Question Paperprajapati1983No ratings yet

- Android - An OverviewDocument39 pagesAndroid - An OverviewMihai Fonoage100% (18)

- Cricket 2011 2020 PDFDocument5 pagesCricket 2011 2020 PDFAshutosh AnandNo ratings yet

- AndroidDocument28 pagesAndroidsunrisesfrom100% (6)

- C1Document25 pagesC1prajapati1983No ratings yet

- Bakery Project in NigeriaDocument8 pagesBakery Project in NigeriaOladeji Idowu100% (1)

- Chapter 06: Understanding Cash Flow StatementsDocument23 pagesChapter 06: Understanding Cash Flow StatementsSadia RahmanNo ratings yet

- BTCL IPO Prospectus (Latest) 06 01 16Document252 pagesBTCL IPO Prospectus (Latest) 06 01 16Nako Yaga NkukuNo ratings yet

- Singer Annual Report 2011Document88 pagesSinger Annual Report 2011Cryptic MishuNo ratings yet

- Reporte Anual 2019 - IkeaDocument54 pagesReporte Anual 2019 - IkeaLeodan ZapataNo ratings yet

- The Economic Impact of The British Greyhound Racing Industry 2014Document32 pagesThe Economic Impact of The British Greyhound Racing Industry 2014artur_ganateNo ratings yet

- Lecture 1 - Introduction To BankingDocument23 pagesLecture 1 - Introduction To BankingLeyli MelikovaNo ratings yet

- For Other Uses, See .: Insurance (Disambiguation)Document8 pagesFor Other Uses, See .: Insurance (Disambiguation)somnathNo ratings yet

- #4 Assignment Description (Ch. 7-8)Document5 pages#4 Assignment Description (Ch. 7-8)Karan BhavsarNo ratings yet

- Hul Distribution ModelDocument5 pagesHul Distribution ModelBhavik LodhaNo ratings yet

- Farmer-Controlled Economic InitiativesDocument73 pagesFarmer-Controlled Economic InitiativesGreen Action Sustainable Technology GroupNo ratings yet

- Factoring and ForfaitingDocument34 pagesFactoring and ForfaitingAbhishek JhaveriNo ratings yet

- Trade War Between China and USDocument5 pagesTrade War Between China and USShayan HiraniNo ratings yet

- AbcdeDocument5 pagesAbcdeDivyany PandeyNo ratings yet

- Learn the fundamentals of simple interest and discountDocument19 pagesLearn the fundamentals of simple interest and discountShiena mae IndacNo ratings yet

- Benefiting From Innovation Value Creation, Value Appropriation and The Role of Industry ArchitecturesDocument22 pagesBenefiting From Innovation Value Creation, Value Appropriation and The Role of Industry Architecturesapi-3851548No ratings yet

- BP Investment AppraisalDocument71 pagesBP Investment Appraisalprashanth AtleeNo ratings yet

- Rakon 2007 Annual ReportDocument64 pagesRakon 2007 Annual Reportjjmaloney100% (3)

- Wolfram Alpha AnnvssksvsgymbDocument4 pagesWolfram Alpha AnnvssksvsgymbenrokNo ratings yet

- Partnership Dissolution and Admission ExplainedDocument14 pagesPartnership Dissolution and Admission ExplainedMila aguasanNo ratings yet

- Financial Accounting I Week 8: Acquisition and DispositionDocument41 pagesFinancial Accounting I Week 8: Acquisition and DispositionJofandio AlamsyahNo ratings yet

- Managerial Accounting: Ray H. Garrison, Eric W. Noreen, Peter C. BrewerDocument50 pagesManagerial Accounting: Ray H. Garrison, Eric W. Noreen, Peter C. BrewermostfaNo ratings yet

- Securities Industry in IndonesiaDocument139 pagesSecurities Industry in Indonesiathe1uploaderNo ratings yet