Professional Documents

Culture Documents

IPSEF KL 2012 - K12 South East Asia-Seizing The Opportunity For British Schools Opening Campuses Abroad

Uploaded by

Alana Rush0 ratings0% found this document useful (0 votes)

100 views16 pagesParthenon's Education Practice is the largest advisory team to focus on the education sector. Parthenon completes more than 150 education projects per year in over 60 countries. This report identifies the critical success factors required to tap into these opportunities.

Original Description:

Original Title

IPSEF KL 2012_ K12 South East Asia-Seizing the Opportunity for British Schools Opening Campuses Abroad

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentParthenon's Education Practice is the largest advisory team to focus on the education sector. Parthenon completes more than 150 education projects per year in over 60 countries. This report identifies the critical success factors required to tap into these opportunities.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

100 views16 pagesIPSEF KL 2012 - K12 South East Asia-Seizing The Opportunity For British Schools Opening Campuses Abroad

Uploaded by

Alana RushParthenon's Education Practice is the largest advisory team to focus on the education sector. Parthenon completes more than 150 education projects per year in over 60 countries. This report identifies the critical success factors required to tap into these opportunities.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 16

Parthenon Perspectives

Boston t London t Mumbai t San Francisco

K-12 Southeast Asia: Seizing the

Opportunity for British Schools

Opening Campuses Abroad

Prepared for

www. par t henon. com

On-the-Ground Education Sector Projects Completed by Parthenon

About The Parthenon Group

Parthenons Global Education Presence

About The Parthenon Groups Education Practice

The Parthenon Group is a leading advisory rm focused on strategy consulting, with ofces in Boston, London, Mumbai,

and San Francisco. Parthenons Education Practice is the largest advisory team to focus on the education sector, both

for-prot and non-prot/government. Parthenon has 40 professionals focused on advising the MENA and Asian education

sectors. The Education Practice is a leading advisor to the global education industry with clients across diverse sectors

that include publishing, primary and secondary education, higher education, consumer education, vocational education,

corporate training, governments, foundations, NGOs, and other non-prot organizations. Parthenon completes more than

150 education projects per year in over 60 countries globally.

Boston t London t Mumbai t San Francisco

Parthenon Perspectives

K-12 Southeast Asia: Seizing the Opportunity for British Schools Opening Campuses Abroad www.parthenon.com

1

Executive Summary

Parthenons research shows there is a strong link between a countrys tertiary

enrolment ratio and economic strength. While the education sector in Southeast Asia

is growing, the tertiary enrolment ratio is likely to increase further as income per capita

increases. This indicates that the Southeast Asian countries are still in their nascent

stages of education development, and as a result, a signicant investment in education

infrastructure is required for these countries to reach international benchmarks. Even

though British brand schools are an increasing phenomenon outside the UK, evidence

suggests that they have a mixed record of success in executing these initiatives. This

report identies the critical success factors required to tap into these opportunities.

In order to establish a successful branch campus abroad, it is crucial to set and achieve

realistic enrolment targets by:

t Evaluating the target population (expats and afuent locals)

t Addressing the level of incremental market demand available in the local market,

given competition and student or parent preferences

Methodology

The Parthenon Group followed a bottom-up approach to collect data at the school level and referred to published

information from government sources to corroborate our ndings and results. Our research for primary and

secondary education sectors comprised of more than 300 international curriculum schools across Southeast Asia,

which enrol more than 150K children.

Parthenon Perspectives

K-12 Southeast Asia: Seizing the Opportunity for British Schools Opening Campuses Abroad www.parthenon.com

2

Economic Strength Is Closely Linked to a Countrys Enrolment Ratio

Tertiary Gross Enrolment Ratio (GER) vs. PPP Adjusted GNI Per Capita

Note: UNESCOs Gross Enrolment ratio ISCED 5 and 6. This ratio is calculated using the number of pupils enroled in International Standard Classication of Education (ISCED) level 5 and 6 repre-

senting stages of tertiary education, regardless of age, expressed as a percentage of the population in the ve-year age group following on from the secondary school leaving age

Parthenons research shows there is a strong link between a countrys tertiary enrolment ratio and economic strength.

While the education sector in Southeast Asia is growing, the tertiary enrolment ratio is likely to increase further as

income per capita increases. This indicates that the Southeast Asian countries are still in their nascent stages of education

development, and as a result, a significant investment in education infrastructure is required for these countries to

reach international benchmarks. In order to develop globally competitive economies, the Southeast Asian region should

consider the development of education infrastructure as a long-term sustained imperative. Signicant investment in K-12

education now will help in preventing a potential tertiary education gap and employment gap in the future.

In addition to being a strategic imperative, K-12 schools are good investment opportunities for the private sector as they

have ve investor friendly characteristics which are rarely found together in one business:

Long-Term

Revenue

Visibility

High Barriers

to Entry

Demand

Greater Than

Supply

Prices Rising

Higher Than

Ination

Negative

Working

Capital

K-12

9 9

Depends on

Catchment Area

9 9

0

20

40

60

80

100%

0 20,000 40,000 60,000

Ukraine

Israel

Finland

Belarus

Australia

Algeria

PPP adjusted GNI per Capita

E

n

r

o

l

m

e

n

t

R

a

t

i

o

Philippines

Vietnam

Myanmar

Laos

Singapore

Uzbekistan

Uruguay

United States

United Republic of Tanzania

UK

Turkey

Tunisia

Thailand

Tajikistan

Switzerland

Sweden

Spain

Slovenia

Slovakia

Russian Federation

Romania

Republic of Moldova

Republic of Korea

Portugal

Poland

Pakistan

Norway

New

Zealand

Netherlands

Nepal

Morocco

Mongolia

Mexico

Malaysia

Madagascar

Macao, China

Lithuania

Lebanon

Latvia

Kazakhstan

Jordan

Japan

Italy

Ireland

Indonesia

India

Iceland

Hungary

Hong Kong (China), SAR

Guatemala

Greece

Ghana

Georgia

France

Ethiopia

Estonia

El Salvador

Denmark

Czech Republic

Cyprus

Croatia

Colombia

China

Chile

Cape Verde

Cambodia

Burundi

Burkina Faso

Bulgaria

Brunei Darussalam

Brazil

Bhutan

Belgium

Bangladesh

Azerbaijan

Austria

Armenia

R

2

= 61%

Southeast Asia

Other

Parthenon Perspectives

K-12 Southeast Asia: Seizing the Opportunity for British Schools Opening Campuses Abroad www.parthenon.com

3

Rise of Household Income and Affordability in Southeast Asia

Over the past few decades, the Southeast Asian countries have gone through signicant economic and social change.

For outside investors, the Southeast Asian countries have become attractive investment opportunities. From within

these countries, household income has rapidly risen, enabling families to afford a higher quality of living. Countries in the

Southeast Asian region have identied education as an enabler to transform their economies and achieve sustainable long-

term growth.

Abdullah Ahmad Badawi, former Malaysian Prime Minister, believes: To develop the human capital, we want our

citizens to be fully equipped with knowledge, practice good moral values, have a broad mind, love the country, and possess

the physical and spiritual strength.

Education has a crucial role in this evolution and will create the necessary workforce for newly developed industries.

The Southeast Asian education sector has gone through important structural changes and is expected to grow strongly,

creating a signicant opportunity for investors. Drivers of growth include increase in average household income,

increase in inflow of FDI, increased demand for English, and increased demand for better infrastructure and quality

of education.

Premium K-12 International Curriculum Revenue Size and Growth

Above 25%

20% 24%

15% 19%

10% 14%

Vietnam, US$0.2B

India

US$0.4B

Thailand

US$0.5B

China

US$1.7B

Singapore

US$0.7B

Malaysia, US$0.3B

Indonesia, US$0.2B

Parthenons research of Southeast Asian countries shows rapid enrolment growth of international curriculum schools,

ranging from overall 3-18% enrolment growth by country.

This report focuses on opportunities and challenges in K-12 education in Kuala Lumpur and Bangkok as they are both

relatively large markets. The fast international curricula enrolment growth levels of the former (~8% at ~$220M) and the

mature international curricula enrolment growth levels of the latter (~3% at ~$380M) make these markets interesting case

studies for investors in education.

Parthenon Perspectives

K-12 Southeast Asia: Seizing the Opportunity for British Schools Opening Campuses Abroad www.parthenon.com

4

Bangkok Is a Mature Market for International Schools

The international school market in Bangkok is estimated to be worth ~US$380M, and enrolment has grown at 2.8% per annum,

which is relatively slow compared to markets in other Southeast Asian countries. Local students currently make up 50% of

the international school population, and their share is growing faster than the expatriates segment of the K-12 school market.

International School Enrolment in Bangkok by Nationality, 2008-2011

Source: Parthenon Schools Survey

The growth of international schools in Bangkok is inuenced by the following factors:

t Increasing afuence of Thai nationals: A 2% increase in annual household income has led to an incremental

enrolment of 3.6% for local students in international schools, predominantly in the budget segment (international

schools charging less than US$6K annual tuition fee).

t Growing expat enrolment in international schools: The expat enrolment in international schools for Bangkok has

grown at 1.9% per year. This is an outcome of the slow growth in the real FDI stock for Bangkok which has only grown

at 2% from 2008-2011.

t Opportunity for differentiation to drive enrolment and school stature: Premium international schools in Bangkok

have 4.5 years of capacity given current utilization and enrolment growth rates, unlike Ho Chi Minh City (already at

capacity) and Kuala Lumpur (one year of current capacity remaining). Schools that differentiate themselves based on

academic rigor, athletics, community values, or the environment could attract a niche segment of parents and grow

their enrolment faster while attracting a motivated set of students.

0

10

20

30

40K

2008

30.5K

2011

Expatriates

Thai

Nationals

33.1K

3.6%

1.9%

('08-'11)

2.3%

CAGR

Parthenon Perspectives

K-12 Southeast Asia: Seizing the Opportunity for British Schools Opening Campuses Abroad www.parthenon.com

5

The International School Market in Kuala Lumpur Is Growing Fast

The international school market in Kuala Lumpur is estimated to be ~US$220M and growing at 8.1% per annum. The total

enrolment in international schools for Kuala Lumpur comprises 85% of the total expatriate enrolment in Malaysia.

International School Enrolment in Kuala Lumpur/Greater Kuala Lumpur

by Nationality, 2008-2011

Source: Parthenon Schools Survey

With 16 schools added to the market from 2005-2010, the growth of the international schools is driven by:

t Increasing afuence of Malaysian nationals: The annual increase of 2.5% in local household income has made

it possible for more Malaysians to attend international schools, especially in the mid-priced segment (international

schools with price points between US$6K-15K). This together with an increased demand for English language

education has led to a 9% growth in the enrolment of Malaysian students in international schools.

t Inux of expatriates: Foreign investment (measured in real FDI stock) has been growing at 8% per year, resulting in

a growing expatriate population in Malaysia. Even though the number of expatriate students is growing slower than

the share of local students, expatriates still make up ~60% of the total incremental enrolment in international schools

between 2008-2011.

0

10

20

30K

2008

17.6K

2011

Expatriates

Malaysian

Nationals

22.2K

7.6%

9.0%

('08-'11)

8.1%

CAGR

Parthenon Perspectives

K-12 Southeast Asia: Seizing the Opportunity for British Schools Opening Campuses Abroad www.parthenon.com

6

A Worldwide Assessment of Performance of British Brand Schools Abroad Suggests

Signicant Potential

Enrolment in Kuala Lumpur and Bangkok by Curriculum, 2011

*Note: The only British + IB school recently opened

The British curriculum and mixed British curriculum combined make ~70% and ~40% of total international enrolment in

Kuala Lumpur and Bangkok, respectively. Investors should explore investment opportunities and trends within this segment.

Through its worldwide research, Parthenon has identied and developed insights into the burgeoning trend of British

schools opening campuses abroad. For the last 13 years, British schools have been opening branch campuses abroad to

serve a growing expatriate population and afuent local students. Currently, there are 18 branch campuses of British

schools across 8 countries enroling 12 thousand students. These 18 campuses have a combined turnover of ~US$275M

growing by 15% a year.

With the establishment of Shrewsbury, Harrow, and Bromsgrove schools, Bangkok has beneted from the ongoing trend of

prestige British schools opening campuses abroad. Although Kuala Lumpur does not have any branch campuses of British

schools, the fast enrolment growth of British curriculum schools and plans for Epsom to open a campus this year in Kuala

Lumpur suggest a strong partnership opportunity with British schools.

0

20

40

60

80

100%

Kuala Lumpur

British

American + IB

Other

IB

22.3K

Bangkok

American

British + IB

British

Other

American + IB

IB

33.2K

British + IB

15+%

10 14%

5 9%

0 4%

<0%

Enrolment Growth 8% 3%

Total Enrolment 15K 33K

British-

Based

Curriculum

British-

Based

Curriculum

Parthenon Perspectives

K-12 Southeast Asia: Seizing the Opportunity for British Schools Opening Campuses Abroad www.parthenon.com

7

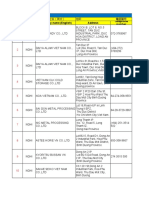

Enrolment in Branch Campuses of British Schools Across the World, 2011

Source: ISC Research Ltd; Parthenon research and analysis

Other than Epsom, Marlborough, Harrow, and Dulwich have also conrmed that they are opening new campuses abroad.

School City Year

Harrow Hong Kong 2012

Epsom Kuala Lumpur 2012

Marlborough Iskandar 2012

Dulwich Abu Dhabi 2012

The assumption of many British school brands is that their reputation will result in parents switching children from local

schools or existing international schools. A related assumption is that economic growth in emerging economies will generate

sufcient demand from expatriates and wealthy locals to ll the school. The experience of British schools abroad so far, in

some cases, has challenged these assumptions given the mixed record of success. These experiences provide insights into

how investors in Kuala Lumpur and Bangkok can approach and seize the opportunity of the ongoing trend of British schools

opening campuses abroad.

Meeting Targets and Protecting the Brand

Of the 18 operational branch campuses of British school brands, 9 are more than 4 years old and of those only 3 have

reached capacity utilization on built capacity of more than 70%. Of all 18 branch campuses, only 3 met or beat their

rst year enrolment targets, despite British branch campuses outperfoming the largest competitor in each market.

0

20

40

60

80

100%

China

Dulwich (Zuhai )

Wellington(Tianjin)

Harrow (Beijing)

Dulwich (Suzhou)

Dulwich (Shanghai)

Dulwich (Beijing)

4.2K

Thailand

Bromsgrove

(Bangkok)

Harrow

(Bangkok)

Shrewsbury

(Bangkok)

2.9K

UAE

Brighton

(Abu Dhabi)

Repton

(Dubai)

2.6K

S

o

u

t

h

K

o

r

e

a

N

o

r

t

h

L

o

n

d

o

n

C

o

l

le

g

ia

t

e

(

J

e

j

u

)

D

u

lw

i

c

h

(

S

e

o

u

l

)

0

.

8

K

K

a

z

a

k

h

s

t

a

n

H

a

il

e

y

b

u

r

y

(

A

s

t

a

n

a

)

H

a

i

l

e

y

b

u

r

y

(

A

l

m

a

t

y

)

0

.

8

K

Q

a

t

a

r

0

.

3

K

S

h

e

r

b

o

r

n

e

(

Q

a

t

a

r

)

Nigeria

B

u

c

k

s

w

o

o

d

Montenegro

K

n

ig

h

t

s

b

r

id

g

e

S

c

h

o

o

l

(

T

i

v

a

t

)

Total =

11.7K

Parthenon Perspectives

K-12 Southeast Asia: Seizing the Opportunity for British Schools Opening Campuses Abroad www.parthenon.com

8

Capacity Utilization and First-Year Enrolment Targets at Branch Campuses of British Schools

Source: Parthenon research and analysis

Given the high cost of capital in emerging markets, missing enrolment targets in early years can signicantly lower

the return on capital and feasibility of the project. Realizing less than 70% utilization by year 4 of operations usually

results in a lower than planned return on capital, which can force investors to generate incremental cash ow by cutting

operating costs such as teacher salaries and facilities maintenance, which in turn will impact quality.

Typical Project IRR of Branch Campus of British School

Based on Year 4 Utilization on Built Capacity (Illustrative)

Source: Parthenon research and analysis

Incorrectly estimating enrolment potential can threaten the feasibility and quality of the branch campus, diluting the value

of the brand, and defeating the rationale for expanding abroad.

At present many British schools do not conduct a data-driven feasibility analysis to quantify potential demand, relying

instead on anecdotal data or reassurance from local investors that the market can support the school.

0

10

20

30%

30% Capacity

Utilization

10%

50% Capacity

Utilization

17%

70% Capacity

Utilization

21%

90% Capacity

Utilization

26%

2 4 2 1

Performance of

Branch Campuses

Threshold IRR Expected in

Developing Countries

0

20

40

60

80

100%

Capacity Utilization

for Schools of

4 or More Years

Since Start

Less than

70%

Capacity

Utilization

70%+

Capacity

Utilization

9

Years Since

Branch

Campus

Founded

4+ Years

Old

Less than 4

Years Old

18

First

Year

Enrolment

Target

Missed

Target

Met or

Exceeded

Target

18

Missed

First Year

Enrolment

Target

Missed by

30%+

Missed by

15-30%

15

Parthenon Perspectives

K-12 Southeast Asia: Seizing the Opportunity for British Schools Opening Campuses Abroad www.parthenon.com

9

Drivers of Enrolment at British Branch Campuses

~85% of enrolment in British branch campuses are children of expatriates. This of course differs by market, and in mature

markets such as Bangkok, locals can account for up to ~70% of total enrolment in British branch campuses. In countries

such as China, schools have to rely on the expatriate population in order to scale up.

EhrolmehI aI Brahch Campuses oI BriIish Schools: EpaIriaIes vs. AIIuehI Locals by CiIy, 2011

Source: Parthenon research and analysis

As the typical expatriate rotation is 4 years, 25% of the expatriate student base churns each year. The result is that

in a market such as Bangkok with a total 2010 enrolment of ~32,300 and ~30% as expats in premium international schools

(including British branch campuses) the annual number of students looking for seats is a combination of incremental market

demand (in Bangkok demand growth is ~900 expatriate children per year) and 25% of the existing expatriate student base.

The result is that ~3,300 students are up for grabs each year. Many branch campuses are opened with the assumption

that they can enrol a large percentage of both incremental market demand and churn in the underlying student base.

Incremental Market Demand and Expatriate Churn in Bangkok, 2010-2011

Note: Market is dened as >US$10

Source: Parthenon research and analysis

0

20

40

60

80

100%

Beijing

100%

Tianjin

100%

Shanghai

100%

Abu

Dhabi

100%

Dubai

100%

Astana

100%

Almaty

100%

Bangkok

A

f

f

l

u

e

n

t

L

o

c

a

l

s

E

x

p

a

t

r

i

a

t

e

s

100%

0

10

20

30

40K

2010

T

o

t

a

l

E

n

r

o

l

m

e

n

t

32.3K

Expatriates

Leaving

Bangkok

-2.4K

New Expatriates

Arriving

in Bangkok

2.4K

Incremental

Market

Demand

0.9K

2011

33.1K

Churn in the Market

Incremental Market Demand

Addressable

by New Market

Entrant

Parthenon Perspectives

K-12 Southeast Asia: Seizing the Opportunity for British Schools Opening Campuses Abroad www.parthenon.com

10

The data demonstrates that every branch campus has enroled a subset of incremental market demand. However,

there has not been a precedent where a branch campus has enroled more students than incremental market growth.

As a result, there is no demonstrated success of accessing student churn resulting in declining enrolment of competing

schools.

However, in most cases branch campuses of British schools have been able to add more incremental enrolment than the

largest competitor in the market, suggesting that British brands have value with parents in these markets and can attract

more incremental enrolment than a generic international brand. For example, Wellington College in Tianjin has been able to

attract 200 students in its rst year of operation, which is the highest number of incremental students added in that market

in that year (compared to 130 incremental students of the largest competitor).

Incremental Market Demand vs. Growth of Branch Campus of British School by City, 2010-2011

Note: Incremental growth for Bangkok includes Bromsgrove, Shrewsbury, and Harrow; capacity utilization for the three schools is ~90%

Source: Parthenon research and analysis

Understanding the role of market size and growth on enrolment potential is important as markets have different growth

rates and existing enrolment levels. In order to establish a successful branch campus abroad, it is important to evaluate the

target population (expats and afuent locals) and what incremental market demand is available given competition.

0

250

500

750

1,000

1,250

Abu Dhabi

1,100

550

Bangkok

900

100

Shanghai

650

180

Tianjin

550

200

Beijing

380

100

Incremental Market Demand

Growth of Branch Campus

of British School

Parthenon Perspectives

K-12 Southeast Asia: Seizing the Opportunity for British Schools Opening Campuses Abroad www.parthenon.com

11

Importance of Quantifying Market and School Enrolment Potential

Sometimes the market potential can be deceptive. For example, in a country like India with 290 million children of school-

going age, there are only 8,000 students enroled in premium international schools, 6,000 of which are children of expat

parents. Premium international schools in India are not running at high utilization, indicating oversupply in the market.

Enrolment of Premium International Schools in India, 2010

Source: Parthenon research and analysis

A city such as Bangkok can dwarf the whole of India in terms of the number of students enroled in premium international

private schools at comparable price points (above US$10K per annum) and demonstrates higher growth.

Enrolment at Premium International Schools Above US$10K in India and Bangkok, 2011

Investors need a rigorous approach to diligencing the market and understanding its potential in detail. Parthenon has

developed a proprietary framework that estimates market potential at the catchment level.

0

20

40

60

80

100%

By

Location

Urban

Rural

290M

By Type of

Ownership

Private

Private

Aided

Govern-

ment

51M

By Price

Point

$500-

$1K

Less

than

$500

14M

By

Curriculum

I

n

t

e

r

n

a

t

i

o

n

a

l

Indian

310K

By Price

Point

>US$10K

$5K-$10K

$1K-

$5K

128K

By

Nationality

Expat

Affluent

Local

8K

>US$1K

0

5

10

15

20K

All of India

8K

Bangkok

20K

Parthenon Perspectives

K-12 Southeast Asia: Seizing the Opportunity for British Schools Opening Campuses Abroad www.parthenon.com

12

Approach to K-12 Investments

K-12: Success in Schools Depends on Local Supply and Demand

K-12 education is a local catchment business. Unlike higher education, where students often move to another city to go to

college, K-12 students will travel within their neighborhood or city to go to school. Parthenon research shows that besides

location, price point, curriculum, and scale will largely determine the economic viability of the school.

Parthenon Proprietary K-12 Micro Market Analysis Framework

Parthenon has a proprietary approach to estimate market potential at the catchment level. This exercise analyzes potential

investment targets and new investment opportunities in K-12, as shown below.

Analysis of the local catchment area can inform investors about the size of local demand (that is, how many children in the

catchment area can afford a schools tuition fees), identify your competitors and give insight to the optimal capacity of the

school. In the early planning stage, investors need to test assumptions on school rollout, price points, and scale, or they

might end up having a school that does not run at full capacity or is nancially unstable.

Approach to Investments K-12

Parthenon Approach

Revenue

Market Size Fee Growth

Potential

Catchment

Enrolment Potential

School Enrol-

ment Potential

Scale Potential

of School

Catchment

Area Analysis

Competition

Benchmarking

Dene Market &

Competition

Key Outputs

Key

Considerations

t Enrolment numbers

t Tuition Fees

t Grades

t Curriculum

t Facilities and

infrastructure

compared to

competitors

t Parent satisfaction

t Drive times to

school and parent

preferences

t Income distribution of

settlement population

t Vacant seats at

competitor schools

t Expected share of

forecast demand

0

20

40

60

80

100%

City A

Target School

Outside

City A

School 1

Facilities

School 2

Target

School

School 3

Parthenon Perspectives

K-12 Southeast Asia: Seizing the Opportunity for British Schools Opening Campuses Abroad www.parthenon.com

13

Karan Khemka

Partner and Head of the Emerging Markets Education Practice

karank@parthenon.com

Ashwin Assomull

Partner

aassomull@parthenon.com

Abhinav Mital

Senior Principal

abhinavm@parthenon.com

Amit Garga

Senior Principal

agarga@parthenon.com

Danish Kamal Faruqui

Principal

dfaruqui@parthenon.com

Ayush Mathur

Principal

amathur@parthenon.com

Akshay Rathod

Associate

arathod@parthenon.com

For further information, please contact Parthenons Emerging Markets Education Team

Follow us on Twitter for regular updates on events, research, and reports

@edupractice

@karan_khemka

Report Development By:

The Parthenon Groups Emerging Markets Education Practice

1015 Raheja Chambers,

Free Press Journal Marg,

Nariman Point, Mumbai 400 021

India

+91 22 6744 2500

For more information about The Parthenon Group

and the work we do, please visit:

www.parthenon.com

You might also like

- Feasibility Report & Business Plan On D Establish of A Nusery and Primary School in Ibadan, Oyo StateDocument118 pagesFeasibility Report & Business Plan On D Establish of A Nusery and Primary School in Ibadan, Oyo Stateadewaleafolabi96% (164)

- Philippine Politics and Governance QuizDocument29 pagesPhilippine Politics and Governance QuizAiza San Pedro Santos100% (3)

- The Economic Case For Education in Vietnam Harry Anthony Patrinos Pham Vu Thang Nguyen Duc ThanhDocument83 pagesThe Economic Case For Education in Vietnam Harry Anthony Patrinos Pham Vu Thang Nguyen Duc ThanhanNo ratings yet

- Respect and Strategies For RECDocument9 pagesRespect and Strategies For RECJewel YeNo ratings yet

- KPMG Education in China 201011Document34 pagesKPMG Education in China 201011Ng Sze HinNo ratings yet

- FDI in Higher Education Research PaperDocument16 pagesFDI in Higher Education Research PaperPoonam IlagNo ratings yet

- Giao TrinhDocument27 pagesGiao TrinhVanNo ratings yet

- HistoryDocument2 pagesHistoryRusty PamaNo ratings yet

- Project On Education MarketDocument49 pagesProject On Education MarketPrem George GanpatNo ratings yet

- Data Binter InggrisDocument10 pagesData Binter InggrismemiNo ratings yet

- Invest in Indian Education Sector: Government InitiativesDocument4 pagesInvest in Indian Education Sector: Government InitiativesRajnikant PatelNo ratings yet

- ASEAN Economic Integration: Its Impact On The PhilippinesDocument8 pagesASEAN Economic Integration: Its Impact On The PhilippinesjeffreyNo ratings yet

- Zaphs 1Document5 pagesZaphs 1Påulinüs Afåm JohnNo ratings yet

- Zaphs FirmDocument5 pagesZaphs FirmPåulinüs Afåm JohnNo ratings yet

- Chinese Investment Into Thai Private Universities - The Need To Keep Standards Up - FULCRUMDocument4 pagesChinese Investment Into Thai Private Universities - The Need To Keep Standards Up - FULCRUMAsoka Sun GaoNo ratings yet

- Education in IndiaDocument22 pagesEducation in IndiaGaurav SrivastavaNo ratings yet

- Education Report - 3G Fund 2Document19 pagesEducation Report - 3G Fund 2Krishnadas P. ManiNo ratings yet

- K 12Document9 pagesK 12Bu-Ugoen ItNabasaNo ratings yet

- ZaphsDocument5 pagesZaphsPåulinüs Afåm JohnNo ratings yet

- Transforming Higher Education in Vietnam: Nita TemmermanDocument21 pagesTransforming Higher Education in Vietnam: Nita TemmermananNo ratings yet

- Adr Vol40no1 9 Shocks Constraints Child Schooling ThailandDocument29 pagesAdr Vol40no1 9 Shocks Constraints Child Schooling ThailandkbhNo ratings yet

- 19 Sept 2016 - 190916minister Nzimande's Statement On 2017 University Fees 180916 Revised-2 PDFDocument6 pages19 Sept 2016 - 190916minister Nzimande's Statement On 2017 University Fees 180916 Revised-2 PDFMshololo MggNo ratings yet

- Aspire Relaunch March 2012 - Illinois News Release - FINALDocument5 pagesAspire Relaunch March 2012 - Illinois News Release - FINALjk3241No ratings yet

- 04 Transforming Education in PakistanDocument12 pages04 Transforming Education in PakistanArqam WaqarNo ratings yet

- Doanh nghiệp câu 3Document11 pagesDoanh nghiệp câu 3Thi PhuongNo ratings yet

- Education Market in VietnamDocument8 pagesEducation Market in VietnamumeshthanaiNo ratings yet

- Incubation ArticleDocument19 pagesIncubation ArticleAwais RazaNo ratings yet

- Myth # 1:: Senior High School (Grades 11 To 12) Is An Alternative To College EducationDocument11 pagesMyth # 1:: Senior High School (Grades 11 To 12) Is An Alternative To College EducationBenjie GoodNo ratings yet

- Ontario - Institutional Vision, Proposed Mandate Statement and Priority Objectives - Conestoga College Institute of Technology and Advanced LearningDocument9 pagesOntario - Institutional Vision, Proposed Mandate Statement and Priority Objectives - Conestoga College Institute of Technology and Advanced LearningclimbrandonNo ratings yet

- Research Papers On Primary Education in PakistanDocument4 pagesResearch Papers On Primary Education in Pakistanfvgh9ept100% (1)

- State of Penang, MalaysiaDocument35 pagesState of Penang, MalaysiaPierre GanNo ratings yet

- The Many Facets of Education Reforms - Latest News, Breaking News, Pakistan News, World News, Business, Sport and Multimedia - DAWNDocument4 pagesThe Many Facets of Education Reforms - Latest News, Breaking News, Pakistan News, World News, Business, Sport and Multimedia - DAWNcrispitchNo ratings yet

- Assignment 2 Industry Analysis of Higher Education Sector of NepalDocument12 pagesAssignment 2 Industry Analysis of Higher Education Sector of NepalShradhaMinkuPradhanangaNo ratings yet

- Higher Education in IndiaDocument14 pagesHigher Education in IndiasibbipriyaNo ratings yet

- Innovative Strategies in Higher Education for Accelerated Human Resource Development in South AsiaFrom EverandInnovative Strategies in Higher Education for Accelerated Human Resource Development in South AsiaNo ratings yet

- Matching University Graduates Competences With emDocument12 pagesMatching University Graduates Competences With emlumutanpatrickjohnNo ratings yet

- Opportunities in Higher EducationDocument2 pagesOpportunities in Higher EducationAakash ChauhanNo ratings yet

- Challenges in The Education SectorDocument32 pagesChallenges in The Education SectorDilshad ShahNo ratings yet

- Zoe 3Document7 pagesZoe 3tttttaaaaammmmm700No ratings yet

- The Cost of Higher Education in MalaysiaDocument12 pagesThe Cost of Higher Education in MalaysiaHAIKAL HAKIMI ABDUL MUIZNo ratings yet

- The Fruits of Opportunism: Noncompliance and the Evolution of China's Supplemental Education IndustryFrom EverandThe Fruits of Opportunism: Noncompliance and the Evolution of China's Supplemental Education IndustryNo ratings yet

- Indian Education Sector FinalDocument35 pagesIndian Education Sector FinalAmit Kumra100% (1)

- Strat 244 EssayDocument5 pagesStrat 244 EssayamyPolinarNo ratings yet

- Code 8623 Assignment 1Document21 pagesCode 8623 Assignment 1Majid KhanNo ratings yet

- Underqualified and Overqualified Fresh Graduates ArticleDocument6 pagesUnderqualified and Overqualified Fresh Graduates ArticleShahril Anwar NazrieNo ratings yet

- Getting Value For Money From The Education of 16-To 18-Year-OldsDocument9 pagesGetting Value For Money From The Education of 16-To 18-Year-OldsEko SupraptoNo ratings yet

- Forecasting of PUP BudgetDocument18 pagesForecasting of PUP BudgetNorberto O. YamuganNo ratings yet

- Graduate Employment in Vietnam: Number 97: Spring 2019Document2 pagesGraduate Employment in Vietnam: Number 97: Spring 2019Gee BeeNo ratings yet

- No Education, No ProgressionDocument2 pagesNo Education, No ProgressionShah KhalidNo ratings yet

- Chapter 1: Introduction 1.1) Industry Profile: Education SectorDocument17 pagesChapter 1: Introduction 1.1) Industry Profile: Education SectorshreenidhiNo ratings yet

- I S: U Xxi: J BGTDocument50 pagesI S: U Xxi: J BGTDin Aswan RitongaNo ratings yet

- Ijriar 03Document15 pagesIjriar 03Student SampleNo ratings yet

- Module 8Document29 pagesModule 8Joanne Michelle B. DueroNo ratings yet

- Imbalanced Student Mobility in India A Serious ConDocument2 pagesImbalanced Student Mobility in India A Serious Condeeprstg_398735892No ratings yet

- Higher Education Look Abroad: FDI in Higher Education: Understanding The Pros and ConsDocument1 pageHigher Education Look Abroad: FDI in Higher Education: Understanding The Pros and ConsAngela LopezNo ratings yet

- Research Paper On Education System in Pakistan PDFDocument7 pagesResearch Paper On Education System in Pakistan PDFbzkonqzndNo ratings yet

- Hs4350 BlogDocument6 pagesHs4350 Bloganon_34167850No ratings yet

- 17-Cambodian Higher Educatio-Subprime DegreesDocument2 pages17-Cambodian Higher Educatio-Subprime Degreeswestern111No ratings yet

- India 3.5%: United States 12 % France 7 % Malaysia 20 % Thailand 27 %Document8 pagesIndia 3.5%: United States 12 % France 7 % Malaysia 20 % Thailand 27 %Rajiv KeshriNo ratings yet

- Tutorial Center FsDocument18 pagesTutorial Center FsJay ArNo ratings yet

- Matsolo Factors-Affecting 2018Document20 pagesMatsolo Factors-Affecting 2018Letsie SebelemetjaNo ratings yet

- KLS8 B.inggris TranslateDocument3 pagesKLS8 B.inggris TranslateEndang SidabutarNo ratings yet

- Ir. Soekarno: 1 President of IndonesiaDocument9 pagesIr. Soekarno: 1 President of IndonesiaDino SugiartoNo ratings yet

- Republic of The Philippines Province of Pangasinan Municipality of Bani Barangay San MiguelDocument2 pagesRepublic of The Philippines Province of Pangasinan Municipality of Bani Barangay San MiguelJackielou Aquino Aviles100% (1)

- Vilrose CanjaDocument6 pagesVilrose CanjaI'm Daniel BrillonesNo ratings yet

- SEAMO X 2023 Global Champions Division Grade 2Document5 pagesSEAMO X 2023 Global Champions Division Grade 2Teacher Pwint Phue WaiNo ratings yet

- Academic Excellence2019 - Q3Document21 pagesAcademic Excellence2019 - Q3Jeanmar CabalarNo ratings yet

- Asian LiteratureDocument18 pagesAsian LiteratureRowena Delos Santos AnyayahanNo ratings yet

- BSK Final1Document38 pagesBSK Final1Jalal HADJI AMERNo ratings yet

- Daftar Kesediaan Angkatan I 2023 Dinas Pendidikan Kab Cirebon 130420230907Document20 pagesDaftar Kesediaan Angkatan I 2023 Dinas Pendidikan Kab Cirebon 130420230907Ade MulyonoNo ratings yet

- Lupang HinirangDocument2 pagesLupang HinirangElmar Jan Lagumbay BolañoNo ratings yet

- Mary Jane B. Rodriguez-Tatel: H D (J - D 2015) 12:2, 110-179Document70 pagesMary Jane B. Rodriguez-Tatel: H D (J - D 2015) 12:2, 110-179Angelita Dela cruzNo ratings yet

- Long Quiz Mapeh 8Document2 pagesLong Quiz Mapeh 8Mark Johnson Dela PeñaNo ratings yet

- Danh Sach Thu Nhap 10tr + NHDocument36 pagesDanh Sach Thu Nhap 10tr + NHquandt106No ratings yet

- Philippine IndependenceDocument10 pagesPhilippine Independencemaster PogiNo ratings yet

- AME List 2022Document8 pagesAME List 2022najibNo ratings yet

- Japanese Occupation of CambodiaDocument3 pagesJapanese Occupation of CambodiaPhok Sophan100% (1)

- Administration Errors in SEADocument7 pagesAdministration Errors in SEAFrancis NgNo ratings yet

- Semerluki - Malay Annals Sulalatus SalatinDocument3 pagesSemerluki - Malay Annals Sulalatus SalatinRaistzNo ratings yet

- Quarter 2 WHLP Filipino 10 Week 2Document2 pagesQuarter 2 WHLP Filipino 10 Week 2Riza ValienteNo ratings yet

- Singapore in Global History Ed. Drek Heng & Syed Aljunied, ICAS V14, 2011, 322ppDocument322 pagesSingapore in Global History Ed. Drek Heng & Syed Aljunied, ICAS V14, 2011, 322ppmte1No ratings yet

- Subanon Tribe Question Set.Document1 pageSubanon Tribe Question Set.MARK BRIAN FLORESNo ratings yet

- Philippine Flag Quick Facts Philippine Flag Colors and SymbolsDocument6 pagesPhilippine Flag Quick Facts Philippine Flag Colors and Symbolsjoefrey BalumaNo ratings yet

- Early Tamil Cultural InfluencesDocument24 pagesEarly Tamil Cultural Influencesmadhanraj91100% (1)

- EinsteinDocument39 pagesEinsteinReggie RegaladoNo ratings yet

- Ottoman Connections To PDFDocument56 pagesOttoman Connections To PDFfauzanrasip100% (1)

- Lang Resource Map - GalolenDocument5 pagesLang Resource Map - GalolenKirstyGusmaoNo ratings yet

- Colonial Language PolicyDocument23 pagesColonial Language Policypianobook5No ratings yet

- DD Compaign-Ms. Nghi, Mr. Thanh (20 Cty)Document10 pagesDD Compaign-Ms. Nghi, Mr. Thanh (20 Cty)Nhiên AnNo ratings yet

- 794-Article Text-3327-2-10-20200630Document16 pages794-Article Text-3327-2-10-20200630Koreo DrafNo ratings yet