Professional Documents

Culture Documents

NTPC Result Updated

Uploaded by

Angel BrokingOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

NTPC Result Updated

Uploaded by

Angel BrokingCopyright:

Available Formats

4QFY2012 Result Update | Power

May 14, 2012

NTPC

Performance Highlights

Y/E March (` cr) Net sales Operating profit OPM (%) Rep. Net profit 4QFY2012 16,264 4,112 25.3 2,593 3QFY2012 15,332 2,855 18.6 2,130 % chg qoq 6.1 44.0 666bp 21.7 4QFY2011 15,519 3,644 23.5 2,782 % chg yoy 4.8 12.9 181bp (6.8)

BUY

CMP Target Price

Investment Period

Stock Info Sector Market Cap (` cr) Beta 52 Week High / Low Avg. Daily Volume Face Value (`) BSE Sensex Nifty Reuters Code Bloomberg Code Power 121,909 0.8 192/146 227693 10 16,216 4,908 NTPC.BO NTPC@IN

`148 `201

12 Months

Source: Company, Angel Research

For 4QFY2012, on a standalone basis, NTPC reported a 6.8% yoy decline in its net profit to `2,593cr. Adjusted net profit (after making adjustments for previous years sales, prior-period items, write-back of provisions, provision for tariff adjustments and other adjustments) fell by 4.9% yoy to `2,188cr. Better coal availability resulted in healthy PAF of 94.7% for coal-based pants for the quarter vs. 85.3% in 3QFY2012. We maintain our Buy view on the stock. Top line grows by 4.8% yoy: NTPC reported a 4.8% yoy increase in its top line to `16,264cr, largely on account of higher fuel costs (passed on) and 1,160MW of higher commercial capacity on a yoy basis. The companys ESO rose by 3.2% yoy to 56BU. Operating profit for the quarter increased by 12.9% yoy to `4,112cr. Actual materialization of coal stood at 103% in 4QFY2012 compared to 92.4% in 4QFY2011. The company has indicated that coal materialization has been in excess of 100% till date in 1QFY2013 as well, and power generation is higher by 4.7% for the period. Outlook and valuation: We expect NTPC to register a CAGR of 15.4% and 8.8% in its top line and bottom line over FY2012-14E, respectively. The stock is currently trading at 1.5x FY2013E and 1.4x FY2014E P/BV. Recently, the stock has corrected significantly due to concerns over sufficient coal availability for its plants in the future. We believe these concerns are overdone as we expect the company to bridge the shortage in domestic supply through coal imports and captive coal going ahead. We continue to maintain our Buy rating on the stock with a target price of `201.

Shareholding Pattern (%) Promoters MF / Banks / Indian Fls FII / NRIs / OCBs Indian Public / Others 84.5 9.4 4.1 2.0

Abs. (%) Sensex NTPC

3m

1yr

3yr 36.6 (21.6)

(9.1) (12.5) (18.4) (15.5)

Key financials (Consolidated)

Y/E March (` cr) Net Sales % chg Net Profit % chg EBITDA (%) EPS (`) P/E (x) P/BV (x) RoE (%) RoCE (%) EV/Sales (x) EV/EBITDA (x)

Source: Company, Angel Research

FY2011 57,418 19.0 9,354 5.8 22.8 11.3 13.0 1.8 14.0 9.1 2.6 11.2

FY2012E 64,958 13.1 9,819 5.0 22.3 11.9 12.4 1.6 13.6 8.8 2.5 11.1

FY2013E 74,766 15.1 10,249 4.4 23.1 12.4 11.9 1.5 13.0 9.3 2.3 10.2

FY2014E 86,549 15.8 11,607 13.2 23.4 14.1 10.5 1.4 13.5 9.7 2.2 9.3

V Srinivasan

022-39357800 Ext: 6831 v.srinivasan@angelbroking.com Amit Patil 022-39357800 Ext: 6503 amit.patil@angelbroking.com

Please refer to important disclosures at the end of this report

NTPC | 4QFY2012 Result Update

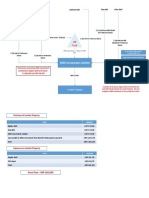

Exhibit 1: Quarterly performance (Standalone)

Y/E March (` cr) Net Sales Fuel cost (% of Sales) Staff Costs (% of Sales) Other Expenses (% of Sales) Total Expenditure Operating Profit OPM Interest Depreciation Other Income PBT (incl. Extr. Items) (% of Sales) Provision for Taxation (% of PBT) Reported PAT PATM EPS (`)

Source: Company, Angel Research

4QFY2012 16,264 10,443 64.2 896 6 812 5 12,151 4,112 25.3 487 736 768 3,657 22 1,064 29.1 2,593 16 3.1

3QFY2012 15,332 10,793 70.4 719 5 965 6 12,477 2,855 18.6 450 756 913 2,563 17 432 16.9 2,130 14 2.6

%Chg qoq 6.1 (3.2) 24.7 (15.9) (2.6) 44.0 8.3 (2.6) (15.9) 42.7 146.0 21.7

4QFY2011 15,519 9,726 63 708 5 1,441 9 11,875 3,644 23.5 360 698 671 3,257 21 475 15 2,782 18 3.4

%Chg yoy 4.8 7.4 26.6 (43.7) 2.3 12.9 35.2 5.5 14.4 12.3 124.0 (6.8)

Exhibit 2: Actual vs. Angel estimates

(` cr) Net Sales Operating Profit OPM (%) Rep. Net Profit

Source: Company, Angel Research

Actual 16,264 4,112 25.3 2,593

Estimates 16,468 4,529 27.5 2,711

Variation (%) (1.2) (9.2) (221)bp (4.3)

May 14, 2012

NTPC | 4QFY2012 Result Update

Operational highlights

During the quarter, NTPCs generation volume rose by 4.1% yoy and 6.8% qoq to 60BU due to improved availability of coal. The companys ESO rose by 3.2% yoy to 56BU. PAF for the quarter stood at 94.2% (85.3%) and 98.7% (97%) for coal and gas-based plants, respectively. Generation loss due to non-availability of coal stood at 0.93BU for the quarter. For FY2012, the company lost 7.8BU (5.1BU in FY2011) due to non-availability of coal. Loss of generation due to grid restriction stood at 4.2BU for the quarter (vs. 2.9BU for 4QFY2011). PLF for coal and gas-based plants stood at 91.1% and 67.0%, respectively.

Exhibit 3: Operational performance

250 200 150 (BU) 100 50 0 FY05 FY06 FY07 FY08 FY09 FY10

PLF (RHS)

94 90 86 82 78 74 FY11 FY12

Generation

Source: Company, Angel Research

Fuel supply

NTPC received 38.6mn tonnes (mt) of coal in 4QFY2012, as against 35.2mt in 4QFY2011. Materialization of coal against actual contracted quantity (ACQ) stood at 103% for the quarter as against 98.6% in 4QFY2011. Due to improved coal availability, the company imported less quantity of coal. NTPC imported 2.2mt of coal during the quarter (vs. 2.6mt in 4QFY2011). Imported coal blending percentage stood at 5.3% in 4QFY2012 (vs. 6.4% during 4QFY2011). The company received 13.4mmscmd of gas in 4QFY2012 as against 13.6mmscmd in 4QFY2011. Gas procured on spot basis during 4QFY2012 stood at 0.48mmscmd. Gas received under long-term RLNG, KG-D6, and APM and PMT mechanisms stood at 1.74mmscmd, 1.42mmscmd, and 9.77mmscmd, respectively.

May 14, 2012

(%)

NTPC | 4QFY2012 Result Update

Capacity addition

NTPC, along with its JVs, currently has 37,014MW capacity, of which 34,416MW of capacity is commercially operational. The two units of 660MW at Solapur and Mauda have obtained all necessary approvals. NTPC also has all necessary permissions for three units of 660MW at Nabinagar, except for acquiring a small portion of land. Also, contract for thermal power project at Vindhyachal is already awarded. Currently, the company targets to add 4,160MW and 4,298MW during FY2013 and FY2014, respectively. The company estimates `20,995cr towards capex in FY2013.

Conference call highlights

NTPCs debtor days as of 4QFY2012 stood at 73 as against 69 days as of 4QFY2011. However, the company indicated that it continues to realize almost 100% of its dues from SEBs in a stipulated time. The increase in debtor days is on account of recovery of sales booked on the basis of revised tariff over a period of six months. Overall coal consumption for FY2012 stood at 141.3mt as against 137mt in FY2011. The company indicated that materialization on ACQ of coal improved to 103% in 4QFY2012 vs. 92.4% in 4QFY2011. CILs switch in pricing mechanism from UHV to GCV has increased NTPCs average cost of generation by ~5%. NTPC has opened tenders of ICBs for importing 4mn tonnes of coal on January 5 and 6, 2012. The company also added that coal prices in the tender were lower by 20-25%. Subsequently, the company has invited tenders on ICB basis to import further 5mn tonnes. NTPC incurred cumulative expenditure of `750cr as of March 2012 towards the development of five mines allotted to it.

Investment arguments

Capacity addition to drive future growth: Going forward, NTPCs growth is expected to be driven by the huge capacity addition planned by the company. The company expects to add 4,160MW capacity in FY2013E and another 4,298MW in FY2014E. In all, the company targets to add ~14,000MW in the Twelfth Plan (FY2012-17). Earnings protected by the regulated return model: NTPC, being a central public utility, is governed by the regulated return model. The CERCs regulations for FY2010-14 provide RoE of 15.5% on regulated equity. As per regulations, fuel costs are a pass-through, which protect the company from cost pressures due to increased fuel costs. NTPC has 85% of its overall output tied up under the long-term PPA route (regulated returns), which ensures power offtake and stable cash flows thereof.

May 14, 2012

NTPC | 4QFY2012 Result Update

Outlook and valuation

We expect NTPC to register a CAGR of 15.4% and 8.8% in its top line and bottom line over FY2012-14E, respectively. The stock is currently trading at 1.5x FY2013E and 1.4x FY2014E P/BV. Recently, the stock has corrected significantly due to concerns over sufficient coal availability for its plants in the future. We believe these concerns are overdone as we expect the company to bridge the shortage in domestic supply through coal imports and captive coal going ahead. We continue to maintain our Buy rating on the stock with a target price of `201.

Exhibit 5: Change in estimates

(` cr) Earlier

Net sales Operating exp. Operating profit Depreciation Interest PBT Tax PAT Source: Angel Research 73,558 56,349 17,208 3,514 3,175 13,685 3,293 10,397

FY2013 Revised Var. (%)

74,766 57,509 17,256 3,747 3,175 13,499 3,248 10,249 1.6 2.1 0.3 6.6 0.0 (1.4) (1.4) (1.4)

FY2014 Earlier

84,843 64,782 20,061 4,114 3,664 15,398 3,782 11,621

Revised

86,549 66,268 20,281 4,387 3,619 15,389 3,780 11,607

Var. (%)

2.0 2.3 1.1 6.6 (1.2) (0.1) (0.1) (0.1)

Exhibit 6: EPS Angel estimates vs. Bloomberg consensus

Year/(`) FY2013E FY2014E

Source: Bloomberg, Angel Research

Angel Est. 12.4 14.1

Bloomberg Consensus Var. (%) over consensus 12.6 14.0 (1.6) 0.4

Exhibit 7: Recommendation summary

Company Reco. Buy Buy Buy CMP (`) Tgt. price (`) Upside (%) FY14E P/BV (x) FY14E P/E (x) FY2012-14E EPS CAGR (%) FY14E RoCE (%) FY14E RoE (%)

CESC GIPCL NTPC

266 63 148

342 98 201

28.8 55.3 35.9

0.6 0.6 1.4

5.5 6.2 10.5

3.9 18.1 8.8

9.3 10.4 9.7

10.9 9.6 13.5

Source: Angel Research

May 14, 2012

NTPC | 4QFY2012 Result Update

Exhibit 8: One-year forward P/BV

310 260 (Share Price `) 210 160 110 60 Apr-06

Apr-07 Price

Apr-08 1.5X

Apr-09 2X

Apr-10 2.5X

Apr-11 3X

Apr-12

Source: BSE, Company, Angel Research

Exhibit 9: Premium/Discount to Sensex P/E

80 70 60 50 40 (%) 30 20 10 0 (10) (20) (30) Apr-05 Apr-06 Apr-07 Apr-08 Apr-09 Apr-10 Apr-11 Apr-12

Prem/Disc to Sensex Source: BSE, Company, Angel Research

Historic Avg Premium

May 14, 2012

NTPC | 4QFY2012 Result Update

Profit and loss statement (Consolidated)

Y/E March (` cr) Total Operating Income % chg Total Expenditure Net Raw Materials Other Mfg costs Personnel EBITDA % chg (% of Net Sales) Depreciation& Amortisation EBIT % chg (% of Net Sales) Interest & other Charges Other Income Share in profit of Associates Recurring PBT Extraordinary Expense/(Inc.) PBT (reported) Tax (% of PBT) PAT (reported) Less Minority Interest PAT After Minority Interest % chg (% of Net Sales) Basic EPS (`) Fully Diluted EPS (`) % chg FY2009 FY2010 FY2011 FY2012 FY2013E FY2014E 44,245 14.5 33,702 27,347 3,823 2,533 10,544 (7.6) 23.8 2,495 8,049 (12.6) 18 2,144 3,402 9,307 9,307 1,215 13.1 8,092 8,092 8.3 18.3 9.8 9.8 8.3 48,231 9.0 35,156 30,188 2,446 2,523 13,075 24.0 27.1 2,894 10,180 26.5 21 2,078 2,947 11,049 11,049 2,211 20.0 8,838 (0.0) 8,838 9.2 18.3 10.7 10.7 9.2 57,418 19.0 44,302 36,414 4,965 2,922 13,117 0.3 22.8 2,720 10,397 2.1 18 2,493 4,488 12,393 12,393 3,044 24.6 9,348 (5.2) 9,354 5.8 16.3 11.3 11.3 5.8 13,137 3,323 25.3 9,814 1.9 9,812 5.0 15.1 11.9 11.9 5.0 64,958 13.1 50,453 43,303 3,900 3,250 14,506 10.6 22.3 3,107 11,399 9.6 18 2,135 3,873 13,137 74,766 15 57,509 49,616 4,340 3,553 17,256 19 23.1 3,747 13,509 19 18 3,175 3,165 13,499 13,499 3,248 24 10,251 1.9 10,249 4.4 14 12.4 12.4 4.4 86,549 16 66,268 57,261 5,023 3,984 20,281 18 23.4 4,387 15,894 18 18 3,619 3,115 15,389 15,389 3,780 25 11,609 1.9 11,607 13.2 13 14.1 14.1 13.2

May 14, 2012

NTPC | 4QFY2012 Result Update

Balance sheet (Consolidated)

Y/E March (` cr) SOURCES OF FUNDS Equity Share Capital Reserves& Surplus Shareholders Funds Minority Interest Total Loans Deferred Tax Liability Total Liabilities APPLICATION OF FUNDS Gross Block Less: Acc. Depreciation Net Block Capital Work-in-Progress Goodwill Investments Current Assets Cash Loans & Advances Others Current liabilities Net Current Assets Mis. Exp. not written off Total Assets 64,741 29,776 34,966 30,929 1 11,696 33,486 17,250 9,006 7,230 12,137 21,349 71,527 32,723 38,804 37,682 1 11,778 33,215 16,053 6,549 10,614 12,908 20,307 20 79,210 34,346 44,863 44,855 1 8,357 38,045 17,860 7,875 12,311 15,274 22,771 87,400 105,400 37,453 49,946 57,665 1 7,357 37,918 14,758 8,909 14,251 15,896 22,021 41,200 64,199 61,665 1 6,357 38,898 12,167 10,329 16,402 16,549 22,349 123,400 45,587 77,812 64,665 1 5,357 41,909 10,879 12,043 18,987 17,235 24,674 172,509 8,246 51,706 59,951 166 38,823 0 8,246 55,993 64,239 279 43,844 230 8,246 61,053 69,298 485 50,392 672 8,246 67,196 75,442 485 60,392 672 8,246 73,776 82,022 485 71,392 672 8,246 81,714 89,960 485 81,392 672 172,509 FY2009 FY2010 FY2011 FY2012E FY2013E FY2014E

98,940 108,592 120,847 136,991 154,571

98,940 108,592 120,847 136,991 154,571

Cash flow statement (Consolidated)

Y/E March (` cr) Profit before tax Depreciation Chg in WC & other adj. Less: Other income Direct taxes paid Cash Flow from Operations (Inc)/ Decin Fixed Assets (Inc)/ Dec in Investments Other income Cash Flow from Investing Issue of Equity Inc./(Dec.) in loans Dividend Paid (Incl. Tax) Others Cash Flow from Financing Inc./(Dec.) in Cash Opening Cash balances Closing Cash balances FY2009

9,307 2,495 (2,782) 3,402 2,566 3,052 (11,344) 1,751 3,402 (6,192) 8,508 3,478 5,030 1,890 15,361 17,250

FY2010

11,049 2,894 408 2,947 2,799 8,606 (14,009) (82) 2,947 (11,144) 5,022 3,682 1,340 (1,198) 17,250 16,053

FY2011 FY2012E FY2013E FY2014E

12,393 2,720 (2,839) 2,590 3,044 6,639 (13,736) 3,420 2,590 (7,726) 6,548 3,654 2,894 1,807 16,053 17,860 13,137 3,107 (2,354) 3,873 3,323 6,694 (21,000) 1,000 3,873 (16,127) 10,000 3,669 6,331 (3,102) 17,860 14,758 13,499 3,747 (2,920) 3,165 3,248 7,913 (22,000) 1,000 3,165 (17,835) 11,000 3,669 7,331 (2,591) 14,758 12,167 15,389 4,387 (3,616) 3,115 3,780 9,266 (21,000) 1,000 3,115 (16,885) 10,000 3,669 6,331 (1,289) 12,167 10,879

May 14, 2012

NTPC | 4QFY2012 Result Update

Key ratios

Y/E March Valuation Ratio (x) P/E (on FDEPS) P/CEPS P/BV Dividend yield (%) EV/Sales EV/EBITDA EV / Total Assets Per Share Data (`) EPS (Basic) EPS (fully diluted) Cash EPS DPS Book Value DuPont Analysis EBIT margin Tax retention ratio Asset turnover (x) ROIC (Post-tax) Cost of Debt (Post Tax) Leverage (x) Operating ROE Returns (%) ROCE (Pre-tax) Angel ROIC (Pre-tax) ROE Turnover ratios (x) Asset Turnover (Gross Block) Inventory / Sales (days) Receivables (days) Payables (days) WC cycle (ex-cash) (days) Solvency ratios (x) Net debt to equity Net debt to EBITDA Interest Coverage (EBIT / Int.)

0.4 2.0 3.8 0.7 26 29 114 25 8.8 17.1 14.2 18.2 86.9 0.6 9.3 5.4 0.6 11.7 9.8 9.8 12.8 4.2 72.7 15.1 11.5 2.0 2.9 3.0 12.5 1.3

FY2009 FY2010 FY2011 FY2012E FY2013E FY2014E 13.8 10.4 1.9 3.0 2.9 10.6 1.3 10.7 10.7 14.2 4.5 77.9 21.1 80.0 0.6 9.4 4.0

0.7

13.0 10.1 1.8 3.0 2.6 11.2 1.2 11.3 11.3 14.6 4.4 84.0 18.1 75.4 0.6 8.0 4.0

0.7

12.4 9.4 1.6 3.0 2.5 11.1 1.2 11.9 11.9 15.7 4.4 91.5 17.5 74.7 0.6 7.6 2.9

0.8

11.9 8.7 1.5 3.0 2.3 10.2 1.1 12.4 12.4 17.0 4.4 99.5 18.1 75.9 0.6 7.8 3.7

0.8

10.5 7.6 1.4 3.0 2.2 9.3 1.1 14.1 14.1 19.4 4.4 109.1 18.4 75.4 0.6 7.9 3.6

0.9

12.9 9.8 19.3 14.2 0.7 26 41 130 32 0.4 2.1 4.9

10.9 9.1 18.4 14.0 0.8 24 49 116 29 0.5 2.5 4.2

11.1 8.8 18.6 13.6 0.8 24 50 113 34 0.6 3.1 5.3

11.2 9.3 18.6 13.0 0.8 25 50 103 43 0.7 3.4 4.3

11.7 9.7 17.9 13.5 0.8 25 50 93 51 0.8 3.5 4.4

May 14, 2012

NTPC | 4QFY2012 Result Update

Research Team Tel: 022 - 39357800

E-mail: research@angelbroking.com

Website: www.angelbroking.com

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement 1. Analyst ownership of the stock 2. Angel and its Group companies ownership of the stock 3. Angel and its Group companies' Directors ownership of the stock 4. Broking relationship with company covered

NTPC No No No No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Returns):

Buy (> 15%) Reduce (-5% to 15%)

Accumulate (5% to 15%) Sell (< -15%)

Neutral (-5 to 5%)

May 14, 2012

10

You might also like

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDocument4 pagesRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingNo ratings yet

- International Commodities Evening Update September 16 2013Document3 pagesInternational Commodities Evening Update September 16 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 16 2013Document6 pagesDaily Metals and Energy Report September 16 2013Angel BrokingNo ratings yet

- WPIInflation August2013Document5 pagesWPIInflation August2013Angel BrokingNo ratings yet

- Oilseeds and Edible Oil UpdateDocument9 pagesOilseeds and Edible Oil UpdateAngel BrokingNo ratings yet

- Daily Agri Tech Report September 14 2013Document2 pagesDaily Agri Tech Report September 14 2013Angel BrokingNo ratings yet

- Daily Agri Report September 16 2013Document9 pagesDaily Agri Report September 16 2013Angel BrokingNo ratings yet

- Derivatives Report 8th JanDocument3 pagesDerivatives Report 8th JanAngel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Currency Daily Report September 16 2013Document4 pagesCurrency Daily Report September 16 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 12 2013Document6 pagesDaily Metals and Energy Report September 12 2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 16 2013Document2 pagesDaily Agri Tech Report September 16 2013Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Document4 pagesDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingNo ratings yet

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDocument6 pagesTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingNo ratings yet

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDocument1 pagePress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument12 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Currency Daily Report September 13 2013Document4 pagesCurrency Daily Report September 13 2013Angel BrokingNo ratings yet

- Metal and Energy Tech Report Sept 13Document2 pagesMetal and Energy Tech Report Sept 13Angel BrokingNo ratings yet

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDocument4 pagesJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingNo ratings yet

- Metal and Energy Tech Report Sept 12Document2 pagesMetal and Energy Tech Report Sept 12Angel BrokingNo ratings yet

- Daily Agri Tech Report September 12 2013Document2 pagesDaily Agri Tech Report September 12 2013Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (19997) / NIFTY (5913)Document4 pagesDaily Technical Report: Sensex (19997) / NIFTY (5913)Angel Broking100% (1)

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Currency Daily Report September 12 2013Document4 pagesCurrency Daily Report September 12 2013Angel BrokingNo ratings yet

- Daily Agri Report September 12 2013Document9 pagesDaily Agri Report September 12 2013Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (19997) / NIFTY (5897)Document4 pagesDaily Technical Report: Sensex (19997) / NIFTY (5897)Angel BrokingNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Akal Company Profile For Wadessa BridgeDocument308 pagesAkal Company Profile For Wadessa BridgeAbudi KasahunNo ratings yet

- On Study of Cash Management at Axis BankDocument18 pagesOn Study of Cash Management at Axis BankHimanshu0% (1)

- 4th SemesterDocument11 pages4th SemesteravimbaNo ratings yet

- Acct 410 #2Document5 pagesAcct 410 #2Mariella NiyoyunguruzaNo ratings yet

- Bookkeeping NC III Assessment Tool Part 2Document1 pageBookkeeping NC III Assessment Tool Part 2Donalyn BannagaoNo ratings yet

- The Nature of Management AccountingDocument7 pagesThe Nature of Management AccountingRui Isaac FernandoNo ratings yet

- FiFA - FA1, FA2, F3Document129 pagesFiFA - FA1, FA2, F3Trann NguyenNo ratings yet

- Gitman pmf13 ppt09Document56 pagesGitman pmf13 ppt09moonaafreenNo ratings yet

- Assurance and Assurance Related Services-Review, Compilation, Profit Forecast, Agreed Upon Procedures and OthersDocument82 pagesAssurance and Assurance Related Services-Review, Compilation, Profit Forecast, Agreed Upon Procedures and OthersWanqi LooNo ratings yet

- Faqs On Overseas Direct Investment: Cs Esha ChakrabortyDocument16 pagesFaqs On Overseas Direct Investment: Cs Esha ChakrabortyStikcon PmcNo ratings yet

- Fabm 2 Module 1Document14 pagesFabm 2 Module 1Marilyn Nelmida TamayoNo ratings yet

- Chapter 1 - Current LiabilitiesDocument25 pagesChapter 1 - Current LiabilitiesKathleen MarcialNo ratings yet

- Annexure: Raghav Bahl Discloses Full Investments in London PropertyDocument2 pagesAnnexure: Raghav Bahl Discloses Full Investments in London PropertyThe Quint100% (1)

- Minutes of The Preferred ShareholdersDocument12 pagesMinutes of The Preferred ShareholdersKlabin_RINo ratings yet

- Financial Performance of Publicly-Traded Agribusinesses (Food Processing Firms) 2013 16pDocument16 pagesFinancial Performance of Publicly-Traded Agribusinesses (Food Processing Firms) 2013 16pdainesecowboyNo ratings yet

- P K Jain Surendra S Yadav Alok Dixit Derrivative Markets in IndiaDocument211 pagesP K Jain Surendra S Yadav Alok Dixit Derrivative Markets in Indiaadv mishraNo ratings yet

- Canara Robeco Large Cap Plus Fund FormDocument8 pagesCanara Robeco Large Cap Plus Fund Formrkdgr87880No ratings yet

- Introduction To IFRS: AccountingDocument16 pagesIntroduction To IFRS: AccountingmulualemNo ratings yet

- Tecniques of Project AppraisalDocument3 pagesTecniques of Project Appraisalqari saibNo ratings yet

- NKNKDocument18 pagesNKNKSophia PerezNo ratings yet

- Exercise Adjusting The AccountDocument4 pagesExercise Adjusting The Accountukandi rukmanaNo ratings yet

- 09 Revenue Recognition IssuesDocument13 pages09 Revenue Recognition Issuesraghavendra_20835414No ratings yet

- BalanceDocument11 pagesBalanceAgreen HotelsNo ratings yet

- AccountingDocument7 pagesAccountingDaniela Pedrosa100% (1)

- Accounting For Merchandising BusinessDocument17 pagesAccounting For Merchandising BusinessFeroz AhmadNo ratings yet

- Session 6 Case Study Questions Workbrain Corp - A Case in Exit StrategyDocument2 pagesSession 6 Case Study Questions Workbrain Corp - A Case in Exit Strategyeruditeaviator0% (1)

- Laporan Keuangan PT Nusa Raya Cipta TBK 30 Juni 2019Document89 pagesLaporan Keuangan PT Nusa Raya Cipta TBK 30 Juni 2019Zaelul AlfinNo ratings yet

- Accounting Study PackDocument113 pagesAccounting Study PackmainardNo ratings yet

- Quiz For Finals With Answers and SolutionsDocument6 pagesQuiz For Finals With Answers and SolutionsCJ GranadaNo ratings yet

- Stern Corporation Case SolutionDocument4 pagesStern Corporation Case SolutionAmanNo ratings yet