Professional Documents

Culture Documents

C.A IPCC Ratio Analysis

Uploaded by

Akash GuptaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

C.A IPCC Ratio Analysis

Uploaded by

Akash GuptaCopyright:

Available Formats

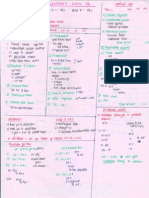

Ratio Analysis: It is concerned with the calculation of relationships, which after proper identification & interpretation may provide

information about the operations and state of affairs of a business enterprise. The analysis is used to provide indicators of past performance in terms of critical success factors of a business. This assistance in decision-making reduces reliance on guesswork and intuition and establishes a basis for sound judgments.

Types of Ratios

Liquidity Measurement Current Ratio Quick Ratio Profitability Indicators Financial Leverage/Gearing Operating Performance Investment Valuation Fixed Assets Turnover Sales/ Revenue Price/Earnings Ratio Price/Earnings to Growth ratio

Profit Margin Analysis Equity Ratio Return on Assets Return on Equity Return on Capital Employed Debt Ratio Debt-Equity Ratio Capitalization Ratio Interest Coverage Ratio

Average Collection Period Dividend Yield Inventory Turnover Total assets Turnover Dividend Payout Ratio

Liquidity Measurement Ratios

Liquidity refers to the ability of a firm to meet its short-term financial obligations when and as they fall due. The main concern of liquidity ratio is to measure the ability of the firms to meet their short-term maturing obligations. The greater the coverage of liquid assets to short-term liabilities the better as it is a clear signal that a company can pay its debts that are coming due in the near future and still fund its ongoing operations. On the other hand, a company with a low coverage rate should raise a red flag for investors as it may be a sign that the company will have difficulty meeting running its operations, as well as meeting its obligations. Ratio Current Ratio Formula Current Assets/Current Liabilities Meaning Analysis

The number of times that the Higher the ratio, the better it is, short term assets can cover the however but too high ratio short term debts. In other words, reflects an in-efficient use of it indicates an ability to meet the resources & too low ratio leads to Current assets includes cash, marketable securities, accounts short term obligations as & wheninsolvency. The ideal ratio is they fall due considered to be 2:1., receivable and inventories. Current liabilities includes accounts payable, short term notes payable, short-term loans, current maturities of long term debt, accrued income taxes and other accrued expenses (Cash+Cash Equivalents+ShortIndicates the ability to meet Term Investments+Accounts short term payments using the Receivables) / Current most liquid assets. This ratio is Liabilities more conservative than the current ratio because it excludes The ideal ratio is 1:1. Another beneficial use is to compare the quick ratio with the current ratio. If the current ratio is significantly higher, it is a clear indication that

Quick Ratio or Acid Test Ratio

inventory and other current the company's current assets are assets, which are more difficult dependent on inventory. to turn into cash Profitability Indicators Ratios Profitability is the ability of a business to earn profit over a period of time.The profitability ratios show the combined effects of liquidity, asset management (activity) and debt management (gearing) on operating results. The overall measure of success of a business is the profitability which results from the effective use of its resources. Ratio Formula Meaning Analysis

Gross Profit Margin

(Gross Profit/Net Sales)*100

A company's cost of goods sold Higher the ratio, the higher is the represents the expense related to profit earned on sales labor, raw materials and manufacturing overhead involved in its production process. This expense is deducted from the company's net sales/revenue, which results in a company's gross profit. The gross profit margin is used to analyze how efficiently a company is using its raw materials, labor and manufacturing-related fixed assets to generate profits. By subtracting selling, general Lower the ratio, lower the and administrative expenses expense related to the sales from a company's gross profit number, we get operating income. Management has much more control over operating expenses than its cost of sales outlays. It Measures the relative impact of operating expenses This ratio measures the ultimate Higher the ratio, the more profitability profitable are the sales. This ratio illustrates how well Higher the return, the more management is employing the efficient management is in company's total assets to make a utilizing its asset base profit. It measures how much the shareholders earned for their investment in the company Higher percentage indicates the management is in utilizing its equity base and the better return is to investors.

Operating Profit Margin

(Operating Profit/Net Sales)*100

Net Profit Margin Return on Assets

(Net Profit/Net Sales)*100 Net Income / Average Total Assets ( Earnings Before Interest & Tax = Net Income)

Return on Equity

Net Income / Average Shareholders Equity*100

Return on Capital Employed

Net Income / Capital EmployedThis ratio complements the return on equity ratio by Capital Employed = Avg. Debt adding a company's debt Liabilities + Avg. Shareholders liabilities, or funded debt, to equity to reflect a company's Equity total "capital employed". This measure narrows the focus to gain a better understanding of a company's ability to generate returns from its available capital base.

It is a more comprehensive profitability indicator because it gauges management's ability to generate earnings from a company's total pool of capital.

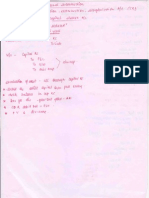

Financial Leverage/Gearing Ratios These ratios indicate the degree to which the activities of a firm are supported by creditors funds as opposed to owners as the relationship of owners equity to borrowed funds is an important indicator of financial strength. The debt requires fixed interest payments and repayment of the loan and legal action can be taken if any amounts due are not paid at the appointed time. A relatively high proportion of funds contributed by the owners indicates a cushion (surplus) which shields creditors against possible losses from default in payment. Financial leverage will be to the advantage of the ordinary shareholders as long as the rate of earnings on capital employed is greater than the rate payable on borrowed funds.

Ratio

Formula

Meaning

Analysis

Equity Ratio

(Ordinary Shareholders Interest / Total assets)*100

This ratio measures the strength A high equity ratio reflects a of the financial structure of the strong financial structure of the company company. A relatively low equity ratio reflects a more speculative situation because of the effect of high leverage and the greater possibility of financial difficulty arising from excessive debt burden. This compares a company's With higher debt ratio (low total debt to its total assets, equity ratio), a very small which is used to gain a general cushion has developed thus not idea as to the amount of giving creditors the security they leverage being used by a require. The company would company. This is the measure of therefore find it relatively financial strength that reflects difficult to raise additional the proportion of capital which financial support from external has been funded by debt, sources if it wished to take that including preference shares. route. The higher the debt ratio

Debt Ratio

Total Debt / Total Assets

the more difficult it becomes for the firm to raise debt. Debt Equity Ratio Total Liabilities / Total Equity . This ratio measures how much A lower ratio is always safer, suppliers, lenders, creditors and however too low ratio reflects an obligors have committed to the in-efficient use of equity. Too company versus what the high ratio reflects either there is a shareholders have committed. debt to a great extent or the This ratio indicates the extent to equity base is too small which debt is covered by shareholders funds. Capitalization Ratio Long Term Debt / (Long Term This ratio measures the debt Debt + Shareholders Equity) component of a company's capital structure, or capitalization (i.e., the sum of long-term debt liabilities and shareholders' equity) to support a company's operations and growth. A low level of debt and a healthy proportion of equity in a company's capital structure is an indication of financial fitness. A company too highly leveraged (too much debt) may find its freedom of action restricted by its creditors and/or have its profitability hurt by high interest costs. This ratio is one of the more meaningful debt ratios because it focuses on the relationship of debt liabilities as a component of a company's total capital base, which is the capital raised by shareholders and lenders.

Interest Coverage Ratio

EBIT / Interest on Long Term This ratio measures the number The lower the ratio, the more the Debt of times a company can meet its company is burdened by debt interest expense expense. When a company's interest coverage ratio is only 1.5 or lower, its ability to meet interest expenses may be questionable.

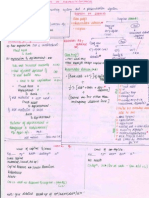

Operating Performance Ratios: These ratios look at how well a company turns its assets into revenue as well as how efficiently a company converts its sales into cash, i.e how efficiently & effectively a company is using its resources to generate sales and increase shareholder value. The better these ratios, the better it is for shareholders.

Ratios

Formula

Meaning

Analysis

Fixed Assets Turnover

Sales / Net Fixed Assets

This ratio is a rough measure of High fixed assets turnovers are the productivity of a preferred since they indicate a company's fixed assets with better efficiency in fixed assets respect to generating sales utilization. The shorter the average collection period, the better the quality of debtors, as a short collection period implies the prompt payment by debtors. An excessively long collection period implies a very liberal and inefficient credit and collection performance. The delay in collection of cash impairs the firms liquidity. On the other hand, too low a collection period is not necessarily favorable, rather it may indicate a very restrictive credit and collection policy which may curtail sales and hence adversely affect profit.

Average Collection Period

( Accounts Receivable/Annual The average collection period Credit Sales )*365 days measures the quality of debtors since it indicates the speed of their collection.

Inventory Turnover Sales / Average Inventory

It measures the stock in relation High ratio indicates that there is to turnover in order to a little chance of the firm determine how often the stock holding damaged or obsolete turns over in the business. stock. It indicates the efficiency of the firm in selling its product. This ratio indicates the Higher the firms total asset efficiency with which the firm turnover, the more efficiently its uses all its assets to generate assets have been utilised. sales.

Total Assets Turnover

Sales / Total Assets

Investment Valuation Ratios: These ratios can be used by investors to estimate the attractiveness of a potential or existing investment and get an idea of its valuation. Ratio Formula Meaning Analysis

Price Earning Ratio Market Price per Share / ( P/E Ratio ) Earnings Per Share

This ratio measures how many A stock with high P/E ratio times a stock is trading (its suggests that investors are price) per each rupee of EPS expecting higher earnings growth in the future compared to the overall market, as investors are paying more for today's earnings in anticipation of future

earnings growth. Hence, stocks with this characteristic are considered to be growth stocks. Conversely, a stock with a low P/E ratio suggests that investors have more modest expectations for its future growth compared to the market as a whole.

Price Earnings to Growth Ratio

( P/E Ratio ) / Earnings Per Share

The price/earnings to growth ratio, commonly referred to as the PEG ratio, is obviously closely related to the P/E ratio. The PEG ratio is a refinement of the P/E ratio and factors in a stock's estimated earnings growth into its current valuation. By comparing a stock's P/E ratio with its projected, or estimated, earnings per share (EPS) growth, investors are given insight into the degree of overpricing or under pricing of a stock's current valuation, as indicated by the traditional P/E ratio.

The general consensus is that if the PEG ratio indicates a value of 1, this means that the market is correctly valuing (the current P/E ratio) a stock in accordance with the stock's current estimated earnings per share growth. If the PEG ratio is less than 1, this means that EPS growth is potentially able to surpass the market's current valuation. In other words, the stock's price is being undervalued. On the other hand, stocks with high PEG ratios can indicate just the opposite - that the stock is currently overvalued.

Dividend Yield Ratio

( Annual Dividend per Share / This ratio allows investors to Market Price per compare the latest dividend they received with the current market value of the share as an Share ) *100 indictor of the return they are earning on their shares (Dividend per Share / Earnings per Share ) * 100 This ratio identifies the percentage of earnings (net income) per common share allocated to paying cash dividends to shareholders. The dividend payout ratio is an indicator of how well earnings support the dividend payment.

This enables an investor to compare ratios for different companies and industries. Higher the ratio, the higher is the return to the investor

Dividend Payout Ratio

You might also like

- Chapter 15 Company AnalysisDocument51 pagesChapter 15 Company Analysissharktale282850% (2)

- Cost of Capital Lecture Slides in PDF FormatDocument18 pagesCost of Capital Lecture Slides in PDF FormatLucy UnNo ratings yet

- Determinants of Financial StructureDocument15 pagesDeterminants of Financial StructureAlexander DeckerNo ratings yet

- Unit 3 Financial Statement Analysis BBS Notes eduNEPAL - Info - PDFDocument3 pagesUnit 3 Financial Statement Analysis BBS Notes eduNEPAL - Info - PDFGrethel Tarun MalenabNo ratings yet

- Cost of Capital ExplainedDocument18 pagesCost of Capital ExplainedzewdieNo ratings yet

- Time Value Money Calculations University NairobiDocument2 pagesTime Value Money Calculations University NairobiDavidNo ratings yet

- Capital Structure Theory - Net Operating Income ApproachDocument3 pagesCapital Structure Theory - Net Operating Income Approachoutlanderlord100% (1)

- Lecture SixDocument10 pagesLecture SixSaviusNo ratings yet

- Partnership AccountingDocument18 pagesPartnership AccountingSani ModiNo ratings yet

- Pepsi and Coke Financial ManagementDocument11 pagesPepsi and Coke Financial ManagementNazish Sohail100% (1)

- B LawDocument240 pagesB LawShaheer MalikNo ratings yet

- Analyze Financial Health with Ratio AnalysisDocument3 pagesAnalyze Financial Health with Ratio AnalysisNeha BatraNo ratings yet

- Treasury Management AssignmentDocument4 pagesTreasury Management AssignmentJed Bentillo100% (1)

- Capital Budgeting MethodsDocument3 pagesCapital Budgeting MethodsRobert RamirezNo ratings yet

- Internship Report Final PDFDocument88 pagesInternship Report Final PDFSumaiya islamNo ratings yet

- Financial Ratio Summary SheetDocument1 pageFinancial Ratio Summary SheetKeith Tomasson100% (1)

- HP Sales Figures & Hedging Policy for FY2014Document7 pagesHP Sales Figures & Hedging Policy for FY2014Tricky TratzNo ratings yet

- Questions Chapter 16 FinanceDocument23 pagesQuestions Chapter 16 FinanceJJNo ratings yet

- Cpa Questions Part XDocument10 pagesCpa Questions Part XAngelo MendezNo ratings yet

- FM CH 1natureoffinancialmanagement 120704104928 Phpapp01 PDFDocument28 pagesFM CH 1natureoffinancialmanagement 120704104928 Phpapp01 PDFvasantharao100% (1)

- Corporate, Business and Functional Level StrategyDocument12 pagesCorporate, Business and Functional Level StrategyASK ME ANYTHING SMARTPHONENo ratings yet

- Leverage PPTDocument13 pagesLeverage PPTamdNo ratings yet

- Af 212 Financial ManagementDocument608 pagesAf 212 Financial ManagementMaster KihimbwaNo ratings yet

- Topic - Week 2 Valuation of Bonds MCQDocument6 pagesTopic - Week 2 Valuation of Bonds MCQmail2manshaaNo ratings yet

- CH 14 FMDocument2 pagesCH 14 FMAsep KurniaNo ratings yet

- Cost of Capital PDFDocument34 pagesCost of Capital PDFMathilda UllyNo ratings yet

- Cecchetti-5e-Ch02 - Money and The Payment SystemDocument46 pagesCecchetti-5e-Ch02 - Money and The Payment SystemammendNo ratings yet

- Applied Corporate Finance TVM Calculations and AnalysisDocument3 pagesApplied Corporate Finance TVM Calculations and AnalysisMuxammil IqbalNo ratings yet

- Hurwicz Criterion in Decision TheroryDocument11 pagesHurwicz Criterion in Decision TherorysubinNo ratings yet

- Banking CompaniesDocument68 pagesBanking CompaniesKiran100% (2)

- Chapter 6 Investing FundamentalsDocument19 pagesChapter 6 Investing Fundamentalsashmita18No ratings yet

- Benefits of Harmonisation and ConvergenceDocument3 pagesBenefits of Harmonisation and ConvergencemclerenNo ratings yet

- Goal of The FirmDocument12 pagesGoal of The FirmCarbon_Adil100% (1)

- Capital StructureDocument59 pagesCapital StructureRajendra MeenaNo ratings yet

- Auditing and Accounting DifferencesDocument65 pagesAuditing and Accounting DifferencesTushar GaurNo ratings yet

- Chapter 10 - Fixed Assets and Intangible AssetsDocument94 pagesChapter 10 - Fixed Assets and Intangible AssetsAsti RahmadaniaNo ratings yet

- Ross 9e FCF SMLDocument425 pagesRoss 9e FCF SMLAlmayayaNo ratings yet

- New Trend BankingDocument9 pagesNew Trend BankingbilalbalushiNo ratings yet

- Dillard R WK #7 Assignment Chapter 7Document2 pagesDillard R WK #7 Assignment Chapter 7Rdillard12100% (1)

- Derivatives Markets: Futures, Options & SwapsDocument20 pagesDerivatives Markets: Futures, Options & SwapsPatrick Earl T. PintacNo ratings yet

- QP March2012 p1Document20 pagesQP March2012 p1Dhanushka Rajapaksha100% (1)

- Cost of CapitalDocument44 pagesCost of CapitalSubia Hasan50% (4)

- Capital Structure Theories ExplainedDocument3 pagesCapital Structure Theories ExplainedshivavishnuNo ratings yet

- Calculating Cost of Capital and WACCDocument21 pagesCalculating Cost of Capital and WACCMardi UmarNo ratings yet

- Chapter 04 Working Capital 1ce Lecture 050930Document71 pagesChapter 04 Working Capital 1ce Lecture 050930rthillai72No ratings yet

- IGNOU MBA MS - 04 Solved Assignment 2011Document12 pagesIGNOU MBA MS - 04 Solved Assignment 2011Nazif LcNo ratings yet

- True and Fair View of Financial StatementsDocument2 pagesTrue and Fair View of Financial StatementsbhaibahiNo ratings yet

- Several Discussion Meetings Have Provided The Following Information About OneDocument1 pageSeveral Discussion Meetings Have Provided The Following Information About OneMuhammad Shahid100% (1)

- Unit-12 Liquidity Vs ProfitabilityDocument14 pagesUnit-12 Liquidity Vs ProfitabilityKusum JaiswalNo ratings yet

- Financial Ratio Analysis, Exercise and WorksheetDocument4 pagesFinancial Ratio Analysis, Exercise and Worksheetatiqahrahim90No ratings yet

- International Portfolio Management Unit 2Document12 pagesInternational Portfolio Management Unit 2Omar Ansar Ali100% (1)

- M09 Gitman50803X 14 MF C09Document56 pagesM09 Gitman50803X 14 MF C09dhfbbbbbbbbbbbbbbbbbhNo ratings yet

- NBFI-Course Outline-2020Document2 pagesNBFI-Course Outline-2020Umair NadeemNo ratings yet

- Financial ManagementDocument51 pagesFinancial Managementarjunmba119624No ratings yet

- Corporate Financial Analysis with Microsoft ExcelFrom EverandCorporate Financial Analysis with Microsoft ExcelRating: 5 out of 5 stars5/5 (1)

- Value Chain Management Capability A Complete Guide - 2020 EditionFrom EverandValue Chain Management Capability A Complete Guide - 2020 EditionNo ratings yet

- Controlling Payroll Cost - Critical Disciplines for Club ProfitabilityFrom EverandControlling Payroll Cost - Critical Disciplines for Club ProfitabilityNo ratings yet

- Sify Notes For C.S ExcDocument16 pagesSify Notes For C.S ExcAkash GuptaNo ratings yet

- Co's Bill Highlights 2013Document18 pagesCo's Bill Highlights 2013Akash GuptaNo ratings yet

- Cs Online Test Sify 1500 Questions MCQDocument110 pagesCs Online Test Sify 1500 Questions MCQcsjournal70% (10)

- Sify Notes For C.S ExcDocument16 pagesSify Notes For C.S ExcAkash GuptaNo ratings yet

- Syllabus Maths Xii (I) To (III)Document3 pagesSyllabus Maths Xii (I) To (III)Akash GuptaNo ratings yet

- EclDocument44 pagesEclAkash GuptaNo ratings yet

- Main Points of Food Security Bill 2013Document2 pagesMain Points of Food Security Bill 2013Akash GuptaNo ratings yet

- Sify NotesDocument3 pagesSify NotesAkash GuptaNo ratings yet

- Partnership AccountsDocument8 pagesPartnership AccountsAkash GuptaNo ratings yet

- Class 11th Cbse AccountsDocument2 pagesClass 11th Cbse AccountsAkash GuptaNo ratings yet

- Sify NotesDocument2 pagesSify NotesAkash GuptaNo ratings yet

- Respaper CA (Icai) - Ipcc - Model Mock Test Group I Paper 1 AccountingDocument6 pagesRespaper CA (Icai) - Ipcc - Model Mock Test Group I Paper 1 AccountingAkash GuptaNo ratings yet

- Class 11th Economics NotesDocument2 pagesClass 11th Economics NotesAkash Gupta0% (1)

- Cs Online Test Sify 1500 Questions MCQDocument110 pagesCs Online Test Sify 1500 Questions MCQcsjournal70% (10)

- Underwiting of Shares & DebenturesDocument1 pageUnderwiting of Shares & DebenturesAkash GuptaNo ratings yet

- Company Final AccountsDocument2 pagesCompany Final AccountsAkash GuptaNo ratings yet

- Self Balancing LedgersDocument2 pagesSelf Balancing LedgersAkash Gupta0% (1)

- Issue and Redemption of DebentureDocument2 pagesIssue and Redemption of DebentureAkash GuptaNo ratings yet

- Accounts From Incomplete RecordsDocument1 pageAccounts From Incomplete RecordsAkash GuptaNo ratings yet

- Investment AccountsDocument1 pageInvestment AccountsAkash GuptaNo ratings yet

- Internal ReconstructionDocument1 pageInternal ReconstructionAkash GuptaNo ratings yet

- Accountants Formulae BookDocument47 pagesAccountants Formulae BookVpln SarmaNo ratings yet

- Accounts of Electricity CompaniesDocument2 pagesAccounts of Electricity CompaniesAkash GuptaNo ratings yet

- Departmental AccountsDocument2 pagesDepartmental AccountsAkash GuptaNo ratings yet

- Cash Flow StatementDocument2 pagesCash Flow StatementCa Anil DangiNo ratings yet

- Branch AccountsDocument4 pagesBranch AccountsAkash GuptaNo ratings yet

- Accounts of Banking CompaniesDocument2 pagesAccounts of Banking CompaniesAkash GuptaNo ratings yet

- Suggested Answers: QuestionsDocument1 pageSuggested Answers: QuestionsAkash GuptaNo ratings yet

- Solved Answer Accounts CA IPCC May. 2010Document13 pagesSolved Answer Accounts CA IPCC May. 2010Akash GuptaNo ratings yet

- ContentsDocument2 pagesContentsAkash GuptaNo ratings yet

- 7 Sections of a Business PlanDocument20 pages7 Sections of a Business PlanamyraeuhjNo ratings yet

- 3608-Case Study - Intercompany and Revenue Recognition Process in SAP For A Professional Services IndustryDocument41 pages3608-Case Study - Intercompany and Revenue Recognition Process in SAP For A Professional Services IndustryVenkata Suryanarayana Murty Pandrangi100% (2)

- Auditing and Assurance ServicesDocument69 pagesAuditing and Assurance Servicesgilli1tr100% (1)

- Kpi Dashboard TemplateDocument15 pagesKpi Dashboard TemplateADINo ratings yet

- Ibm - WK - Co-Om - IbmDocument57 pagesIbm - WK - Co-Om - IbmAnonymous 0xdva5uN2No ratings yet

- Unit 4 Preparation of Final Accounts of A Company: ObjectiveDocument20 pagesUnit 4 Preparation of Final Accounts of A Company: ObjectiveWajid AhmedNo ratings yet

- Cash Flow - Wikipedia, The Free EncyclopediaDocument4 pagesCash Flow - Wikipedia, The Free EncyclopediaSachinsuhaNo ratings yet

- Accounting Concepts and Conventions MCQs Financial Accounting MCQs Part 2 Multiple Choice QuestionsDocument9 pagesAccounting Concepts and Conventions MCQs Financial Accounting MCQs Part 2 Multiple Choice QuestionsKanika BajajNo ratings yet

- Income Statement Problem SolvingDocument12 pagesIncome Statement Problem SolvingMaryjoy CuyosNo ratings yet

- Air Arabia 2017 Financial StatementsDocument62 pagesAir Arabia 2017 Financial StatementsRatika AroraNo ratings yet

- Compare Voltas With Blue Star - EquitymasterDocument12 pagesCompare Voltas With Blue Star - Equitymasteratul.jha2545No ratings yet

- Abm 3 Exam ReviewerDocument7 pagesAbm 3 Exam Reviewerjoshua korylle mahinayNo ratings yet

- F5 Performance Management Question Bank - PDF Dopeeee PDFDocument260 pagesF5 Performance Management Question Bank - PDF Dopeeee PDFmirirai midzi100% (3)

- IFRS 15 SupplementDocument63 pagesIFRS 15 SupplementErwin DavidNo ratings yet

- ch07 SM Carlon 5eDocument39 pagesch07 SM Carlon 5eKyle100% (1)

- Tax Manager in Dallas TX Resume Karen SmithDocument3 pagesTax Manager in Dallas TX Resume Karen Smithkarensmith2No ratings yet

- OSV Piotroski F Score SpreadsheetDocument4 pagesOSV Piotroski F Score SpreadsheetWilliam David EccliNo ratings yet

- Espinola Corp financial analysisDocument6 pagesEspinola Corp financial analysisHannah JoyNo ratings yet

- Taxation of Income in NepalDocument24 pagesTaxation of Income in NepalSophiya PrabinNo ratings yet

- ANALYSIS OF ACQUISITION OF MERCURY ATHLETIC BY ACTIVE GEARDocument9 pagesANALYSIS OF ACQUISITION OF MERCURY ATHLETIC BY ACTIVE GEARVedantam GuptaNo ratings yet

- NYSF Walmart Solutionv2Document41 pagesNYSF Walmart Solutionv2Vianna NgNo ratings yet

- Marginal Analysis of Revenue and Costs Economic ProfitDocument46 pagesMarginal Analysis of Revenue and Costs Economic ProfitKring KringNo ratings yet

- Practical Accounting 1 ReviewerDocument13 pagesPractical Accounting 1 ReviewerKimberly RamosNo ratings yet

- Final Exammm 3Document10 pagesFinal Exammm 3Marianne Adalid MadrigalNo ratings yet

- MAS 08 - FS Analysis PDFDocument20 pagesMAS 08 - FS Analysis PDFAaron tamboongNo ratings yet

- Acctng Reviewer 1Document19 pagesAcctng Reviewer 1alliahnah50% (2)

- 07 Sample PaperDocument42 pages07 Sample Papergaming loverNo ratings yet

- Format of All Accounts For O LevelsDocument1 pageFormat of All Accounts For O Levelsshelaz ngwenyaNo ratings yet

- Pennantpark Investment Corporation: PNNT - NasdaqDocument8 pagesPennantpark Investment Corporation: PNNT - NasdaqnicnicooNo ratings yet

- 16 Interpreting Ratio Analysis: Unit 1 Financial Planning and Analysis Activity Worksheets AnswersDocument2 pages16 Interpreting Ratio Analysis: Unit 1 Financial Planning and Analysis Activity Worksheets AnswersteeeNo ratings yet