Professional Documents

Culture Documents

Faysal Bank deposit products guide

Uploaded by

Shakeel AhmadOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Faysal Bank deposit products guide

Uploaded by

Shakeel AhmadCopyright:

Available Formats

Deposit Products:

Faysal Sahulat - Current Account Faysal Sahulat Current Account addresses your need for instant access to your account from any branch of Faysal Bank nationwide. There is no limit on the number of transactions you can make. Product Features & Benefits

Minimum balance of Rs. 5,000/- is required On maintaining monthly average balance of Rs. 500,000/- or more, following facilities are provided free of charge Cheque Book (upto 100 leaves per year) Pay Orders (upto 5 per month) Monthly Account Statement You also have free access to your account through online banking at all Faysal Bank branches nationwide Easy access to your account through chequebook and Pocketmate Visa Debit Card. Pocketmate can be used globally at more than a million ATMs and over 28 million point of sale (POS) terminals. Service charges apply as per the Banks prevailing Schedule of Charges Faysal Business First - Current Account Faysal Business First Current Account is especially designed to cater your business needs, with minimum balance requirement of Rs. 5,000/- only. It empowers you with the transactional solutions to drive your business forward while facilitating your evolving personal and lifestyle needs. Transactional Waivers: On maintaining monthly average balance of Rs. 150,000/- or more, following facilities are provided free of charge. Chequebook (upto 100 leaves per annum) Pay Orders / Demand Drafts (upto 10 per month) Outward Clearing Cheque Return Free online transaction facility.

Insurance Privileges: Free Faysal aikFaisla Cash Withdrawal Insurance on maintaining a monthly average balance of Rs. 500,000 or more. The plan provides ATM Cash Withdrawal Insurance up to a limit of Rs. 100,000* and over the counter Cash Withdrawal Insurance from any Faysal Bank Branch up to a limit of Rs. 50,000*. Free Business Cover that provides Comprehensive Business Insurance for your business up to a limit of Rs. 1 million* on maintaining a monthly average balance of Rs. 1.5 million or above. The plan provides coverage against: Structural Damage of Business Property Burglary Cash in safe Personal Accident (for Account Holders only) Facial signboard / signage damage Terrorism

Convenience and Accessibility: Free e-statement facility to keep you informed of your daily transactions. Fund transfer facility between any two Faysal Bank accounts or from a Faysal Bank account to 1 Link member bank accounts. Deposit cash at selected Faysal Bank ATMs Easy access to your account through chequebook and Pocketmate Visa Debit Card. Pocketmate can be used globally at more than a million ATMs and over 28 million point of sale (POS) terminals. You can also enjoy the following value added services: Bill payment facility for your utility bills through any Faysal Bank ATM or Customer Interaction Centre. Real time SMS alerts on your transactions. Access to your account at over 225 online branches nationwide. Access to our Customer Interaction Center with dedicated phone banking officers serving you round the clock. Drop box facility at over 125 convenient locations across the country.

Note: All taxes are applicable as per government rules and regulations *Insurance Product Terms & Conditions apply. Faysal Moavin - Savings Account: Faysal Moavin Savings Account allows individual savers like you to enjoy regular profits on monthly basis. Your deposited savings increase in value as monthly profits are added to your savings. Product Features & Benefits:

Minimum balance of Rs.50,000/- is required Attractive profit rates. You are provided with an incentive to save more through a tiered profit structure * Profit is calculated on your daily balance and paid to you on a monthly basis No limit on number of transactions that can be made each month You can easily access your account through chequebook and ATM/Debit Card. You also have access to your account through online banking at all Faysal Bank branches nationwide Service charges apply as per the Banks prevailing Schedule of Charges *Please contact your relationship manager for prevailing profit rates and amount caps. Note: All taxes and Zakat are applicable as per Government regulations.

You might also like

- You’Re a Business Owner, Not a Dummy!: Understand Your Merchant AccountFrom EverandYou’Re a Business Owner, Not a Dummy!: Understand Your Merchant AccountRating: 2 out of 5 stars2/5 (1)

- Agent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaFrom EverandAgent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaNo ratings yet

- Banking Should Be Effortless. With HDFC Bank, The Efforts AreDocument28 pagesBanking Should Be Effortless. With HDFC Bank, The Efforts AreashokscribdaNo ratings yet

- Products and Services of Meezan BankDocument15 pagesProducts and Services of Meezan Bankkakakus100% (1)

- Deposit Schemes: Savings Plus AccountDocument17 pagesDeposit Schemes: Savings Plus AccountMAnmit SIngh DadraNo ratings yet

- Saving AccountDocument29 pagesSaving AccountramshaNo ratings yet

- Faysal Bank SWOT AnalysisDocument11 pagesFaysal Bank SWOT AnalysisMuhammadSufianNo ratings yet

- SAVE MONEY WITH BANK SAVINGS ACCOUNTSDocument11 pagesSAVE MONEY WITH BANK SAVINGS ACCOUNTSপ্রিয়াঙ্কুর ধরNo ratings yet

- Axix Bank AccountsDocument18 pagesAxix Bank AccountsSindhu PriyaNo ratings yet

- Casa PresentationDocument25 pagesCasa PresentationGupta Bhawna GuptaNo ratings yet

- Icici BankDocument56 pagesIcici BankvishwanathvrNo ratings yet

- HDFC Bank provides nationwide banking services with 2000+ branchesDocument16 pagesHDFC Bank provides nationwide banking services with 2000+ branchesVenkateshwar Dasari NethaNo ratings yet

- Allied Bank Different AccountsDocument8 pagesAllied Bank Different AccountsShahzaib KhanNo ratings yet

- Pakassignment - Blogs: Send Your Assignments and Projects To Be Displayed Here As Sample For Others atDocument38 pagesPakassignment - Blogs: Send Your Assignments and Projects To Be Displayed Here As Sample For Others atPakassignmentNo ratings yet

- Standard Offer Letter For Regular CA CustomersDocument3 pagesStandard Offer Letter For Regular CA CustomersmaheshvkrishnaNo ratings yet

- History Faysal BankDocument15 pagesHistory Faysal BankAmeer Ahmad ShaikhNo ratings yet

- Savings Deposit Products FeaturesDocument10 pagesSavings Deposit Products FeaturesHarish YadavNo ratings yet

- Current AccountsDocument21 pagesCurrent AccountsSupriyo SenNo ratings yet

- Difference Between Islamic Banking and Conventional Banking: Account OpeningDocument15 pagesDifference Between Islamic Banking and Conventional Banking: Account OpeningHammad AnwarNo ratings yet

- Difference Between Islamic Banking and Conventional Banking: Account OpeningDocument15 pagesDifference Between Islamic Banking and Conventional Banking: Account OpeningHammad AnwarNo ratings yet

- Faysal Bank LimitedDocument26 pagesFaysal Bank LimitedLaibNo ratings yet

- Marketing Mix OldDocument15 pagesMarketing Mix OldAisha rashidNo ratings yet

- History and Islamic banking services of Allied Bank LimitedDocument21 pagesHistory and Islamic banking services of Allied Bank LimitedRiaz MirzaNo ratings yet

- Savings AccountDocument27 pagesSavings AccountkjlgururajNo ratings yet

- Regular Savings Account - India Post Payments BankDocument2 pagesRegular Savings Account - India Post Payments Bankkaran kolheNo ratings yet

- FM Current Account 1Document9 pagesFM Current Account 1varinder_saroaNo ratings yet

- Retail InfoDocument6 pagesRetail InfoRajeshNo ratings yet

- Internet Banking : Welcome AboardDocument6 pagesInternet Banking : Welcome AboardSmuthu MariNo ratings yet

- Key PointsDocument5 pagesKey PointsAbdul SattarNo ratings yet

- Current AccountDocument21 pagesCurrent AccountSan Awale33% (3)

- CA Account ProductDocument8 pagesCA Account ProductRkNo ratings yet

- HSBC Savings AccountDocument3 pagesHSBC Savings AccountLavanya VitNo ratings yet

- Marketing Mix of Bank Al Habib PakistanDocument6 pagesMarketing Mix of Bank Al Habib Pakistankhalid100% (2)

- Bank IslamiDocument30 pagesBank IslamiEhsan QadirNo ratings yet

- Presentation Senior Club Sav AccDocument20 pagesPresentation Senior Club Sav AccSourabh dubeyNo ratings yet

- HSBC Bank Operations and ServicesDocument21 pagesHSBC Bank Operations and ServicesgtmdewanNo ratings yet

- HSBC Bank Operations and ServicesDocument21 pagesHSBC Bank Operations and ServicesgtmdewanNo ratings yet

- Ibpf FinalDocument38 pagesIbpf FinalHafiz Abdul RehmanNo ratings yet

- STP Analysis For ICICI BankDocument27 pagesSTP Analysis For ICICI BankRohit Jain100% (1)

- BPIDocument58 pagesBPIDaleKevinAmagsilaRoqueNo ratings yet

- ICICI Bank recurring deposits help achieve financial goalsDocument6 pagesICICI Bank recurring deposits help achieve financial goalsDhiraj AhujaNo ratings yet

- Savings Accnt: Privy LeagueDocument8 pagesSavings Accnt: Privy LeagueJashan VirkNo ratings yet

- Types of AccountsDocument7 pagesTypes of AccountsAnna LeeNo ratings yet

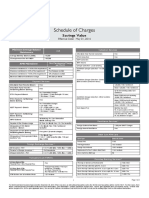

- Schedule of Charges: Savings ValueDocument2 pagesSchedule of Charges: Savings ValueNavjot SinghNo ratings yet

- Products of SoneriDocument17 pagesProducts of SoneriRafay JamshaidNo ratings yet

- Products and Documentation of Meezan Bank LTDDocument23 pagesProducts and Documentation of Meezan Bank LTDzabihullah0% (1)

- PDS Revision Eng & BM Online (Final)Document6 pagesPDS Revision Eng & BM Online (Final)Faiziya BanuNo ratings yet

- Cimb Bank PH Pds Gsave Account 14022019Document3 pagesCimb Bank PH Pds Gsave Account 14022019Joseph Guevarra GillesaniaNo ratings yet

- BPI Banking Services GuideDocument58 pagesBPI Banking Services GuideMarijobel L. SanggalangNo ratings yet

- Afghanistan International BankDocument21 pagesAfghanistan International BankSohel BangiNo ratings yet

- 5 6226516373657356654Document230 pages5 6226516373657356654Sangeeta HatwalNo ratings yet

- Roaming Current AccountDocument3 pagesRoaming Current AccountSumit MewariNo ratings yet

- Badhti Ka Naam ZindagiiDocument14 pagesBadhti Ka Naam Zindagiiamruta_patade_vashiNo ratings yet

- HDFC Bank We Understand Your WorldDocument5 pagesHDFC Bank We Understand Your Worldaaashu77No ratings yet

- PNC - Consumer Schedule of Service Charges and FeesDocument4 pagesPNC - Consumer Schedule of Service Charges and FeesblarghhhhNo ratings yet

- Bab ADocument3 pagesBab ABaba AijazNo ratings yet

- Current AccountsDocument8 pagesCurrent AccountsAnonymous fcqc0EsXHNo ratings yet

- HBL Current Accounts Guide - Basic, Conventional, Freedom & MoreDocument8 pagesHBL Current Accounts Guide - Basic, Conventional, Freedom & MoreAnonymous fcqc0EsXHNo ratings yet

- MidDocument1 pageMidSdspl DelhiNo ratings yet

- Employee Banking Salary Account: For CompaniesDocument8 pagesEmployee Banking Salary Account: For CompaniesNafees NaeemNo ratings yet

- The Indian Navy - Inet (Officers)Document3 pagesThe Indian Navy - Inet (Officers)ANKIT KUMARNo ratings yet

- What Is Taekwondo?Document14 pagesWhat Is Taekwondo?Josiah Salamanca SantiagoNo ratings yet

- Investment Decision RulesDocument113 pagesInvestment Decision RulesHuy PanhaNo ratings yet

- Network Marketing - Money and Reward BrochureDocument24 pagesNetwork Marketing - Money and Reward BrochureMunkhbold ShagdarNo ratings yet

- Mobile phone controlled car locking systemDocument13 pagesMobile phone controlled car locking systemKevin Adrian ZorillaNo ratings yet

- Aclc College of Tacloban Tacloban CityDocument3 pagesAclc College of Tacloban Tacloban Cityjumel delunaNo ratings yet

- Service Culture Module 2Document2 pagesService Culture Module 2Cedrick SedaNo ratings yet

- Test Bank For Goulds Pathophysiology For The Health Professions 5 Edition Karin C VanmeterDocument36 pagesTest Bank For Goulds Pathophysiology For The Health Professions 5 Edition Karin C Vanmetermulctalinereuwlqu100% (41)

- Flowserve Corp Case StudyDocument3 pagesFlowserve Corp Case Studytexwan_No ratings yet

- Dua' - Study Circle 1Document12 pagesDua' - Study Circle 1Dini Ika NordinNo ratings yet

- Introduction To The Appian PlatformDocument13 pagesIntroduction To The Appian PlatformbolillapalidaNo ratings yet

- Fortianalyzer v6.2.8 Upgrade GuideDocument23 pagesFortianalyzer v6.2.8 Upgrade Guidelee zwagerNo ratings yet

- Taxation of XYZ Ltd for 2020Document2 pagesTaxation of XYZ Ltd for 2020zhart1921No ratings yet

- SAS HB 06 Weapons ID ch1 PDFDocument20 pagesSAS HB 06 Weapons ID ch1 PDFChris EfstathiouNo ratings yet

- ECC Ruling on Permanent Disability Benefits OverturnedDocument2 pagesECC Ruling on Permanent Disability Benefits OverturnedmeymeyNo ratings yet

- The Legend of Lam-ang: How a Boy Avenged His Father and Won His BrideDocument3 pagesThe Legend of Lam-ang: How a Boy Avenged His Father and Won His Brideazyl76% (29)

- Microsoft Word - I'm Secretly Married To A Big S - Light DanceDocument4,345 pagesMicrosoft Word - I'm Secretly Married To A Big S - Light DanceAliah LeaNo ratings yet

- Apply for Letter of AdministrationDocument5 pagesApply for Letter of AdministrationCharumathy NairNo ratings yet

- Employee Separation Types and ReasonsDocument39 pagesEmployee Separation Types and ReasonsHarsh GargNo ratings yet

- People v. Romorosa y OstoyDocument12 pagesPeople v. Romorosa y OstoyArjay ElnasNo ratings yet

- CRPC 1973 PDFDocument5 pagesCRPC 1973 PDFAditi SinghNo ratings yet

- Payment of Bonus Form A B C and DDocument13 pagesPayment of Bonus Form A B C and DAmarjeet singhNo ratings yet

- ERA1209-001 Clarification About Points 18.4 and 18.5 of Annex I of Regulation 2018-545 PDFDocument10 pagesERA1209-001 Clarification About Points 18.4 and 18.5 of Annex I of Regulation 2018-545 PDFStan ValiNo ratings yet

- Encyclopædia Americana - Vol II PDFDocument620 pagesEncyclopædia Americana - Vol II PDFRodrigo SilvaNo ratings yet

- A Research Agenda For Creative Tourism: OnlineDocument1 pageA Research Agenda For Creative Tourism: OnlineFelipe Luis GarciaNo ratings yet

- BusLaw Chapter 1Document4 pagesBusLaw Chapter 1ElleNo ratings yet

- Handout 2Document2 pagesHandout 2Manel AbdeljelilNo ratings yet

- SYD611S Individual Assignment 2024Document2 pagesSYD611S Individual Assignment 2024Amunyela FelistasNo ratings yet

- Chua v. CFI DigestDocument1 pageChua v. CFI DigestMae Ann Sarte AchaNo ratings yet

- Decathlon - Retail Management UpdatedDocument15 pagesDecathlon - Retail Management UpdatedManu SrivastavaNo ratings yet