Professional Documents

Culture Documents

Dividend Payout, IPOs and Bearish Market Trend - 200512

Uploaded by

ProshareCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Dividend Payout, IPOs and Bearish Market Trend - 200512

Uploaded by

ProshareCopyright:

Available Formats

Dividend Payout, IPOs and Bearish Market Trend - Proshare

Dividend Payouts, IPOs and Bearish Market Trend

May 20, 2012 / Proshare Research

Stock markets over the years have provided a veritable avenue for well known companies to raise new capital much more easily than they could try to otherwise, just by selling new stock issues to the wide public. Those who bought were almost exclusively those who had enough wealth and income that they could afford to take the risks involved in the expectation that they would then share through dividends paid on the stock in the profits made by the companies whose stock they bought. This worked up until the banking consolidation exercise of 2004-2007 which opened up the market to a larger number of retail but unsophisticated investors who saw dividend payments as an answer to the money markets. Over the ensuing years, and post the market crash, companies are now increasingly financing their new investments out of profits that they retain rather than paying it out in dividends. So the stock markets now exist largely to facilitate trading in outstanding issues of companies stock. In effect, stock market prices are now determined largely by speculators seeking capital gains. For a market that has traditionally been assessing value from dividend payments, the current bearish trend challenges this paradigm. Investors who expect to enjoy capital gains arising from share price appreciation on their investments now face a reversal of expectations. We ran a screen on capital gains/dividend per stocks for those with bearish sales trends. Analysis revealed that out of the forty (40) quoted companies listed between 2008 and 2010, thirty-seven (37) firms are trading below their listing prices while only three (3) stock are trading above their listing price. Starcomms Plc led the chart with -96.51% price declines in relation to its listing price while Daar Communications and Omatek Plc followed closed with -90.48% and 90.27% respectively. However, Pinnacle Point Group, Capital Hotel and McNichols Plc all recorded price appreciation of +10.14%, +4.31% and +4.08% respectively after their listing on the bourse.

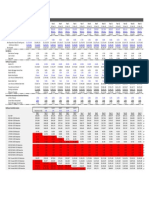

Listing Dates 14-Jul-08 26-Sep-08 18-Jun-08 04-Jun-08 28-Nov-08 17-Sep-09 25-Apr-08 23-Jun-08 11-Sep-08 18-May-09 23-Jul-08 No of Shares Listed (bln) 6,878.48 8,000.00 2,941.79 1,500.00 4,893.59 20,585.00 8,679.15 3,211.63 3,553.14 4,237.27 2,200.00 Current Price (16-May-2012) 0.50 0.50 0.50 0.93 0.50 0.50 0.50 0.50 0.50 0.50 0.50

Compan(ies) STARCOMMS DAARCOMM OMATEK FIDSON MTI AFRINSURE ASOSAVINGS TANTALIZER UNIONDAC AFROMEDIA FTNCOCOA

Listing Price 14.33 5.25 5.14 7.87 4.00 3.67 3.67 3.67 3.00 2.92 2.85

% Return -96.51% -90.48% -90.27% -88.18% -87.50% -86.38% -86.38% -86.38% -83.33% -82.88% -82.46%

www.proshareng.com

Dividend Payout, IPOs and Bearish Market Trend - Proshare

CHAMS COURTVILLE BECOPETRO UNITYKAP MULTIVERSE PAINTCOM HMARKINS UNIVINSURE HONYFLOUR REGALINS GOLDINSURE PORTPAINT MTECH MULTITREX IAINSURE ABBEYBDS IHS DANGFLOUR BAGCO GTASSURE RESORTSAL NPFMCRFBK DANGCEM ETRANZACT SKYESHELT UHOMREIT MCNICHOLS CAPHOTEL PNG

24-Sep-08 01-Apr-09 07-Oct-09 17-Dec-09 08-Oct-08 02-Nov-10 22-Feb-08 11-Feb-08 20-Oct-09 27-May-08 12-Feb-08 09-Jul-09 09-Jun-09 01-Nov-10 09-May-08 21-Oct-08 27-Jan-09 04-Feb-08 09-Apr-08 19-Nov-09 23-Nov-09 01-Dec-10 26-Oct-10 10-Jul-09 26-Feb-08 02-Jul-10 18-Dec-09 14-Aug-08 17-Mar-09

4,620.60 2,960.00 3,716.98 13,000.00 4,261.94 792.91 6,000.00 16,000.00 7,930.20 6,668.75 4,549.95 400.00 4,966.67 3,722.49 28,000.00 4,200.00 4,400.00 5,000.00 6,215.00 10,000.00 13,175.73 2,286.64 17,040.50 4,200.00 20.00 250.02 201.89 1,548.78 4,579.78

2.62 2.62 2.5 2.38 2.15 3.90 1.94 1.94 8.50 1.75 1.89 10.00 2.50 3.00 1.36 3.89 5.25 15.00 4.09 3.00 0.95 1.50 135.00 4.8 105.00 52.50 0.98 6.50 6.61

0.50 0.50 0.50 0.50 0.50 1.00 0.50 0.50 2.25 0.50 0.55 3.60 0.91 1.10 0.50 1.44 2.35 6.95 1.99 1.57 0.50 1.07 112.00 4.47 100.00 50.00 1.02 6.78 7.28

-80.92% -80.92% -80.00% -78.99% -76.74% -74.36% -74.23% -74.23% -73.53% -71.43% -70.90% -64.00% -63.60% -63.33% -63.24% -62.98% -55.24% -53.67% -51.34% -47.67% -47.37% -28.67% -17.04% -6.88% -4.76% -4.76% 4.08% 4.31% 10.14%

Source: Proshare Research/NSE

Despite majority of the quoted companies recording price depreciation, some quoted firms rewarded investors with cash dividends or bonus shares which helped compensate for the capital losses recorded as a result of the wholesome price depreciations on the bourse. To the naked eye, the difference between an investment returning say 15% per annum and the one returning 17% per annum may not look like much in the near term. But as the time horizon increases, the difference keeps getting bigger. For instance, after 10 years, the investment yielding 17% per annum will have accumulated nearly 20% more money than the one with 15%. And after 20 years, the difference would have gone up by as much as 40%. Thus, when it comes to investing, even a couple of percentage points of extra returns matter. However, we routinely encounter cases where investors turn a blind eye to these facts. Nowhere is this more evident than in the case of dividends paid out. Ask most

www.proshareng.com

Dividend Payout, IPOs and Bearish Market Trend - Proshare

(retail predominantly) investors and they will say that they invest in stocks only because of the capital appreciation potential of the same. Dividends are seldom the decision drivers. However, from the example above shows, such investors are likely to end up paying a significant price for their dividend negligence over the long term. In 2010, out the eighty-four (84) companies that declared dividend or bonuses, fortyseven (47) recorded price appreciation, thirty-three (33) recorded price depreciation while four (4) closed flat. Berger Paints and Capital Hotels Plc led the gainers with +175% and +139.13% while Unity Kapital Assurance and Beco Petroleum Plc led the losers with -78.99% and -76.28% respectively.

Company Returns in 2010 Company Berger Paints Capital Hotels Plc Ashaka Cement Plc Ikeja Hotels Plc Julius Berger Plc Flour Mills Nigeria Plc Northern Nigeria Flour Mills Plc Nigerian Bottling Company Plc Dangote Flour Mills Plc Benue Cement Plc Skye Bank Plc Total Nigeria Plc Fidson Healthcare Plc Nestle Nigeria Plc Guinness Nigeria Plc Nigerian Breweries Plc Nigerian Bag Man. Co. Plc Mobil Oil Nigeria Plc Nahco Aviance Plc Red Star Express Plc National Salt Company Nig Plc Lafarge Wapco Plc Seven-Up Plc University Press Plc Conoil Plc Stanbic IBTC Bank Plc PZ Cussons Nig Plc Access Bank Plc Glaxosmithkline Plc Cap Plc A.G. Leventis Cement Co. of Northern Nigeria Vitafoam Plc Guaranty Trust Bank 10k N0.24 N2.00 80k N0.50 50k N1.00 N0.05 N8.28, 200k N0.22 N10.60 825k N1.50, 0.89k 13k N7.00 25k,45k 30k 50k N0.10 1.75k 40k 150k N0.30 86K 20k N0.75 N1.60k, N1.00 10k 10k N0.25k N0.75, 25k 1 for 4 1 for 3 1 for 10 1 for 4 1 for 5 1 for 10 1 for 5 Dividend Declared 50k N0.075 1 for 8 Bonus Declared Share Price 04-Jan-10 3.2 1.38 11.39 0.87 25.79 36.2 22.94 22.49 10.42 43.01 5.48 149 1.86 239.5 127.5 53 1.52 98.8 7.18 2.15 4.56 30 29.4 4.97 27.63 7.16 25 7.55 22.4 28 2.47 13 5.37 15.78 31-Dec-10 8.8 3.3 26.5 1.79 50 67.7 40.43 38 16.54 68 8.63 234 2.91 368.55 190.56 77 2.18 141 9.9 2.88 6.1 40 39 6.57 36.44 9.2 31.45 9.3 27.49 34.03 2.95 15.5 6.06 17.8 % Change 175.00% 139.13% 132.66% 105.75% 93.87% 87.02% 76.24% 68.96% 58.73% 58.10% 57.48% 57.05% 56.45% 53.88% 49.46% 45.28% 43.42% 42.71% 37.88% 33.95% 33.77% 33.33% 32.65% 32.19% 31.89% 28.49% 25.80% 23.18% 22.72% 21.54% 19.43% 19.23% 12.85% 12.80%

www.proshareng.com

Dividend Payout, IPOs and Bearish Market Trend - Proshare

Zenith Bank Plc Presco Plc Japaul Oil & Maritime Services Plc Custodian & Allied Insurance Plc FCMB Beta Glass Plc May and Baker Nigeria Plc Dangote Sugar Refinery Plc Fidelity Bank PLc FTN Cocoa Ecobank Transnational Plc UACN Plc Law Union & Rock Insurance Plc Courteville Guinea Insurance Plc Multiverse Resort Savings & Loans Plc Transnationwide Express Plc SCOA Plc Portland Paints Plc First Bank Plc MRS Nigeria Plc Smarts Products Nigeria Plc Roads Plc Continental Reinsurance Plc NCR( Nigeria) Plc UBA Adswitch Plc Abbey Building Society Plc Longman Nigeria Plc UACN Prop Starcomms Cutix Plc Guaranty Trust Assurance Plc Associated Bus Company Plc Academy Press Plc Oando Plc Afromedia Plc Boc Gases Airline Services and Logistics Plc Okomu oil Palm Plc C & I Leasing Plc Honeywell Flour Mills Plc Chellarams Plc Prestige Assurance Plc

N0.45 N0.20 N0.08 6 kobo 5k N0.36

1 for 4

13.5 5.6 1.18 2.86 7.01 14.26

15.01 6.22 1.31 3.15 7.7 15.58 4.2 16 2.7 0.57 15.7 37.56 0.52 0.5 0.5 0.5 0.5 6.4 8.71 5.55 13.7 66.56 1.43 3.01 1 7.3 9.17 1.9 1.33 7.3 16.02 1.45 2.21 1.59 0.53 3.87 66.2 0.56 9.2 1.72 14.5 1.61 5.1 8.08 2.2

11.19% 11.07% 11.02% 10.14% 9.84% 9.26% 8.81% 7.38% 7.14% 5.56% 4.67% 2.20% 1.96% 0.00% 0.00% 0.00% 0.00% -0.78% -1.14% -2.12% -2.14% -4.63% -5.92% -8.79% -13.04% -14.22% -15.17% -17.39% -17.39% -19.16% -19.34% -19.44% -26.33% -27.06% -27.40% -28.33% -29.57% -30.00% -31.75% -35.09% -36.26% -39.25% -40.00% -42.82% -45.00%

2 for 5 N1.00 N0.025 N3.50k 0.3cents N1.30k 3k 4k 1k 1k 0.01k 5k N0.10 12k N0.10 1.25k 9k N0.45 5.5k 5k N0.10 2 kobo 4k 50k 50k Nil 12k 4k 3k 7k N3.00 N0.05 N0.30 10k N0.30 2k 11k 8k 10k 1 for 3 1 for 2 1 for 4 1 for 5 1 for 8 1 for 4

3.86 14.9 2.52 0.54 15 36.75 0.51 0.5 0.5 0.5 0.5 6.45 8.81 5.67 14 69.79 1.52 3.3 1.15 8.51 10.81 2.3 1.61 9.03 19.86 1.8 3 2.18 0.73 5.4 93.99 0.8 13.48 2.65 22.75 2.65 8.5 14.13 4

www.proshareng.com

Dividend Payout, IPOs and Bearish Market Trend - Proshare

Goldlink Insurance Plc RT Briscoe Plc Poly Products Plc Beco Petroleum Unity Kapital Assurance Plc Source: Proshare Research/NSE

2k N0.10 8k N0.01 1 for 19 1 for 5

0.91 6.15 4.45 2.53 2.38

0.5 3 1.95 0.6 0.5

-45.05% -51.22% -56.18% -76.28% -78.99%

In 2011, seventy-nine (79) firms declared cash and bonus dividends with very few recording positive share price movement. Of this number, fourteen (14) quoted firms that declared dividends recorded price appreciation, while sixty (60) firms recorded price decline, with the remaining five (5) closing flat.

Company Returns in 2011 Company Roads Plc Capital Hotels Plc Okomu Oil Palm Plc NCR Plc Guiness Nigeria Plc Presco Plc Airline Services & Logistics Plc Nigerian Breweries Plc Nestle Nig Plc Seven-Up Bottling Co. Plc Unilever Nigeria Plc Abbey Building Society Plc Neimeth Plc Lafarge WAPCO Plc Consolidated Hallmark Insurance Plc Courtville Investment Plc Regency Alliance Insurance Plc Royal Exchange Plc Sovereign Trust Insurance Plc Portland Paints Plc Tantalizer Plc Flour Mills Plc GTAssure Plc Dangote Cement Plc Nem Insurance Plc ABC Plc IHS Nig Plc Aluminium Extrusion Ind. Plc MRS Oil Plc Stanbic IBTC Bank Plc Law Union & Rock Plc PZ Cussons Plc 0.03 16 kobo 2k 2.00 9k 2.25 0.05 2kobo, 3k 6k 5kobo 1.25k 39k 5kobo 0.86 1 for 4 Dividend Declared 50k 0.075 100k, 50k 3.00 10.00 0.2, 0.50 15k 1.25k 10.60kobo, 1.50k 200k 1.10 5kobo 0.05k 25kobo 3kobo 4.5k 2k 1 for 8 1 for 5 Bonus Declared Share Price 04-Jan-11 3.01 3.3 15.2 6.94 190.56 6.85 1.72 77.32 368.55 39 26.1 1.33 1.01 41 0.5 0.5 0.5 0.5 0.5 5.28 0.53 70 1.52 120 0.59 0.55 2.86 12.39 66.56 9.39 0.57 32.01 30-Dec-11 8.69 6.78 23.1 9.31 250 8.67 2.17 94.42 445.66 46.47 29 1.44 1.08 43.25 0.5 0.5 0.5 0.5 0.5 5.11 0.5 65.45 1.42 110.77 0.54 0.5 2.59 11.15 59 8.3 0.5 28 % Change 188.70% 105.45% 51.97% 34.15% 31.19% 26.57% 26.16% 22.12% 20.92% 19.15% 11.11% 8.27% 6.93% 5.49% 0.00% 0.00% 0.00% 0.00% 0.00% -3.22% -5.66% -6.50% -6.58% -7.69% -8.47% -9.09% -9.44% -10.01% -11.36% -11.61% -12.28% -12.53%

www.proshareng.com

Dividend Payout, IPOs and Bearish Market Trend - Proshare

Conoil Plc Nigerian Enamelware Plc Chellarams Plc Continental Reinsurance Plc Niger Insurance Plc UAC Plc Red Star Express Plc Total Nigeria Plc Zenith Bank Plc GTBank Plc Vitafoam Nig Plc Custodian & Allied Insurance Plc BOC Gases Plc Nigerian Bags Manufacturing Company Plc Smart Products Plc UPDC Plc Cutix Plc ETI Plc National Salt Coy of Nigeria Plc Julius Berger Plc NPF Micrrofinance Bank Plc First Bank Plc Academy Press Plc AIICO Insurance Plc AG Leventis Plc Trasnationwide Plc Northern Nig Flour Mills Plc FCMB Plc University Press Plc Fidelity Bank Plc Nacho Aviance Plc Access Bank Plc Honeywell Flour Mills Plc Prestige Assurance Plc Unity Bank Plc CAP Plc Skye Bank Plc RT Briscoe Plc Ashaka Cement Plc Longman Oando Plc Dangote Sugar Refinery Plc Dangote Flour Mills Plc UBA Plc

2.00 42k 10kobo 7.5k 1 for 10 1.10 0.30 600k, 200 85k 75k,25k 30 kobo 7k ( Interim) 36k 13kobo 0.12k 55 kobo 12k 0.4cents 50k 2.00 5k 0.60k 7.5 5kobo 12k 5k 90k 35k 35k 0.14 40k, 15k 0.20k, 30k 13k 0.06 0.5k 2.00 0.40 10k 30k 0.25 N3.00 60k 20k 5k 1 for 4 1 for 4 1 for 5 1 for 6 1 for 20 1 for 1 1 for 2 1 for 4 1 for 4 1 for 4

36.44 42.66 7.6 1 0.6 38.13 2.97 234 15.39 18.26 6.5 3 9.2 2.3 1.43 16.51 2.21 15.7 6.09 50 1.78 14.19 3.68 0.9 2.54 6.4 39.88 7.79 6.5 2.82 10.2 9.97 5 2.09 1.26 34.03 9.08 2.9 27.83 7.3 67 16 17.1 9.5

31.5 36.19 6.43 0.84 0.5 31.18 2.39 188.1 12.18 14.25 5.06 2.28 6.85 1.7 1.04 12 1.55 10.5 4.01 31.6 1.12 8.9 2.2 0.5 1.38 3.45 21.48 4.18 3.4 1.46 5.14 4.8 2.31 0.94 0.55 14.5 3.84 1.22 11.3 2.95 22 4.7 5 2.59

-13.56% -15.17% -15.39% -16.00% -16.67% -18.23% -19.53% -19.62% -20.86% -21.96% -22.15% -24.00% -25.54% -26.09% -27.27% -27.32% -29.86% -33.12% -34.15% -36.80% -37.08% -37.28% -40.22% -44.44% -45.67% -46.09% -46.14% -46.34% -47.69% -48.23% -49.61% -51.86% -53.80% -55.02% -56.35% -57.39% -57.71% -57.93% -59.40% -59.59% -67.16% -70.63% -70.76% -72.74%

www.proshareng.com

Dividend Payout, IPOs and Bearish Market Trend - Proshare

Fidson Healthcare Plc Diamond Bank Plc Paints & Coatings Plc Source: Proshare Research/NSE

10kobo 15k 6k

3.06 7.87 3.36

0.79 1.92 0.52

-74.18% -75.60% -84.52%

As at April 2012, forty-nine (49) quoted firms have declared dividends of various amounts. Based on the price return analysis done on those companies as at 11th May, 2012, twenty-one (21) of such stocks recording price appreciations while twenty (20) recorded a depreciation in share price, with the remaining eight (8) closing flat till date.

Company Returns in 2012 Dividend Declared 8 kobo 1.50k 1.00k 25k 3.00k 70k 1 for 50 10k 3 for 20 10k 80k 95kobo 3.00 30k 0.08k 1.25k 0.4cents 1.50k 11.05k (Final), 1.50k (Int) 75k 8k 0.025 6k 0.7k 5 kobo 4 Kobo 2k 1.40k 5k 5.00k 2k 2.40k 5k 5k 1 for 5 1 for 20 1 for10 1 for 5 1 for 5 Share Price 03-Jan-12 11-May-12 0.52 14.5 8.67 5.39 9.31 4.07 2.6 1.01 4.1 1.22 9.07 12.3 95.03 5.23 1.35 110.77 10.5 31.48 423.38 43.25 0.8 0.5 0.52 6.78 0.5 0.5 0.5 29 0.5 133.91 1.12 31.6 3.45 11.15 1.05 24.3 13.65 8.16 13.8 6 3.81 1.31 5.25 1.52 11.3 14.99 112 6.01 1.55 121.5 11.5 34.01 439.95 44.94 0.82 0.5 0.52 6.78 0.5 0.5 0.5 29 0.5 132.9 1.07 30.1 3.28 10.6

Company

Bonus Declared

% Change 101.92% 67.59% 57.44% 51.39% 48.23% 47.42% 46.54% 29.70% 28.05% 24.59% 24.59% 21.87% 17.86% 14.91% 14.81% 9.69% 9.52% 8.04% 3.91% 3.91% 2.50% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% -0.75% -4.46% -4.75% -4.93% -4.93%

Paints & Coatings Mfg. Plc CAP Plc Presco Plc Nacho Plc NCR Nigeria Plc Nascon Plc UBA Plc Sterling Bank Plc FCMB Plc RT Briscoe Plc First Bank Plc Zenith Bank Plc Nigerian Breweries Plc Dangote Flour Mills Plc GTAssure Plc Dangote Cement Plc ETI Plc UAC of Nig Plc Nestle Nig Plc Lafarge Wapco Plc Continental Reinsurance Plc Afromedia Plc AIICO Insurance Plc Capital Hotels Plc Courteville Bus. Solutions Plc Sovereign Trust Ins. Plc Tantalizer Plc Unilever Nigeria Plc UTC Nigeria Plc Mobil Oil Plc NPF Microfinance Plc Julius Berger Plc Trans-Nationwide Exp. Plc Aluminum Extrusion Ind. Plc

www.proshareng.com

Dividend Payout, IPOs and Bearish Market Trend - Proshare

Fidelity Bank Plc UAC Propety Devt Co. Plc Ashaka Cement Plc Nem Insurance Plc Beta Glass Plc Skye Bank Plc AG Leventis Plc GlaxoSmithKline Plc Stanbic IBTC Bank Plc Custodian & Allied Ins. Plc Total Nigeria Plc Portland Paints Plc Vitafoam Plc Japaul Oil & Maritime Plc MRS Oil Plc Source: Proshare Research/NSE

14k 0.65k 40k 5k 0.40k 25k 14k 1.20k 0.10k 8k 7.00k 20k 30kobo 2k 70k

1.43 12 11.61 0.56 12.71 3.9 1.38 23 8.02 2.34 188.1 5.11 5.31 0.94 59

1.33 11.01 10.49 0.5 11.1 3.35 1.17 19 6.62 1.8 138.95 3.42 3.51 0.57 35

-6.99% -8.25% -9.65% -10.71% -12.67% -14.10% -15.22% -17.39% -17.46% -23.08% -26.13% -33.07% -33.90% -39.36% -40.68%

Thus, as we have seen, dividends not only help propel investment returns over the long term, they also help generate sizeable returns during periods when the stock markets go through lean times. Little wonder, dividend paying stocks remain a must have in one's portfolio. Yet this trend is changing and investors should be aware. It is time to start adjusting expectations and note that the promise of dividend in offers or private placements ahead of listings may not be guaranteed.

DISCLAIMER/ADVICE TO READERS:

While the website is checked for accuracy, we are not liable for any incorrect information included. The details of this publication should not be construed as an investment advice by the author/analyst or the publishers/Proshare. Proshare Limited, its employees and analysts accept no liability for any loss arising from the use of this information. All opinions on this page/site constitute the authors best estimate judgement as of this date and are subject to change without notice. Investors should see the content of this page as one of the factors to consider in making their investment decision. We recommend that you make enquiries based on your own circumstances and, if necessary, take professional advice before entering into transactions. This information is published with the consent of the author(s) for circulation in/to our online investment community in accordance with the terms of usage. Further enquiries should be directed to the author.

www.proshareng.com

You might also like

- Stock Certificate TemplateDocument2 pagesStock Certificate TemplateAnasor Go80% (5)

- Walter SchlossDocument40 pagesWalter SchlossB.C. Moon91% (11)

- Market Internals v2 PDFDocument30 pagesMarket Internals v2 PDFJayBajrangNo ratings yet

- Ust Inc Case SolutionDocument16 pagesUst Inc Case SolutionJamshaid Mannan100% (2)

- Debt Policy at UST Inc.Document47 pagesDebt Policy at UST Inc.karthikk1990100% (2)

- Evercore Partners 8.6.13 PDFDocument6 pagesEvercore Partners 8.6.13 PDFChad Thayer VNo ratings yet

- CPSE ETF - FFO PresentationDocument34 pagesCPSE ETF - FFO PresentationBhanuprakashReddyDandavoluNo ratings yet

- The Conceptual Foundations of Investing: A Short Book of Need-to-Know EssentialsFrom EverandThe Conceptual Foundations of Investing: A Short Book of Need-to-Know EssentialsNo ratings yet

- ch16 Dilutive Securities - Amp - EPS OLDDocument120 pagesch16 Dilutive Securities - Amp - EPS OLDnandidhiya100% (1)

- Owls Creek's Fourth Quarter Letter To InvestorsDocument14 pagesOwls Creek's Fourth Quarter Letter To InvestorsDealBook100% (14)

- LatAm Startup Market Monthly Overview - ItauDocument10 pagesLatAm Startup Market Monthly Overview - ItauAngel NovoaNo ratings yet

- Petrolera Zuata Petrozuata CA. AnswerDocument8 pagesPetrolera Zuata Petrozuata CA. AnswerKelvinItemuagbor100% (1)

- Case Study 2: Growing Pains ForecastDocument15 pagesCase Study 2: Growing Pains ForecastCheveem Grace Emnace100% (1)

- BudgetBrief2012 PDFDocument90 pagesBudgetBrief2012 PDFIdara Tehqiqat Imam Ahmad RazaNo ratings yet

- Nifty CalculationDocument25 pagesNifty Calculationpratz2706No ratings yet

- Noble Group Valuation Case StudyDocument39 pagesNoble Group Valuation Case StudyVarshneyaSridharanNo ratings yet

- Refinance Risk Analysis Tool: Visit This Model's WebpageDocument4 pagesRefinance Risk Analysis Tool: Visit This Model's WebpageAyush PandeNo ratings yet

- Key Tenets To Reduce Risks While Investing in EquitDocument8 pagesKey Tenets To Reduce Risks While Investing in EquitdigthreeNo ratings yet

- GCC StrategyDocument132 pagesGCC StrategyAmedo MosayNo ratings yet

- New Malls Contribute: Capitamalls AsiaDocument7 pagesNew Malls Contribute: Capitamalls AsiaNicholas AngNo ratings yet

- NothingbutNet 2008InternetInvestmentGuideDocument312 pagesNothingbutNet 2008InternetInvestmentGuideUbaid DhiyanNo ratings yet

- ITC detailed analysis strengths weaknesses forecastsDocument14 pagesITC detailed analysis strengths weaknesses forecastsShivang KalraNo ratings yet

- Annual Letter 2018Document28 pagesAnnual Letter 2018Incandescent Capital100% (1)

- STAADocument17 pagesSTAABlack Stork Research60% (5)

- Daily Trade Journal - 14.05.2013Document6 pagesDaily Trade Journal - 14.05.2013Randora LkNo ratings yet

- 3M Company: 20.1 15.0 Recent Price P/E Ratio Relative P/E Ratio Div'D YLDDocument1 page3M Company: 20.1 15.0 Recent Price P/E Ratio Relative P/E Ratio Div'D YLDasdzxcv1234No ratings yet

- Daily Trade Journal - 17.06.2013Document7 pagesDaily Trade Journal - 17.06.2013Randora LkNo ratings yet

- The Need To InvestDocument10 pagesThe Need To InvestÂj AjithNo ratings yet

- Quantletter Q30Document3 pagesQuantletter Q30pareshpatel99No ratings yet

- Smelling of Roses in London: Ho Bee InvestmentsDocument7 pagesSmelling of Roses in London: Ho Bee InvestmentsphuawlNo ratings yet

- Essar SteelDocument10 pagesEssar Steelchin2dabgarNo ratings yet

- NAV Mutual FundsDocument18 pagesNAV Mutual FundsBriana DizonNo ratings yet

- 2009-01-26 CEE Valuation MonitorDocument66 pages2009-01-26 CEE Valuation MonitorInternational Business TimesNo ratings yet

- Please Don't Get Cocky: April 2013 Volume 4, No. 7Document6 pagesPlease Don't Get Cocky: April 2013 Volume 4, No. 7Marites Mayo CuyosNo ratings yet

- QuanticoDocument6 pagesQuantico19EBKCS082 PIYUSHLATTANo ratings yet

- C450 - Long Term Liabilites - Lecture NotesDocument14 pagesC450 - Long Term Liabilites - Lecture NotesFreelansirNo ratings yet

- Personal InvestmentDocument93 pagesPersonal InvestmentPratham Poovaiah MalavandaNo ratings yet

- 10 1016@j Pacfin 2018 09 003Document18 pages10 1016@j Pacfin 2018 09 003gogayin869No ratings yet

- DSE Index Beta Calculation and Stock ValuationDocument16 pagesDSE Index Beta Calculation and Stock ValuationHassan NasifNo ratings yet

- Apollo Hospitals Enterprise LTDDocument12 pagesApollo Hospitals Enterprise LTDAkash KaleNo ratings yet

- JP Morgan Best Equity Ideas 2014Document61 pagesJP Morgan Best Equity Ideas 2014Sara Lim100% (1)

- Pledged Shares AnalysisDocument4 pagesPledged Shares AnalysisAtul TandonNo ratings yet

- Annual Letter 2016Document25 pagesAnnual Letter 2016Incandescent CapitalNo ratings yet

- ValuEngine Weekly NewsletterDocument14 pagesValuEngine Weekly NewsletterValuEngine.comNo ratings yet

- Daily Trade Journal - 11.03.2014Document6 pagesDaily Trade Journal - 11.03.2014Randora LkNo ratings yet

- Rendementsmozaiek Hedgefund StrategienDocument2 pagesRendementsmozaiek Hedgefund Strategienj.fred a. voortmanNo ratings yet

- Results Came in Line With Our Estimates. We Are Upgrading Our Recommendation To BUYDocument9 pagesResults Came in Line With Our Estimates. We Are Upgrading Our Recommendation To BUYÁngel Josue Aguilar VillaverdeNo ratings yet

- Daily Market Sheet 1-5-10Document2 pagesDaily Market Sheet 1-5-10chainbridgeinvestingNo ratings yet

- Daily Trade Journal - 05.03Document7 pagesDaily Trade Journal - 05.03ran2013No ratings yet

- Corp Fin - Radio One IncDocument39 pagesCorp Fin - Radio One IncMarco Quispe PerezNo ratings yet

- Comprehensive Stock Analysis Table with Key MetricsDocument6 pagesComprehensive Stock Analysis Table with Key MetricsJay GalvanNo ratings yet

- 2008 MFI BenchmarksDocument47 pages2008 MFI BenchmarksVũ TrangNo ratings yet

- Refinance Analysis v1.01Document1 pageRefinance Analysis v1.01AlexNo ratings yet

- OSIMDocument6 pagesOSIMKhin QianNo ratings yet

- Daily Trade Journal - 22.04.2014Document6 pagesDaily Trade Journal - 22.04.2014Randora LkNo ratings yet

- Nestle India Result UpdatedDocument11 pagesNestle India Result UpdatedAngel BrokingNo ratings yet

- South Indian Bank Share Price AnalysisDocument28 pagesSouth Indian Bank Share Price AnalysisANKIT YADAVNo ratings yet

- Sarin Technologies: SingaporeDocument8 pagesSarin Technologies: SingaporephuawlNo ratings yet

- Lincoln Crowne Engineering Mining Services Research 26 July 2013Document2 pagesLincoln Crowne Engineering Mining Services Research 26 July 2013Lincoln Crowne & CompanyNo ratings yet

- And Investment Holdings 32015Document10 pagesAnd Investment Holdings 32015Milan PetrikNo ratings yet

- Michael Kors PresentationDocument21 pagesMichael Kors PresentationJeremy_Edwards11No ratings yet

- O&G Services - Jason Saw DMG PartnersDocument18 pagesO&G Services - Jason Saw DMG Partnerscybermen35No ratings yet

- Tesla (TSLA) - WedbushDocument9 pagesTesla (TSLA) - WedbushpachzevelNo ratings yet

- FY 2011-12 Third Quarter Results: Investor PresentationDocument34 pagesFY 2011-12 Third Quarter Results: Investor PresentationshemalgNo ratings yet

- CALCULATE MCLRDocument8 pagesCALCULATE MCLRSravya NamburiNo ratings yet

- Top Stocks 2017: A Sharebuyer's Guide to Leading Australian CompaniesFrom EverandTop Stocks 2017: A Sharebuyer's Guide to Leading Australian CompaniesNo ratings yet

- Service Delivery Propelled by Innovations in The NCM - June 2014 SSS ReportDocument13 pagesService Delivery Propelled by Innovations in The NCM - June 2014 SSS ReportProshareNo ratings yet

- Aliko Dangote - 1 Year in Charge of The NSE PresidencyDocument23 pagesAliko Dangote - 1 Year in Charge of The NSE PresidencyIsaac OsagieNo ratings yet

- The Nigerian Capital Market Service Report - Improvement On Minimal Market ActivitiesDocument18 pagesThe Nigerian Capital Market Service Report - Improvement On Minimal Market ActivitiesProshareNo ratings yet

- Investing in Oando PLC Rights IssueDocument22 pagesInvesting in Oando PLC Rights IssueProshare100% (1)

- CIBN Presentation To NASS On CBN Act Amendment - May 28, 2012Document11 pagesCIBN Presentation To NASS On CBN Act Amendment - May 28, 2012ProshareNo ratings yet

- Technical Analyst Reviews/Calls July 2014Document74 pagesTechnical Analyst Reviews/Calls July 2014ProshareNo ratings yet

- Cadbury PLC Sets New 4-Yr High, Drops in Today's SessionDocument2 pagesCadbury PLC Sets New 4-Yr High, Drops in Today's SessionProshareNo ratings yet

- Cement Sub Sector Review - Turnover, PBT and Share Price 2011 - 2012Document2 pagesCement Sub Sector Review - Turnover, PBT and Share Price 2011 - 2012ProshareNo ratings yet

- Cash-Flow Challenges Cast Dark Cloud' Over Oil & Gas Stocks As Sector BleedsDocument5 pagesCash-Flow Challenges Cast Dark Cloud' Over Oil & Gas Stocks As Sector BleedsProshareNo ratings yet

- 52 Weeks High and Lows in 2012 at The NSE - The AnalystDocument8 pages52 Weeks High and Lows in 2012 at The NSE - The AnalystProshareNo ratings yet

- Investor Confidence Builds Up As 2012 Reverses Trend - 080113Document4 pagesInvestor Confidence Builds Up As 2012 Reverses Trend - 080113ProshareNo ratings yet

- Nigerian Market Is Completely Out of Bottomed-Out Stage - ProshareDocument6 pagesNigerian Market Is Completely Out of Bottomed-Out Stage - ProshareProshareNo ratings yet

- 66 Stocks On The Caution List For 2013 @NSE - ProshareDocument4 pages66 Stocks On The Caution List For 2013 @NSE - ProshareProshareNo ratings yet

- Which Sector Made You Money in 2012 - TheAnalystDocument10 pagesWhich Sector Made You Money in 2012 - TheAnalystProshareNo ratings yet

- NSE Remains A Leading Frontier Market in 2012 - 311212Document3 pagesNSE Remains A Leading Frontier Market in 2012 - 311212ProshareNo ratings yet

- Why Is This The Perfect Time To Identify Great StocksDocument8 pagesWhy Is This The Perfect Time To Identify Great StocksProshareNo ratings yet

- Guide To Investing in 2013 - ProshareDocument8 pagesGuide To Investing in 2013 - ProshareProshareNo ratings yet

- In Nigeria, A Concrete Get-Rich Scheme - The Dangote StoryDocument5 pagesIn Nigeria, A Concrete Get-Rich Scheme - The Dangote StoryProshareNo ratings yet

- Investor Alert - Stocks That Made Headlines 110612Document3 pagesInvestor Alert - Stocks That Made Headlines 110612ProshareNo ratings yet

- 42 Stocks Listed From 2008 Till Date - How They Are Faring! - ProshareDocument23 pages42 Stocks Listed From 2008 Till Date - How They Are Faring! - ProshareProshareNo ratings yet

- The Crisis of Confidence in Insurance - Ekerete Gam IkonDocument3 pagesThe Crisis of Confidence in Insurance - Ekerete Gam IkonProshareNo ratings yet

- Market Slides Into Oversold Region 070612 - ProshareDocument3 pagesMarket Slides Into Oversold Region 070612 - ProshareProshareNo ratings yet

- Stocks No One Is Patronising - 100612Document6 pagesStocks No One Is Patronising - 100612ProshareNo ratings yet

- Audited Results - Analysis of Quoted Stocks @120712Document4 pagesAudited Results - Analysis of Quoted Stocks @120712ProshareNo ratings yet

- Will There Be A Revival in The IPO Markets Soon - 170612Document5 pagesWill There Be A Revival in The IPO Markets Soon - 170612ProshareNo ratings yet

- 55 Stocks Trading at N0 50k Today - What NextDocument43 pages55 Stocks Trading at N0 50k Today - What NextProshareNo ratings yet

- CBN Act Amendment - CBN Memo To NASS - ProshareDocument34 pagesCBN Act Amendment - CBN Memo To NASS - ProshareProshareNo ratings yet

- Market Sentiment Analysis Report For WE 090612 - ProshareDocument8 pagesMarket Sentiment Analysis Report For WE 090612 - ProshareProshareNo ratings yet

- SEC Allotment of 2008 Stracomms Offer and Return of MoniesDocument3 pagesSEC Allotment of 2008 Stracomms Offer and Return of MoniesProshareNo ratings yet

- Pakistan Stock ExchangeDocument11 pagesPakistan Stock Exchangeumar jilaniNo ratings yet

- Xii Mcqs CH - 9 Issue of SharesDocument7 pagesXii Mcqs CH - 9 Issue of SharesJoanna Garcia100% (1)

- Geekaywire 12042023172516 GeekaywireDocument2 pagesGeekaywire 12042023172516 GeekaywireAnjesh MauryaNo ratings yet

- 1.2 Investment - Securities MarketDocument35 pages1.2 Investment - Securities MarketMd. Ruhol AminNo ratings yet

- 2018 Equity Valuation and Financial AnalysisDocument66 pages2018 Equity Valuation and Financial AnalysisAdi PratamaNo ratings yet

- Equity Valuation Models MCQ ChapterDocument45 pagesEquity Valuation Models MCQ ChapterAstrid TanNo ratings yet

- Screen Based Trading, Financial MarketDocument9 pagesScreen Based Trading, Financial MarketApu ChakrabortyNo ratings yet

- Zerodha ChargesDocument4 pagesZerodha ChargesHancock willsmithNo ratings yet

- Eastern Disruptors Report HOW To WEB 2019Document54 pagesEastern Disruptors Report HOW To WEB 2019Vlad Andriescu100% (2)

- Entrepreneurial FinanceDocument112 pagesEntrepreneurial FinanceJohnny BravoNo ratings yet

- Section e - QuestionsDocument4 pagesSection e - QuestionsAhmed Raza MirNo ratings yet

- S&P 500Document15 pagesS&P 500HS RazNo ratings yet

- MGFC10 Cheat SheetDocument5 pagesMGFC10 Cheat SheetĐức Hải NguyễnNo ratings yet

- Fs Analysis MC ProblemsDocument7 pagesFs Analysis MC ProblemsarkishaNo ratings yet

- Difference Between Shares and DebenturesDocument4 pagesDifference Between Shares and DebenturesVinodKumarMNo ratings yet

- Shailesh Shah: BSE LimitedDocument4 pagesShailesh Shah: BSE Limitednaresh kayadNo ratings yet

- 163 Main MergedDocument141 pages163 Main Mergedglimmertwins100% (1)

- Blij - Back-Testing Magic - 2011Document63 pagesBlij - Back-Testing Magic - 2011Jens GruNo ratings yet

- Dividend Policy 1Document9 pagesDividend Policy 1Almira BesoniaNo ratings yet

- Adjudication Order in The Matter of Harita Seating Systems Ltd.Document54 pagesAdjudication Order in The Matter of Harita Seating Systems Ltd.Shyam SunderNo ratings yet

- Differences Between SharesDocument9 pagesDifferences Between SharesAnjan IkonNo ratings yet

- Talisay Corporation Financial StatementsDocument10 pagesTalisay Corporation Financial StatementsRiza Mae AlceNo ratings yet

- Soal Latihan Sesi 7-DikonversiDocument2 pagesSoal Latihan Sesi 7-DikonversiAlyaNo ratings yet