Professional Documents

Culture Documents

Managing Risk in Nonprofit Organizations

Uploaded by

Tate Tryon CPAsCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Managing Risk in Nonprofit Organizations

Uploaded by

Tate Tryon CPAsCopyright:

Available Formats

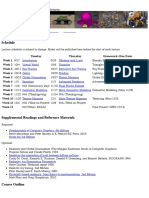

Managing Risk In Nonprofit Organizations

Charles F. Tate, CPA Managing Partner Tate & Tryon, CPAs and Consultants Washington, DC January 13, 2012

What Well Discuss Today

1. Overview of COSO and Publications 2. COSOs ERM 3. COSOs Internal Control 4. Relationship of COSO to Auditing Standards

1. Overview of COSO and Publications

COSO is the Acronym For:

A. Class of Service Overrides B. Combat Oriented Supply Operations C. Committee of Sponsoring Organizations Answer C: Committee Of Sponsoring Organizations of the Treadway Commission

What is the Treadway Commission?

A. Governmental Commission B. Presidential Commission C. Congressional Commission D. All of the Above E. None of the Above Answer E: The Treadway Commission is a Joint Private Sector Initiative

Which Organization is not Part of the Private Sector Initiative (i.e., a Sponsoring Organization)?

A. American Accounting Association (AAA) B. American Institute of CPAs (AICPA) C. Association of Financial Professionals (AFP) D. Financial Executives International (FEI) E. Institute of Internal Auditors (IIA) F. Institute of Management Accountants (IMA) Answer C: AFP is not part of the 5 member Sponsoring Committee

COSO Publications

COSO Publications

Which Prominent Accounting Firm Authored a COSO Publication?

A. Price Waterhouse Coopers (PWC) B. Grant Thornton (GT) C. Tate & Tryon (T&T) D. Coopers & Lybrand (C&L) E. Both A. and D. F. Bothe A. B. and D. Answer F: PWC, GT, and C&L all authored a COSO Publication

COSOs Definitions and Objectives

A process, effected by an entitys board of directors, management and other personnel, designed to provide reasonable assurance regarding the achievement of objectives in the following categories: ERM 1. Strategy setting 2. Identify & manage potential events 3. Manage risks to be within its risk appetite

Internal Control

1. Effectiveness and efficiency of operations. 2. Reliability of financial reporting. 3. Compliance with laws and regulations.

Which Individual Did Not Influence SOX Legislation?

A. B. C. D.

Answer D: Michael M. Tryon Had No Influence on SOX

2. COSOs ERM

COSO Enterprise Risk Management Integrated Framework

Components unique to ERM

COSO Internal Control Integrated Framework

Comparison of COSO IC and ERM

Relationship of COSO Objectives

Enterprise Risk Management (2004)

Strategic Operations Compliance Financial Reporting

Internal Control (1992)

Internal Control Over Financial Reporting (2006)

Operations Compliance Financial Reporting

Financial Reporting

ERM Expands on Internal Control Adding Three Components

Control Environment ERM Objective Setting Control Activities

ERM Event Identification

Monitoring

ERM Risk Response

Information & Communication

Risk Assessment

ERM Expands on Internal Control

Objective Setting

Strategic Objectiveshigh level Related Objectivesoperations, reporting, & compliance Achievement of Objectivesreasonable assurance Risk Appetiteguidepost in strategy setting Risk Tolerancesacceptable levels of variation

Forming Risk Appetite (Exhibit 3.5 ERM Guidance)

ERM Expands on Internal Control

Event Identification

Events can be positive, negative impact, or both Events are interdependentnot isolated Events are driven by external and internal factors

Implementation Event Identification External Factors

External

Economic Natural Environment Political Social Technological

Internal

Infrastructure Personnel Process Technology

COSO Components & PrinciplesERM

Risk Response

Avoidance, reduction, sharing, acceptance Evaluation of risk likelihood and impact Assessing costs versus benefits Opportunities in response to options Portfolio view

Implementation Risk Response

Avoidance Disposing of a program Deciding not to engage in new initiatives/activities Sharing Buy insurance Joint venture/outsource Hedging risks

Risk Response Reduction Diversifying/rebalance Limits/processes Acceptance Self insure Accept risk that conforms to risk tolerance

Simplified Process For ERM

Strategy & Objectives Event Identification & Likelihood

Risk Response & Quantification

Financial Model

Financial Impact of Key Scenarios

Major Activity Donations Biomedical Services Fundraising Events Government Grants Investments & other Total Probability

(H-M-L)

Potential Scenario Terrorist or political uprising Donation mismanagement Virus War, natural disaster Weather Pandemic Economic downturn Contract mismanagement Financial meltdown Fraud (Madoff or Stanford)

Annual Amount

(in millions)

Increase (Decrease) 100 -20 -400 -600 -0-40 -0-30 -10 -1,000

H L M H L L H M M M

1,000 2,400 50 60 90 3,600

3. COSOs Internal Control

COSO ComponentsInternal Control

Control Environment

Risk Assessment

Control Activities

Information & Communication

Monitoring

COSO Internal Control Components & Principles

Environment Principles

Management Philosophy Board of Directors Integrity and Ethical Values Commitment to Competence Organizational Structure Assignment of Authority and Responsibility Human Resource Standards Risk Appetite

Control Environment/Internal Environment is the Foundation of the 5 Components

COSO Internal Control Components & Principles

Risk Assessment Principles

Specify objectives Risk identification & analysis Inherent and residual risk

Risk Assessment Matrix

As % of Total Characteristics Impact on F/S Account Business Process Fraud Risk EntityOverall wide Rating Factors

Balance Sheet Account ASSETS Cash & cash equivalents Pledges receivable Investments Property & equipment Prepaid & other assets Total Assets LIABILITIES Accounts Payable Deferred Revenue Mortgage (IRB) Pension & post retirement Total Liabilities Net Assets Total Liabilities and Net Assets

5% 15% 40% 35% 5% 100% 5% 20% 25% 10% 60% 30% 100%

L M H H L

M H H M L

L H H M L

H M L H L

L M L M L

L H H M L

L H H M H

M H H H M

M H L H L

H L L L L

M H M H L

M H M H L

Implementation Risk Assessment Significant Assertions

Significant Assertions Balance Sheet Account Cash & cash equivalents Pledges receivable Investments Property & equipment Prepaid & other assets Accounts Payable Deferred Revenue Mortgage (IRB) Pension & post retirement Net assets Existence Completeness Valuation or Allocation Rights & Obligations Presentation & Disclosure

COSO Internal Control Components & Principles

Control Activities Principles

Integration with risk assessment Selection and development of control activities Controls over information systems/technology Policies and procedures are communicated

COSO Internal Control Components & Principles

Information & Communication Principles

Quality of information Internal & external communication Means of communication Strategic and integrated systems

COSO Internal Control Components & Principles

Monitoring Principles

Ongoing monitoring activities Reporting deficiencies

4. Relationship of COSO to Auditing Standards

Auditing Standards Risk Assessment

Identifying risks through considering: The entity and its environment, including its internal control Classes of transactions, account balances, and disclosures

Relating the identified risks to what could go wrong at the relevant assertion level

Intersection of COSO and the Auditors Responsibilities

COSO (2004) Enterprise Risk Management COSO (1992) Internal Control Integrated Framework COSO (2006) Internal Control over Financial Reporting SAS 109 Understanding of the Entity & Environment

Broader Objectives More than Internal Control Operations Financial Reporting Compliance with Laws/Regulations

Financial Reporting

Understand Five Components Focus on Controls Relevant to Financial Reporting

Summary of Risk Assessment Standards

No.

104

Concept

Expands the definition of reasonable assurance as a high level of assurance

105 106

107 108

Internal control is replaced by the entity and its environment, including its internal control Use of managements assertions in obtaining audit evidence recognition, measurement, presentation and disclosure

Reduce audit risk to a low level that is, in the auditors professional judgment, appropriate for expressing an opinion on the financial statements Adequately plan the work and must properly supervise any assistants

109

110 111

Sufficient understanding of the entity and its environment, including its IC, to assess the risk of material misstatement

Sufficient appropriate audit evidence to afford a reasonable basis for an opinion Enhanced guidance on tolerable misstatement

Auditors Assessment of Material Misstatement SAS 106

Classes of Transactions

Occurrence Completeness Accuracy Cutoff Classification

Account Balances

Existence Rights and obligations Completeness Valuation and allocation

Presentation and Disclosures

Occurrence/Rights and obligations Completeness Classification and understandability Accuracy and valuation

GAAS & COSO Use of Financial Statement Assertions to Assess Risk

GAAS Risk Assessment Standards SAS 106

Existence Occurrence Completeness Rights and Obligations Valuation and Allocation Accuracy Cutoff Classification Understandability

COSO Internal Control Over Financial Reporting/1.

Existence or Occurrence Completeness Rights and Obligations Valuation or Allocation Presentation and Disclosure

/1. Source: SAS 31, Evidential Matter prior to amendment by SAS 106

Audit Risk Assessment and COSO

Financial Statements

Investments & Income Receivables & Revenue Real Estate & Debt Payables & Expenses Deferred Revenue Net Assets & Restrictions

Assertions

Completeness Existence Valuation Rights & Obligations Presentation & Disclosure

Risks

Processes Competency IT Infrastructure Fraud Risk Entity-Wide Factors

Control Objectives

Appropriate Accounting Statements Informative Classification Appropriate Reflect Transactions Reflect Materiality

Entity-Wide Controls

Process-Level Controls Preventive or Detective Manual or Automated

Adapted from an article by Michael Ramos CPA, entitled Risk-Based Audit Practices, Journal of Accountancy, Dec., 2009

COSO is the Acronym For:

A. Class of Service Overrides B. Combat Oriented Supply Operations C. Committee of Sponsoring Organizations Answer C: Committee Of Sponsoring Organizations of the Treadway Commission

What is the Treadway Commission?

A. Governmental Commission B. Presidential Commission C. Congressional Commission D. All of the Above E. None of the Above Answer E: The Treadway Commission is a Joint Private Sector Initiative

Which Organization is not Part of the Private Sector Initiative (i.e., a Sponsoring Organization)?

A. American Accounting Association (AAA) B. American Institute of CPAs (AICPA) C. Association of Financial Professionals (AFP) D. Financial Executives International (FEI) E. Institute of Internal Auditors (IIA) F. Institute of Management Accountants (IMA) Answer C: AFP is not part of the 5 member Sponsoring Committee

Which Prominent Accounting Firm Authored a COSO Publication?

A. Price Waterhouse Coopers (PWC) B. Grant Thornton (GT) C. Tate & Tryon (T&T) D. Coopers & Lybrand (C&L) E. Both A. and D. F. Bothe A. B. and D. Answer F: PWC, GT, and C&L all authored a COSO Publication

You might also like

- Tate & Tryon CPAs Announces Staff PromotionsDocument2 pagesTate & Tryon CPAs Announces Staff PromotionsTate Tryon CPAsNo ratings yet

- 403b Plan UpdateDocument29 pages403b Plan UpdateTate Tryon CPAsNo ratings yet

- Tate Tryon Contintues To Expand With New HiresDocument2 pagesTate Tryon Contintues To Expand With New HiresTate Tryon CPAsNo ratings yet

- Form 990 Vs Audited FinancialsDocument46 pagesForm 990 Vs Audited FinancialsTate Tryon CPAs100% (2)

- Deborah Kosnett Speaking at AICPA National Tax ConferenceDocument1 pageDeborah Kosnett Speaking at AICPA National Tax ConferenceTate Tryon CPAsNo ratings yet

- What The Watchdogs Are WatchingDocument26 pagesWhat The Watchdogs Are WatchingTate Tryon CPAsNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Shell Omala s2 GX 320 TdsDocument2 pagesShell Omala s2 GX 320 TdsOnie Hammamz OylNo ratings yet

- MB0048 Operation Research Assignments Feb 11Document4 pagesMB0048 Operation Research Assignments Feb 11Arvind KNo ratings yet

- (The Nineteenth Century Series) Grace Moore - Dickens and Empire - Discourses of Class, Race and Colonialism in The Works of Charles Dickens-Routledge (2004) PDFDocument223 pages(The Nineteenth Century Series) Grace Moore - Dickens and Empire - Discourses of Class, Race and Colonialism in The Works of Charles Dickens-Routledge (2004) PDFJesica LengaNo ratings yet

- JQuery Interview Questions and AnswersDocument5 pagesJQuery Interview Questions and AnswersShailesh M SassNo ratings yet

- Functions and Uses of CCTV CameraDocument42 pagesFunctions and Uses of CCTV CameraMojere GuardiarioNo ratings yet

- Sap On Cloud PlatformDocument2 pagesSap On Cloud PlatformQueen ValleNo ratings yet

- Class B Digital Device Part 15 of The FCC RulesDocument7 pagesClass B Digital Device Part 15 of The FCC RulesHemantkumarNo ratings yet

- U-Blox Parameters Setting ProtocolsDocument2 pagesU-Blox Parameters Setting Protocolspedrito perezNo ratings yet

- Solved Suppose That The Velocity of Circulation of Money Is VDocument1 pageSolved Suppose That The Velocity of Circulation of Money Is VM Bilal SaleemNo ratings yet

- Poverty Eradication Cluster HLPF Position Paper With Case StudiesDocument4 pagesPoverty Eradication Cluster HLPF Position Paper With Case StudiesJohn Paul Demonteverde ElepNo ratings yet

- Human Resource Management - Introduction - A Revision Article - A Knol by Narayana RaoDocument7 pagesHuman Resource Management - Introduction - A Revision Article - A Knol by Narayana RaoHimanshu ShuklaNo ratings yet

- 3a. Systems Approach To PoliticsDocument12 pages3a. Systems Approach To PoliticsOnindya MitraNo ratings yet

- LIC - Jeevan Labh - Brochure - 9 Inch X 8 Inch - EngDocument13 pagesLIC - Jeevan Labh - Brochure - 9 Inch X 8 Inch - Engnakka_rajeevNo ratings yet

- Morales v. Lockheed Martin, 10th Cir. (2000)Document2 pagesMorales v. Lockheed Martin, 10th Cir. (2000)Scribd Government DocsNo ratings yet

- Evaporator EfficiencyDocument15 pagesEvaporator EfficiencySanjaySinghAdhikariNo ratings yet

- Vitus Bering, Centre For Higher Education: Jens Bertelsen & Jens Peder PedersenDocument50 pagesVitus Bering, Centre For Higher Education: Jens Bertelsen & Jens Peder PedersenAnca IscruNo ratings yet

- Java ProgramsDocument36 pagesJava ProgramsPrashanth MohanNo ratings yet

- Thermo King Tool Catalog Part 2Document53 pagesThermo King Tool Catalog Part 2Alb NewgateNo ratings yet

- Process Plant Layout and Piping DesignDocument4 pagesProcess Plant Layout and Piping Designktsnl100% (1)

- Data Sheet: Permanent Magnet GeneratorDocument2 pagesData Sheet: Permanent Magnet Generatordiegoadjgt100% (1)

- Circular Motion ProblemsDocument4 pagesCircular Motion ProblemsGheline LexcieNo ratings yet

- WoodCarving Illustrated 044 (Fall 2008)Document100 pagesWoodCarving Illustrated 044 (Fall 2008)Victor Sanhueza100% (7)

- MLCP - Area State Ment - 09th Jan 2015Document5 pagesMLCP - Area State Ment - 09th Jan 201551921684No ratings yet

- BMW Speakers Install BSW Stage 1 E60 Sedan Logic7Document13 pagesBMW Speakers Install BSW Stage 1 E60 Sedan Logic7StolnicuBogdanNo ratings yet

- Magicolor2400 2430 2450FieldSvcDocument262 pagesMagicolor2400 2430 2450FieldSvcKlema HanisNo ratings yet

- CS 148 - Introduction To Computer Graphics and ImagingDocument3 pagesCS 148 - Introduction To Computer Graphics and ImagingMurtaza TajNo ratings yet

- 2008 Reverse Logistics Strategies For End-Of-life ProductsDocument22 pages2008 Reverse Logistics Strategies For End-Of-life ProductsValen Ramirez HNo ratings yet

- Group9 SecADocument7 pagesGroup9 SecAshivendrakadamNo ratings yet

- What Is Bitcoin MiningDocument4 pagesWhat Is Bitcoin MiningCarmen M Leal CurielNo ratings yet

- Nature Hill Middle School Wants To Raise Money For A NewDocument1 pageNature Hill Middle School Wants To Raise Money For A NewAmit PandeyNo ratings yet