Professional Documents

Culture Documents

A Holistic Approach To Asset Allocation Reichenstein Jennings

Uploaded by

Tolis ApostolosOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

A Holistic Approach To Asset Allocation Reichenstein Jennings

Uploaded by

Tolis ApostolosCopyright:

Available Formats

CHAPTER 3

A Holistic Approach to Asset Allocation

william w. jennings and william reichenstein

ooks for professional advisers are intended to make life easier by answering questions or addressing difcult issues. This chapter may make your life harder by raising questions on asset allocation that you havent considered and challenging the approach you take to it. But the answers that result are likely to make you a better nancial planner. Personal nancial planning regularly adopts sophisticated techniques developed for institutional money managers, yet individual portfolios are different from institutional portfolios in at least two important ways: First, individuals pay taxes, whereas many institutions, like endowment funds and pension plans, do not. Second, its clear what assets belong in institutional portfolios, but the same is not true for individual portfolios. This chapter explores those differences. Well also consider how focusing on after-tax valuation of the extended portfolio interacts with mean-variance optimization. Most of these ideas are included in our book Integrating Investments and the Tax Code.1 In the process of working on that book, we developed a holistic approachone based on after-tax valuation of the extended portfoliothat we believe represents an improvement to the traditional approach to managing individuals portfolios.

39

40

The Portfolio

Distinguishing Pretax Funds From After-tax Funds

Our holistic approach to managing individual portfolios makes two modications to the traditional approach to asset allocation. First, we distinguish pretax funds from after-tax funds. We convert all account values to after-tax values and then calculate the asset mix based on aftertax values. Second, when addressing retirement preparedness, we believe nancial planners should manage an extended portfolio that contains both nancial assets and other off-balance-sheet assets that affect the individuals nancial well-being, including things like the present value of projected income from Social Security and dened-benet (DB) plans. In short, we calculate the current asset mix based on after-tax values of an extended portfolio. Sam Smythes Portfolio Sam Smythe, age sixty-ve, recently retired and asked Jan Jones, his nancial planner, for advice. His nancial assets include $400,000 in a 401(k) plan and $600,000 in taxable accounts. In addition, hell receive $1,400 a month from Social Security, an amount that will increase with ination. Like most nancial planners, Jan Jones believes that the choice of asset allocation is an investors most important decision. In reaching her recommendation, she follows these three steps, which we call the traditional approach to setting the asset allocation. 1 She calculates the value of his portfolio. Following tradition, she includes only the nancial assets in his portfolio. Henceforth, this is called his traditional portfolio, and it contains funds in the 401(k) and taxable accounts worth $1 million. 2 She determines the optimal asset allocation and applies it to the traditional portfolio. For simplicity, assume there are only two asset classesstocks and bonds. Given six parameter estimates expected return and risk of stocks, expected return and risk of bonds, correlation between stocks and bonds, and Sams risk toleranceshe determines the optimal asset allocation. Later in this chapter, we examine this step in detail. For now, assume the optimal allocation is 60 percent bonds and 40 percent stocks. 3 After determining the asset allocation, she determines the asset location. That is, to the degree possible should stocks be held in the 401(k) plan and bonds in taxable accounts, or vice versa? Following conventional wisdom, she places stocks in the tax-deferred account and bonds in the taxable account.2

A Holistic Approach to Asset Allocation

41

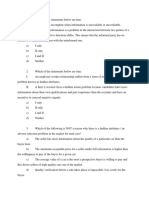

FIGURE

3.1 Sam Smythes Traditional Portfolio

AMOUNT SAVINGS VEHICLE

ASSET CLASS

Bond funds Stock funds

$600,000 $400,000

taxable accounts 401(k)

Once these steps are completed, Jan recommends and Sam adopts the portfolio in FIGURE 3.1. It has the desired 60 percent bonds/40 percent stocks asset allocation and the desired asset location. Many nancial planners use this traditional approach to asset allocation, but as we shall see, it ignores taxes. Moreover, its based on the traditional portfolio, which, we argue, is the wrong portfolio when addressing retirement preparedness. The 401(k) plan contains pretax funds, while the taxable account contains after-tax funds; the book value and market value of the bond funds are equal. If Sam is in the 25 percent tax bracket and withdraws $1,000 from his 401(k), he pays $250 in taxes and can buy $750 of goods and services. If he withdraws $1,000 from this taxable account, he can buy $1,000 of goods and services. Since retirement planning concerns the clients ability to buy goods and services, it must distinguish between pretax funds and after-tax funds. We have yet to talk to a nancial planner who thinks taxes should be ignored; that is, we have yet to talk to someone who thinks the traditional portfolio, which ignores taxes, is correct. Consequently, the question seems to be How should we adjust for taxes? and not Should we adjust for taxes? We recommend converting all funds to after-tax funds and then calculating the asset mix based on after-tax funds. To convert qualied retirement accounts such as 401(k)s, 403(b)s, simplied employee pension individual retirement accounts (SEP IRAs), traditional (deductible) IRAs, and Keogh accounts to after-tax funds, we simply multiply the pretax value by (1 tr ), where tr is the expected tax rate during retirement. If Sam expects to be in the 25 percent tax bracket during retirement, his $400,000 of pretax 401(k) funds converts to $300,000 of after-tax funds. Since the profession now treats these pretax funds as being equivalent to after-tax funds, it implicitly assumes tr will be zero. Although the expected tax rate during retirement is unknown, any reasonable estimate should improve on the traditional approachs implicit estimate of zero.

42

The Portfolio

Taxable accounts sometimes contain both after-tax and pretax funds. Suppose a taxable account contains stocks with a market value of $14,000, including $4,000 of unrealized capital gains. In this case, we would advocate adjusting the $14,000 market value to reect anticipated taxes. No single procedure is always the best one for converting unrealized gains into after-tax dollars. If the gain will be realized immediately and taxed at 15 percent, the accounts after-tax value is $13,400, where $600 is the capital gains tax. In Integrating Investments and the Tax Code, we argue that the $13,400 estimate is usually reasonable since most investors realize gains within a few years. However, in some circumstances, this treatment may be inappropriate. The tax rate on the unrealized gain would be zero if the gain were realized after receiving a step-up in basis at death or if the appreciated asset were given to charity. For example, suppose an elderly couple in Texas, a community property state, owns stock with a cost basis of $20,000 and a market value of $120,000. If they plan to realize the gain after the death of the rst to die, there will be no taxes. Or they could plan to give the appreciated asset to charity without paying taxes. In these cases, there is no embedded tax liability on the unrealized gains. By talking with Sam and informing him about the tax consequences of his decision on the timing of capital gains, Jan provides a valuable nancial-planning service. A nonqualied tax-deferred annuity is a hybrid account that contains pretax and after-tax funds. Someone may invest $40,000 of after-tax funds at age sixty, and fteen years later it may be worth $75,000, including $35,000 of pretax deferred returns. In that case, taxes must eventually be paid on the deferred returns. Although this strategy is not perfect, the account could be converted to after-tax funds by assuming that the $35,000 is taxed immediately at the tax rate in retirement. (For further discussion of converting market values to after-tax values, see Integrating Investments and the Tax Code.) Following the traditional approach, Jan rst determines the optimal asset allocation and applies it to the traditional portfolio without adjusting for taxes, and then determines the asset location. This procedure is inappropriate because, as the following examples show, the asset location affects the after-tax asset allocation. In Figure 3.1, Sams portfolio contains $400,000 in stocks in the 401(k) and $600,000 in bonds in taxable accounts (with market value equal to book value). So his aftertax asset allocation contains $600,000 in bonds and $300,000 in stocks, or 33 percent stocks. Instead, suppose his asset location placed bonds in the retirement account. If he had $400,000 in bonds in the 401(k) and $400,000 in stocks and $200,000 in bonds in taxable accounts (with market values equal to book values), his after-tax asset allocation would

A Holistic Approach to Asset Allocation

43

contain $500,000 in bonds and $400,000 in stocks or 44 percent stocks. In both examples, the traditional portfolio has a 60/40 bond/stock mix, but the after-tax asset allocations differ signicantly. The traditional approach to calculating the asset allocation tends to overstate the true exposure to the dominant asset held in tax-deferred retirement accounts. For example, in Figure 3.1, Sam holds stocks in the retirement account and the traditional approach says he has a 40 percent stock exposure when his after-tax stock exposure is only 33 percent. In practice, a dollar of funds in a taxable account is worth more after taxes than a dollar of funds in a qualied retirement account.3 It follows that since Sam holds only stocks in his retirement account, he overstates his portfolios true stock allocation as measured using after-tax values. The lessons are clear: The two-stage procedure of rst determining the traditional asset allocation and then determining the asset location is inappropriate. Traditional asset allocation overstates the true value of retirement accounts and thus overstates the asset weight of the dominant asset class held in retirement accounts.

The Right Assets for the Family Portfolio

Which assets belong in a family portfolio? The answer: It depends. If the question concerns estate taxes, last-to-die insurance and the personal residence count. In this chapter, were concerned about whether the family has enough resources to meet its retirement needs. To that end, we adopt Maria Crawford Scotts criterion for deciding what belongs in the extended portfolio.4 Scott includes items that produce cash ows, either now or later, that can be used to nance retirement needs. As such, we exclude last-to-die insurance and the personal residence. But lets consider some examples that suggest that the traditional portfolio of nancial assets is not the best portfolio to consider when estimating a familys optimal asset allocation. Inheritance. Suppose Sams aunt recently died and left him $200,000 that should be available after probate. A nancial planner should not include an inheritance in the extended portfolio unless that inheritance is virtually certain. If theres little question that the aunts estate will pass smoothly through probate, we believe it should be included in Sams portfolio. Obviously, to provide optimal advice, Jan must be managing the appropriate portfolio. We believe the extended-portfolio view is correct and the traditional-portfolio view is suspect. Lottery. Assume the Dorr family wins a lottery that pays $1 million a year for ten years. The traditional portfolio would exclude the value of the lottery because it is not a nancial asset. In many states, a lottery winner

44

The Portfolio

can sell the future payments. But even if a state could prevent a family from selling the future payments, we believe the after-tax present value of the payments should be included in the portfolio. Lack of marketability means only that the asset cannot be sold; it does not mean that the asset has no value. The present value of the after-tax cash ows from the lottery should be included as an asset in the extended portfolio, and it should be treated as a bond. An immediate annuity. Suppose Mary, age sixty-ve, just retired with $1 million in nancial assets. All assets are in taxable accounts, and the market values and book values are equal. Following the advice of Gary, her nancial planner, she invests $600,000 in stocks funds and $400,000 in bond funds. She will withdraw $2,400 automatically each month from her bond funds. One month later, Mary asks Gary about the advantages and disadvantages of an immediate xed annuity with a lifetime payout option and no guaranteed certain period. He explains that the major advantage is that this payout annuity would provide a monthly payment for the rest of her life. The major disadvantage is that, after her death, the annuity would be worthless, so there would be no remaining value to bequeath. Since both of her parents lived into their nineties and Mary has no children, the trade-off appeals to her. At Garys recommendation, she purchases an immediate xed annuity with the proceeds from the bond funds. It pays her $2,400 a month. What is Marys asset allocation after the annuity purchase? Should the payout annuity be included in her extended portfolio? We believe it should. Her nancial position after the purchase of the annuity was similar to what it was before. With the payout annuity, she will never run out of money, but after her death there will nothing left from the proceeds of the bond funds for her beneciaries. If she invests in the bond funds and withdraws funds each month, they will probably be depleted in about twenty-ve years. But if she dies within twenty-ve years, there will probably be funds available to leave to her beneciaries. The choice between the immediate annuity and bond fund with monthly withdrawals involves the trade-off between longevity risk and bequest motive. However, we believe that the traditional portfolio is wrong when it ignores the annuity and says she had a 60 percent stock exposure before the annuity purchase and a 100 percent stock exposure after the purchase. Social Security and pension plans. We recommend that the after-tax present value of projected payments from Social Security and denedbenet pension plans be included as bonds in the extended portfolio. If the annuity counts, then its logical that the present value of projected payments from pensions should count too. In the previous example, the pay-

A Holistic Approach to Asset Allocation

45

out annuity provided Mary with $2,400 a month for the rest of her life. If her companys dened-benet plan pays her $2,400 a month for the rest of her life, it should count, too. The dened-benet income is taxable, so we would include its after-tax present value. Similarly, income from Social Security should count in the portfolio. In Integrating Investments and the Tax Code, we present separate models that value income from Social Security, dened-benet plans, and military retirement. Mortgage. In her AAII Journal article, Maria Crawford Scott includes in the portfolio all assets that produce a cash ow either now or later. Based on this criterion, we believe the mortgage should be considered a short bond position in the family portfolio. Suppose Sam has the same portfolio as in Figure 3.1, but he also has a $100,000 mortgage. He could liquidate $100,000 in bonds and pay off his mortgage. When the mortgage is included in the extended portfolio and viewed as a short bond position, his net bond position is $500,000 before prepayment and $500,000 after prepayment. If the mortgage is ignored, it is as if he has a smaller net bond position and higher stock allocation after prepayment than before.5 Personal residence. In general, we do not believe the extended portfolio should contain the value of the residence. If the family continues to live in the residence, it will not produce cash inows. The exception is if the family expects to downsize its residence. In this case, the value of the freed funds could be viewed as part of the portfolio and counted as real estate. Sams Extended Portfolio presents Sams extended portfolio. It contains the after-tax values of nancial assets and projected Social Security payments. The extended portfolio is worth approximately $1,088,000 after taxes and contains 28 percent stocks and 72 percent bonds. Recall that Jan Jones estimated an optimal asset allocation of 40 percent stocks and 60 percent bonds. To be clear, we are not saying that the optimal asset allocation of Sams extended portfolio should be 40 percent stocks. Rather, we believe Jan (and the nancial-planning profession) has been thinking along these lines. For someone with Sams risk tolerance, with typical income from Social Security and no other extended assets, the traditional portfolio should be approximately 60/40 bonds/stocks, which translates into a smaller stock allocation in the extended portfolio. That is, the profession has implicitly recognized the value of Social Security for a typical family, but it has not recognized that Social Securitys value is atypical for some families. Moreover, the profession has not recognized the value of other, nonnancial assets in the extended portfolio. Consequently, the allocation of the after-tax traditional portfolio should be affected by the amount of extended assetsthat is, assets beyond

FIGURE 3.2

46

The Portfolio

FIGURE

3.2 Sam Smythes Extended Portfolio

ASSET CLASS PRETAX VALUES AFTER-TAX VALUES SAVINGS VEHICLE

ASSET

Stock funds Bond funds Social Security

stocks bonds bonds

$400,000 $600,000 $239,000

$300,000 $600,000 $188,000 $1,088,000

401(k) taxable amount

The $239,000 pretax present value assumes $16,800 ($1,400 monthly) will be received each year for 17.6 years, the life expectancy of an average 65-year-old male, and a 2.7% annual discount rate, where the latter is the real yield on Treasury Ination-Linked Securities. The $188,000 is approximately $239,000 (1 .2125), where 21.25% is the effective tax rate assuming 85% of Social Security income is taxed at 25%. See chapter 11 of Integrating Investments and the Tax Code for a more detailed model.

the traditional portfolio. If Sam has a high level of retirement income perhaps receiving income from dened-benet plans or a xed-payout annuity in addition to Social Securitythen, with everything else the same, his traditional portfolio should contain more stocks. In contrast, if Sam has a low level of retirement income, then, with everything else the same, his traditional portfolio should contain more bonds. (See FIGURE 3.3.) To recap, we recommend that an individuals extended portfolio include, at a minimum, the after-tax present value of projected income from Social Security, dened-benet pension plans, and payout annuities. In addition, it may include the after-tax present value of other near-certain cash ows.

Mean-Variance Analysis

Lets look again at the second step in the traditional approach to asset allocation, in which the nancial planner determines the clients optimal asset allocation. Often, the prescribed optimal asset allocation is the end product of mean-variance analysis. The planner uses traditional mean-variance analysis to determine the optimal asset allocation. In this traditional analysis, the inputs in meanvariance optimization are pretax risk and pretax returns; taxes are ignored.

A Holistic Approach to Asset Allocation

47

FIGURE

3.3 Approaches to Calculating Sam Smythes Asset Allocation

Ignores taxes Considers taxes

Ignores extended assets

A partial improvement over the traditional approach

Asset mix: 60% bonds / 40% stocks

Traditional Approach

Has extended assets

A partial improvement over the traditional approach

Asset mix: 72% bonds / 28% stocks

After-Tax Extended Approach

The planner estimates the pretax standard deviation and pretax expected return for each asset class, the correlation coefcient between each pair of asset classes, and the clients risk tolerance. Given that input, the optimal asset allocation can be calculated. Some nancial planners perform constrained optimization, where the allocation to each asset class may be constrained within a range.6 Other planners implicitly apply mean-variance analysis; that is, they recommend allocations that reect the principles behind Markowitzs Nobel-laureate work, but because of the potential for errors in estimation, they prefer not to use explicit estimates. Each example, whether based on explicit or implicit estimates, is an instance of traditional mean-variance analysis. The key characteristic is that the analysis does not adjust for taxes. FIGURE 3.4 presents input in the mean-variance analysis when adjusted for taxes. For simplicity, we assume two asset classes, but now these two assets can be held either in the 401(k) or in a taxable account. In essence, this produces four assets: bonds held in the 401(k), stocks

48

The Portfolio

FIGURE

3.4 Mean-Variance Analysis Applied to Sam Smythes Traditional Portfolio

AFTER-TAX EXPECTED RETURN AFTER-TAX STANDARD DEVIATION MATRIX CORRELATION PORTFOLIO WEIGHT

ASSET CLASS

1. Bonds in 401(k) 2. Stocks in 401(k) 3. Bonds in taxable accounts 4. Stocks in taxable accounts

4.6% 7 3.45 5.95

10% 15 7.5 12.75

1 .2 1 1 .2 1 .2 1 .2 1

W1 W2 W3 W4

Constraints W1 + W2 = 0.333 Wi 0 for all i W1 + W2 + W3 + W4 = 1.0

401(k) is 1/3 of nancial portfolio No short selling Fully invested

held in the 401(k), bonds held in a taxable account, and stocks held in a taxable account. In this optimization, we use the after-tax return and after-tax risk of each of these four asset classes. In Figure 3.4, we assume that bonds pretax return and pretax standard deviation are 4.6 percent and 10 percent and stocks pretax return and pretax standard deviation are 7 percent and 15 percent. For funds held in 401(k) and other qualied retirement accounts, after-tax return and after-tax risk are the same as the pretax return and pretax risk. Recall that todays after-tax value of $1 in the 401(k) is $1(1 tr ), where tr is the tax rate in retirement. If the $1 is withdrawn n years later after earning a geometric average pretax return of i percent per year, the after-tax ending wealth is $1(1 + i )n(1 tr ). It grows from $1(1 tr ) today to $1(1 + i )n(1 tr ) in n years. The after-tax value grows at the pretax rate of return. On funds held in a qualied retirement account, the individual investor receives all of the returns and bears all of the risk. Next, consider the after-tax risk and after-tax returns on bonds held in taxable accounts. Interest income is taxed each year. If $1 is invested in bonds yielding i percent, after n years its after-tax value will be $1[1 +

A Holistic Approach to Asset Allocation

49

i(1 t )]n, where t is the marginal tax rate for the next n years. When held in taxable accounts, bonds earn an i(1 t ) percent after-tax rate of return. If the pretax return is 4.6 percent, the bond investor earns 3.45 percent after taxes. In essence, the government taxes 25 percent of the returns and assumes 25 percent of the risk. The individual investor receives 75 percent of the returns and bears 75 percent of the risk. When stocks are held in taxable accounts, the government taxes some of the stocks returns and assumes some of the stocks risk. For stocks, the amount of returns taxed and risk borne by the government depends on whether returns are in the form of dividends or capital gains and how quickly the individual investor realizes gains. If the individual realizes gains within one year, they are taxed at the ordinary income tax rate. At the other extreme, there are no taxes on the gains if the individual awaits the step-up in basis or gives the appreciated asset to charity. In Figure 3.4, we assume Sam realizes gains each year (technically, in one year and one day) and pays taxes at 15 percent on both dividends and capital gains. Sam earns 5.95 percent, or 7 percent (1 .15) after taxes, on stocks and his risk is 12.75 percent. The government takes 15 percent of the returns and bears 15 percent of the risk. Sam receives 85 percent of the returns and bears 85 percent of the risk. The key insight is that the government shares some of the risk and returns on stocks held in taxable accounts. Again, the asset location affects an asset classs risk and returns. Because of taxes, the government shares in risk and returns of taxable assets. Figure 3.4 presents input in the optimization for Sam Smythe. He chooses among four assetsbonds in the 401(k), stocks in the 401(k), bonds in taxable accounts, and stocks in taxable accounts. Since his after-tax asset allocation contains $300,000 in a 401(k) and $600,000 in taxable accounts, his portfolio is constrained to have one-third of nancial assets in the 401(k) assets. The weights in each asset class must be greater than or equal to zero, and the sum of the four weights must equal 100 percent. Lets review the errors in the traditional mean-variance analysis as applied to an individuals traditional portfolio. When addressing the question of retirement preparedness, we believe the expanded portfolio properly includes, at a minimum, the after-tax present value of retirement income streams. For simplicity, we suppress expanded portfolio thinking to focus on the errors in tax-oblivious traditional mean-variance analysis. By failing to consider taxes, traditional mean-variance analysis results in the following errors: The traditional asset allocation does not distinguish between pretax and after-tax funds, so it says Sam has $400,000 in a 401(k) and $600,000 in taxable accounts. After adjusting for taxes, his 401(k) is worth $300,000 and his taxable accounts are worth $600,000.

50

The Portfolio

These after-tax values should be used in the calculations of his asset allocation. Stocks and bonds expected returns and risk depend on whether theyre held in the 401(k) or a taxable account. The same asset held in a taxable account is effectively a different asset when an individual holds it in a qualied retirement account. The asset-location decision affects the asset-allocation decision. The traditional two-step procedure of rst making the asset-allocation decision and then the asset-location decision is inadequate. Only the integrated, concurrent optimization of asset allocation and asset location uses all available information to determine the best portfolio for a client. In chapter 14 of Integrating Investments and the Tax Code, we demonstrate after-tax mean-variance analysis more fully.

Since 1998, we have spent considerable time thinking about these differences between personal and institutional portfolios and examining the implications. There remains much work to be done. Over the next decade, we believe and hope leading professionals and academics will spend considerable effort addressing the shortcomings of the traditional approach to asset allocation. In the process, some of our suggestions will be modied, and some may be rejected. But we suspect most of our suggestions and insights will remain valid. One thing is certain. Taxes matter to clients. The traditional approach of ignoring taxes is inadequate. So, too, are approaches to asset allocation that ignore nonnancial assets. Our profession has a lot of work to do to integrate investment and the tax code.

Chapter Notes

1. W. Reichenstein and W. W. Jennings, Integrating Investments and the Tax Code (Wiley, 2003). 2. John B. Shoven and Clemens Sialm, Long-run Asset Allocation for Retirement Savings, Journal of Private Portfolio Management (since renamed Journal of Wealth Management) (Summer 1998): 1326; W. Reichenstein, Calculating a Familys Asset Mix, Financial Services Review 7(3) (1998): 195206; S. M. Horan, After-tax Valuation of Tax-sheltered Assets, Financial Services Review 11(3) (2002): 253276; J. Poterba, Valuing Assets in Retirement Saving Accounts (MIT working paper, 2003).

A Holistic Approach to Asset Allocation

51

3. Recall that to convert the value of qualied retirement accounts to after-tax funds, we multiply the pretax value by (1 tr ). Even if the book value of the asset in the taxable account was zero and the gain would be realized immediately, we would calculate the assets after-tax value by multiplying its pretax value by (1 tcg ), where tcg is the capital gains tax rate. Since tcg is generally less than tr , it follows that $1 of pretax funds in a taxable account is worth more after taxes than $1 of pretax funds in a qualied retirement account. 4. Maria Crawford Scott, Dening Your Investment Portfolio: What Should You Include? AAII (American Association of Individual Investors) Journal (November 1995): 1517. 5. W. Reichenstein Rethinking the Familys Asset Allocation, Journal of Financial Planning (May 2001): 102109. 6. H. Evensky, Wealth Management: The Financial Advisors Guide to Investing and Managing Client Assets (McGraw-Hill, 1997).

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- PA v0.25Document18 pagesPA v0.25Sai PawanNo ratings yet

- Chapter 12 - Solution ManualDocument23 pagesChapter 12 - Solution Manualjuan100% (2)

- 1 Assignment BBA 101Document10 pages1 Assignment BBA 101Farhana78% (9)

- Cbse Test Paper AccountancyDocument3 pagesCbse Test Paper Accountancyankita roy chaudhuryNo ratings yet

- Actual, Nominal, Temperate and First 4 of ExemplaryDocument126 pagesActual, Nominal, Temperate and First 4 of Exemplarydnel13No ratings yet

- International Monetary Fund: HistoryDocument2 pagesInternational Monetary Fund: HistoryGEEKNo ratings yet

- Jaclyn Resume New 1Document4 pagesJaclyn Resume New 1api-297244528No ratings yet

- South Bay Digs 8.18.13Document91 pagesSouth Bay Digs 8.18.13South Bay DigsNo ratings yet

- SARFAESI Checklist: Steps for Secured Asset RecoveryDocument4 pagesSARFAESI Checklist: Steps for Secured Asset RecoverypraveenparthivNo ratings yet

- Sesbreno vs. CADocument5 pagesSesbreno vs. CALyNne OpenaNo ratings yet

- Microeconomics - Problem Set 4Document4 pagesMicroeconomics - Problem Set 4Juho ViljanenNo ratings yet

- Sathya's Iob ProjectDocument35 pagesSathya's Iob ProjectVenkatesh ChowdaryNo ratings yet

- The Future of Notarization Is OnlineDocument14 pagesThe Future of Notarization Is OnlineForeclosure FraudNo ratings yet

- Work Measurement Techniques Methods TypesDocument5 pagesWork Measurement Techniques Methods TypesManoj BallaNo ratings yet

- Metro Bank Case StudyDocument26 pagesMetro Bank Case Studyudaya_shankar_kNo ratings yet

- QuestionsDocument87 pagesQuestionsramu_n16100% (2)

- Acc Ch-7 Average Due Date SaDocument15 pagesAcc Ch-7 Average Due Date SaShivaSrinivas100% (3)

- RENUNCIATION RULINGDocument2 pagesRENUNCIATION RULINGCristelle Elaine ColleraNo ratings yet

- PESTEL Analysis of Political, Economic, Social, Technological, Environmental and Legal Factors Affecting Barclays BankDocument11 pagesPESTEL Analysis of Political, Economic, Social, Technological, Environmental and Legal Factors Affecting Barclays BankDennis Varghese0% (1)

- Opsional PlanDocument3 pagesOpsional PlanMuhammad Khori AntoNo ratings yet

- Micro Credit in CanadaDocument16 pagesMicro Credit in CanadatextbooksneedthemNo ratings yet

- Case Digest - PBC Vs Aruedo, G.R. L-25836-38Document2 pagesCase Digest - PBC Vs Aruedo, G.R. L-25836-38J Yasser PascubilloNo ratings yet

- E.W.F. LOAN APPLICATION FORMDocument2 pagesE.W.F. LOAN APPLICATION FORMapi-3710215No ratings yet

- BR - PAL - HAL and PDYLDocument2 pagesBR - PAL - HAL and PDYLZahed IbrahimNo ratings yet

- Affidavit of Thomas Adams For US Bank V CongressDocument9 pagesAffidavit of Thomas Adams For US Bank V CongressJohn StupNo ratings yet

- Project Costs and Budgeting For BBADocument11 pagesProject Costs and Budgeting For BBAHimanshu TulshyanNo ratings yet

- Export Finance: Project Guide: Prof.S.B. Kasture Project Prepared By: Sachin Parab Nmims MFM - Iii B ROLL NO.113Document56 pagesExport Finance: Project Guide: Prof.S.B. Kasture Project Prepared By: Sachin Parab Nmims MFM - Iii B ROLL NO.113rahulsatelli100% (2)

- Prudential Guaranty vs. EquinoxDocument1 pagePrudential Guaranty vs. EquinoxAhmad_deedatt03No ratings yet

- Corporate Law ProjectDocument15 pagesCorporate Law ProjectAyushi VermaNo ratings yet

- Contract perfection dispute over property saleDocument16 pagesContract perfection dispute over property saleEujeanNo ratings yet