Professional Documents

Culture Documents

KPMG Ifrs

Uploaded by

hlibre75Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

KPMG Ifrs

Uploaded by

hlibre75Copyright:

Available Formats

IFRS Financial Statements, Reporting and Disclosures: Are You Prepared for the 135-Day Crunch?

KPMG LLP

ROBERT D. BROUWER

The Accounting Standards Board (AcSB) has set January 1, 2011 as the date of conversion from Canadian GAAP to International Financial Reporting Standards (IFRS). This means that the December 31, 2010 financial statements will be your companys last reporting under Canadian GAAP. Calendar year-end companies have 90 days to issue their 2010 annual Canadian GAAP financial statements, followed by 45 days for Q1 interim IFRS financial statements (along with Q1 2010 IFRS comparatives); in other words, from January 1 to May 15, 2011. This has been affectionately termed the 135-day crunch. The timeline on the following page illustrates the financial reporting activities that Canadian companies will need to perform during the conversion to IFRS.

Transition Reporting Requirements Looking at the timeline, January 1, 2010, seems very near. This is the transition date for Canadian companies trying to take advantage of any elections under IFRS 1, First-time Adoption of International Financial Reporting Standards. Indeed, for many companies, the accounting policy choices that relate to specific exemptions permitted by IFRS 1 have already been made, or will be decided shortly. Given that IROs will have varying levels of exposure to IFRS projects within their companies, it is worthwhile to consider how the transition to IFRS will change financial reporting, both on transition and going forward.

KPMG, Toronto

MAG STEWART

KPMG, Toronto

Once the transition date of January 1, 2010 passes, accounting departments will begin to assemble both the opening IFRS balance sheet, and some interim reporting information that will be needed for the 2011 interim reporting comparative figures and disclosures. The requirements to report under Canadian GAAP in 2010 havent changed, so we expect most companies will prepare IFRS quarterly information in tandem with regular interim reporting. Ideally, much of this work should be completed during 2010, as preparing the IFRS-required reconciliations will be a challenge in the first quarter of 2011, and its important to provide management with ongoing information on the impact of IFRS. In order to give a sense of the extent of financial reporting that needs to be produced during the crunch, we list below the IFRS financial statements, information and reconciliations that will be required for Q1 2011: First-time adoption requirements in Q1 2011 Balance sheets for: March 31, 2011; Restated December 31, 2010; and Restated January 1, 2010. Income statements for three months ended: March 31, 2011; and Restated March 31, 2010. Statement of cash flows for three months ended: March 31, 2011; and Restated March 31, 2010.

THE 135-DAY CRUNCH

Statement of changes in equity for three months ended: March 31, 2011; Restated March 31, 2010; Reconciliations (Canadian GAAP to IFRS); Equity at transition date (January 1, 2010); Equity at end of comparative annual period (December 31, 2010); Equity as at comparative interim date (March 31, 2010); Comprehensive income for the annual period (December 31, 2010); and Comprehensive income for comparative interim period (March 31, 2010). Many other considerations, for instance: Full set of IFRS accounting policies; Material adjustments to the cash flow statement; and Information regarding impairment losses or reversals recognized at transition. Although the reconciliations are specifically required on first-time adoption, companies should not underestimate the fact that presentation of financial statements under IFRS is not the same as under Canadian GAAP, and even traditional reporting, like the income statement, may look different under IFRS. Differences in Income Statement Presentation Under IFRS, expenses are classified by nature or by function based on which method provides information that is reliable and more relevant. To classify by nature, expenses are aggregated in the income statement according to their nature (for example: depreciation; purchases of materials; transport costs; employee benefits; and advertising costs), and are not reallocated among functions within the entity. This method may be easier to apply because allocations of expenses to functional classifications are not necessary. Alternatively, classification by function aggregates expenses according to the function they relate to (for example: cost of sales and cost of distribution). This method may provide more relevant information to users than the classification of expenses by nature, but allocating costs to functions may require arbitrary decisions and involve considerable judgment. Under this method all expenses, including staff costs, depreciation and amortization, should be allocated to the appropriate functions. Also, if classification by function is chosen, additional information on the nature of expenses, including depreciation and amortization expense and employee benefits expense, must be disclosed. Most Canadian companies currently present expenses in the income statement using a mix of nature and function, which is prohibited under IFRS. The appropriate choice between the use of function or nature will depend on historical and industry factors. IROs will want to weigh in on this decision and be cognizant of what competitors are doing locally, if possible, and internationally. In some cases industry groups may have adopted predominantly one style for presentation. In countries that have already adopted IFRS, manufacturing companies typically present expenses by function and retail companies present it by nature. If gross profit is a key performance measure that analysts use to track your company, then presenting your expenses by function may be preferable. However, presenting expenses by function requires more allocation and may require more data than accounting systems are currently providing.

On the following page is an extract of an income statement presented by function, followed by the same income statement presented by nature. Conclusion While weve focused in this article on financial statements on transition, and the new income statement specifically, in upcoming columns we will look at transition differences that will change the information communicated to investors through the financial reporting process. IROs need to understand the Canadian GAAP/IFRS accounting differences that are starting to be discussed in the MD&A, and how financial information will be presented in the financials after 2011. IROs can provide valuable feedback as to what information will be important for investors. The time to influence presentation decisions is now, as there will be little appetite for changing plans during the crunch time, and many companies will begin compiling comparative information for the first interim statements in the first half of 2010. Rob Brouwer is a Partner and Mag Stewart is a Senior Manager with KPMG in Toronto.

kpmg.ca

KPMG and the KPMG logo are registered trademarks of KPMG International, a Swiss cooperative. 2009 KPMG LLP, a Canadian limited liability partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International, a Swiss cooperative. All rights reserved The information contained herein is of a general nature and is not intended to address the circumstances of any particular individual or entity. Although we endeavor to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. No one should act on such information without appropriate professional advice after a thorough examination of the particular situation.

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Gigacampus Final ReportDocument28 pagesGigacampus Final Reportmacao100No ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Bora AmusementDocument69 pagesBora Amusementabere100% (2)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Oxford Scholarly Authorities On International Law - 5 Compensation in - Compensation and Restitution in InvestorDocument37 pagesOxford Scholarly Authorities On International Law - 5 Compensation in - Compensation and Restitution in InvestorArushi SinghNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Investor Presentation Feb 2019Document26 pagesInvestor Presentation Feb 2019ROBINSON CHIRAN ACOSTA100% (1)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Circular 323-2016Document52 pagesCircular 323-2016Om PrakashNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Financial Ratio AnalysisDocument8 pagesFinancial Ratio AnalysisrapsisonNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Meridium APM Now: Questions?Document2 pagesMeridium APM Now: Questions?SANDRA TORRESNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Essay 1: How To Scan For Quality Gold Producers Using Goldnerds ProDocument4 pagesEssay 1: How To Scan For Quality Gold Producers Using Goldnerds PromentorgurusNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Britannia Industry AnalysisDocument10 pagesBritannia Industry AnalysisTomthin Ahanthem100% (1)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Example of Business Plan Andrea Gold PeruDocument62 pagesExample of Business Plan Andrea Gold PerufatimascNo ratings yet

- EY Optimize Network Opex and CapexDocument12 pagesEY Optimize Network Opex and Capexjhgkuugs100% (1)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Ebony Oil & Gas Limitedcls - ProfileDocument6 pagesEbony Oil & Gas Limitedcls - Profileaddo.terrenceNo ratings yet

- Chapter 6 - TestbankDocument14 pagesChapter 6 - TestbankCharles MK ChanNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Finance - United UtilitiesDocument4 pagesFinance - United UtilitiesRohit DhoundiyalNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- KPMG Disruptive Tech 2017 Part1 2Document40 pagesKPMG Disruptive Tech 2017 Part1 2CrowdfundInsider100% (7)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Fair Value Option ASC 825 (FAS159) Student Ver S10Document21 pagesThe Fair Value Option ASC 825 (FAS159) Student Ver S10andri juniawanNo ratings yet

- From Help Desk To Service DeskDocument57 pagesFrom Help Desk To Service DeskteacherignouNo ratings yet

- Phoenix Light SF Limited Vs Morgan StanleyDocument311 pagesPhoenix Light SF Limited Vs Morgan StanleyRazmik BoghossianNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- D16Document12 pagesD16neo14No ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Alternative Investment2Document39 pagesAlternative Investment2kenNo ratings yet

- List of Students Not Allowed For Final Term Exam Due To Shortage of Attendance BBA 4th Cost Accounting Money Banking Oral CommunicationDocument7 pagesList of Students Not Allowed For Final Term Exam Due To Shortage of Attendance BBA 4th Cost Accounting Money Banking Oral CommunicationAhmad KhawajaNo ratings yet

- Budget 2018-19: L'intégralité Des MesuresDocument145 pagesBudget 2018-19: L'intégralité Des MesuresL'express Maurice100% (1)

- Musharakah by Sheikh Muhammad Taqi UsmaniDocument9 pagesMusharakah by Sheikh Muhammad Taqi UsmaniMUSALMAN BHAINo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Transcript / Minutes of Conference Call (Company Update)Document20 pagesTranscript / Minutes of Conference Call (Company Update)Shyam SunderNo ratings yet

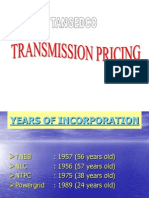

- Transmission PricingDocument57 pagesTransmission PricingMuruganNo ratings yet

- Port Mana - hdfc-22Document55 pagesPort Mana - hdfc-22MOHAMMED KHAYYUMNo ratings yet

- Page 1: What Is Franchising?: Being Their Own BossDocument4 pagesPage 1: What Is Franchising?: Being Their Own BossBela KagranaNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- BMC Writing Test ADocument8 pagesBMC Writing Test AvigneshNo ratings yet

- Stakeholder Relations Guideline 2012 en (FMGT)Document4 pagesStakeholder Relations Guideline 2012 en (FMGT)SalmaAlnofaliNo ratings yet

- Claw Assignment NewestDocument6 pagesClaw Assignment NewestclaraNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)