Professional Documents

Culture Documents

Cooper's Pestel

Uploaded by

Ig NaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cooper's Pestel

Uploaded by

Ig NaCopyright:

Available Formats

Arenas

Where will we be active? ( and with how

Products that have an inverse relation market for gas engines have to balan original products from Cooper.? Which channels? Which market segments? Which geographic areas? Which core technologies Which value-creation strategies?

Staging

What will be our speed and

sequence of moves? Speed of adquisitions was slow in order do not assigne to manager, innnecesaries activities. It took 20 years to buy the third company. Sequence of initiatives

Arenas

Staging

Economic logic

Economic logic

Differentiators

Economic logic

Differentiators

How will returns be obtained?

Sell the units that do not contribute to the goal (33 business between 1970 and 1988). The acquisitions complete the basic growth target of cooper (increase in pretax sbeneficios action to a composite index of 11%) and improve the quality of benefits to add stability. Sales the unit that do nor Lowest costs through scope and replication advantages Premium prices due to unmatchable service? Premium prices due to proprietary product features?

Differentiators

How will we win?

High Quality in products Customization? Price? Styling? Product reliability? Speed to market?

be active? ( and with how much emphasis?) have an inverse relationship of income that the s engines have to balance the low sales of ucts from Cooper.?

t segments? aphic areas? echnologies creation strategies?

Arenas

Vehicles

How will we get there?

Economic logic Vehicles

Differentiators

Growth and diversification through acquisitions of companies recognized successful and manufacture high quality, such as aerospace (Dallas Airmotive and Superior) and services company. Gardner-Denver was the

Differentiators

ntiators

will we win? Quality in products. tomization?

duct reliability? ed to market?

company. Gardner-Denver was the mayor adquisition almost same sixe that Cooper, could meet the full range of needs from the exploration, production, transmission, distribution and aamacenje for the sector of oil and natural gas. Crouse-hinds and Belden gave to Cooper 50% more in its revenue.

Simple but felxible internal estructure, 10 people who guided the Company with Directors bottom of them. Cooperization, process that was an internal practice used to adapt the new companies to Cooper reality Joint ventures? Licensing/franchising? Experimentation?

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Motivation LetterDocument2 pagesMotivation LetterSUNNY KUMARNo ratings yet

- Railway Reservation System DocumentationDocument19 pagesRailway Reservation System DocumentationSaroj Cipher80% (5)

- Volkswagen AR2014Document504 pagesVolkswagen AR2014cherikokNo ratings yet

- Billypugh Practice1Document9 pagesBillypugh Practice1Bernie SimcsNo ratings yet

- Ejot - Delta PT DsDocument2 pagesEjot - Delta PT DsLucas VeronaNo ratings yet

- Maintenance Audit SampleDocument4 pagesMaintenance Audit Sampleemad sabriNo ratings yet

- Ready Mix Concrete and Batching PlantDocument23 pagesReady Mix Concrete and Batching PlantJohnsonDaniel100% (1)

- FDA GMP GuidelinesDocument7 pagesFDA GMP Guidelinesm_ihab777629No ratings yet

- Brosur Kitarack 2022Document2 pagesBrosur Kitarack 2022Yulianto WangNo ratings yet

- 2nd ANNUAL CHINA AERONAUTICAL MATERIALS AND PROCESS SUMMITDocument8 pages2nd ANNUAL CHINA AERONAUTICAL MATERIALS AND PROCESS SUMMITGengbei ShiNo ratings yet

- EI 1581 SummaryDocument2 pagesEI 1581 SummarywholenumberNo ratings yet

- Jurnal e CommerceDocument8 pagesJurnal e Commercewawan_goodNo ratings yet

- Epcmd 2 Qm00 Jep Ci 004 - 01Document4 pagesEpcmd 2 Qm00 Jep Ci 004 - 01Rakesh RanjanNo ratings yet

- Nghi Son Ii Thermal Power Plant 1. DescriptionDocument2 pagesNghi Son Ii Thermal Power Plant 1. DescriptionDoan Ngoc DucNo ratings yet

- HYPERGROWTH by David Cancel PDFDocument76 pagesHYPERGROWTH by David Cancel PDFAde Trisna100% (1)

- PBN1Document10 pagesPBN1Vibhore Kumar SainiNo ratings yet

- Sap MM and SD Module CodesDocument48 pagesSap MM and SD Module Codesvishal_160184No ratings yet

- Risk Based Approach To ValidationDocument6 pagesRisk Based Approach To ValidationAlex CristiNo ratings yet

- BMW 745i E65 4.4 Valvetronic: Digital Adrenaline For YourDocument11 pagesBMW 745i E65 4.4 Valvetronic: Digital Adrenaline For YourPOCHOLO1968No ratings yet

- Maruti Bba Project For MarketingDocument92 pagesMaruti Bba Project For Marketingkaushal244256% (9)

- Lathe MachineDocument35 pagesLathe MachineRahul PatilNo ratings yet

- Install GCC 4.7 On RHEL 6Document3 pagesInstall GCC 4.7 On RHEL 6Zhou Yupeng PaulNo ratings yet

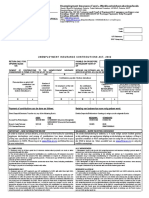

- Form - U17 - UIF - Payment AdviceDocument2 pagesForm - U17 - UIF - Payment Advicesenzo scholarNo ratings yet

- ARCADIS White Paper Building Information Modeling HalvorsonDocument16 pagesARCADIS White Paper Building Information Modeling HalvorsonCarlos Lopez FigueroaNo ratings yet

- Pulse Jet Bag Filters PDFDocument12 pagesPulse Jet Bag Filters PDFPetros IosifidisNo ratings yet

- Spring Hangers - AnvilDocument7 pagesSpring Hangers - AnvilRicardo De JesusNo ratings yet

- 2012 Q3 - McKinsey Quarterly - Leading in The 21 Century PDFDocument136 pages2012 Q3 - McKinsey Quarterly - Leading in The 21 Century PDFBayside BlueNo ratings yet

- Clamp Ring Closures: Sizes: 4-Inch and LargerDocument4 pagesClamp Ring Closures: Sizes: 4-Inch and LargerFilipNo ratings yet

- Weighbridge Integration With SapDocument9 pagesWeighbridge Integration With SapSandip SarodeNo ratings yet

- 2.what Are Fundamental Stages of Data Warehousing?: WikipediaDocument7 pages2.what Are Fundamental Stages of Data Warehousing?: WikipediaRajan SinghNo ratings yet