Professional Documents

Culture Documents

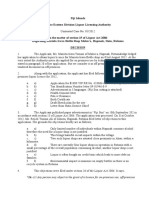

MF0015 - International Financial Management Summer Spring 2012

Uploaded by

balakalassOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MF0015 - International Financial Management Summer Spring 2012

Uploaded by

balakalassCopyright:

Available Formats

Spring / February 2012 Master of Business Administration- MBA Semester 4 MF0015 International Financial Management - 4 Credits (Book ID:

: B1316) Assignment Set- 1 (60 Marks) Note: Each Question carries 10 marks. Answer all the questions. Q1. You are given the following information: Spot EUR/USD : 0.7940/0.8007 Spot USD/GBP: 1.8215/1.8240 Three months swap: 25/35 Calculate three month EUR/USD rate. Ans:Forward Points = ((Spot * (1 + (OCR rate * n/360))) / (1 + (BCR rate * n/360))) - Spot OCR = Other Currency Rate BCR = Base Currency Rate Forward points = ((0.07940 * (1 + (0.018215 * 90/360))) / (1 + (0.08007 * 90/360))) 0.07940 SWAP = -0.00120 Forward rate = 0.07940 - 0.00120 = 0.0782 Customer sells EUR 3 Mio against USD at 0.0782 at 3 month (0.07940 - 0.00120). Customer wants to Buy EUR 3 Mio against USD 3 months forward. Dear Students, Get your assignments from Our ESTEEMED ORGANIZATION smumbaassignment.com Just email to kvsude@gmail.com or S M S your email to +91 9995105420. message Format - <E-MAIL ID> Space <Name> To +91 9995105420 , we will reach back you with in 24H

Or Directly call our Middle East Office +974 55702886 . More Info, Kindly visit smumbaassignment.com or http://smumbaassignments.in Best Regards, Admin smumbaassignment.com

Q2. Distinguish between Eurobond and foreign bonds. What are the unique characteristics of Eurobond markets? Ans:- A Eurobond is underwritten by an international syndicate of banks and other securities firms, and is sold exclusively in countries other than the country in whose currency the issue is denominated. For example, a bond issued by a U.S. corporation, denominated in U.S. dollars, but sold to investors in Europe and Japan (not to investors in the United States), would be a Eurobond. Eurobonds are issued by multinational corporations, large domestic corporations,

Dear Students, Get your assignments from Our ESTEEMED ORGANIZATION smumbaassignment.com Just email to kvsude@gmail.com or S M S your email to +91 9995105420. message Format - <E-MAIL ID> Space <Name> To +91 9995105420 , we will reach back you with in 24H Or Directly call our Middle East Office +974 55702886 . More Info, Kindly visit smumbaassignment.com or http://smumbaassignments.in Best Regards, Admin smumbaassignment.com

Q3. What is sub-prime lending? Explain the drivers of sub-prime lending? Explain briefly the different exchange rate regime that is prevalent today.

Q4. Explain (a) Parallel Loans (b) Back to- Back loans

Q5. Explain double taxation avoidance agreement in detail

Q6. What do you mean by optimum capital structure? What factors affect cost of capital across nations?

Dear Students, Get your assignments from Our ESTEEMED ORGANIZATION smumbaassignment.com Just email to kvsude@gmail.com or S M S your email to +91 9995105420. message Format - <E-MAIL ID> Space <Name> To +91 9995105420 , we will reach back you with in 24H Or Directly call our Middle East Office +974 55702886 . More Info, Kindly visit smumbaassignment.com or http://smumbaassignments.in Best Regards, Admin smumbaassignment.com

Spring / February 2012 Master of Business Administration- MBA Semester 4 MF0015 International Financial Management - 4 Credits (Book ID: B1316) Assignment Set- 2 (60 Marks) Note: Each Question carries 10 marks. Answer all the questions. Q1. Because of its broad global environment, a number of disciplines (geography, history, political science, etc.) are useful to help explain the conduct of International Business. Elucidate with examples. International Finance is a distinct field of study and certain features set it apart from other fields. The important distinguishing features of international finance are discussed below: Foreign exchange risk: An understanding of foreign exchange risk is essential for managers and investors in the modern day environment of unforeseen changes in foreign exchange rates. In a domestic economy this risk is generally ignored because a single national currency serves as the main medium of exchange within a country. When different national currencies are exchanged for each other, there is a definite risk of volatility in foreign exchange rates. The present International Monetary System set up is characterized by a mix of floating and managed exchange rate policies adopted by each nation keeping in view its interests. In fact, this variability of exchange rates is widely regarded as the most serious international financial problem facing corporate managers and policy makers. Political risk: Another risk that firms may encounter in international finance is political risk. Political risk ranges from the risk of loss (or gain) from unforeseen government actions or other events of a political character such as acts of terrorism to outright expropriation of assets held by foreigners. MNCs must assess the political risk not only in countries where it is currently doing business but also where it expects to establish subsidiaries. The extreme form of political risk is when the sovereign country changes the rules of the game and the affected parties have no alternatives open to them.

Expanded opportunity sets: When firms go global, they also tend to benefit from expanded opportunities which are available now. They can raise funds in capital markets where cost of capital is the lowest. In addition, firms can also gain from greater economies of scale when they operate on a global basis. Market imperfections: The final feature of international finance that distinguishes it from domestic finance is that world markets today are highly imperfect. There are profound differences among nations laws, tax systems, business practices and general cultural environments. Imperfections in the world financial markets tend to restrict the extent to which investors can diversify their portfolio. Though there are risks and costs in coping with these market imperfections, they also offer managers of international firms abundant opportunities.

Dear Students, Get your assignments from Our ESTEEMED ORGANIZATION smumbaassignment.com Just email to kvsude@gmail.com or S M S your email to +91 9995105420. message Format - <E-MAIL ID> Space <Name> To +91 9995105420 , we will reach back you with in 24H Or Directly call our Middle East Office +974 55702886 . More Info, Kindly visit smumbaassignment.com or http://smumbaassignments.in Best Regards, Admin smumbaassignment.com

Q2. What is a credit transaction and a debit transaction? Which are the broad categories of international transactions classified as credits and as debits? Q3. What is cross rates? Explain the two methods of quotations for exchange rates with examples.

Q4. Explain covered and uncovered interest rate arbitrage. Q5. Explain briefly the mechanism of futures trading Q6. Briefly explain the difference between functional currency and reporting currency. Identify the factors that help in selecting an appropriate functional currency that can be used by an organisation.

Dear Students, Get your assignments from Our ESTEEMED ORGANIZATION smumbaassignment.com Just email to kvsude@gmail.com or S M S your email to +91 9995105420. message Format - <E-MAIL ID> Space <Name> To +91 9995105420 , we will reach back you with in 24H Or Directly call our Middle East Office +974 55702886 . More Info, Kindly visit smumbaassignment.com or http://smumbaassignments.in Best Regards, Admin smumbaassignment.com

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- METHODOLOG1Document3 pagesMETHODOLOG1Essa M RoshanNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- March 2023 Complete Month Dawn Opinion With Urdu TranslationDocument361 pagesMarch 2023 Complete Month Dawn Opinion With Urdu Translationsidra shabbirNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Lapid V CADocument11 pagesLapid V CAChami YashaNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Coreapb3: Nivin PaulDocument19 pagesCoreapb3: Nivin PaulNivin PaulNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Operating Instruction PMD55Document218 pagesOperating Instruction PMD55Dilip ARNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Bacnet Today: W W W W WDocument8 pagesBacnet Today: W W W W Wmary AzevedoNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- ECEN 160 Final Project Logisim Instrs and DecoderDocument2 pagesECEN 160 Final Project Logisim Instrs and DecoderEvandro Fernandes LedemaNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- NAGIOS Inspeção Relatório de DadosDocument2 pagesNAGIOS Inspeção Relatório de DadosRuben QuintNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Subject: Industrial Marketing Topic/Case Name: Electrical Equipment LTDDocument4 pagesSubject: Industrial Marketing Topic/Case Name: Electrical Equipment LTDRucha ShirudkarNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Group5 - CHE11 - Midterm Essay - Seminar (CH4516E)Document28 pagesGroup5 - CHE11 - Midterm Essay - Seminar (CH4516E)Bình LêNo ratings yet

- Create New Project CodeVision AVR (LED)Document5 pagesCreate New Project CodeVision AVR (LED)calvinNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Kumara SwamiyamDocument21 pagesKumara SwamiyamVijey KumarNo ratings yet

- Violence Against NursesDocument22 pagesViolence Against NursesQuality Assurance Officer Total Quality ManagementNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Workflows in RUP PDFDocument9 pagesWorkflows in RUP PDFDurval NetoNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Optimizing The Office.: Transforming Business ProcessesDocument10 pagesOptimizing The Office.: Transforming Business ProcessesNOSHEEN MEHFOOZNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Mathswatch Student GuideDocument8 pagesMathswatch Student Guideolamideidowu021No ratings yet

- Siningbayan Field Book PDFDocument232 pagesSiningbayan Field Book PDFnathaniel zNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- ION 900 Series Owners ManualDocument24 pagesION 900 Series Owners ManualParosanu IonelNo ratings yet

- Mystique-1 Shark Bay Block Diagram: Project Code: 91.4LY01.001 PCB (Raw Card) : 12298-2Document80 pagesMystique-1 Shark Bay Block Diagram: Project Code: 91.4LY01.001 PCB (Raw Card) : 12298-2Ion PetruscaNo ratings yet

- Sweet Delight Co.,Ltd.Document159 pagesSweet Delight Co.,Ltd.Alice Kwon100% (1)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Critical Minimum Effort TheoryDocument3 pagesCritical Minimum Effort TheorycarolsaviapetersNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Pmgsy Unified BSR December 2019 PDFDocument87 pagesPmgsy Unified BSR December 2019 PDFRoopesh Chaudhary100% (1)

- Indian - Origin Girls Bag Google Science Honour - Yahoo! India EducationDocument3 pagesIndian - Origin Girls Bag Google Science Honour - Yahoo! India EducationRiyaz RafiqueNo ratings yet

- El Condor1 Reporte ECP 070506Document2 pagesEl Condor1 Reporte ECP 070506pechan07No ratings yet

- Slates Cembrit Berona 600x300 Datasheet SirDocument2 pagesSlates Cembrit Berona 600x300 Datasheet SirJNo ratings yet

- in Re Irava Bottle ShopDocument10 pagesin Re Irava Bottle ShopCYMON KAYLE LubangcoNo ratings yet

- Dahua Network Speed Dome & PTZ Camera Web3.0 Operation ManualDocument164 pagesDahua Network Speed Dome & PTZ Camera Web3.0 Operation ManualNiksayNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Special Power of AttorneyDocument1 pageSpecial Power of Attorneywecans izza100% (1)

- RBA Catalog Maltby GBR Aug 16 2023 NL NLDocument131 pagesRBA Catalog Maltby GBR Aug 16 2023 NL NLKelvin FaneyteNo ratings yet

- 20-21 Ipads Shopping GuideDocument1 page20-21 Ipads Shopping Guideapi-348013334No ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)