Professional Documents

Culture Documents

Benjamin Graham Investing Rules - Value Investing - Get Money Rich - Investment Advice

Uploaded by

pudiwalaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Benjamin Graham Investing Rules - Value Investing - Get Money Rich - Investment Advice

Uploaded by

pudiwalaCopyright:

Available Formats

3/2/2011

Benjamin Graham Investing Rules: Valu

Industry Ratios: Financial Analysis of stock

Invaluable Investment tips for first time investors

Benjamin Graham Investing Rules: Value Investing

BY INV ESTMENT BLOGGER, ON MA RCH 20TH, 2010

Value investing is more a habit than a process of investment. Value investing focuses on market price of a stock which is lower than the intrinsic value of the underlying business. Few stalwarts of Value investing like Warren Buffett, John Put Dividends to Work W e althDaily.co m /drip-report Burr and Philip Fisher have made the concept of value Compound your returns with DRIPs Full report investment (Benjamin Graham investing technique) popular. by Steve Christ. They believed that it is very important to know the intrinsic value of NSE Stock Market Training Nse program s.Manipa le ducatio n.in business before buying any stock. If the value of a Weekend classes. Hands-on training by industry business is more (by a multiplying factor) than the current market price of its stock then it automatically becomes a experts. Register Now good-buy. Benjamin Graham investing methods brought High Return Investments www.Po licyBa zaa r.com /P ureforward the concept of value investing which later was made Investm e nt Invest Just 2.1K pm & Get Rs.35 lac Return. more popular by Warren Buffett. In line with Benjamin Grow your Savings Now! Graham investing ways, we will discuss three principals of value investing: Invest In Healthcare www.m a rk etgainer.co m Break Through For Alc oholism Small Cap Company Has Breakthrough (1) Maintain a Margin of Safety. This is the rule one of Benjamin Graham investing techniques. Value investors make sure before buying any stocks that its current market price is substantially below its intrinsic value. As per Benjamin Graham investing rules a, the market price of a stock should be 2/3 of its calculated intrinsic value (or else book value). But it must be told here that book value is not the actual value of a business, it does not take care of other non-tangible values of business. A true follower of Benjamin Graham investing rules will have their own set of rules defined to calculate the intrinsic value of business. (2) Estimating Intrinsic Value.

Stock Tips For Short Term 99% accurate Track Record Tips in Stocks Below 100 Rs www.ca llo ptio nputo ption.com

Birla SunLife Mutual Fund Choose a Fund that Suits your Needs Visit Now For More Information. Mutua lfund.BirlaSunLife .co Online Share Trading A/C Zero A/C Opening Charges & DP AMC. Low Brokerage. Full Fayda Offer! rathionline ca m paigns.co

As margin of safety principal is the backbone of Benjamin Graham investing rule (value investing), calculating intrinsic value gives the toughness to that backbone. Intrinsic value principal is based on one theory which says a dollar in hand today is worth more than a dollar paid in future. This happens not only because of inflation of money but also because if one has dollars in hand today then he can invest it in deposits and earn extra interest on these dollars. According to Benjamin Graham investing rule, an estimate of intrinsic value of a company is calculated by estimating the future cash flow of company. (3) Evaluate Long term prospects Value investors think almost opposite of traders. Benjamin Graham investing rules actually are opposite to the concepts of traders. Traders are more focused on short term prospects of particular stocks, whereas Benjamin Graham investing techniques asks investors to think long term. Traders analysis of stocks is based on historical behavior of stock prices (called technical analysis). But Benjamin Graham investing rules forces value investors to focuses on long-term prospects of stocks. Value investors buy stocks with no immediate objective of selling. Long term business stocks are characterized by showing inclination towards customer focus, brand name, huge market capture and above all high quality managers managing the business. Benjamin Graham investing allows value investors to buys stocks with objective of holding it forever. Warren Buffett is live example among league of excellent investors who follows the Benjamin Graham investing rules more popularly known as value investing to buy business and stocks.

getmoneyrich.com/value-investing/

1/2

3/2/2011

Benjamin Graham Investing Rules: Valu

STOC KS

WAR R EN BU FFETT

Industry Ratios: Financial Analysis of stock

Invaluable Investment tips for first time investors

1 comment to Benjamin Graham Investing Rules: Value Investing

fuongl

March 21, 2010 at 2:14 am Very good

Industry Ratios: Financial Analysis of stock

Invaluable Investment tips for first time investors

getmoneyrich.com/value-investing/

2/2

You might also like

- 3D Value Investing: Triangulating the Best Investment TargetsFrom Everand3D Value Investing: Triangulating the Best Investment TargetsRating: 4 out of 5 stars4/5 (2)

- Nilesh Shah PresentationDocument57 pagesNilesh Shah PresentationAmit Desai PredictorNo ratings yet

- A simple approach to equity investing: An introductory guide to investing in equities to understand what they are, how they work and what the main strategies areFrom EverandA simple approach to equity investing: An introductory guide to investing in equities to understand what they are, how they work and what the main strategies areNo ratings yet

- Think Equity Think QGLP Contest 2019: Application FormDocument20 pagesThink Equity Think QGLP Contest 2019: Application Formvishakha100% (1)

- Warren BuffettDocument5 pagesWarren BuffettAtique RehmanNo ratings yet

- DR Muthu 1 PDFDocument233 pagesDR Muthu 1 PDFPratik Mehta100% (1)

- Prof Sanjay Bakshi's Fav Stock Falls From Grace Even As ValuePickr Forum's Ominous Warning Rings TrueDocument7 pagesProf Sanjay Bakshi's Fav Stock Falls From Grace Even As ValuePickr Forum's Ominous Warning Rings Truebhaskar.jain20021814No ratings yet

- Li Lu Lecture 2010 Cbs PDF FreeDocument3 pagesLi Lu Lecture 2010 Cbs PDF FreeKostNo ratings yet

- How to Make Money While You Sleep (Beginner Guide to Investment)From EverandHow to Make Money While You Sleep (Beginner Guide to Investment)No ratings yet

- A Practical Approach to the Study of Indian Capital MarketsFrom EverandA Practical Approach to the Study of Indian Capital MarketsNo ratings yet

- Ben Graham Net Current Asset Values A Performance UpdateDocument9 pagesBen Graham Net Current Asset Values A Performance UpdateB.C. MoonNo ratings yet

- Rakesh Jhunjhunwala's Model Portfolio For 2012Document9 pagesRakesh Jhunjhunwala's Model Portfolio For 2012rakeshjhunjhunwalaNo ratings yet

- Investing For Growth 1Document8 pagesInvesting For Growth 1kegnataNo ratings yet

- Lesson 3 Value Investing For Smart People Safal NiveshakDocument3 pagesLesson 3 Value Investing For Smart People Safal NiveshakKohinoor RoyNo ratings yet

- Options Trading for Beginners: Learn Strategies from the Experts on how to Day Trade Options for a Living!From EverandOptions Trading for Beginners: Learn Strategies from the Experts on how to Day Trade Options for a Living!No ratings yet

- A Word From One Investor To Another: Based On Techniques And Wisdom Provided By The World's Most Famous And Successful Investor Warren BuffettFrom EverandA Word From One Investor To Another: Based On Techniques And Wisdom Provided By The World's Most Famous And Successful Investor Warren BuffettNo ratings yet

- How To Invest in Stocks Market in 2020 - 15 Steps Procedure Guide With AdsDocument12 pagesHow To Invest in Stocks Market in 2020 - 15 Steps Procedure Guide With AdsKarthik PoluriNo ratings yet

- Loads of Money: Guide to Intelligent Stock Market Investing: Common Sense Strategies for Wealth CreationFrom EverandLoads of Money: Guide to Intelligent Stock Market Investing: Common Sense Strategies for Wealth CreationNo ratings yet

- Jean Marie Part 1Document5 pagesJean Marie Part 1ekramcalNo ratings yet

- Buffett - 50% ReturnsDocument3 pagesBuffett - 50% ReturnsRon BourbondyNo ratings yet

- OPTIONS TRADING CRASH COURSE: Mastering Strategies for Financial Success (2023 Guide for Beginners)From EverandOPTIONS TRADING CRASH COURSE: Mastering Strategies for Financial Success (2023 Guide for Beginners)No ratings yet

- Behind the Berkshire Hathaway Curtain: Lessons from Warren Buffett's Top Business LeadersFrom EverandBehind the Berkshire Hathaway Curtain: Lessons from Warren Buffett's Top Business LeadersRating: 2 out of 5 stars2/5 (1)

- Ambit - Strategy Errgrp - Forensic Accounting Identifying The Zone of Trouble'Document39 pagesAmbit - Strategy Errgrp - Forensic Accounting Identifying The Zone of Trouble'shahavNo ratings yet

- Best Time To Buy Stocks Is When You Don't Feel Like Buying'Document7 pagesBest Time To Buy Stocks Is When You Don't Feel Like Buying'dhruvasomayajiNo ratings yet

- The Death of Capital Gains Investing: And What to Replace It WithFrom EverandThe Death of Capital Gains Investing: And What to Replace It WithNo ratings yet

- Building Your Financial Future: A Practical Guide For Young AdultsFrom EverandBuilding Your Financial Future: A Practical Guide For Young AdultsNo ratings yet

- Investing in Credit Hedge Funds: An In-Depth Guide to Building Your Portfolio and Profiting from the Credit MarketFrom EverandInvesting in Credit Hedge Funds: An In-Depth Guide to Building Your Portfolio and Profiting from the Credit MarketNo ratings yet

- Value InvestingDocument24 pagesValue InvestingjucazarNo ratings yet

- Why You Suck At Investing And How You Can Easily and Dramatically Beat the Odds With a Brain Dead Easy, Set-It-And-Forget-It MethodFrom EverandWhy You Suck At Investing And How You Can Easily and Dramatically Beat the Odds With a Brain Dead Easy, Set-It-And-Forget-It MethodRating: 4 out of 5 stars4/5 (4)

- The Buy Low Sell High Trading and Investing Guidebook for BeginnersFrom EverandThe Buy Low Sell High Trading and Investing Guidebook for BeginnersRating: 4 out of 5 stars4/5 (1)

- Lesson 19 Value Investing For Smart People Safal NiveshakDocument3 pagesLesson 19 Value Investing For Smart People Safal NiveshakKohinoor RoyNo ratings yet

- "Masterclass With Super Investors" - Key Learnings - Mumbai 22nd Feb 2019Document1 page"Masterclass With Super Investors" - Key Learnings - Mumbai 22nd Feb 2019rushabh mundadaNo ratings yet

- Economic Moats: The Five Rules For Successful Stock InvestingDocument13 pagesEconomic Moats: The Five Rules For Successful Stock InvestingSachin KumarNo ratings yet

- The Moses of Wall Street: Investing The Right Way For The Right ReasonsFrom EverandThe Moses of Wall Street: Investing The Right Way For The Right ReasonsNo ratings yet

- Quality Money Management: Process Engineering and Best Practices for Systematic Trading and InvestmentFrom EverandQuality Money Management: Process Engineering and Best Practices for Systematic Trading and InvestmentRating: 3 out of 5 stars3/5 (1)

- Stay Rich with a Balanced Portfolio: The Price You Pay for Peace of MindFrom EverandStay Rich with a Balanced Portfolio: The Price You Pay for Peace of MindRating: 3 out of 5 stars3/5 (1)

- The Real Warren Buffett (Review and Analysis of O'Loughlin's Book)From EverandThe Real Warren Buffett (Review and Analysis of O'Loughlin's Book)Rating: 5 out of 5 stars5/5 (1)

- Ken Fisher "Super Stocks" Raimondas LenceviciusDocument13 pagesKen Fisher "Super Stocks" Raimondas LenceviciusAravind MauryaNo ratings yet

- Security Analysis (Book)Document3 pagesSecurity Analysis (Book)LinaNo ratings yet

- Make Business, Not War, or The Optimal Solutions of Major ProblemsFrom EverandMake Business, Not War, or The Optimal Solutions of Major ProblemsNo ratings yet

- GannDocument11 pagesGannrajivnk100% (1)

- 6.3. Flags: Trade Chart Patterns Like The ProsDocument6 pages6.3. Flags: Trade Chart Patterns Like The Prospudiwala100% (1)

- Esignal Manual Ch14Document8 pagesEsignal Manual Ch14eldujailiNo ratings yet

- Slow Stochastic & Trendline AflDocument1 pageSlow Stochastic & Trendline AflpudiwalaNo ratings yet

- Intrinsic Value - Stock Valuation BasicsDocument8 pagesIntrinsic Value - Stock Valuation BasicspudiwalaNo ratings yet

- Money ManagementDocument1 pageMoney ManagementpudiwalaNo ratings yet

- Adx Rules For TradingDocument1 pageAdx Rules For Tradingpudiwala100% (1)

- Sharekhan - Fundamental AnalysisDocument72 pagesSharekhan - Fundamental Analysissomeshol9355100% (8)

- Company - LLP Registration - InDIADocument28 pagesCompany - LLP Registration - InDIAgvs_2000No ratings yet

- Benefits of Surya Namaskar - ChildrenDocument11 pagesBenefits of Surya Namaskar - ChildrenpudiwalaNo ratings yet

- Maruti Celerio BrochureDocument8 pagesMaruti Celerio BrochureNikesh MirchandaniNo ratings yet

- Indian Auto Industry AnalysisDocument23 pagesIndian Auto Industry AnalysispudiwalaNo ratings yet

- Ichimoku Cloud E BookDocument18 pagesIchimoku Cloud E Bookpudiwala100% (2)

- Ichimoku Cloud E BookDocument18 pagesIchimoku Cloud E Bookpudiwala100% (2)

- Benefits of Surya Namaskar - ChildrenDocument11 pagesBenefits of Surya Namaskar - ChildrenpudiwalaNo ratings yet

- Kannada Class - Session I Handout: Kannada Word English Word Simple SentenceDocument19 pagesKannada Class - Session I Handout: Kannada Word English Word Simple Sentenceapi-3751327100% (7)

- Chanakya VVS 070309Document21 pagesChanakya VVS 070309akkisantosh7444No ratings yet

- Bpfinancial PDFDocument22 pagesBpfinancial PDFpudiwalaNo ratings yet

- Super AdxDocument5 pagesSuper AdxpudiwalaNo ratings yet

- Soumya Rajan Essential of TradingDocument48 pagesSoumya Rajan Essential of TradingRaj Malhotra100% (1)

- Toastmaster IcebreakerDocument4 pagesToastmaster IcebreakerSergio KrugNo ratings yet

- Ichimoku Kinko HyoDocument38 pagesIchimoku Kinko HyopudiwalaNo ratings yet

- Options Trading SimplifiedDocument12 pagesOptions Trading Simplifiedpudiwala0% (1)

- Sales Alert - SAP Ranked Worldwide BI, Analytics and Performance Management Leader by GartnerDocument2 pagesSales Alert - SAP Ranked Worldwide BI, Analytics and Performance Management Leader by GartnerpudiwalaNo ratings yet

- Corruption in India 2010 and BeforeDocument49 pagesCorruption in India 2010 and BeforeHaindava KeralamNo ratings yet

- World Sex Guide Escort Reviews - Europe - Czech Republic - Prague3Document7 pagesWorld Sex Guide Escort Reviews - Europe - Czech Republic - Prague3pudiwalaNo ratings yet

- Eric Schmidt TranscriptDocument8 pagesEric Schmidt TranscriptGuyNo ratings yet

- Basics Fundamental AnalysisDocument5 pagesBasics Fundamental AnalysispudiwalaNo ratings yet

- Right To Emergency CareDocument1 pageRight To Emergency Careretr_oldpwdNo ratings yet

- Payment 380 490413BDocument2 pagesPayment 380 490413BJohanny SantosNo ratings yet

- 4TH GroupDocument5 pages4TH Groupmandeep_hs7698100% (1)

- Business PlanDocument12 pagesBusiness PlanDivya ShrithaNo ratings yet

- 2014 Speed Report 025 Fortificação de Alimentos Básicos em MoçambiqueDocument39 pages2014 Speed Report 025 Fortificação de Alimentos Básicos em MoçambiqueMauro VieiraNo ratings yet

- DCF ModellDocument7 pagesDCF ModellVishal BhanushaliNo ratings yet

- Raising Money Summit Recap - Gene TrowbridgeDocument19 pagesRaising Money Summit Recap - Gene TrowbridgeDJ ScruggsNo ratings yet

- Wood - Eurocentric Anti-EurocentrismDocument8 pagesWood - Eurocentric Anti-EurocentrismJennifer PadillaNo ratings yet

- Allen Brouwer: Director of Marketing / CMO / Growth & Scaling ExpertDocument1 pageAllen Brouwer: Director of Marketing / CMO / Growth & Scaling ExpertallenNo ratings yet

- LN10Moffett38115 04 FMF LN10Document77 pagesLN10Moffett38115 04 FMF LN10Kwichobela BonaventureNo ratings yet

- PV Technologies, Inc.: Were They Asleep at The Switch?Document12 pagesPV Technologies, Inc.: Were They Asleep at The Switch?Sumedh Bhagwat0% (1)

- PRM Process MapDocument5 pagesPRM Process Mapsalesforce.com100% (1)

- 1st Barcelona Metropolitan Strategic PlanDocument42 pages1st Barcelona Metropolitan Strategic PlanTbilisicds GeorgiaNo ratings yet

- Quarterly Journal of Economics: Vol. 135 2020 Issue 2Document84 pagesQuarterly Journal of Economics: Vol. 135 2020 Issue 2Lucas OrdoñezNo ratings yet

- Poem 4Document7 pagesPoem 4Jenny ManalastasNo ratings yet

- Securities and Exchange Commission: Sec Form 17-QDocument3 pagesSecurities and Exchange Commission: Sec Form 17-QJamil MacabandingNo ratings yet

- Kotler Mm15e Inppt 18Document25 pagesKotler Mm15e Inppt 18EnTe Saxophonist100% (1)

- What The Heck Is Going On With LEAS and BBDADocument54 pagesWhat The Heck Is Going On With LEAS and BBDAtriguy_2010No ratings yet

- MODULE 4 Group 6Document17 pagesMODULE 4 Group 6Denisse Nicole SerutNo ratings yet

- Cost Accounting Objective Type QuestionsDocument2 pagesCost Accounting Objective Type QuestionsJoshua Stalin Selvaraj75% (16)

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)AnishRoyNo ratings yet

- Brand NameDocument10 pagesBrand NameashabNo ratings yet

- LIFI FIFO Methods AccountingDocument71 pagesLIFI FIFO Methods AccountingThelearningHightsNo ratings yet

- QuizDocument5 pagesQuizCasey NonNo ratings yet

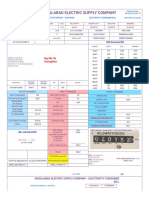

- Fesco Online BillDocument2 pagesFesco Online BillSaqLain AliNo ratings yet

- Case Study TeslaDocument2 pagesCase Study TeslaNey JNo ratings yet

- Soal Akuntansi KeuanganDocument4 pagesSoal Akuntansi Keuanganekaeva03No ratings yet

- Module-5 Recent Trends in Marketing Online MarketingDocument7 pagesModule-5 Recent Trends in Marketing Online Marketingmurshidaman3No ratings yet

- s5 Economics - Topical Economics QuestionsDocument83 pagess5 Economics - Topical Economics QuestionsHasifa Konso100% (2)

- P&G PresentationDocument23 pagesP&G PresentationSaman Sharif50% (2)

- Stock Option Plan Berg Company Adopted A Stock Option Plan On PDFDocument1 pageStock Option Plan Berg Company Adopted A Stock Option Plan On PDFAnbu jaromiaNo ratings yet