Professional Documents

Culture Documents

Jyothy Laboratories: Ready For Takeoff

Uploaded by

Angel BrokingOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Jyothy Laboratories: Ready For Takeoff

Uploaded by

Angel BrokingCopyright:

Available Formats

4QFY2012 Result Update| FMCG

May 28, 2012

Jyothy Laboratories

Ready for takeoff

JLL Standalone 4QFY2012 highlights

Y/E March (` cr) Net Sales Operating profit OPM (%) Adj. PAT 4QFY12 219 36 16.6 28 3QFY12 167 28 17 29 % chg. (qoq) 31.4 28.9 (32)bp (4) 4QFY11 159 17 10.5 22 % chg. (yoy) 37.5 118 614bp 25.7

BUY

CMP Target Price

Investment Period

Stock Info Sector Market Cap (` cr) Beta 52 Week High / Low Avg. Daily Volume Face Value (`) BSE Sensex Nifty Reuters Code Bloomberg Code

`214 `268

12 Months

Source: Company, Angel Research

Jyothy Laboratories Ltd.s (JLL) standalone results came in better than our expectations during 4QFY2012. On the revenue front, it reported 37.5% yoy growth to `219cr, with operating profit margin improving by 614bp yoy to 16.6%. Raw-material cost as a percentage of net sales increased sharply during the quarter; however, lower employee cost offset the same and helped the margin to sustain its level. Profit for the quarter grew by 25.7% yoy to `28cr. We maintain our Buy recommendation on JLL.

FMCG 1,725 0.4 252 / 125 22,894 1 16,417 4,986 JYOI.BO SRTY IN

Shareholding Pattern (%) Promoters MF / Banks / Indian Fls FII / NRIs / OCBs Indian Public / Others 65.2 17.5 12.8 4.6

Henkels 4QFY2012 performance: Henkel India (HIL) reported a healthy

30.8% qoq growth in net sales at `101cr and operating margin of 4.4%, an improvement of 130bp on qoq basis. However, the bottomline was still in negative zone with a loss of `8cr.

Outlook and valuation

We expect JLLs consolidated revenue to post a CAGR of 31.0% to `1,568cr with an operating margin of 11.1% and profit to post a CAGR of 40.2% to `88cr over FY2012-14E. We maintain Buy on JLL with an SOTP target price of `268.

Abs.(%) Sensex JLL 3m 8.7 1yr 4.1 3yr 14.8 172.7 (7.4) (10.0)

SOTP valuation

Method JLL (Standalone) Henkel (Consol.) JFSL

P/E P/E EV

Remarks

20x FY2014E earnings 28x FY2014E earning, (for 83.7% stake) Discounted at 50%, for 75% stake

Expected Mcap (` cr)

1,760 247 150

`/share

218 31 19

Total

Source: Company, Angel Research

268

Key financials (Consolidated)

Y/E March (` cr)

Net sales % chg Adj. net profit % chg OPM (%) EPS (`) P/E (x) P/BV (x) RoE (%) RoCE (%) EV/Sales (x) FY2010 594 64.5 74 93.9 15.4 10.3 23.2 4.4 20.3 0.2 2.7 FY2011 610 3.6 69 (7.6) 11.7 8.5 25.1 2.7 13.5 0.1 2.4 FY2012* 913 47.4 45 (35.2) 9.2 5.5 38.7 2.8 7.2 0.1 2.2 FY2013E 1,315 44.0 51 15.3 8.6 6.4 33.6 2.8 8.4 0.1 1.6 FY2014E 1,568 19.2 88 70.5 11.1 10.9 19.7 2.7 13.9 0.1 1.3

Tejashwini Kumari

022-39357800 Ext: 6856 tejashwini.kumari@angelbroking.com

EV/EBITDA (x) 17.6 20.1 24.4 18.7 12.1 Source: Company, Angel Research, *FY2012E includes Henkel numbers post August 22, 2011

Please refer to important disclosures at the end of this report

Jyothy Laboratories | 4QFY2012 Result Update

JLL Standalone 4QFY2012 performance

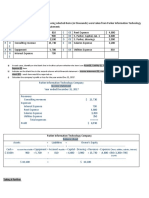

Exhibit 1: 4QFY2012 Performance highlights (Standalone)

Y/E March (` cr) Net Sales Net raw material (% of Sales) Employee Cost (% of Sales) Other Expenses (% of Sales) Total Expenditure Operating Profit OPM (%) Interest Depreciation Other Income PBT (% of Sales) Tax (% of PBT) Reported PAT Extraordinary Expense/(Inc.) Adjusted PAT PATM Equity capital (cr) EPS (`)

Source: Company, Angel Research

4QFY12 219 132 60.5 15 7.1 35 15.8 182 36 16.6 13 3 15 35 15.9 7 19.8 28 28 12.8 8.1 3.5

3QFY12 167 87 52.1 22 13.3 29 17.6 138 28 17.0 2 6 14 34 20.4 5 14.5 29 29 17.5 8.1 3.6

% chg. (qoq) 31.4 52.6 (30.2) 17.6 31.9 28.9 (32)bp 484.4 (44.9) 6.5 2.3 39.4 (4.0) (4.0)

4QFY11 159 84 52.6 19 12.1 39 24.8 142 17 10.5 0 2 9 24 14.8 1 5.8 22 22 14.0 8.1

% chg. (yoy) 37.5 58.1 (19.4) (12.4) 28.1 118.0 614bp 8,822.4 69.6 68.5 47.8 407.3 25.7 25.7

FY2012

663 373 56.2 78 11.8 130 19.6 580 83 12.5 19 17 57 103 15.6 20 19.1 84 84 12.6 8.06

FY2011 600 311 51.9 75 12.5 134 22.4 521 79 13.2 0 11 28 96 15.9 15 16.0 80 4 77 12.8 8.1 9.5

% chg 10.5 19.6 4.3 (3.5) 11.5 4 (73)bp 4,639.0 57.8 106.6 8.0 28.7 4.1 9.0

(4.0)

2.8

25.7

10.4

9.0

Revenue surged; however profit declined on higher interest outgo

The company posted strong revenue growth of 31.4% qoq to `219cr. The companys operating margin stood at 16.6%, improving on a yoy basis; however, it witnessed cost pressure on a qoq basis, mainly on the back of a steep increase in raw-material prices (crude and guar gum prices). Employee cost, which saw a decline of 30.2% qoq because of the reversal of incentives on underperformance to sales staff, offset the raw-material price hike and helped the margin to sustain its level. Also, interest cost for the quarter rose sharply at `13cr, on account of debt of `430cr at a rate of 11.25% taken for providing loan to HIL, which affected the profit adversely which came in at `28cr, registering a decline of 4% on a qoq basis.

May 28, 2012

Jyothy Laboratories | 4QFY2012 Result Update

Exhibit 2: Revenue continued the uptrend

250 200 150 60 40

Exhibit 3: Margin contracted due to hike in RM price

40 30 30 25 20

(`cr)

20 0 (20) (40)

(`cr)

100 50 0

(%)

10 0

10 5 0

1QFY10

2QFY10

3QFY10

4QFY10

1QFY11

2QFY11

3QFY11

4QFY11

1QFY12

2QFY12

3QFY12

4QFY12

1QFY10

2QFY10

3QFY10

4QFY10

1QFY11

2QFY11

3QFY11

4QFY11

1QFY12

2QFY12

3QFY12

Revenue (LHS)

yoy growth (RHS)

EBITDA (LHS)

EBITDA Margin (RHS)

Source: Company, Angel Research

Source: Company, Angel Research

Segmental performance Maxo made a comeback

JLLs (Standalone) revenue for the quarter witnessed 37.5% yoy growth, aided by growth momentum in all the three segments. Fabric care grew by 34%, Maxo increased by 32% and Exo grew by 84% for the quarter on yoy basis. The major surprise came from growth in Maxo, which was witnessing pressure since the past few quarters due to fierce competition. Maxo reported sales of `62cr in 4QFY2012 compared to `28cr in 3QFY2012. With the new advertisement, featuring Bollywood actor R. Madhavan, the company is now focusing on Maxo liquid and expects growth momentum to continue. The company also expects growth of fabric care and Exo to continue, led by advertisement spend for brand building coupled with the synergizing distribution network of JLL and Henkel.

Exhibit 4: All segments showing growth momentum

120 100 80 Fabric care Mosquito repellent Dishwashing

(`cr)

60 40 20 0

4QFY10

1QFY11

2QFY11

3QFY11

4QFY11

1QFY12

2QFY12

3QFY12

Source: Company, Angel Research

May 28, 2012

4QFY12

4QFY12

(%)

20

15

Jyothy Laboratories | 4QFY2012 Result Update

Henkels performance

Henkel Indias (HIL) revenue recovered post the strike in Karaikal plant, which had adversely affected the companys revenue in 3QFY2012. It reported a healthy 30.8% qoq growth in net sales at `101cr and operating margin of 4.4%, an improvement of 130bp on qoq basis. However, the operating margin was lower than our estimate on account of the increased raw-material prices and high employee cost for the quarter. Also, despite the decent growth in revenue as well as expansion in operating margin, the bottomline for the company was is still in negative zone with a loss of `8cr, due to high interest outgo.

Exhibit 5: Henkels Quarterly performance (Consolidated)

Y/E March (` cr) Net Sales Operating profit OPM (%) Adj. PAT

Source: Company, Angel Research

4QFY12 101 4 4.4 (8)

3QFY12 77 2 3.1 (11)

% chg. (qoq) 30.8 85.4 130bp 24.5

4QFY11 119 (8) (6.8) (18)

% chg. (yoy) (15.6) 154.7 1,124bp 54.0

JLL is all set to launch the new commercials of Margo and Pril, which is expected to revamp and reposition its brands and help in driving its sales volumes, and commercials for Fa and Henko are underway.

May 28, 2012

Jyothy Laboratories | 4QFY2012 Result Update

Investment arguments

Synergies of JLL-HIL major driver for the business

With the strategic acquisition of HIL, JLL (consolidated) is expected to witness a robust performance growth in the long term. The acquisition of HIL has provided JLL - 1) a combined basket of 10 brands, three of its own (Ujala, Maxo and Exo) and seven brands of HIL (Henko, Pril, Fa, Margo, Mr. White, Neem and Chek), 2) a strong entry in the urban market as HILs ratio of rural and urban presence is 30:70, which is 75:25 for JLL; and 3) strong combined distribution network complementing both the companies, and facilitating them to enjoy a pan-India presence at a low cost. With the HILs turnaround plan in place, we expect the synergies to start showing results in coming years.

Turnaround of Henkel to add to profit by FY2014E

With synergies of both businesses at place, JLL consolidated revenue is expected to witness a 31.0% CAGR to `1,568cr. We are expecting the turnaround of Henkel to happen by FY2014E with `11cr profit. Once HIL starts yielding profits, consolidated profit of JLL will witness a significant jump of 70.5% yoy to `88cr in FY2014E.

Advertisement spend coupled with price hike to drive sales

JLL is all set with new advertisements for Margo, Pril and Maxo, which was much needed for the revamping of the brand. The company expects to increase its advertisement cost going forward. We expect JLL (standalone) to spend `58cr and `67cr in FY2013E and FY2014E, respectively. After launching the TV commercials of Margo and Pril, the company will start focusing on its other brands (Fa and Henko). We expect this to drive the companys sales. Apart from revamping of brands, management is also increasing the prices of all Henkel products by 15%, the effect of which will be visible from 1QFY2013E.

JFSL A long-term growth driver

JLLs laundry business, Jyothy Fabricare Services Ltd. (JFSL), its 75% subsidiary, is now countrys biggest laundry chain with 122 retail outlets across Delhi, Mumbai, Pune and Chennai. JFSL has a key client base of 116, which includes hotels, airlines, service apartments and health clubs. It has bagged a BOOT (build, own, operate and transfer) contract for 10 years from Western Railways, Ahmedabad (minimum guaranteed business worth `65cr) and a BOOT contract for 15 years from Delhi International Airport Ltd. (DIAL). JFSL further plans to expand to Tier I and Tier II cities through the franchisee. According to managements forecast, JFSLs revenue is expected to reach `193cr, with operating margin of 26.1% and profit of `30cr by FY2014E. Also, JSFL will now have only two brands under its umbrella FabricSpa (premium category) and Wardrobe (economy category). We expect this laundry business to be a long term growth driver for JLL after consolidation of its business.

May 28, 2012

Jyothy Laboratories | 4QFY2012 Result Update

Appointment of new CEO A right move

The company has appointed Mr. S. Raghunandan as its Chief Executive Officer (CEO). Mr. Raghunandan has worked with Reckitt Benckiser, Paras Pharma, Dabur India, and HUL, among others, at senior positions. The step seems to be a positive move at the right time since JLL-Henkel consolidation has been completed and the company is now ready for a takeoff. We believe the new CEO will enrich the company, which has now seven brands in its basket.

Key takeaways of the analyst meet

Mr. S. Raghunandan appointed as the CEO of the company. The cross selling of JLL-Henkel will start from May 2012, which will boost the companys sales significantly. Management guided for 20-25% growth in JLL (standalone) business and 20-45% growth on Henkels business. The Bangladesh JV, Jyothy Kallol will have complete access to JLLs and Henkels products from October 2012 (only Ujala is being exported there presently). As per management, Jyothy Kallols project cost will be `15cr. The board has recommended a dividend of `2.50/equity share and declared a bonus of 1:1. The company expects Jyothy Fabricare Services Ltd. (JSFL) to become profitable by FY2013E, provided it does not enter Chennai and Hyderabad. JSFL will now have only two brands under its umbrella FabricSpa (premium category) and Wardrobe (economy category).

May 28, 2012

Jyothy Laboratories | 4QFY2012 Result Update

Financials

JLL (Standalone) Healthy growth going ahead

Realization and volume growth to drive the companys revenue

JLL (Standalone) reported a 10.5% increase in its net sales for FY2012 to `663cr. Management has guided for 20-25% sales growth; however, we have incorporated a revenue CAGR of 16.6% over FY2012-14E, from `663cr in FY2012 to `901cr in FY2014E. Major drivers for the same will be the increase in realization and expected volume growth.

Exhibit 6: Healthy sales backed by volume growth

1000 800 600 400 200 0 FY2009* FY2010 FY2011 FY2012 FY2013E FY2014E Revenue (LHS) Revenue growth (RHS) 80 60 40 20 0 (20) (%)

Source: Company, Angel Research; Note: *FY2009 was for 9 months

Assuming that rural GDP grows at 14.7% and 15.6% yoy in 2013E and 2014E, respectively, we expect the JLLs total sales to post a CAGR of 16.6% over FY201214E, as most of the companys sales come from rural areas. We expect CAGR for homecare segment to be 15.0% (to `257cr) while that for soaps and detergent segment to be 17.2% (to `521cr) over FY2012-14E. Volumes of the manufactured products are estimated to post a CAGR of 12.7% and 11.6% in the home care and soaps and detergent segments, respectively, over FY2012-14E.

Exhibit 7: Sales growth for JLL (Standalone)

FY2010 Rural GDP (at factor cost) growth (%) Sales growth for JLL (Standalone) (%) Home care (%) Soaps and Detergents (%)

Source: Company, Angel Research, *CAGR over FY2012-14E

(`cr)

FY2011 17.9 4.4 (9.0) 13.7

FY2012E 14.7 10.6 2.1 15.3

FY2013E 14.7 17.2 17.8 16.9

FY2014E 15.6 15.8 12.3 17.6

CAGR*

15.2 16.5 15.0 17.2

16.0 63.5 54.2 70.7

Increasing raw material prices impacted margin

JLLs (Standalone) operating margin for FY2012 declined by 73bp to 12.5% due to increased raw-material cost due to rupee depreciation. We expect the margin to be under pressure going forward because of the same reason and with the planned increase in advertisement expense. We expect the company to report an operating margin of 12.3% in FY2013E. However, with cost stabilization going forward, it can improve to 13.1% in FY2014E.

May 28, 2012

Jyothy Laboratories | 4QFY2012 Result Update

Exhibit 8: EBITDA margin to witness marginal improvement in FY2014E

140 120 100 18 16 14 12 8 6 4 2 0 FY2009* FY2010 FY2011 FY2012 FY2013E FY2014E EBITDA (LHS) EBITDA Margin (RHS)

60 40 20 0

Source: Company, Angel Research; Note: *FY2009 was for 9 months

Profit to experience muted growth

JLL (Standalone) reported PAT of `84cr in FY2012, registering 9% yoy growth. We expect the companys profit to remain muted in FY2013E to `80cr, mainly on the back of margin contraction and increased interest cost to `49cr. Though EBITDA margin is expected to improve in FY2014E, it would be offset by higher tax outgo on account of losing MAT credit benefits after FY2013E. However, if JLL-Henkel merger happens, JLL will further enjoy the tax shield due to the carried forward losses of Henkel. We expect JLLs standalone profit to post a muted CAGR of 3% over FY201214E to `88cr.

Exhibit 9: Muted growth on the PAT front

100 80 60 40 20 0 FY2009* FY2010 FY2011 PAT (LHS) FY2012 FY2013E FY2014E PAT growth (RHS) 125 100 75 50 25 0 (25)

(`cr)

Source: Company, Angel Research; Note: *FY2009 was for 9 months

May 28, 2012

(%)

(%)

(`)

80

10

Jyothy Laboratories | 4QFY2012 Result Update

Henkel (Consolidated) Breakeven by 2014E

Henkel posted a 1.2% dip in its top line to `527cr in FY2012 on consolidated basis because of business restructuring (and the 62-day shutdown at Karaikal plant (September 26 to December 26), which manufactures Henko Stain Champion, which adversely affected production. However, we expect Henkel to breakeven by FY2014E with profit of `11cr. Major factors helping the growth will be 1) hike of 15% in realization across all products in FY2013E, 2) repositioning of brands (Margo and Prils TV commercials to start soon, and rest underway), 3) change in distribution channel and 4) reduction in total expenditure as a percentage of net sales (mainly employee cost and other expense). HIL has changed its financial year ending from December to March, thus reporting numbers for 15 months in FY2012. We expect Henkel to post a consolidated revenue CAGR of 10% over FY2012-14E. Management has guided for 20-45% growth, but we have considered 25% growth. With lower expenditure, we expect margin to expand to 6.1% and 10.9% in FY2013E and FY2014E, respectively and expect the business to start reporting profit from FY2014E.

Exhibit 10: Financials

Y/E March (` cr) Net Sales % chg Adj. Net Profit % chg OPM (%) EPS (`) P/E (x) P/BV (x) RoE (%) RoCE (%) EV/Sales (x) EV/EBITDA (x) CY2010

534 (9.9) (55) 69.1 (4.2) (4.7) (5.3) (1.8) 40.3 (0.1) 1.4 (33.2)

FY2012*

527 (1.2) (41) 25.2 2.9 (3.5) (7.0) (1.6) 24.3 0.0 1.3 46.4

FY2013

510 (3.3) (24) 40.1 6.1 (2.1) (11.7) (1.4) 13.0 0.1 1.4 23.6

FY2014E

638 25.0 11 143.1 10.9 0.9 27.2 (1.5) 5.4 0.2 1.1 10.4

Source: Company, Angel Research, *FY2012 is of 15 months

May 28, 2012

Jyothy Laboratories | 4QFY2012 Result Update

Outlook and valuation

On a consolidated basis, we expect JLLs revenue to post a 31.0% CAGR over FY2012-14E to `1,568cr. With stabilizing costs after business consolidation, JLLs operating margin is likely to improve by 184bp to 11.1% and its consolidated profit is expected to post a 40.2% CAGR to `88cr. We have valued JLL (consolidated) on an SOTP basis. JLL (standalone) is valued at target PE of 20x for FY2014E at a price of `218/share; Henkel has been valued at PE of 28x for FY2014E at a price of `31/share for 83.7% stake; and JSFL has been valued by stake sell method, discounted at 50% for 75% stake at a price of `19/share. Currently, at `214, JLL (standalone) is trading at PE of 19.6x for FY2014E. We maintain our Buy recommendation on the stock with a target price of `268, based on SOTP valuation.

Exhibit 11: SOTP valuation of JLL

JLL (Standalone)

Mcap (` cr) Net worth (2014E) (` cr) PAT (2014E) (` cr) Current PE (x) Target PE (x) Expected value (` cr) Outstanding shares (in cr) Expected price/ share (`) (A)

1,725 834 88 19.6 20.0 1760 8.1 218

Henkel (Consolidated) Mcap (in ` cr) Net worth (2014E) (` cr) PAT (2014E) (` cr) Current PE (x) Target PE (x) Expected value (in ` cr) (for 83.7% stake) Outstanding shares (cr) Expected price/ share (`) (B)

287 (191) 11 27.2 28.0 247 8.1 31

JSFL Total EV (in ` cr) (including debt of `60cr) EV (Discounting at 50%) (in `cr) Value for JLL's 75% stake in JFSL (in `cr) Outstanding shares (in cr) Expected price/ share (`) (C)

400 200 150 8.1 19

Target price (`) (A+B+C)

Source: Company, Angel Research

268

May 28, 2012

10

Jyothy Laboratories | 4QFY2012 Result Update

Exhibit 12: One-year forward PE band

350 300 250 200 (`) 150 100 50 0 Feb-09 May-10 Mar-11 Oct-10 Aug-11 Apr-08 Sep-08 Dec-09 Jan-12 Jul-09 6x

Price (`) Source: Company, Angel Research

10x

14x

18x

Exhibit 13: Comparative analysis

Company JLL Standalone JLL Consolidated Emami* Marico Dabur Year end

FY2013E FY2014E FY2013E FY2014E FY2013E FY2014E FY2013E FY2014E FY2013E FY2014E

Mcap (` cr)

1,725 1,725 1,725 1,725 7,662 7,662 11,478 11,478 18,266 18,266

Sales (` cr)

778 901 1315 1568 1741 2051 4667 5427 5878 6799

OPM (%)

12.3 13.1 6.6 9.3 18.1 17.9 12.8 12.9 16.8 17.0

PAT (` cr)

80 88 51 88 310 367 409 500 722 856

EPS (`)

9.9 10.9 6.4 10.9 20.5 24.3 6.6 8.1 4.1 4.9

RoE (%)

11.1 11.0 8.4 13.9 35.7 36.2 30.0 28.8 39.3 42.0

P/E (x)

21.6 19.6 33.6 19.7 24.7 20.9 26.8 21.9 25.3 21.3

P/BV (x)

2.2 2.1 2.8 2.7 7.9 6.3 7.2 5.6 9.2 7.5

EV/Sales (x)

2.2 1.8 1.6 1.3 3.9 3.2 2.5 2.1 3.1 2.7

Source: Company, Angel Research, * Bloomberg estimates

Risk factors

Business integration and delay in Henkels breakeven

Going forward, the major concern for JLL is the risk associated with the integration of HIL. JLL is almost done with Henkel turnaround steps; however, synergizing the distribution network of JLL and HIL is underway. If things go haywire, JLLs growth could face a serious risk. Furthermore, any delay in the breakeven (expected by FY2014E) can be a negative for the company and may pose downside risk to our estimate.

Raw-material cost

The companys operating margin saw pressure in FY2012 due the rise in raw material price led by higher crude price and rupee depreciation. HDPE, which constitutes the largest raw-material expenditure, is a derivative of crude oil and is exposed to great price fluctuation. Any further rise in rupee depreciation and crude oil price may pose risk to the companys business.

May 28, 2012

11

Jyothy Laboratories | 4QFY2012 Result Update

Profit and Loss (Standalone)

Y/E March (` cr) Net Sales Other operating income Total operating income % chg Net Raw Materials % chg Other Mfg costs % chg Personnel % chg Other % chg Total Expenditure EBITDA % chg (% of Net Sales) Depreciation & Amortisation EBIT % chg (% of Net Sales) Interest & other Charges Other Income (% of Net Sales) Recurring PBT % chg PBT (reported) Tax (% of PBT) PAT (reported) Extraordinary Expense/(Inc.) ADJ. PAT % chg (% of Net Sales) Basic EPS (`) Fully Diluted EPS (`) % chg FY2010 573 573 63.7 311 58.1 17 51.1 67 55.9 84 71.3 479 94 87.8 16.4 10 83 93.2 14.6 1 18 3.2 83 93.4 101 21 20.8 80 80 99.6 14.0 11.0 11.0 99.6 FY2011 600 600 4.7 311 0.1 20 21.3 75 11.0 114 35.9 521 79 (15.7) 13.2 11 68 (18.1) 11.4 0 28 4.6 68 (18.0) 96 15 16.0 80 4 77 (4.3) 12.8 9.5 9.5 (13.9) FY2012 663 663 10.5 373 19.6 22 7.0 78 4.3 108 (5.4) 580 83 4.4 12.5 17 66 (4.0) 9.9 19 57 8.6 46 (32.0) 103 20 19.1 84 84 9.0 12.6 10.4 10.4 9.0 FY2013E 778 778 17.3 433 16.2 26 17.3 93 18.6 131 21.2 682 96 15.9 12.3 15 81 23.3 10.4 49 69 8.9 32 (30.5) 101 21 21.1 80 80 (4.5) 10.3 9.9 9.9 (4.5) FY2014E 901 901 15.8 494 14.1 30 15.8 107 15.8 151 15.8 782 118 23.5 13.1 16 103 26.8 11.4 43 72 8.0 59 85.2 132 44 33.1 88 88 10.3 9.8 10.9 10.9 10.3

May 28, 2012

12

Jyothy Laboratories | 4QFY2012 Result Update

Balance Sheet (Standalone)

Y/E March (` cr) SOURCES OF FUNDS Equity Share Capital Reserves& Surplus Shareholders Funds Total Loans Deferred Tax (Net) Total Liabilities APPLICATION OF FUNDS Gross Block Less: Acc. Depreciation Less: Impairment Net Block Capital Work-in-Progress Lease adjustment Goodwill Investments Current Assets Cash Loans & Advances Inventory Debtors Current liabilities Net Current Assets Misc. Exp. not written off Total Assets 249 49 5 195 3 3 18 309 121 52 66 70 116 193 412 270 62 3 204 19 3 78 534 278 86 66 104 107 427 732 283 80 3 200 3 3 378 773 51 600 79 43 229 544 1,128 297 94 3 200 3 3 378 786 74 600 69 43 146 640 1,224 312 110 3 199 3 3 378 823 93 600 80 49 167 656 1,238 7 392 399 0 412 8 645 653 64 732 8 665 674 439 1,128 8 761 769 439 1,224 8 826 834 389 1,238 FY2010 FY2011 FY2012 FY2013E FY2014E

May 28, 2012

13

Jyothy Laboratories | 4QFY2012 Result Update

Cash Flow (Standalone)

Y/E March (` cr) Profit before tax Depreciation Change in Working Capital Direct taxes paid Others Cash Flow from Operations (Inc.)/Dec. in Fixed Assets (Inc.)/Dec. in Investments Others Cash Flow from Investing Issue of Equity Inc./(Dec.) in loans Dividend Paid (Incl. Tax) Others Cash Flow from Financing Inc./(Dec.) in Cash Opening Cash balances Closing Cash balances FY2010 101 10 (17) (21) (22) 51 (21) (1) 9 (12) (34) 16 (18) 21 100 121 FY2011 96 11 (77) (15) (13) 1 (37) (61) 9 (89) 1 64 (47) 228 245 157 121 278 FY2012 103 17 (344) (20) (57) (300) 3 (299) 17 (279) 375 (23) 352 (227) 278 51 FY2013E 101 15 (73) (21) (69) (48) (14) 108 94 (23) (23) 23 51 74 FY2014E 132 16 4 (44) (72) 35 (15) 72 57 (50) (23) (73) 19 74 93

May 28, 2012

14

Jyothy Laboratories | 4QFY2012 Result Update

Key Ratios (Standalone)

Y/E March Valuation Ratio (x) P/E (on FDEPS) P/CEPS P/BV EV/Net sales EV/EBITDA EV / Total Assets Per Share Data (`) EPS (Basic) EPS (fully diluted) Cash EPS DPS Book Value DuPont Analysis EBIT margin Tax retention ratio Asset turnover (x) ROIC (Post-tax) Cost of Debt (Post Tax) Leverage (x) Operating ROE Returns (%) ROCE (Pre-tax) Angel ROIC (Pre-tax) ROE Turnover ratios (x) Asset TO (Gross Block) Inventory / Net sales (days) Receivables (days) Payables (days) WC cycle (ex-cash) (days) Solvency ratios (x) Net debt to equity Net debt to EBITDA Int. Coverage (EBIT/ Int.) (0.3) (1.5) 136.8 (0.4) (3.7) 166.8 0.0 0.1 3.4 (0.0) (0.1) 1.7 (0.1) (0.7) 2.4 2.4 35 36 69 46 2.3 40 53 78 91 2.4 40 20 78 271 2.7 35 20 78 266 3.0 30 20 78 228 0.2 32.9 21.3 0.1 20.2 14.6 0.1 9.7 12.6 0.1 10.8 11.1 0.1 11.0 14.6 0.8 2.3 26.1 268.4 (0.3) 110.5 11.4 0.8 1.8 17.0 1.1 (0.4) 9.9 9.9 0.8 1.0 7.8 6.3 0.0 7.9 10.4 0.8 1.0 8.5 8.8 (0.0) 8.5 11.4 0.7 1.2 9.2 7.0 (0.1) 9.0 11.0 11.0 12.5 4.0 55.0 9.5 9.5 10.8 5.0 80.9 10.4 10.4 12.5 2.5 83.5 9.9 9.9 11.7 2.5 95.4 10.9 10.9 12.8 2.5 103.4 21.6 19.1 4.3 2.8 16.9 4.0 22.5 19.7 2.6 2.4 18.1 2.0 20.7 17.2 2.6 2.6 21.0 1.6 21.6 18.2 2.2 2.2 17.9 1.4 19.6 16.6 2.1 1.8 13.9 1.3 FY2010 FY2011 FY2012 FY2013E FY2014E

May 28, 2012

15

Jyothy Laboratories | 4QFY2012 Result Update

Profit and Loss (Consolidated)

Y/E March (` cr) Net Sales Other operating income Total operating income % chg Net Raw Materials % chg Other Mfg costs % chg Personnel % chg Other % chg Total Expenditure EBITDA % chg (% of Net Sales) Depreciation & Amortisation EBIT % chg (% of Net Sales) Interest & other Charges Other Income (% of Net Sales) Recurring PBT % chg PBT (reported) Tax (% of PBT) PAT (reported) Minority interest PAT after MI Extraordinary Expense/(Inc.) ADJ. PAT % chg (% of Net Sales) Basic EPS (`) Fully Diluted EPS (`) % chg FY2010 594 4 598 64.5 317 59.7 24 70.7 75 58.7 90 64.6 506 92 88.2 15.4 12 79 92.4 13.4 2 18 3.0 78 91.6 96 21 22.5 74 (0) 74 0 74 93.9 12.5 10.3 10.3 93.9 FY2011 610 9 619 3.6 320 1.0 25 4.7 81 7.9 121 33.9 547 73 (21.0) 11.7 13 60 (25.1) 9.8 2 24 3.9 57 (26.2) 81 15 19.0 66 (3) 69 0 69 (7.6) 11.3 8.5 8.5 (16.8) FY2012# 913 0 913 47.4 503 57.1 36 47.4 114 39.8 176 45.8 829 84 15.9 9.2 25 59 (0.1) 6.5 24 23 2.5 36 (37.9) 58 20 34.2 38 (6) 45 0 45 (35.2) 4.9 5.5 5.5 (35.2) FY2013E 1315 1,315 44.0 731 45.4 46 26.2 142 24.6 282 60.6 1201 114 35.2 8.6 27 87 46.3 6.6 52 34 2.6 35 (2.5) 69 21 31.2 47 (4) 51 0 51 15.3 3.9 6.4 6.4 15.3 FY2014E 1568 1,568 19.2 860 17.6 53 15.9 156 9.9 325 15.2 1394 173 52.5 11.1 27 146 67.7 9.3 49 36 2.3 97 179.1 133 44 32.8 89 2 88 0 88 70.5 5.6 10.9 10.9 70.5

Note: #FY2012 includes Henkel numbers post August 22, 2011

May 28, 2012

16

Jyothy Laboratories | 4QFY2012 Result Update

Balance Sheet (Consolidated)

Y/E March (` cr) SOURCES OF FUNDS Equity Share Capital Reserves& Surplus Shareholders Funds Minority Interest Total Loans Deferred Tax (Net) Total Liabilities APPLICATION OF FUNDS Gross Block Less: Acc. Depreciation Less: Impairment Net Block Capital Work-in-Progress Lease adjustment Goodwill Investments Current Assets Cash Loans & Advances Inventory Debtors Current liabilities Net Current Assets Misc. Exp. not written off Total Assets 287 55 5 228 4 6 0 302 122 35 73 71 120 181 419 306 68 3 235 20 6 61 510 281 55 69 105 110 401 722 608 92 3 513 3 521 54 329 63 62 123 81 341 (13) 1,078 633 166 3 464 4 521 54 282 17 66 124 76 263 20 1,062 648 193 3 452 4 521 54 349 19 94 146 90 305 44 1,074 7 381 388 1 18 13 419 8 623 631 0 74 16 722 8 604 612 7 443 16 1,078 8 602 610 (33) 469 16 1,062 8 642 650 (31) 439 16 1,074 FY2010 FY2011 FY2012# FY2013E FY2014E

Note: #FY2012E includes Henkel numbers post August 22, 2011

May 28, 2012

17

Jyothy Laboratories | 4QFY2012 Result Update

Cash Flow (Consolidated)

Y/E March (` cr) Profit before tax Depreciation Change in Working Capital Direct taxes paid Others Cash Flow from Operations (Inc.)/Dec. in Fixed Assets (Inc.)/Dec. in Investments Others Cash Flow from Investing Issue of Equity Inc./(Dec.) in loans Dividend Paid (Incl. Tax) Others Cash Flow from Financing Inc./(Dec.) in Cash Opening Cash balances Closing Cash balances Note:

#

FY2010 96 12 (14) (21) (21) 51 (39) 0 1 (37) 0 17 (34) 23 7 20 102 122

FY2011 81 13 (61) (15) (23) (5) (34) (61) (148) (243) 0.8 57 (47) 396 407 158 122 281

FY2012# 58 25 196 (20) (23) 236 (800) 7 (5) (799) 368 (23) 345 (218) 281 63

FY2013E 69 27 (78) (21) (34) (38) (26) 0 15 (11) 26 (23) 3 (46) 63 17

FY2014E 133 27 (22) (44) (36) 58 (15) 0 12 (3) (30) (23) (53) 2 17 19

FY2012E includes Henkel numbers post August 22, 2011

May 28, 2012

18

Jyothy Laboratories | 4QFY2012 Result Update

Key Ratios (Consolidated)

Y/E March Valuation Ratio (x) P/E (on FDEPS) P/CEPS P/BV EV/Net sales EV/EBITDA EV / Total Assets Per Share Data (`) EPS (Basic) EPS (fully diluted) Cash EPS DPS Book Value DuPont Analysis EBIT margin Tax retention ratio Asset turnover (x) ROIC (Post-tax) Cost of Debt (Post Tax) Leverage (x) Operating ROE Returns (%) ROCE (Pre-tax) Angel ROIC (Pre-tax) ROE Turnover ratios (x) Asset TO (Gross Block) Inventory / Net sales (days) Receivables (days) Payables (days) WC cycle (ex-cash) (days) Solvency ratios (x) Net debt to equity Net debt to EBITDA Int. Coverage (EBIT/ Int.) (0.3) (1.1) 46.7 (0.4) (3.7) 27.7 0.5 3.9 2.5 0.7 3.5 1.7 0.6 2.1 3.0 2.3 37 35 68 36 2.1 42 52 77 71 2.0 39 37 99 (30) 2.1 34 22 92 1 2.4 31 19 74 6 0.2 29.1 20.3 0.1 17.6 13.5 0.1 14.1 7.2 0.1 19.3 8.4 0.1 31.7 13.9 13.3 0.8 2.2 22.5 14.6 (0.3) 20.4 9.6 0.8 1.8 14.3 3.8 (0.4) 9.8 6.5 0.7 2.2 9.3 6.1 0.5 11.0 6.6 0.7 2.9 13.3 7.9 0.7 16.8 9.3 0.7 3.4 21.3 7.2 0.6 29.2 10.3 10.3 12.0 4.0 53.4 8.5 8.5 10.1 5.0 78.3 5.5 5.5 8.6 2.5 76.0 6.4 6.4 9.7 2.5 75.7 10.9 10.9 14.3 2.5 80.6 23.2 19.9 4.4 2.7 17.6 4.0 25.1 21.1 2.7 2.4 20.1 2.1 38.7 24.9 2.8 2.2 24.4 1.9 33.6 22.1 2.8 1.6 18.7 2.0 19.7 15.0 2.7 1.3 12.1 2.0 FY2010 FY2011 FY2012# FY2013E FY2014E

Note: *FY2009 was only for 9 months, #FY2012E includes Henkel numbers post August 22, 2011

May 28, 2012

19

Jyothy Laboratories | 4QFY2012 Result Update

Research Team Tel: 022 - 39357800

E-mail: research@angelbroking.com

Website: www.angelbroking.com

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement 1. Analyst ownership of the stock 2. Angel and its Group companies ownership of the stock 3. Angel and its Group companies' Directors ownership of the stock 4. Broking relationship with company covered

Jyothy Laboratories No No No No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors.

Ratings (Returns):

Buy (> 15%) Reduce (-5% to 15%)

Accumulate (5% to 15%) Sell (< -15%)

Neutral (-5 to 5%)

May 28, 2012

20

You might also like

- Cadila Healthcare: Performance HighlightsDocument12 pagesCadila Healthcare: Performance HighlightsAngel BrokingNo ratings yet

- Colgate: Performance HighlightsDocument9 pagesColgate: Performance HighlightsAngel BrokingNo ratings yet

- United Spirits 4Q FY 2013Document10 pagesUnited Spirits 4Q FY 2013Angel BrokingNo ratings yet

- Hul 2qfy2013ruDocument12 pagesHul 2qfy2013ruAngel BrokingNo ratings yet

- Indoco Remedies Result UpdatedDocument11 pagesIndoco Remedies Result UpdatedAngel BrokingNo ratings yet

- Cipla: Performance HighlightsDocument11 pagesCipla: Performance HighlightsAngel BrokingNo ratings yet

- Colgate: Performance HighlightsDocument10 pagesColgate: Performance HighlightsAngel BrokingNo ratings yet

- Cipla: Performance HighlightsDocument11 pagesCipla: Performance HighlightsAngel BrokingNo ratings yet

- Colgate Result UpdatedDocument10 pagesColgate Result UpdatedAngel BrokingNo ratings yet

- Godrej Consumer ProductsDocument12 pagesGodrej Consumer ProductsAngel BrokingNo ratings yet

- Ceat Result UpdatedDocument11 pagesCeat Result UpdatedAngel BrokingNo ratings yet

- Rallis India Result UpdatedDocument9 pagesRallis India Result UpdatedAngel BrokingNo ratings yet

- Colgate 2QFY2013RUDocument10 pagesColgate 2QFY2013RUAngel BrokingNo ratings yet

- United Phosphorus Result UpdatedDocument11 pagesUnited Phosphorus Result UpdatedAngel BrokingNo ratings yet

- Britannia: Performance HighlightsDocument11 pagesBritannia: Performance HighlightsAngel BrokingNo ratings yet

- GSK Consumer, 21st February, 2013Document10 pagesGSK Consumer, 21st February, 2013Angel BrokingNo ratings yet

- Dr. Reddy's Laboratories: Performance HighlightsDocument11 pagesDr. Reddy's Laboratories: Performance HighlightsAngel BrokingNo ratings yet

- Bhel 4qfy2012ru 240512Document12 pagesBhel 4qfy2012ru 240512Angel BrokingNo ratings yet

- HUL Result UpdatedDocument11 pagesHUL Result UpdatedAngel BrokingNo ratings yet

- Performance Highlights: NeutralDocument12 pagesPerformance Highlights: NeutralAngel BrokingNo ratings yet

- Dishman Pharmaceuticals: Performance HighlightsDocument10 pagesDishman Pharmaceuticals: Performance HighlightsAngel BrokingNo ratings yet

- United Phosphorus: Performance HighlightsDocument12 pagesUnited Phosphorus: Performance HighlightsAngel BrokingNo ratings yet

- Cadila Healthcare Result UpdatedDocument12 pagesCadila Healthcare Result UpdatedAngel BrokingNo ratings yet

- Rallis India: Performance HighlightsDocument10 pagesRallis India: Performance HighlightsAngel BrokingNo ratings yet

- Finolex Cables: Performance HighlightsDocument10 pagesFinolex Cables: Performance HighlightsAngel BrokingNo ratings yet

- Reliance Industries Result UpdatedDocument13 pagesReliance Industries Result UpdatedAngel BrokingNo ratings yet

- Dr. Reddy's Laboratories Result UpdatedDocument11 pagesDr. Reddy's Laboratories Result UpdatedAngel BrokingNo ratings yet

- Godrej Consumer Products: Performance HighlightsDocument11 pagesGodrej Consumer Products: Performance HighlightsAngel BrokingNo ratings yet

- Abbott India: Performance HighlightsDocument13 pagesAbbott India: Performance HighlightsAngel BrokingNo ratings yet

- MOIL Result UpdatedDocument10 pagesMOIL Result UpdatedAngel BrokingNo ratings yet

- Ipca Labs Result UpdatedDocument12 pagesIpca Labs Result UpdatedAngel BrokingNo ratings yet

- Greenply Result UpdatedDocument10 pagesGreenply Result UpdatedAngel BrokingNo ratings yet

- Asian Paints Result UpdatedDocument10 pagesAsian Paints Result UpdatedAngel BrokingNo ratings yet

- DB Corp.: Performance HighlightsDocument11 pagesDB Corp.: Performance HighlightsAngel BrokingNo ratings yet

- Ipca Labs: Performance HighlightsDocument11 pagesIpca Labs: Performance HighlightsAngel BrokingNo ratings yet

- United Spirits: Performance HighlightsDocument11 pagesUnited Spirits: Performance HighlightsAngel BrokingNo ratings yet

- Indraprastha GasDocument11 pagesIndraprastha GasAngel BrokingNo ratings yet

- Abbott India: Performance HighlightsDocument11 pagesAbbott India: Performance HighlightsAngel BrokingNo ratings yet

- Rallis India: Performance HighlightsDocument10 pagesRallis India: Performance HighlightsAngel BrokingNo ratings yet

- Rallis India Result UpdatedDocument10 pagesRallis India Result UpdatedAngel BrokingNo ratings yet

- Lakshmi Machine Works: Performance HighlightsDocument11 pagesLakshmi Machine Works: Performance HighlightsAngel BrokingNo ratings yet

- Bajaj Electricals: Performance HighlightsDocument10 pagesBajaj Electricals: Performance HighlightsAngel BrokingNo ratings yet

- Performance Highlights: CMP '203 Target Price '248Document10 pagesPerformance Highlights: CMP '203 Target Price '248Angel BrokingNo ratings yet

- Orchid Chemicals Result UpdatedDocument11 pagesOrchid Chemicals Result UpdatedAngel BrokingNo ratings yet

- Indoco Remedies: Performance HighlightsDocument11 pagesIndoco Remedies: Performance HighlightsAngel BrokingNo ratings yet

- Glaxosmithkline Pharma: Performance HighlightsDocument11 pagesGlaxosmithkline Pharma: Performance HighlightsAngel BrokingNo ratings yet

- Alembic Pharma: Performance HighlightsDocument11 pagesAlembic Pharma: Performance HighlightsAngel BrokingNo ratings yet

- Glaxo Smithkline PharmaDocument11 pagesGlaxo Smithkline PharmaAngel BrokingNo ratings yet

- Cadila Healthcare Result UpdatedDocument12 pagesCadila Healthcare Result UpdatedAngel BrokingNo ratings yet

- HT Media: Performance HighlightsDocument11 pagesHT Media: Performance HighlightsAngel BrokingNo ratings yet

- Indoco Remedies: Performance HighlightsDocument11 pagesIndoco Remedies: Performance HighlightsAngel BrokingNo ratings yet

- Performance Highlights: 2QFY2012 Result Update - Oil & GasDocument10 pagesPerformance Highlights: 2QFY2012 Result Update - Oil & GasAngel BrokingNo ratings yet

- Asian Paints: Performance HighlightsDocument10 pagesAsian Paints: Performance HighlightsAngel BrokingNo ratings yet

- Alembic Pharma Result UpdatedDocument9 pagesAlembic Pharma Result UpdatedAngel BrokingNo ratings yet

- Dr. Reddy's Laboratories Result UpdatedDocument11 pagesDr. Reddy's Laboratories Result UpdatedAngel BrokingNo ratings yet

- GSK Consumer 1Q CY 2013Document10 pagesGSK Consumer 1Q CY 2013Angel BrokingNo ratings yet

- Alembic Pharma: Performance HighlightsDocument11 pagesAlembic Pharma: Performance Highlightsvicky168No ratings yet

- Dishman Pharmaceuticals: Performance HighlightsDocument10 pagesDishman Pharmaceuticals: Performance HighlightsAngel BrokingNo ratings yet

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosFrom EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosNo ratings yet

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- International Commodities Evening Update September 16 2013Document3 pagesInternational Commodities Evening Update September 16 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 16 2013Document6 pagesDaily Metals and Energy Report September 16 2013Angel BrokingNo ratings yet

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDocument4 pagesRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingNo ratings yet

- WPIInflation August2013Document5 pagesWPIInflation August2013Angel BrokingNo ratings yet

- Oilseeds and Edible Oil UpdateDocument9 pagesOilseeds and Edible Oil UpdateAngel BrokingNo ratings yet

- Daily Agri Tech Report September 14 2013Document2 pagesDaily Agri Tech Report September 14 2013Angel BrokingNo ratings yet

- Daily Agri Report September 16 2013Document9 pagesDaily Agri Report September 16 2013Angel BrokingNo ratings yet

- Derivatives Report 8th JanDocument3 pagesDerivatives Report 8th JanAngel BrokingNo ratings yet

- Currency Daily Report September 16 2013Document4 pagesCurrency Daily Report September 16 2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 16 2013Document2 pagesDaily Agri Tech Report September 16 2013Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Document4 pagesDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingNo ratings yet

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDocument1 pagePress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument12 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Metal and Energy Tech Report Sept 12Document2 pagesMetal and Energy Tech Report Sept 12Angel BrokingNo ratings yet

- Metal and Energy Tech Report Sept 13Document2 pagesMetal and Energy Tech Report Sept 13Angel BrokingNo ratings yet

- Currency Daily Report September 13 2013Document4 pagesCurrency Daily Report September 13 2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 12 2013Document2 pagesDaily Agri Tech Report September 12 2013Angel BrokingNo ratings yet

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDocument4 pagesJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingNo ratings yet

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDocument6 pagesTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingNo ratings yet

- Daily Technical Report: Sensex (19997) / NIFTY (5913)Document4 pagesDaily Technical Report: Sensex (19997) / NIFTY (5913)Angel Broking100% (1)

- Currency Daily Report September 12 2013Document4 pagesCurrency Daily Report September 12 2013Angel BrokingNo ratings yet

- Daily Agri Report September 12 2013Document9 pagesDaily Agri Report September 12 2013Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (19997) / NIFTY (5897)Document4 pagesDaily Technical Report: Sensex (19997) / NIFTY (5897)Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 12 2013Document6 pagesDaily Metals and Energy Report September 12 2013Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Cash and Receivables Cash and ReceivablesDocument61 pagesCash and Receivables Cash and Receivablesakif123456No ratings yet

- Installment06 ModuleDocument5 pagesInstallment06 ModuleMocha FurrerNo ratings yet

- Financial Statement Analysis - Jollibee and MaxDocument21 pagesFinancial Statement Analysis - Jollibee and MaxRemNo ratings yet

- CVR - Case - Excel FileDocument7 pagesCVR - Case - Excel FileVinay JajuNo ratings yet

- Fabm1 Quarter4 Module 10 Week 2Document16 pagesFabm1 Quarter4 Module 10 Week 2Princess Nicole EsioNo ratings yet

- IM ACCO 20033 Financial Accounting and Reporting Part 1Document95 pagesIM ACCO 20033 Financial Accounting and Reporting Part 1Montales, Julius Cesar D.No ratings yet

- Financial Plan - Cash Budget, Working CapitalDocument14 pagesFinancial Plan - Cash Budget, Working CapitalMAYANK KUMAR0% (1)

- ACCT 2211 Assignment 1Document12 pagesACCT 2211 Assignment 1Tannaz SNo ratings yet

- Problems For CBDocument28 pagesProblems For CBĐức HàNo ratings yet

- Financial Statements, Taxes, and Cash FlowDocument46 pagesFinancial Statements, Taxes, and Cash FlowgagafikNo ratings yet

- FAR Quiz No. 3 Set A Ocampo/Cabarles/Soliman/Ocampo October 2019Document3 pagesFAR Quiz No. 3 Set A Ocampo/Cabarles/Soliman/Ocampo October 2019ChjxksjsgskNo ratings yet

- CHAPTER-5 Advance Acctg GuerreroDocument20 pagesCHAPTER-5 Advance Acctg GuerreroKassandra EbolNo ratings yet

- Chapter 5 - The Accounting EquationDocument9 pagesChapter 5 - The Accounting EquationUel DizonNo ratings yet

- SW - Chapter 7Document8 pagesSW - Chapter 7andrie gardoseNo ratings yet

- Assignment 2 Fin632 Amal Mobaraki 441212274Document4 pagesAssignment 2 Fin632 Amal Mobaraki 441212274Amal MobarakiNo ratings yet

- Practice Question On Group AccountsDocument12 pagesPractice Question On Group Accountsemerald75% (4)

- Note On Financial Ratio AnalysisDocument9 pagesNote On Financial Ratio Analysisabhilash831989No ratings yet

- Question Bank (Repaired)Document7 pagesQuestion Bank (Repaired)jayeshNo ratings yet

- PBID Annual Report 2019Document166 pagesPBID Annual Report 2019rosida ibrahimNo ratings yet

- How To Record Opening and Closing StockDocument5 pagesHow To Record Opening and Closing StockSUZANAMIKENo ratings yet

- 716-Article Text-3346-2-10-20220731 PDFDocument11 pages716-Article Text-3346-2-10-20220731 PDFFatihah rachmah PramuditaNo ratings yet

- Roic Current Ratio Operating Cycle: Unilever PLC GSK PLC Unilever PLC GSK PLC Unilever PLC GSK PLCDocument4 pagesRoic Current Ratio Operating Cycle: Unilever PLC GSK PLC Unilever PLC GSK PLC Unilever PLC GSK PLCMd. Real MiahNo ratings yet

- Bad Debts and Provisionfor Doubtful Debts Worksheet1watermark-230320-140940Document8 pagesBad Debts and Provisionfor Doubtful Debts Worksheet1watermark-230320-140940Navid BackupNo ratings yet

- FAR Mock ExamDocument9 pagesFAR Mock ExamchristineNo ratings yet

- E - CAsh Flow Question Meath With Solution and WorkingsDocument5 pagesE - CAsh Flow Question Meath With Solution and Workingschalah DeriNo ratings yet

- Pas 1 - Presentation of Financial StatementsDocument30 pagesPas 1 - Presentation of Financial StatementsLee Anne Gallema Camarao100% (3)

- CSEC POA Jan 2021 P2Document22 pagesCSEC POA Jan 2021 P2Karyn Grant100% (2)

- AIK Pertanyaan CH 7-11 Kelompok 6-1Document16 pagesAIK Pertanyaan CH 7-11 Kelompok 6-1DindaNo ratings yet

- Accounting Maynard CompanyDocument3 pagesAccounting Maynard CompanyAdit AdityaNo ratings yet

- C3 - Matching and Adjusting ProcessDocument12 pagesC3 - Matching and Adjusting ProcessIvy Jean Ybera-PapasinNo ratings yet