Professional Documents

Culture Documents

Corpo Digests

Uploaded by

lawYearOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Corpo Digests

Uploaded by

lawYearCopyright:

Available Formats

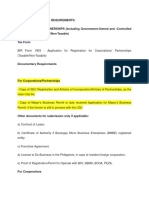

A.

DEFINITON

TAYAG vs. BENGUET CONSOLIDATED, INC.

G.R. No. L-23145 November 29, 1968

Facts:

donah Slade Perkins, died in New York in 1960, left among others, two stock certificates covering 33,002 shares of Benguet

Consolidated, the certificates being in the possession of the County Trust Company of New York, the domiciliary

administrator of the estate of the deceased.

A dispute arose between the domiciary administrator in New York and the ancillary administrator in the Philippines as to

which of them was entitled to the possession of the stock certificates in question. Anciallry administrator wanted possession

of the shares so as to satisfy the legitimate claims of local creditors.

On January 27, 1964, the Court of First nstance of Manila ordered the domiciliary administrator, County Trust Company, to

"produce and deposit" them with the ancillary administrator or with the Clerk of Court. The domiciliary administrator did not

comply with the order, and on February 11, 1964, the ancillary administrator petitioned the court to "issue an order declaring

the certificate or certificates of stocks covering the 33,002 shares issued in the name of donah Slade Perkins by Benguet

Consolidated, nc., be declared [or] considered as lost."

The order of the Lower Court is of the following tenor: "(1) considers as lost for all purposes in connection with the

administration and liquidation of the Philippine estate of donah Slade Perkins the stock certificates covering the 33,002

shares of stock standing in her name in the books of the Benguet Consolidated, nc., (2) orders said certificates cancelled,

and (3) directs said corporation to issue new certificates in lieu thereof, the same to be delivered by said corporation to either

the incumbent ancillary administrator or to the Probate Division of this Court."

Appeal to the order was made by Benguet Consolidated. Appellant opposed the petition of the ancillary administrator

because the said stock certificates are in existence, they are today in the possession of the domiciliary administrator, the

County Trust Company, in New York, U.S.A...."

Issue/ HeId: WON the appeaI is meritorious.- NO. The order was caIIed for by the reaIities of the situation.

Ratio: The Court took into account the factual circumstances in uphoding the oder by the Lower Court that the shares of

stock be considered lost t for all purposes in connection with the administration and liquidation of the Philippine estate of

donah Slade Perkins.

1. Territorial scope of authority of administrator. t is a "general rule universally recognized" that administration, whether

principal or ancillary, certainly "extends to the assets of a decedent found within the state or country where it was

granted," the corollary being "that an administrator appointed in one state or country has no power over property in

another state or country." Since the actual situs of the shares of stock of a domestic corporation is in the Philippines,

it should be administered by the ancillary admisnitrator.

2. EIement of fiction of Ioss is necessary given the factuaI circumstances. Since there is a refusal, persistently

adhered to by the domiciliary administrator in New York, to deliver the shares of stocks of appellant corporation

owned by the decedent to the ancillary administrator in the Philippines, there was nothing unreasonable or arbitrary

in considering them as lost and requiring the appellant to issue new certificates in lieu thereof. Otherwise, to yield to

the stubborn refusal of the domicillary administrator, the task incumbent under the law of the ancillary administrator

could not be discharged and his responsibility fulfilled.

3. Lawful order of the court overrides the by-laws of Benguet Consolidated. Benguet Consolidated stresses that in the

event of a contest or the pendency of an action regarding ownership of such certificate or certificates of stock

allegedly lost, stolen or destroyed, the issuance of a new certificate or certificates would await the "final decision by

[a] court regarding the ownership [thereof]." SC held that Benguet Consolidated's obedience to a lawful court order

certainly constitutes a valid defense, assuming that such apprehension of a possible court action against it could

possibly materialize.

4. A corporation is not immune from judicial action.

Definitions of Corporation:

"...a corporation is an artificial being created by operation of law...." t owes its life to the state, its birth being purely

dependent on its will. As Berle so aptly stated: "Classically, a corporation was conceived as an artificial person, owing its

1

existence through creation by a sovereign power." (Berle, The Theory of Enterprise Entity, 47 Co. Law Rev. 343 (1907).

"an artificial being, invisible, intangible, and existing only in contemplation of law." (Chief Justice Marshall, Dartmouth

College v. Woodward )

"A corporation is not in fact and in reality a person, but the law treats it as though it were a person by process of fiction, or

by regarding it as an artificial person distinct and separate from its individual stockholders.... t owes its existence to law. t is

an artificial person created by law for certain specific purposes, the extent of whose existence, powers and liberties is fixed

by its charter." (Fletcher, Cyclopedia Corporations )

"...a juristic person, resulting from an association of human beings granted legal personality by the state, puts the matter

neatly. (Pound on Jurisprudence)

There is thus a rejection of Gierke's genossenchaft theory, the basic theme of which to quote from Friedmann, "is the reality

of the group as a social and legal entity, independent of state recognition and concession." A corporation as known to

Philippine jurisprudence is a creature without any existence until it has received the imprimatur of the state according to law.

t is logically inconceivable therefore that it will have rights and privileges of a higher priority than that of its creator. More than

that, it cannot legitimately refuse to yield obedience to acts of its state organs, certainly not excluding the judiciary, whenever

called upon to do so.

As a matter of fact, a corporation once it comes into being, following American law still of persuasive authority in our

jurisdiction, comes more often within the ken of the judiciary than the other two coordinate branches. t institutes the

appropriate court action to enforce its right. Correlatively, it is not immune from judicial control in those instances, where a

duty under the law as ascertained in an appropriate legal proceeding is cast upon it.

To assert that it can choose which court order to follow and which to disregard is to confer upon it not autonomy which may

be conceded but license which cannot be tolerated. t is to argue that it may, when so minded, overrule the state, the source

of its very existence; it is to contend that what any of its governmental organs may lawfully require could be ignored at will.

So extravagant a claim cannot possibly merit approval.

2

MONFORT HERMANOS AGRICULTURAL DEVELOPMENT CORPORATION vs ANTONIO B. MONFORT III

G.R. No. 152542 : JuIy 8, 2004

G.R. No. 155472 : JuIy 8, 2004

Facts:

Monfort Hermanos Agricultural Development Corporation, a domestic private corporation, is the registered owner of a farm,

fishpond and sugar cane plantation known as Haciendas San Antonio , Marapara, Pinanoag and Tinampa-an, all situated in

Cadiz City. t also owns one unit of motor vehicle and two units of tractors. The same allowed Ramon H. Monfort, its

Executive Vice President, to breed and maintain fighting cocks in his personal capacity at Hacienda San Antonio. n 1997,

the group of Antonio Monfort , through force and intimidation, allegedly took possession of the 4 Haciendas, the produce

thereon and the motor vehicle and tractors, as well as the fighting cocks of Ramon H. Monfort.

n G.R. No. 155472: The Corporation, represented by its President, Ma. Antonia M. Salvatierra, and Ramon H. Monfort, in his

personal capacity, filed against the group of Antonio Monfort , a complaint for delivery of motor vehicle, tractors and 378

fighting cocks, with prayer for injunction and damages. Motion to dismiss on the ground of Ma. Antonia M. Salvatierra's lack

of capacity to sue on behalf of the Corporation was denied.

n G.R. No. 152542: Ma. Antonia M. Salvatierra filed on behalf of the Corporation a complaint for forcible entry, preliminary

mandatory injunction with temporary restraining order and damages against the group of Antonio Monfort .

The group of Antonio Monfort alleged that they are possessing and controlling the Haciendas and harvesting the produce

therein on behalf of the corporation and not for themselves. They likewise raised the affirmative defense of lack of legal

capacity of Ma. Antonia M. Salvatierra to sue on behalf of the Corporation.

Complaint was eventually dismissed.

Basis of claim of Salvatierra\s lack of capacity to sue: The group of Antonio Monfort claims that the March 31, 1997 Board

Resolution authorizing Ma. Antonia M. Salvatierra and/or Ramon H. Monfort to represent the Corporation is void because the

purported Members of the Board who passed the same were not validly elected officers of the Corporation.

Issue/ HeId: WON Ma. Antonia M. SaIvatierra has the IegaI capacity to sue on behaIf of the Corporation. -NO. Ma.

Antonia M. SaIvatierra faiIed to prove that four of those who authorized her to represent the Corporation were the

IawfuIIy eIected Members of the Board of the Corporation. As such, they cannot confer vaIid authority for her to sue

on behaIf of the corporation.

Ratio:

A corporation has no power except those expressIy conferred on it by the Corporation Code and those that are

impIied or incidentaI to its existence. In turn, a corporation exercises said powers through its board of directors

and/or its duIy authorized officers and agents. Thus, it has been observed that the power of a corporation to sue

and be sued in any court is Iodged with the board of directors that exercises its corporate powers. In turn, physicaI

acts of the corporation, Iike the signing of documents, can be performed onIy by naturaI persons duIy authorized

for the purpose by corporate by-Iaws or by a specific act of the board of directors.

Corporation failed to comply with Section 26 of the Corporation Code, requiring submission to the SEC within thirty (30) days

after the election the names, nationalities and residences of the elected directors, trustees and officers of the Corporation.

1. n the case at bar, the fact that four of the six Members of the Board listed in the 1996 General nformation Sheet

are already dead at the time the March 31, 1997 Board Resolution was issued, does not automatically make the

four signatories (i.e., Paul M. Monfort, Yvete M. Benedicto, Jaqueline M. Yusay and Ester S. Monfort) to the said

Board Resolution (whose name do not appear in the 1996 General nformation Sheet) as among the incumbent

Members of the Board. This is because it was not established that they were duly elected to replace the said

deceased Board Members.

To correct the alleged error in the General nformation Sheet, the retained accountant of the Corporation informed the SEC in

its November 11, 1998 letter that the non-inclusion of the lawfully elected directors in the 1996 General nformation Sheet

was attributable to its oversight and not the fault of the Corporation. This belated attempt, however, did not erase the doubt

as to whether an election was indeed held.

2. What further militates against the purported election of those who signed the March 31, 1997 Board Resolution was

the belated submission of the alleged Minutes of the October 16, 1996 meeting where the questioned officers were

elected. The issue of legal capacity of Ma. Antonia M. Salvatierra was raised before the lower court by the group of

Antonio Monfort as early as 1997, but the Minutes of said October 16, 1996 meeting was presented by the

Corporation only in its September 29, 1999 Comment before the Court of Appeals. Moreover, the Corporation failed

to prove that the same October 16, 1996 Minutes was submitted to the SEC.

3

PHILIPPINE STOCK EXCHANGE, INC., vs. THE HONORABLE COURT OF APPEALS

G.R. No. 125469 October 27, 1997

Facts:

The Puerto Azul Land, nc. (PAL), a domestic real estate corporation, had sought to offer its shares to the public in order to

raise funds allegedly to develop its properties and pay its loans with several banking institutions. n January, 1995, PAL was

issued a Permit to Sell its shares to the public by the Securities and Exchange Commission (SEC). To facilitate the trading of

its shares among investors, PAL sought to course the trading of its shares through the Philippine Stock Exchange, nc.

(PSE), for which purpose it filed with the said stock exchange an application to list its shares, with supporting documents

attached.

On February 8, 1996, the Listing Committee of the PSE, upon a perusal of PAL's application, recommended to the PSE's

Board of Governors the approval of PAL's listing application.

On February 14, 1996, before it could act upon PAL's application, the Board of Governors of the PSE received a letter from

the heirs of Ferdinand E. Marcos, claiming that the late President Marcos was the legal and beneficial owner of certain

properties forming part of the Puerto Azul Beach Hotel and Resort Complex which PAL claims to be among its assets and

that the Ternate Development Corporation, which is among the stockholders of PAL, likewise appears to have been held and

continue to be held in trust by one Rebecco Panlilio for then President Marcos and now, effectively for his estate, and

requested PAL's application to be deferred. PAL was requested to comment upon the said letter.

PAL's answer stated that the properties forming part of the Puerto Azul Beach Hotel and Resort Complex were not claimed

by PAL as its assets. On the contrary, the resort is actually owned by Fantasia Filipina Resort, nc. and the Puerto Azul

Country Club, entities distinct from PAL. Furthermore, the Ternate Development Corporation owns only 1.20% of PAL.

The Board of Governors of the PSE reached its decision to reject PAL's application, citing the existence of serious claims,

issues and circumstances surrounding PAL's ownership over its assets that adversely affect the suitability of listing PAL's

shares in the stock exchange.

PAL wrote a letter to the SEC addressed to the then Acting Chairman, Perfecto R. Yasay, Jr., bringing to the SEC's attention

the action taken by the PSE. SEC rendered its Order, reversing the PSE's decision. SEC ordered to immediately cause the

listing of the PAL shares in the Exchange.

CA: SEC had both jurisdiction and authority to look into the decision of the petitioner PSE, for the purpose of ensuring fair

administration of the exchange. Both as a corporation and as a stock exchange, the petitioner is subject to public

respondent's jurisdiction, regulation and control. PAL complied with all the requirements for public listing, affirming the

SEC's ruling.

Issue/HeId: WON SEC has the authority to order the PSE to Iist the shares of PALI in the stock exchange. - YES, but

he Court finds that the SEC had acted arbitrariIy in arrogating unto itseIf the discretion of approving the appIication

for Iisting in the PSE of the private respondent PALI, since this is a matter addressed to the sound discretion of the

PSE, a corporation entity, whose business judgments are respected in the absence of bad faith.

Ratio:

1. SEC with jurisdition. t is undeniable that the petitioner PSE is not an ordinary corporation, in that although it is

clothed with the markings of a corporate entity, it functions as the primary channel through which the vessels of

capital trade ply. The PSE's relevance to the continued operation and filtration of the securities transactions in the

country gives it a distinct color of importance such that government intervention in its affairs becomes justified, if not

necessarily. ndeed, as the only operational stock exchange in the country today, the PSE enjoys a monopoly of

securities transactions, and as such, it yields an immense influence upon the country's economy.

Due to this special nature of stock exchanges, the country's lawmakers has seen it wise to give special treatment to the

administration and regulation of stock exchanges

Sections 3, 6, and 38 of PD 902-A give the SEC the special mandate to be vigilant in the supervision of the affairs of stock

exchanges so that the interests of the investing public may be fully safeguard.

Section 3

1

of Presidential Decree 902-A, standing alone, is enough authority to uphold the SEC's challenged control authority

over the petitioner PSE even as it provides that "the Commission shall have absolute jurisdiction, supervision, and control

over all corporations, partnerships or associations, who are the grantees of primary franchises and/or a license or permit

issued by the government to operate in the Philippines. . ." The SEC's regulatory authority over private corporations

1This Act shall be administered by the (Securities and Exchange) Commission which shall continue to have the organization, powers, and functions provided by

Presidential Decree Numbered 902-A, 1653, 1758, and 1799 and Executive Order No. 708. The Commission shall, except as otherwise expressly provided, have

the power to promulgate such rules and regulations as it may consider appropriate in the public interest for the enforcement of the provisions hereof.

4

encompasses a wide margin of areas, touching nearly all of a corporation's concerns. This authority springs from the fact that

a corporation owes its existence to the concession of its corporate franchise from the state.

The SEC's power to look into the subject ruling of the PSE, therefore, may be implied from or be considered as necessary or

incidental to the carrying out of the SEC's express power to insure fair dealing in securities traded upon a stock exchange or

to ensure the fair administration of such exchange. t is, likewise, observed that the principal function of the SEC is the

supervision and control over corporations, partnerships and associations with the end in view that investment in these entities

may be encouraged and protected, and their activities for the promotion of economic development.

This is not to say, however, that the PSE's management prerogatives are under the absoIute controI of the SEC. The

PSE is, aIter aII, a corporation authorized by its corporate franchise to engage in its proposed and duIy approved

business.

A corporation is but an association of individuals, allowed to transact under an assumed corporate name, and with a distinct

legal personality. n organizing itself as a collective body, it waives no constitutional immunities and perquisites appropriate

to such a body. As to its corporate and management decisions, therefore, the state will generally not interfere with the

same. Questions of policy and of management are left to the honest decision of the officers and directors of a corporation,

and the courts are without authority to substitute their judgment for the judgment of the board of directors. The board is the

business manager of the corporation, and so long as it acts in good faith, its orders are not reviewable by the courts.

Thus, notwithstanding the regulatory power of the SEC over the PSE, and the resultant authority to reverse the PSE's

decision in matters of application for listing in the market, the SEC may exercise such power only if the PSE's judgment is

attended by bad faith. n Board of Liquidators vs. Kalaw, it was held that bad faith does not simply connote bad judgment or

negligence. t imports a dishonest purpose or some moral obliquity and conscious doing of wrong. t means a breach of a

known duty through some motive or interest of ill will, partaking of the nature of fraud.

2. There was no bad faith in the decision of PSE not to aIIow Iisting of PALI shares. n reaching its decision to

deny the application for listing of PAL, the PSE considered important facts, which, in the general scheme, brings to

serious question the qualification of PAL to sell its shares to the public through the stock exchange.

During the time for receiving objections to the application, the PSE heard from the representative of the late

President Ferdinand E. Marcos and his family who claim the properties of the private respondent to be part of

the Marcos estate. n time, the PCGG confirmed this claim. n fact, an order of sequestration has been issued

covering the properties of PAL, and suit for reconveyance to the state has been filed in the Sandiganbayan

Court. How the properties were effectively transferred, despite the sequestration order, from the TDC and

MSDC to Rebecco Panlilio, and to the private respondent PAL, in only a short span of time, are not yet

explained to the Court, but it is clear that such circumstances give rise to serious doubt as to the integrity of

PAL as a stock issuer.

For the purpose of determining whether PSE acted correctly in refusing the application of PAL, the true

ownership of the properties of PAL need not be determined as an absolute fact. What is material is that the

uncertainty of the properties' ownership and alienability exists, and this puts to question the qualification of

PAL's public offering.

5

TAN BOON BEE & CO., INC. vs. JARENCIO

G.R. No. L-41337 June 30, 1988

Facts:

Anchor Supply Co. sold on credit to Graphic Publishing, nc paper products. Partial payments were made and the balance

was covered by a promissory note. n the said promissory note, it was stipulated that the amount will be paid on monthly

installments and that failure to pay any installment would make the amount immediately demandable with an interest of 12%

per annum. For failure of GRAPHC to pay any installment, petitioner filed with the CF a collection case. The trial court

ordered GRAPHC to pay the petitioner the sum of P30,365.99 with 12% interest from March 30, 1973 until fully paid, plus

the costs of suit. A writ of execution was issued.

Pursuant to the said issued alias writ of execution, the executing sheriff levied upon one (1) unit printing machine found in the

premises of GRAPHC. The printing machine was already scheduled for auction sale but Philippine American Drug Company

(PADCO for short) had informed the sheriff that the printing machine is its property and not that of GRAPHC, and

accordingly, advised the sheriff to cease and desist from carrying out the scheduled auction sale. Notwithstanding the said

letter, the sheriff proceeded with the scheduled auction sale, sold the property to the petitioner, it being the highest bidder,

and issued a Certificate of Sale in favor of petitioner. More than five (5) hours after the auction sale and the issuance of the

certificate of sale, PADCO filed an "Affidavit of Third Party Claim" with the Office of the City Sheriff; thereafter a Motion was

filed to nullify the sale. Respondent judge ruled in favor of PADCO; hence the auction sale was nullified.

The petitioner, however, contends that the controlling stockholders of the Philippine American Drug Co. are also the same

controlling stockholders of the Graphic Publishing, nc. and, therefore, the levy upon the said machinery which was found in

the premises occupied by the Graphic Publishing, nc. should be upheld.

Issue/ HeId: WON the respondent judge graveIy abused his discretion when he refused to pierce the PADCO's

(identity) and despite the abundance of evidence cIearIy showing that PADCO was convenientIy shieIding under the

theory of corporate petition.- YES, Respondent judge shouId have pierced PADCO's veiI of corporate Identity.

espondent judge shouId have pierced PADCO's veiI of corporate Identity.

Ratio:

t is true that a corporation, upon coming into being, is invested by law with a personality separate and distinct from that of

the persons composing it as well as from any other legal entity to which it may be related. As a matter of fact, the doctrine

that a corporation is a legal entity distinct and separate from the members and stockholders who compose it is recognized

and respected in all cases which are within reason and the law. However, this separate and distinct personality is merely a

fiction created by law for convenience and to promote justice. Accordingly, this separate personality of the corporation may

be disregarded, or the veil of corporate fiction pierced, in cases where it is used as a cloak or cover for fraud or illegality, or to

work an injustice, or where necessary to achieve equity or when necessary for the protection of creditors. Corporations are

composed of natural persons and the legal fiction of a separate corporate personality is not a shield for the commission of

injustice and inequity. Likewise, this is true when the corporation is merely an adjunct, business conduit or alter ego of

another corporation. n such case, the fiction of separate and distinct corporation entities should be disregarded.

Factual indicators that PADCO and GRAPHC are one and the same entity:

PADCO was never engaged in the printing business;

The board of directors and the officers of GRAPHC and PADCO were the same;

PADCO holds 50% share of stock of GRAPHC.

The printing machine in question had been in the premises of GRAPHC since May, 1965, long before PADCO

even acquired its alleged title on July 11, 1966 from Capitol Publishing. That the said machine was allegedly

leased by PADCO to GRAPHC on January 24, 1966, even before PADCO purchased it from Capital Publishing

on July 11, 1966, only serves to show that PADCO's claim of ownership over the printing machine is not only

farce and sham but also unbelievable.

6

D. NATURE AND ATTRIBUTES

SMITH, BELL & COMPANY (LTD.) vs NATIVIDAD

G.R. No. 15574 September 17, 1919

Facts:

Smith, Bell & Co., (Ltd.), is a corporation organized and existing under the laws of the Philippine slands. A majority of its

stockhoIders are British subjects. t is the owner of a motor vessel known as the Bato built for it in the Philippine slands in

1916, of more than fifteen tons gross The Bato was brought to Cebu in the present year for the purpose of transporting

plaintiff's merchandise between ports in the slands. Application was made at Cebu, the home port of the vessel, to the

Collector of Customs for a certificate of Philippine registry. The Collector refused to issue the certificate, giving as his reason

that all the stockholders of Smith, Bell & Co., Ltd., were not citizens either of the United States or of the Philippine slands.

The instant action is the result.

On February 23, 1918, the Philippine Legislature enacted Act No. 2761. The first section of this law amended section 1172 of

the Administrative Code to read as follows:

SEC. 1172. Certificate of Philippine register. Upon registration of a vessel of domestic ownership, and of more than fifteen tons

gross, a certificate of Philippine register shall be issued for it. f the vessel is of domestic ownership and of fifteen tons gross or

less, the taking of the certificate of Philippine register shall be optional with the owner.

"Domestic ownership," as used in this section, means ownership vested in some one or more of the following classes of persons:

(a) Citizens or native inhabitants of the Philippine slands; (b) citizens of the United States residing in the Philippine slands; (c )

any corporation or company composed wholly of citizens of the Philippine Islands or of the United States or of both ,

created under the laws of the United States, or of any State thereof, or of thereof, or the managing agent or master of the vessel

resides in the Philippine slands

Any vessel of more than fifteen gross tons which on February eighth, nineteen hundred and eighteen, had a certificate of

Philippine register under existing law, shall likewise be deemed a vessel of domestic ownership so long as there shall not be any

change in the ownership thereof nor any transfer of stock of the companies or corporations owning such vessel to person not

included under the last preceding paragraph.

The first paragraph of the Philippine Bill of Rights of the Philippine Bill, repeated again in the first paragraph of the Philippine

Bill of Rights as set forth in the Jones Law, provides "That no law shall be enacted in said slands which shall deprive any

person of life, liberty, or property without due process of law, or deny to any person therein the equal protection of the laws."

Counsel says that Act No. 2761 denies to Smith, Bell & Co., Ltd., the equal protection of the laws because it, in effect,

prohibits the corporation from owning vessels, and because classification of corporations based on the citizenship of one or

more of their stockholders is capricious, and that Act No. 2761 deprives the corporation of its properly without due process of

law because by the passage of the law company was automatically deprived of every beneficial attribute of ownership in the

Bato and left with the naked title to a boat it could not use .

Issue/HeId: WON the Government of the PhiIippine IsIands, through its LegisIature, can deny the registry of vesseI

in its coastwise trade to corporations having aIien stockhoIders.- YES, this is a vaIid exercise of poIice power.

Common carriers which in the PhiIippines as in the United States and other countries are, as Lord HaIe said,

"affected with a pubIic interest," can onIy be permitted to use these pubIic waters as a priviIege and under such

conditions as to the representatives of the peopIe may seem wise. Act No. 2761 of the Philippine Legislature, in denying

to corporations such as Smith, Bell &. Co. Ltd., the right to register vessels in the Philippines coastwise trade, does not

belong to that vicious species of class legislation which must always be condemned, but does fall within authorized

exceptions, notably, within the purview of the police power, and so does not offend against the constitutional provision.

Ratio: The guaranties of the Fourteenth Amendment and so of the first paragraph of the Philippine Bill of Rights, are

universal in their application to all person within the territorial jurisdiction, without regard to any differences of race, color, or

nationality. The word "person" includes aliens. Private corporations, Iikewise, are "persons" within the scope of the

guaranties in so far as their property is concerned. Classification with the end in view of providing diversity of treatment

may be made among corporations, but must be based upon some reasonable ground and not be a mere arbitrary selection.

Examples of laws held unconstitutional because of unlawful discrimination against aliens could be cited. Generally, these

decisions relate to statutes which had attempted arbitrarily to forbid aliens to engage in ordinary kinds of business to earn

their living.

One of the exceptions to the general rule, most persistent and far reaching in influence is, that neither the Fourteenth

Amendment to the United States Constitution, broad and comprehensive as it is, nor any other amendment, "was designed

to interfere with the power of the State, sometimes termed its `police power,' to prescribe regulations to promote the health,

peace, morals, education, and good order of the people, and legislate so as to increase the industries of the State, develop

7

its resources and add to its wealth and prosperity. From the very necessities of society, legislation of a special character,

having these objects in view, must often be had in certain districts." his is the same police power which the United States

Supreme Court say "extends to so dealing with the conditions which exist in the state as to bring out of them the greatest

welfare in of its people." For quite similar reasons, none of the provision of the Philippine Organic Law could could have had

the effect of denying to the Government of the Philippine slands, acting through its Legislature, the right to exercise that

most essential, insistent, and illimitable of powers, the sovereign police power, in the promotion of the general welfare and

the public interest.

Another notable exception permits of the regulation or distribution of the public domain or the common property or resources

of the people of the State, so that use may be limited to its citizens. Even as to classification, it is admitted that a State may

classify with reference to the evil to be prevented; the question is a practical one, dependent upon experience.

8

Bache and Co. v. Ruiz

GR No. L-32409 February 27, 1971

Facts:

n their petition Bache & Co. (Phil.), nc., a corporation duly organized and existing under the laws of the Philippines, and its

President, Frederick E. Seggerman, pray this Court to: (1) declare null and void the Search Warrant issued; (2) order

respondents to desist from enforcing the same and/or keeping the documents, papers and effects seized by virtue thereof, as

well as from enforcing the tax assessments on petitioner corporation alleged by petitioners to have been made on the basis

of the said documents, papers and effects; and (3) order the return of the latter to petitioners.

At that time the request for the issuance of the Search Warrant was made by respondent De Leon, with his witness Logronio,

respondent Judge was hearing a certain case; so, by means of a note, he instructed his Deputy Clerk of Court to take the

depositions of respondents De Leon and Logronio. After the session had adjourned, respondent Judge was informed that the

depositions had already been taken. The stenographer, upon request of respondent Judge, read to him her stenographic

notes; and thereafter, respondent Judge asked respondent Logronio to take the oath and warned him that if his deposition

was found to be false and without legal basis, he could be charged for perjury. Respondent Judge signed respondent de

Leon's application for search warrant and respondent Logronio's deposition, the Search Warrant was then sign by

respondent Judge and accordingly issued.

Three days later, the BR agents served the search warrant petitioners at the offices of petitioner corporation on Ayala

Avenue, Makati, Rizal. Petitioners' lawyers protested the search on the ground that no formal complaint or transcript of

testimony was attached to the warrant. The agents nevertheless proceeded with their search which yielded six boxes of

documents. Documents were uses as basis in assessing the Corporation for tax deficiencies.

Issue/HeId: WON a corporation is entitIed to protection against unreasonabIe search and seizures.- YES.

Ratio:

"Although, for the reasons above stated, we are of the opinion that an officer of a corporation which is charged with a

violation of a statute of the state of its creation, or of an act of Congress passed in the exercise of its constitutional powers,

cannot refuse to produce the books and papers of such corporation, we do not wish to be understood as holding that a

corporation is not entitled to immunity, under the 4th Amendment, against unreasonable searches and seizures. A corporation

is, after all, but an association of individuals under an assumed name and with a distinct legal entity. n organizing itself as a

collective body it waives no constitutional immunities appropriate to such body. ts property cannot be taken without

compensation. t can only be proceeded against by due process of law, and is protected, under the 14th Amendment, against

unlawful discrimination . . ." (Hale v. Henkel, 201 U.S. 43, 50 L. ed. 652.)

"n Linn v. United States, 163 C.C.A. 470, 251 Fed. 476, 480, it was thought that a different rule applied to a corporation, the

ground that it was not privileged from producing its books and papers. But the rights of a corporation against unlawful search

and seizure are to be protected even if the same result might have been achieved in a lawful way." (Silverthorne Lumber

Company, et al. v. United States of America, 251 U.S. 385, 64 L. ed. 319.)

n Stonehill, et al. vs. Diokno, et al., supra, this Court impliedly recognized the right of a corporation to object against

unreasonable searches and seizures, thus:

"As regards the first group, we hold that petitioners herein have no cause of action to assail the legality of the contested

warrants and of the seizures made in pursuance thereof, for the simple reason that said corporations have their respective

personalities, separate and distinct from the personality of herein petitioners, regardless of the amount of shares of stock

or the interest of each of them in said corporations, whatever, the offices they hold therein may be. ndeed, it is well

settled that the legality of a seizure can be contested only by the party whose rights have been impaired thereby, and that

the objection to an unlawful search and seizure is purely personal and cannot be availed of by third parties. Consequently,

petitioners herein may not validly object to the use in evidence against them of the documents, papers and things seized

from the offices and premises of the corporations adverted to above, since the right to object to the admission of said

papers in evidence belongs exclusively to the corporations, to whom the seized effects belong, and may not be invoked

by the corporate officers in proceedings against them in their individual capacity . . ."

n the Stonehill case only the officers of the various corporations in whose offices documents, papers and effects were

searched and seized were the petitioners. n the case at bar, the corporation to whom the seized documents belong, and

whose rights have thereby been impaired, is itself a petitioner.

Issue/HeId: WON the Search Warrant is nuII and void.- YES

Ratio:

a) Respondent Judge failed to personally examine the complainant and his witness; his participation was limited to

listening to the stenographer's readings of her notes, to a few words of warning against the commission of perjury,

9

and to administering the oath to the complainant and his witness. This cannot be considered a personal

examination.

b) The search warrant was issued for more than one specific offense. Search Warrant was issued for "[v]iolation of

Sec. 46(a) of the National nternal Revenue Code in relation to all other pertinent provisions thereof particularly

Secs. 53, 72, 73, 208 and 209."

c) The search warrant does not particularly describe the things to be seized.

BARREDO, J., concurring:

Search Warrant is null and void. The search warrant was issued for more than one specific offense.

10

STONEHILL vs. DIOKNO

2

G.R. No. L-19550 June 19, 1967

Facts: A total of 42 search warrants against petitioners herein and/or the corporations of which they were officers, directed to

the any peace officer, to search the persons above-named and/or the premises of their offices, warehouses and/or

residences, and to seize and take possession of the following personal property to wit:

Books of accounts, financial records, vouchers, correspondence, receipts, ledgers, journals, portfolios, credit

journals, typewriters, and other documents and/or papers showing all business transactions including

disbursements receipts, balance sheets and profit and loss statements and Bobbins (cigarette wrappers).

as "the subject of the offense; stolen or embezzled and proceeds or fruits of the offense," or "used or intended to be used as

the means of committing the offense," which is described in the applications adverted to above as "violation of Central Bank

Laws, Tariff and Customs Laws, nternal Revenue (Code) and the Revised Penal Code."

Petitioners allege that the search warrants are null and void because: (1) they do not describe with particularity the

documents, books and things to be seized; (2) cash money, not mentioned in the warrants, were actually seized; (3) the

warrants were issued to fish evidence against the aforementioned petitioners in deportation cases filed against them; (4) the

searches and seizures were made in an illegal manner; and (5) the documents, papers and cash money seized were not

delivered to the courts that issued the warrants, to be disposed of in accordance with law.

n their answer, respondents-prosecutors alleged, (1) that the contested search warrants are valid and have been issued in

accordance with law; (2) that the defects of said warrants, if any, were cured by petitioners' consent; and (3) that, in any

event, the effects seized are admissible in evidence against herein petitioners, regardless of the alleged illegality of the

aforementioned searches and seizures.

The documents, papers, and things seized under the alleged authority of the warrants in question may be split into two (2)

major groups, namely: (a) those found and seized in the offices of the aforementioned corporations, and (b) those found and

seized in the residences of petitioners herein.

ssues/Held: WON as to the first group, petitioners as officers of the Corporation have a cause of action to assail the legality

of the contested warrants and of the seizures made in pursuance thereof.- NO

Ratio:

Said corporations have their respective personaIities, separate and distinct from the personaIity of

herein petitioners, regardIess of the amount of shares of stock or of the interest of each of them in

said corporations, and whatever the offices they hoId therein may be.

t is well settled that the legality of a seizure can be contested only by the party whose rights have been

impaired thereby, and that the objection to an unlawful search and seizure is purely personal and cannot

be availed of by third parties. f these papers were unlawfully seized and thereby the constitutional rights of

or any one were invaded, they were the rights of the corporation and not the rights of the other defendants.

Consequently, petitioners herein may not validly object to the use in evidence against them of the

documents, papers and things seized from the offices and premises of the corporations adverted to above,

since the right to object to the admission of said papers in evidence belongs exclusively to the

corporations, to whom the seized effects belong, and may not be invoked by the corporate officers in

proceedings against them in their individual capacity.

2 HARRY S. STONEHLL, ROBERT P. BROOKS, JOHN J. BROOKS and KARL BECK, petitioners, vs. HON. JOSE W. DOKNO, in his capacity as

SECRETARY OF JUSTCE; JOSE LUKBAN, in his capacity as Acting Director, National Bureau of nvestigation; SPECAL PROSECUTORS PEDRO D.

CENZON, EFREN . PLANA and MANUEL VLLAREAL, JR. and ASST. FSCAL MANASES G. REYES; JUDGE AMADO ROAN, Municipal Court of Manila;

JUDGE ROMAN CANSNO, Municipal Court of Manila; JUDGE HERMOGENES CALUAG, Court of First nstance of Rizal-Quezon City Branch, and JUDGE

DAMAN JMENEZ, Municipal Court of Quezon City, respondents.

11

BATAAN SHIPYARD AND ENGINEERING vs. PCGG

G.R. No. 75885 May 27, 1987

Facts:

Challenged by a private corporation known as the Bataan Shipyard and Engineering Co., nc. are: (1) Executive Orders

Numbered 1 and 2, promulgated by President Corazon C. Aquino on February 28, 1986 and March 12, 1986, respectively,

and (2) the sequestration, takeover, and other orders issued, and acts done, in accordance with said executive orders by the

Presidential Commission on Good Government and/or its Commissioners and agents, affecting said corporation.

BASECO describes itself in its petition as "a shiprepair and shipbuilding company * * incorporated as a domestic private

corporation * * (on Aug. 30, 1972) by a consortium of Filipino shipowners and shipping executives. ts main office is at

Engineer sland, Port Area, Manila, where its Engineer sland Shipyard is housed, and its main shipyard is located at

Mariveles Bataan." Barely six months after its incorporation, BASECO acquired from National Shipyard & Steel Corporation,

or NASSCO, a government-owned or controlled corporation, the latter's shipyard at Mariveles, Bataan, known as the Bataan

National Shipyard (BNS), and except for NASSCO's Engineer sland Shops and certain equipment of the BNS, consigned

for future negotiation all its structures, buildings, shops, quarters, houses, plants, equipment and facilities, in stock or in

transit. This it did in virtue of a "Contract of Purchase and Sale with Chattel Mortgage" executed on February 13, 1973. The

price was P52,000,000.00.

Unaccountably, the price of P52,000,000.00 was reduced by more than one-half, to P24,311,550.00, about eight (8) months

later. A document to this effect was executed on October 9, 1973, entitled "Memorandum Agreement," and was signed for

NASSCO by Arturo Pacificador, as Presiding Officer of the Board of Directors, and David R. nes, as General Manager. This

agreement bore, at the top right corner of the first page, the word "APPROVED" in the handwriting of President Marcos,

followed by his usual full signature.

On October 1, 1974, BASECO acquired three hundred (300) hectares of land in Mariveles from the Export Processing Zone

Authority for the price of P10,047,940.00 of which, as set out in the document of sale, P2,000.000.00 was paid upon its

execution, and the balance stipulated to be payable in installments.

Some nine months afterwards, or on July 15, 1975, to be precise, BASECO, again with the intervention of President Marcos,

acquired ownership of the rest of the assets of NASSCO which had not been included in the first two (2) purchase

documents. Transferred to BASECO were NASSCO's "ownership and all its titles, rights and interests over all equipment and

facilities including structures, buildings, shops, quarters, houses, plants and expendable or semi-expendable assets, located

at the Engineer sland, known as the Engineer sland Shops, including all the equipment of the Bataan National Shipyards

(BNS) which were excluded from the sale of NBS to BASECO but retained by BASECO and all other selected equipment and

machineries of NASSCO at J. Panganiban Smelting Plant."

Other evidence submitted to the Court by the SoIicitor GeneraI proves that President Marcos not onIy exercised

control over BASECO, but aIso that he actually owns weII nigh one hundred percent of its outstanding stock.

The Solicitor General has drawn the Court's attention to the intriguing circumstance that found in Malacanang shortly after

the sudden flight of President Marcos, were certificates corresponding to more than ninety-five percent (95%) of all the

outstanding shares of stock of BASECO, endorsed in blank, together with deeds of assignment of practically all the

outstanding shares of stock of the three (3) corporations above mentioned (which hold 95.82% of all BASECO stock), signed

by the owners thereof although not notarized.

The Sequestration, Takeover, and Other Orders CompIained of:

a. Basic sequestration order of various companies and The TAKEOVER Order- While BASECO concedes that

"sequestration without resorting to judicial action, might be made within the context of Executive Orders Nos. 1 and 2

before March 25, 1986 when the Freedom Constitution was promulgated, under the principle that the law promulgated

by the ruler under a revolutionary regime is the law of the land, it ceased to be acceptable when the same ruler opted to

promulgate the Freedom Constitution on March 25, 1986 wherein under Section of the same, Article V (Bill of Rights)

of the 1973 Constitution was adopted providing, among others, that "No person shall be deprived of life, liberty and

property without due process of law." (Const., Art. V, Sec. 1)."

b. Order of production of business documents and records- BASECO argues that the order to produce corporate records

from 1973 to 1986, which it has apparently already complied with, was issued without court authority and infringed its

constitutional right against self-incrimination, and unreasonable search and seizure.

c. BASECO contends that the PCGG had unduly interfered with its right of dominion and management of its business

affairs on the following matters:

12

i. Orders Re Engineer sland-

1. Termination of Contract for Security Services

2. Change of Mode of Payment of Entry Charges

ii. Aborted contract for improvement of wharf at Engineer sland

iii. Order for Operation of Sesiman Rock Quarry, Mariveles, Bataan

iv. Order to Dispose of Scrap, etc.

v. Termination of Services of BASECO Officers

Executive Order No. 1

Executive Order No. 1 stresses the "urgent need to recover all ill-gotten wealth," and postulates that "vast resources of the

government have been amassed by former President Ferdinand E. Marcos, his immediate family, relatives, and close

associates both here and abroad." Upon these premises, the Presidential Commission on Good Government was created,

"charged with the task of assisting the President in regard to (certain specified) matters," among which was precisely-

* * The recovery of all in-gotten wealth accumulated by former President Ferdinand E. Marcos, his immediate family,

relatives, subordinates and close associates, whether located in the Philippines or abroad, including the takeover or

sequestration of all business enterprises and entities owned or controlled by them, during his administration, directly or

through nominees, by taking undue advantage of their public office and/or using their powers, authority, influence,

connections or relationship.

Executive Order No. 2

Executive Order No. 2 gives additional and more specific data and directions respecting "the recovery of ill-gotten properties

amassed by the leaders and supporters of the previous regime." t declares that:

1) * * the Government of the Philippines is in possession of evidence showing that there are assets and properties

purportedly pertaining to former Ferdinand E. Marcos, and/or his wife Mrs. melda Romualdez Marcos, their close

relatives, subordinates, business associates, dummies, agents or nominees which had been or were acquired by them

directly or indirectly, through or as a result of the improper or illegal use of funds or properties owned by the government

of the Philippines or any of its branches, instrumentalities, enterprises, banks or financial institutions, or by taking undue

advantage of their office, authority, influence, connections or relationship, resulting in their unjust enrichment and

causing grave damage and prejudice to the Filipino people and the Republic of the Philippines:" and

2) * * said assets and properties are in the form of bank accounts, deposits, trust accounts, shares of stocks, buildings,

shopping centers, condominiums, mansions, residences, estates, and other kinds of real and personal properties in the

Philippines and in various countries of the world."

Executive Order No. 14

PCGG is empowered, "with the assistance of the Office of the Solicitor General and other government agencies, * * to file

and prosecute all cases investigated by it * * as may be warranted by its findings." All such cases, whether civil or criminal,

are to be filed "with the Sandiganbayan which shall have exclusive and original jurisdiction thereof."

Issue/HeId: WON the issuance of the sequestration and take-over orders was vaIid- Yes

Ratio: n the light of the affirmative showing by the Government that, prima facie at least, the stockholders and directors of

BASECO as of April, 1986 were mere "dummies," nominees or alter egos of President Marcos; at any rate, that they are no

longer owners of any shares of stock in the corporation, the conclusion cannot be avoided that said stockholders and

directors have no basis and no standing whatever to cause the filing and prosecution of the instant proceeding; and to grant

relief to BASECO, as prayed for in the petition, would in effect be to restore the assets, properties and business sequestered

and taken over by the PCGG to persons who are "dummies," nominees or alter egos of the former president.

The facts herein stated at some length do indeed show that the private corporation known as BASECO was "owned or

controlled by former President Ferdinand E. Marcos * * during his administration, * * through nominees, by taking advantage

of * * (his) public office and/or using * * (his) powers, authority, influence * *," and that NASSCO and other property of the

government had been taken over by BASECO; and the situation justified the sequestration as well as the provisional

takeover of the corporation in the public interest, in accordance with the terms of Executive Orders No. 1 and 2, pending the

filing of the requisite actions with the Sandiganbayan to cause divestment of title thereto from Marcos, and its adjudication in

favor of the Republic pursuant to Executive Order No. 14.

Issue/HeId: WON the Executive Orders are BiIIs of Attainder.- NO, Executive Orders not a Bill of Attainder.

13

Ratio:

1. Nothing in the executive orders can be reasonably construed as a determination or declaration of guilt. On the

contrary, the executive orders, inclusive of Executive Order No. 14, make it perfectly clear that any judgment of guilt

in the amassing or acquisition of "ill-gotten wealth" is to be handed down by a judicial tribunal, in this case, the

Sandiganbayan, upon complaint filed and prosecuted by the PCGG.

2. N o punishment is inflicted by the executive orders, as the merest glance at their provisions will immediately make

apparent. n no sense, therefore, may the executive orders be regarded as a bill of attainder.

Issue/Held: WON there is a violation of right against self-incrimination and unreasonable searches and seizure.- NO

Ratio:

t is elementary that the right against self-incrimination has no application to juridical persons.

While an individual may lawfully refuse to answer incriminating questions unless protected by an immunity

statute, it does not follow that a corporation, vested with special privileges and franchises, may refuse to

show its hand when charged with an abuse of such privileges

Relevant jurisprudence is also cited by the Solicitor General.

* * corporations are not entitled to all of the constitutional protections which private individuals have. * *

They are not at all within the privilege against self-incrimination, although this court more than once has

said that the privilege runs very closely with the 4th Amendment's Search and Seizure provisions. It is also

settled that an officer of the company cannot refuse to produce its records in its possession upon the plea

that they will either incriminate him or may incriminate it." (Oklahoma Press Publishing Co. v. Walling, 327

U.S. 186; emphasis, the Solicitor General's).

* * The corporation is a creature of the state. t is presumed to be incorporated for the benefit of the public.

t received certain special privileges and franchises, and holds them subject to the laws of the state and the

limitations of its charter. ts powers are limited by law. t can make no contract not authorized by its charter.

ts rights to act as a corporation are only preserved to it so long as it obeys the laws of its creation. There is

a reserve right in the legislature to investigate its contracts and find out whether it has exceeded its

powers. t would be a strange anomaly to hold that a state, having chartered a corporation to make use of

certain franchises, could not, in the exercise of sovereignty, inquire how these franchises had been

employed, and whether they had been abused, and demand the production of the corporate books and

papers for that purpose. The defense amounts to this, that an officer of the corporation which is charged

with a criminal violation of the statute may plead the criminality of such corporation as a refusal to produce

its books. To state this proposition is to answer it. While an individual may lawfully refuse to answer

incriminating questions unless protected by an immunity statute, it does not follow that a corporation,

vested with special privileges and franchises may refuse to show its hand when charged with an abuse of

such privileges. (Wilson v. United States, 55 Law Ed., 771, 780 [emphasis, the Solicitor General's])

At any rate, Executive Order No. 14-A, amending Section 4 of Executive Order No. 14 assures protection to individuals

required to produce evidence before the PCGG against any possible violation of his right against self-incrimination. t gives

them immunity from prosecution on the basis of testimony or information he is compelled to present. As amended, said

Section 4 now provides that

xxx xxx xxx

The witness may not refuse to comply with the order on the basis of his privilege against self-incrimination;

but no testimony or other information compelled under the order (or any information directly or indirectly

derived from such testimony, or other information) may be used against the witness in any criminal case,

except a prosecution for perjury, giving a false statement, or otherwise failing to comply with the order.

The constitutional safeguard against unreasonable searches and seizures finds no application to the case at bar either.

There has been no search undertaken by any agent or representative of the PCGG, and of course no seizure on the

occasion thereof.

TEEHANKEE, CJ., concurring:

The Court is unanimous insofar as the judgment at bar upholds the imperative need of recovering the ill-gotten properties

amassed by the previous regime, which "deserves the fullest support of the judiciary and all sectors of society." The Court is

likewise unanimous in its judgment dismissing the petition to declare unconstitutional and void Executive Orders Nos. 1 and 2

to annul the sequestration order of April 14, 1986. For indeed, the 1987 Constitution overwhelmingly adopted by the people

14

at the February 2, 1987 plebiscite expressly recognized in Article XV, section 26 thereof the vital functions of respondent

PCGG to achieve the mandate of the people to recover such ill-gotten wealth and properties as ordained by Proclamation

No. 3 promulgated on March 25, 1986. The Court is likewise unanimous as to the general rule set forth in the main opinion

that "the PCGG cannot exercise acts of dominion over property sequestered, frozen or provisionally taken over" and "(T)he

PCGG may thus exercise only powers of administration over the property or business sequestered or provisionally taken

over, much like a court-appointed receiver, such as to bring and defend actions in its own name; receive rents; collect debts

due; pay outstanding debts; and generally do such other acts and things as may be necessary to fulfill its mission as

conservator and administrator.

PADILLA, J., concurring:

The majority opinion penned by Mr. Justice Narvasa maintains and upholds the valid distinction between acts of conservation

and preservation of assets and acts of ownership. Sequestration, freeze and temporary take-over encompass the first type of

acts. They do not include the second type of acts which are reserved only to the rightful owner of the assets or business

sequestered or temporarily taken over.

MELENCIO-HERRERA, J., concurring:

Melencio- Herrera qualifies the concurrence in so far as the voting of sequestered stork is concerned.

The voting of sequestered stock is, to my mind, an exercise of an attribute of ownership. t goes beyond the purpose of a writ

of sequestration, which is essentially to preserve the property in litigation (Article 2005, Civil Code). Sequestration is in the

nature of a judicial deposit (ibid.).

GUTIERREZ, JR., J., concurring and dissenting:

We are all agreed in the Court that the PCGG is not a judge. t is an investigator and prosecutor. Sequestration is only a

preliminary or ancillary remedy. There must be a principal and independent suit filed in court to establish the true ownership

of sequestered properties. The factual premise that a sequestered property was ill-gotten by former President Marcos, his

family, relatives, subordinates, and close associates cannot be assumed. The fact of ownership must be established in a

proper suit before a court of justice.

CRUZ, J., dissenting:

Cruz is convinced and so submit that the PCGG cannot at this time take over the BASECO without any court order and

exercise thereover acts of ownership without court supervision. Voting the shares is an act of ownership. Reorganizing the

board of directors is an act of ownership. Such acts are clearly unauthorized. As the majority opinion itself stresses, the

PCGG is merely an administrator whose authority is limited to preventing the sequestered properties from being dissipated or

clandestinely transferred.

15

PNB vs CA

3

G.R. No. L-27155 May 18, 1978

Facts:

Defendant Rita Guenco Tapnio secured a crop loan from PNB. This crop loan was secured by a mortgage on her standing

crop including her sugar quota allocation for the agricultural year corresponding to said standing crop. Philmagen executed

its Bond, with defendant Rita Gueco Tapnio as principal, in favor of the Philippine National Bank Branch at San Fernando,

Pampanga, to guarantee the payment of defendant Rita Gueco Tapnio's account with said Bank. n turn, to guarantee the

payment of whatever amount the bonding company would pay to the Philippine National Bank, both defendants (Rita Gueco

Tapnio and Cecilio Gueco) executed the indemnity agreement.

t is not disputed that defendant Rita Gueco Tapnio was indebted to the bank in the sum of P2,000.00, plus accumulated

interests unpaid, which she failed to pay despite demands. The Bank wrote a letter of demand to Philmagen, whereupon

Philmagen accordingly paid the full amount due and owing in the sum of P2,379.91, for and on account of defendant Rita

Gueco's obligation.

Defendant Rita Gueco Tapnio admitted all the foregoing facts. She claims, however, when demand was made upon her by

plaintiff for her to pay her debt to the Bank, that she told the Plaintiff that she did not consider herself to be indebted to the

Bank at all because she had an agreement with one Jacobo-Nazon whereby she had leased to the latter her unused export

sugar quota for the 1956-1957 agricultural year. his lease agreement, according to her, was with the knowledge of the bank.

But the Bank has pIaced obstacIes to the consummation of the Iease, and the deIay caused by said obstacIes forced

'Nazon to rescind the Iease contract. Thus, Rita Gueco Tapnio filed her third-party complaint against the Bank to recover

from the latter any and all sums of money which may be adjudged against her and in favor of the plaitiff plus moral damages,

attorney's fees and costs.

Sometimes, a planter harvest less sugar than her quota, so her excess quota is utilized by another who pays her for its use.

This is the arrangement entered into between Mrs. Tapnio and Mr. Tuazon regarding the former's excess quota for 1956-

1957.

Since the quota was mortgaged to the P.N.B., the contract of lease had to be approved by said Bank, The same was

submitted to the branch manager at San Fernando, Pampanga.

Consideration of the evidence discloses that when the branch manager of the Philippine National Bank at San Fernando

recommended the approval of the contract of lease at the price of P2.80 per picul, whose recommendation was concurred in

by the Vice-president of said Bank, J. V. Buenaventura, the board of directors required that the amount be raised to 13.00 per

picul. Mr. Tuazon asked for a reconsideration of the price per picul but thaw same was not acted upon the PNB's BOD. The

parties were notified of the refusal on the part of the board of directors of the Bank to grant the motion for reconsideration. As

such, Tuazon wrote a letter to the Bank informing the Bank that he was no longer interested to continue the deal, referring to

the lease of sugar quota allotment in favor of defendant Rita Gueco Tapnio. The result is that the latter lost the sum of

P2,800.00 which she should have received from Tuazon and which she could have paid the Bank to cancel off her

indebtedness.

3 PHLPPNE NATONAL BANK, petitioner,vs THE COURT OF APPEALS, RTA GUECO TAPNO, CECLO GUECO and THE PHLPPNE AMERCAN

GENERAL NSURANCE COMPANY, NC., respondents.

16

Issue/HeId: WON the rescission of the Iease contract of the 1,000 picuIs of sugar quota aIIocation of respondent Rita

Gueco Tapnio by Jacobo C. Tuazon was due to the unjustified refusaI of petitioner to approve said Iease contract,

and its unreasonabIe insistence on the rentaI price of P3.00 instead of P2.80 per picuI.- YES

Ratio: t has been clearly shown that when the Branch Manager of petitioner required the parties to raise the consideration of

the lease from P2.50 to P2.80 per picul, or a total of P2,800-00, they readily agreed. Hence, in his letter to the Branch

Manager of the Bank on August 10, 1956, Tuazon informed him that the minimum lease rental of P2.80 per picul was

acceptable to him and that he even offered to use the loan secured by him from petitioner to pay in full the sum of P2,800.00

which was the total consideration of the lease. This arrangement was not only satisfactory to the Branch Manager but it was

also approves by Vice-President J. V. Buenaventura of the PNB. Under that arrangement, Rita Gueco Tapnio could have

realized the amount of P2,800.00, which was more than enough to pay the balance of her indebtedness to the Bank which

was secured by the bond of Philamgen.

There is no question that Tapnio's failure to utilize her sugar quota for the crop year 1956-1957 was due to the disapproval of

the lease by the Board of Directors of petitioner.

Time is of the essence in the approval of the lease of sugar quota allotments, since the same must be utilized during the

milling season, because any allotment which is not filled during such milling season may be reallocated by the Sugar Quota

Administration to other holders of allotments. There was no proof that there was any other person at that time willing to lease

the sugar quota allotment of private respondents for a price higher than P2.80 per picul. "The fact that there were isolated

transactions wherein the consideration for the lease was P3.00 a picul", according to the trial court, "does not necessarily

mean that there are always ready takers of said price." The unreasonableness of the position adopted by the petitioner's

Board of Directors is shown by the fact that the difference between the amount of P2.80 per picul offered by Tuazon and the

P3.00 per picul demanded by the Board amounted only to a total sum of P200.00.

Issue/HeId: WON PNB is IiabIe for the damage caused.- YES

Ratio: While petitioner had the ultimate authority of approving or disapproving the proposed lease since the quota was

mortgaged to the Bank, the latter certainly cannot escape its responsibility of observing, for the protection of the interest of

private respondents, that degree of care, precaution and vigilance which the circumstances justly demand in approving or

disapproving the lease of said sugar quota.

The law makes it imperative that every person "must in the exercise of his rights and in the performance of his duties, act

with justice, give everyone his due, and observe honesty and good faith. This petitioner failed to do. Certainly, it knew that the

agricultural year was about to expire, that by its disapproval of the lease private respondents would be unable to utilize the

sugar quota in question.

n failing to observe the reasonable degree of care and vigilance which the surrounding circumstances reasonably impose;

petitioner is consequently liable for the damages caused on private respondents. Under Article 21 of the New Civil Code,

"any person who wilfully causes loss or injury to another in a manner that is contrary to morals, good customs or public policy

shall compensate the latter for the damage." The afore-cited provisions on human relations were intended to expand the

concept of torts in this jurisdiction by granting adequate legal remedy for the untold number of moral wrongs which is

impossible for human foresight to specifically provide in the statutes.

A corporation is civiIIy IiabIe in the same manner as naturaI persons for torts, because "generaIIy speaking, the

ruIes governing the IiabiIity of a principaI or master for a tort committed by an agent or servant are the same

whether the principaI or master be a naturaI person or a corporation, and whether the servant or agent be a naturaI

or artificiaI person. AII of the authorities agree that a principaI or master is IiabIe for every tort which he expressIy

directs or authorizes, and this is just as true of a corporation as of a naturaI person, A corporation is IiabIe,

therefore, whenever a tortious act is committed by an officer or agent under express direction or authority from the

stockhoIders or members acting as a body, or, generaIIy, from the directors as the governing body."

17

CHING vs. SECRETARY OF JUSTICE

G. R. No. 164317 February 6, 2006

Facts:

Petitioner was the Senior Vice-President of Philippine Blooming Mills, nc. (PBM). Sometime in September to October 1980,

PBM, through petitioner, applied with the Rizal Commercial Banking Corporation (respondent bank) for the issuance of

commercial letters of credit to finance its importation of assorted goods.

RCBC approved the application, and irrevocable letters of credit were issued in favor of petitioner. The goods were

purchased and delivered in trust to PBM. Petitioner signed 13 trust receipts

as surety, acknowledging delivery of respective

goods.

Under the receipts, petitioner agreed to hold the goods in trust for the said bank, with authority to sell but not by way of

conditional sale, pledge or otherwise; and in case such goods were sold, to turn over the proceeds thereof as soon as

received, to apply against the relative acceptances and payment of other indebtedness to respondent bank. n case the

goods remained unsold within the specified period, the goods were to be returned to respondent bank without any need of

demand. Thus, said "goods, manufactured products or proceeds thereof, whether in the form of money or bills, receivables,

or accounts separate and capable of identification" were respondent bank's property.

When the trust receipts matured, petitioner failed to return the goods to respondent bank, or to return their value amounting

to P6,940,280.66 despite demands. Thus, a criminal case for estafa was filed

against the Senior VP.

The RTC, however, granted the Motion to Quash the nformations filed by petitioner on the ground that the material

allegations therein did not amount to estafa.

n the meantime, the Court rendered judgment in Allied Banking Corporation v. Ordoez,

holding that the penal provision of

P.D. No. 115 encompasses any act violative of an obligation covered by the trust receipt; it is not limited to transactions

involving goods which are to be sold (retailed), reshipped, stored or processed as a component of a product ultimately sold.

The Court also ruled that "the non-payment of the amount covered by a trust receipt is an act violative of the obligation of the

entrustee to pay."

Thus, the criminal complaint for estafa was re-filed.

Issue: WON the HonorabIe Secretary of Justice correctIy ruIed that petitioner AIfredo Ching is the officer

responsibIe for the offense charged.- NO

Ratio:

Assertions of Petitioner that he had no direct participation in the transaction other than being the Senior VP of the PBM is too

dull that it cannot even just dent the findings of the respondent Secretary, viz:

"x x x it is apropos to quote section 13 of PD 115 which states in part, viz:

'xxx f the violation or offense is committed by a corporation, partnership, association or other judicial entities, the penalty

provided for in this Decree shall be imposed upon the directors, officers, employees or other officials or persons therein

responsible for the offense, without prejudice to the civil liabilities arising from the criminal offense.'

"There is no dispute that it was the respondent, who as senior vice-president of PBM, executed the thirteen (13) trust

receipts. As such, the law points to him as the official responsible for the offense. Since a corporation cannot be

proceeded against criminally because it cannot commit crime in which personal violence or malicious intent is required,

criminal action is limited to the corporate agents guilty of an act amounting to a crime and never against the corporation

itself (West Coast Life ns. Co. vs. Hurd, 27 Phil. 401; Times, []nc. v. Reyes, 39 SCRA 303). Thus, the execution by

respondent of said receipts is enough to indict him as the official responsible for violation of PD 115.

xxx

"n regard to the other assigned errors, we note that the respondent bound himself under the terms of the trust receipts

not only as a corporate official of PBM but also as its surety. t is evident that these are two (2) capacities which do not

exclude the other. Logically, he can be proceeded against in two (2) ways: first, as surety as determined by the Supreme

Court in its decision in RCBC vs. Court of Appeals, 178 SCRA 739; and, secondly, as the corporate official responsible for

the offense under PD 115, the present case is an appropriate remedy under our penal law.

"Moreover, PD 115 explicitly allows the prosecution of corporate officers 'without prejudice to the civil liabilities arising from

the criminal offense' thus, the civil liability imposed on respondent in RCBC vs. Court of Appeals case is clearly separate

and distinct from his criminal liability under PD 115.'"

18

The Court rules that although petitioner signed the trust receipts merely as Senior Vice-President of PBM and had no

physical possession of the goods, he cannot avoid prosecution for violation of P.D. No. 115.

4

The crime defined in P.D. No. 115 is malum prohibitum but is classified as estafa under paragraph 1(b), Article 315 of the

Revised Penal Code, or estafa with abuse of confidence. t may be committed by a corporation or other juridical entity or by

natural persons.

Though the entrustee is a corporation, nevertheless, the law specifically makes the officers, employees or other officers or

persons responsible for the offense, without prejudice to the civil liabilities of such corporation and/or board of directors,

officers, or other officials or employees responsible for the offense. The rationale is that such officers or employees are

vested with the authority and responsibility to devise means necessary to ensure compliance with the law and, if they fail to

do so, are held criminally accountable; thus, they have a responsible share in the violations of the law.

If the crime is committed by a corporation or other juridicaI entity, the directors, officers, empIoyees or other officers

thereof responsibIe for the offense shaII be charged and penaIized for the crime, preciseIy because of the nature of

the crime and the penaIty therefor. A corporation cannot be arrested and imprisoned; hence, cannot be penaIized for

a crime punishabIe by imprisonment.

However, a corporation may be charged and prosecuted for a crime if the