Professional Documents

Culture Documents

Assignment On Merger & Acquisitions

Uploaded by

Praneet KumarOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Assignment On Merger & Acquisitions

Uploaded by

Praneet KumarCopyright:

Available Formats

Assignment on Merger & Acquisitions

Mergers and Acquisitions

Mergers and acquisitions are strategic decisions taken for maximization of a company's growth by enhancing its production and marketing operations. They are being used in a wide array of fields such as information technology, telecommunications, and business process outsourcing as well as in traditional businesses in order to gain strength, expand the customer base, cut competition or enter into a new market or product segment.

Mergers or Amalgamations

A merger is a combination of two or more businesses into one business. Laws in India use the term 'amalgamation' for merger. The Income Tax Act,1961 [Section 2(1A)]defines amalgamation as the merger of one or more companies with another or the merger of two or more companies to form a new company, in such a way that all assets and liabilities of the amalgamating companies become assets and liabilities of the amalgamated company and shareholders not less than nine-tenths in value of the shares in the amalgamating company or companies become shareholders of the amalgamated company. Thus, mergers or amalgamations may take two forms:

Merger through Absorption:- An absorption is a combination of two or more companies into an 'existing company'. All companies except one lose their identity in such a merger. For example, absorption of Tata Fertilizers Ltd (TFL) by Tata Chemicals Ltd. (TCL). TCL, an acquiring company (a buyer), survived after merger while TFL, an acquired company (a seller), ceased to exist. TFL transferred its assets, liabilities and shares to TCL. Merger through Consolidation:- A consolidation is a combination of two or more companies into a 'new company'. In this form of merger, all companies are legally dissolved and a new entity is created. Here, the acquired company transfers its assets, liabilities and shares to the acquiring company for cash or exchange of shares. For example, merger of Hindustan Computers Ltd, Hindustan Instruments Ltd, Indian Software Company Ltd and Indian Reprographics Ltd into an entirely new company called HCL Ltd.

A fundamental characteristic of merger (either through absorption or consolidation) is that the acquiring company (existing or new) takes over the ownership of other companies and combines their operations with its own operations. Besides, there are three major types of mergers:

Horizontal merger: - is a combination of two or more firms in the same area of business. For example, combining of two book publishers or two luggage manufacturing companies to gain dominant market share. Vertical merger: - is a combination of two or more firms involved in different stages of production or distribution of the same product. For example, joining of a TV manufacturing (assembling) company and a TV marketing company or joining of a spinning company and a weaving company. Vertical merger may take the form of forward or backward merger. When a company combines with the supplier of material, it is called backward merger and when it combines with the customer, it is known as forward merger. Conglomerate merger: - is a combination of firms engaged in unrelated lines of business activity. For example, merging of different businesses like manufacturing of cement products,

fertilizer products, electronic products, insurance investment and advertising agencies. L&T and Voltas Ltd are examples of such mergers. Acquisitions and Takeovers An acquisition may be defined as an act of acquiring effective control by one company over assets or management of another company without any combination of companies. Thus, in an acquisition two or more companies may remain independent, separate legal entities, but there may be a change in control of the companies. When an acquisition is 'forced' or 'unwilling', it is called a takeover. In an unwilling acquisition, the management of 'target' company would oppose a move of being taken over. But, when managements of acquiring and target companies mutually and willingly agree for the takeover, it is called acquisition or friendly takeover. Under the Monopolies and Restrictive Practices Act, takeover meant acquisition of not less than 25 percent of the voting power in a company. While in the Companies Act (Section 372), a company's investment in the shares of another company in excess of 10 percent of the subscribed capital can result in takeovers. An acquisition or takeover does not necessarily entail full legal control. A company can also have effective control over another company by holding a minority ownership.

Procedure for evaluating the decision for mergers and acquisitions

The three important steps involved in the analysis of mergers and acquisitions are:

Planning:- of acquisition will require the analysis of industry-specific and firm-specific information. The acquiring firm should review its objective of acquisition in the context of its strengths and weaknesses and corporate goals. It will need industry data on market growth, nature of competition, ease of entry, capital and labour intensity, degree of regulation, etc. This will help in indicating the product-market strategies that are appropriate for the company. It will also help the firm in identifying the business units that should be dropped or added. On the other hand, the target firm will need information about quality of management, market share and size, capital structure, profitability, production and marketing capabilities, etc. Search and Screening:- Search focuses on how and where to look for suitable candidates for acquisition. Screening process short-lists a few candidates from many available and obtains detailed information about each of them. Financial Evaluation:- of a merger is needed to determine the earnings and cash flows, areas of risk, the maximum price payable to the target company and the best way to finance the merger. In a competitive market situation, the current market value is the correct and fair value of the share of the target firm. The target firm will not accept any offer below the current market value of its share. The target firm may, in fact, expect the offer price to be more than the current market value of its share since it may expect that merger benefits will accrue to the acquiring firm. A merger is said to be at a premium when the offer price is higher than the target firm's premerger market value. The acquiring firm may have to pay premium as an incentive to target firm's shareholders to induce them to sell their shares so that it (acquiring firm) is able to obtain the control of the target firm.

Regulations for Mergers & Acquisitions

Mergers and acquisitions are regulated under various laws in India. The objective of the laws is to make these deals transparent and protect the interest of all shareholders. They are regulated through the provisions of:

The Companies Act, 1956 The competition Act FEMA SEBI The Indian Income Tax , Act Mandatory permission from court Stamp Duty

Indian Legal Issues involved in Merger & Acquisitions

SEBI Takeover Regulations Due diligence in M&A Contractual Issues in M&A Intellectual Properties in M&A Exchange control issue Monopolies and restrictive trade practice Act and Competition Act Tax implications in M&A

Legal Procedure for Bringing About Merger Of Companies

(1) Examination of object clauses: The MOA of both the companies should be examined to check the power to amalgamate is available. Further, the object clause of the merging company should permit it to carry on the business of the merged company. If such clauses do not exist, necessary approvals of the share holders, board of directors, and company law board are required. (2) Intimation to stock exchanges: The stock exchanges where merging and merged companies are listed should be informed about the merger proposal. From time to time, copies of all notices, resolutions, and orders should be mailed to the concerned stock exchanges. (3) Approval of the draft merger proposal by the respective boards: The draft merger proposal should be approved by the respective BODs. The board of each company should pass a resolution authorizing its directors/executives to pursue the matter further. (4) Application to high courts: Once the drafts of merger proposal is approved by the respective boards, each company should make an application to the high court of the state where its registered office is situated so that it can convene the meetings of share holders and creditors for passing the merger proposal. (5) Dispatch of notice to share holders and creditors: In order to convene the meetings of share holders and creditors, a notice and an explanatory statement of the meeting, as approved by the high court, should be dispatched by each company to its shareholders and creditors so that they get 21 days advance intimation. The notice of the meetings should also be published in two news papers.

(6) Holding of meetings of share holders and creditors: A meeting of share holders should be held by each company for passing the scheme of mergers at least 75% of shareholders who vote either in person or by proxy must approve the scheme of merger. Same applies to creditors also. (7) Petition to High Court for confirmation and passing of HC orders: Once the mergers scheme is passed by the share holders and creditors, the companies involved in the merger should present a petition to the HC for confirming the scheme of merger. A notice about the same has to be published in 2 newspapers. (8) Filing the order with the registrar: Certified true copies of the high court order must be filed with the registrar of companies within the time limit specified by the court. (9) Transfer of assets and liabilities: After the final orders have been passed by both the HCs, all the assets and liabilities of the merged company will have to be transferred to the merging company. (10) Issue of shares and debentures: The merging company, after fulfilling the provisions of the law, should issue shares and debentures of the merging company. The new shares and debentures so issued will then be listed on the stock exchange.

Waiting Period in Merger

International experience shows that 80-85% of mergers and acquisitions do not raise competitive concerns and are generally approved between 30-60 days. The rest tend to take longer time and, therefore, laws permit sufficient time for looking into complex cases. The International Competition Network, an association of global competition authorities, had recommended that the straight forward cases should be dealt with within six weeks and complex cases within six months. The Indian competition law prescribes a maximum of 210 days for determination of combination, which includes mergers, amalgamations, acquisitions etc. This however should not be read as the minimum period of compulsory wait for parties who will notify the Competition Commission. In fact, the law clearly states that the compulsory wait period is either 210 days from the filing of the notice or the order of the Commission, whichever is earlier. In the event the Commission approves a proposed combination on the 30th day, it can take effect on the 31st day. The internal time limits within the overall gap of 210 days are proposed to be built in the regulations that the Commission will be drafting, so that the over whelming proportion of mergers would receive approval within a much shorter period. The time lines prescribed under the Act and the Regulations do not take cognizance of the compliances to be observed under other statutory provisions like the SEBI (Substantial Acquisition of Shares and Takeovers) Regulations, 1997 (SEBI Takeover Regulations). SEBI Takeover Regulations require the acquirer to complete all procedures relating to the public offer including payment of consideration to the shareholders who have accepted the offer, within 90 days from the date of public announcement. Similarly, mergers and amalgamations get completed generally in 3-4 months time. Failure to make payments to the shareholders in the public offer within the time stipulated in the SEBI Takeover Regulations entails payment of interest by the acquirer at a rate as may be specified by SEBI. [Regulation 22(12) of the SEBI Takeover Regulations] It would therefore be essential that the maximum turnaround time for CCI should be reduced from 210 days to 90 days.

Conclusion

With the FDI policies becoming more liberalized, Mergers, Acquisitions and alliance talks are heating up in India and are growing with an ever increasing cadence. They are no more limited to one particular type of business. The list of past and anticipated mergers covers every size and variety of business -- mergers are on the increase over the whole marketplace, providing platforms for the small companies being acquired by bigger ones. The basic reason behind mergers and acquisitions is that organizations merge and form a single entity to achieve economies of scale, widen their reach, acquire strategic skills, and gain competitive advantage. In simple terminology, mergers are considered as an important tool by companies for purpose of expanding their operation and increasing their profits, which in faade depends on the kind of companies being merged. Indian markets have witnessed burgeoning trend in mergers which may be due to business consolidation by large industrial houses, consolidation of business by multinationals operating in India, increasing competition against imports and acquisition activities. Therefore, it is ripe time for business houses and corporates to watch the Indian market, and grab the opportunity.

CASE of 2010

Vodafone & Hutchisons Case

Introduction: In 2007, Vodafone Group bought the Indian telecom assets of Hong Kong's Hutchison Telecommunications International Ltd. It paid US$11 billion for a 67% stake in Hutchison Essar. The latter was the operating company in India for what is now the third-largest operator with 111 million users. Vodafone was the buyer. Hutchison, the seller, made huge capital gains. Yet since then, Vodafone has been battling it out in the courts against the Indian Income Tax (IT) department, which has saddled it with a US$2.1 billion tax claim. Hutchison, which pocketed the capital gains, is nowhere in the picture.

Facts:Many important documents relevant to the deal have never been made public, so it is unclear if the tax claim is a result of Vodafone's overlooking a key issue or overconfidence. In such transactions, the buyer is supposed to deduct tax at source (or withholding tax) and pay that to the government. This is a transaction involving foreign companies and the seller can easily disappear once the money is in the bank. The buyer, on the other hand, has the Indian assets and, in a worst case scenario, those can be attached if there is any default. The question many are asking is: Why is Vodafone left holding the bag? One possibility is that Vodafone is a better candidate to be the public face of the tax dispute, some analysts say. Hutchison, fat on the proceeds, may have found a less sympathetic court than Vodafone, which is being asked to pay up a second time.

Courts Decision:The Bombay High Court observed that the controlling interest does not constitute a distinct capital asset for the purpose of the Indian tax law. In other words, controlling interest arises from the acquisition of a sufficient number of shares in a company as would enable the shareholder to exercise significant voting power which would result in the control of the management of the company. The controlling interest is therefore not an identifiable or distinct capital asset independent of the shareholding. Accordingly, the high court seems to imply that part of sale consideration which relates to the value of the share of the Cayman Company including controlling interest should not be subject to tax in India as the share is located outside of India. However, the court agreed with Revenues contention that this is not a case of simply transfer of shares but the transaction involves a variety of business rights and interest which are all located in India. In arriving at this conclusion, the court has considered the commercial and business understanding between the parties and the various legal documents, which were entered into to consummate transfer of business in India. The court has specifically held these bundles of rights and entitlements as capital assets and hence consideration attributable to such rights and entitlements situated in India would be subject to tax in India. The high court has left it for the tax officer to apportion the income between what is attributable to these business rights in India and what is attributable to the shareholding outside of India.

In a massive setback to Vodafone, the Bombay High Court ruled on September 8, 2010 against the telecom company and in favour of the Income Tax department in the Rs 12,000 crore tax liability case. The Bombay High Court has said that the I-T department has the jurisdiction to proceed against Vodafone. In a 200-page order delivered, the Bombay High Court ruled that the Vodafone-Hutchison deal is taxable in India. But the implications are wider, experts point out. "The court has stated that the purchase of shares of a foreign company by one non-resident from another non-resident attracts Indian tax if the object is to acquire the Indian assets held by the foreign company". "The key issue in case of Vodafone is not the stated law but the substantive nature of the transaction and the growing tendency of tax authorities worldwide to disregard structures not having commercial substance."

Impact on cross-border transactions:

This ruling seems to suggest a fundamentally different approach to taxation of transactions where there is a transfer of controlling interest in India regardless of the fact that such transfer is affected by way of sale of shares of an overseas company. This will create a degree of uncertainty in respect of similar transactions, which have already taken place and where the revenue department will make an attempt to take support of the Bombay High Court judgment to tax those transactions. Having said this, in cases which can be distinguished on facts and especially in those situations where there is no transfer of business or other valuable commercial rights in India it will still be possible to argue against taxation arising in India. For example, where there is not an outright sale of business in India but a large interest in the Indian company is indirectly transferred through shares of a foreign company, the earlier position should prevail i.e., sale of a foreign company not being subject to tax in India. The verdict will have far-reaching implications on future cross-border deals. The costs related to tax on transfer of India assets have to be considered and negotiated. This verdict will discourage foreign investments in India at a time when we need strong capital inflows to achieve higher economic growth and capital investment.

You might also like

- Before Starting A Business Start Up ChecklistDocument65 pagesBefore Starting A Business Start Up ChecklistJude21No ratings yet

- Novation of ContractDocument2 pagesNovation of ContractZaman Ali100% (1)

- What Are The Four Basic Areas of FinanceDocument1 pageWhat Are The Four Basic Areas of FinanceHaris Hafeez100% (5)

- Project On Merger and AcquisitionDocument8 pagesProject On Merger and Acquisitionaashish0128No ratings yet

- Philippine Competition Act and IRR MatrixDocument64 pagesPhilippine Competition Act and IRR MatrixBinkee Villarama100% (1)

- Corporate Restructuring - Meaning, Types, and CharacteristicsDocument6 pagesCorporate Restructuring - Meaning, Types, and CharacteristicsPrajwalNo ratings yet

- Zero To One SummaryDocument6 pagesZero To One Summaryakjhkjasdf100% (1)

- Corporate GovernanceDocument67 pagesCorporate GovernanceAna Micaela JusayNo ratings yet

- Advantages of Mergers and AcqusitionsDocument21 pagesAdvantages of Mergers and AcqusitionsAkshay PatniNo ratings yet

- Financial Strategy: Strategic Implications of AcquisitionsDocument24 pagesFinancial Strategy: Strategic Implications of AcquisitionsRebecca ClassenNo ratings yet

- CORPORATE GOVERNANCE - 9th SEMESTERDocument18 pagesCORPORATE GOVERNANCE - 9th SEMESTERAnand Hitesh SharmaNo ratings yet

- M&a in Indian BanksDocument48 pagesM&a in Indian Banksvikas_kumar820No ratings yet

- Regulations in IndiaDocument8 pagesRegulations in IndiaHimanshu GuptaNo ratings yet

- Bora AmusementDocument69 pagesBora Amusementabere100% (2)

- Project On Analysis of Merger and Acquistion - Shruti Jain (Task-02)Document42 pagesProject On Analysis of Merger and Acquistion - Shruti Jain (Task-02)We Love TravellNo ratings yet

- Indian Takeover CodeDocument10 pagesIndian Takeover CodeMoiz ZakirNo ratings yet

- Six Merger Waves in The Historical MergersDocument6 pagesSix Merger Waves in The Historical MergersMei YunNo ratings yet

- La Liste Noire Des Sites Darnaques de lADC France Au 14.10.2023Document109 pagesLa Liste Noire Des Sites Darnaques de lADC France Au 14.10.2023Michael CollinsNo ratings yet

- Tata Motors Acquisition of Daewoo Commercial VehiclesDocument8 pagesTata Motors Acquisition of Daewoo Commercial VehiclesRanjan Bhagat100% (1)

- Presentation On Corporate Level StragegiesDocument12 pagesPresentation On Corporate Level StragegiesVaibhav SinghNo ratings yet

- Fdi in Indian Defence SectorDocument18 pagesFdi in Indian Defence SectorAnonymous Y0M10GZVNo ratings yet

- Hart Venture CapitalDocument32 pagesHart Venture CapitalJoyce Kwok100% (1)

- Demerger and Tax On M&aDocument5 pagesDemerger and Tax On M&aChandan SinghNo ratings yet

- Mergers and Acquisitions NotesDocument12 pagesMergers and Acquisitions NotesUjjwal AnandNo ratings yet

- M A - Merger-TypesDocument24 pagesM A - Merger-TypesSonalir RaghuvanshiNo ratings yet

- Cross Boader Merger & AcquisitionDocument9 pagesCross Boader Merger & AcquisitionsangeetagoeleNo ratings yet

- CROSS BORDER MERGERS & ACQUISITIONSCross Border Mergers & AcquisitionsDocument36 pagesCROSS BORDER MERGERS & ACQUISITIONSCross Border Mergers & Acquisitionssuresh1969No ratings yet

- Merger and AquiseationDocument13 pagesMerger and AquiseationBabasab Patil (Karrisatte)100% (1)

- Regulatory Framework of M&ADocument5 pagesRegulatory Framework of M&ARaghuramNo ratings yet

- Merger and AquisitionsDocument22 pagesMerger and AquisitionsIshAkhterNo ratings yet

- Shares: Meaning and Nature of SharesDocument9 pagesShares: Meaning and Nature of SharesNeenaNo ratings yet

- Competition Law ProjectDocument11 pagesCompetition Law Projectprithvi yadavNo ratings yet

- Title Page: Valuation of Mergers and AcquisitionsDocument58 pagesTitle Page: Valuation of Mergers and Acquisitionsgirish8911No ratings yet

- Module 2-EDDocument26 pagesModule 2-EDNikhil RankaNo ratings yet

- MA 3103 6. Valuation in Mergers and AcquisitionsDocument21 pagesMA 3103 6. Valuation in Mergers and AcquisitionsAnna Paula GallemitNo ratings yet

- Preference SharesDocument3 pagesPreference SharesDipti AryaNo ratings yet

- Structure of Capital Market: Dr. Deepa Soni Assistant Professor Department of Economics Mlsu (Ucssh) UdaipurDocument5 pagesStructure of Capital Market: Dr. Deepa Soni Assistant Professor Department of Economics Mlsu (Ucssh) UdaipurAnonymous 1ClGHbiT0J0% (1)

- Care Economy in IndiaDocument43 pagesCare Economy in IndiaSayak BhattacharyaNo ratings yet

- BDI Vs CDIDocument2 pagesBDI Vs CDImallikaaaNo ratings yet

- Private EquityDocument11 pagesPrivate Equityanurag yadavNo ratings yet

- Mergers and AcquisitionsDocument10 pagesMergers and AcquisitionsGanesh KumarNo ratings yet

- Meaning and Concept Types of Takeovers: Unit - IIIDocument30 pagesMeaning and Concept Types of Takeovers: Unit - IIISoorajKrishnanNo ratings yet

- All Chapters M&A Final PDFDocument182 pagesAll Chapters M&A Final PDFshiva karnati100% (1)

- Merger FinalDocument24 pagesMerger FinalMd SufianNo ratings yet

- 08 Chapter 1 - Managerial RemunerationDocument26 pages08 Chapter 1 - Managerial RemunerationMbaStudent56No ratings yet

- Mergera & Acquisitions in InsuranceDocument12 pagesMergera & Acquisitions in Insurancessiyal840100% (1)

- Hostile Takeover in Respect To IndiaDocument39 pagesHostile Takeover in Respect To IndiadebankaNo ratings yet

- Corporate GovernanceDocument8 pagesCorporate GovernanceSanjay Kumar VaniyanNo ratings yet

- Corporate Governance in A Developing Economy: Barriers, Issues, and Implications For FirmsDocument16 pagesCorporate Governance in A Developing Economy: Barriers, Issues, and Implications For FirmsTahir ZahoorNo ratings yet

- What Is Equity MarketDocument2 pagesWhat Is Equity MarketVinod AroraNo ratings yet

- Company Law - Insider Trading in IndiaDocument10 pagesCompany Law - Insider Trading in IndiaShubhanshu YadavNo ratings yet

- Fund Based ActivitiesDocument35 pagesFund Based Activitiesyaminipawar509100% (3)

- Mergers and AcquisitionDocument17 pagesMergers and AcquisitionRaghu NarayanNo ratings yet

- Non Convertible DebenturesDocument3 pagesNon Convertible DebenturesAbhinav AroraNo ratings yet

- Mergers and AcquisitionsDocument81 pagesMergers and Acquisitionsleen_badiger911No ratings yet

- Doctrine of Caveat EmptorDocument3 pagesDoctrine of Caveat EmptorHira BukhariNo ratings yet

- Anti Takeover Amendments - MergersDocument7 pagesAnti Takeover Amendments - MergersBalajiNo ratings yet

- Takeover Code PDFDocument25 pagesTakeover Code PDFSanjeev KaranjekarNo ratings yet

- Impact of GST On Different Sectors of Indian Economy PDFDocument3 pagesImpact of GST On Different Sectors of Indian Economy PDFRaveena JangidNo ratings yet

- Cross Border Merger & AcquisitionDocument23 pagesCross Border Merger & AcquisitionVarun TewariNo ratings yet

- Company Law ProjectDocument18 pagesCompany Law ProjectShafat GeelaniNo ratings yet

- Compromise, Arrangement and AmalgamationsDocument13 pagesCompromise, Arrangement and AmalgamationsUttaraVijayakumaranNo ratings yet

- Equity Carve OutDocument32 pagesEquity Carve OutmuditsingNo ratings yet

- Angel Investor-A Real Angel To Budding Entrepreneur: EP VenkateshDocument9 pagesAngel Investor-A Real Angel To Budding Entrepreneur: EP VenkateshVenkatesh EpNo ratings yet

- Universal - Health - Coverage - in - India - A Long Road AheadDocument8 pagesUniversal - Health - Coverage - in - India - A Long Road AheadrenjithNo ratings yet

- Types of NBFCDocument16 pagesTypes of NBFCathiraNo ratings yet

- DepositoryDocument29 pagesDepositoryChirag VaghelaNo ratings yet

- Special Contracts PDFDocument52 pagesSpecial Contracts PDFSakshi VermaNo ratings yet

- Refusal To Deal in The EUDocument32 pagesRefusal To Deal in The EUFrancis Njihia KaburuNo ratings yet

- Investigation into the Adherence to Corporate Governance in Zimbabwe’s SME SectorFrom EverandInvestigation into the Adherence to Corporate Governance in Zimbabwe’s SME SectorNo ratings yet

- 10851517471389221020181828432896Document1 page10851517471389221020181828432896Hari NamNo ratings yet

- Aileron Market Balance: Special Reference Issue: Money ManagementDocument10 pagesAileron Market Balance: Special Reference Issue: Money ManagementDan ShyNo ratings yet

- 1 BCDocument17 pages1 BCayeshaashrafNo ratings yet

- A Project Report ON "Indian Banking System"Document34 pagesA Project Report ON "Indian Banking System"Prasant SamantarayNo ratings yet

- Moot MemorialDocument28 pagesMoot MemorialsangitaNo ratings yet

- Introduction of The in Duplum Rule in KenyaDocument15 pagesIntroduction of The in Duplum Rule in KenyaMacduff RonnieNo ratings yet

- Oil and Gas Roundtable Members 29-5-15Document30 pagesOil and Gas Roundtable Members 29-5-15Quang Huy TrầnNo ratings yet

- PAN FormDocument3 pagesPAN FormStephen GreenNo ratings yet

- Business Cycle Fund ClosureDocument4 pagesBusiness Cycle Fund ClosureDhananjay ManeNo ratings yet

- Financial Publication MarchDocument2 pagesFinancial Publication MarchFuaad DodooNo ratings yet

- BFW3121 Tutorial Answers For Week 2 MoodleDocument2 pagesBFW3121 Tutorial Answers For Week 2 Moodlehi2joeyNo ratings yet

- E IBD100208Document24 pagesE IBD100208cphanhuyNo ratings yet

- NBFCs Sip 2020Document52 pagesNBFCs Sip 2020Prashant AgarkarNo ratings yet

- 2go Travel-Mendoza, DianneDocument8 pages2go Travel-Mendoza, DianneCarysNo ratings yet

- PMCourse Fall2022-2023 CH3Document35 pagesPMCourse Fall2022-2023 CH3شاكر احمدNo ratings yet

- 7401M002 Management AccountingDocument10 pages7401M002 Management AccountingMadhuram SharmaNo ratings yet

- Chapter 5 Basics of Analysis Multiple CHDocument7 pagesChapter 5 Basics of Analysis Multiple CHEslam AwadNo ratings yet

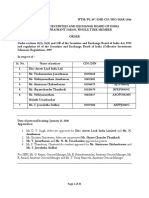

- Order in The Matter of Disc Assets Lead India LTDDocument25 pagesOrder in The Matter of Disc Assets Lead India LTDShyam SunderNo ratings yet

- Summary and Discussion - Chapter 3 - A Century of Stock-Market History: The Level of Stock Prices in Early 1972Document2 pagesSummary and Discussion - Chapter 3 - A Century of Stock-Market History: The Level of Stock Prices in Early 1972JLSavardNo ratings yet

- UntitledDocument6 pagesUntitledMuhammad AbdullahNo ratings yet