Professional Documents

Culture Documents

Investment Analysis Notes Previous Years Questions

Uploaded by

Jamal Hossain ShuvoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Investment Analysis Notes Previous Years Questions

Uploaded by

Jamal Hossain ShuvoCopyright:

Available Formats

Investment Analysis (short notes) Previous Years Questions

Investment: An investment is the current commitment of funds for a period of time in order to derive a future flow of funds that will compensate the investor for the time value of money, the expected rate of inflation over the life of the investment, and provide a premium for the uncertainty associated with this future flow of funds. Required rate of return: The required rate of return is the minimum rate of return (expressed as a percentage) that an investor requires before investing capital. Strong-form efficiency: Stronger formulation of the notion of market efficiency, which states that the price of a stock already takes all possible market information into account. Under strong form efficiency, insider trading cannot offer an advantage, as the information is already "priced-in" to the value of the stock. Portfolio Risk: In risk analysis, it is the risk that a particular combination of projects, assets, units or whatever is in the portfolio will fail to meet the overall objectives of the portfolio because of poor balance of risks within the portfolio. Right share: A security giving stockholders entitlement to purchase new shares issued by the corporation at a predetermined price (normally less than the current market price) in proportion to the number of shares already owned. Rights are issued only for a short period of time, after which they expire. Book Building: The process by which an underwriter attempts to determine at what price to offer an IPO based on demand from institutional investors. OTC: A security which is not traded on an organized stock exchange, usually due to an inability to meet listing requirements. OTC market: A decentralized market of securities not listed on an exchange where market participants trade over the telephone, facsimile or electronic network instead of a physical trading floor. There is no central exchange or meeting place for this market. Short sale: It is the sale of stock that an investor does not own with the intent of purchasing it back later at a lower price. A market transaction in which an investor sells borrowed securities in anticipation of a price decline and is required to return an equal number of shares at some point in the future. Random walk theory: An investment theory which claims that market prices follow a random path up and down, without any influence by past price movements, making it impossible to predict with any accuracy which direction the market will move at any point. Private placement: The sale of securities to a relatively small number of select investors as a way of raising capital. Investors involved in private placements are usually large banks, mutual funds, insurance companies and pension funds. It does not require SEC registration, provided the securities are bought for investment purposes rather than resale. Capital market line (CML): A line used in the capital asset pricing model to illustrate the rates of return for efficient portfolios depending on the risk-free rate of return and the level of risk (standard deviation) for a particular portfolio. Fundamental analysis: A method of security valuation which involves examining the company's financials and operations, especially sales, earnings, growth potential, assets, debt, management, products, and competition. Fundamental analysis takes into consideration only those variables that are directly related to the company itself, rather than the overall state of the market or technical analysis data.

Jamal Hossain Shuvo

www.Quickincometips.com

Investment Analysis (short notes) Previous Years Questions

Efficient Frontier: A set of optimal portfolios that offers the highest expected return for a defined level of risk or the lowest risk for a given level of expected return. Duration: A measure of the sensitivity of the price (the value of principal) of a fixed-income investment to a change in interest rates. Duration is expressed as a number of years. Rising interest rates mean falling bond prices, while declining interest rates mean rising bond prices. Jensen ratio: A risk-adjusted performance measure that represents the average return on a portfolio over and above that predicted by the capital asset pricing model (CAPM), given the portfolio's beta and the average market return. Continuous Market: A market with sufficient activity that a normal-sized trade can be made at any time without affecting the current market price. Earning Momentum: Pattern where a company experiences increasing earnings per share from period to period. Security market line (SML): A line that graphs the systematic, or market, risk versus return of the whole market at a certain time and shows all risky marketable securities. Margin: Difference between the amount of loan advanced by a stockbroker to a speculator and the current value of the securities deposited by him or her with the stockbroker as collateral. Company analysis: Research using the calculation of financial ratios and/or complex forecasting of profits, cash flows and dividends. Analysis gives a basis for the valuation of shares and decisions on when to buy sell and hold shares. Gordon Growth Model: A model for determining the intrinsic value of a stock, based on a future series of dividends that grow at a constant rate. Given a dividend per share that is payable in one year, and the assumption that the dividend grows at a constant rate in perpetuity, the model solves for the present value of the infinite series of future dividends. YTC (Yield to call) : Yield on a bond computed on the basis of assumption that its issuer will redeem it at the first call date stated in the bond's prospectus (indenture agreement). Markowitz mode: A model for selecting an optimum investment portfolio, devised by H. M. Markowitz. It uses a discrete-time, continuous-outcome approach for modeling investment problems, often called the mean-variance paradigm. See also efficient frontier. Single Index Model: A model of stock returns that decomposes influences on returns into a systematic factor, as measured by the return on a broad market index, and firm-specific factors. Capital allocation line (CAL): A line created in a graph of all possible combinations of risky and risk-free assets. Also known as the "reward-to-variability ratio".

Jamal Hossain Shuvo

www.Quickincometips.com

You might also like

- Securities Analysis & Portfolio Management GuideDocument52 pagesSecurities Analysis & Portfolio Management GuideruchisinghnovNo ratings yet

- Investments Essentials Chapter 1-5 SummaryDocument12 pagesInvestments Essentials Chapter 1-5 Summaryagrawal3436No ratings yet

- Securities Analysis and Portfolio ManagementDocument50 pagesSecurities Analysis and Portfolio ManagementrimonasharmaNo ratings yet

- Securities Analysis & Portfolio Management IntroDocument50 pagesSecurities Analysis & Portfolio Management IntrogirishNo ratings yet

- Securities Analysis & Portfolio Management For BSEC Investor EducationDocument37 pagesSecurities Analysis & Portfolio Management For BSEC Investor EducationHole StudioNo ratings yet

- Maricris G. Alagar BA-101 Finance IIDocument5 pagesMaricris G. Alagar BA-101 Finance IIMharykhriz AlagarNo ratings yet

- Unit 27 Glossary-Basics of Capital MarketDocument9 pagesUnit 27 Glossary-Basics of Capital MarketVipul AgrawalNo ratings yet

- Finance Concept (PGEXE)Document10 pagesFinance Concept (PGEXE)Abhiruchi DawraNo ratings yet

- Financial Terminology GuideDocument28 pagesFinancial Terminology GuideKunal DeshmukhNo ratings yet

- Banking TermsDocument6 pagesBanking TermsvenkateshrachaNo ratings yet

- Assumptions of CAPM: Rate of Return Asset Portfolio DiversifiableDocument10 pagesAssumptions of CAPM: Rate of Return Asset Portfolio Diversifiableখালেদ কায়ছার রনিNo ratings yet

- Financial Assets ValuationDocument9 pagesFinancial Assets ValuationGraceNo ratings yet

- Chapter 13 The Stock MarketDocument7 pagesChapter 13 The Stock Marketlasha KachkachishviliNo ratings yet

- Banking and Financial Terms ExplainedDocument5 pagesBanking and Financial Terms ExplainedPawan KumarNo ratings yet

- Accretion/Dilution Analysis EPS ImpactDocument27 pagesAccretion/Dilution Analysis EPS Impactrohitsahu1001No ratings yet

- Glossary of Terms: Accounts Payable (Payables)Document18 pagesGlossary of Terms: Accounts Payable (Payables)sameer patel07No ratings yet

- ADMINISTRACIÓN DE RIESGOS Y PRODUCTOS DERIVADOSDocument7 pagesADMINISTRACIÓN DE RIESGOS Y PRODUCTOS DERIVADOSVero MenaNo ratings yet

- Corporate Finance GlocarryDocument20 pagesCorporate Finance GlocarryNaren PandianNo ratings yet

- IAPM AnswersDocument3 pagesIAPM AnswersSukhchain patel PatelNo ratings yet

- NISM XB Invt Advisor 2 Short NotesDocument32 pagesNISM XB Invt Advisor 2 Short NotesAnchal100% (1)

- Bu283 Midterm 2 NotesDocument8 pagesBu283 Midterm 2 NotesSally MarshallNo ratings yet

- Guia Administracion de RiesgosDocument8 pagesGuia Administracion de RiesgosPaola GalvanNo ratings yet

- Glossary: A Type of Preferred Stock Where The Dividends Issued Will Vary With A Benchmark, Most Often A T-Bill RateDocument14 pagesGlossary: A Type of Preferred Stock Where The Dividends Issued Will Vary With A Benchmark, Most Often A T-Bill Ratepun33tNo ratings yet

- Finp5 Mid Term ReviewerDocument4 pagesFinp5 Mid Term ReviewerMae CalindongNo ratings yet

- 1.1) Introduction To The IndustryDocument51 pages1.1) Introduction To The IndustryneetliNo ratings yet

- What Does The DFL of 3 Times Imply?Document7 pagesWhat Does The DFL of 3 Times Imply?Sushil ShresthaNo ratings yet

- BBA5 Unit 3Document3 pagesBBA5 Unit 3gorang GehaniNo ratings yet

- Chapter - IntroductionDocument6 pagesChapter - IntroductionNahidul Islam IUNo ratings yet

- Three Main Financial Statements and Capital MarketsDocument12 pagesThree Main Financial Statements and Capital MarketsnishaNo ratings yet

- IapmDocument4 pagesIapmnandiniNo ratings yet

- Assignment of FinanceDocument6 pagesAssignment of Financejitendrapareek98No ratings yet

- Fundamentals of Valuation: Chapter TWO: Return ConceptsDocument13 pagesFundamentals of Valuation: Chapter TWO: Return ConceptsAhmed RedaNo ratings yet

- FinmanDocument30 pagesFinmanMike OcampoNo ratings yet

- Glossary of Financial TermsDocument17 pagesGlossary of Financial Termsandfg_05No ratings yet

- BNPParibasAceManager GlossaryDocument6 pagesBNPParibasAceManager GlossaryMaria CorinaNo ratings yet

- Efficient Market Hypothesis and Behavioral FinanceDocument25 pagesEfficient Market Hypothesis and Behavioral FinanceZarmeen QureshiNo ratings yet

- Financial RatioDocument13 pagesFinancial RatioMahnoor ChathaNo ratings yet

- Finance ManagementDocument17 pagesFinance ManagementJackieNo ratings yet

- Mutual Fund: A Glossary of TermsDocument16 pagesMutual Fund: A Glossary of TermsIqbal BabaNo ratings yet

- Security Analysis Bba-Iv (Elective Finance)Document21 pagesSecurity Analysis Bba-Iv (Elective Finance)Bahawal Khan JamaliNo ratings yet

- Corp Finance TheoryDocument19 pagesCorp Finance Theoryinspiredbysims4No ratings yet

- Capital Market NotesDocument8 pagesCapital Market NotesEshanMishraNo ratings yet

- Accrued Interest: ArbitrageDocument9 pagesAccrued Interest: ArbitragetarunNo ratings yet

- Security Analysis & Portfolio ManagementDocument18 pagesSecurity Analysis & Portfolio ManagementPriya ShindeNo ratings yet

- Glossary Investment TermsDocument15 pagesGlossary Investment TermsBehroozRaadNo ratings yet

- Updated Glossary of Financial TermsDocument7 pagesUpdated Glossary of Financial TermsAnonymous 1YxTHyNo ratings yet

- Finance Terminologies: 1. Abnormal ReturnDocument29 pagesFinance Terminologies: 1. Abnormal ReturnruhiNo ratings yet

- Unit 1: Understanding Equity: Public Equity Vs Private EquityDocument10 pagesUnit 1: Understanding Equity: Public Equity Vs Private EquityPulkit AggarwalNo ratings yet

- Capital Market Concepts ExplainedDocument8 pagesCapital Market Concepts ExplainedShubham NathNo ratings yet

- Chapter 1 Investment EnviromentDocument33 pagesChapter 1 Investment EnviromentN ENo ratings yet

- Investment ProcessssssssssDocument10 pagesInvestment ProcessssssssssuckabcedefNo ratings yet

- Introduction To Financial Markets and InstitutionsDocument12 pagesIntroduction To Financial Markets and Institutionssusheel kumarNo ratings yet

- Investment Analysis Part 1: Risk, Return, MarketsDocument15 pagesInvestment Analysis Part 1: Risk, Return, Marketswdqkj.nsd,ndsNo ratings yet

- 5-Step Investing Formula Online Course Manual: Section 11 of 11Document28 pages5-Step Investing Formula Online Course Manual: Section 11 of 11SIVA KRISHNA PRASAD ARJANo ratings yet

- Trading Mechanism, Portfolio Theory and Fundamental AnalysisDocument75 pagesTrading Mechanism, Portfolio Theory and Fundamental Analysiseuge_prime2001No ratings yet

- Concept of Securities: MBAF - 104 What Are Securities? Write Any Two Fetures of SecuritiesDocument3 pagesConcept of Securities: MBAF - 104 What Are Securities? Write Any Two Fetures of SecuritiesUsman SayyedNo ratings yet

- Operating Systems MCQ BankDocument21 pagesOperating Systems MCQ BankJamal Hossain Shuvo100% (1)

- Powerpoint MCQ Bank PDFDocument21 pagesPowerpoint MCQ Bank PDFquickincometips0% (1)

- Internship Report - CRM (Credit Risk Management) Practice of BASIC Bank Limited, BangladeshDocument67 pagesInternship Report - CRM (Credit Risk Management) Practice of BASIC Bank Limited, BangladeshJamal Hossain Shuvo100% (2)

- Bbbaa VivaDocument4 pagesBbbaa VivaJamal Hossain ShuvoNo ratings yet

- Comparative Short NotesDocument1 pageComparative Short NotesJamal Hossain ShuvoNo ratings yet

- Management Foundations Assessment 2 Business Report 2013Document7 pagesManagement Foundations Assessment 2 Business Report 2013Jamal Hossain ShuvoNo ratings yet

- Bear Call Spread Strategy ExplainedDocument2 pagesBear Call Spread Strategy ExplainedJamal Hossain ShuvoNo ratings yet

- Powerpoint MCQ Bank PDFDocument21 pagesPowerpoint MCQ Bank PDFquickincometips0% (1)

- JSC composition suggestionsDocument3 pagesJSC composition suggestionsJamal Hossain ShuvoNo ratings yet

- Main Body Part - CRGDocument24 pagesMain Body Part - CRGJamal Hossain ShuvoNo ratings yet

- Arif's CVDocument3 pagesArif's CVJamal Hossain ShuvoNo ratings yet

- CRM Slide Jamal50duDocument18 pagesCRM Slide Jamal50duJamal Hossain ShuvoNo ratings yet

- 1 Managing-ProjectsDocument9 pages1 Managing-ProjectsJamal Hossain ShuvoNo ratings yet

- Interpersonal CommunicationDocument2 pagesInterpersonal CommunicationJamal Hossain ShuvoNo ratings yet

- Ethics Case Study ADocument2 pagesEthics Case Study AJamal Hossain ShuvoNo ratings yet

- Essay Mid-Semester Exam - 6 August 2013Document2 pagesEssay Mid-Semester Exam - 6 August 2013Jamal Hossain ShuvoNo ratings yet

- Shantii Marketing AssignmentDocument4 pagesShantii Marketing AssignmentJamal Hossain ShuvoNo ratings yet

- Ent MGT Assignment 1 Detailed GuidelineDocument2 pagesEnt MGT Assignment 1 Detailed GuidelineJamal Hossain ShuvoNo ratings yet

- Assessment 2 International Marketing StrategyDocument4 pagesAssessment 2 International Marketing StrategyJamal Hossain ShuvoNo ratings yet

- Assessment 1 International Marketing StrategyDocument2 pagesAssessment 1 International Marketing StrategyJamal Hossain ShuvoNo ratings yet

- AuditDocument3 pagesAuditJamal Hossain ShuvoNo ratings yet

- Statistics Term Paper FINALDocument60 pagesStatistics Term Paper FINALJamal Hossain ShuvoNo ratings yet

- Islamic BankingDocument1 pageIslamic BankingJamal Hossain ShuvoNo ratings yet

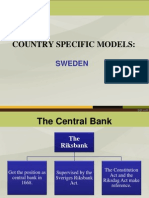

- SWEDEN'S CENTRAL BANK AND PARLIAMENTARY OVERSIGHTDocument8 pagesSWEDEN'S CENTRAL BANK AND PARLIAMENTARY OVERSIGHTJamal Hossain ShuvoNo ratings yet

- AuditDocument3 pagesAuditJamal Hossain ShuvoNo ratings yet

- CV of Jamal HossainDocument2 pagesCV of Jamal HossainJamal Hossain ShuvoNo ratings yet

- Audit FinalDocument4 pagesAudit FinalJamal Hossain ShuvoNo ratings yet

- HRMDocument5 pagesHRMJamal Hossain ShuvoNo ratings yet

- Investment BankingDocument3 pagesInvestment BankingJamal Hossain ShuvoNo ratings yet

- Step10 PlagiarismDocument15 pagesStep10 PlagiarismJamal Hossain Shuvo100% (1)

- Level 10 Halfling For DCCDocument1 pageLevel 10 Halfling For DCCQunariNo ratings yet

- EIRA v0.8.1 Beta OverviewDocument33 pagesEIRA v0.8.1 Beta OverviewAlexQuiñonesNietoNo ratings yet

- An Introduction To Ecology and The BiosphereDocument54 pagesAn Introduction To Ecology and The BiosphereAndrei VerdeanuNo ratings yet

- Induction ClassesDocument20 pagesInduction ClassesMichelle MarconiNo ratings yet

- Guidelines - MIDA (Haulage)Document3 pagesGuidelines - MIDA (Haulage)Yasushi Charles TeoNo ratings yet

- Evaluative Research DesignDocument17 pagesEvaluative Research DesignMary Grace BroquezaNo ratings yet

- Paper SizeDocument22 pagesPaper SizeAlfred Jimmy UchaNo ratings yet

- Evil Days of Luckless JohnDocument5 pagesEvil Days of Luckless JohnadikressNo ratings yet

- United States Bankruptcy Court Southern District of New YorkDocument21 pagesUnited States Bankruptcy Court Southern District of New YorkChapter 11 DocketsNo ratings yet

- Process Financial Transactions and Extract Interim Reports - 025735Document37 pagesProcess Financial Transactions and Extract Interim Reports - 025735l2557206No ratings yet

- Excel Solver Optimization ReportDocument9 pagesExcel Solver Optimization ReportMy Duyen NguyenNo ratings yet

- Arta Kelmendi's resume highlighting education and work experienceDocument2 pagesArta Kelmendi's resume highlighting education and work experienceArta KelmendiNo ratings yet

- Tutorial 1 Discussion Document - Batch 03Document4 pagesTutorial 1 Discussion Document - Batch 03Anindya CostaNo ratings yet

- What Is A Problem?: Method + Answer SolutionDocument17 pagesWhat Is A Problem?: Method + Answer SolutionShailaMae VillegasNo ratings yet

- Indian Standard: Pla Ing and Design of Drainage IN Irrigation Projects - GuidelinesDocument7 pagesIndian Standard: Pla Ing and Design of Drainage IN Irrigation Projects - GuidelinesGolak PattanaikNo ratings yet

- Ailunce HD1 Software ManualDocument33 pagesAilunce HD1 Software ManualMarc LaBarberaNo ratings yet

- Annual Plan 1st GradeDocument3 pagesAnnual Plan 1st GradeNataliaMarinucciNo ratings yet

- Use Visual Control So No Problems Are Hidden.: TPS Principle - 7Document8 pagesUse Visual Control So No Problems Are Hidden.: TPS Principle - 7Oscar PinillosNo ratings yet

- Money Laundering in Online Trading RegulationDocument8 pagesMoney Laundering in Online Trading RegulationSiti Rabiah MagfirohNo ratings yet

- Maxx 1657181198Document4 pagesMaxx 1657181198Super UserNo ratings yet

- Aries Computer Repair SolutionsDocument9 pagesAries Computer Repair SolutionsedalzurcNo ratings yet

- Oxygen Cost and Energy Expenditure of RunningDocument7 pagesOxygen Cost and Energy Expenditure of Runningnb22714No ratings yet

- Seminar Course Report ON Food SafetyDocument25 pagesSeminar Course Report ON Food SafetyYanNo ratings yet

- Beauty ProductDocument12 pagesBeauty ProductSrishti SoniNo ratings yet

- Dermatology Study Guide 2023-IvDocument7 pagesDermatology Study Guide 2023-IvUnknown ManNo ratings yet

- Equilibruim of Forces and How Three Forces Meet at A PointDocument32 pagesEquilibruim of Forces and How Three Forces Meet at A PointSherif Yehia Al MaraghyNo ratings yet

- GS16 Gas Valve: With On-Board DriverDocument4 pagesGS16 Gas Valve: With On-Board DriverProcurement PardisanNo ratings yet

- HSSC English Model PaperDocument32 pagesHSSC English Model PaperMaryam Abdus SalamNo ratings yet