Professional Documents

Culture Documents

HUL MQ 12 Results Statement - tcm114-286728

Uploaded by

Karunakaran JambunathanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

HUL MQ 12 Results Statement - tcm114-286728

Uploaded by

Karunakaran JambunathanCopyright:

Available Formats

-

(0)

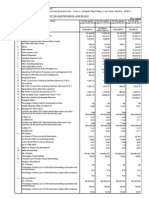

HINDUSTAN UNILEVER LIMITED

AUDITED FINANCIAL RESULTS FOR THE YEAR ENDED 31st MARCH, 2012

STANDALONE

Unaudited Results for the

Quarter ended

31st March

2012

2011

Unaudited Results for the

Quarter ended

31st December

2011

566,048

448,024

101,436

549,460

16,588

10,542

576,590

498,958

207,955

76,621

27,649

27,513

5,707

67,733

85,780

77,632

6,996

84,628

20

84,608

2,808

87,416

(18,755)

68,661

68,661

68,661

489,367

362,391

94,148

456,539

32,828

7,473

496,840

438,183

211,108

74,829

(19,517)

23,460

5,563

62,328

80,412

58,657

6,031

64,688

2

64,686

8,360

73,046

(16,128)

56,918

56,918

56,918

21,615

21,595

584,431

447,061

96,401

543,462

40,969

11,179

595,610

504,243

234,603

76,128

(2,738)

27,412

5,682

69,018

94,138

91,367

8,008

99,375

45

99,330

(1,238)

98,092

(22,711)

75,381

75,381

75,381

Particulars

1.a. Net Sales from Operations(Net of excise duty) [sum of (i) to (iii)]

i) Domestic FMCG - HPC

ii) Domestic FMCG - Foods

Domestic FMCG - Total (i+ii)

iii) Others

1.b. Other Operating Income

1. Total Income from operations (net) [1.a. + 1.b.]

2. Expenses [sum of (a) to (g)]

a) Cost of materials consumed

b) Purchases of stock-in-trade

c) Changes in inventories of finished goods, work-in-progress and stock-in-trade

d) Employee benefits expense

e) Depreciation and amortisation expense

f) Advertising & Promotions

g) Other expenses

3. Profit from operations before other income, finance costs and exceptional items (1-2)

4. Other Income

5. Profit from ordinary activities before finance costs and exceptional items (3+4)

6. Finance costs

7. Profit from ordinary activities after finance costs but before exceptional items (5-6)

8. Exceptional Items - credit/(charge)

9. Profit from ordinary activities before tax (7+8)

10. Tax expense

11. Net Profit from ordinary activities After Tax [9+10]

12. Extraordinary Items

13. Net Profit for the period (11+12)

14. Share of profit of associates

15. Minority Interest

16. Net Profit after taxes, minority interest and share of profit of associates (13+14+15)

21,610 17. Paid up Equity Share Capital (face value Re. 1 per share)

18. Reserves excluding Revaluation Reserve as per balance sheet of previous accounting year

2,173,560

1,723,533

391,897

2,115,430

58,130

38,077

2,211,637

1,904,328

858,489

302,414

12,873

110,728

21,825

263,478

334,521

307,309

27,831

335,140

124

335,016

11,887

346,903

(77,763)

269,140

269,140

269,140

0

21,615

1,938,101

1,443,457

347,151

1,790,608

147,493

35,450

1,973,551

1,727,795

755,049

281,813

(29,053)

96,126

22,083

276,423

325,354

245,756

27,288

273,044

24

273,020

20,683

293,703

(63,104)

230,599

230,599

230,599

2,298,773

1,721,283

391,897

2,113,180

185,593

44,860

2,343,633

2,018,631

948,701

291,949

9,515

120,094

23,354

269,696

355,322

325,002

25,962

350,964

165

350,799

11,369

362,168

(82,154)

280,014

1,964,769

1,441,780

347,151

1,788,931

175,838

37,486

2,002,255

1,754,063

779,687

269,275

(30,760)

101,486

22,929

279,705

331,741

248,192

25,518

273,710

101

273,609

22,082

295,691

(65,028)

230,663

21,595

280,014

(948)

279,066

0

21,615

230,663

(1,058)

229,605

(0)

21,595

329,611

244,290

346,426

251,833

3.18

3.18

2.61

2.61

19.i Earnings Per Share (EPS) before extraordinary items (of Re. 1/- each) (not annualsed):

3.49 (a) Basic - Rs.

3.49 (b) Diluted - Rs.

12.46

12.45

10.58

10.56

12.92

12.91

10.53

10.52

3.18

3.18

2.61

2.61

19.ii Earnings Per Share (EPS) after extraordinary items (of Re. 1/- each) (not annualsed):

3.49 (a) Basic - Rs.

3.49 (b) Diluted - Rs.

12.46

12.45

10.58

10.56

12.92

12.91

10.53

10.52

1,026,663,032

47.50%

Nil

NA

NA

1,134,849,460

100.00%

52.50%

1,024,622,508

47.45%

Nil

NA

NA

1,134,849,460

100.00%

52.55%

A. PARTICULARS OF SHAREHOLDING

1. Public Shareholding

1,026,195,165 - Number of Shares

47.49% - Percentage of Shareholding

2. Promoters and Promoter Group Shareholding

a) Pledged/Encumbered

Nil

- Number of shares

NA

- Percentage of shares (as a % of the total shareholding of promoter and promoter group)

NA

- Percentage of shares (as a % of the total share capital of the company)

b) Non-Encumbered

1,134,849,460 - Number of shares

100.00% - Percentage of shares (as a % of the total shareholding of promoter and promoter group)

52.51% - Percentage of shares (as a % of the total share capital of the company)

B. INVESTOR COMPLAINTS

Pending at the beginning of the quarter

Received during the quarter

Disposed of during the quarter

Remaining unresolved at the end of the quarter

(Rs. in lakhs)

CONSOLIDATED

Audited Results for the

Year ended

31st March

2012

2011

STANDALONE

Audited Results for the

Year ended

31st March

2012

2011

1,026,663,032

47.50%

1,024,622,508

47.45%

1,026,663,032

47.50%

1,024,622,508

47.45%

Nil

NA

NA

Nil

NA

NA

Nil

NA

NA

Nil

NA

NA

1,134,849,460

100.00%

52.50%

1,134,849,460

100.00%

52.55%

1,134,849,460

100.00%

52.50%

1,134,849,460

100.00%

52.55%

Quarter ended 31st March 2012

NIL

18

18

NIL

.

SEGMENT WISE REVENUE, RESULTS AND CAPITAL EMPLOYED, UNDER CLAUSE 41 OF THE LISTING AGREEMENT

STANDALONE

Unaudited Results for the

Quarter ended

31st March

2012

2011

283,438

171,094

68,317

34,805

18,230

575,884

575,884

220,750

146,085

63,470

31,737

34,138

496,180

496,180

32,008

44,919

9,838

(371)

(489)

85,905

(20)

1,531

87,416

0

16,504

36,519

9,928

465

1,519

64,935

(2)

8,113

73,046

0

(4,078)

2,545

29,993

21,487

(7,507)

42,440

308,853

351,293

(36,558)

15,068

34,624

13,345

16,964

43,443

222,509

265,952

Unaudited Results for

the Quarter ended

31st December

2011

264,813

188,772

67,093

30,666

43,606

594,950

594,950

Particulars

Segment Revenue (Sales and Other operating income)

- Soaps and Detergents

- Personal Products

- Beverages

- Packaged Foods

- Others (includes Exports, Chemicals, Water, etc)

Total Segment Revenue

Less: Inter Segment Revenue

Net Segment Revenue

Segment Results (Profit before tax and interest from ordinary activities)

35,589 - Soaps and Detergents

48,812 - Personal Products

10,518 - Beverages

(597) - Packaged Foods

3,435 - Others (includes Exports, Chemicals, Water, etc)

97,757 Total Segment Results

(45) Less: Finance costs

380 Add/(Less): Other unallocable income net of unallocable expenditure

98,092 Total Profit Before Tax from ordinary activities

Capital Employed (Segment assets less Segment liabilities)

(48,307) - Soaps and Detergents

6,098 - Personal Products

22,824 - Beverages

18,500 - Packaged Foods

9,606 - Others (includes Exports, Chemicals, Water, etc)

8,721 Total Capital Employed in segments

376,562 Add: Unallocable corporate assets less corporate liabilities

385,283 Total Capital Employed in company

Registered Office : Unilever House, B. D. Sawant Marg, Chakala, Andheri (E), Mumbai 400 099

(Rs. in lakhs)

CONSOLIDATED

Audited Results for the

Year ended

31st March

2012

2011

STANDALONE

Audited Results for the

Year ended

31st March

2012

2011

1,063,628

684,586

261,743

135,946

63,636

2,209,539

2,209,539

880,106

585,039

234,650

117,843

153,931

1,971,569

1,971,569

1,063,628

700,876

261,743

135,947

180,135

2,342,329

880,118

585,727

234,650

117,842

182,205

2,000,542

2,342,329

2,000,542

123,327

174,460

36,668

2,417

(2,492)

334,380

(124)

12,647

346,903

(0)

82,077

149,480

35,776

2,987

1,143

271,463

(24)

22,264

293,703

0

123,326

174,294

36,668

2,417

15,310

352,015

(165)

10,318

362,168

(0)

82,077

146,956

35,776

2,987

5,683

273,479

(101)

22,313

295,691

(0)

(4,078)

2,545

29,993

21,487

(7,507)

42,440

308,853

351,293

(0.00)

(36,558)

15,068

34,624

13,345

16,964

43,443

222,509

265,952

(0)

(4,078)

9,978

29,993

21,488

(1,874)

55,507

314,431

369,938

(36,558)

12,350

34,623

13,345

20,045

43,805

231,148

274,953

HINDUSTAN UNILEVER LIMITED

AUDITED FINANCIAL RESULTS FOR THE YEAR ENDED 31st MARCH, 2012

(Rs. in lakhs)

Statement of Assets and Liabilities

Particulars

Consolidated

Audited Results for the

Year ended 31st March

2012

2011

EQUITY AND LIABILITIES

1 Shareholders funds

(a) Share capital

(b) Reserves and surplus

(c) Money received against share warrants

Sub-total - Shareholders' funds

21,615

329,678

351,293

21,595

244,357

265,952

21,615

346,493

368,108

21,595

251,900

273,495

2 Share application money pending allotment

3 Minority interest *

1,830

1,458

32,969

66,695

99,664

21,920

66,387

88,307

33,167

67,430

100,597

21,923

67,366

89,289

462,296

54,677

127,897

644,870

500,905

55,459

105,643

662,007

484,387

56,436

129,367

670,190

507,902

56,656

105,982

670,540

1,095,827

1,016,266

1,140,725

1,034,782

1 Non-current assets

(a) Fixed assets

(b) Goodwill on consolidation *

(c) Non-current investments

(d) Deferred tax assets (net)

(e) Long-term loans and advances

(f) Other non-current assets

Sub-total - Non-current assets

236,292

18,631

21,424

39,618

315,965

245,786

12,058

20,966

40,031

318,841

249,050

7,025

20,991

38,082

315,148

251,264

4,841

20,737

40,427

317,269

2 Current assets

(a) Current investments

(b) Inventories

(c) Trade receivables

(d) Cash and cash equivalents

(e) Short-term loans and advances

(f) Other current assets

Sub-total - Current assets

225,190

251,665

67,899

183,004

48,579

3,525

779,862

114,009

281,077

94,321

162,847

41,635

3,536

697,425

225,191

266,737

85,674

199,643

44,611

3,721

825,577

114,009

287,569

96,329

177,568

38,262

3,776

717,513

1,095,827

1,016,266

1,140,725

1,034,782

4 Non-current liabilities

(a) Long-term borrowings

(b) Deferred tax liabilities (net)

(c) Other long-term liabilities

(d) Long-term provisions

Sub-total - Non-current liabilities

5 Current liabilities

(a) Short-term borrowings

(b) Trade payables

(c) Other current liabilities

(d) Short-term provisions

Sub-total - Current liabilities

TOTAL - EQUITY AND LIABILITIES

B

Standalone

Audited Results for the

Year ended 31st March

2012

2011

ASSETS

TOTAL - ASSETS

You might also like

- MSSL Results Quarter Ended 31st December 2011Document4 pagesMSSL Results Quarter Ended 31st December 2011kpatil.kp3750No ratings yet

- 2009-10 Annual ResultsDocument1 page2009-10 Annual ResultsAshish KadianNo ratings yet

- Avt Naturals (Qtly 2011 06 30) PDFDocument1 pageAvt Naturals (Qtly 2011 06 30) PDFKarl_23No ratings yet

- Q1FY2013Document1 pageQ1FY2013Suresh KumarNo ratings yet

- HCL Technologies LTD 170112Document3 pagesHCL Technologies LTD 170112Raji_r30No ratings yet

- Sony Corporation Financial StatementDocument4 pagesSony Corporation Financial StatementSaleh RehmanNo ratings yet

- Consolidated AFR 31mar2011Document1 pageConsolidated AFR 31mar20115vipulsNo ratings yet

- PDF Processed With Cutepdf Evaluation EditionDocument2 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderNo ratings yet

- Summit Bank Annual Report 2012Document200 pagesSummit Bank Annual Report 2012AAqsam0% (1)

- Financial Results For The Quarter Ended 30 June 2012Document2 pagesFinancial Results For The Quarter Ended 30 June 2012Jkjiwani AccaNo ratings yet

- Corporate Centre, Mumbai - 400 021: State Bank of IndiaDocument1 pageCorporate Centre, Mumbai - 400 021: State Bank of IndiajoshijaysoftNo ratings yet

- Income Statement: Assets Non-Current AssetsDocument213 pagesIncome Statement: Assets Non-Current AssetsAhmed_Raza_ShahNo ratings yet

- MSSL Unaudited Financial Results For The Quarter Nine Months Ended 31dec 2012Document4 pagesMSSL Unaudited Financial Results For The Quarter Nine Months Ended 31dec 2012kpatil.kp3750No ratings yet

- Letter To Shareholders and Financial Results September 2012Document5 pagesLetter To Shareholders and Financial Results September 2012SwamiNo ratings yet

- 2013-5-14 FirstResources 1Q2013 Financial AnnouncementDocument17 pages2013-5-14 FirstResources 1Q2013 Financial AnnouncementphuawlNo ratings yet

- Avt Naturals (Qtly 2011 12 31) PDFDocument1 pageAvt Naturals (Qtly 2011 12 31) PDFKarl_23No ratings yet

- Sandisk Corporation Financial StatementDocument4 pagesSandisk Corporation Financial StatementSaleh RehmanNo ratings yet

- ASX Appendix 4E Results For Announcement To The Market: Ilh Group LimitedDocument14 pagesASX Appendix 4E Results For Announcement To The Market: Ilh Group LimitedASX:ILH (ILH Group)No ratings yet

- Consolidated Accounts June-2011Document17 pagesConsolidated Accounts June-2011Syed Aoun MuhammadNo ratings yet

- Consolidated Balance Sheet: As at 31st December, 2011Document21 pagesConsolidated Balance Sheet: As at 31st December, 2011salehin1969No ratings yet

- Financial Modelling Assignment - Ghizal Naqvi (Attock Petroleum Limited)Document13 pagesFinancial Modelling Assignment - Ghizal Naqvi (Attock Petroleum Limited)Ghizal NaqviNo ratings yet

- 494.Hk 2011 AnnReportDocument29 pages494.Hk 2011 AnnReportHenry KwongNo ratings yet

- Financial - CocaColaDocument45 pagesFinancial - CocaColadung nguyenNo ratings yet

- Puma Energy Results Report q3 2016 v3Document8 pagesPuma Energy Results Report q3 2016 v3KA-11 Єфіменко ІванNo ratings yet

- Quarterly Acc 3rd 2011 12Document10 pagesQuarterly Acc 3rd 2011 12Asif Al AminNo ratings yet

- Balance Sheet: Titan Industries LimitedDocument4 pagesBalance Sheet: Titan Industries LimitedShalini ShreyaNo ratings yet

- HDFC Consolidate Q3Document5 pagesHDFC Consolidate Q3Satish MehtaNo ratings yet

- ICI Pakistan Limited Condensed Interim Unconsolidated Balance Sheet (Unaudited) As at March 31, 2011Document9 pagesICI Pakistan Limited Condensed Interim Unconsolidated Balance Sheet (Unaudited) As at March 31, 2011Sehrish HumayunNo ratings yet

- JUL'Sep'12 Jul-Sep'11 Rupees RupeesDocument8 pagesJUL'Sep'12 Jul-Sep'11 Rupees RupeesMansoor AliNo ratings yet

- DQ'12 ResultsDocument4 pagesDQ'12 ResultsAdib RahmanNo ratings yet

- Re Ratio AnalysisDocument31 pagesRe Ratio AnalysisManish SharmaNo ratings yet

- Consolidated Financial StatementsDocument78 pagesConsolidated Financial StatementsAbid HussainNo ratings yet

- Assignments Semester IDocument13 pagesAssignments Semester Idriger43No ratings yet

- Avt Naturals (Qtly 2011 09 30) PDFDocument1 pageAvt Naturals (Qtly 2011 09 30) PDFKarl_23No ratings yet

- Avt Naturals (Qtly 2012 12 31)Document1 pageAvt Naturals (Qtly 2012 12 31)Karl_23No ratings yet

- GodrejDocument21 pagesGodrejVishal V. ShahNo ratings yet

- Din Textile MillsDocument41 pagesDin Textile MillsZainab Abizer MerchantNo ratings yet

- Nations Trust Bank PLC and Its Subsidiaries: Company Number PQ 118Document19 pagesNations Trust Bank PLC and Its Subsidiaries: Company Number PQ 118haffaNo ratings yet

- Selected Financial Summary (U.S. GAAP) : For The YearDocument82 pagesSelected Financial Summary (U.S. GAAP) : For The YearshanzarapunzleNo ratings yet

- Tata Annual Report 2012Document6 pagesTata Annual Report 2012Vaibhav BindrooNo ratings yet

- Key RatiosDocument2 pagesKey RatiosKhalid MahmoodNo ratings yet

- SMRT Corporation LTD: Unaudited Financial Statements For The Second Quarter and Half-Year Ended 30 September 2011Document18 pagesSMRT Corporation LTD: Unaudited Financial Statements For The Second Quarter and Half-Year Ended 30 September 2011nicholasyeoNo ratings yet

- Annual Report OfRPG Life ScienceDocument8 pagesAnnual Report OfRPG Life ScienceRajesh KumarNo ratings yet

- Kohinoor Chemical Company LTD.: Horizontal AnalysisDocument19 pagesKohinoor Chemical Company LTD.: Horizontal AnalysisShehreen ArnaNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document2 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document8 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Annual Performance 2012Document3 pagesAnnual Performance 2012Anil ChandaliaNo ratings yet

- Six Years at A Glance: Chairman's Review Financial Analysis Financial Statements Annual General Meeting GovernanceDocument5 pagesSix Years at A Glance: Chairman's Review Financial Analysis Financial Statements Annual General Meeting GovernanceraviaxgNo ratings yet

- Standalone Consolidated Audited Financial Results For The Year Ended March 31, 2011Document1 pageStandalone Consolidated Audited Financial Results For The Year Ended March 31, 2011Santosh VaishyaNo ratings yet

- Accounting Presentation (Beximco Pharma)Document18 pagesAccounting Presentation (Beximco Pharma)asifonikNo ratings yet

- Accounts AssignmentDocument7 pagesAccounts AssignmentHari PrasaadhNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- AuditedStandaloneFinancialresults 31stmarch, 201111121123230510Document2 pagesAuditedStandaloneFinancialresults 31stmarch, 201111121123230510Kruti PawarNo ratings yet

- CH 12 Case StudyDocument15 pagesCH 12 Case StudyMahmoud Yassen El GhannamNo ratings yet

- Bajaj Electrical Q1 FY2012Document4 pagesBajaj Electrical Q1 FY2012Tushar DasNo ratings yet

- CVM Minerals - Announcement of Final Results For The Financial Year Ended 31 December 2012 PDFDocument59 pagesCVM Minerals - Announcement of Final Results For The Financial Year Ended 31 December 2012 PDFalan888No ratings yet

- Notes SAR'000 (Unaudited) 14,482,456 6,998,836 34,094,654 115,286,635 399,756 411,761 1,749,778 3,671,357Document10 pagesNotes SAR'000 (Unaudited) 14,482,456 6,998,836 34,094,654 115,286,635 399,756 411,761 1,749,778 3,671,357Arafath CholasseryNo ratings yet

- TCS Ifrs Q3 13 Usd PDFDocument23 pagesTCS Ifrs Q3 13 Usd PDFSubhasish GoswamiNo ratings yet

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosFrom EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosNo ratings yet

- Marginal Costing: Definition: (CIMA London)Document4 pagesMarginal Costing: Definition: (CIMA London)Pankaj2cNo ratings yet

- Term Sheet-36Inc-30042018-v2Document3 pagesTerm Sheet-36Inc-30042018-v2harshdeep gumberNo ratings yet

- Radiant Semiconductor: Project Management Development Program - PMDPDocument74 pagesRadiant Semiconductor: Project Management Development Program - PMDPsravanNo ratings yet

- 19-09 Software Solutions NFLDocument13 pages19-09 Software Solutions NFLprasanthNo ratings yet

- Peloton Case Study Assignment InstructionsDocument5 pagesPeloton Case Study Assignment Instructionsdineshupadhyay213No ratings yet

- Business Studies GR 10 Paper 1Document7 pagesBusiness Studies GR 10 Paper 1KaraboNo ratings yet

- Kasus ABA 6 - Sarah Russell, Staff AccountantDocument3 pagesKasus ABA 6 - Sarah Russell, Staff AccountanttabithaNo ratings yet

- SAMPLE Partnership DeedDocument8 pagesSAMPLE Partnership DeedBIG BULLNo ratings yet

- Britannia - Sustainability - Report 21 - v4.6Document39 pagesBritannia - Sustainability - Report 21 - v4.6yashneet kaurNo ratings yet

- Supply Chain ManagementDocument110 pagesSupply Chain ManagementKeerthana LikhithaNo ratings yet

- DSN 97Document28 pagesDSN 97Frantz DenisNo ratings yet

- Atty. C. Llamado: Introduction To Income TaxDocument29 pagesAtty. C. Llamado: Introduction To Income TaxMyrrielNo ratings yet

- IMC Plan of Interwood Mobel PVT LTDDocument15 pagesIMC Plan of Interwood Mobel PVT LTDUnEeb WaSeemNo ratings yet

- Problems: Problem I: True or FalseDocument75 pagesProblems: Problem I: True or FalseRosemarie Cruz100% (1)

- Mahindra Earthmaster - An IntroductionDocument24 pagesMahindra Earthmaster - An IntroductionDhimate BhaaratNo ratings yet

- Data Analysis PortfolioDocument20 pagesData Analysis PortfoliokalakanishkNo ratings yet

- Elsewedy Electric Cables International Business and Global Strategy Final VersionDocument73 pagesElsewedy Electric Cables International Business and Global Strategy Final VersionMohamed RaheemNo ratings yet

- Money and Banking PPT QuestionsDocument41 pagesMoney and Banking PPT Questionszainab130831No ratings yet

- Enterprise Resource Planning: MPC 6 Edition Chapter 1aDocument25 pagesEnterprise Resource Planning: MPC 6 Edition Chapter 1aKhaled ToffahaNo ratings yet

- PCM Book - Part IDocument72 pagesPCM Book - Part Ithilina madhushanNo ratings yet

- Next Generation Internal AuditDocument22 pagesNext Generation Internal AuditWajahat Ali100% (2)

- Phases of Marketing FunnelDocument6 pagesPhases of Marketing Funneltanzeel khanNo ratings yet

- Annual Report 2014-2015 of Jamuna Oil Company Limited PDFDocument100 pagesAnnual Report 2014-2015 of Jamuna Oil Company Limited PDFfahimNo ratings yet

- Finals - Business Acctg-To PrintDocument3 pagesFinals - Business Acctg-To PrintSHENo ratings yet

- Business Law 1Document18 pagesBusiness Law 1Sədaqət AbdullayevaNo ratings yet

- Regional Sales Manager Operations Director in New Orleans LA Resume Marc GonickDocument2 pagesRegional Sales Manager Operations Director in New Orleans LA Resume Marc GonickMarcGonickNo ratings yet

- EconomicsDocument37 pagesEconomicsegy1971No ratings yet

- Dissertation of Records ManagementDocument7 pagesDissertation of Records ManagementCanSomeoneWriteMyPaperCanada100% (1)

- Meaning and Reasons For International TradeDocument6 pagesMeaning and Reasons For International TradeMOHAMMED DEMMUNo ratings yet

- 1 EntrepDocument16 pages1 EntrepTanya Jane PeñarandaNo ratings yet