Professional Documents

Culture Documents

R.V. Nerurkar High School - Form 16 1

Uploaded by

rvnjcOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

R.V. Nerurkar High School - Form 16 1

Uploaded by

rvnjcCopyright:

Available Formats

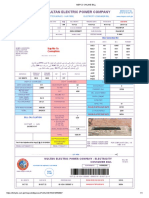

Certificate No.

: RVNHS/11-12/MAP/001

FORM No. 16 [See rule 31(1)(a)] PART A

Certificate under section 203 of the Income-tax Act, 1961for Tax deducted at source on Salary

Name and address of the Employer Name and Designation of the Employee R. V. NERURKAR HIGH SCHOOL PATIL MADHUKAR AKARAM R.V. Nerurkar High School,Dombivli Pandurang Wadi, Manpada Road, Manpada Road, Taluka Kalyan Thane, Maharashtra Dombivli (E), Maharashtra 421201 PAN of the Deductor TAN of the Deductor Pan of the Employee AABTS4721P PNER07589B AFGPP6990P CIT (TDS) Period Assessment Year Address : The Commissioner of Income Tax (TDS) From To 4th Fl., A Wing, PMT Commercial Complex, 2012-13 01.04.11 31.03.12 Shankar Sheth Rd., Swargate, Pune 411037 Summary of tax deducted at source

Quarter Quarter 1 Quarter 2 Quarter 3 Quarter 4 Total Receipt Numbers of original statements of TDS under sub-section (3) of section 200. Amount of tax deducted in respect of the employee Amount of tax deposited/remitted in respect of the employee

DDHXXWMC DDHXXJMD DDHXBTHA DDHXEEUB

3,000 9,000 24,333 36,333

3,000 9,000 24,333 36,333

1 (a) (b) (c) (d) 2

PART B (Refer Note 1) Details of Salary paid and any other income and tax deducted Rs. Rs. Gross Salary Salary as per provisions contained in sec. 17(1) 628,474 Value of perquisities u/s 17(2) (as per Form No. 12BB, whether applicable) Profits in lieu of salary under section 17(3) ( as per Form No. 12BB, wherever applicable) Total 628,474 628,474 Less : Allowance to the extent exempt u/s 10 Allowance Rs.

Conveyance 9,600 9,600 9,600 618,874

Rs.

3 4 (a) (b) 5 6 7

Balance (1-2) Deductions : Entertainment allowance Tax on employment Aggregate of 4(a) and (b) Income chargeable under the head 'salaries' (3-5) Add : Any other income reported by the employee Income Rs.

2,500 2,500 616,374

Gross total income (6+7)

616,374

2...

: 2 : 9 (A) (a) Deduction under Chapter VIA sections 80C, 80CCC and 80CCD section 80C

(i) Provident Fund (ii) (iii) (iv) (v) (vi) (vii) (b) section 80CCC (c) section 80CCD

Gross Amount 105,886 -

Deductible Amount 105,886

(B) (i) (ii) (iii) (iv) (v) 10 11 12 13 14 15 16

Shall not exceed one lakh rupees. Aggregate amount deductible under the three section i.e. 80C,80CCC and 80CCD shall not exceed one lakh rupees. Other sections (e.g. 80E, 80G etc.) under Chapter VIA Gross section section section section section Aggregate of deductible amount under Chapter VIA Total Income (8-10) Tax on total income Eduction Cess @3% (on tax computed at S.No. 12) Tax Payable (12+13) Less : Relief under section 89 (attach details) Tax Payable (14-15) Verification

Amount -

Qualifying Deductible Amount Amount 100,000 516,374 35,275 1,058 36,333 36,333

I,Madhukar A. Patil son/ daughter of Akaram Patil working in the capacity of Principal do hereby certify that a sum of Rs. Thirty Six Thousand Three Hundred Thirty Three Only (Rs.36,333/- Only) has been deducted and deposited to the credit of the Central Government. I further certify that the information given above is true, complete and correct and is based on the books of accounts, documents, TDS statements, TDS deposited and other available records.

Place

DOMBIVLI

Place Date

DOMBIVLI 25.05.2012 Signature of person responsible for deduction of tax Full Name : Mr. Madhukar A. Patil

Designation : Principal

Life Insurance Corporation of India

Certificate No.: RVNHS/11-12/RTP/002

FORM No. 16 [See rule 31(1)(a)] PART A

Certificate under section 203 of the Income-tax Act, 1961for Tax deducted at source on Salary

Name and address of the Employer Name and Designation of the Employee R. V. NERURKAR HIGH SCHOOL PHALAK RAVINDRA TUKARAM R.V. Nerurkar High School,Dombivli Manpada Road, Thane, Maharashtra PAN of the Deductor TAN of the Deductor Pan of the Employee AABTS4721P PNER07589B ABUPP7764R CIT (TDS) Period Assessment Year Address : The Commissioner of Income Tax (TDS) From To 4th Fl., A Wing, PMT Commercial Complex, 2012-13 01.04.11 31.03.12 Shankar Sheth Rd., Swargate, Pune 411037 Summary of tax deducted at source

Quarter Quarter 1 Quarter 2 Quarter 3 Quarter 4 Total Receipt Numbers of original statements of TDS under sub-section (3) of section 200. Amount of tax deducted in respect of the employee

DDHXXWMC DDHXXJMD DDHXBTHA DDHXEEUB

3,000 9,000 19,139 31,139

Amount of tax deposited/remitted in respect of the employee

3,000 9,000 19,139 31,139

1 (a) (b) (c) (d) 2

PART B (Refer Note 1) Details of Salary paid and any other income and tax deducted Rs. Rs. Gross Salary Salary as per provisions contained in sec. 17(1) 600,897 Value of perquisities u/s 17(2) (as per Form No. 12BB, whether applicable) Profits in lieu of salary under section 17(3) ( as per Form No. 12BB, wherever applicable) Total 600,897 600,897 Less : Allowance to the extent exempt u/s 10 Allowance Rs.

Conveyance 8,427 8,427 8,427 592,470

Rs.

3 4 (a) (b) 5 6 7

Balance (1-2) Deductions : Entertainment allowance Tax on employment Aggregate of 4(a) and (b) Income chargeable under the head 'salaries' (3-5) Add : Any other income reported by the employee Income Rs.

2,500 2,500 589,970

Gross total income (6+7)

589,970

2...

: 2 : 9 (A) (a) Deduction under Chapter VIA sections 80C, 80CCC and 80CCD section 80C

(i) Provident Fund (ii) Life Insurance Corporation of India (iii) (iv) (v) (vi) (vii) (b) section 80CCC (c) section 80CCD

Gross Amount 68,946 40,028 -

Deductible Amount 68,946 40,028

(B) (i) (ii) (iii) (iv) (v) 10 11 12 13 14 15 16

Shall not exceed one lakh rupees. Aggregate amount deductible under the three section i.e. 80C,80CCC and 80CCD shall not exceed one lakh rupees. Other sections (e.g. 80E, 80G etc.) under Chapter VIA Gross section 80D : Mediclaim section section section section Aggregate of deductible amount under Chapter VIA Total Income (8-10) Tax on total income Eduction Cess @3% (on tax computed at S.No. 12) Tax Payable (12+13) Less : Relief under section 89 (attach details) Tax Payable (14-15) Verification

Amount -

Qualifying Deductible Amount Amount 7,654 7,654 107,654 482,316 30,232 907 31,139 31,139

I,Madhukar A. Patil son/ daughter of Akaram Patil working in the capacity of Principal do hereby certify that a sum of Rs. Thirty One Thousand One Hundred Thirty Nine Only (Rs.31,139/- Only) has been deducted and deposited to the credit of the Central Government. I further certify that the information given above is true, complete and correct and is based on the books of accounts, documents, TDS statements, TDS deposited and other available records.

Place

DOMBIVLI

Place Date

DOMBIVLI 25.05.2012 Signature of person responsible for deduction of tax Full Name : Mr. Madhukar A. Patil

Designation : Principal

31139

Certificate No.: RVNHS/11-12/SAP/003

FORM No. 16 [See rule 31(1)(a)] PART A

Certificate under section 203 of the Income-tax Act, 1961for Tax deducted at source on Salary

Name and address of the Employer Name and Designation of the Employee R. V. NERURKAR HIGH SCHOOL PATIL SHUBHA ARAVIND R.V. Nerurkar High School,Dombivli Manpada Road, Pandurang Wadi, Manpada Road, Dombivli (E), Kalyan Thane, Maharashtra Thane , Maharashtra 421201 PAN of the Deductor TAN of the Deductor Pan of the Employee AABTS4721P PNER07589B ACKPP0314N CIT (TDS) Period Assessment Year Address : The Commissioner of Income Tax (TDS) From To 4th Fl., A Wing, PMT Commercial Complex, 2012-13 01.04.11 31.03.12 Shankar Sheth Rd., Swargate, Pune 411037 Summary of tax deducted at source

Quarter Quarter 1 Quarter 2 Quarter 3 Quarter 4 Total Receipt Numbers of original statements of TDS under sub-section (3) of section 200. Amount of tax deducted in respect of the employee

DDHXXWMC DDHXXJMD DDHXBTHA DDHXEEUB

1,500 4,500 17,829 23,829

Amount of tax deposited/remitted in respect of the employee

1,500 4,500 17,829 23,829

1 (a) (b) (c) (d) 2

PART B (Refer Note 1) Details of Salary paid and any other income and tax deducted Rs. Rs. Gross Salary Salary as per provisions contained in sec. 17(1) 561,975 Value of perquisities u/s 17(2) (as per Form No. 12BB, whether applicable) Profits in lieu of salary under section 17(3) ( as per Form No. 12BB, wherever applicable) Total 561,975 561,975 Less : Allowance to the extent exempt u/s 10 Allowance Rs.

Conveyance 8,427 8,427 8,427 553,548

Rs.

3 4 (a) (b) 5 6 7

Balance (1-2) Deductions : Entertainment allowance Tax on employment Aggregate of 4(a) and (b) Income chargeable under the head 'salaries' (3-5) Add : Any other income reported by the employee Income Rs.

2,500 2,500 551,048

Gross total income (6+7)

551,048

2...

: 2 : 9 (A) (a) Deduction under Chapter VIA sections 80C, 80CCC and 80CCD section 80C

(i) Provident Fund (ii) Life Insurance Corporation of India (iii) (iv) (v) (vi) (vii) (b) section 80CCC (c) section 80CCD

Gross Amount 92,949 8,394 -

Deductible Amount 92,949 8,394

(B) (i) (ii) (iii) (iv) (v) 10 11 12 13 14 15 16

Shall not exceed one lakh rupees. Aggregate amount deductible under the three section i.e. 80C,80CCC and 80CCD shall not exceed one lakh rupees. Other sections (e.g. 80E, 80G etc.) under Chapter VIA Gross section 80CCF - Infrastructure Bond section 80D - Mediclaim section section section Aggregate of deductible amount under Chapter VIA Total Income (8-10) Tax on total income Eduction Cess @3% (on tax computed at S.No. 12) Tax Payable (12+13) Less : Relief under section 89 (attach details) Tax Payable (14-15) Verification

Amount -

Qualifying Deductible Amount Amount 20,000 20,000 9,700 9,700 129,700 421,348 23,135 694 23,829 23,829

I,Madhukar A. Patil son/ daughter of Akaram Patil working in the capacity of Principal do hereby certify that a sum of Rs. Twenty Three Thousand Eight Hundred Twenty Nine Only (Rs.23,829/- Only) has been deducted and deposited to the credit of the Central Government. I further certify that the information given above is true, complete and correct and is based on the books of accounts, documents, TDS statements, TDS deposited and other available records.

Place

DOMBIVLI

Place Date

DOMBIVLI 25.05.2012 Signature of person responsible for deduction of tax Full Name : Mr. Madhukar A. Patil

Designation : Principal

Life Insurance Corporation of India 101,343

Certificate No.: RVNHS/11-12/BBB/004

FORM No. 16 [See rule 31(1)(a)] PART A

Certificate under section 203 of the Income-tax Act, 1961for Tax deducted at source on Salary

Name and address of the Employer Name and Designation of the Employee R. V. NERURKAR HIGH SCHOOL BHALERAO BHIMRAO BANDU R.V. Nerurkar High School,Dombivli Pandurang Wadi, Manpada Road, Manpada Road, Dombivli (E), Thane, Maharashtra Thane , Maharashtra 421201 PAN of the Deductor TAN of the Deductor Pan of the Employee AABTS4721P PNER07589B ABJPB1854B CIT (TDS) Period Assessment Year Address : The Commissioner of Income Tax (TDS) From To 4th Fl., A Wing, PMT Commercial Complex, 2012-13 01.04.11 31.03.12 Shankar Sheth Rd., Swargate, Pune 411037 Summary of tax deducted at source

Quarter Quarter 1 Quarter 2 Quarter 3 Quarter 4 Total Receipt Numbers of original statements of TDS under sub-section (3) of section 200. Amount of tax deducted in respect of the employee

DDHXXWMC DDHXXJMD DDHXBTHA DDHXEEUB

1,000 3,000 15,399 19,399

Amount of tax deposited/remitted in respect of the employee

1,000 3,000 15,399 19,399

1 (a) (b) (c) (d) 2

PART B (Refer Note 1) Details of Salary paid and any other income and tax deducted Rs. Rs. Gross Salary Salary as per provisions contained in sec. 17(1) 560,103 Value of perquisities u/s 17(2) (as per Form No. 12BB, whether applicable) Profits in lieu of salary under section 17(3) ( as per Form No. 12BB, wherever applicable) Total 560,103 560,103 Less : Allowance to the extent exempt u/s 10 Allowance Rs.

Conveyance 8,427 8,427 8,427 551,676

Rs.

3 4 (a) (b) 5 6 7

Balance (1-2) Deductions : Entertainment allowance Tax on employment Aggregate of 4(a) and (b) Income chargeable under the head 'salaries' (3-5) Add : Any other income reported by the employee Income Rs.

2,500 2,500 549,176

Hsg. Loan Int. Gross total income (6+7)

(60,834)

(60,834)

488,342

2...

: 2 : 9 (A) (a) Deduction under Chapter VIA sections 80C, 80CCC and 80CCD section 80C

(i) Provident Fund (ii) Life Insurance Corporation of India (iii) Tuition Fees (iv) (v) (vi) (vii) (b) section 80CCC (c) section 80CCD

Gross Amount 80,994 39,122 3,000 -

Deductible Amount 80,994 39,122 3,000

(B) (i) (ii) (iii) (iv) (v) 10 11 12 13 14 15 16

Shall not exceed one lakh rupees. Aggregate amount deductible under the three section i.e. 80C,80CCC and 80CCD shall not exceed one lakh rupees. Other sections (e.g. 80E, 80G etc.) under Chapter VIA Gross section 80CCF - Infrastructure Bond section section section section Aggregate of deductible amount under Chapter VIA Total Income (8-10) Tax on total income Eduction Cess @3% (on tax computed at S.No. 12) Tax Payable (12+13) Less : Relief under section 89 (attach details) Tax Payable (14-15) Verification

Amount -

Qualifying Deductible Amount Amount 20,000 20,000 120,000 368,342 18,834 565 19,399 19,399

I,Madhukar A. Patil son/ daughter of Akaram Patil working in the capacity of Principal do hereby certify that a sum of Rs. Nineteen Thousand Three Hundred Ninety Nine Only (Rs.19,399/- Only) has been deducted and deposited to the credit of the Central Government. I further certify that the information given above is true, complete and correct and is based on the books of accounts, documents, TDS statements, TDS deposited and other available records.

Place

DOMBIVLI

Place Date

DOMBIVLI 25.05.2012 Signature of person responsible for deduction of tax Full Name : Mr. Madhukar A. Patil

Designation : Principal

123,116

Certificate No.: RVNHS/11-12/SCL/005

FORM No. 16 [See rule 31(1)(a)] PART A

Certificate under section 203 of the Income-tax Act, 1961for Tax deducted at source on Salary

Name and address of the Employer Name and Designation of the Employee R. V. NERURKAR HIGH SCHOOL LAHANE SHIVAJI CHINDHAJI R.V. Nerurkar High School,Dombivli Pandurang Wadi, Manpada Road, Patharli Village, Manpada Rd., Kalyan Thane, Maharashtra Thane , Maharashtra 421201 PAN of the Deductor TAN of the Deductor Pan of the Employee AABTS4721P PNER07589B AAWPL9899A CIT (TDS) Period Assessment Year Address : The Commissioner of Income Tax (TDS) From To 4th Fl., A Wing, PMT Commercial Complex, 2012-13 01.04.11 31.03.12 Shankar Sheth Rd., Swargate, Pune 411037 Summary of tax deducted at source

Quarter Quarter 1 Quarter 2 Quarter 3 Quarter 4 Total Receipt Numbers of original statements of TDS under sub-section (3) of section 200. Amount of tax deducted in respect of the employee

DDHXXWMC DDHXXJMD DDHXBTHA DDHXEEUB

1,000 3,000 22,647 26,647

Amount of tax deposited/remitted in respect of the employee

1,000 3,000 22,647 26,647

1 (a) (b) (c) (d) 2

PART B (Refer Note 1) Details of Salary paid and any other income and tax deducted Rs. Rs. Gross Salary Salary as per provisions contained in sec. 17(1) 541,392 Value of perquisities u/s 17(2) (as per Form No. 12BB, whether applicable) Profits in lieu of salary under section 17(3) ( as per Form No. 12BB, wherever applicable) Total 541,392 541,392 Less : Allowance to the extent exempt u/s 10 Allowance Rs.

Conveyance 8,427 8,427 8,427 532,965

Rs.

3 4 (a) (b) 5 6 7

Balance (1-2) Deductions : Entertainment allowance Tax on employment Aggregate of 4(a) and (b) Income chargeable under the head 'salaries' (3-5) Add : Any other income reported by the employee Income Rs.

2,500 2,500 530,465

Hsg. Loan Int. Gross total income (6+7)

(21,180)

(21,180)

509,285

2...

: 2 : 9 (A) (a) Deduction under Chapter VIA sections 80C, 80CCC and 80CCD section 80C

(i) Provident Fund (ii) Life Insurance Corporation of India (iii) (iv) (v) (vi) (vii) (b) section 80CCC (c) section 80CCD

Gross Amount 69,019 1,560 -

Deductible Amount 69,019 1,560 -

(B) (i) (ii) (iii) (iv) (v) 10 11 12 13 14 15 16

Shall not exceed one lakh rupees. Aggregate amount deductible under the three section i.e. 80C,80CCC and 80CCD shall not exceed one lakh rupees. Other sections (e.g. 80E, 80G etc.) under Chapter VIA Gross section section section section section Aggregate of deductible amount under Chapter VIA Total Income (8-10) Tax on total income Eduction Cess @3% (on tax computed at S.No. 12) Tax Payable (12+13) Less : Relief under section 89 (attach details) Tax Payable (14-15) Verification

Amount -

Qualifying Deductible Amount Amount 70,579 438,706 25,871 776 26,647 26,647

I,Madhukar A. Patil son/ daughter of Akaram Patil working in the capacity of Principal do hereby certify that a sum of Rs. Twenty Six Thousand Six Hundred Forty Seven Only (Rs.26,647/- Only) has been deducted and deposited to the credit of the Central Government. I further certify that the information given above is true, complete and correct and is based on the books of accounts, documents, TDS statements, TDS deposited and other available records.

Place

DOMBIVLI

Place Date

DOMBIVLI 25.05.2012 Signature of person responsible for deduction of tax Full Name : Mr. Madhukar A. Patil

Designation : Principal

70,579

section 80CCF - Infrastructure Bond

Certificate No.: RVNHS/11-12/KHG/006

FORM No. 16 [See rule 31(1)(a)] PART A

Certificate under section 203 of the Income-tax Act, 1961for Tax deducted at source on Salary

Name and address of the Employer Name and Designation of the Employee R. V. NERURKAR HIGH SCHOOL GAWARE KALPANA HINDURAO R.V. Nerurkar High School,Dombivli 12, Ninad Building, Manpada Road, Opp. Pandurang Vidyalaya, Manpada Rd., Thane, Maharashtra Dombivli, Thane , Maharashtra 421201 PAN of the Deductor TAN of the Deductor Pan of the Employee AABTS4721P PNER07589B ABSPG7695Q CIT (TDS) Period Assessment Year Address : The Commissioner of Income Tax (TDS) From To 4th Fl., A Wing, PMT Commercial Complex, 2012-13 01.04.11 31.03.12 Shankar Sheth Rd., Swargate, Pune 411037 Summary of tax deducted at source

Quarter Quarter 1 Quarter 2 Quarter 3 Quarter 4 Total Receipt Numbers of original statements of TDS under sub-section (3) of section 200. Amount of tax deducted in respect of the employee

DDHXXWMC DDHXXJMD DDHXBTHA DDHXEEUB

800 2,400 10,519 13,719

Amount of tax deposited/remitted in respect of the employee

800 2,400 10,519 13,719

1 (a) (b) (c) (d) 2

PART B (Refer Note 1) Details of Salary paid and any other income and tax deducted Rs. Rs. Gross Salary Salary as per provisions contained in sec. 17(1) 548,151 Value of perquisities u/s 17(2) (as per Form No. 12BB, whether applicable) Profits in lieu of salary under section 17(3) ( as per Form No. 12BB, wherever applicable) Total 548,151 548,151 Less : Allowance to the extent exempt u/s 10 Allowance Rs.

Conveyance 8,427 8,427 8,427 539,724

Rs.

3 4 (a) (b) 5 6 7

Balance (1-2) Deductions : Entertainment allowance Tax on employment Aggregate of 4(a) and (b) Income chargeable under the head 'salaries' (3-5) Add : Any other income reported by the employee Income Rs.

2,500 2,500 537,224

Hsg. Loan Int. Gross total income (6+7)

(109,991)

(109,991)

427,233

2...

: 2 : 9 (A) (a) (i) (ii) (iii) (iv) (v) (vi) (vii) (b) (c) Deduction under Chapter VIA sections 80C, 80CCC and 80CCD section 80C Provident Fund Life Insurance Corporation of India Public Provident Fund Housing Loan - Principal

section 80CCC section 80CCD

Gross Amount 60,185 37,791 500 16,930 -

Deductible Amount 60,185 37,791 500 16,930

(B) (i) (ii) (iii) (iv) (v) 10 11 12 13 14 15 16

Shall not exceed one lakh rupees. Aggregate amount deductible under the three section i.e. 80C,80CCC and 80CCD shall not exceed one lakh rupees. Other sections (e.g. 80E, 80G etc.) under Chapter VIA Gross section 80D : Mediclaim section section section section Aggregate of deductible amount under Chapter VIA Total Income (8-10) Tax on total income Eduction Cess @3% (on tax computed at S.No. 12) Tax Payable (12+13) Less : Relief under section 89 (attach details) Tax Payable (14-15) Verification

Amount -

Qualifying Deductible Amount Amount 4,458 4,458 104,458 322,775 13,278 398 13,676 13,676

I,Madhukar A. Patil son/ daughter of Akaram Patil working in the capacity of Principal do hereby certify that a sum of Rs. Thirteen Thousand Seven Hundred Nineteen Only (Rs.13,719/- Only) has been deducted and deposited to the credit of the Central Government. I further certify that the information given above is true, complete and correct and is based on the books of accounts, documents, TDS statements, TDS deposited and other available records.

Place

DOMBIVLI

Place Date

DOMBIVLI 25.05.2012 Signature of person responsible for deduction of tax Full Name : Mr. Madhukar A. Patil

Designation : Principal

115,406

section 80CCF - Infrastructure Bond

Certificate No.: RVNHS/11-12/KSS/007

FORM No. 16 [See rule 31(1)(a)] PART A

Certificate under section 203 of the Income-tax Act, 1961for Tax deducted at source on Salary

Name and address of the Employer Name and Designation of the Employee R. V. NERURKAR HIGH SCHOOL KARAJANGI SHOBHA SIDRAM R.V. Nerurkar High School,Dombivli B-12, Laxman Mukund CHSL, Manpada Road, Behind New Optica, Manpada Rd., Thane, Maharashtra Dombivli, Thane , Maharashtra 421201 PAN of the Deductor TAN of the Deductor Pan of the Employee AABTS4721P PNER07589B ACGPK5263K CIT (TDS) Period Assessment Year Address : The Commissioner of Income Tax (TDS) From To 4th Fl., A Wing, PMT Commercial Complex, 2012-13 01.04.11 31.03.12 Shankar Sheth Rd., Swargate, Pune 411037 Summary of tax deducted at source

Quarter Quarter 1 Quarter 2 Quarter 3 Quarter 4 Total Receipt Numbers of original statements of TDS under sub-section (3) of section 200. Amount of tax deducted in respect of the employee

DDHXXWMC DDHXXJMD DDHXBTHA DDHXEEUB

2,000 17,949 19,949

Amount of tax deposited/remitted in respect of the employee

2,000 17,949 19,949

1 (a) (b) (c) (d) 2

PART B (Refer Note 1) Details of Salary paid and any other income and tax deducted Rs. Rs. Gross Salary Salary as per provisions contained in sec. 17(1) 549,401 Value of perquisities u/s 17(2) (as per Form No. 12BB, whether applicable) Profits in lieu of salary under section 17(3) ( as per Form No. 12BB, wherever applicable) Total 549,401 549,401 Less : Allowance to the extent exempt u/s 10 Allowance Rs.

Conveyance 5,867 5,867 5,867 543,534

Rs.

3 4 (a) (b) 5 6 7

Balance (1-2) Deductions : Entertainment allowance Tax on employment Aggregate of 4(a) and (b) Income chargeable under the head 'salaries' (3-5) Add : Any other income reported by the employee Income Rs.

2,500 2,500 541,034

Hsg. Loan Int. Gross total income (6+7)

(57,353)

(57,353)

483,681

2...

: 2 : 9 (A) (a) Deduction under Chapter VIA sections 80C, 80CCC and 80CCD section 80C

(i) Provident Fund (ii) Housing Loan - Principal (iii) (iv) (v) (vi) (vii) (b) section 80CCC (c) section 80CCD

Gross Amount 63,995 70,074 -

Deductible Amount 63,995 70,074 -

(B) (i) (ii) (iii) (iv) (v) 10 11 12 13 14 15 16

Shall not exceed one lakh rupees. Aggregate amount deductible under the three section i.e. 80C,80CCC and 80CCD shall not exceed one lakh rupees. Other sections (e.g. 80E, 80G etc.) under Chapter VIA Gross section section section section section Aggregate of deductible amount under Chapter VIA Total Income (8-10) Tax on total income Eduction Cess @3% (on tax computed at S.No. 12) Tax Payable (12+13) Less : Relief under section 89 (attach details) Tax Payable (14-15) Verification

Amount -

Qualifying Deductible Amount Amount 100,000 383,681 19,368 581 19,949 19,949

I,Madhukar A. Patil son/ daughter of Akaram Patil working in the capacity of Principal do hereby certify that a sum of Rs. Nineteen Thousand Nine Hundred Forty Nine Only (Rs.19,949/- Only) has been deducted and deposited to the credit of the Central Government. I further certify that the information given above is true, complete and correct and is based on the books of accounts, documents, TDS statements, TDS deposited and other available records.

Place

DOMBIVLI

Place Date

DOMBIVLI 25.05.2012 Signature of person responsible for deduction of tax Full Name : Mr. Madhukar A. Patil

Designation : Principal

134,069

section 80CCF - Infrastructure Bond section 80D : Mediclaim

Certificate No.: RVNHS/11-12/SRW/008

FORM No. 16 [See rule 31(1)(a)] PART A

Certificate under section 203 of the Income-tax Act, 1961for Tax deducted at source on Salary

Name and address of the Employer Name and Designation of the Employee R. V. NERURKAR HIGH SCHOOL WANKHEDE SHARAD RAMDAS R.V. Nerurkar High School,Dombivli Pandurang Wadi, Manpada Road, Manpada Rd.,Dombivli (E) Thane, Maharashtra Maharashtra 421201 PAN of the Deductor TAN of the Deductor Pan of the Employee AABTS4721P PNER07589B AAIPW2250J CIT (TDS) Period Assessment Year Address : The Commissioner of Income Tax (TDS) From To 4th Fl., A Wing, PMT Commercial Complex, 2012-13 01.04.11 31.03.12 Shankar Sheth Rd., Swargate, Pune 411037 Summary of tax deducted at source

Quarter Quarter 1 Quarter 2 Quarter 3 Quarter 4 Total Receipt Numbers of original statements of TDS under sub-section (3) of section 200. Amount of tax deducted in respect of the employee

DDHXXWMC DDHXXJMD DDHXBTHA DDHXEEUB

500 1,500 5,928 7,928

Amount of tax deposited/remitted in respect of the employee

500 1,500 5,928 7,928

1 (a) (b) (c) (d) 2

PART B (Refer Note 1) Details of Salary paid and any other income and tax deducted Rs. Rs. Gross Salary Salary as per provisions contained in sec. 17(1) 521,808 Value of perquisities u/s 17(2) (as per Form No. 12BB, whether applicable) Profits in lieu of salary under section 17(3) ( as per Form No. 12BB, wherever applicable) Total 521,808 521,808 Less : Allowance to the extent exempt u/s 10 Allowance Rs.

Conveyance 8,427 8,427 8,427 513,381

Rs.

3 4 (a) (b) 5 6 7

Balance (1-2) Deductions : Entertainment allowance Tax on employment Aggregate of 4(a) and (b) Income chargeable under the head 'salaries' (3-5) Add : Any other income reported by the employee Income Rs.

2,500 2,500 510,881

Hsg. Loan Int. Gross total income (6+7)

(144,590)

(144,590) 366,291

2...

: 2 : 9 (A) (a) Deduction under Chapter VIA sections 80C, 80CCC and 80CCD section 80C

(i) Provident Fund (ii) Life Insurance Corporation of India (iii) (iv) (v) (vi) (vii) (b) section 80CCC (c) section 80CCD

Gross Amount 68,176 43,310 -

Deductible Amount 68,176 43,310 -

(B) (i) (ii) (iii) (iv) (v) 10 11 12 13 14 15 16

Shall not exceed one lakh rupees. Aggregate amount deductible under the three section i.e. 80C,80CCC and 80CCD shall not exceed one lakh rupees. Other sections (e.g. 80E, 80G etc.) under Chapter VIA Gross section 80D : Mediclaim section 80G : Donation section section section Aggregate of deductible amount under Chapter VIA Total Income (8-10) Tax on total income Eduction Cess @3% (on tax computed at S.No. 12) Tax Payable (12+13) Less : Relief under section 89 (attach details) Tax Payable (14-15) Verification

Amount -

Qualifying Deductible Amount Amount 9,025 9,025 300 300 109,325 256,966 7,697 231 7,927 7,927

I,Madhukar A. Patil son/ daughter of Akaram Patil working in the capacity of Principal do hereby certify that a sum of Rs. Seven Thousand Nine Hundred Twenty Eight Only (Rs.7,928/- Only) has been deducted and deposited to the credit of the Central Government. I further certify that the information given above is true, complete and correct and is based on the books of accounts, documents, TDS statements, TDS deposited and other available records.

Place

DOMBIVLI

Place Date

DOMBIVLI 25.05.2012 Signature of person responsible for deduction of tax Full Name : Mr. Madhukar A. Patil

Designation : Principal

111,486

section 80CCF - Infrastructure Bond

Certificate No.: RVNHS/11-12/PHP/009

FORM No. 16 [See rule 31(1)(a)] PART A

Certificate under section 203 of the Income-tax Act, 1961for Tax deducted at source on Salary

Name and address of the Employer Name and Designation of the Employee R. V. NERURKAR HIGH SCHOOL PATIL PURUSHOTTAM HARI R.V. Nerurkar High School,Dombivli A-32, 4th Floor, Sairam, Manpada Road, Nerurkar Road, Sangita Wadi, Thane, Maharashtra Dombivli, Thane, Maharashtra 421201 PAN of the Deductor TAN of the Deductor Pan of the Employee AABTS4721P PNER07589B ABUPP7761L CIT (TDS) Period Assessment Year Address : The Commissioner of Income Tax (TDS) From To 4th Fl., A Wing, PMT Commercial Complex, 2012-13 01.04.11 31.03.12 Shankar Sheth Rd., Swargate, Pune 411037 Summary of tax deducted at source

Quarter Quarter 1 Quarter 2 Quarter 3 Quarter 4 Total Receipt Numbers of original statements of TDS under sub-section (3) of section 200. Amount of tax deducted in respect of the employee

DDHXXWMC DDHXXJMD DDHXBTHA DDHXEEUB

2,000 6,000 14,942 22,942

Amount of tax deposited/remitted in respect of the employee

2,000 6,000 14,942 22,942

1 (a) (b) (c) (d) 2

PART B (Refer Note 1) Details of Salary paid and any other income and tax deducted Rs. Rs. Gross Salary Salary as per provisions contained in sec. 17(1) 522,554 Value of perquisities u/s 17(2) (as per Form No. 12BB, whether applicable) Profits in lieu of salary under section 17(3) ( as per Form No. 12BB, wherever applicable) Total 522,554 522,554 Less : Allowance to the extent exempt u/s 10 Allowance Rs.

Conveyance 8,427 8,427 8,427 514,127

Rs.

3 4 (a) (b) 5 6 7

Balance (1-2) Deductions : Entertainment allowance Tax on employment Aggregate of 4(a) and (b) Income chargeable under the head 'salaries' (3-5) Add : Any other income reported by the employee Income Rs.

2,500 2,500 511,627

Hsg. Loan Int. Gross total income (6+7)

(8,888)

(8,888) 502,739

2...

: 2 : 9 (A) (a) Deduction under Chapter VIA sections 80C, 80CCC and 80CCD section 80C

(i) Provident Fund (ii) Life Insurance Corporation of India (iii) (iv) (v) (vi) (vii) (b) section 80CCC (c) section 80CCD

Gross Amount 213,722 5,676 -

Deductible Amount 213,722 5,676 -

(B) (i) (ii) (iii) (iv) (v) 10 11 12 13 14 15 16

Shall not exceed one lakh rupees. Aggregate amount deductible under the three section i.e. 80C,80CCC and 80CCD shall not exceed one lakh rupees. Other sections (e.g. 80E, 80G etc.) under Chapter VIA Gross section section section section section Aggregate of deductible amount under Chapter VIA Total Income (8-10) Tax on total income Eduction Cess @3% (on tax computed at S.No. 12) Tax Payable (12+13) Less : Relief under section 89 (attach details) Tax Payable (14-15) Verification

Amount -

Qualifying Deductible Amount Amount 100,000 402,739 22,274 668 22,942 22,942

I,Madhukar A. Patil son/ daughter of Akaram Patil working in the capacity of Principal do hereby certify that a sum of Rs. Twenty Two Thousand Nine Hundred Forty Two Only (Rs.22,942/- Only) has been deducted and deposited to the credit of the Central Government. I further certify that the information given above is true, complete and correct and is based on the books of accounts, documents, TDS statements, TDS deposited and other available records.

Place

DOMBIVLI

Place Date

DOMBIVLI 25.05.2012 Signature of person responsible for deduction of tax Full Name : Mr. Madhukar A. Patil

Designation : Principal

219,398

section 80CCF - Infrastructure Bond section 80D : Mediclaim section 80G : Donation

Certificate No.: RVNHS/11-12/KNZ/009

FORM No. 16 [See rule 31(1)(a)] PART A

Certificate under section 203 of the Income-tax Act, 1961for Tax deducted at source on Salary

Name and address of the Employer Name and Designation of the Employee R. V. NERURKAR HIGH SCHOOL KUMAWAT NANBHAU ZENDU R.V. Nerurkar High School,Dombivli 1756, Shrikrishna Nagar, Manpada Road, Shivaji Nagar, Ambernath (E) Thane, Maharashtra Thane, Maharashtra 421501 PAN of the Deductor TAN of the Deductor Pan of the Employee AABTS4721P PNER07589B ACVPK9180A CIT (TDS) Period Assessment Year Address : The Commissioner of Income Tax (TDS) From To 4th Fl., A Wing, PMT Commercial Complex, 2012-13 01.04.11 31.03.12 Shankar Sheth Rd., Swargate, Pune 411037 Summary of tax deducted at source

Quarter Quarter 1 Quarter 2 Quarter 3 Quarter 4 Total Receipt Numbers of original statements of TDS under sub-section (3) of section 200. Amount of tax deducted in respect of the employee

DDHXXWMC DDHXXJMD DDHXBTHA DDHXEEUB

1,000 3,000 10,194 14,194

Amount of tax deposited/remitted in respect of the employee

1,000 3,000 10,194 14,194

1 (a) (b) (c) (d) 2

PART B (Refer Note 1) Details of Salary paid and any other income and tax deducted Rs. Rs. Gross Salary Salary as per provisions contained in sec. 17(1) 521,808 Value of perquisities u/s 17(2) (as per Form No. 12BB, whether applicable) Profits in lieu of salary under section 17(3) ( as per Form No. 12BB, wherever applicable) Total 521,808 521,808 Less : Allowance to the extent exempt u/s 10 Allowance Rs.

Conveyance 8,427 8,427 8,427 513,381

Rs.

3 4 (a) (b) 5 6 7

Balance (1-2) Deductions : Entertainment allowance Tax on employment Aggregate of 4(a) and (b) Income chargeable under the head 'salaries' (3-5) Add : Any other income reported by the employee Income Rs.

2,500 2,500 510,881

Hsg. Loan Int. Gross total income (6+7)

(93,075)

(93,075) 417,806

2...

: 2 : 9 (A) (a) Deduction under Chapter VIA sections 80C, 80CCC and 80CCD section 80C

(i) Provident Fund (ii) Life Insurance Corporation of India (iii) Housing Loan - Principal (iv) (v) (vi) (vii) (b) section 80CCC (c) section 80CCD

Gross Amount 60,576 11,472 36,561 -

Deductible Amount 60,576 11,472 36,561

(B) (i) (ii) (iii) (iv) (v) 10 11 12 13 14 15 16

Shall not exceed one lakh rupees. Aggregate amount deductible under the three section i.e. 80C,80CCC and 80CCD shall not exceed one lakh rupees. Other sections (e.g. 80E, 80G etc.) under Chapter VIA Gross section section section section section Aggregate of deductible amount under Chapter VIA Total Income (8-10) Tax on total income Eduction Cess @3% (on tax computed at S.No. 12) Tax Payable (12+13) Less : Relief under section 89 (attach details) Tax Payable (14-15) Verification

Amount -

Qualifying Deductible Amount Amount 100,000 317,806 13,781 413 14,194 14,194

I,Madhukar A. Patil son/ daughter of Akaram Patil working in the capacity of Principal do hereby certify that a sum of Rs. ForteenThousand One Hundred Ninety Four Only (Rs.14,194/- Only) has been deducted and deposited to the credit of the Central Government. I further certify that the information given above is true, complete and correct and is based on the books of accounts, documents, TDS statements, TDS deposited and other available records.

Place

DOMBIVLI

Place Date

DOMBIVLI 25.05.2012 Signature of person responsible for deduction of tax Full Name : Mr. Madhukar A. Patil

Designation : Principal

108,609

section 80CCF - Infrastructure Bond section 80D : Mediclaim section 80G : Donation

Certificate No.: RVNHS/11-12/GAS/010

FORM No. 16 [See rule 31(1)(a)] PART A

Certificate under section 203 of the Income-tax Act, 1961for Tax deducted at source on Salary

Name and address of the Employer Name and Designation of the Employee R. V. NERURKAR HIGH SCHOOL GAWAI ARUN SATYAWAN R.V. Nerurkar High School,Dombivli D-58, Ganesh Colony, Manpada Road, Gajanan Nagar, Ulhasnagar 4 Thane, Maharashtra Thane, Maharashtra 421004 PAN of the Deductor TAN of the Deductor Pan of the Employee AABTS4721P PNER07589B ABLPG7873P CIT (TDS) Period Assessment Year Address : The Commissioner of Income Tax (TDS) From To 4th Fl., A Wing, PMT Commercial Complex, 2012-13 01.04.11 31.03.12 Shankar Sheth Rd., Swargate, Pune 411037 Summary of tax deducted at source

Quarter Quarter 1 Quarter 2 Quarter 3 Quarter 4 Total Receipt Numbers of original statements of TDS under sub-section (3) of section 200. Amount of tax deducted in respect of the employee

DDHXXWMC DDHXXJMD DDHXBTHA DDHXEEUB

500 1,500 14,930 16,930

Amount of tax deposited/remitted in respect of the employee

500 1,500 14,930 16,930

1 (a) (b) (c) (d) 2

PART B (Refer Note 1) Details of Salary paid and any other income and tax deducted Rs. Rs. Gross Salary Salary as per provisions contained in sec. 17(1) 522,051 Value of perquisities u/s 17(2) (as per Form No. 12BB, whether applicable) Profits in lieu of salary under section 17(3) ( as per Form No. 12BB, wherever applicable) Total 522,051 522,051 Less : Allowance to the extent exempt u/s 10 Allowance Rs.

Conveyance 8,427 8,427 8,427 513,624

Rs.

3 4 (a) (b) 5 6 7

Balance (1-2) Deductions : Entertainment allowance Tax on employment Aggregate of 4(a) and (b) Income chargeable under the head 'salaries' (3-5) Add : Any other income reported by the employee Income Rs.

2,500 2,500 511,124

Hsg. Loan Int. Gross total income (6+7)

(59,763)

(59,763) 451,361

2...

: 2 : 9 (A) (a) Deduction under Chapter VIA sections 80C, 80CCC and 80CCD section 80C

(i) Provident Fund (ii) Life Insurance Corporation of India (iii) Housing Loan - Principal (iv) (v) (vi) (vii) (b) section 80CCC (c) section 80CCD

Gross Amount 69,219 26,784 44,637 -

Deductible Amount 69,219 26,784 44,637

(B) (i) (ii) (iii) (iv) (v) 10 11 12 13 14 15 16

Shall not exceed one lakh rupees. Aggregate amount deductible under the three section i.e. 80C,80CCC and 80CCD shall not exceed one lakh rupees. Other sections (e.g. 80E, 80G etc.) under Chapter VIA Gross section 80D : Mediclaim section section section section Aggregate of deductible amount under Chapter VIA Total Income (8-10) Tax on total income Eduction Cess @3% (on tax computed at S.No. 12) Tax Payable (12+13) Less : Relief under section 89 (attach details) Tax Payable (14-15) Verification

Amount -

Qualifying Deductible Amount Amount 6,988 6,988 106,988 344,373 16,437 493 16,930 16,930

I,Madhukar A. Patil son/ daughter of Akaram Patil working in the capacity of Principal do hereby certify that a sum of Rs. Sixteen Thousand Nine Hundred Thirty Only (Rs.16,930/- Only) has been deducted and deposited to the credit of the Central Government. I further certify that the information given above is true, complete and correct and is based on the books of accounts, documents, TDS statements, TDS deposited and other available records.

Place

DOMBIVLI

Place Date

DOMBIVLI 25.05.2012 Signature of person responsible for deduction of tax Full Name : Mr. Madhukar A. Patil

Designation : Principal

140,640

section 80CCF - Infrastructure Bond section 80D : Mediclaim section 80G : Donation

Certificate No.: RVNHS/11-12/BCA/011

FORM No. 16 [See rule 31(1)(a)] PART A

Certificate under section 203 of the Income-tax Act, 1961for Tax deducted at source on Salary

Name and address of the Employer Name and Designation of the Employee R. V. NERURKAR HIGH SCHOOL BIRDE CHANDULAL ARJUN R.V. Nerurkar High School,Dombivli 101, Nana Patil Sadan, Manpada Road, Gaikwad Wadi, Phule Rd., Dombivli Thane, Maharashtra Thane, Maharashtra 421201 PAN of the Deductor TAN of the Deductor Pan of the Employee AABTS4721P PNER07589B ABIPB0829R CIT (TDS) Period Assessment Year Address : The Commissioner of Income Tax (TDS) From To 4th Fl., A Wing, PMT Commercial Complex, 2012-13 01.04.11 31.03.12 Shankar Sheth Rd., Swargate, Pune 411037 Summary of tax deducted at source

Quarter Quarter 1 Quarter 2 Quarter 3 Quarter 4 Total Receipt Numbers of original statements of TDS under sub-section (3) of section 200. Amount of tax deducted in respect of the employee

DDHXXWMC DDHXXJMD DDHXBTHA DDHXEEUB

1,500 4,500 12,683 18,683

Amount of tax deposited/remitted in respect of the employee

1,500 4,500 12,683 18,683

1 (a) (b) (c) (d) 2

PART B (Refer Note 1) Details of Salary paid and any other income and tax deducted Rs. Rs. Gross Salary Salary as per provisions contained in sec. 17(1) 509,445 Value of perquisities u/s 17(2) (as per Form No. 12BB, whether applicable) Profits in lieu of salary under section 17(3) ( as per Form No. 12BB, wherever applicable) Total 509,445 509,445 Less : Allowance to the extent exempt u/s 10 Allowance Rs.

Conveyance 8,427 8,427 8,427 501,018

Rs.

3 4 (a) (b) 5 6 7

Balance (1-2) Deductions : Entertainment allowance Tax on employment Aggregate of 4(a) and (b) Income chargeable under the head 'salaries' (3-5) Add : Any other income reported by the employee Income Rs.

2,500 2,500 498,518

Hsg. Loan Int. Gross total income (6+7)

(37,125)

(37,125) 461,393

2...

: 2 : 9 (A) (a) Deduction under Chapter VIA sections 80C, 80CCC and 80CCD section 80C

(i) Provident Fund (ii) Life Insurance Corporation of India (iii) Housing Loan - Principal (iv) (v) (vi) (vii) (b) section 80CCC (c) section 80CCD

Gross Amount 68,393 30,465 36,602 -

Deductible Amount 68,393 30,465 36,602

(B) (i) (ii) (iii) (iv) (v) 10 11 12 13 14 15 16

Shall not exceed one lakh rupees. Aggregate amount deductible under the three section i.e. 80C,80CCC and 80CCD shall not exceed one lakh rupees. Other sections (e.g. 80E, 80G etc.) under Chapter VIA Gross section section section section section Aggregate of deductible amount under Chapter VIA Total Income (8-10) Tax on total income Eduction Cess @3% (on tax computed at S.No. 12) Tax Payable (12+13) Less : Relief under section 89 (attach details) Tax Payable (14-15) Verification

Amount -

Qualifying Deductible Amount Amount 100,000 361,393 18,139 544 18,683 18,683

I,Madhukar A. Patil son/ daughter of Akaram Patil working in the capacity of Principal do hereby certify that a sum of Rs. Eighteen Thousand Six Hundred Eighty Three Only (Rs.18,683/- Only) has been deducted and deposited to the credit of the Central Government. I further certify that the information given above is true, complete and correct and is based on the books of accounts, documents, TDS statements, TDS deposited and other available records.

Place

DOMBIVLI

Place Date

DOMBIVLI 25.05.2012 Signature of person responsible for deduction of tax Full Name : Mr. Madhukar A. Patil

Designation : Principal

135,460

section 80CCF - Infrastructure Bond section 80D : Mediclaim section 80G : Donation

Certificate No.: RVNHS/11-12/PDT/012

FORM No. 16 [See rule 31(1)(a)] PART A

Certificate under section 203 of the Income-tax Act, 1961for Tax deducted at source on Salary

Name and address of the Employer Name and Designation of the Employee R. V. NERURKAR HIGH SCHOOL TAGWALE PRAKASH DHANA R.V. Nerurkar High School,Dombivli Pandurang Wadi, Manpada Road, Manpada Road, Dombivli (E) Thane, Maharashtra Thane, Maharashtra 421201 PAN of the Deductor TAN of the Deductor Pan of the Employee AABTS4721P PNER07589B AAZPT5066C CIT (TDS) Period Assessment Year Address : The Commissioner of Income Tax (TDS) From To 4th Fl., A Wing, PMT Commercial Complex, 2012-13 01.04.11 31.03.12 Shankar Sheth Rd., Swargate, Pune 411037 Summary of tax deducted at source

Quarter Quarter 1 Quarter 2 Quarter 3 Quarter 4 Total Receipt Numbers of original statements of TDS under sub-section (3) of section 200. Amount of tax deducted in respect of the employee

DDHXXWMC DDHXXJMD DDHXBTHA DDHXEEUB

500 1,500 7,880 9,880

Amount of tax deposited/remitted in respect of the employee

500 1,500 7,880 9,880

1 (a) (b) (c) (d) 2

PART B (Refer Note 1) Details of Salary paid and any other income and tax deducted Rs. Rs. Gross Salary Salary as per provisions contained in sec. 17(1) 468,495 Value of perquisities u/s 17(2) (as per Form No. 12BB, whether applicable) Profits in lieu of salary under section 17(3) ( as per Form No. 12BB, wherever applicable) Total 468,495 468,495 Less : Allowance to the extent exempt u/s 10 Allowance Rs.

Conveyance 2,107 2,107 2,107 466,388

Rs.

3 4 (a) (b) 5 6 7

Balance (1-2) Deductions : Entertainment allowance Tax on employment Aggregate of 4(a) and (b) Income chargeable under the head 'salaries' (3-5) Add : Any other income reported by the employee Income Rs.

2,500 2,500 463,888

Hsg. Loan Int. Gross total income (6+7)

(87,969)

(87,969) 375,919

2...

: 2 : 9 (A) (a) Deduction under Chapter VIA sections 80C, 80CCC and 80CCD section 80C

(i) Provident Fund (ii) Life Insurance Corporation of India (iii) Housing Loan - Principal (iv) (v) (vi) (vii) (b) section 80CCC (c) section 80CCD

Gross Amount 70,282 45,192 11,574 -

Deductible Amount 70,282 45,192 11,574

(B) (i) (ii) (iii) (iv) (v) 10 11 12 13 14 15 16

Shall not exceed one lakh rupees. Aggregate amount deductible under the three section i.e. 80C,80CCC and 80CCD shall not exceed one lakh rupees. Other sections (e.g. 80E, 80G etc.) under Chapter VIA Gross section section section section section Aggregate of deductible amount under Chapter VIA Total Income (8-10) Tax on total income Eduction Cess @3% (on tax computed at S.No. 12) Tax Payable (12+13) Less : Relief under section 89 (attach details) Tax Payable (14-15) Verification

Amount -

Qualifying Deductible Amount Amount 100,000 275,919 9,592 288 9,880 9,880

I,Madhukar A. Patil son/ daughter of Akaram Patil working in the capacity of Principal do hereby certify that a sum of Rs. Nine Thousand Eight Hundred Eighty Only (Rs.9.880/- Only) has been deducted and deposited to the credit of the Central Government. I further certify that the information given above is true, complete and correct and is based on the books of accounts, documents, TDS statements, TDS deposited and other available records.

Place

DOMBIVLI

Place Date

DOMBIVLI 25.05.2012 Signature of person responsible for deduction of tax Full Name : Mr. Madhukar A. Patil

Designation : Principal

127,048 Housing Loan - Principal

section 80CCF - Infrastructure Bond section 80D : Mediclaim section 80G : Donation

Certificate No.: RVNHS/11-12/RAP/013

FORM No. 16 [See rule 31(1)(a)] PART A

Certificate under section 203 of the Income-tax Act, 1961for Tax deducted at source on Salary

Name and address of the Employer Name and Designation of the Employee R. V. NERURKAR HIGH SCHOOL PATIL RAJESH ADHAR R.V. Nerurkar High School,Dombivli 105, Pushpanjali Apartment, Manpada Road, Katrap Badlapur (E), Ambernath Thane, Maharashtra Thane, Maharashtra 421503 PAN of the Deductor TAN of the Deductor Pan of the Employee AABTS4721P PNER07589B AFYPP7710F CIT (TDS) Period Assessment Year Address : The Commissioner of Income Tax (TDS) From To 4th Fl., A Wing, PMT Commercial Complex, 2012-13 01.04.11 31.03.12 Shankar Sheth Rd., Swargate, Pune 411037 Summary of tax deducted at source

Quarter Quarter 1 Quarter 2 Quarter 3 Quarter 4 Total Receipt Numbers of original statements of TDS under sub-section (3) of section 200. Amount of tax deducted in respect of the employee

DDHXXWMC DDHXXJMD DDHXBTHA DDHXEEUB

1,000 3,000 10,399 14,399

Amount of tax deposited/remitted in respect of the employee

1,000 3,000 10,399 14,399

1 (a) (b) (c) (d) 2

PART B (Refer Note 1) Details of Salary paid and any other income and tax deducted Rs. Rs. Gross Salary Salary as per provisions contained in sec. 17(1) 485,667 Value of perquisities u/s 17(2) (as per Form No. 12BB, whether applicable) Profits in lieu of salary under section 17(3) ( as per Form No. 12BB, wherever applicable) Total 485,667 485,667 Less : Allowance to the extent exempt u/s 10 Allowance Rs.

Conveyance 8,427 8,427 8,427 477,240

Rs.

3 4 (a) (b) 5 6 7

Balance (1-2) Deductions : Entertainment allowance Tax on employment Aggregate of 4(a) and (b) Income chargeable under the head 'salaries' (3-5) Add : Any other income reported by the employee Income Rs.

2,500 2,500 474,740

Hsg. Loan Int. Gross total income (6+7)

(54,936)

(54,936) 419,804

2...

: 2 : 9 (A) (a) (i) (ii) (iii) (iv) (v) (vi) (vii) (b) (c) Deduction under Chapter VIA sections 80C, 80CCC and 80CCD section 80C Provident Fund Life Insurance Corporation of India Housing Loan - Principal Tuition Fees

section 80CCC section 80CCD

Gross Amount 70,450 62,460 19,655 11,000 -

Deductible Amount 70,450 62,460 19,655 11,000

(B) (i) (ii) (iii) (iv) (v) 10 11 12 13 14 15 16

Shall not exceed one lakh rupees. Aggregate amount deductible under the three section i.e. 80C,80CCC and 80CCD shall not exceed one lakh rupees. Other sections (e.g. 80E, 80G etc.) under Chapter VIA Gross section section section section section Aggregate of deductible amount under Chapter VIA Total Income (8-10) Tax on total income Eduction Cess @3% (on tax computed at S.No. 12) Tax Payable (12+13) Less : Relief under section 89 (attach details) Tax Payable (14-15) Verification

Amount -

Qualifying Deductible Amount Amount 100,000 319,804 13,980 419 14,399 14,399

I,Madhukar A. Patil son/ daughter of Akaram Patil working in the capacity of Principal do hereby certify that a sum of Rs. Forteen Thousand Three Hundred Ninety Nine Only (Rs.14,399/- Only) has been deducted and deposited to the credit of the Central Government. I further certify that the information given above is true, complete and correct and is based on the books of accounts, documents, TDS statements, TDS deposited and other available records.

Place

DOMBIVLI

Place Date

DOMBIVLI 25.05.2012 Signature of person responsible for deduction of tax Full Name : Mr. Madhukar A. Patil

Designation : Principal

163,565 Housing Loan - Principal

section 80CCF - Infrastructure Bond section 80D : Mediclaim section 80G : Donation

Certificate No.: RVNHS/11-12/VSP/015

FORM No. 16 [See rule 31(1)(a)] PART A

Certificate under section 203 of the Income-tax Act, 1961for Tax deducted at source on Salary

Name and address of the Employer Name and Designation of the Employee R. V. NERURKAR HIGH SCHOOL PATIL VIDYA SHIVAJI R.V. Nerurkar High School,Dombivli 8, Janardhan Niwas, Manpada Road, Kopergaon, Dombivli (E) Thane, Maharashtra Thane, Maharashtra 421202 PAN of the Deductor TAN of the Deductor Pan of the Employee AABTS4721P PNER07589B AWFPP1632A CIT (TDS) Period Assessment Year Address : The Commissioner of Income Tax (TDS) From To 4th Fl., A Wing, PMT Commercial Complex, 2012-13 01.04.11 31.03.12 Shankar Sheth Rd., Swargate, Pune 411037 Summary of tax deducted at source

Quarter Quarter 1 Quarter 2 Quarter 3 Quarter 4 Total Receipt Numbers of original statements of TDS under sub-section (3) of section 200. Amount of tax deducted in respect of the employee

DDHXXWMC DDHXXJMD DDHXBTHA DDHXEEUB

200 600 9,905 10,705

Amount of tax deposited/remitted in respect of the employee

200 600 9,905 10,705

1 (a) (b) (c) (d) 2

PART B (Refer Note 1) Details of Salary paid and any other income and tax deducted Rs. Rs. Gross Salary Salary as per provisions contained in sec. 17(1) 358,537 Value of perquisities u/s 17(2) (as per Form No. 12BB, whether applicable) Profits in lieu of salary under section 17(3) ( as per Form No. 12BB, wherever applicable) Total 358,537 358,537 Less : Allowance to the extent exempt u/s 10 Allowance Rs.

Conveyance 2,107 2,107 2,107 356,430

Rs.

3 4 (a) (b) 5 6 7

Balance (1-2) Deductions : Entertainment allowance Tax on employment Aggregate of 4(a) and (b) Income chargeable under the head 'salaries' (3-5) Add : Any other income reported by the employee Income Rs.

2,500 2,500 353,930

Gross total income (6+7)

353,930

2...

: 2 : 9 (A) (a) Deduction under Chapter VIA sections 80C, 80CCC and 80CCD section 80C

(i) Public Provident Fund (ii) Mutual Fund (iii) (iv) (v) (vi) (vii) (b) section 80CCC (c) section 80CCD

Gross Amount 20,000 40,000 -

Deductible Amount 20,000 40,000 -

(B) (i) (ii) (iii) (iv) (v) 10 11 12 13 14 15 16

Shall not exceed one lakh rupees. Aggregate amount deductible under the three section i.e. 80C,80CCC and 80CCD shall not exceed one lakh rupees. Other sections (e.g. 80E, 80G etc.) under Chapter VIA Gross section section section section section Aggregate of deductible amount under Chapter VIA Total Income (8-10) Tax on total income Eduction Cess @3% (on tax computed at S.No. 12) Tax Payable (12+13) Less : Relief under section 89 (attach details) Tax Payable (14-15) Verification

Amount -

Qualifying Deductible Amount Amount 60,000 293,930 10,393 312 10,705 10,705

I,Madhukar A. Patil son/ daughter of Akaram Patil working in the capacity of Principal do hereby certify that a sum of Rs. Ten Thousand Seven Hundred Five Only (Rs.10,705/- Only) has been deducted and deposited to the credit of the Central Government. I further certify that the information given above is true, complete and correct and is based on the books of accounts, documents, TDS statements, TDS deposited and other available records.

Place

DOMBIVLI

Place Date

DOMBIVLI 25.05.2012 Signature of person responsible for deduction of tax Full Name : Mr. Madhukar A. Patil

Designation : Principal

60,000

Provident Fund Life Insurance Corporation of India Housing Loan - Principal

section 80CCF - Infrastructure Bond section 80D : Mediclaim section 80G : Donation

Certificate No.: RVNHS/11-12/MSS/016

FORM No. 16 [See rule 31(1)(a)] PART A

Certificate under section 203 of the Income-tax Act, 1961for Tax deducted at source on Salary

Name and address of the Employer Name and Designation of the Employee R. V. NERURKAR HIGH SCHOOL MORE SMITA SANTOSH R.V. Nerurkar High School,Dombivli 3-17, Sai Nagari, Manpada Road, Mith Bunder Rd., Chendani Koli Wada, Thane, Maharashtra Thane(E), Maharashtra 400603 PAN of the Deductor TAN of the Deductor Pan of the Employee AABTS4721P PNER07589B ARGPM5017Q CIT (TDS) Period Assessment Year Address : The Commissioner of Income Tax (TDS) From To 4th Fl., A Wing, PMT Commercial Complex, 2012-13 01.04.11 31.03.12 Shankar Sheth Rd., Swargate, Pune 411037 Summary of tax deducted at source

Quarter Quarter 1 Quarter 2 Quarter 3 Quarter 4 Total Receipt Numbers of original statements of TDS under sub-section (3) of section 200. Amount of tax deducted in respect of the employee

DDHXXWMC DDHXXJMD DDHXBTHA DDHXEEUB

600 600

Amount of tax deposited/remitted in respect of the employee

600 600

1 (a) (b) (c) (d) 2

PART B (Refer Note 1) Details of Salary paid and any other income and tax deducted Rs. Rs. Gross Salary Salary as per provisions contained in sec. 17(1) 348,147 Value of perquisities u/s 17(2) (as per Form No. 12BB, whether applicable) Profits in lieu of salary under section 17(3) ( as per Form No. 12BB, wherever applicable) Total 348,147 348,147 Less : Allowance to the extent exempt u/s 10 Allowance Rs.

Conveyance 2,107 2,107 2,107 346,040

Rs.

3 4 (a) (b) 5 6 7

Balance (1-2) Deductions : Entertainment allowance Tax on employment Aggregate of 4(a) and (b) Income chargeable under the head 'salaries' (3-5) Add : Any other income reported by the employee Income Rs.

2,500 2,500 343,540

Hsg. Loan Int. Gross total income (6+7)

(54,559)

(54,559) 288,981

2...

: 2 : 9 (A) (a) (i) (ii) (iii) (iv) (v) (vi) (vii) (b) (c) Deduction under Chapter VIA sections 80C, 80CCC and 80CCD section 80C Fixed Deposit Mutual Fund Life Insurance Corporation of India - ULIP Housing Loan - Principal

section 80CCC section 80CCD

Gross Amount 12,000 18,000 50,000 19,841 -

Deductible Amount 12,000 18,000 50,000 19,841

(B) (i) (ii) (iii) (iv) (v) 10 11 12 13 14 15 16

Shall not exceed one lakh rupees. Aggregate amount deductible under the three section i.e. 80C,80CCC and 80CCD shall not exceed one lakh rupees. Other sections (e.g. 80E, 80G etc.) under Chapter VIA Gross section section section section section Aggregate of deductible amount under Chapter VIA Total Income (8-10) Tax on total income Eduction Cess @3% (on tax computed at S.No. 12) Tax Payable (12+13) Less : Relief under section 89 (attach details) Tax Payable (14-15) Verification

Amount -

Qualifying Deductible Amount Amount 99,841 189,140 NIL NIL NIL NIL

I,Madhukar A. Patil son/ daughter of Akaram Patil working in the capacity of Principal do hereby certify that a sum of Rs. Six Hundred Five Only (Rs.600/- Only) has been deducted and deposited to the credit of the Central Government. I further certify that the information given above is true, complete and correct and is based on the books of accounts, documents, TDS statements, TDS deposited and other available records.

Place

DOMBIVLI

Place Date

DOMBIVLI 25.05.2012 Signature of person responsible for deduction of tax Full Name : Mr. Madhukar A. Patil

Designation : Principal

99,841

Public Provident Fund Provident Fund Life Insurance Corporation of India Housing Loan - Principal

section 80CCF - Infrastructure Bond section 80D : Mediclaim section 80G : Donation

Certificate No.: RVNHS/11-12/MST/017

FORM No. 16 [See rule 31(1)(a)] PART A

Certificate under section 203 of the Income-tax Act, 1961for Tax deducted at source on Salary

Name and address of the Employer Name and Designation of the Employee R. V. NERURKAR HIGH SCHOOL TENDULKAR MANSI SHASHIKANT R.V. Nerurkar High School,Dombivli Pandurang Wadi, Manpada Road, Manpada Road, Dombivli (E) Thane, Maharashtra Thane, Maharashtra 421201 PAN of the Deductor TAN of the Deductor Pan of the Employee AABTS4721P PNER07589B AATPT6242Q CIT (TDS) Period Assessment Year Address : The Commissioner of Income Tax (TDS) From To 4th Fl., A Wing, PMT Commercial Complex, 2012-13 01.04.11 31.03.12 Shankar Sheth Rd., Swargate, Pune 411037 Summary of tax deducted at source

Quarter Quarter 1 Quarter 2 Quarter 3 Quarter 4 Total Receipt Numbers of original statements of TDS under sub-section (3) of section 200. Amount of tax deducted in respect of the employee

DDHXXWMC DDHXXJMD DDHXBTHA DDHXEEUB

600 1,800 13,759 16,159

Amount of tax deposited/remitted in respect of the employee

600 1,800 13,759 16,159

1 (a) (b) (c) (d) 2

PART B (Refer Note 1) Details of Salary paid and any other income and tax deducted Rs. Rs. Gross Salary Salary as per provisions contained in sec. 17(1) 476,680 Value of perquisities u/s 17(2) (as per Form No. 12BB, whether applicable) Profits in lieu of salary under section 17(3) ( as per Form No. 12BB, wherever applicable) Total 476,680 476,680 Less : Allowance to the extent exempt u/s 10 Allowance Rs.

Conveyance 2,107 2,107 2,107 474,573

Rs.

3 4 (a) (b) 5 6 7

Balance (1-2) Deductions : Entertainment allowance Tax on employment Aggregate of 4(a) and (b) Income chargeable under the head 'salaries' (3-5) Add : Any other income reported by the employee Income Rs.

2,500 2,500 472,073

Gross total income (6+7)

472,073

2...

: 2 : 9 (A) (a) Deduction under Chapter VIA sections 80C, 80CCC and 80CCD section 80C

(i) Provident Fund (ii) (iii) (iv) (v) (vi) (vii) (b) section 80CCC (c) section 80CCD

Gross Amount 153,101

Deductible Amount 153,101 -

(B) (i) (ii) (iii) (iv) (v) 10 11 12 13 14 15 16

Shall not exceed one lakh rupees. Aggregate amount deductible under the three section i.e. 80C,80CCC and 80CCD shall not exceed one lakh rupees. Other sections (e.g. 80E, 80G etc.) under Chapter VIA Gross section 80CCF - Infrastructure Bond section 80D : Mediclaim section section section Aggregate of deductible amount under Chapter VIA Total Income (8-10) Tax on total income Eduction Cess @3% (on tax computed at S.No. 12) Tax Payable (12+13) Less : Relief under section 89 (attach details) Tax Payable (14-15) Verification

Amount -

Qualifying Deductible Amount Amount 20,000 20,000 5,190 5,190 125,190 346,883 15,688 471 16,159 16,159

I,Madhukar A. Patil son/ daughter of Akaram Patil working in the capacity of Principal do hereby certify that a sum of Rs. Sixteen Thousand One Hundred Fifty Nine Only (Rs.16,159/- Only) has been deducted and deposited to the credit of the Central Government. I further certify that the information given above is true, complete and correct and is based on the books of accounts, documents, TDS statements, TDS deposited and other available records.

Place

DOMBIVLI

Place Date

DOMBIVLI 25.05.2012 Signature of person responsible for deduction of tax Full Name : Mr. Madhukar A. Patil

Designation : Principal

153,101

Provident Fund Life Insurance Corporation of India Housing Loan - Principal Public Provident Fund Mutual Fund

section 80CCF - Infrastructure Bond section 80D : Mediclaim section 80G : Donation

Certificate No.: RVNHS/11-12/SBC/018

FORM No. 16 [See rule 31(1)(a)] PART A

Certificate under section 203 of the Income-tax Act, 1961for Tax deducted at source on Salary

Name and address of the Employer Name and Designation of the Employee R. V. NERURKAR HIGH SCHOOL CHAVAN SANDHYA BALAKRISHNA R.V. Nerurkar High School,Dombivli Pandurang Wadi, Manpada Road, Manpada Road, Dombivli (E) Thane, Maharashtra Thane, Maharashtra 421201 PAN of the Deductor TAN of the Deductor Pan of the Employee AABTS4721P PNER07589B AAWPC2922M CIT (TDS) Period Assessment Year Address : The Commissioner of Income Tax (TDS) From To 4th Fl., A Wing, PMT Commercial Complex, 2012-13 01.04.11 31.03.12 Shankar Sheth Rd., Swargate, Pune 411037 Summary of tax deducted at source

Quarter Quarter 1 Quarter 2 Quarter 3 Quarter 4 Total Receipt Numbers of original statements of TDS under sub-section (3) of section 200. Amount of tax deducted in respect of the employee

DDHXXWMC DDHXXJMD DDHXBTHA DDHXEEUB

500 1,500 15,975 17,975

Amount of tax deposited/remitted in respect of the employee

500 1,500 15,975 17,975

1 (a) (b) (c) (d) 2

PART B (Refer Note 1) Details of Salary paid and any other income and tax deducted Rs. Rs. Gross Salary Salary as per provisions contained in sec. 17(1) 469,114 Value of perquisities u/s 17(2) (as per Form No. 12BB, whether applicable) Profits in lieu of salary under section 17(3) ( as per Form No. 12BB, wherever applicable) Total 469,114 469,114 Less : Allowance to the extent exempt u/s 10 Allowance Rs.

Conveyance 2,107 2,107 2,107 467,007

Rs.

3 4 (a) (b) 5 6 7

Balance (1-2) Deductions : Entertainment allowance Tax on employment Aggregate of 4(a) and (b) Income chargeable under the head 'salaries' (3-5) Add : Any other income reported by the employee Income Rs.

2,500 2,500 464,507

Gross total income (6+7)

464,507

2...

: 2 : 9 (A) (a) Deduction under Chapter VIA sections 80C, 80CCC and 80CCD section 80C

(i) Provident Fund (ii) Life Insurance Corporation of India (iii) (iv) (v) (vi) (vii) (b) section 80CCC (c) section 80CCD

Gross Amount 128,706 28,014 -

Deductible Amount 128,706 28,014 -

(B) (i) (ii) (iii) (iv) (v) 10 11 12 13 14 15 16

Shall not exceed one lakh rupees. Aggregate amount deductible under the three section i.e. 80C,80CCC and 80CCD shall not exceed one lakh rupees. Other sections (e.g. 80E, 80G etc.) under Chapter VIA Gross section section section section section Aggregate of deductible amount under Chapter VIA Total Income (8-10) Tax on total income Eduction Cess @3% (on tax computed at S.No. 12) Tax Payable (12+13) Less : Relief under section 89 (attach details) Tax Payable (14-15) Verification

Amount -

Qualifying Deductible Amount Amount 100,000 364,507 17,451 524 17,974 17,974

I,Madhukar A. Patil son/ daughter of Akaram Patil working in the capacity of Principal do hereby certify that a sum of Rs. Seventeen Thousand Nine Hundred Seventy Five Only (Rs.17,975/- Only) has been deducted and deposited to the credit of the Central Government. I further certify that the information given above is true, complete and correct and is based on the books of accounts, documents, TDS statements, TDS deposited and other available records.

Place

DOMBIVLI

Place Date

DOMBIVLI 25.05.2012 Signature of person responsible for deduction of tax Full Name : Mr. Madhukar A. Patil

Designation : Principal

156,720

Provident Fund Life Insurance Corporation of India Housing Loan - Principal Public Provident Fund Mutual Fund

section 80CCF - Infrastructure Bond section 80D : Mediclaim section 80G : Donation

Certificate No.: RVNHS/11-12/STB/019

FORM No. 16 [See rule 31(1)(a)] PART A

Certificate under section 203 of the Income-tax Act, 1961for Tax deducted at source on Salary

Name and address of the Employer Name and Designation of the Employee R. V. NERURKAR HIGH SCHOOL BHOIR SAVITA TUKARAM R.V. Nerurkar High School,Dombivli Shivaji Nagar, 2nd Rabodi Bhoir Chawl, Manpada Road, Near Asha Building, Tahne (W) Thane, Maharashtra Thane, Maharashtra 400601 PAN of the Deductor TAN of the Deductor Pan of the Employee AABTS4721P PNER07589B AEXPB7163G CIT (TDS) Period Assessment Year Address : The Commissioner of Income Tax (TDS) From To 4th Fl., A Wing, PMT Commercial Complex, 2012-13 01.04.11 31.03.12 Shankar Sheth Rd., Swargate, Pune 411037 Summary of tax deducted at source

Quarter Quarter 1 Quarter 2 Quarter 3 Quarter 4 Total Receipt Numbers of original statements of TDS under sub-section (3) of section 200. Amount of tax deducted in respect of the employee

DDHXXWMC DDHXXJMD DDHXBTHA DDHXEEUB

Amount of tax deposited/remitted in respect of the employee

100 300 6,885 7,285

100 300 6,885 7,285

1 (a) (b) (c) (d) 2

PART B (Refer Note 1) Details of Salary paid and any other income and tax deducted Rs. Rs. Gross Salary Salary as per provisions contained in sec. 17(1) 385,341 Value of perquisities u/s 17(2) (as per Form No. 12BB, whether applicable) Profits in lieu of salary under section 17(3) ( as per Form No. 12BB, wherever applicable) Total 385,341 385,341 Less : Allowance to the extent exempt u/s 10 Allowance Rs.

Conveyance 2,107 2,107 2,107 383,234

Rs.

3 4 (a) (b) 5 6 7

Balance (1-2) Deductions : Entertainment allowance Tax on employment Aggregate of 4(a) and (b) Income chargeable under the head 'salaries' (3-5) Add : Any other income reported by the employee Income Rs.

2,500 2,500 380,734

Gross total income (6+7)

380,734

2...

: 2 : 9 (A) (a) Deduction under Chapter VIA sections 80C, 80CCC and 80CCD section 80C

(i) Provident Fund (ii) Life Insurance Corporation of India (iii) National Savings Certificate (iv) (v) (vi) (vii) (b) section 80CCC (c) section 80CCD

Gross Amount 44,346 17,748 40,000 -

Deductible Amount 44,346 17,748 40,000

(B) (i) (ii) (iii) (iv) (v) 10 11 12 13 14 15 16

Shall not exceed one lakh rupees. Aggregate amount deductible under the three section i.e. 80C,80CCC and 80CCD shall not exceed one lakh rupees. Other sections (e.g. 80E, 80G etc.) under Chapter VIA Gross section 80CCF - Infrastructure Bond section section section section Aggregate of deductible amount under Chapter VIA Total Income (8-10) Tax on total income Eduction Cess @3% (on tax computed at S.No. 12) Tax Payable (12+13) Less : Relief under section 89 (attach details) Tax Payable (14-15) Verification

Amount -

Qualifying Deductible Amount Amount 20,000 20,000 120,000 260,734 7,073 212 7,285 7,285

I,Madhukar A. Patil son/ daughter of Akaram Patil working in the capacity of Principal do hereby certify that a sum of Rs. Seven Thousand Two Hundred Eighty Five Only (Rs.7,285/- Only) has been deducted and deposited to the credit of the Central Government. I further certify that the information given above is true, complete and correct and is based on the books of accounts, documents, TDS statements, TDS deposited and other available records.

Place

DOMBIVLI

Place Date

DOMBIVLI 25.05.2012 Signature of person responsible for deduction of tax Full Name : Mr. Madhukar A. Patil

Designation : Principal

102,094

Provident Fund Life Insurance Corporation of India Housing Loan - Principal Public Provident Fund Mutual Fund

section 80CCF - Infrastructure Bond section 80D : Mediclaim section 80G : Donation

Certificate No.: RVNHS/11-12/YSG/020

FORM No. 16 [See rule 31(1)(a)] PART A

Certificate under section 203 of the Income-tax Act, 1961for Tax deducted at source on Salary

Name and address of the Employer Name and Designation of the Employee R. V. NERURKAR HIGH SCHOOL GANGURDE YOGEETA SHANKER R.V. Nerurkar High School,Dombivli Dombivli R.V. Nerurkar SH Manpada Rd, Manpada Road, Dombivli (E) Thane, Maharashtra Thane, Maharashtra 421203 PAN of the Deductor TAN of the Deductor Pan of the Employee AABTS4721P PNER07589B AHEPG7589D CIT (TDS) Period Assessment Year Address : The Commissioner of Income Tax (TDS) From To 4th Fl., A Wing, PMT Commercial Complex, 2012-13 01.04.11 31.03.12 Shankar Sheth Rd., Swargate, Pune 411037 Summary of tax deducted at source

Quarter Quarter 1 Quarter 2 Quarter 3 Quarter 4 Total Receipt Numbers of original statements of TDS under sub-section (3) of section 200. Amount of tax deducted in respect of the employee

DDHXXWMC DDHXXJMD DDHXBTHA DDHXEEUB

524 524

Amount of tax deposited/remitted in respect of the employee

524 524

1 (a) (b) (c) (d) 2

PART B (Refer Note 1) Details of Salary paid and any other income and tax deducted Rs. Rs. Gross Salary Salary as per provisions contained in sec. 17(1) 357,752 Value of perquisities u/s 17(2) (as per Form No. 12BB, whether applicable) Profits in lieu of salary under section 17(3) ( as per Form No. 12BB, wherever applicable) Total 357,752 357,752 Less : Allowance to the extent exempt u/s 10 Allowance Rs.

Conveyance 2,107 2,107 2,107 355,645

Rs.

3 4 (a) (b) 5 6 7

Balance (1-2) Deductions : Entertainment allowance Tax on employment Aggregate of 4(a) and (b) Income chargeable under the head 'salaries' (3-5) Add : Any other income reported by the employee Income Rs.

2,500 2,500 353,145

Housing Loan - Prin Gross total income (6+7)

(58,052)

(58,052) 295,093

2...

: 2 : 9 (A) (a) Deduction under Chapter VIA sections 80C, 80CCC and 80CCD section 80C

(i) Provident Fund (ii) Life Insurance Corporation of India (iii) Housing Loan - Principal (iv) (v) (vi) (vii) (b) section 80CCC (c) section 80CCD

Gross Amount 43,118 27,034 66,748 -

Deductible Amount 43,118 27,034 66,748

(B) (i) (ii) (iii) (iv) (v) 10 11 12 13 14 15 16

Shall not exceed one lakh rupees. Aggregate amount deductible under the three section i.e. 80C,80CCC and 80CCD shall not exceed one lakh rupees. Other sections (e.g. 80E, 80G etc.) under Chapter VIA Gross section section section section section Aggregate of deductible amount under Chapter VIA Total Income (8-10) Tax on total income Eduction Cess @3% (on tax computed at S.No. 12) Tax Payable (12+13) Less : Relief under section 89 (attach details) Tax Payable (14-15) Verification

Amount -

Qualifying Deductible Amount Amount 100,000 195,093 509 15 524 524

I,Madhukar A. Patil son/ daughter of Akaram Patil working in the capacity of Principal do hereby certify that a sum of Rs. Five Hundred Twenty Four Only (Rs.524/- Only) has been deducted and deposited to the credit of the Central Government. I further certify that the information given above is true, complete and correct and is based on the books of accounts, documents, TDS statements, TDS deposited and other available records.

Place

DOMBIVLI

Place Date

DOMBIVLI 25.05.2012 Signature of person responsible for deduction of tax Full Name : Mr. Madhukar A. Patil

Designation : Principal

136,900

Provident Fund Life Insurance Corporation of India Housing Loan - Principal Public Provident Fund Mutual Fund

section 80CCF - Infrastructure Bond section 80D : Mediclaim section 80G : Donation

Certificate No.: RVNHS/11-12/LHH/021

FORM No. 16 [See rule 31(1)(a)] PART A

Certificate under section 203 of the Income-tax Act, 1961for Tax deducted at source on Salary

Name and address of the Employer Name and Designation of the Employee R. V. NERURKAR HIGH SCHOOL HADAL LAHU KISAN R.V. Nerurkar High School,Dombivli 36, Prabhakar Bldg., Manpada Road, Surya Nagar, Phase -I, MIDC Rd, kulgaon Thane, Maharashtra Badlapur, Maharashtra 421503 PAN of the Deductor TAN of the Deductor Pan of the Employee AABTS4721P PNER07589B ACRPH5927L CIT (TDS) Period Assessment Year Address : The Commissioner of Income Tax (TDS) From To 4th Fl., A Wing, PMT Commercial Complex, 2012-13 01.04.11 31.03.12 Shankar Sheth Rd., Swargate, Pune 411037 Summary of tax deducted at source

Quarter Quarter 1 Quarter 2 Quarter 3 Quarter 4 Total Receipt Numbers of original statements of TDS under sub-section (3) of section 200. Amount of tax deducted in respect of the employee

DDHXXWMC DDHXXJMD DDHXBTHA DDHXEEUB

200 600 3,829 4,629

Amount of tax deposited/remitted in respect of the employee

200 600 3,829 4,629

1 (a) (b) (c) (d) 2

PART B (Refer Note 1) Details of Salary paid and any other income and tax deducted Rs. Rs. Gross Salary Salary as per provisions contained in sec. 17(1) 329,549 Value of perquisities u/s 17(2) (as per Form No. 12BB, whether applicable) Profits in lieu of salary under section 17(3) ( as per Form No. 12BB, wherever applicable) Total 329,549 329,549 Less : Allowance to the extent exempt u/s 10 Allowance Rs.

Conveyance 2,107 2,107 2,107 327,442

Rs.

3 4 (a) (b) 5 6 7

Balance (1-2) Deductions : Entertainment allowance Tax on employment Aggregate of 4(a) and (b) Income chargeable under the head 'salaries' (3-5) Add : Any other income reported by the employee Income Rs.

2,500 2,500 324,942

Gross total income (6+7)

324,942

2...

: 2 : 9 (A) (a) Deduction under Chapter VIA sections 80C, 80CCC and 80CCD section 80C

(i) Provident Fund (ii) Life Insurance Corporation of India (iii) Birla Sunlife (iv) (v) (vi) (vii) (b) section 80CCC (c) section 80CCD

Gross Amount 45,215 12,953 44,988 -

Deductible Amount 45,215 12,953 44,988 -

(B) (i) (ii) (iii) (iv) (v) 10 11 12 13 14 15 16

Shall not exceed one lakh rupees. Aggregate amount deductible under the three section i.e. 80C,80CCC and 80CCD shall not exceed one lakh rupees. Other sections (e.g. 80E, 80G etc.) under Chapter VIA Gross section section section section section Aggregate of deductible amount under Chapter VIA Total Income (8-10) Tax on total income Eduction Cess @3% (on tax computed at S.No. 12) Tax Payable (12+13) Less : Relief under section 89 (attach details) Tax Payable (14-15) Verification

Amount -

Qualifying Deductible Amount Amount 100,000 224,942 4,494 135 4,629 4,629

I,Madhukar A. Patil son/ daughter of Akaram Patil working in the capacity of Principal do hereby certify that a sum of Rs. Four Thousand Six Hundred Twenty Nine Only (Rs.4,629/- Only) has been deducted and deposited to the credit of the Central Government. I further certify that the information given above is true, complete and correct and is based on the books of accounts, documents, TDS statements, TDS deposited and other available records.

Place

DOMBIVLI

Place Date

DOMBIVLI 25.05.2012 Signature of person responsible for deduction of tax Full Name : Mr. Madhukar A. Patil

Designation : Principal

103,156 Housing Loan - Principal

section 80CCF - Infrastructure Bond section 80D : Mediclaim section 80G : Donation

Certificate No.: RVNHS/11-12/KTB/022

FORM No. 16 [See rule 31(1)(a)] PART A

Certificate under section 203 of the Income-tax Act, 1961for Tax deducted at source on Salary

Name and address of the Employer Name and Designation of the Employee R. V. NERURKAR HIGH SCHOOL BENDKOLI KHANDU TUKARAM R.V. Nerurkar High School,Dombivli R V Nerurkar High School, Pandurang Wadi, Manpada Road, Manpada Road, Dombivli (E) Thane, Maharashtra Thane, Maharashtra 421201 PAN of the Deductor TAN of the Deductor Pan of the Employee AABTS4721P PNER07589B AKNPB0831D CIT (TDS) Period Assessment Year Address : The Commissioner of Income Tax (TDS) From To 4th Fl., A Wing, PMT Commercial Complex, 2012-13 01.04.11 31.03.12 Shankar Sheth Rd., Swargate, Pune 411037 Summary of tax deducted at source

Quarter Quarter 1 Quarter 2 Quarter 3 Quarter 4 Total Receipt Numbers of original statements of TDS under sub-section (3) of section 200. Amount of tax deducted in respect of the employee

DDHXXWMC DDHXXJMD DDHXBTHA DDHXEEUB

Amount of tax deposited/remitted in respect of the employee

1 (a) (b) (c) (d) 2

PART B (Refer Note 1) Details of Salary paid and any other income and tax deducted Rs. Rs. Gross Salary Salary as per provisions contained in sec. 17(1) 323,869 Value of perquisities u/s 17(2) (as per Form No. 12BB, whether applicable) Profits in lieu of salary under section 17(3) ( as per Form No. 12BB, wherever applicable) Total 323,869 323,869 Less : Allowance to the extent exempt u/s 10 Allowance Rs.

Conveyance 2,107 2,107 2,107 321,762

Rs.

3 4 (a) (b) 5 6 7

Balance (1-2) Deductions : Entertainment allowance Tax on employment Aggregate of 4(a) and (b) Income chargeable under the head 'salaries' (3-5) Add : Any other income reported by the employee Income Rs.

2,500 2,500 319,262

Hsg. Loan - Prin. Gross total income (6+7)

(90,937)

(90,937) 228,325