Professional Documents

Culture Documents

203905853

Uploaded by

Krisna Eka PutraOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

203905853

Uploaded by

Krisna Eka PutraCopyright:

Available Formats

International Journal of Forecasting 16 (2000) 509515 www.elsevier.

com / locate / ijforecast

Automatic neural network modeling for univariate time series

a, b Sandy D. Balkin *, J. Keith Ord

b a Ernst & Young LLP, 1225 Connecticut Avenue, NW, Washington, DC 20037, USA McDonough School of Business, 320 Old North, Georgetown University, Washington, DC 20057, USA

Abstract Articial neural networks (ANNs) are an information processing paradigm inspired by the way the brain processes information. Using neural networks requires the investigator to make decisions concerning the architecture or structure used. ANNs are known to be universal function approximators and are capable of exploiting nonlinear relationships between variables. This method, called Automated ANNs, is an attempt to develop an automatic procedure for selecting the architecture of an articial neural network for forecasting purposes. It was entered into the M-3 Time Series Competition. Results show that ANNs compete well with the other methods investigated, but may produce poor results if used under certain conditions. 2000 Elsevier Science B.V. All rights reserved.

Keywords: Articial neural networks; Automated ANNs; Architecture

1. Introduction An articial neural network (ANN) is an information processing paradigm that is inspired by the way the brain processes information. The key element of this paradigm is the novel structure of the information processing system. It is composed of highly interconnected processing elements (neurons) working in unison to solve specic problems. ANNs, like people, learn by example. An ANN is congured for a specic application, such as pattern recognition or data classication, through a learning pro*Corresponding author. E-mail addresses: sandy.balkin@ey.com (S.D. Balkin), ordk@msb.edu (J. . Ord).

cess. Learning in biological systems involves adjustments to the synaptic connections that exist between the neurons. This is true of ANNs as well. In statistical parlance, the ANN network corresponds to a nonlinear model and the learning process to parameter estimation. For an introduction to ANNs see, for example, Hinton (1992) or Lippmann (1987), and for a review from a statistical perspective, see Cheng and Titterington (1994). Recently, ANNs have been investigated as a tool for time series forecasting. A survey of the literature is given in Zhang, Patuwo, and Hu (1998). The most popular class, used exclusively in this study, is the multilayer perceptron, a feedforward network trained by backpropagation. This class of network consists of an input

0169-2070 / 00 / $ see front matter 2000 Elsevier Science B.V. All rights reserved. PII: S0169-2070( 00 )00072-8

510

S.D. Balkin, J.K. Ord / International Journal of Forecasting 16 (2000) 509 515

the important relationships in the time series being forecast. For a feedforward neural network with one hidden layer, the prediction equation, given by Faraway and Chateld (1998), for computing forecasts x t using selected past observations, x t2j 1 , . . . , x t 2j k , at lags ( j 1 , . . . , j k ) and h nodes in the hidden layer will be referred to as NN[ j 1 , . . . , j k ; h]. Thus, the network in Fig. 1 is NN[1, 12, 13; 2]. The functional form may be written as x t 5 fo w co 1

O w f Sw 1O w x DD

ho h ch h i ih t 2j i

(1)

Fig. 1. Multilayer perceptron.

layer, a number of hidden layers and an output layer. Fig. 1 is an example of an ANN of this type with three neurons in the input layer, a single hidden layer with two neurons, and one neuron in the output layer. Using this type of ANN requires the investigator to make certain decisions concerning the structure, known as the architecture of the network. Neural networks are known to be universal function approximators (Hornik, Stinchcombe, & White, 1989). This property does not necessarily hold for time series where forecasting involves extrapolation. It holds when an unknown function is dened over a nite range of its arguments. The property may be of limited value in forecasting where: 1. processes are stochastic so that, at best, only the signal can be estimated; 2. prediction necessarily involves moving beyond the time range of historical inputs. In general, for an ANN to perform well, the inputs and number of nodes in the hidden layer must be carefully chosen. Since they learn by example, it is vital that the inputs characterize

where hw ch j denote the weights for the connections between the constant input and the hidden neurons and w co denotes the weight of the direct connection between the constant input and the output. The weights hw ih j and hw ho j denote the weights for the other connections between the inputs and the hidden neurons and between the hidden neurons and the output, respectively. The two functions fh and fo denote the activation functions that dene the mappings from inputs to hidden nodes and from hidden nodes to output(s), respectively. The logistic function, y 5 f (x) 5 1 /(1 1 e 2x) is widely used in the ANN literature. Faraway and Chateld (1998) recommend that for forecasting applications fh be logistic and f0 be the identify function. Forecasts are generated iteratively by performing successive one-step ahead forecasts using previous forecasts as estimates of observables.

2. Description of method Our goal is to develop a set of rules on which to base the design decisions. Our primary concern is to make the model selection process data dependent. We tried to follow the paradigm used in more traditional forecasting methods

S.D. Balkin, J.K. Ord / International Journal of Forecasting 16 (2000) 509 515

511

while not inhibiting the exibility of the neural network method. The following is a detailed explanation of the decision-making process we implemented. Since the parameters of the ANN are estimated by least squares, efcient estimates result only when the error terms are independent and have equal variances. If the process is intrinsically non-stationary, the error terms may well be dependent and have different variances. For the purposes of this exercise, we decided not to apply differencing, since proponents of ANN forecasting seem to regard such a step as unnecessary. This question is explored in greater detail elsewhere (Balkin, 1999, 2000). Thus, the rst step is to determine if a natural log transformation of the series is necessary. This step is accomplished using the likelihood ratio. Let 1 2 w 5] n and 1 s2 5 ] n 1 O Slog(x ) 2 ] O log(x)D . n

2 i i i

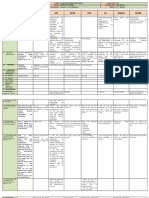

Table 1 Lags used as inputs based on time resolution Time unit Lags Yearly 14 Quarterly 16 Monthly 115 Other 16

O (x 2 x )

i i

The likelihood is greater for the transformed series than the raw series when 2 log(s 2 ) . log(w 2 ) 1 ] n

2. The possible lags are chosen based on the time resolution of the series shown in Table 1. The inputs to the neural network are then chosen by considering all models that resulted in an F-statistic greater than 4.0 and choosing the one with the greatest number of included lags. For quarterly and other types of series, if the series length is less than 20, we only investigate lags 14. This rule is not parsimonious in terms of the number of lags, but our empirical studies suggest than an ANN may perform better with more lags than would be usual for an ARIMA model. However, Faraway and Chateld (1998) present evidence suggesting one may easily go too far in that regard. The neural network is now trained on the inputs with the number of hidden nodes in the single hidden layer ranging from 1 to the number of inputs. The best network is chosen based on the minimum GCV value as described in Nychka, Bailey, Ellner, Haaland, and OConnell (1996) where 1 GCV(c) 5 ] 3 RSS /(1 2 p 3 c /n)2 n where p denotes the number of parameters tted and c is a cost coefcient, set equal to 2 in this study. Thus, the number of hidden nodes is limited even further for small series to ensure that enough degrees of freedom exist to estimate all the model parameters. Then, a simple linear auto-regression is t with the same lags as variables selected by the GCV criterion. The linear AR model, ANN model and Naive (random walk) models are compared using the SBC criter-

O log(x )D;

i i

if the inequality holds, take the log transform. When necessary, making the transformation should yield more efcient estimates since the ANN is tted using the ordinary least squares criterion which requires constant error variance over time for efcient estimation. Next, we need to select the inputs used to train the network. The inputs to the network are chosen using a forward stepwise regression procedure with critical F-value equal to

512

S.D. Balkin, J.K. Ord / International Journal of Forecasting 16 (2000) 509 515

ion. The one with smallest value is chosen to generate the forecasts. The comparison allows us to see whether a neural network is even necessary. For if the series is truly linear and a nonlinear model is used, the extra structure will add noise to the system and distort the forecasts. Forecasts are now generated from the selected model in an iterative fashion. A reverse transformation is applied, if necessary.

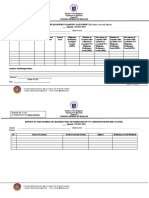

4. Numerical example [1 As an example of how this method works, consider series N0702 from the M-3 Competition data set, which is a quarterly microeconomic series with 37 observations. The rst step is to determine if a log transform is required. We rst determine that s 2 5 33 669.8 and w 2 5 0.002815279 and test whether 2 log(33 669.8) . log(0.002815279) 1 ] 37 3 301.2136 10.4244 . 10.4091 These values correspond to a likelihood ratio test marginally in favor of a logarithmic transformation. Next, we determine which lags to use as inputs. Since this series is quarterly, lags 1 through 6 are considered as candidates. We then run a forward stepwise regression. Lags 1, 2, 4 and 5 are chosen to be the inputs to the neural network. We now train the neural networks with one and two nodes in the hidden layer. The results are given in Table 2, which shows that model 1 with one node in the hidden layer is the preferred neural network model. We now t a linear regression model with the same lags and compare its SBC with that of the neural network. The SBC for the linear model is 276 while that of the neural network is 2296. The Naive model has a SBC equal to 2117. These results indicate that the neural network model provides a better t for this series and will be used to generate the forecasts. The actual series and forecasts are shown in Fig. 2.

3. Method analysis Estimating the weights of (or training) the neural network requires that the training data be representative of the process being forecast. The more training data, the more the network can learn about the series. How well a neural network does in forecasting stems from this idea. Thus, this method will not perform well for extremely short series or a series that is not representative of the process being modeled. An instance of the latter would be a series that requires intervention analysis to account for some uncharacteristic movements in the past. A majority of the research on neural networks concerns classication and pattern recognition (cf. Cheng & Titterington, 1994). When ANNs are described as being robust to noisy data, it is with reference to classication and pattern recognition. Typically, either the noise level is low or the data set is very large. It is still under investigation when and whether these characteristics apply to time series forecasting as well.

Table 2 Neural network t statistics Model 1 2 No. hidden units 1 2 DF model 7 13 DF residuals 25 19 Root MSE 0.10930 0.07042 GCV(1) 0.015290 0.008353 GCV(2) 0.02949 0.08376

S.D. Balkin, J.K. Ord / International Journal of Forecasting 16 (2000) 509 515

513

Fig. 2. Series N0702 and forecasts.

5. Numerical example [2 As an example of how this method may fail to provide reasonable forecasts, consider series N1386, from the M-3 Competition data set, which is a quarterly demographic data with 36 observations. The original series is shown in Fig. 3. Our analysis indicates that a log transformation is desirable and we select lags 1, 3, 4, 5 and 6 as inputs to the neural network. A neural network model with one node in the hidden layer is found to be the best. The SBC for the ANN is 2180 whereas that for the linear model is 276 and 264 for the Naive model. Thus, we nd that the neural network model provides a better t for this series and is used to generate the forecasts. The actual series and forecasts are shown in Fig. 4. It is obvious that these forecasts are characteristically different than the data used to generate them. Thus, in this example, the neural network model produced very poor forecasts. A possible reason for this is

the ANN model is particularly susceptible to outliers or level shifts that occur at the very end of the series and project unwarranted rapid exponential growth.

6. Conclusion Our paradigm attempts to provide an intelligent choice of inputs using recognized statistical procedures. An ANN typically has more parameters than most time series models. Therefore, it is expected that they will perform better on longer series with stable patterns for training. By construction, we would expect the ANN to provide superior forecasts when the process is nonlinear. The reason for using a complex method must be that a process contains elements not captured by simple forecasting methods, notably nonlinearity in the case of ANNs. For an ANN to outperform simple methods, we must have a sufciently long series to detect the nonlinearity and to provide reliable estimates of

514

S.D. Balkin, J.K. Ord / International Journal of Forecasting 16 (2000) 509 515

Fig. 3. Series N1386.

Fig. 4. Series N1386 and forecasts.

the parameters. When these conditions are satised, we can expect ANN to outperform simpler methods. Conversely, a simple method like exponential smoothing may well be adequate for forecasting most series, particularly when the series are short or have low information

content. Results for the M3 and other competitions are generalized over a large number of series. So, simple methods may produce overall better results, but the complex models will perform better for those series with the relevant structure. Such distinctions require that we

S.D. Balkin, J.K. Ord / International Journal of Forecasting 16 (2000) 509 515

515

analyze each series individually. This requirement comes as no surprise and is the reason that methods such as exponential smoothing are often used when automatic forecasting without user intervention is necessary. Acknowledgements The software we used for tting the neural networks for this competition is described in Nychka et al. (1996) and we thank them for making their work publicly available. Earlier work used software described in Venables and Ripley (1994). References

Balkin, S. D. (1999). Stationarity Concerns When Forecasting using Neural Networks, INFORMS Presentation, Philadelphia, PA. Balkin, S. D. (2000). A Statistical Implementation of Feedforward Neural Networks for Univariate Time Series Forecasting, The Pennsylvania State University, Department of Management Science & Information Systems, Unpublished Ph.D. dissertation. Cheng, B., & Titterington, D. M. (1994). Neural networks: a review from a statistical perspective. Statistical Science 9 (1), 254. Faraway, J., & Chateld, C. (1998). Time series forecasting with neural networks: a comparative study using the airline data. Applied Statistics 47 (2), 231250.

Hinton, G. (1992). How neural networks learn from experience. Scientic America, 145151, September. Hornik, K., Stinchcombe, M., & White, H. (1989). Multilayer feedforward networks are universal approximators. Neural Networks 2, 359366. Lippmann, R. P. (1987). An introduction to computing with neural nets. IEEE ASSP Mag. 4, 422, April. Nychka, D., Bailey, B., Ellner, S., Haaland, P., & OConnell, M. (1996). FUNFITS: data analysis and statistical tools for estimating functions, Department of Statistics, North Carolina State University. Venables, W. N., & Ripley, B. D. (1994). Modern Applied Statistics with S-Plus, Springer-Verlag, New York. Zhang, G., Patuwo, B. E., & Hu, M. Y. (1998). Forecasting with articial neural networks: the state of the art. International Journal of Forecasting 14 (1), 3562. Biographies: Sandy BALKIN is a statistical consultant with the Policy Economics and Quantitative Analysis group at Ernst & Young LLP in Washington, DC. He recently received his Ph.D. in Business Administration from the Pennsylvania State University. He specializes in forecasting and applied and computational statistics. Keith ORD is Professor of Decision Sciences in the McDonough School of Business at Georgetown University. He is co-author of the latest editions of Kendall s Advanced Theory of Statistics. His research interests include time series and forecasting, and inventory modeling. He is an editor of the International Journal of Forecasting.

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Modal Verbs in German - Everything You Need To KnowDocument9 pagesModal Verbs in German - Everything You Need To KnowPlatina 010203100% (2)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- IELTS Listening LectureDocument25 pagesIELTS Listening LectureIELTSguru100% (1)

- Mouse Tales (I Can Read Book 2)Document64 pagesMouse Tales (I Can Read Book 2)Humera Mistry100% (10)

- P. C. Deshmukh - Foundations of Classical Mechanics-Cambridge University Press (2019)Document590 pagesP. C. Deshmukh - Foundations of Classical Mechanics-Cambridge University Press (2019)RatoDorimeNo ratings yet

- Notional Syllabuses by David Arthur WilkDocument78 pagesNotional Syllabuses by David Arthur WilkpacoNo ratings yet

- Intra Uterine Growth RetardationDocument46 pagesIntra Uterine Growth RetardationIba Ghannam100% (1)

- Curriculum Planning & DevelopmentDocument13 pagesCurriculum Planning & DevelopmentMark Madridano100% (1)

- Grade 3 DLL All Subjects Q3 January 7, 2019Document4 pagesGrade 3 DLL All Subjects Q3 January 7, 2019Marlyn E. AzurinNo ratings yet

- Antiquarian LDocument60 pagesAntiquarian LSoumyajit DasNo ratings yet

- Report On The Learning Assessment MAAM MARIDocument6 pagesReport On The Learning Assessment MAAM MARImae santosNo ratings yet

- Aligarh Muslim University, Aligarh: Provisional Admit Card For Admission Test of Ph.D. in Clinical PsychologyDocument2 pagesAligarh Muslim University, Aligarh: Provisional Admit Card For Admission Test of Ph.D. in Clinical Psychologyalbaanamu321No ratings yet

- OriginalDocument3 pagesOriginalMagdi MohsenNo ratings yet

- Thesis On Compact Heat ExchangerDocument8 pagesThesis On Compact Heat Exchangerafkogsfea100% (2)

- Google Meet Video Conferencing Platform Improved - WorksheetDocument4 pagesGoogle Meet Video Conferencing Platform Improved - WorksheetHooshang Ghadiri SoofiNo ratings yet

- Info 2Document4 pagesInfo 2IanEmmanuel PomzNo ratings yet

- Individual Assignment - LAN Proposal ITT459Document5 pagesIndividual Assignment - LAN Proposal ITT459Fahim Amar0% (1)

- 02 WholeDocument156 pages02 WholeNgvinh PieNo ratings yet

- Learn How To Study BDocument22 pagesLearn How To Study BQuazi Aritra ReyanNo ratings yet

- Youtube Channel For Computer Science - It EngineeringDocument9 pagesYoutube Channel For Computer Science - It EngineeringpriyasNo ratings yet

- Sistem Informasi Manajemen McLeod Chapter 01Document29 pagesSistem Informasi Manajemen McLeod Chapter 01AgungTriyadiNo ratings yet

- Gujarat Technological University: Bachelor of Engineering Subjectcode: 3142201Document3 pagesGujarat Technological University: Bachelor of Engineering Subjectcode: 3142201simant kumar sinhaNo ratings yet

- Applied Mining Geology: Printed BookDocument1 pageApplied Mining Geology: Printed BookJavier CisnerosNo ratings yet

- Bilingual Education PDFDocument1 pageBilingual Education PDFMaria Martinez SanchezNo ratings yet

- DTLD ScoringDocument8 pagesDTLD Scoringblessy jonesNo ratings yet

- Informed Choices 2016 PDFDocument35 pagesInformed Choices 2016 PDFRamshaNo ratings yet

- ResumeDocument2 pagesResumeMa. Yedda BravoNo ratings yet

- Leadership: 1. Who Are Leaders and What Is LeadershipDocument10 pagesLeadership: 1. Who Are Leaders and What Is Leadershiphien cungNo ratings yet

- July 2020 Zadankai Speaker Emcee ScriptDocument1 pageJuly 2020 Zadankai Speaker Emcee ScriptMMilanNo ratings yet

- Cyber Security ConsultantDocument2 pagesCyber Security ConsultantFerdous WahidNo ratings yet

- Noemie BeaulieuDocument1 pageNoemie Beaulieumaricel ludiomanNo ratings yet