Professional Documents

Culture Documents

Factors for M&A Success and Failure

Uploaded by

xouyang3Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Factors for M&A Success and Failure

Uploaded by

xouyang3Copyright:

Available Formats

Page |1

Christian Montgomery Johns Hopkins University- Carey Business School Business Communication- 120.601(86) 5.8.2012

Page |2

Table of Contents I. Executive SummaryPage 3 II. Historical AnalysisPage 4 III. Common Pitfalls of M&A...Page 5 IV. Success for Our Customers.Page 7 V. Success for Our Employees..Page 7 VI. Success in Buyer M&A; a new school of thought..Page 8 VII. Validation of new approach through past failure..Page 9 VIII. Conclusion...Page 10 IX. References...Page 11

Page |3

Mergers & Acquisitions; what factors in to our potential success or failure?

Executive Summary: Every year there are thousands of mergers and acquisitions in the United States and thousands more from all over the world. They involve companies merging or acquiring in similar industries and they also involve two companies coming together with no related business activities. Some involve purchasing the controlling interest in the form of stock, others in the form of equity. Some involve retaining key personnel from the acquired company and others involve installing a new management team. Each deal is unique in the intricacies that lead up to the point that the deal is signed and unique in the varying outcomes after the deal closes and they are unique for both the seller and the buyer. The point of this is to illustrate that the world of mergers & acquisitions, or M&A, is extremely vast with each deal having its own uniqueness and confidential information that leads each party to come to their mutual agreement to move forward. Since we have established that the world of M&A is extremely complicated and confidential, we can also now assume that there is not one success formula to ensure sustained and long-term profits after the deal closes because of too many differentiating variables. In fact, despite their popularity, most mergers and acquisitions are financial failures and produce undesirable consequences for the people and companies involved. (Marks, Mirvis, 2011) The goal here is not to provide the reader with an analysis of one or two specific examples of M&A success or failure. Instead, the goal is to use the knowledge and analyses of many scholarly sources to come to a blended conclusion of trends that parallel examples of M&A success, microeconomic

Page |4

variables that seem to lead to an increase in M&A activity and then combine some ideas for best practices and recommendations to follow. Historical Analysis: When analyzing general trends of mergers and acquisitions, it is tough to separate out and dissect any one trend or a mathematical equation or function that leads to success. Because the arena is so segmented and each industry has their own deal intricacies that are inclusive and vital to the future success of their combined entity, one has to look in a more general way to find common themes amongst successful M&A deals. As a frame of reference, we have singled out two industries that seem to have a high volume of M&A activity in their arena every year; healthcare and technology. Specific to the healthcare industry is a rapid and seemingly ever changing regulatory environment. The healthcare sector is poised to undergo radical changes due to new regulatory regimes, political, and economic pressures. To withstand these powerful forces and operate in this highly competitive environment, entities have recognized a need to achieve greater economies of scale. As senior executives contemplate various growth scenarios, one avenue that continues to be of significant interest is mergers and acquisitions. Not since the mid- 1990s has the healthcare sector experienced such a significant number of consolidations. (Healthcare Financial Management, 2011) Along with the every changing regulatory environment, which are squeezing profits and forcing healthcare executives to analyze their revenue streams and economies of scale, accounting changes have also had a profound effect on these companies strategic maneuvers. In April 2009, the Financial Accounting Standards Board (FASB) issued Statement of Financial Accounting Standards No. 164, Not-for-Profit Entities: Mergers and Acquisitions (ASU 2010-17), which fundamentally changed the accounting not only for mergers

Page |5

and acquisitions but also for goodwill, intangible assets, and noncontrolling interests (NCIs). (Healthcare Financial Management, 2011) Before this accounting change, mergers or combinations in this sector were defined by if consideration was present. Meaning, if a hospital purchased a long-term care facility for $1MM, consideration was exchanged but if two hospitals simply merged to form a larger hospital, there was no consideration present. The accounting of no consideration was handled by the pooling-of-interest method which means all assets, liabilities and shareholders equity would be combined and going forward, assumed to be one. Today, the new GAAP requires these types of mergers to be classified as acquisitions and require the acquirer to determine the fair market value of all assets and liabilities of the acquired. This can be a very expensive and time consuming process for assets such as buildings, land, patents, etc. Applying the acquisition method will present unique challenges to not-for-prof its, and due to the many valuation issues associated with the guidance, it may require skill sets not currently possessed by internal resources. (Healthcare Financial Management, 2011) The technology sector is also a very active and vibrant M&A arena. As the restrictions on cross (industry) ownership and service provision were removed by deregulation and technological progress, the technology, media and telecommunications (TMT) industry embarked on the most fundamental change in its history and a massive wave of mergers and acquisitions followed. (Jope, Schiereck, & Zeidler, 2010) Similar to the healthcare industry, the deregulation of the technology sector and the economic developments lead to a hot bed of M&A activity. Common Pitfalls of M&A: For the use of this report, we will focus on typical ways deals fail for the buyer since that is the position our company is in. According to a survey that we conducted, we have found the normal catalysts for a destruction of value after a deal closes to be broken down into the what,

Page |6

where, who, how and the why of M&A failure. The what centers on the fact that M&A is not a losers game but also is not necessarily a winners game. Returns to buyers have a large standard deviation around the average indicating that this industry is like we have already stated, highly segmented and highly individualized. This is why it is important for our management team to be extremely diligent in our analysis and work in a worst-case scenario to forecast our economic gains before moving forward. The where describes the already present notion that hitting a grand slam may not be plausible so we must remain centered on returning the average to our investors. Our research shows a few typical ways buyers are more likely to fail in M&A; the buyer enters a fundamentally unprofitable industry or refuses to exit from one, the economic benefits of the deal are improbable or not marginal to the deal, the buyer does not structure the deal to the individual situation, and the buyer has poor systems of governance and incentives. The who is meant to describe the profiles of failure and success. We state that the buyer is more likely to fail when they acquire out of weakness and when the acquisition market is slow or cooled. (Bruner, 2005) This value destruction might be justified through necessary strategic positioning, however, since rival companies are also documented to suffer negative abnormal returns around announcement of such transactions. (Jope et al. 2010). The How of M&A failure may be one of the most robust and complicated components to our analysis. Business complexity makes it tough for managers to understand what is going on with the merger, those managers have limited or no flexibility, flaws in the operational team hamper responses to customer issues and the merger identified, structured and managed in a top-down manner.

Page |7

We have articulated some common problems or pitfalls of typical M&A failure but it is also important to talk about the people and resources it can affect and how we can develop alternative solutions to remain successful. Success for Our Customers: When a brand that a customer has been loyal to for many years ceases to exist, there are sometimes serious feelings involved which can lead to negative customer retention for the acquiring company. Customers may believe their personal freedom of choice has been restricted and consequently react negatively to the merged brand. When informed about an acquirerdominant M&A, customers of the acquired brand will develop greater intentions to switch. Efficient and strategic competitors will try and capitalize on these customers reduced loyalty by marketing to the acquiring companys weakness. That is why it is crucial that customers need to perceive a sense of choice in their future business with this new corporate entity (Dahln, Thorbjrnsen, 2011). Success for Our Employees: There are four areas of concern for employees as their company goes through a merger or acquisition; loss of identity (where do I fit in the new organization?), lack of information, obsession of survival (maintain their status, prestige and power), and lost talent (employees voluntary exit from the company) (Maden, 2011). All of these areas have a psychological effect on the employees which is why it is important to target that area of the mind through a merger preview where management lets their employees know whats going on and ensures them of their future job status. It is also important to combine the two organizations into integrated teams early so relationships can begin to be built before legal day one (Marks, Mirvis, 2011). Maden continues on to suggest that the HR decisions made following a merger or acquisition may go as

Page |8

far as to challenge individuals job motivation and career paths (Maden, 2011). But it is generally agreed upon that the sharing of information early and often with your employees is vital to the future success of the organization after the deal closes. Success in Buyer M&A; a new school of thought: Shareholders of target firms benefit the most in business combination transactions based upon the high control premiums they receive (Francoeur, Rakoto, & Walid, 2012). For our purposes, we want to know what happens to the buyer. Historically, acquiring or purchasing firms shareholders get a flat or even negative return, particularly for stock-financed M&A deals (Francoeur et al. 2012). Research needs to focus on what the purchasing firm can control to try and mitigate what history tells us inevitably going to be a loss situation. This starts with breaking the tradition of how past M&A deals were identified and structured and who was in control of them. We need to adapt a team oriented approach to identify and lead the organizations merger and acquisition department. Many companies are now focusing on this method to ensure they have clear aspirations, an acquisition strategy, uncovering more deal opportunities by relying on outside sources (ie- investment banks), performing due diligence, having an integration strategy and maximizing growth potential (Parry, 2011). Research done for this article suggests similar variations of this same team-based, strategic mission style. Previous to this, most M&A deals were structured over a business lunch or on the golf course. One CEO would agree upon a purchase price with the other CEO before talking through any due diligence because the focus was on getting the deal done. Most of the research indicates that the more ego that is removed from a potential deal, the higher the odds of success. It is crucial to involve not only the legal and

Page |9

financial people but also the human resources, the IT, and the marketing people (Marks, Mirvis, 2011). Validation of new approach through past failure: Bruner examined ten M&A deals ranging from 1968 (merger of the Pennsylvania and New York Central Railroads) to January 2002 (acquisition program of Tyco International) that crossed industries, decades, management styles and countries. We feel as though this type of research supports what we have been describing throughout this paper which is M&A is vast, complex and highly local. By local we mean a deal done in New York in one industry can be completely different in California, even in the same industry. Our company needs to be aware of this as we attempt to grow outside of our current footprint. We are not concerned with the lack of recent deal research missing from here because most of the principles Bruner describes transcend years. Bruner explains, Every one of the 10 deals from hell featured major turbulence, including from technology (AT&T/NCR), capital markets (AOL/Time Warner, Dynegy/Enron, Revco), industry overcapacity (Renault/Volvo), rising costs (Sony/Columbia), competitor entry (Quacker/Snapple), or government action (Tyco, Penn Central) (Bruner, 2005). This speaks to the How M&A deal fail in regards to business is not as usual and there may be trouble in one or multiple parts of the acquired company management is not aware of. Mergers and acquisitions fail because of the convergence of forces, a perfect storm of poor choices, poor execution, cognitive biases, and bad external conditions (Bruner, 2005). This covers the Why and begs the question, Why would we focus on this type of strategy? As we have seen, M&A is not a winners game and it is not a losers game. It is a complicated algorithm of elements that are within managements control and outside of managements control. Our research suggest that as a Company we focus on the process of picking M&A opportunities

P a g e | 10

rather than on perceived outcomes as our belief is that how you do business has a big influence on the results. Bruner states we should expect:

Ethical behavior of corporations and their advisors. Where there is no trust, corporations forfeit their support from the public. Systems of governance that are loyal to the interests of stakeholders and careful in the sense of keen attention to the details of M&A proposals. Deal design with enough slack in their transactions to allow for adequate variance from business as usual. Systems of merger integration that employ best practices in planning, information and implementation. Teams of executives to work together in ways that permit dissent and foster high reliability. Suspension of hubris and other cognitive biases at the door of each M&A transaction. (Bruner, 2005)

These six points will not ensure we will not stumble in our M&A pursuits but the adoption of practices like these will lower our odds of failure. Managing the odds, rather than eliminating them, is what we should aim to do. (Bruner, 2005) Conclusion: Integrating two firms either through a mutual merger or a friendly or hostile acquisition involves many moving and complicated parts. It is important for us to focus on a new way of managing our M&A activity. We need to form a task force across finance, human resources, capital projects, infrastructure, community outreach and marketing who are knowledgeable experts in their divisions. We need to stay true to our roots and only analyze deals that support our business model and footprint and not our egos. In going through a merger or acquisition, tt is vital to communicate often with our work force to keep them feeling informed and engaged and it is vital to communicate to the customer base about the transition and what may or may not be changing. The world of M&A is filled with pitfalls that lead to potential failure. But if we can change our M&A culture, as we have outlined here, we will be better armed to lead this company through the M&A battlefield while maintaining customer satisfaction, employee morale and great economic payoffs.

P a g e | 11

REFERENCES: Francoeur, C., Rakoto, P., & Walid, B. A. (2012). Ownership structure, earnings management and acquiring firm post-merger market performance. International Journal of Managerial Finance, 8(2), 100-119. Dahln, M., & Thorbjrnsen, H. (2011). Customer reactions to acquirer-dominant mergers and acquisitions. International Journal of Research in Marketing, 28(4), 332. Hsieh, J., Lyandres, E., & Zhdanov, A. (2011). A theory of merger-driven IPOs. Journal of Financial and Quantitative Analysis, 46(5), 1367. Maden, C. (2011). Dark side of mergers & acquisitions: Organizational interventions and survival strategies. Journal of American Academy of Business, Cambridge, 17(1), 188-195. Marks, M. L., & Mirvis, P. H. (2011). Merge ahead: A research agenda to increase merger and acquisition success. Journal of Business and Psychology, 26(2), 161-168. Parry, R. (2011). A better way to merge companies? Business Strategy Review, 22(4), 46-49. Ismail, A., & Krause, A. (2010). Determinants of the method of payment in mergers and acquisitions. Quarterly Review of Economics and Finance, 50(4), 471. Mergers and Acquisitions: What Has Changed. (2011). hfm (Healthcare Financial Management), 65(1), 105-108. Jope, F., Schiereck, D., & Zeidler, F. (2010). Value generation of mergers and acquisitions in the technology, media. Journal Of Telecommunications Management, 2(4), 369-386. Bruner, R. F. (2005). Deals from hell: M & A lessons that rise above the ashes. Hoboken, N.J.: Wiley.

You might also like

- Planning For GrowthDocument22 pagesPlanning For GrowthGeorgetaNo ratings yet

- Understanding Industry Change Through McGahan's Four TrajectoriesDocument8 pagesUnderstanding Industry Change Through McGahan's Four Trajectoriesjen324820% (1)

- MACR-03 - Drivers For M&ADocument6 pagesMACR-03 - Drivers For M&AVivek KuchhalNo ratings yet

- Ess WoolDocument11 pagesEss WoolRadu MirceaNo ratings yet

- StrategiesDocument3 pagesStrategiesMd.Amir hossain khanNo ratings yet

- 316082Document28 pages316082Lim100% (1)

- How To Do A SWOT Analysis?Document4 pagesHow To Do A SWOT Analysis?Neel ManushNo ratings yet

- Solution ManualDocument28 pagesSolution Manualdavegeek0% (1)

- Managerial Economist Role and ResponsibilitiesDocument8 pagesManagerial Economist Role and Responsibilitiesansalmch100% (2)

- How To Write A Financial Analysis Research PaperDocument8 pagesHow To Write A Financial Analysis Research Paperafnhiheaebysya100% (1)

- Implications of M&As:: Is There A Case For Human ValuesDocument29 pagesImplications of M&As:: Is There A Case For Human ValuesPankaj SharmaNo ratings yet

- Saudi Electronic University College of Administrative and Financial Sciences E-Commerce DepartmentDocument9 pagesSaudi Electronic University College of Administrative and Financial Sciences E-Commerce Departmentklm klmNo ratings yet

- 1 s2.0 S1877042811016235 Main PDFDocument12 pages1 s2.0 S1877042811016235 Main PDFAlina StanciuNo ratings yet

- Cost MGMT To Cost L'shipDocument5 pagesCost MGMT To Cost L'shipvjjani2204No ratings yet

- Commercial Excellence: Slide 1 - Title SlideDocument8 pagesCommercial Excellence: Slide 1 - Title SlideMridul DekaNo ratings yet

- M&As Fail to Create Value for AcquirersDocument7 pagesM&As Fail to Create Value for Acquirerssampath221No ratings yet

- Sample Thesis Financial AnalysisDocument5 pagesSample Thesis Financial AnalysisTye Rausch100% (2)

- Master of Business Administration - MBA Semester 2 (Book ID: B1134) Assignment Set-1 (60 Marks)Document26 pagesMaster of Business Administration - MBA Semester 2 (Book ID: B1134) Assignment Set-1 (60 Marks)Usman IlyasNo ratings yet

- A Case Study of Acquisition of Spice Communications by Isaasdaddea Cellular LimitedDocument13 pagesA Case Study of Acquisition of Spice Communications by Isaasdaddea Cellular Limitedsarge1986No ratings yet

- Mastering The Building Blocks of StrategyDocument12 pagesMastering The Building Blocks of StrategyBossoni AdamNo ratings yet

- Post Holdings Buys Weetabix: Strategic AnalysisDocument9 pagesPost Holdings Buys Weetabix: Strategic AnalysisThompson TemboNo ratings yet

- Resume 11Document5 pagesResume 11MariaNo ratings yet

- Turnaround StrategyDocument37 pagesTurnaround StrategyAakash Mehta100% (3)

- Strategic Management Competitiveness and Globalisation 6th Edition Manson Solutions ManualDocument35 pagesStrategic Management Competitiveness and Globalisation 6th Edition Manson Solutions Manualnutlet.anticlyljwg100% (28)

- Term Paper of Financial ManagementDocument6 pagesTerm Paper of Financial Managementafmzmxkayjyoso100% (1)

- HR Challenges in Mergers and AcquisitionsDocument16 pagesHR Challenges in Mergers and Acquisitionsyogigarg_89No ratings yet

- Fundamental vs Technical Analysis Key DifferencesDocument12 pagesFundamental vs Technical Analysis Key DifferencesShakti ShuklaNo ratings yet

- Mastering Revenue Growth in M&ADocument7 pagesMastering Revenue Growth in M&ASky YimNo ratings yet

- NEO AXEL M. BMEC1 ASSIGNMENTSDocument4 pagesNEO AXEL M. BMEC1 ASSIGNMENTSAxel NeoNo ratings yet

- PWC Adaptable Financial Institution Operating ModelDocument40 pagesPWC Adaptable Financial Institution Operating Modelkhalid.n.ali818No ratings yet

- Private Equity Investment CriteriaDocument14 pagesPrivate Equity Investment CriteriaoliverNo ratings yet

- Determinants of Capital Structure ThesisDocument8 pagesDeterminants of Capital Structure Thesisgbwygt8n100% (1)

- Assignment Subject: International BusinessDocument6 pagesAssignment Subject: International BusinessRizwan PazheriNo ratings yet

- Solution Manual For Ethical Obligations and Decision Making in Accounting Text and Cases 4th EditionDocument30 pagesSolution Manual For Ethical Obligations and Decision Making in Accounting Text and Cases 4th Editiongabrielthuym96j100% (16)

- Role and Responsibilities of Managerial EconomistDocument6 pagesRole and Responsibilities of Managerial EconomistAmrit Tiwana100% (1)

- PHD Thesis Financial Statement AnalysisDocument8 pagesPHD Thesis Financial Statement Analysisveronicapadillaalbuquerque100% (2)

- Why Mergers Fail and How To Prevent ItDocument4 pagesWhy Mergers Fail and How To Prevent ItAkshay RawatNo ratings yet

- Case Study Interview TechniquesDocument8 pagesCase Study Interview Techniquesedpeg1970No ratings yet

- 02 Idea Assessment Feasibility Analysis Business ModelDocument4 pages02 Idea Assessment Feasibility Analysis Business ModelImaan IqbalNo ratings yet

- Strategic Management ProcessDocument8 pagesStrategic Management ProcessDio CalediNo ratings yet

- Credit Suisse - Measuring The MoatDocument70 pagesCredit Suisse - Measuring The MoatJames Kuah100% (1)

- MBA-4TH SEMESTER STRATEGY SUBJECTDocument7 pagesMBA-4TH SEMESTER STRATEGY SUBJECTAnonymous UFaC3TyiNo ratings yet

- S STRATEGIES FOR EFFECTIVE NPA RECOVERIEStrategies For Effective Npa RecoveriesDocument12 pagesS STRATEGIES FOR EFFECTIVE NPA RECOVERIEStrategies For Effective Npa RecoveriesambujchinuNo ratings yet

- Research Paper Topics For Managerial EconomicsDocument5 pagesResearch Paper Topics For Managerial Economicsgw1g9a3s100% (1)

- Cerulli Report - Targeting The Affluent and The Emerging AffluentDocument25 pagesCerulli Report - Targeting The Affluent and The Emerging AffluentJoin RiotNo ratings yet

- Measuring The Moat PDFDocument70 pagesMeasuring The Moat PDFFlorent CrivelloNo ratings yet

- Issues of HRDocument6 pagesIssues of HRsaba kurawleNo ratings yet

- Topic 3 Environmental ScanningDocument19 pagesTopic 3 Environmental Scanningfrancis MagobaNo ratings yet

- IMT 56 Strategic Management M1Document28 pagesIMT 56 Strategic Management M1Divyangi WaliaNo ratings yet

- Business Environment Unit 4Document8 pagesBusiness Environment Unit 4Kainos GreyNo ratings yet

- Term Paper Topics For Financial ManagementDocument5 pagesTerm Paper Topics For Financial Managementc5r0qjcf100% (1)

- Strategic Management and Strategic Competitiveness: Chapter OverviewDocument15 pagesStrategic Management and Strategic Competitiveness: Chapter OverviewAizen SosukeNo ratings yet

- Strategic Decision-Making Assignment 1Document11 pagesStrategic Decision-Making Assignment 1Fungai MajuriraNo ratings yet

- Strategic Management CHP 1 SummaryDocument11 pagesStrategic Management CHP 1 SummaryAshnaa FauzanNo ratings yet

- Balanced Scorecard Origins and Key PerspectivesDocument4 pagesBalanced Scorecard Origins and Key PerspectivesSivaKumarBaduguNo ratings yet

- Making The Most of UncertainyDocument7 pagesMaking The Most of UncertainyShahriar RawshonNo ratings yet

- The What, The Why, The How: Mergers and AcquisitionsFrom EverandThe What, The Why, The How: Mergers and AcquisitionsRating: 2 out of 5 stars2/5 (1)

- Targeted Tactics®: Transforming Strategy into Measurable ResultsFrom EverandTargeted Tactics®: Transforming Strategy into Measurable ResultsNo ratings yet

- Business Plan Checklist: Plan your way to business successFrom EverandBusiness Plan Checklist: Plan your way to business successRating: 5 out of 5 stars5/5 (1)

- Merger of UBS and SBC in 1997Document20 pagesMerger of UBS and SBC in 1997Zakaria SakibNo ratings yet

- Chapter 9 - Operations, Dividends, BVPS, & EPSDocument6 pagesChapter 9 - Operations, Dividends, BVPS, & EPSSarah Nicole S. LagrimasNo ratings yet

- Deed of Absolute Sale of A Motor VehicleDocument2 pagesDeed of Absolute Sale of A Motor VehicleFroilan FerrerNo ratings yet

- Master Chef Employment Agmt (14 Pages)Document14 pagesMaster Chef Employment Agmt (14 Pages)Jonny DuppsesNo ratings yet

- 100 Best Businesses FreeDocument34 pages100 Best Businesses Freemally4dNo ratings yet

- 2013 Ar En18Document35 pages2013 Ar En18zarniaung.gpsNo ratings yet

- Favelle FavcoDocument5 pagesFavelle Favconurul syahiraNo ratings yet

- PGTRB Commerce Unit 3 Study Material English MediumDocument20 pagesPGTRB Commerce Unit 3 Study Material English MediumAnithaNo ratings yet

- Contact ListDocument4 pagesContact ListNandika RupasingheNo ratings yet

- Quarry of Agreement JuliusDocument2 pagesQuarry of Agreement JuliusLavon Naze50% (2)

- Global Trust in Advertising Report Sept 2015Document22 pagesGlobal Trust in Advertising Report Sept 2015Jaime CubasNo ratings yet

- Battle Card MFG For SAP 3.0Document8 pagesBattle Card MFG For SAP 3.0anishthankachanNo ratings yet

- Employees Come FirstDocument4 pagesEmployees Come FirstLeonWilfanNo ratings yet

- Evotech Case Study 3D Printed Bike Frame PDFDocument2 pagesEvotech Case Study 3D Printed Bike Frame PDFThe DNo ratings yet

- Brochure - B2B - Manufacturing - Urban CarnivalDocument8 pagesBrochure - B2B - Manufacturing - Urban CarnivalGaurav GoyalNo ratings yet

- Javeria Essay 3Document7 pagesJaveria Essay 3api-241524631No ratings yet

- FMC Plug Valve Manifolds Prices Not Current FC PVMCDocument16 pagesFMC Plug Valve Manifolds Prices Not Current FC PVMCSUMSOLCA100% (1)

- Putting The Balanced Scorecard To Work: Rockwater: Responding To A Changing IndustryDocument2 pagesPutting The Balanced Scorecard To Work: Rockwater: Responding To A Changing IndustrySakshi ShahNo ratings yet

- 70 Important Math Concepts Explained Simply and ClearlyDocument41 pages70 Important Math Concepts Explained Simply and ClearlyDhiman NathNo ratings yet

- GB922 InformationFramework Concepts R9 0 V7-14Document57 pagesGB922 InformationFramework Concepts R9 0 V7-14youssef MCHNo ratings yet

- 1 Taxpayer Identification Number (TIN) 2 RDO Code 3 Contact Number - 4 Registered NameDocument3 pages1 Taxpayer Identification Number (TIN) 2 RDO Code 3 Contact Number - 4 Registered NameRose O. DiscalzoNo ratings yet

- RTO ProcessDocument5 pagesRTO Processashutosh mauryaNo ratings yet

- Generational Personality Quiz HandoutDocument2 pagesGenerational Personality Quiz HandoutPnp KaliboNo ratings yet

- New TeDocument9 pagesNew Tephillip19wa88No ratings yet

- Materi PDFDocument19 pagesMateri PDFUlyviatrisnaNo ratings yet

- A Guide To Business PHD ApplicationsDocument24 pagesA Guide To Business PHD ApplicationsSampad AcharyaNo ratings yet

- Role of NabardDocument7 pagesRole of Nabardashits00No ratings yet

- Entry Test Sample Paper ForDocument5 pagesEntry Test Sample Paper ForShawn Parker100% (3)

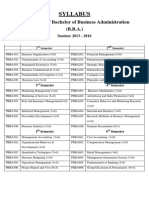

- BBA Syllabus 2013-2016Document59 pagesBBA Syllabus 2013-2016GauravsNo ratings yet

- Maharashtra Blacklisted Engineering CollegesDocument3 pagesMaharashtra Blacklisted Engineering CollegesAICTENo ratings yet