Professional Documents

Culture Documents

0TTTP 30122008

Uploaded by

International Business TimesOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

0TTTP 30122008

Uploaded by

International Business TimesCopyright:

Available Formats

Investment Research Danske Research

Today's Technical Trading Points

30/12/2008 8:01 (CET)

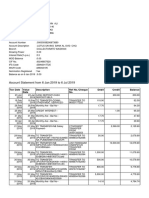

Today's Trading Points Technical Strategy ( Short- Medium Term)

MARKET LAST Sup.3 Sup.2 Sup.1 KEY Res.1 Res.2 Res.3 Trend 5DCHG Strategy Entry 1st profit 2nd profit Stop Derived

FIXED INCOME

Euro Bund (10yr), Mar 09 125.51 123.75 124.48 124.87 125.21 125.61 125.95 126.68 È 0.71% Go Long> 125.57 126.71 Go Short< 124.82 122.86

Euro BOBL (5yr), Mar 09 116.58 115.55 115.98 116.22 116.41 116.65 116.84 117.27 È 0.70% Go Long> 116.660 116.970 Go Short< 115.940 115.480

Euro Schatz (2yr), Mar 09 107.580 107.230 107.380 107.475 107.530 107.625 107.680 107.830 È 0.27% Go Long> 107.590 107.790 Go Short< 107.240 107.090

30 Yr US T-Bonds, Mar 09 140 27/32 138 3/32 139 18/32 140 7/32 141 141 22/32 142 15/32 143 29/32 * 0.11% Go Long> 141 28/32 144 20/32 Go Short< 139 129 19/32

10 Yr US T-Notes, Mar 09 127 28/32 125 11/32 126 17/32 127 5/32 127 23/32 128 11/32 128 29/32 130 3/32 Ê 0.75% Go Long> 128 22/32 129 30/32 Go Short< 126 20/32 122 6/32

3 mth Euribor, Mar 09 97.770 97.665 97.710 97.735 97.755 97.780 97.800 97.845 È 0.17% Go Long> 97.790 97.880 Go Short< 97.580 97.500

YIELD

U.S. Ten Year Note Yield 2.069 1.872 1.989 2.045 2.106 2.162 2.223 2.340 * -4.79% Go Long> 2.298 2.750 Go Short< 2.036 1.836

U.S. Five Year Note Yield 1.461 1.162 1.303 1.378 1.444 1.519 1.585 1.726 È 2.04% Go Long> 1.570 1.815 Go Short< 1.327 1.234

German Ten Year Yield 2.900 2.781 2.846 2.873 2.911 2.938 2.976 3.040 * -2.55% Go Long> 3.060 3.145 Go Short< 2.880 2.807

German Five Year Yield 2.263 2.122 2.205 2.234 2.289 2.317 2.372 2.455 Ê -7.67% Go Long> 2.337 2.512 Go Short< 2.250 2.201

CURRENCIES - Majors

EUR/USD 1.4003 1.3191 1.3630 1.3778 1.4069 1.4217 1.4508 1.4947 Ê 0.52% Go Long> 1.4377 1.4678 Go Short< 1.3912 1.3895

USD/JPY 90.29 88.40 89.40 90.04 90.40 91.04 91.40 92.40 È -0.75% Go Long> 91.35 92.44 Go Short< 89.50 83.81

EUR/JPY 126.42 120.46 123.93 125.10 127.40 128.57 130.87 134.34 * -0.24% Go Long> 129.75 130.18 Go Short< 126.18 125.24

GBP/USD 1.4452 1.3742 1.4129 1.4261 1.4516 1.4648 1.4903 1.5290 Ê -1.83% n Go Long> 1.4805 1.5016 Go Short< 1.4378 1.4211

EUR/GBP 0.9689 0.9273 0.9481 0.9578 0.9689 0.9786 0.9897 1.0105 È 2.44% Go Long> 0.9804 0.9894 Go Short< 0.9586 0.9205

GBP/JPY 130.48 124.86 128.14 129.31 131.42 132.59 134.70 137.98 * -2.61% Go Long> 139.20 143.70 Go Short< 130.19 125.81

USD/CHF 1.0566 0.9886 1.0227 1.0423 1.0568 1.0764 1.0909 1.1250 Ê -2.96% Go Long> 1.0717 1.1089 Go Short< 1.0366 1.0141

EUR/CHF 1.4796 1.4294 1.4579 1.4686 1.4864 1.4971 1.5149 1.5434 Ê -2.43% Go Long> 1.5048 1.5280 Go Short< 1.4753 1.4593

Dollar Index 81.140 76.771 78.698 79.691 80.625 81.618 82.552 84.479 * -0.12% Go Long> 81.558 83.518 Go Short< 79.631 77.688

CURRENCIES - Scandies

USD/DKK 5.3216 4.9705 5.1335 5.2415 5.2965 5.4045 5.4595 5.6225 È -0.54% Go Long> 5.3534 5.5992 Go Short< 5.1879 5.0616

USD/SEK 7.8523 6.7534 7.2452 7.5705 7.7370 8.0623 8.2288 8.7206 Ê -2.05% Go Long> 7.9041 8.2105 Go Short< 7.6480 7.3227

EUR/SEK 10.9953 10.1962 10.5799 10.7863 10.9636 11.1700 11.3473 11.7310 Ê -1.50% Go Long> 11.3390 11.5840 Go Short< 10.9662 10.7010

USD/NOK 7.0955 6.6412 6.8545 6.9933 7.0678 7.2066 7.2811 7.4944 È -0.01% Go Long> 7.3150 7.5130 Go Short< 6.8085 6.5400

EUR/NOK 9.9387 9.6720 9.8054 9.8723 9.9388 10.0057 10.0722 10.2056 È 0.42% Go Long> 10.1765 10.4160 Go Short< 9.5485 9.3830

NOK/SEK 1.1062 1.0628 1.0866 1.0961 1.1104 1.1199 1.1342 1.1580 Ê -1.92% Go Long> 1.1297 1.1458 Go Short< 1.0979 1.0731

CURRENCIES Non majors

EUR/PLN 4.1300 3.8761 4.0076 4.0663 4.1391 4.1978 4.2706 4.4021 * 0.59% Go Long> 4.2119 4.3175 Go Short< 4.0604 3.9142

EUR/HUF 267.25 259.94 263.21 265.18 266.48 268.45 269.75 273.02 È 1.19% Go Long> 270.00 273.50 Go Short< 258.00 252.70

EUR/CZK 26.590 25.977 26.265 26.428 26.553 26.716 26.841 27.129 * 0.88% Go Long> 26.690 27.018 Go Short< 26.145 25.640

EUR/TRY 2.1256 2.0094 2.0716 2.0925 2.1338 2.1547 2.1960 2.2582 Ê 0.34% Go Long> 2.1762 2.1925 Go Short< 2.1054 2.0797

USD/ZAR 9.4954 8.9551 9.2449 9.3645 9.5347 9.6543 9.8245 10.1143 Ê -1.93% Go Long> 10.0755 10.3800 Go Short< 9.4152 9.0751

USD/CAD 1.2196 1.1860 1.2014 1.2111 1.2168 1.2265 1.2322 1.2476 * 0.02% SHORT 1.1863 1.1580 1.2255 1.2280

EUR/CAD 1.7080 1.6089 1.6624 1.6811 1.7159 1.7346 1.7694 1.8229 Ê 0.55% Go Long> 1.7513 1.7776 Go Short< 1.6876 1.6452

AUD/USD 0.6881 0.6619 0.6752 0.6801 0.6885 0.6934 0.7018 0.7151 È 1.13% Go Long> 0.7140 0.7369 Go Short< 0.6758 0.6615

NZD/USD 0.5790 0.5520 0.5650 0.5704 0.5780 0.5834 0.5910 0.6040 È 2.04% LONG 0.5922 0.5727 0.5538

STOCK MARKET INDICES FUTURES

S&P500, Mar 09 873 824 845 858 866 878 886 907 * 0.26% LONG 945 990 854 808

Nasdaq , Mar 09 1179 1091 1134 1155 1176 1197 1219 1261 Ê -1.42% LONG 1300 1349 1160 1070

DAX Index, Mar 09 4762 4529 4624 4684 4719 4779 4814 4909 È 0.62% LONG 5033 5202 4624 4223

FTSE , Mar 09 4334 4067 4170 4237 4273 4340 4376 4479 È 1.45% LONG 4605 4678 4155 3978

CAC40, Jan 09 3165 3009 3077 3115 3144 3182 3212 3279 * -0.77% LONG 3496 3577 3105 3034

Euro STOXX 50, Mar 09 2414 2320 2361 2384 2402 2425 2443 2484 * -0.66% LONG 2624 2707 2339 2264

STOCK MARKET INDICES

DJ Industrial Average 8484 8361 8432 8474 8503 8545 8575 8646 * -1.11% Close> 8787 9705 Close< 8347 7823

Nasdaq Composite Index 1510 1502 1514 1522 1527 1535 1540 1552 Ê -3.45% LONG 1663 1728 1478 1295

Nikkei 225 Index 8860 8466 8591 8669 8716 8794 8842 8967 È 1.56% LONG 9522 10329 8087 7591

COMMODITIES

Crude Light, Feb 09 39.71 30.58 35.25 37.63 39.92 42.30 44.59 49.26 È -0.50% Go Long> 45.65 51.57 Go Short< 32.40 29.66

ICE Brent C, Feb 09 40.25 30.57 35.60 38.07 40.63 43.10 45.66 50.69 * -1.95% Go Long> 46.70 52.10 Go Short< 36.20 26.97

RBOB Gasoline, Feb 09 90.90 69.32 81.12 86.48 92.92 98.28 104.72 116.52 * -2.07% LONG 106.40 87.50 82.60

GOLD, Feb 09 874.90 842.10 861.10 868.20 880.10 887.20 899.10 918.10 È 3.27% LONG 920.70 843.00 808.80

New update

The authors of this publication may hold positions for the account of the bank in the investments mentioned in the publication.

Technical Research:

Technical Analyst Klaus Ikast Direct + 45 45128501, kik@danskebank.com / kikast@bloomberg.net

Technical Analyst Kim Cramer Larsson Direct + 45 45128499, kimn@danskebank.com / klarsson@bloomberg.net

www.danskebank.com www.danskebank.com/research www.danskebank.com/danskemarketresearch

Investment Research Danske Research

Chart - EUR/USD

Pic 1

Chart - Euro Bund (10y) Future

Pic2

Source: "CQG © 2008

www.danskebank.com www.danskebank.com/research www.danskebank.com/danskemarketresearch

Investment Research Danske Research

Reading Guide

This report has been prepared by Danske Markets, a division of Danske Bank. Danske Bank is under supervision by the Danish Financial Supervisory Authority.

Danske Bank has established procedures to prevent conflicts of interest and to ensure the provision of high quality research based on research objectivity and

independence. These procedures are documented in the Danske Bank Research Policy. Employees within the Danske Bank Research Departments have been

instructed that any request that might impair the objectivity and independence of research shall be referred to Research Management and to the Compliance

Officer. Danske Bank Research departments are organised independently from and do not report to other Danske Bank business areas. Research analysts are

remunerated in part based on the over-all profitability of Danske Bank, which includes investment banking revenues, but do not receive bonuses or other

remuneration linked to specific corporate finance or dept capital transactions.

Danske Bank research reports are prepared in accordance with the Danish Society of Investment Professionals Ethical rules and the Recommendations of the

Danish Securities Dealers Association.

Financial models and/or methodology used in this report

Technical analysis is a method of evaluating securities by analysing statistics generated by market activity, past prices, and volumes. Technical analysts look for

patterns and indicators on charts that could determine future performance. Various technical analysis models are used to evaluate the market.

Risk warning

The estimate of the future performance of (financial) instruments, see above, in this report may deviate from the actual performance of the instruments.

Expected updates

Technical outlook Today's Technical Trading Points are updated daily.

First date of publication

Please see the front page of this research report.

Please go to www.danskeequities.com/ www.danskebank.com/Research for further disclosures and information in accordance with Danish legislation and

selfregulation standards.

Disclaimer

This publication has been prepared by Danske Bank for information purposes only. It may support near-term trading strategies that differ at times from Danske

Banks ratings based on other research. This publication is not an offer or solicitation of any offers to purchase or sell any securities, currency or financial

instrument. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or

completeness and no liability is accepted for any loss arising from reliance on it.

Danske Bank, its affiliates or staff may perform business services, hold, establish, change or cease to hold positions in any securities, currency or financial

instrument mentioned in this publication.

This publication is not intended for retail customers in the UK or any person in the US. Danske Markets is a division of Danske Bank A/S. Danske Bank A/S is

authorized by the Danish Financial Supervisory Authority and subject to limited regulation by the Financial Services Authority (UK). Details on the extent of our

regulation by the Financial Services Authority are available from us on request. Copyright (C) Danske Bank A/S. All rights reserved. This publication is protected

by copyright and may not be reproduced in whole or in part without permission.

www.danskebank.com www.danskebank.com/research www.danskebank.com/danskemarketresearch

You might also like

- Immigration Standards 3 0Document1 pageImmigration Standards 3 0International Business TimesNo ratings yet

- Gang of Eight Immigration ProposalDocument844 pagesGang of Eight Immigration ProposalThe Washington PostNo ratings yet

- Immigration Standards 3 0Document1 pageImmigration Standards 3 0International Business TimesNo ratings yet

- State Letter-February Sequester HearingDocument5 pagesState Letter-February Sequester HearingInternational Business TimesNo ratings yet

- DOT Letter-February Sequester HearingDocument2 pagesDOT Letter-February Sequester HearingInternational Business TimesNo ratings yet

- IRS TeaPartyLetterDocument7 pagesIRS TeaPartyLetterInternational Business TimesNo ratings yet

- HHS Letter-February Sequester HearingDocument3 pagesHHS Letter-February Sequester HearingInternational Business TimesNo ratings yet

- Interior Letter-February Sequester HearingDocument4 pagesInterior Letter-February Sequester HearingInternational Business TimesNo ratings yet

- Defense Letter-February Sequester HearingDocument3 pagesDefense Letter-February Sequester HearingInternational Business TimesNo ratings yet

- Interior Letter-February Sequester HearingDocument4 pagesInterior Letter-February Sequester HearingInternational Business TimesNo ratings yet

- Labor Letter-February Sequester HearingDocument4 pagesLabor Letter-February Sequester HearingInternational Business TimesNo ratings yet

- Education Letter-February Sequester HearingDocument3 pagesEducation Letter-February Sequester HearingInternational Business TimesNo ratings yet

- Interior Letter-February Sequester HearingDocument4 pagesInterior Letter-February Sequester HearingInternational Business TimesNo ratings yet

- Interior Letter-February Sequester HearingDocument4 pagesInterior Letter-February Sequester HearingInternational Business TimesNo ratings yet

- Homeland Letter-February Sequester HearingDocument3 pagesHomeland Letter-February Sequester HearingInternational Business TimesNo ratings yet

- A Bipartisan Path Toward Securing Americas Future FinalDocument4 pagesA Bipartisan Path Toward Securing Americas Future FinalInternational Business TimesNo ratings yet

- Energy Letter-February Sequester HearingDocument4 pagesEnergy Letter-February Sequester HearingInternational Business TimesNo ratings yet

- Department of Commerce Sequestration Letter To CongressDocument4 pagesDepartment of Commerce Sequestration Letter To CongressFedScoopNo ratings yet

- Bills 112hr SC AP Fy13 DefenseDocument154 pagesBills 112hr SC AP Fy13 DefenseInternational Business TimesNo ratings yet

- Agriculture Letter-February Sequester HearingDocument7 pagesAgriculture Letter-February Sequester HearingInternational Business TimesNo ratings yet

- CPAC ScheduleDocument18 pagesCPAC ScheduleFoxNewsInsiderNo ratings yet

- Greater Mekong Species Report Web Ready Version Nov 14 2011-1-1Document24 pagesGreater Mekong Species Report Web Ready Version Nov 14 2011-1-1International Business TimesNo ratings yet

- Έρευνα Αμερικανών ακαδημαϊκών για καταδίκες αθώων στις ΗΠΑ (1989-2012)Document108 pagesΈρευνα Αμερικανών ακαδημαϊκών για καταδίκες αθώων στις ΗΠΑ (1989-2012)LawNetNo ratings yet

- Omb Sequestration ReportDocument394 pagesOmb Sequestration ReportJake GrovumNo ratings yet

- FedBillDocument5 pagesFedBillInternational Business TimesNo ratings yet

- University of Notre Dame v. HHS Et AlDocument57 pagesUniversity of Notre Dame v. HHS Et AlDoug MataconisNo ratings yet

- Adam II 2011 Annual RPT Web Version CorrectedDocument177 pagesAdam II 2011 Annual RPT Web Version CorrectedInternational Business Times100% (1)

- EtfilesDocument33 pagesEtfilesInternational Business TimesNo ratings yet

- Whitney Houston Coroner ReportDocument42 pagesWhitney Houston Coroner ReportSharonWaxman100% (4)

- EtfilesDocument33 pagesEtfilesInternational Business TimesNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- CONTRACT SPECSDocument12 pagesCONTRACT SPECSprabuNo ratings yet

- 20140217170246chapter 7 - InCOME STATEMENT-An IntroductionDocument14 pages20140217170246chapter 7 - InCOME STATEMENT-An IntroductionAlhana AwangNo ratings yet

- Campus BuzzDocument2 pagesCampus BuzzHarveyNo ratings yet

- Paper From Advance America Cash AdvanceDocument6 pagesPaper From Advance America Cash AdvanceJoyNo ratings yet

- Dewata Raya Ep 3Document2 pagesDewata Raya Ep 3Betta UcupNo ratings yet

- White Oak Capital Management Summer Internship Job DescriptionDocument2 pagesWhite Oak Capital Management Summer Internship Job DescriptionVaishnaviRaviNo ratings yet

- A 241Document1 pageA 241AnuranjanNo ratings yet

- Stock Market VocabularyDocument3 pagesStock Market VocabularyMitali Vadgama100% (1)

- XLSXDocument8 pagesXLSXKennyNo ratings yet

- NYSEDocument2 pagesNYSEkokabNo ratings yet

- Bullish Trend Bearish Trend: Bull Pattern Bear PatternDocument2 pagesBullish Trend Bearish Trend: Bull Pattern Bear PatternJefry R SiregarNo ratings yet

- The January Size Effect Revisited: Is It A Case of Risk Mismeasurement?Document6 pagesThe January Size Effect Revisited: Is It A Case of Risk Mismeasurement?Ciornei OanaNo ratings yet

- Traders Magazine Dec 2011Document68 pagesTraders Magazine Dec 2011connytheconNo ratings yet

- Counter TradeDocument499 pagesCounter TradeVaalu MuthuNo ratings yet

- 228module - A PDFDocument20 pages228module - A PDFSatishKumarRajendranNo ratings yet

- CBO Hatch Letter On Financial Transaction TaxDocument6 pagesCBO Hatch Letter On Financial Transaction TaxMilton RechtNo ratings yet

- Causes and Effects of Demutualization of Financial ExchangesDocument49 pagesCauses and Effects of Demutualization of Financial Exchangesfahd_faux9282No ratings yet

- IV: Dupont Analysis: Return On Equity RatioDocument5 pagesIV: Dupont Analysis: Return On Equity RatioLưu Tố UyênNo ratings yet

- Different COGS GL Account For Sample Material DeliveryDocument6 pagesDifferent COGS GL Account For Sample Material DeliverySoumenNo ratings yet

- Fundamentals of Corporate Finance 2nd Edition Parrino Test BankDocument20 pagesFundamentals of Corporate Finance 2nd Edition Parrino Test BankElizabethValdezbcrze100% (13)

- The Big Mac Index For The Year 2000Document10 pagesThe Big Mac Index For The Year 2000Cherylynne EddyNo ratings yet

- Using Historical Probabilities To Trade The Opening Gap: Scott AndrewsDocument32 pagesUsing Historical Probabilities To Trade The Opening Gap: Scott Andrewsjosecsantos83No ratings yet

- Chapter 7 SolutionsDocument2 pagesChapter 7 SolutionsDinesh Raghavendra100% (1)

- The Real Estate Development ProcessDocument4 pagesThe Real Estate Development ProcessBinod KumarNo ratings yet

- M 14 IPCC Taxation Guideline AnswersDocument14 pagesM 14 IPCC Taxation Guideline Answerssantosh barkiNo ratings yet

- Lotus Savings Bank account statement from Jan to Jul 2019Document4 pagesLotus Savings Bank account statement from Jan to Jul 2019Zulnu Rain AliNo ratings yet

- Derivatives and Financial InnovationsDocument85 pagesDerivatives and Financial InnovationschinmayhpNo ratings yet

- Corporate Presentation Highlights Company and CustomersDocument19 pagesCorporate Presentation Highlights Company and Customersrachmat_solihinNo ratings yet

- Prakash 123Document47 pagesPrakash 123Prakash VishwakarmaNo ratings yet

- Turtle StrategyDocument31 pagesTurtle StrategyJeniffer Rayen100% (3)