Professional Documents

Culture Documents

2012.06 RAM-Score Trending Recap

Uploaded by

diane_estes937Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2012.06 RAM-Score Trending Recap

Uploaded by

diane_estes937Copyright:

Available Formats

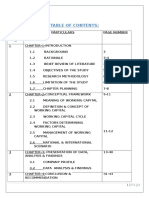

PORTFIIMULAS

FORMuLAIc TRENDING MONEY MANAGER

The Formulaic Trending Monthly Recap

June 7, 2012: Overall RAM Score

=

+14.95

RAM Score is a proprietary market-trending tool that takes into account several dynamic components related to the U.S. markets and economy. It features a core baseline which allows for correlation between these multiple components so that they may be added together for an overall Ram Score. As a market trending tool, we believe that a positive RAM Score indicates that the odds are stacked in favor of equity investments and a negative RAM Score indicates that odds are stacked against equity investments. Obviously, this does not guarantee that the market will increase when the score is positive or decrease when the score is negative, but we believe the long term correlation may be a powerful tool for investing... Combining our trending features of RAM Score with our Portformulas intricate Formulaic Investing Strategies results in a uniquely logical approach to investing that is exclusively available through Portformulas. The overall RAM Score has decreased from 40.58 last month to +14.95 this month... Representing a significant 25 point decline... Once again, the decrease was driven primarily by renewed and ongoing concerns over European economic issues. Any way you wish to slice it, the month of May posted as a tough one for the markets. During the month of May, the markets gave back any remaining gains for this year to date. As has been the case, most of the negativity driving the markets downward has been from European concerns more so than US concerns. But regardless of where the pressure comes from, it has resulted in a fairly dramatic decrease in RAM

Score. However, on the flipside, 6 of the 7 subcomponents within RAM Score are currently positive, although 6 of 7 also decreased or declined for the month.

.

Moving on to the first week in June, and in particular yesterday (June 6), stocks had their largest one-day gains of 2012. This was in response to a fresh optimism about European rescue plans that increased sentiment significantly. Fed officials also reiterated their willingness to take action if the economy deteriorates further. The Dow surged nearly 300 points, or 2.4%, and crossed back into positive territory for the year. The S&P 500 and the NASDAQ were also up 2.4% on the day. However, today (June 7), Bernanke squelched some of the exuberance by essentially stating that the Fed stands ready to act if necessary, but he stopped short of signaling any pending or imminent action. At the time of this writing, the markets are still reacting favorably, butjust not quite as favorable as they began the day. GOOD NEWS: n May

th 8

we announced our soft launch for the new Freedom Series of investment models... And the response was

g, especially given the little amount of attention we gave to it. By month end 433 accounts were invested in the new Freedom

Series! And, ironically, I believe much of that new Freedom activity was driven by the economic concerns we have just been discussing here. You see, the Freedom series takes certain Ram Score type subcomponents and imbeds them into the stock selection process. The end result is that the Freedom series may ebb and flow (or feather itself, as one might say) in and out of the market as more or less stocks within any

given index qualify. And if too few qualify, then we apply the same screening or selection process to ETFs (rather than just bond funds or

money markets) so that the available universe of possibilities is expanded. It really is quite a breakthrough and may prove very useful

depending upon your investment goals and overall financial plan.

Our development ofthe Freedom series has also resulted in our having additional measuring sticks to share with you regarding certain indexes

. M (and arguably the overall markets). Below (page 3) you will see that I have added some of this data under the heading, Mapper Scor& As

more Mapper Score data continues to be accumulated, these additional sources will become more and more interesting[teworfhy and indicative Therefore, I will soon begin providing comment upon them much as I do our tried and true workhorse, RAM Score.

FINAL THOUGHTS: This may be the month when we finally learn how serious the world leaders and policymakers are regarding economic stimulus. Right now (meaning as I write this) it appears that the markets are beginning to bet that we will soon see additional stimulus. RAM Score reflects that 6 out of 7 subcomponents remain positive even though there was a 25 point decline this month. Therefore, even though RAM declined numerically, only one subcomponent has actually reached negative territory as RAM Score posts +14.95 for June. For more information and educational tools you can visit www.portformulas.net or speak with your Financial Advisor Best of Investing, Mike Walters, CEO Portformulas Investing Corporation TM Formulaic Trending Money Manager SEC Registered Investment Advisor 6020 E Fulton St. I Ada, MI 49301 (888) 869-5994

www.portformulas.net

Page 1 of3

p 0 R T FjR flu

u LAS

FORMuLAIc TRENDING MDNEY MANAGER

C CD

1 h SI

a) w

0

w

0

II

SEb

CD CD

cl,

0

CD

C

3

U

U

I

I -n

0 C F

3

.

S

<?

d I

:.

SI

S

4

I

I

z

II, I

c

I

<7

cTQr

0

CD

CI)

(D

V\X

%

-I

(%

a)

Q) :

I

x

U

>

a) 0

-<

3

I

cn Z

U

-_(D 0

Si

SII

U

z

3

0

3

11

Di

cn

R -C

<

$1

S

4

A 11

(D

___)

U,

ft.j4g/s/i1

/LJIIIJ

C,L/ J

PORTF5RMULAS.

FORMuLAIc TRENDING MONEY MANAGER

Various Indexes

Dow Jones 30 Stocks Mapped. = 4 Mapper ScoreTj3%

Russell 3000 Stocks Mapped =J8Q Mapper ScoreTMJp

Russell 2000 Stocks Mapped 5Q Mapper Score TM

S&P 400 Stocks Mapp Mapper Score = 1 0.75% T

cz

-:_ 1 A/

6:L,A-

Please note that there are a number of important disclosures that must be considered before investing in Portformulas. Please read the information and disclosures contained in Portformulas hypothetical carefully before investing. Any performance figures referenced herein are hypothetical and are not indicative of future results. Purchases and sales of securities within Portformulas various strategies may be made without regard to how long you have been invested which could result in tax implications. RAM Score General Disclosure This illustration does not represent any particular Portformula strategy nor is it intended to recommend any Portformula strategy or the RAM Score feature. The information on this page simply attempts to illustrate how our firms RAM Score Allocation Management feature operates. This feature can be applied to many Portformula models at no additional cost. RAM Score was not developed until January 2010. Priorto January 2010, clients were utilizing RAM Scores predecessor, RAM. Clients utilizing RAM may have had different results than clients utilizing RAM Score. RAM Score movement prior to 201 0 is hypothetical and based on retroactive application of RAM Scores indicators to market and economic conditions existing at the time. Portformulas was not managing assets prior to 2007. It is important to understand that RAM Score is only a tool designed to assist our firms management of your account. RAM Score does not guarantee any specific results or performance and even with RAM Score on your account, it is possible that your account will lose value. RAM Score moves assets into or out of the market based on various economic and market indicators. It is possible that the market will move positively while you are not invested or negatively while you are invested, resulting in losses. Any Portformula strategy may underperform or produce negative results. This illustration utilizes the S&P 500 index because it is a well-known index and provides a recognizable frame of reference. Indexes such as the S&P 500 are not publically available investment vehicles and cannot be purchased. The S&P 500 has not endorsed Portformulas in any way.

PORTFRMULAS

FORMULAIc TRENDING

MDNEY IV1ANAGER

Page 3 of 3

Portformulas Investing Corporation Form ulaic Trending Money Manager TM SEC Registered Investment Advisor 6020 E Fulton St. I Ada, MI 49301 (888) 869-5994 www.portformulas.net

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Limitations On The Power of TaxationDocument2 pagesLimitations On The Power of TaxationApril Anne Costales100% (1)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Financial Statement AnalysisDocument77 pagesFinancial Statement AnalysisJebin Jacob100% (1)

- CHAPTER 5.overview of Risk and ReturnDocument61 pagesCHAPTER 5.overview of Risk and ReturnDimple EstacioNo ratings yet

- Declaration of Trust With Power of AttorneyDocument1 pageDeclaration of Trust With Power of AttorneyCora EleazarNo ratings yet

- @icmaifamily CA CMA Final SFM Theory NotesDocument156 pages@icmaifamily CA CMA Final SFM Theory NotesOmkar Pednekar100% (1)

- Syndicated Loan MarketDocument56 pagesSyndicated Loan MarketYolanda Glover100% (1)

- Radio One Inc: M&A Case StudyDocument11 pagesRadio One Inc: M&A Case StudyRishav AgarwalNo ratings yet

- ADX Based Trading SystemDocument18 pagesADX Based Trading Systemjacs6401100% (7)

- Investments - Chap. 6Document31 pagesInvestments - Chap. 6AndreaNo ratings yet

- 1600 Tax RatesDocument2 pages1600 Tax RatesmelizzeNo ratings yet

- Portformulas: Formulaic Trending Monthly AbstractDocument5 pagesPortformulas: Formulaic Trending Monthly Abstractdiane_estes937No ratings yet

- Formulaic Trending Monthly: Due To Mike Walters' Travel Schedule, Only Charts Are Being Supplied This MonthDocument4 pagesFormulaic Trending Monthly: Due To Mike Walters' Travel Schedule, Only Charts Are Being Supplied This Monthdiane_estes937No ratings yet

- Portførmulas: The Formulaic Trending Monthly AbstractDocument11 pagesPortførmulas: The Formulaic Trending Monthly Abstractdiane_estes937No ratings yet

- Portførmula$: The Formulaic Trending Mon Thly AbstractDocument5 pagesPortførmula$: The Formulaic Trending Mon Thly Abstractdiane_estes937No ratings yet

- 2012.07 RAM-Score Trending RecapDocument4 pages2012.07 RAM-Score Trending Recapdiane_estes937No ratings yet

- HOURAwardAnnouncement 2012Document1 pageHOURAwardAnnouncement 2012diane_estes937No ratings yet

- Security Analysis and Portfolio ManagementDocument21 pagesSecurity Analysis and Portfolio ManagementShiva ShankarNo ratings yet

- Exercises/Problems:) R 1 (Ue Termnalval VCF) R 1 (VCF) R 1 (VCF) R 1 (VCF) R 1 (VCFDocument1 pageExercises/Problems:) R 1 (Ue Termnalval VCF) R 1 (VCF) R 1 (VCF) R 1 (VCF) R 1 (VCFIT manNo ratings yet

- Economic Calendar Economic CalendarDocument5 pagesEconomic Calendar Economic CalendarAtulNo ratings yet

- Accounting 162 - Material 002Document2 pagesAccounting 162 - Material 002Angelli LamiqueNo ratings yet

- Review PKG1 PDFDocument25 pagesReview PKG1 PDFjennifer weiNo ratings yet

- Merger, Acquisition and Consolidation: Presented byDocument7 pagesMerger, Acquisition and Consolidation: Presented byFebin.Simon1820 MBANo ratings yet

- Project On Human RightsDocument2 pagesProject On Human RightsRahul sawadiaNo ratings yet

- Stock and Bond Valuation: Annuities and Perpetuities: Important Shortcut FormulasDocument18 pagesStock and Bond Valuation: Annuities and Perpetuities: Important Shortcut FormulasSantiago BohnerNo ratings yet

- Garcia V BOIDocument7 pagesGarcia V BOITheodore BallesterosNo ratings yet

- Scholes and Williams (1977)Document19 pagesScholes and Williams (1977)DewiRatihYunusNo ratings yet

- Certificate of Merger Instructions For FilingDocument6 pagesCertificate of Merger Instructions For FilingMark ReinhardtNo ratings yet

- Working Capital On WIPRO ITCDocument50 pagesWorking Capital On WIPRO ITCB Swaraj100% (1)

- SRE LLP Annual Report 2017-18Document9 pagesSRE LLP Annual Report 2017-18Saba MullaNo ratings yet

- Business Secrets of Dhirubhai AmbaniDocument15 pagesBusiness Secrets of Dhirubhai AmbaniRajesh GhadgeNo ratings yet

- 7 - Role of Fiis in The Indian Capital MarketDocument12 pages7 - Role of Fiis in The Indian Capital MarketpreethamdNo ratings yet

- Antipolo Realty Corp. vs. NHA, G.R. No. L-50444, August 31, 1987Document6 pagesAntipolo Realty Corp. vs. NHA, G.R. No. L-50444, August 31, 1987Lou Ann AncaoNo ratings yet

- Buying and Selling Securities: Fundamentals InvestmentsDocument47 pagesBuying and Selling Securities: Fundamentals InvestmentsarifulseuNo ratings yet

- Time Value Money ProblemsDocument6 pagesTime Value Money ProblemsWendell Markus Peliño SabulberoNo ratings yet

- Mergers & Acquisitions: Merger Evaluation: RIL & Network 18Document13 pagesMergers & Acquisitions: Merger Evaluation: RIL & Network 18DilipSamantaNo ratings yet

- Stock Market Participants: Claudine Jane L. HibanDocument4 pagesStock Market Participants: Claudine Jane L. HibanJerbert JesalvaNo ratings yet