Professional Documents

Culture Documents

Write Up On Foreign Investment in India

Uploaded by

Harsh Vardhan BhandariOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Write Up On Foreign Investment in India

Uploaded by

Harsh Vardhan BhandariCopyright:

Available Formats

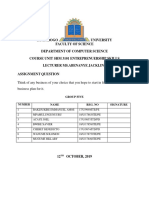

S.

Dhanapal & Associates

Practising Company Secretaries Chennai

WRITE UP ON RECENT DEVELOPMENTS

ON

FOREIGN INVESTMENTS IN INDIA & ACQUISITION OF PROPERTY

Foreign Direct Investment is freely permitted in almost all sectors except those sectors specifically prohibited/restricted. Under the Foreign Direct Investments (FDI) Scheme, investments can be made by non-residents in the shares / both convertible or non convertible debentures / preference shares of an Indian company, through two routes; the Automatic Route and the Government Route. Under the Automatic Route, the foreign investor or the Indian company does not require any approval from the Reserve Bank or Government of India for the investment. Under the Government Route, prior approval of the Government of India, Ministry of Finance, and Foreign Investment Promotion Board (FIPB) is required. FDI Policy is formulated by the Government of India. The Ministry of Commerce and Industry, Department of Industrial Policy and Promotion has issued a Consolidate FDI Policy Circular dated March 31,2010 elaborating the policy and the process in respect of FDI in India, which is available in public domain FEMA Regulations prescribe the mode of investments i.e. manner of receipt of funds, issue of shares / convertible debentures and preference shares and reporting of the investments to the Reserve Bank.

Foreign Direct Investment (FDI) in India is governed by the FDI Policy announced by the Government of India and the provisions of the Foreign Exchange Management Act (FEMA), 1999. Reserve Bank has issued Notification No. FEMA 20 /2000-RB dated May 3, 2000 which contains the Regulations in this regard. This Notification has been amended from time to time.

Prohibition on investment in India Foreign investment in any form is prohibited in a company or a partnership firm or a proprietary concern or any entity, whether incorporated or not (such as, Trusts) which is engaged or proposes to engage in the following activities:

(a) Business of chit fund, or (b) Nidhi company, or

Copy Right @2010 SD Associates S.Dhanapal, B.Com, BA.BL, A.C.S Managing Partner

S.Dhanapal & Associates

Practising Company Secretaries Chennai

(c) Agricultural or plantation activities, or (d) Real estate business, or construction of farm houses, or (e) Trading in Transferable Development Rights (TDRs).

Investment in the form of FDI is also prohibited in certain sectors such as (a) Retail Trading (except single brand product retailing) (b) Atomic Energy (c) Lottery Business including Government / private lottery, online lotteries, etc. (d) Gambling and betting including casinos, etc (e) Business of chit fund (f) Nidhi company (g) Trading in Transferable Development Rights (TDRs) (h) Activities / sectors not opened to private sector investment (i) Agriculture (excluding Floriculture, Horticulture, Development of seeds, Animal Husbandry, Pisciculture and cultivation of vegetables, mushrooms, etc. under controlled conditions and services related to

Eligibility for Investment in India (i) A person resident outside India (other than a citizen of Pakistan) or an entity incorporated outside India, (other than an entity incorporated in Pakistan) can invest in India, subject to the FDI Policy of the Government of India. A person who is a citizen of Bangladesh or an entity incorporated in Bangladesh can invest in India under the FDI Scheme, with the prior approval of the FIPB.

(ii) Overseas Corporate Body (OCB) means a company, partnership firm, society and other corporate body owned directly or indirectly to the extent of at least sixty per cent by NonResident Indians and includes overseas trust in which not less than sixty per cent beneficial interest is held by Non- Resident Indians, directly or indirectly, but irrevocably. OCBs have been de-recognised as a class of investors in India with effect from September 16, 2003. Erstwhile OCBs which are incorporated outside India and are not under adverse notice of the Reserve Bank can make fresh investments under the FDI Scheme as incorporated nonresident entities, with the prior approval of the Government of India if the investment is through the Government Route; and with the prior approval of the Reserve Bank if the investment is through the Automatic Route.

Copy Right @2010 SD Associates S.Dhanapal, B.Com, BA.BL, A.C.S Managing Partner

S.Dhanapal & Associates

Practising Company Secretaries Chennai

ISSUANCE OF NON-CONVERTIBLE DEBENTURES

A corporate shall be eligible to issue NCDs with original or initial maturity up to one year and issued by way of private placement; if it fulfills the following criteria, namely, a) the corporate has a tangible net worth of not less than Rs.4 crore, as per the latest audited balance sheet; b) the corporate has been sanctioned working capital limit or term loan by bank/s or all-India financial institution/s; and c) the borrowal account of the corporate is classified as a Standard Asset by the financing bank/s or institution/s. Basic Requirements a. NCDs shall not be issued for maturities of less than 90 days from the date of issue. b. Every corporate issuing NCDs shall appoint a Debenture Trustee (DT) for each issuance of the NCDs. c. The exercise date of option (put/call), if any, attached to the NCDs shall not fall within the period of 90 days from the date of issue. d. The tenor of the NCDs shall not exceed the validity period of the credit rating of the instrument. e. NCDs may be issued in denominations with a minimum of Rs.5 lakh (face value) and in multiples of Rs.1 lakh. f. The aggregate amount of NCDs issued by a corporate shall be within such limit as may be approved by the Board of Directors of the corporate or as indicated by the Credit Rating Agency, whichever is lower. Procedure for Issuance i. The corporate shall disclose to the prospective investors, its financial position as per the standard market practice. ii. The auditors of the corporate shall certify to the investors that all the eligibility conditions set forth in these directions for the issue of NCDs are met by the corporate. iii. The requirements of all the provisions of the Companies Act, 1956 and the Securities and Exchange Board of India (Issue and Listing of Debt Securities) Regulations, 2008, or any other law, that may be applicable, shall be complied with by the corporate. iv. The Debenture Certificate shall be issued within the period prescribed in the Companies Act, 1956 or any other law as in force at the time of issuance. v. NCDs may be issued at face value carrying a coupon rate or at a discount to face value as zero coupon instruments as determined by the corporate.

Copy Right @2010 SD Associates S.Dhanapal, B.Com, BA.BL, A.C.S Managing Partner

S.Dhanapal & Associates

Practising Company Secretaries Chennai

WHO CAN DO FOREIGN INVESTMENT IN INDIA?

Foreign Investments

Foreign Direct Investments

Automatic Route

Government Route

Persons Resident outside India

Foreign Portfolio Investments

FIIs NRIs, PIO

Foreign Venture Capital Investments

SEBI regd. FVCIs

VCF IVCUs

Other Investments (G sec, NCDs, etc) FIIs NRIs, PIO

Investments on nonrepatriable basis

NRIs PIO

Copy Right @2010 SD Associates

S.Dhanapal, B.Com, BA.BL, A.C.S Managing Partner

S.Dhanapal & Associates

Practising Company Secretaries Chennai

SOME HIGHLIGHTS ON PROVISION RELATING TO ESTABLISHMENT OF BRANCH/ LIASION /PROJECT OFFICE IN INDIA BY FOREIGN ENTITIES

PARTICULARS

BRANCH OFFICE

LIASION OFFICE

PROJECT OFFICE

MEANING

--Represent parent /other

the company -- Place of business of Company in

foreign -- Place of business Foreign India

companies in various in India matters in India _________________ _________________

--Does not undertake _________________ commercial/industrial

-- Profit earned by /trading Branch offices

activity

is directly or indirectly -- Execution of project in India

freely remittable from India, payment applicable taxes. _________________ subject to _________________ of -channel

of _________________

communication between Head Office

--Not allowed to carry abroad and parties in out manufacturing, India

processing activities _________________ directly/indirectly _________________ --Expenses of such offices are to be met --Not allowed to entirely through

undertake

Retail inward remittances of exchange

Trading activities of foreign

Copy Right @2010 SD Associates

S.Dhanapal, B.Com, BA.BL, A.C.S Managing Partner

S.Dhanapal & Associates

Practising Company Secretaries Chennai

any nature in India

from the Head Office outside India

ENTRY ROUTE

--

Both

under --Foreign

Insurance --

Reserve

Bank

has

Automatic Route and companies Government Route _________________ establish

can granted Liaison permission to

general foreign

Offices in India only companies to establish after obtaining Project Offices in India, from the provided they have

--Foreign banks do approval

not require separate Insurance Regulatory secured a contract from approval under and Development an Indian company to execute a project in India

FEMA, for opening Authority branch office in India but has to obtain _________________

_________________

necessary

approval

under the provisions --Foreign banks can -- In case the criteria for of the Banking establish Liaison establishment are not

Regulation Act, 1949, Offices in India only fulfilled, the foreign entity from Department of after Banking & Operations approval obtaining has to approach the RBI, from the central of approval. office for

Development, Department Banking and

Reserve Bank. _________________

Operations Development Reserve

(DBOD),

-- Reserve Bank has Bank of India. given general _________________

permission to foreign companies establishing for --Permission to set up such offices is

branch/unit in Special initially granted for a Economic Zones period of 3 years and

(SEZ5) to undertake this may be extended manufacturing service activities. and from time to time by an AD Category I bank.

Copy Right @2010 SD Associates S.Dhanapal, B.Com, BA.BL, A.C.S Managing Partner

S.Dhanapal & Associates

Practising Company Secretaries Chennai

TRACK RECORD/ CRITERIA

-- The project is funded directly by inward

remittance from abroad A profit making track A profit making track or record during the record during by a bilateral or

the multilateral International Financing Agency; or three _________________

immediately preceding

immediately five preceding

financial years in the financial years in the -- the project has been home country home country cleared by an

appropriate authority; or _________________ -- a company or entity in India contract awarding has the been

granted Term Loan by a Public Financial

Institution or a bank in India for the project. --Copy CLOSURE Reserve of the --Copy Banks Reserve of the --The Foreign currency Banks accounts have to be

permission/ approval permission/ approval closed on completion on from the sectoral from the sectoral projects for

regulator(s)

for regulator(s)

establishing the BO / establishing the BO / _________________ LO _________________ --Auditors certificate LO _________________ --Auditors certificate -- AD Category I bank can permit intermittent remittances by Project Offices pending winding -- No-objection / Tax -- No-objection / Tax up/ completion of the Clearance Certificate Clearance Certificate project provided they are from authority Income-Tax from for the authority Income-Tax satisfied with the for the bonafide of the transaction, subject to the following:

Copy Right @2010 SD Associates S.Dhanapal, B.Com, BA.BL, A.C.S Managing Partner

remittance/s.

remittance/s.

S.Dhanapal & Associates

Practising Company Secretaries Chennai

_________________

_________________

_________________

--Applicant/parent company

--Applicant/parent company

a) The Project Office submits an Auditors /

confirmation that no confirmation that no Chartered Accountants legal proceedings in legal proceedings in Certificate to the effect any Court in India are any Court in India are that sufficient provisions pending and there is pending and there is have been made to meet no legal impediment no legal impediment the liabilities in India to the remittance to the remittance including Income Tax, etc. _________________ _________________ _________________ b) An undertaking from -- Report from the -- Report from the the Project Office that the Registrar of Registrar of remittance will not, in any

Companies regarding Companies regarding way, affect the compliance with the compliance with the completion of the Project provisions Companies 1956, in case of the provisions Act, Companies of 1956, in case of the in India and that any Act, shortfall of funds for of meeting any liability in

winding up of the winding up of the India will be met by Office in India Office in India inward remittance from abroad. _________________ _________________ _________________ -- Inter-Project transfer of funds -Any other -Any requires of prior the Office of Bank the under the

other permission specified Regional

Document

specified Document

by RBI while granting by RBI while granting concerned approval. approval. Reserve whose

jurisdiction

Project Office is situated.

Copy Right @2010 SD Associates

S.Dhanapal, B.Com, BA.BL, A.C.S Managing Partner

S.Dhanapal & Associates

Practising Company Secretaries Chennai

ENTRY ROUTES IN INDIA THROUGH FOREIGN INVESTMENT

Copy Right @2010 SD Associates

S.Dhanapal, B.Com, BA.BL, A.C.S Managing Partner

S.Dhanapal & Associates

Practising Company Secretaries Chennai

ACQUISITION AND TRANSFER

OF IMMOVABLE PROPERTY IN INDIA

NON RESIDENT INDIAN (NRI)

Purchase of Immovable property A NRI can acquire any Immovable property by way of purchase (Other than Agricultural land/ Plantation property/ Farm house) in India 2) A NRI may transfer any immovable property to an Indian citizen or a PIO resident outside India (Other than Agricultural land/ Plantation property/ Farm house) 1) Fund received in India through normal banking channels by way of inward remittance from any place outside India/ by debit to his NRE/ FCNR(B) / NRO account _________________ Transfer of immovable property Payment for acquisition of immovable property Other aspects

1) A NRI may transfer any immovable property in India to a person resident in India. _________________

NRIs can make payment for acquisition of

No documents to be filed if a NRI

immovable property (Other purchases than Agricultural land/ Plantation property/ Farm house) out of: _________________ Residential or commercial property under general permission

2) Such payments cannot be made either by travelers cheque/ foreign currency notes/ by other mode except those specifically mentioned

Copy Right @2010 SD Associates

S.Dhanapal, B.Com, BA.BL, A.C.S Managing Partner

S.Dhanapal & Associates

Practising Company Secretaries Chennai

PERSON OF INDIAN ORIGIN

Purchase of Immovable property A PIO can acquire any Immovable property by way of purchase (Other than Agricultural land/ Plantation property/ Farm house) in India Gift/ Inheritance Of Immovable Property Payment for Other acquisition of aspects immovable property 1) A PIO may 1) A PIO can transfer A PIO can make No acquire any any property in India payment for documents property in India by way of gift by way of sale to a acquisition of to be filed from a person person resident in immovable property if a PIO resident in India/ NRI/ PIO India Other than (Other than purchases ______________ Agricultural land/ Agricultural land/ Residential 2) A PIO may Plantation property/ Plantation property/ or acquire any Farm house. Farm house) commercial immovable _________________ out of: property property in India 2) He may transfer _________________ under by way of Agricultural land/ 1) Fund received in general inheritance from Plantation property/ India through normal permission a person resident Farm house in India, banking channels by in India/ a person by way of sale or gift way of inward resident outside to a person resident in remittance from any India who had India, who is a citizen place outside India/ acquired the of India by debit to his NRE/ property in _________________ FCNR(B) / NRO accordance with 3) He may transfer account the provisions of residential/commercial _________________ the foreign property in India by 2) Such payments exchange law in way of gift to a person cannot be made force or FEMA resident in India/ to a either by travelers regulations, at person resident cheque/ foreign the time of outside India, who is a currency notes/ by acquisition of the citizen of India or to a other mode except property. person of Indian origin those specifically resident outside India mentioned Transfer of immovable property

Copy Right @2010 SD Associates

S.Dhanapal, B.Com, BA.BL, A.C.S Managing Partner

S.Dhanapal & Associates

Practising Company Secretaries Chennai

FOREIGN EMBASSIES/ DIPLOMATS/ CONSULATE GENERALS

In regulation 5A of the Foreign Exchange Management (Acquisition and Transfer of Immovable property in India) Regulations 2000, Foreign Embassies/ Diplomats/ Consulate Generals may purchase/ sell immovable property (Other than Agricultural land/ Plantation property/ Farm house) in India provided:

Clearance from the government of India, The

consideration

for

acquisition

of

Ministry of External Affairs is obtained for such immovable property in India is paid out of purchase/ sale funds remitted from abroad through the normal banking channels.

PERSON RESIDENT OUTSIDE INDIA FOR CARRYING ON A PERMITTED ACTIVITY

A person resident outside India who has established a Branch, Office or other place of business, excluding a Liaison office, for carrying on in India any activity in accordance with the foreign exchange management (Establishment in India of Branch or Office or other place of business) Regulations, 2000 may -

Clause (a)

Acquire any immovable property in India, Transfer by way of mortgage to an which is necessary for or incidental to carry on Authorised Dealer as a security for any such activity, provided that all applicable laws, borrowing, the immovable property

rules, regulations or directions for the time acquired in pursuance of clause (a) being in force are duly complied with, and the person files with the RBI a declaration in the form IPI (Annex - 2 ) not later than 90 days from the date of such acquisition

Copy Right @2010 SD Associates

S.Dhanapal, B.Com, BA.BL, A.C.S Managing Partner

S.Dhanapal & Associates

Practising Company Secretaries Chennai

CURRENT ACCOUNT TRANSACTIONS LIBERLISATION

FOREIGN EXCHANGE MANAGEMENT (CURRENT ACCUNT TRANSACTION) RULES, 2000 - ITEM 8 OF SCHEDULE II The existing policy of Government of India on the payment of royalties under Foreign Technology Collaboration provides for automatic approval for foreign technology transfers involving payment of lumpsum fee of US$ 2 million and payment of royalty of 5% on domestic sales and 8% on exports. In addition, where there is no technology transfer involved, royalty up to 2% for exports and 1% for domestic sales is allowed under automatic route on use of trademarks and brand names of the foreign collaborator. Technology transfers involving payments above these limits required prior permission of the Government of India (Project Approval Board, Department of Industrial Policy and Promotion). i.e according to Rule 4 of the Foreign Exchange management (Current Account Transactions) Rules 2000, prior approval of the Ministry of Commerce and Industry, Government of India, is required for drawing foreign exchange for remittances under technical collaboration agreements where payment of royalty exceeds 5% on local sales and 8 % on exports and lump sum payment exceeds USD 2 million.

RECENT AMENDMENT A.P. (DIR SERIES) CIRCULAR NO.52 DATED MAY 13, 2010 AD category I banks may permit drawal of foreign exchange by persons for payment of royalty and lump sum payment under Technical Collaboration Agreements without the approval of Ministry of Commerce and Industry, Government of India.

The GOI reviewed the extant policy with regard to liberalization of foreign technology agreement and it was decided to permit, with immediate effect, payments for royalty, lump sum fee for transfer of technology and payments for use of trademark/ brand name on the automatic route i.e. without any approval of the Government of India. All such payments will be subject to Foreign Exchange Management (Current Account Transactions) Rules, 2000 as amended from time to time. Accordingly, GOI issue a press note on 16.12.2009. Hence the rule shall be deemed to have come into force with retrospective effect from 16.12.2009.No person will be adversely affected by giving retrospective effect to these rules.

Copy Right @2010 SD Associates

S.Dhanapal, B.Com, BA.BL, A.C.S Managing Partner

S.Dhanapal & Associates

Practising Company Secretaries Chennai

EXTERNAL COMMERCIAL BORROWINGS

External Commercial Borrowings (ECB) refer to commercial loans in the form of bank loans, buyers credit, suppliers credit, securitized instruments (e.g. floating rate notes and fixed rate bonds, non-convertible, optionally convertible or partially convertible preference shares) availed of from non-resident lenders with a minimum average maturity of 3 years.

ECB can be accessed under two routes, viz(i) Automatic Route and (ii) Approval Route

PARTICULARS

AUTOMATICE ROUTE

APPROVAL ROUTE

ECB beyond 50 per cent funds of the by owned financial

ELIGIBLE BORROWERS

Corporate Infrastructure Finance Companies except financial

institutions which are classified Infrastructure Companies as Finance are

intermediaries, such as banks, financial institutions, Housing

Finance Companies and NonBanking Financial Companies are eligible to raise ECB. Individuals, Trusts and Non-Profit making organizations are not eligible to raise ECB.

considered on a case to case basis. Banks and financial

institutions which had participated in the

textile or steel sector restructuring package

as approved by the Government Units in Special Economic Zones (SEZ) are allowed to raise ECB for their own requirement. ECB with minimum

average maturity of 5 years by Non-Banking Financial Companies

Copy Right @2010 SD Associates

S.Dhanapal, B.Com, BA.BL, A.C.S Managing Partner

S.Dhanapal & Associates

Practising Company Secretaries Chennai

However, they cannot transfer or on-lend ECB funds to sister

Infrastructure Companies Foreign Convertible

Finance

Currency Bonds

concerns or any unit in the Domestic Tariff Area.

(FCCB5) by Housing Finance Companies

satisfying the minimum criteria Non-Government Organizations activities are eligible to avail of ECB Special Vehicles Multi-State operative Societies SEZ avail developers of ECBs can for CoPurpose

(NGO5) engaged in micro finance

providing infrastructure facilities within SEZ, as defined in the extant ECB policy Corporate which have violated the extant ECB policy Cases falling outside the purview of the

automatic route limits

RECOGNISED LENDERS

(a) Borrowers can raise ECB from (a) Borrowers can raise ECB internationally recognized sources such from internationally recognised as (i) international banks, (ii) International capital markets, (iii) multilateral financial institutions (such as IFC, ADB, CDC, etc) sources international such as (i) (N)

banks,

international capital markets, (Ni) multilateral financial

institutions (such as IFC, ADB,

Copy Right @2010 SD Associates

S.Dhanapal, B.Com, BA.BL, A.C.S Managing Partner

S.Dhanapal & Associates

Practising Company Secretaries Chennai

(iv) export credit agencies, (v) suppliers of equipments, (vi) foreign collaborators and

CDC, etc.), (iv) export credit agencies, equipment, (v) suppliers (vi) of

foreign

(vii) Foreign equity holders (other than collaborators and (v) foreign erstwhile Overseas Corporate Bodies). equity holders (other than

erstwhile OCB5). (b) A foreign equity holder to be eligible as recognized lender under the (b) From foreign equity holder

automatic route would require minimum where the minimum paid-up holding of paid-up equity in the borrower equity held directly by the company as set out below: foreign equity lender is 25 per cent but ECBs: equity ratio (i) For ECB up to USD 5 million - exceeds 4:1 (i.e. the proposed minimum paid-up equity of 25 per cent ECB exceeds four times the held directly by the lender, direct foreign equity holding).

(ii) For ECB more than USD 5 million minimum paid-up equity of 25 per cent held directly by the lender and debtequity ratio not exceeding 4:1 (i.e. the proposed ECB not exceeding four times the direct foreign equity holding) a) The maximum amount of ECB which Corporate can avail of ECB of AMOUNT MATUIRITY & can be raised by a corporate other than an additional amount of USD those in the hotel, hospital and software 250 million with average

sectors is USD 500 million or its maturity of more than 10 years equivalent during a financial year. under the approval route, over and above the existing limit of b) Corporate in the services sector viz, USD 500 million under the hotels, hospitals and software sector are automatic route, during a

allowed to avail of ECB up to USD 100 financial year. million or its equivalent in a financial year for meeting foreign currency and/ or Other ECB criteria, such as Rupee

Copy Right @2010 SD Associates

capital

expenditure

for end-use, recognized lender,

S.Dhanapal, B.Com, BA.BL, A.C.S Managing Partner

S.Dhanapal & Associates

Practising Company Secretaries Chennai

permissible end-uses. The proceeds of etc., need to be complied with. the ECBs should not be used for Prepayment acquisition of land. and call/put

options, however, would not be permissible for such ECB

c) ECB up to USD 20 million or its up to a period of 10 years. equivalent minimum years. in a financial maturity year of with three

average

d) ECB above USD 20 million or equivalent and up to USD 500 million or its equivalent with a minimum average maturity of five years.

e) NGOs engaged in micro finance activities can raise ECB up to USD 5 million or its equivalent during a financial year. Designated AD bank has to ensure that at the time of drawdown the forex exposure of the borrower is fully hedged.

f) ECB up to USD 20 million or equivalent can have call/put option provided the minimum average maturity of three years is complied with before exercising call/put option. Borrowers PROCEDURE may enter into loan Applicants are required to

agreement complying with the ECB submit an application in form guidelines with recognised lender for ECB through designated AD raising ECB under Automatic Route bank to the Chief General without the prior approval of the Reserve Manager-in-Charge, Bank. The borrower must obtain a Loan Exchange Foreign

Department,

Registration Number (LRN) from the Reserve Bank of India, Central Reserve Bank of India before drawing Office, External Commercial

Copy Right @2010 SD Associates S.Dhanapal, B.Com, BA.BL, A.C.S Managing Partner

S.Dhanapal & Associates

Practising Company Secretaries Chennai

down the ECB.

Borrowings Division, Mumbai 400 001, along with

necessary documents. a) ECB can be raised for investment (a) ECB can be raised only for END-USE [such as import of capital goods (as classified by DGFT in the Foreign Trade Policy), new of investment [such as import of capital goods (as classified by DGFT in the Foreign Trade

projects, Policy), implementation of new existing projects, modernization/expansion of

modernization/expansion

production units] in real sector - industrial sector including small and

existing production units] in

medium real sector - industrial sector including small and medium enterprises (SME) and

enterprises (SME), infrastructure sector and specified service sectors

infrastructure sector - in India.

b) Overseas direct investment in Joint Ventures Subsidiaries existing (JV)/ (WOS) Wholly subject on Indian Owned to

(b) Overseas direct investment in Joint Ventures, Wholly

Owned Subsidiaries subject to existing guidelines on

the the

guidelines

Direct

Indian Direct Investment in JV, WOS abroad.

Investment in JV/ WOS abroad. (c) The payment by eligible c) Utilization of ECB proceeds is borrowers in the Telecom

sector, for spectrum allocation permitted for first stage acquisition of may, initially, be met out of resources bidders, by to the be

shares in the disinvestment process and Rupee also in the mandatory second stage offer to the public under the Governments disinvestment shares. programme of

successful

refinanced with a long-term ECB, under the approval

PSU route, subject to the following conditions:

Copy Right @2010 SD Associates

S.Dhanapal, B.Com, BA.BL, A.C.S Managing Partner

S.Dhanapal & Associates

Practising Company Secretaries Chennai

(i) The ECB should be raised d) For lending to self-help groups or for micro-credit or for bonafide micro finance activity including capacity building by NGOs engaged in micro finance (ii) The designated I bank AD within 12 months from the date of payment of the final

installment to the Government;

Category activities.

should

monitor the end-use of funds;

e) Payment for Spectrum Allocation.

(iii) Banks in India will not be permitted to provide any form of guarantees; and

f) Infrastructure Finance Companies i.e. Non Banking Financial Companies iv) All other conditions of ECB, categorized as IFCs by the Reserve such as eligible borrower,

Bank, are permitted to avail of ECBs, recognized lender, all-in-cost, including the outstanding ECBs, up to 50 per cent of their owned funds, for onlending to the infrastructure sector as (d) The first stage acquisition defined under the ECB policy, subject to their complying with the following of shares in the disinvestment process and also in the average maturity, etc, should be complied with.

mandatory second stage offer to the public under the

conditions: i) compliance with the norms prescribed in the DNBS Circular

Governments

disinvestment

programme of PSU shares.

DNBS.PD.CCNo.168 / 03.02.089 / 2009- (e) Corporate engaged in the 10 dated February 12, 2010 development township as of integrated defined by

Ministry of Commerce and ii) hedging of the currency risk in full. Industry, DIPP, SIA (FC

Division), Press Note 3 (2002

Copy Right @2010 SD Associates S.Dhanapal, B.Com, BA.BL, A.C.S Managing Partner

S.Dhanapal & Associates

Practising Company Secretaries Chennai

Designated Authorised Dealer should Series) dated January 4, 2002. ensure compliance with the extant norms while certifying the ECB application. Integrated township includes housing, commercial

premises, hotels, resorts, city and regional level urban

infrastructure facilities, such as roads and bridges, mass rapid transit manufacture materials. land and systems of and building of

Development providing forms

allied an

infrastructure

integrated part of townships development. The minimum area to be developed should be 100 acres for which norms and standards are to be

followed as per local byelaws/rules. In the absence of such minimum bye-laws/rules, of two a

thousand

dwelling units for about ten thousand population will need to be developed. This facility is available up to December 31, 2010.

(a) For on-lending or investment in (a) END-USES NOT PERMITTED

For

on-lending

or

capital market or acquiring a company investment in capital market or (or a part thereof) in India by a corporate acquiring a company (or a part except Companies, institutions Infrastructure banks and Finance thereof) in India by a corporate financial [investment in Special Purpose Vehicles, Money Market

Mutual Funds, etc., are also

Copy Right @2010 SD Associates S.Dhanapal, B.Com, BA.BL, A.C.S Managing Partner

S.Dhanapal & Associates

Practising Company Secretaries Chennai

(b) For real estate. However, the term considered as investment in real estate excludes development of capital markets). integrated township as defined by the Ministry of Commerce and Industry, (b) for real estate sector DIPP, SIA (FC Division), Press Note 3 (2002 Series) dated January 4, 2002. (c) for working capital, general corporate purpose and

(c) For working capital, general corporate repayment of existing Rupee purpose and repayment of existing loans.

Rupee loans.

FOREIGN DIRECT INVESTMENT (FDI) IN INDIA - TRANSFER OF SHARES / PREFERENCE SHARES / CONVERTIBLE DEBENTURES

BY WAY OF SALE - REVISED PRICING GUIDELINES

PARTICULARS EXISTING PROVISIONS

REVISED PROVISION

Transfer Resident Non resident

By To incorporated non resident entity to Other then erstwhile OCB, foreign national, FII, NRI

To foreign national, NRI, FII and incorporated non resident entity other than erstwhile OCB

a) the ruling market incase the shares are listed on stock exchange a) where shares of an Indian company are listed on a

recognized stock exchange in India, the price of shares

Copy Right @2010 SD Associates

S.Dhanapal, B.Com, BA.BL, A.C.S Managing Partner

S.Dhanapal & Associates

Practising Company Secretaries Chennai

transferred by way of sale shall not be less than the price at which a preferential allotment of shares can be made under the SEBI Guidelines, as applicable, provided that the same is

determined for such duration as specified therein, preceding the relevant date, which shall be the date of purchase or sale of shares b) Incase of unlisted shares, fair valuation chartered guidelines of shares done as by a CCI company are not listed on a recognized stock exchange in India, the transfer of shares shall be at a price not less than the fair value to be determined by a SEBI registered Category - I Merchant Banker or a Chartered Accountant discounted method. as free per cash the flow

b) where the shares of an Indian

accountant

per

The price per share arrived at should be certified by a SEBI

Copy Right @2010 SD Associates

S.Dhanapal, B.Com, BA.BL, A.C.S Managing Partner

S.Dhanapal & Associates

Practising Company Secretaries Chennai

registered Category-I-Merchant Banker / Chartered Accountant.

Transfer by non By incorporated non-resident entity, resident resident to erstwhile OCB, foreign national, NRI, FII

By

incorporated

non-resident

entity, erstwhile OCB, foreign national, NRI and FII

Where

the

shares

of

an

Indian Price of shares transferred by way of sale, by non-resident to

company are traded on stock exchange a) The sale is at the prevailing market price on stock exchange and is

resident shall not be more than

effected through a merchant banker the minimum price at which the registered with the SEBI or through a transfer of shares can be made stock broker registered with the stock from a resident to a non-resident exchange. a) where shares of an Indian b) if the transfer is other than that referred to in clause (a), the price shall company are listed on a

be arrived at by taking the average recognized stock exchange in quotations (average of daily high and India, the price of shares low) for one week preceding the date of transferred by way of sale shall application with 5 per cent variation. not be less than the price at Where, however, the shares are being which a preferential allotment of sold by the foreign collaborator or the shares can be made under the foreign promoter of the Indian company to the existing promoters in India with SEBI Guidelines, as applicable, the objective of passing management provided that the same is control in favour of the resident determined for such duration as promoters the proposal for sale will be

Copy Right @2010 SD Associates

S.Dhanapal, B.Com, BA.BL, A.C.S Managing Partner

S.Dhanapal & Associates

Practising Company Secretaries Chennai

considered at a price which may be specified therein, preceding the higher by up to a ceiling of 25 per cent over the price arrived at as above. date of purchase or sale of shares relevant date, which shall be the

Where

the

shares

of

an

Indian b) where the shares of an Indian company are not listed on a recognized stock exchange in

company are not listed on stock exchange or are thinly traded

a) if the consideration payable for the India, the transfer of shares shall transfer does not exceed Rs. 20 lakhs per seller per company, at a price mutually agreed to between the seller fair value to be determined by a and the buyer, based on any valuation SEBI registered Category - I methodology currently in vogue, on submission of a certificate from the statutory auditors of the Indian Accountant as free per cash the flow Merchant Banker or a Chartered be at a price not less than the

company whose shares are proposed discounted to be transferred, regarding the method. valuation of the shares, and

b) if the amount of consideration

The price per share arrived at

payable for the transfer exceeds Rs.20 should be certified by a SEBI lakhs per seller per company, at a price registered Category-I-Merchant arrived at, at the seller's option, in any Banker / Chartered Accountant. of the following manner, namely:

1) a price based on earning per share (EPS) linked to the Price Earning (P/E) multiple, or a price based on the Net Asset Value (NAV) linked to book value multiple, whichever is higher,

Copy Right @2010 SD Associates

S.Dhanapal, B.Com, BA.BL, A.C.S Managing Partner

S.Dhanapal & Associates

Practising Company Secretaries Chennai

(Or)

2) the prevailing market price in small lots as may be laid down by the Reserve Bank so that the entire shareholding is sold in not less than five trading days through screen based trading system (or)

3) where the shares are not listed on any stock exchange, at a price which is lower of the two independent

valuations of share, one by statutory auditors of the company and the other by a Chartered Accountant or by a Merchant registered Banker with in Category 1 and

Securities

Exchange Board of India.

Place : Chennai Date : 08.07.2010

S.Dhanapal

Practising Company Secretary

Disclaimer This write-up has been prepared based on my bona-fide understanding of the provisions provided in the Act and the legal provisions as they exist. This write up would be an indicative expression of my personal understanding and thoughts about the provisions provided in the Act and need not be conclusive one and the same should not be construed as professional advise. This write up only provides basic and elementary knowledge to its readers. Independent professional advice should be sought from experts if there requires any further clarity in the provisions of law depending upon various circumstances.

Copy Right @2010 SD Associates S.Dhanapal, B.Com, BA.BL, A.C.S Managing Partner

, eetCIJcllffig8mng

BuSinessLine

^,flaY V' )nrn

omfilmco (nsonDl

oa,c4|l: Lorordolr,o .o"iilooceo) 6(nl(rrlaua@ocot c6L(B &(nl(rr1 6coj ol(rocei@). tdlo{cdjl4 pc(ful .Oa;m,fd mj6'1" - 2o1o q(r)d0l eoo)joi c"r,6r!A 6icod cDoo6o6rD oaccodmtoal a"ncd eaed.r c6i?rcoso.ru,.te6 codororpi"jooog (o9aaoiioLs(ot (r)loi rD."rs'lCd o(\)ol(r)cd eB migl(ni 6J6. oc.oco)6m dololql odeoi6rl. Od"ercs(r)" c"r"6Dd olai urmilcuofl raoroi oldat nOoA.cotc(r) (slo(l)ja,gj(o) 6)o6r)lal 41. orDql-d o,l^co)6ocdA

@COrlL(Bcn,4 JgOCS(tI) GId66)^]6IIB

Transparency, to key corporategovernance

our Bureau it, otherwise it would be Kochi,July 1 open to the chargeof acting public interest. A seminar on the theme against 'Emerging Dimensions for Corporates and profesProfessionals' u'as sionals could contribute, in Corporate organised the Centre for their own waysin, achieving by and socialjustice. CorporateDevelopment Training (a Division of Baiju Millions of peoplegowithRamachandran Associates' out the basic {acilities and & Corporate SolrtionsP\t Ltd) much more remains to be in association with the Indi- done by NGOs, corporates an chamber of commerce etc,he added. rnl rn.1'rc*v horp Mr Bharat N. Khona, forInauguratingthe Serninar mer President ofICCI, in his Dr JusticeK. Narayana Ku- presidential address, menrup, former actingChiefJus- tioned that the purpose of tice, High Court of Madras, the seminar is to generate pointed out that sound pol- awareness amongthe corpodirectorsand icies and actions that fulfil rates,company and the aspirations the people corporateprofessionals of should form the bedrock of to provide a platform to disgovernance. cuss and deliberate upon anycorporate Transparency shalL the valious aspects the Combe of Law hall-markofall corporate ac- pany Settlement tions - transparency the Scheme2010 and EasyExit to 2010. shareholders,to thc crcd- Schcmc Mr Baiju Ramachandran itors,to the statutoryauthorities, to the courts and to of CCDTgavea brief outline everybodywho deals with of the two schemesintroentity,he said. ducedby the Union Ministry the corporate To be successful,apart ofCorporateAffairs aimedat frorn making profit at any reducingthe number of decost, every corporation faulters and weed out comthat arenot interested should be committed to a panies core ideologyand live up to in doingbusiness. .

af,cocorc(oEetrng6mocaJ, 6,(r)l (rt om)t65an nO(rU. (l)(')dcoE (r)so|orl. ns,i6rD" "Ocril(xd k'rrac

THE NEW INDIAN EXPRESS

transparency ideology, Callfor corporate

News Express service Kgchi, 1 July

. :Ii'

policiesand actionsthat SOUND fuLhli the aspirations the people of shouldform the bedrockof corporate governance, JusticeK Narayana Kuruphassaid. Inaugurating seminal on the a 'Emerging dimensions corpolbr rate professionais' organisedby the Centrefor CorporateDevelopin rnentandTraining (CCDT) associationwith the Indian Chamber of Commerce Industry he saicl and transparency shouldbe the hall tg r li i cN K actions- trans. J L r s t i Ke a r a y d n au f u p n a u g u r a t i nh e s e m i n ao r ' E m e r q i l 'dgm e n s i o n s mafk of cQrporate professionals'organised Ientrefor C0Iporate by the pareucyto thc shaleholders, the f0r c0rpordte to (hamber0f with and creditors,to the statutory ar.rthori- Devel0pment Jrainifgin association the Indian in 0n and ties, to the courts,and to every- C0mmerce Industry, Koclli Thursday bodywho dealswith the corporate Corporates and proiessionals dress, former ICCI president entity. "To bc successful, apArttrom can contribute to achieve social Bharat N Khona said the purpose of the seminar was to generate lnahiDgprofit at any cost,evcry lustice. corporation shorLld committecl NIillions of peopLe are living alvarenessamong the corporates, be to a coi'eideologyand live up to it, \\'ithout thc basic facillties, and company directors and corporate as other\!iseit woulcibe opento more remains to be donc by the professionals and to provide a platform to discuss and deliberate public NGOSar1.l corporates,hc said. thechargc actingagainst of Dclivering the presidenlial ad' upon various aspectsof the Com_ interest," Jltstice Kurup said.

a M i l l i o no f p e o p l e r e s w living ithouthe f sn b a s i c a c i l i t i ea , d o m o r er e m a i nts b e d o n eb y t h e , N G O s n a n oc o r p o r a t e s t

2010 pany Law Settlement Scheme ' 2010. and EasyExit Scheme of Baiju Ramachandran CCDT, in his welcomeaddress,gave a brief outline of the two schemes introducedby the Union Ministry of Corporate Affairs in order to reduce the number of defaulters which are and weedout companies not intlresied in doing business. In the iechnical sessionsthat like'multidisci. follolved, subjects plinary firms in India through LLBS,'and 'CLSS2010and DES handted GopalKrishby 2010'were na Raju, CharteredAccoltI-Itant, PractisChennai,and S Dhanapal, Chennai, Secretary ing.Company tespecuvery

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- WeWork Case Study Analysis: Venture Growth and DevelopmentDocument8 pagesWeWork Case Study Analysis: Venture Growth and DevelopmentHervé Kubwimana50% (2)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Chapter 4-Art of WarDocument3 pagesChapter 4-Art of WarMaria Gracia MolinaNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hindustan Coca-Cola Beverage PVT Ltd. VaranasiDocument16 pagesHindustan Coca-Cola Beverage PVT Ltd. VaranasijunaidrpNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Diff Coke and PepsiDocument1 pageDiff Coke and PepsiAnge DizonNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Sample MidTerm Multiple Choice Spring 2018Document3 pagesSample MidTerm Multiple Choice Spring 2018Barbie LCNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- 14.17 Al MuqasatDocument5 pages14.17 Al Muqasatamelia stephanie100% (1)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Kyambogo University Business Plan for Buildmax Hardware CenterDocument51 pagesKyambogo University Business Plan for Buildmax Hardware CenterEmma AmosNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Cost Behavior 2nd Exam BSADocument4 pagesCost Behavior 2nd Exam BSARica Jayne Gerona CuizonNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- MTO CSO Interview Customer Service TrendsDocument4 pagesMTO CSO Interview Customer Service Trendsgl02ruNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- Big Data Management and Data AnalyticsDocument6 pagesBig Data Management and Data AnalyticsLelaki Pertama TamboenNo ratings yet

- Leave Policy in IndiaDocument2 pagesLeave Policy in Indiaup mathuraNo ratings yet

- Introduction To Strategic IntelligenceDocument10 pagesIntroduction To Strategic IntelligenceJorge Humberto Fernandes100% (6)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Ohsms Lead Auditor Training: Question BankDocument27 pagesOhsms Lead Auditor Training: Question BankGulfam Shahzad100% (10)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- TOGAF and BIAN Service LandscapeDocument43 pagesTOGAF and BIAN Service Landscapehanan100% (1)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Balancing Off & Trial Balance: Week 3Document27 pagesBalancing Off & Trial Balance: Week 3Vilyana PashovaNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- ISO 14001 2015 Checklist 13 August 2018Document1 pageISO 14001 2015 Checklist 13 August 2018Belajar K3LNo ratings yet

- Ensuring Global Insurance Compliance with Local LawsDocument9 pagesEnsuring Global Insurance Compliance with Local LawsDjordje NedeljkovicNo ratings yet

- Indian FMCG Industry, September 2012Document3 pagesIndian FMCG Industry, September 2012Vinoth PalaniappanNo ratings yet

- Introduction To Digital MarketingDocument16 pagesIntroduction To Digital Marketingareeza aijazNo ratings yet

- Multinational Cost of Capital and Capital StructureDocument11 pagesMultinational Cost of Capital and Capital StructureMon LuffyNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Accounting transactions and financial statementsDocument3 pagesAccounting transactions and financial statementsHillary MoreyNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Module 5Document28 pagesModule 5nucleya nxsNo ratings yet

- Research Report Sample Format EditedDocument13 pagesResearch Report Sample Format EditedRajveer KumarNo ratings yet

- Chapter-16: Developing Pricing Strategies and ProgramsDocument16 pagesChapter-16: Developing Pricing Strategies and ProgramsTaufiqul Hasan NihalNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Domino's Pizza SWOT AnalysisDocument17 pagesDomino's Pizza SWOT AnalysisNora FahsyaNo ratings yet

- Merchandising Operations IncomeDocument46 pagesMerchandising Operations IncomeSina RahimiNo ratings yet

- Policy Surrender Form CANARA HSBC OBC LIFE INSURANCEDocument2 pagesPolicy Surrender Form CANARA HSBC OBC LIFE INSURANCEvikas71% (7)

- Basel II and Banks in PakistanDocument67 pagesBasel II and Banks in PakistanSadaf FayyazNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- SPMSDocument51 pagesSPMSChris HNo ratings yet

- Engineer - Trainee and Your Personal Level Will Be 3.: Mysore, India. JulyDocument11 pagesEngineer - Trainee and Your Personal Level Will Be 3.: Mysore, India. Julyദീപക് വർമ്മ50% (4)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)