Professional Documents

Culture Documents

Taxation (United Kingdom) : Tuesday 12 June 2012

Uploaded by

Iftekhar IfteOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Taxation (United Kingdom) : Tuesday 12 June 2012

Uploaded by

Iftekhar IfteCopyright:

Available Formats

Fundamentals Level Skills Module

Taxation (United Kingdom)

Tuesday 12 June 2012

Time allowed Reading and planning: Writing:

15 minutes 3 hours

ALL FIVE questions are compulsory and MUST be attempted. Rates of tax and tables are printed on pages 24.

Do NOT open this paper until instructed by the supervisor. During reading and planning time only the question paper may be annotated. You must NOT write in your answer booklet until instructed by the supervisor. This question paper must not be removed from the examination hall.

The Association of Chartered Certified Accountants

Paper F6 (UK)

SUPPLEMENTARY INSTRUCTIONS 1. 2. 3. Calculations and workings need only be made to the nearest . All apportionments should be made to the nearest month. All workings should be shown.

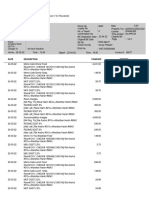

TAX RATES AND ALLOWANCES The following tax rates and allowances are to be used in answering the questions. Income tax Normal rates % 20 40 50 Dividend rates % 10 325 425

Basic rate Higher rate Additional rate

1 35,000 35,001 to 150,000 150,001 and over

A starting rate of 10% applies to savings income where it falls within the first 2,560 of taxable income.

Personal allowance Personal allowance Personal allowance Personal allowance Income limit for age related allowances Income limit for standard personal allowance Standard 65 74 75 and over 7,475 9,940 10,090 24,000 100,000

Car benefit percentage The base level of CO2 emissions is 125 grams per kilometre. A rate of 5% applies to petrol cars with CO2 emissions of 75 grams per kilometre or less, and a rate of 10% applies where emissions are between 76 and 120 grams per kilometre.

Car fuel benefit The base figure for calculating the car fuel benefit is 18,800.

Individual savings accounts (ISAs) The overall investment limit is 10,680, of which 5,340 can be invested in a cash ISA.

Pension scheme limit Annual allowance The maximum contribution that can qualify for tax relief without any earnings is 3,600. 50,000

Authorised mileage allowances: cars Up to 10,000 miles Over 10,000 miles 45p 25p

Capital allowances: rate of allowances % Plant and machinery Main pool Special rate pool Motor cars (purchases since 6 April 2009 (1 April 2009 for limited companies)) New cars with CO2 emissions up to 110 grams per kilometre CO2 emissions between 111 and 160 grams per kilometre CO2 emissions over 160 grams per kilometre Annual investment allowance First 100,000 of expenditure 20 10

100 20 10

100

Corporation tax Financial year Small profits rate Main rate Lower limit Upper limit Standard fraction 2009 21% 28% 1,300,000 1,500,000 7/400 2010 21% 28% 1,300,000 1,500,000 7/400 2011 20% 26% 1,300,000 1,500,000 3/200

Marginal relief Standard fraction x (U A) x N/A

Value added tax (VAT) Standard rate Registration limit Deregistration limit 20% 73,000 71,000

Inheritance tax: tax rates 1 325,000 Excess Death rate Lifetime rate Nil 40% 20%

Inheritance tax: taper relief Years before death Percentage reduction % 20 40 60 80

Over Over Over Over

3 4 5 6

but but but but

less less less less

than than than than

4 5 6 7

years years years years

[P.T.O.

Capital gains tax Rates of tax Lower rate Higher rate Annual exempt amount Entrepreneurs relief Lifetime limit Rate of tax 18% 28% 10,600 10,000,000 10%

National insurance contributions (Not contracted out rates) Class 1 Employee 1 7,225 per year 7,226 42,475 per year 42,476 and above per year 1 7,072 per year 7,073 and above per year % Nil 120 120 Nil 138 138 250 per week Small earnings exemption 1 7,225 per year 7,226 42,475 per year 42,476 and above per year 5,315 Nil 90 20

Class 1 Class 1A Class 2 Class 4

Employer

Rates of interest (assumed) Official rate of interest Rate of interest on underpaid tax Rate of interest on overpaid tax 40% 30% 05%

This is a blank page. Question 1 begins on page 6.

[P.T.O.

ALL FIVE questions are compulsory and MUST be attempted 1 On 6 April 2011 Flick Pick, aged 23, commenced employment with 3D Ltd as a film critic. On 1 January 2012 she commenced in partnership with Art Reel running a small cinema, preparing accounts to 30 April. The following information is available for the tax year 201112: Employment (1) During the tax year 201112 Flick was paid a gross annual salary of 23,700. (2) Throughout the tax year 201112 3D Ltd provided Flick with living accommodation. The company had purchased the property in 2002 for 89,000, and it was valued at 144,000 on 6 April 2011. The annual value of the property is 4,600. The property was furnished by 3D Ltd during March 2011 at a cost of 9,400. Partnership (1) The partnerships tax adjusted trading profit for the four-month period ended 30 April 2012 is 29,700. This figure is before taking account of capital allowances. (2) The only item of plant and machinery owned by the partnership is a motor car that cost 15,000 on 1 February 2012. The motor car has a CO2 emission rate of 190 grams per kilometre. It is used by Art, and 40% of the mileage is for private journeys. (3) Profits are shared 40% to Flick and 60% to Art. This is after paying an annual salary of 6,000 to Art. Property income (1) Flick owns a freehold house which is let out furnished. The property was let throughout the tax year 201112 at a monthly rent of 660. (2) During the tax year 201112 Flick paid council tax of 1,320 in respect of the property, and also spent 2,560 on replacing damaged furniture. (3) Flick claims the wear and tear allowance. Value added tax (VAT) (1) The partnership voluntarily registered for VAT on 1 January 2012, and immediately began using the flat rate scheme to calculate the amount of VAT payable. The relevant flat rate scheme percentage for the partnerships trade is 12%. (2) For the quarter ended 31 March 2012 the partnership had standard rated sales of 59,700, and these were all made to members of the general public. For the same period standard rated expenses amounted to 27,300. Both figures are stated inclusive of VAT. (3) The partnership has two private boxes in its cinema that can be booked on a special basis by privileged customers. Such customers can book the boxes up to two months in advance, at which time they have to pay a 25% deposit. An invoice is then given to the customer on the day of the screening of the film, with payment of the balance of 75% required within seven days. For VAT purposes, the renting out of the cinema boxes is a supply of services.

Required: (a) Calculate Flick Picks taxable income for the tax year 201112. (12 marks)

(b) State what classes of national insurance contribution will be paid in respect of Flick Picks income for the tax year 201112, and in each case who is responsible for paying them. Note: You are not required to calculate the actual national insurance contributions. (4 marks)

(c) List the advantages and disadvantages for the partnership of choosing 30 April as its accounting date rather than 5 April. (4 marks) (d) (i) Explain whether or not it was beneficial for the partnership to have used the VAT flat rate scheme for the quarter ended 31 March 2012; Notes: 1. Your answer should be supported by appropriate calculations. 2. You should ignore the 1% reduction from the flat rate that is available during the first year of VAT registration. (3 marks) (ii) Explain whether or not it was financially beneficial for the partnership to have voluntarily registered for VAT from 1 January 2012; Note: Your answer should be supported by appropriate calculations. (3 marks)

(iii) Advise the partnership as to when it should account for output VAT on the renting out of its private boxes to privileged customers. (4 marks) (30 marks)

[P.T.O.

Heavy Ltd runs a music publishing business. On 1 September 2010 Heavy Ltd acquired 100% of the ordinary share capital of Soft Ltd, a company that runs a music recording studio. Neither company has any other associated companies. Heavy Ltd has prepared accounts for the year ended 31 December 2011, whilst Soft Ltd has prepared accounts for the 16-month period ended 31 December 2011 so as to make its accounting date coterminous with that of Heavy Ltd. The following information is available: Heavy Ltd (1) The operating profit for the year ended 31 December 2011 is 433,100. Depreciation of 12,880 and amortisation of leasehold property of 9,000 (see note (2) below) have been deducted in arriving at this figure. (2) On 1 January 2011 Heavy Ltd acquired a leasehold office building, paying a premium of 90,000 for the grant of a ten-year lease. The office building was used for business purposes by Heavy Ltd throughout the year ended 31 December 2011. (3) On 1 January 2011 the tax written down values of Heavy Ltds plant and machinery were as follows: Main pool Motor car [1] Motor car [2] Motor car [3] Special rate pool 900 15,100 8,800 13,200 21,700

The following purchases and disposals of plant and machinery took place during the year ended 31 December 2011: Cost/(Proceeds) 22,400 (14,600) (12,300)

23 March 2011 19 July 2011 28 July 2011

Purchased office equipment Sold motor car [3] Sold all the items included in the special rate pool

All the motor cars were purchased prior to 31 March 2009, originally cost more than 12,000, and have CO2 emission rates of between 111 and 160 grams per kilometre. Motor car [2] is used by the managing director of Heavy Ltd, and 60% of the mileage is for private journeys. Motor car [3] sold on 19 July 2011 originally cost 19,200. (4) On 18 October 2011 Heavy Ltd sold a freehold office building to Soft Ltd for 113,600. The indexed cost of the office building on that date was 102,800. (5) During the year ended 31 December 2011 Heavy Ltd received the following dividends: Company paying the dividend An unconnected United Kingdom company Soft Ltd An unconnected overseas company These figures were the actual cash amounts received. Soft Ltd (1) The tax adjusted trading profit for the 16-month period ended 31 December 2011 is 120,200. This figure is before taking account of capital allowances. (2) On 1 September 2010 the tax written down value of Soft Ltds plant and machinery in the main pool was 24,000. On 15 December 2011 Soft Ltd sold an item of plant for 3,900. The plant had originally cost 5,200. (3) On 4 August 2011 Soft Ltd disposed of some investments and this resulted in a chargeable gain of 16,650. On 3 September 2011 the company made a further disposal and this resulted in a capital loss of 2,900. 18,000 6,300 9,000

Required: (a) Calculate Heavy Ltds corporation tax liability for the year ended 31 December 2011. (18 marks)

(b) Calculate Soft Ltds corporation tax liabilities in respect of the 16-month period ended 31 December 2011. (7 marks) (25 marks)

[P.T.O.

(a) Tax is charged when there is a chargeable disposal of a chargeable asset by a chargeable person. Required: (i) State which individuals are subject to capital gains tax on the disposal of chargeable assets situated in the United Kingdom; (1 mark)

(ii) State which companies are subject to corporation tax on the disposal of chargeable assets situated in the United Kingdom. (1 mark) (b) On 19 May 2011 Winston King disposed of a painting, and this resulted in a chargeable gain of 45,860. For the tax year 201112 Winston has taxable income of 22,400 after the deduction of the personal allowance. Winston is considering the sale of a business that he has run as a sole trader since 1 July 2004. The business will be sold for 260,000, and this figure, along with the respective cost of each asset, is made up as follows: Sale proceeds 140,000 88,000 32,000 260,000 Cost 80,000 102,000 32,000

Freehold shop Freehold warehouse Net current assets

The assets have all been owned for more than one year. The freehold warehouse has never been used by Winston for business purposes. Where possible, Winston will claim entrepreneurs relief in respect of this disposal. Required: (i) Assuming that Winston King does not sell his sole tradership business, calculate his capital gains tax liability for the tax year 201112; (3 marks)

(ii) Calculate Winston Kings capital gains tax liability for the tax year 201112 if he sold his sole tradership business on 25 March 2012. (4 marks) (c) Wiki Ltd sold a freehold warehouse on 3 February 2012 for 312,000. The warehouse had been purchased on 12 November 2001 for 171,000. Wiki Ltd incurred legal fees of 2,200 in connection with the purchase of the warehouse, and legal fees of 3,400 in connection with the disposal. The relevant retail price indexes (RPIs) are as follows: November 2001 February 2012 1736 2280

Wiki Ltd is unsure as to how to reinvest the proceeds from the sale of the warehouse. The company can either purchase a freehold factory for 166,000, or it can purchase a freehold office building for 296,000. The reinvestment will take place during July 2012. All of the above buildings have been, or will be, used for business purposes by Wiki Ltd. Required: (i) Before taking account of any available rollover relief, calculate Wiki Ltds chargeable gain in respect of the disposal of the warehouse; (3 marks)

(ii) Advise Wiki Ltd of the rollover relief that will be available in respect of each of the two alternative reinvestments. Note: Your answer should include details of the base cost of the replacement asset for each alternative. (3 marks) (15 marks)

10

(a) The UK Government uses tax policies to encourage certain types of activity. Required: Briefly explain how the UK Governments tax policies encourage: (i) Individuals to save; (1 mark) (1 mark) (2 marks)

(ii) Individuals to support charities; (iii) Entrepreneurs to build their own businesses and to invest in plant and machinery.

(b) You are a trainee chartered certified accountant and your manager has asked for your help regarding two taxpayers who have both made trading losses. Michael Michael commenced in self-employment on 1 July 2010, preparing accounts to 5 April. His results for the first two periods of trading were as follows: Nine-month period ended 5 April 2011 Trading loss Year ended 5 April 2012 Trading profit (24,600) 7,100

For the tax years 200607 to 200809 Michael had the following income from employment: 200607 200708 200809 44,500 16,800 50,600

Michael did not have any income during the period 6 April 2009 to 30 June 2010. Sean Sean has been in self-employment since 2001, but ceased trading on 31 December 2011. He has always prepared accounts to 31 December. His results for the final five years of trading were as follows: Year Year Year Year Year ended ended ended ended ended 31 31 31 31 31 December December December December December 2007 2008 2009 2010 2011 Trading Trading Trading Trading Trading profit profit profit profit loss 21,300 14,400 18,900 3,700 (23,100)

For each of the tax years 200708 to 201112 Sean has property business profits of 7,800. Sean has unused overlap profits brought forward of 3,600. Required: For each of the two taxpayers Michael and Sean, identify the loss relief claims that are available to them, and explain which of the available claims would be the most beneficial. Notes: 1. You should clearly state the amount of any reliefs claimed and the rates of income tax saved. However, you are not expected to calculate any income tax liabilities. 2. You should assume that the tax rates and allowances for the tax year 201112 apply throughout. 3. The following mark allocation is provided as guidance for this requirement: Michael (5 marks) Sean (6 marks) (11 marks) (15 marks)

11

[P.T.O.

You should assume that todays date is 15 March 2012. Ning Gao, aged 71, owns the following assets: (1) Two properties respectively valued at 674,000 and 442,000. The first property has an outstanding repayment mortgage of 160,000, and the second property has an outstanding endowment mortgage of 92,000. (2) Vintage motor cars valued at 172,000. (3) Investments in individual savings accounts valued at 47,000, National Savings & Investments savings certificates valued at 36,000, and government stocks (gilts) valued at 69,000. Ning owes 22,400 in respect of a personal loan from a bank, and she has also verbally promised to pay legal fees of 4,600 incurred by her nephew. Under the terms of her will Ning has left all of her estate to her children. Nings husband died on 12 March 2002, and 70% of his inheritance tax nil rate band was not used. On 14 August 2001 Ning had made a gift of 100,000 to her daughter, and on 7 November 2011 she made a gift of 220,000 to her son. Both these figures are after deducting all available exemptions. The nil rate band for the tax year 200102 is 242,000. Required: (a) Advise Ning Gao as to how much nil rate band will be available when calculating the inheritance tax payable in respect of her estate were she to die on 20 March 2012. (4 marks) (b) (i) Calculate the inheritance tax that would be payable in respect of Ning Gaos estate were she to die on 20 March 2012, and state who will be responsible for paying the tax; (7 marks)

(ii) Advise Ning Gao as to whether the inheritance tax payable in respect of her estate would alter if she were to live for either another six or another seven years after 20 March 2012, and if so by how much. Note: You should assume that both the value of Ning Gaos estate and the nil rate band will remain unchanged. (2 marks) (c) State what conditions would have to be met if Ning Gao wanted to make gifts out of her income to her children so that these gifts are exempt from inheritance tax. (2 marks) (15 marks)

End of Question Paper

12

You might also like

- ICAEW Professional Level Tax Compliance Question & Answer Bank March 2016 To March 2020 PDFDocument414 pagesICAEW Professional Level Tax Compliance Question & Answer Bank March 2016 To March 2020 PDFOptimal Management Solution100% (1)

- ACCA F6 - Trading Profit AdjustmentDocument2 pagesACCA F6 - Trading Profit AdjustmentIftekhar Ifte100% (1)

- UCP-600 in BanglaDocument18 pagesUCP-600 in BanglaMOHAMMED ALI CHOWDHURY91% (57)

- Financial Accounting and Reporting: Blank PageDocument28 pagesFinancial Accounting and Reporting: Blank PageMehtab NaqviNo ratings yet

- Mock 1Document14 pagesMock 1Simon YossefNo ratings yet

- AC100 Exam 2012Document17 pagesAC100 Exam 2012Ruby TangNo ratings yet

- PL Financial Accounting and Reporting Sample Paper 1Document11 pagesPL Financial Accounting and Reporting Sample Paper 1karlr9No ratings yet

- AnswerDocument8 pagesAnswerJericho PedragosaNo ratings yet

- Financial Management September 2011 Exam Paper ICAEWDocument7 pagesFinancial Management September 2011 Exam Paper ICAEWMuhammad Ziaul HaqueNo ratings yet

- Effective Audit Report Writing MaterialDocument65 pagesEffective Audit Report Writing MaterialIftekhar Ifte100% (2)

- Audit Report Format BDDocument2 pagesAudit Report Format BDIftekhar Ifte50% (2)

- F6uk 2012 Dec QDocument13 pagesF6uk 2012 Dec QSaad HassanNo ratings yet

- Taxation (United Kingdom) : Monday 6 June 2011Document14 pagesTaxation (United Kingdom) : Monday 6 June 2011tayabkhalidNo ratings yet

- Taxation (United Kingdom) : Tuesday 4 June 2013Document22 pagesTaxation (United Kingdom) : Tuesday 4 June 2013Eric MugaNo ratings yet

- F6uk 2011 Dec QDocument12 pagesF6uk 2011 Dec Qmosherif2011No ratings yet

- ACCA F6 Revision Mock June 2013 QUESTIONS Version 2 FINAL at 25 March 2013Document15 pagesACCA F6 Revision Mock June 2013 QUESTIONS Version 2 FINAL at 25 March 2013syedtahaali100% (1)

- Preparing Taxation Computations: (UK Stream)Document11 pagesPreparing Taxation Computations: (UK Stream)Phoenix ZhangNo ratings yet

- MockDocument6 pagesMockZohair SiddiquiNo ratings yet

- ACCA CAT Paper T9 Preparing Taxation Computations Solved Past PapersDocument190 pagesACCA CAT Paper T9 Preparing Taxation Computations Solved Past PapersJennifer Edwards0% (1)

- F6 InterimDocument7 pagesF6 InterimSad AnwarNo ratings yet

- Ac5007 QuestionsDocument8 pagesAc5007 QuestionsyinlengNo ratings yet

- CSF Annual Report 2011Document60 pagesCSF Annual Report 2011red cornerNo ratings yet

- Afa Revision - Final Session Activities QsDocument2 pagesAfa Revision - Final Session Activities Qshaddad2020No ratings yet

- P6uk 2007 Dec QDocument12 pagesP6uk 2007 Dec QAlizeh TrNo ratings yet

- P1 - Corporate Reporting April 09Document21 pagesP1 - Corporate Reporting April 09IrfanNo ratings yet

- PL Tax Compliance j14 Exam PaperDocument12 pagesPL Tax Compliance j14 Exam Paperkarlr9No ratings yet

- Cat/fia (FTX)Document21 pagesCat/fia (FTX)theizzatirosliNo ratings yet

- AC1025 ZA d1Document12 pagesAC1025 ZA d1Amna AnwarNo ratings yet

- Corporation Tax 1Document4 pagesCorporation Tax 1Sanjida KhanNo ratings yet

- Uog Year 2 Taxation Paper Uog March 2013Document9 pagesUog Year 2 Taxation Paper Uog March 2013helenxiaochingNo ratings yet

- Sa Feb12 f6 GainsDocument14 pagesSa Feb12 f6 GainsShuja Muhammad LaghariNo ratings yet

- P1 - Corporate Reporting April 11Document20 pagesP1 - Corporate Reporting April 11Abdurrazaq PanhwarNo ratings yet

- Financial Management and Control: Time Allowed 3 HoursDocument9 pagesFinancial Management and Control: Time Allowed 3 HoursnsarahnNo ratings yet

- PM Q T7Document10 pagesPM Q T7Waqas Siddique SammaNo ratings yet

- F6 Pilot PaperDocument19 pagesF6 Pilot PaperSoon SiongNo ratings yet

- Budget 2011/12Document1 pageBudget 2011/12api-94211403No ratings yet

- Third Quarter Report MAR 31 2012Document20 pagesThird Quarter Report MAR 31 2012Asad Imran MunawwarNo ratings yet

- F6rom Jun 2011 QuDocument13 pagesF6rom Jun 2011 Qusorin8488No ratings yet

- p1 Managerial Finance August 2017Document24 pagesp1 Managerial Finance August 2017ghulam murtazaNo ratings yet

- Dec 2007 PDFDocument9 pagesDec 2007 PDFeric_mdisNo ratings yet

- FM202 - Exam Q - 2011-2 - Financial Accounting 202 V3 - AM NV DRdocDocument6 pagesFM202 - Exam Q - 2011-2 - Financial Accounting 202 V3 - AM NV DRdocMaxine IgnatiukNo ratings yet

- Acc 3013 - Fwa Revision QuestionsDocument12 pagesAcc 3013 - Fwa Revision Questionsfalnuaimi001No ratings yet

- Capital AllowanceDocument6 pagesCapital AllowanceAbhiraj RNo ratings yet

- AC1025 2008-Principles of Accounting Main EQP and Commentaries AC1025 2008-Principles of Accounting Main EQP and CommentariesDocument59 pagesAC1025 2008-Principles of Accounting Main EQP and Commentaries AC1025 2008-Principles of Accounting Main EQP and Commentaries전민건No ratings yet

- April 2013 PDFDocument22 pagesApril 2013 PDFJasonSpringNo ratings yet

- P6UK 2014 Dec QDocument14 pagesP6UK 2014 Dec QAlina TariqNo ratings yet

- (N11) Advisory ACTDocument8 pages(N11) Advisory ACTMuguti EriazeriNo ratings yet

- Mock Exam Paper: Time AllowedDocument9 pagesMock Exam Paper: Time AllowedVannak2015No ratings yet

- Accounting Accn3: General Certificate of Education Advanced Level Examination June 2010Document8 pagesAccounting Accn3: General Certificate of Education Advanced Level Examination June 2010Sam catlinNo ratings yet

- ABE Dip 1 - Financial Accounting JUNE 2005Document19 pagesABE Dip 1 - Financial Accounting JUNE 2005spinster40% (1)

- 2010 LCCI Level 3 Series 2 Question Paper (Code 3012)Document8 pages2010 LCCI Level 3 Series 2 Question Paper (Code 3012)mappymappymappyNo ratings yet

- Acct 2005 Practice Exam 1Document16 pagesAcct 2005 Practice Exam 1laujenny64No ratings yet

- TAX RATES 2012/13: Telephone: 01437 765556 WWW - Ashmole.co - UkDocument7 pagesTAX RATES 2012/13: Telephone: 01437 765556 WWW - Ashmole.co - Ukapi-135774334No ratings yet

- Financial Accounting: Formation 2 Examination - April 2008Document11 pagesFinancial Accounting: Formation 2 Examination - April 2008Luke ShawNo ratings yet

- Model Answers Series 2 2010Document17 pagesModel Answers Series 2 2010Jack Tsang100% (1)

- Tax IllustrationsDocument7 pagesTax IllustrationsMsema KweliNo ratings yet

- F9FM Mock1 Qs - d08Document10 pagesF9FM Mock1 Qs - d08ErclanNo ratings yet

- Business Reporting July 2010 Marks PlanDocument24 pagesBusiness Reporting July 2010 Marks PlanMohammed HammadNo ratings yet

- 2009-Financial Reporting Main EQP and CommentariesDocument46 pages2009-Financial Reporting Main EQP and CommentariesBryan SingNo ratings yet

- General Automotive Repair Revenues World Summary: Market Values & Financials by CountryFrom EverandGeneral Automotive Repair Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Operating a Business and Employment in the United Kingdom: Part Three of The Investors' Guide to the United Kingdom 2015/16From EverandOperating a Business and Employment in the United Kingdom: Part Three of The Investors' Guide to the United Kingdom 2015/16No ratings yet

- Automotive Glass Replacement Shop Revenues World Summary: Market Values & Financials by CountryFrom EverandAutomotive Glass Replacement Shop Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Technical & Trade School Revenues World Summary: Market Values & Financials by CountryFrom EverandTechnical & Trade School Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Audit of Bank and CashDocument4 pagesAudit of Bank and CashIftekhar IfteNo ratings yet

- The Audit of LiabilitiesDocument3 pagesThe Audit of LiabilitiesIftekhar Ifte100% (3)

- p5 2012 Jun QDocument12 pagesp5 2012 Jun QIftekhar IfteNo ratings yet

- The Audit of InventoriesDocument6 pagesThe Audit of InventoriesIftekhar Ifte100% (3)

- Acca QualificationDocument2 pagesAcca QualificationIftekhar IfteNo ratings yet

- Question Verbs For ACCA StudentsDocument3 pagesQuestion Verbs For ACCA StudentsIftekhar IfteNo ratings yet

- Ifrs 9Document8 pagesIfrs 9Iftekhar IfteNo ratings yet

- BRPD 11Document1 pageBRPD 11Iftekhar IfteNo ratings yet

- ICAB List of FirmsDocument25 pagesICAB List of FirmsIftekhar Ifte100% (4)

- BRPD Circular No 14Document17 pagesBRPD Circular No 14Iftekhar IfteNo ratings yet

- Corporate Governance Code - Final 20 Feb06Document6 pagesCorporate Governance Code - Final 20 Feb06Wasik Abdullah MomitNo ratings yet

- BRPD Circular No 05Document14 pagesBRPD Circular No 05Iftekhar Ifte100% (1)

- SIB BusinessDirectory2010 2011Document86 pagesSIB BusinessDirectory2010 2011Mbamali Chukwunenye100% (1)

- Middle Management Development ProgramDocument8 pagesMiddle Management Development Programapi-256128986No ratings yet

- IB Business (HL) Topic 4 - MarketingDocument19 pagesIB Business (HL) Topic 4 - MarketingTanya AdvaniNo ratings yet

- Actulux en 12101-10Document2 pagesActulux en 12101-10giuseppegelsominoNo ratings yet

- 0 GSIS Finals QuestionsDocument11 pages0 GSIS Finals QuestionsClauds GadzzNo ratings yet

- Invoice::: Group Agent: Company Name Fssai NoDocument2 pagesInvoice::: Group Agent: Company Name Fssai NoSuryaNo ratings yet

- JPIA CUP 6 The AUDITING THEORY of Everything Answer KeyDocument12 pagesJPIA CUP 6 The AUDITING THEORY of Everything Answer Keykate kateNo ratings yet

- Consumer Behaviour PresentationDocument28 pagesConsumer Behaviour PresentationRajesh JaiswalNo ratings yet

- Special Characteristics Agreement v1bDocument3 pagesSpecial Characteristics Agreement v1bGelu BoneaNo ratings yet

- Bharti AxaDocument18 pagesBharti AxaDIVYA DUBEYNo ratings yet

- Range Trading GuideDocument21 pagesRange Trading GuideFox Fox0% (1)

- Div Fy2020 Aps-7200aa20aps00013 PDFDocument24 pagesDiv Fy2020 Aps-7200aa20aps00013 PDFGoodman HereNo ratings yet

- Home Business Fall 2017Document52 pagesHome Business Fall 2017Home Business Magazine100% (1)

- Cir v. Cebu HoldingsDocument4 pagesCir v. Cebu HoldingsAudrey50% (2)

- Paper SpecsDocument6 pagesPaper SpecsHuy NguyenNo ratings yet

- Ansbacher Cayman Report Appendix 4Document714 pagesAnsbacher Cayman Report Appendix 4thestorydotieNo ratings yet

- BL Racingas PDFDocument2 pagesBL Racingas PDFMarcoAntonioGilIturreguiNo ratings yet

- MaggiDocument61 pagesMaggiShailaja PatilNo ratings yet

- Ce-Emc Voc Shem140800217301itc Tvi Cam 2cc52,2ce56 2014-10-13Document2 pagesCe-Emc Voc Shem140800217301itc Tvi Cam 2cc52,2ce56 2014-10-13Ciobotaru Florin NicolaeNo ratings yet

- Suggested Answers: QuestionsDocument104 pagesSuggested Answers: QuestionsabhishekkgargNo ratings yet

- Advisory 7 API Licensee Code of Conduct 20160413 MandarinDocument3 pagesAdvisory 7 API Licensee Code of Conduct 20160413 MandarinairlinemembershipNo ratings yet

- HR Challenges For SelfRidgesDocument5 pagesHR Challenges For SelfRidgesDinar KhanNo ratings yet

- ClusterDocument60 pagesClustersuryanath0% (1)

- Consumer Relationship Management:A Case Study of Piaggio: Submitted ToDocument70 pagesConsumer Relationship Management:A Case Study of Piaggio: Submitted ToAashna AggarwalNo ratings yet

- The Art of Negotiating: T. SivasankaranDocument60 pagesThe Art of Negotiating: T. SivasankaranMora SyahroniNo ratings yet

- Customer Satisfaction at McDonald's and Burger King, UK. - Dissertation Writing Samples - 2writeDocument46 pagesCustomer Satisfaction at McDonald's and Burger King, UK. - Dissertation Writing Samples - 2writedavidNo ratings yet

- Soal-Soal VocabDocument6 pagesSoal-Soal VocabShella OktafianiNo ratings yet

- Case Writing Lucky CementDocument20 pagesCase Writing Lucky CementM.TalhaNo ratings yet

- Musharakah Investment AgreementDocument9 pagesMusharakah Investment AgreementEthica Institute of Islamic Finance™100% (1)

- Empowerment & Org ChangeDocument11 pagesEmpowerment & Org ChangeowaishazaraNo ratings yet