Professional Documents

Culture Documents

Ted Prince-It's A Gas! 11JUN12

Uploaded by

sam ignarskiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ted Prince-It's A Gas! 11JUN12

Uploaded by

sam ignarskiCopyright:

Available Formats

MOVING GOODS

ItS a GaS

IN the curreNt SeaSON of the AMC

hit series Mad Men, protagonist Don Draper heads to a Rolling Stones concert in an attempt to use one of their songs in a commercial. While Drapers fictional foray to license Time Is on My Side is unsuccessful, hits from the Stones repertoire have indeed successfully made their way into famous ads. The standout might be Microsoft using Start Me Up to introduce Windows 95. With the worlds increased focus on natural gas, we may soon see the likes of Boone Pickens embracing the refrain of Jumping Jack Flash (Its a gas, gas, gas!). The world economy and the transportation industry have grown together through cheap and plentiful oil. After World War II, the U.S. transportation system was built around cars, truck and airplanes. Infrastructure and population trends changed accordingly. The ascendance of the truck was complete in the early 1980s when deregulation enabled advanced truckload companies to become the preferred transportation mode in a just-in-time logistics model. At the same time, railroads developed sophisticated operating and commercial methodologies to handle ever-increasing amounts of coal for export and utilities. Globalization was the other driver. Distance wasnt a barrier, as low-cost labor and raw materials were utilized wherever manufactured goods could be produced at the lowest cost. Ocean shipping and air cargo networks developed to support these trends. As the cost of oil increased, however, many modes came under severe profitability pressure. Not only was oil a major cost of production, but the economic impact of oil shocks also depressed underlying consumer (and overall transportation) demand. Participants throughout the supply chain responded. Retailers changed packaging and loading configurations to load more product in

fewer vehicles. Delta Air Lines purchased an oil refinery to obviate the need for expensive strategies such as hedging. Not only oil is under pressure. Coal, traditionally our nations most abundant resource, also is encountering economic and environmental pressures. The Environmental Protection Agencys regulatory initiatives determine whether electric utilities generate power with coal. Now the abundance of domestic natural gas has provided a lower-cost hydrocarbon without most of the environmental degradation. Although a large embedded base of electric utilities is burning coal, some experts believe they could be displaced quickly. A 2010 study by PFC Energy maintains there is sufficient latent generating capacity in existing gas-fired power plants to replace almost all coal-fired output. Ironically, the coal industry may need the help of its traditional environmentalist enemies to survive. Should hydraulic fracturing (fracking) prove as harmful as some fear, the rosy forward-looking projections may go unrealized. Should cap and trade be resuscitated, coal also might become economically viable again. Natural gas is more than just an electricity source. Its also rapidly changing the transportation industry. Many trucking companies hope to replace diesel-powered tractors with natural gas. Historically, the two biggest obstacles have been the lack of a widespread fueling network and limited engine size. Both problems, however, are being overcome by the increasing demand created by the immense, available savings. Future changes might be even more far-reaching. Whereas port facilities efforts to import LNG were held off by outbreaks of NIMBY-ism, there appears to be much less resistance to terminals being built for export. Ocean transportation of LNG is a profitable niche for a handful of carriers; with

high barriers to entry, the financial benefits are more sustainable than other trades. (Many observers believe the three Japanese container lines have managed to stay in business the past 15 years solely because of LNG imports from Qatar. NonJapanese lines have been excluded from this business.) If railroad coal traffic continues to diminish, the landscape may change markedly. While other traffic segments are available, the billions of dollars invested to support Powder River coal arent redeployed easily. Some railroads are doubling down on carrying oil from the Bakken shale, but a tank car is a 20- to 40-year asset, and the demand for rail transportation is expected to diminish in five to 10 years as pipelines reach this new source.

Ted Prince

Natural GaS IS MOre thaN JuSt aN electrIcIty SOurce. ItS alSO rapIDly chaNGING the traNSpOrtatION INDuStry.

Perhaps the biggest impact of natural gas may be accelerated onshoring. As energy costs exceed labor costs in the manufacturing process, low-cost energy from natural gas may help resuscitate U.S. manufacturing. Even Mexico with its high fuel costs could be adversely affected. Natural gas may indeed be our nations energy game-changer for this century. One thing is for certain: Its already transforming what and how we move. JOc

Ted Prince is principal, T. Prince & Associates. Contact him at ted@tpassociatesllc.com.

www.joc.com THEJOURNALOFCOMMERCE 31

You might also like

- M Taher & Co WorldECR Interview 01.04.19Document4 pagesM Taher & Co WorldECR Interview 01.04.19sam ignarskiNo ratings yet

- A Tribute To John Banks: at A Golf Club in New MaldenDocument3 pagesA Tribute To John Banks: at A Golf Club in New Maldensam ignarskiNo ratings yet

- Lmaa Seminar Singapore May 2016Document2 pagesLmaa Seminar Singapore May 2016sam ignarskiNo ratings yet

- Moore & Co ComplaintDocument50 pagesMoore & Co Complaintsam ignarskiNo ratings yet

- Joe Hughes Speech 24MAY17Document7 pagesJoe Hughes Speech 24MAY17sam ignarskiNo ratings yet

- 2016 InterManager President New Year MessageDocument3 pages2016 InterManager President New Year Messagesam ignarskiNo ratings yet

- Mlaanz SMDG Event Sydney 2016Document2 pagesMlaanz SMDG Event Sydney 2016sam ignarskiNo ratings yet

- Bill Birch Reynardson Obituary - The Daily Telegraph 16.8.2017Document3 pagesBill Birch Reynardson Obituary - The Daily Telegraph 16.8.2017sam ignarskiNo ratings yet

- Shincho To KumoDocument7 pagesShincho To Kumosam ignarskiNo ratings yet

- The BlobDocument3 pagesThe Blobsam ignarskiNo ratings yet

- Moore & Co ComplaintDocument50 pagesMoore & Co Complaintsam ignarskiNo ratings yet

- Moore and Co Precendential OpinionDocument29 pagesMoore and Co Precendential Opinionsam ignarskiNo ratings yet

- Wikborg Global Offshore Projects DEC15Document13 pagesWikborg Global Offshore Projects DEC15sam ignarskiNo ratings yet

- Happy HolidaysDocument1 pageHappy Holidayssam ignarskiNo ratings yet

- ETL 2015 ProgramDocument1 pageETL 2015 Programsam ignarskiNo ratings yet

- AJG Marine P&I Commercial Market Review September 2015Document94 pagesAJG Marine P&I Commercial Market Review September 2015sam ignarskiNo ratings yet

- Implications of Nigerian DirectiveDocument4 pagesImplications of Nigerian Directivesam ignarskiNo ratings yet

- Tysers P&I Report 2015Document36 pagesTysers P&I Report 2015sam ignarskiNo ratings yet

- Nigerian National Petroleum Corporation July 2015 DirectiveDocument7 pagesNigerian National Petroleum Corporation July 2015 Directivesam ignarskiNo ratings yet

- PL Ferrari Newsletter 2-15Document2 pagesPL Ferrari Newsletter 2-15sam ignarskiNo ratings yet

- Row Around Singapore Island BrochureDocument12 pagesRow Around Singapore Island Brochuresam ignarskiNo ratings yet

- Michael DavarDocument2 pagesMichael Davarsam ignarskiNo ratings yet

- PLF Newsletter 08-14Document2 pagesPLF Newsletter 08-14sam ignarskiNo ratings yet

- The Clothes-Line RigDocument5 pagesThe Clothes-Line Rigsam ignarskiNo ratings yet

- Tysers P&I Update 08dec14Document19 pagesTysers P&I Update 08dec14sam ignarskiNo ratings yet

- Lloyd's List Global Maritime Lawyer of The Year Acceptance Speech 30SEP14Document2 pagesLloyd's List Global Maritime Lawyer of The Year Acceptance Speech 30SEP14sam ignarskiNo ratings yet

- New Year's Resolutions For The Transport Industry 2015Document2 pagesNew Year's Resolutions For The Transport Industry 2015sam ignarskiNo ratings yet

- China Sample Pollution Response AgreementDocument16 pagesChina Sample Pollution Response Agreementsam ignarskiNo ratings yet

- George Grishin 30 Years in InsuranceDocument18 pagesGeorge Grishin 30 Years in Insurancesam ignarskiNo ratings yet

- Bow Wave Readers BreakdownDocument6 pagesBow Wave Readers Breakdownsam ignarskiNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Online Rail Project ProposalDocument2 pagesOnline Rail Project Proposalb2uty77_593619754No ratings yet

- Current Affairs Pocket PDF - January 2019 by AffairsCloudDocument60 pagesCurrent Affairs Pocket PDF - January 2019 by AffairsCloudarjunNo ratings yet

- HampshireDocument89 pagesHampshireTajti HedvigNo ratings yet

- Supply Chains A Managers GuideDocument193 pagesSupply Chains A Managers GuideLoredana Mihaela BobeicaNo ratings yet

- Super elevation guide for train tracksDocument5 pagesSuper elevation guide for train tracksbeneyam alemuNo ratings yet

- Man Booker Prize 2017Document13 pagesMan Booker Prize 2017Oscar PinillosNo ratings yet

- Malaysia Tourism Promotion BoardDocument8 pagesMalaysia Tourism Promotion BoardSelvam LathaNo ratings yet

- Sevenoaks School ENGLISH Y7 2017 Exam PaperDocument4 pagesSevenoaks School ENGLISH Y7 2017 Exam PaperlusavkaNo ratings yet

- Finalplansw PDFDocument146 pagesFinalplansw PDFOffice of PlanningNo ratings yet

- Standards/Manuals/ Guidelines For Small Hydro DevelopmentDocument42 pagesStandards/Manuals/ Guidelines For Small Hydro Developmentluisbitron1527No ratings yet

- Reservation Form A4Document1 pageReservation Form A4pvdasNo ratings yet

- Andhra Pradesh - Wikipedia, The Free EncyclopediaDocument25 pagesAndhra Pradesh - Wikipedia, The Free EncyclopediaPrabhu Charan TejaNo ratings yet

- Get train details from Nagpur Junction to Raipur JunctionDocument1 pageGet train details from Nagpur Junction to Raipur Junctionnilima_sapNo ratings yet

- Balancing Reciprocating Masses QuestionsDocument3 pagesBalancing Reciprocating Masses QuestionsSunny BhatiaNo ratings yet

- Esc-215 - NSW TRACK DESIGN SPECIFICATIONDocument64 pagesEsc-215 - NSW TRACK DESIGN SPECIFICATIONOm SinghNo ratings yet

- DIY Barn Door Baby GateDocument17 pagesDIY Barn Door Baby GateJessicaMaskerNo ratings yet

- Propulsion ResistanceDocument14 pagesPropulsion ResistanceEduardo LopesNo ratings yet

- Pipe LayingDocument14 pagesPipe Layingfrancis pacaigueNo ratings yet

- Welding Techniques Full Book PDFDocument80 pagesWelding Techniques Full Book PDFKaranam Vamsi Ranga RaoNo ratings yet

- G&SRDocument478 pagesG&SRMukeshkumar Garg67% (3)

- Japu Ji Sahib VyakhyaDocument269 pagesJapu Ji Sahib VyakhyawakeupbewiseNo ratings yet

- Komatsu PC30MR-2 Mini-Excavator SpecsDocument8 pagesKomatsu PC30MR-2 Mini-Excavator SpecsLU YONo ratings yet

- Drilling and Foundation Equipment CatalogueDocument28 pagesDrilling and Foundation Equipment CatalogueMelahat AkyolNo ratings yet

- Mahasiswa Skripsi AKK FKM Periode November 2022Document22 pagesMahasiswa Skripsi AKK FKM Periode November 2022SUSTER APEN SIGELENo ratings yet

- Lahore Orange Line Metro Project BriefDocument13 pagesLahore Orange Line Metro Project BriefHaris ButtNo ratings yet

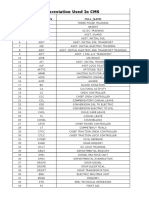

- Abbreviation Used in CmsDocument4 pagesAbbreviation Used in Cmsapi-598356408No ratings yet

- PERHITUNGANDocument19 pagesPERHITUNGANM Abi Yazid Al BustomiNo ratings yet

- Koppel Industrial Car PDFDocument280 pagesKoppel Industrial Car PDFIgnacio Venturini100% (1)

- Chicago Access - Michigan East Project Narrative FINAL 5-23-2022Document29 pagesChicago Access - Michigan East Project Narrative FINAL 5-23-2022Ann DwyerNo ratings yet

- Ramdevji Temple Ramdevra Rajasthan, Ramdevra, Ramdevra in Rajasthan, Ramdevji Temple at Ramdevra in RajasthanDocument2 pagesRamdevji Temple Ramdevra Rajasthan, Ramdevra, Ramdevra in Rajasthan, Ramdevji Temple at Ramdevra in RajasthanmkuniqueNo ratings yet