Professional Documents

Culture Documents

Use This Template To Complete The Problem 4-32 Based Upon The 3 Step Approach Below

Uploaded by

Joshua LenardsonOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Use This Template To Complete The Problem 4-32 Based Upon The 3 Step Approach Below

Uploaded by

Joshua LenardsonCopyright:

Available Formats

Given Data P04-32 Sam Corporation outstanding common stock acquired by Father, Inc. Cash paid by Father, Inc.

for Sam Corporation shares Book value of Sam Corporation Sam accounts values on 1/1/09 Book Value $ 60,000 275,000 100,000 130,000 Father, Inc. 12/31/2009 $ (1,360,000) 700,000 260,000 44,000 (105,000) $ (461,000) Fair Value $ 225,000 250,000 200,000 120,000 Sam Corporation 12/31/2009 $ (540,000) 385,000 10,000 5,000 5,000 $ (135,000) 80% $ 680,000 600,000

Use this template to complete the

Land Buildings and equipment (10-year remaining life) Copyright (20-year life) Notes payable (due in 8 years)

Step 1: Complete purchase price alloca Step 2: Complete Journal Entries on Ta Step 3: Input journal entries into Tab 4-3 Step 4: Complete consolidated totals on

Revenues Cost of goods sold Depreciation expense Amortization expense Interest expense Equity in income of Sam Net income Retained earnings, 1/1/0 Net income Dividends paid Retained earnings, 12/31/09 Current assets Investment in Sam Land Buildings and equipment (net) Copyright Total assets Accounts payable Notes payable Common stock Additional paid-in capital Retained earnings Total liabilities and equity

(1,265,000) (440,000) (461,000) (135,000) 260,000 65,000 $ (1,466,000) $ (510,000) $ 965,000 733,000 292,000 877,000 $ 2,867,000 $ $ 528,000 60,000 265,000 95,000 948,000

(191,000) $ (148,000) (460,000) (130,000) (300,000) (100,000) (450,000) (60,000) (1,466,000) (510,000) $ (2,867,000) $ (948,000)

Note: Credits are indicated by parentheses.

se this template to complete the Problem 4-32 based upon the 3 step approach below:

tep 1: Complete purchase price allocation on Tab 4-32 tep 2: Complete Journal Entries on Tab 4-32 Journal Entries tep 3: Input journal entries into Tab 4-32 consolidation worksheet tep 4: Complete consolidated totals on Tab 4-32

Journal Entries to Record Consolidation

"S" Entry DR Retained Earnings Common Stock APIC Inv. In Sam NCI 510,000 100,000 60,000 536,000 134,000 670,000 Elimination of the subsidiary's stockholder's equity accounts. 670,000 CR

"A" Entry Land Copyright Notes Payable Investment in Sam Buildings & Equipment NCI 165,000 100,000 10,000 200,000 25,000 50,000 275,000 Allocation of subsidiary total fair value in excess of book value 275,000

"I" Entry Equity in Income Investment in Sam 105,000 105,000 105,000 105,000

Elimination of intercompany income (equity accrual less amortization expenses)

"D" Entry Investment in Sam Dividends Paid 52,000 52,000 52,000 Elimination of intercompany dividend payments. 52,000

"E" Entry

Amortization Expense Interest Expense Buildings & Equipment Depreciation Expense Copyright Notes Payable

5,000 1,250 2,500 2,500 5,000 1,250 8,750 8,750

Recognition of amortization expenses on fair-value allocations.

1,110,750

1,110,750

Student Name: Class: Problem 04-32

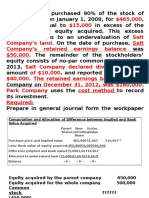

FATHER, INC. AND SAM CORPORATION - Purchase price allocation and annual amortization Acqisition-date subsidiary fair value Book value of subsidiary Fair value in excess of book value $ 850,000 600,000 $ 250,000 Correct!

Allocations to specific accounts based on difference between fair value and book value: Land $ 165,000 Buildings and equipment (25,000) Copyright 100,000 Notes payable 10,000 250,000 Total $ Correct!

Annual excess amortizations: Buildings and equipment Copyright Notes payable Total

(25,000) 100,000 10,000

Life (years) 10 20 8

Excess Amortizations $ (2,500) 5,000 1,250 $ 3,750

Correct!

Student Name: Class: Problem 04-32

Totals for the business combination for the year ending December 31, 2006 FATHER, INC. AND SAM CORPORATION Account Name Revenues Balance Explanation 1,900,000 Sum of Father and Sam's revenues for the year

Cost of goods sold

1,085,000 Sum of Father and Sam's COGS for the year

Depreciation expense

267,500 Sum of Father and Sam's depreciation for the year less excess buildings and equipment amortization 10,000 Sum of Father and Sam's amortization for the year add excess copyright amortization 50,250 Sum of Father and Sam's interest expense for the year add excess notes payable amortization This is elimnated, hence ZERO

Amortization expense

Interest expense

Equity in income of Sam

Net income

487,250 Net income of Father and Sam except equity in income of Sam adjusted for amotization of excess fair value 1,265,000 Retained earnings of Father

Retained earnings, 1/1

Noncontrolling interest in income of subsidiary Dividends paid

26,250 Net income of Sam less amortization of excess fair value multiplied by 20% 260,000 Dividends of Father only

Retained earnings, 12/31

1,466,000 Retained earnings of Father

Current assets

1,493,000 Sum of Father and Sam's current assets

Investment in Sam

Consolidated amount is zero

Land

517,000 Sum of Father and Sam's land accounts plus excess fair value 1,119,500 Sum of Father and Sam's building accounts plus excess fair value less amortization 190,000 Sum of Father and Sam's copyright accounts plus excess fair value less amortization 3,319,500 339,000 Sum of Father and Sam's accounts payable account

Buildings and equipment (net)

Copyright

Total assets Accounts payable

Notes payable

581,250 Sum of Father and Sam's notes payable accounts plus excess fair value less amortization 183,250 Net assets of Sam adjusted for unamortized fair value excess multiplied by 20% 300,000 Common stock of Fathers only

Noncontrolling interest in Sam

Common stock

Additional paid-in capital

450,000 APIC of Fathers only

Retained earnings, 12/31

1,466,000 Retained earnings of Fathers only

Total liabilities & equities

2,216,000

Student Name: Class: Problem 04-32

FATHER, INC. AND SAM CORPORATION Consolidation Worksheet Father, Sam Inc. Corporation $ (1,360,000) $ (540,000) 700,000 385,000 260,000 10,000 5,000 [E] 44,000 5,000 [E] (105,000) [I] $ (461,000) $ (135,000) Consolidation Entries Debit Credit Noncontrolling Interest Consolidated Totals $ (1,900,000) 1,085,000 267,500 10,000 50,250 $ 26,250 (487,250) 26,250 (461,000) $ (1,265,000) (461,000) 260,000 $ (1,466,000) $ 1,493,000 -

Accounts Revenues Cost of goods sold Depreciation expense Amortization expense Interest expense Equity in income of Sam Separate company net income Consolidated net income Noncontrolling interest in Sam's income Controlling interest in CNI Retained earnings, 1/1 Net income Dividends paid Retained earnings, 12/31 Current assets Investment in Sam

[E] 5,000 1,250 105,000

2,500

Correct! Correct! Correct! Correct! Correct! Correct! Correct! Correct! Correct! Correct! Correct! Correct! Correct! Correct! Correct!

$ (1,265,000) $ (461,000) 260,000 $ (1,466,000) $ $ 965,000 733,000 $

(440,000) [S] (135,000) [ I ] 65,000 (510,000) 528,000 -

352,000 108,000

[E] [D]

3,750 52,000

88,000 26,250 13,000

[S] [A] [A] [A] 165,000 [A] 95,000

536,000 197,000

Land Buildings and equipment (net) Copyright Total assets Accounts payable Notes payable NCI in Sam 1/1 NCI in Sam 12/31 Common stock Additional paid-in capital Retained earnings, 12/31 Total liabilities and equity Parentheses indicate a credit balance.

292,000 877,000 2,867,000 (191,000) (460,000)

60,000 265,000 95,000 948,000

22,500

517,000 1,119,500 190,000 $ 3,319,500 (339,000) (581,250) (183,250) (300,000) (450,000) (1,466,000) $ (3,319,500)

Correct! Correct! Correct! Correct! Correct! Correct! Correct! Correct! Correct! Correct! Correct! Correct!

(148,000) (130,000) [A]

8,750 [*C] 183,250

(300,000) (450,000) (1,466,000) $ (2,867,000) $

(100,000) [S] (60,000) [S] (510,000) [*C] (948,000)

100,000 60,000 510,000

You might also like

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- Chapter 4 AnswersDocument4 pagesChapter 4 Answerscialee100% (2)

- AC517Document11 pagesAC517Inaia ScottNo ratings yet

- Ch02 P14 Build A ModelDocument6 pagesCh02 P14 Build A ModelKhurram KhanNo ratings yet

- Test and Exam Qs Topic 2 - Solutions - v2 PDFDocument20 pagesTest and Exam Qs Topic 2 - Solutions - v2 PDFCindy YinNo ratings yet

- Ch02 P14 Build A Model AnswerDocument4 pagesCh02 P14 Build A Model Answersiefbadawy1No ratings yet

- Assign 1 - Sem II 12-13Document8 pagesAssign 1 - Sem II 12-13Anisha ShafikhaNo ratings yet

- IFRS Chapter 9 The Consolidated Statement of Financial PositonDocument44 pagesIFRS Chapter 9 The Consolidated Statement of Financial PositonMahvish Memon0% (1)

- ACCT550 Homework Week 2Document5 pagesACCT550 Homework Week 2Natasha Declan100% (2)

- Solution To Ch02 P14 Build A ModelDocument4 pagesSolution To Ch02 P14 Build A Modeljcurt8283% (6)

- Financial Accounting11Document14 pagesFinancial Accounting11AleciafyNo ratings yet

- Problem Sets Solutions 1 Accounting Statements and Cash FlowDocument5 pagesProblem Sets Solutions 1 Accounting Statements and Cash FlowYaoyin Bonnie ChenNo ratings yet

- FM AssignmentDocument4 pagesFM AssignmentDuren JayaNo ratings yet

- Chapter 4 Problem 32Document9 pagesChapter 4 Problem 32morgan.bertoneNo ratings yet

- CH 4 - Brief Exercises - 16thDocument18 pagesCH 4 - Brief Exercises - 16thkesey100% (2)

- Complete Equity Method Workpaper Entries - Year 2010Document14 pagesComplete Equity Method Workpaper Entries - Year 2010jeankoplerNo ratings yet

- 5 15Document8 pages5 15Indra PramanaNo ratings yet

- Chapter 3 HomeworkDocument12 pagesChapter 3 HomeworkRangerNo ratings yet

- SCH 06Document9 pagesSCH 06Hemali MehtaNo ratings yet

- CFA Lecture 4 Examples Suggested SolutionsDocument22 pagesCFA Lecture 4 Examples Suggested SolutionsSharul Islam100% (1)

- Analysis of Financial StatementDocument9 pagesAnalysis of Financial StatementSums Zubair MoushumNo ratings yet

- 2010-10-22 003512 Yan 8Document19 pages2010-10-22 003512 Yan 8Natsu DragneelNo ratings yet

- Financial Accounting ProblemsDocument20 pagesFinancial Accounting Problemsmobinil1No ratings yet

- CH 01Document5 pagesCH 01deelol99No ratings yet

- Solutions To Problem Set ADocument5 pagesSolutions To Problem Set AGalih Eka PutraNo ratings yet

- Chapter 06 XLSolDocument8 pagesChapter 06 XLSolZachary Thomas CarneyNo ratings yet

- Chapter 4Document25 pagesChapter 4Anonymous XOv12G67% (3)

- Self Study Solutions Chapter 5Document16 pagesSelf Study Solutions Chapter 5Jannatul FerdousNo ratings yet

- Advance Accounting Beams 10th eDocument15 pagesAdvance Accounting Beams 10th eHecel OlitaNo ratings yet

- Elliott Homework Week1Document8 pagesElliott Homework Week1Juli ElliottNo ratings yet

- CH 04Document27 pagesCH 04ClaraNo ratings yet

- Financial Planning and ForecastingDocument24 pagesFinancial Planning and ForecastingMikee Ballesteros ManzanoNo ratings yet

- Assignment 3 Sem 1-11-12Document5 pagesAssignment 3 Sem 1-11-12Hana HamidNo ratings yet

- HorngrenIMA14eSM ch16Document53 pagesHorngrenIMA14eSM ch16Piyal HossainNo ratings yet

- AaaaamascpaDocument12 pagesAaaaamascpaRichelle Joy Reyes BenitoNo ratings yet

- Consolidated Financial Statements-Subsequent PartialDocument24 pagesConsolidated Financial Statements-Subsequent PartialJoseph SalidoNo ratings yet

- ACCT5101Pretest PDFDocument18 pagesACCT5101Pretest PDFArah OpalecNo ratings yet

- Sanchez Daisy A1Document12 pagesSanchez Daisy A1api-300102702No ratings yet

- IFRS Chapter 10 The Consolidated Income StatementDocument34 pagesIFRS Chapter 10 The Consolidated Income StatementJuBin DeliwalaNo ratings yet

- Boeing: I. Market InformationDocument20 pagesBoeing: I. Market InformationJames ParkNo ratings yet

- Solution Manual Advanced Accounting Beams 11e Chp1 PDFDocument14 pagesSolution Manual Advanced Accounting Beams 11e Chp1 PDFArifta Nur Rahmat100% (21)

- BDP Financial Final PartDocument14 pagesBDP Financial Final PartDeepak G.C.No ratings yet

- Accy 517 HW PB Set 1Document30 pagesAccy 517 HW PB Set 1YonghoChoNo ratings yet

- Concepts Review and Critical Thinking Questions 4Document6 pagesConcepts Review and Critical Thinking Questions 4fnrbhcNo ratings yet

- Chapter 4 Sample BankDocument18 pagesChapter 4 Sample BankWillyNoBrainsNo ratings yet

- Income Statement: Results of Operating Performance: 15.511 Corporate AccountingDocument36 pagesIncome Statement: Results of Operating Performance: 15.511 Corporate Accountingoluomo1No ratings yet

- Name: Curie Falentina Pandiangan Class: International MBA - 10 NIM: 20/465214/PEK/26217 Financial Management AssignmentsDocument4 pagesName: Curie Falentina Pandiangan Class: International MBA - 10 NIM: 20/465214/PEK/26217 Financial Management AssignmentsDuren JayaNo ratings yet

- Excercise Sheet Lecture 3Document30 pagesExcercise Sheet Lecture 3Mohamed ZaitoonNo ratings yet

- Financial Statements, Cash Flow, and TaxesDocument29 pagesFinancial Statements, Cash Flow, and TaxesHooriaKhanNo ratings yet

- Du PontDocument8 pagesDu PontTên Hay ThếNo ratings yet

- Cash FlowDocument25 pagesCash Flowshaheen_khan6787No ratings yet

- Financial Statement AnalysisDocument9 pagesFinancial Statement Analysiswahab_pakistan50% (2)

- Guilaran, Kerr John BDocument18 pagesGuilaran, Kerr John BKerr John GuilaranNo ratings yet

- Corporate Value Creation: An Operations Framework for Nonfinancial ManagersFrom EverandCorporate Value Creation: An Operations Framework for Nonfinancial ManagersRating: 4 out of 5 stars4/5 (4)

- Comparative Study On Services Provided by Icici and HDFC BankDocument61 pagesComparative Study On Services Provided by Icici and HDFC Bankgovind mahatoNo ratings yet

- Capital StructureDocument32 pagesCapital StructureFebson Lee Mathew100% (1)

- Financial Statement Sivaswathi TEXTILESDocument103 pagesFinancial Statement Sivaswathi TEXTILESSakhamuri Ram'sNo ratings yet

- Chapter 1Document34 pagesChapter 1pikaNo ratings yet

- Corporate Governance Practices, Ownership Structure, and Corporate Performance in The GCC CountriesDocument51 pagesCorporate Governance Practices, Ownership Structure, and Corporate Performance in The GCC CountriesAnggita DwiantariNo ratings yet

- Lanuza Vs CADocument3 pagesLanuza Vs CARyan ChristianNo ratings yet

- Tax - Simplified Table of RatesDocument5 pagesTax - Simplified Table of RatesLouNo ratings yet

- 1013201695227122Document67 pages1013201695227122polbisente100% (1)

- Risk and Return Note 1Document12 pagesRisk and Return Note 1Bikram MaharjanNo ratings yet

- Extinguishing Financial Liabilities With Equity Instruments: IFRIC Interpretation 19Document8 pagesExtinguishing Financial Liabilities With Equity Instruments: IFRIC Interpretation 19rosettejoy278No ratings yet

- Teo DailyDocument2 pagesTeo DailyFederico ChaptoNo ratings yet

- NON Stock Corporations Stock CorporationsDocument7 pagesNON Stock Corporations Stock CorporationsJay Vhee OohNo ratings yet

- Prakas On Licensing of General and Life Insurance CompaniesDocument9 pagesPrakas On Licensing of General and Life Insurance Companiesjefchu0% (1)

- M&a - Case DetailsDocument5 pagesM&a - Case DetailsBinoti PutchuNo ratings yet

- PAMI Asia Balanced Fund Product Primer v3 Intro TextDocument1 pagePAMI Asia Balanced Fund Product Primer v3 Intro Textgenie1970No ratings yet

- Ananya ProjectDocument108 pagesAnanya ProjectDevashish KanooNo ratings yet

- A Compilation On Mergers & AcquisitionsDocument71 pagesA Compilation On Mergers & Acquisitionssajidsakib4uNo ratings yet

- Startups in India: SUKESH R - 15MBAP054 - I Year MBA - KAHEDocument3 pagesStartups in India: SUKESH R - 15MBAP054 - I Year MBA - KAHESukesh RNo ratings yet

- Corporate Law ProjectDocument18 pagesCorporate Law ProjectPrashant Paul KerkettaNo ratings yet

- Vodafone Class 5Document6 pagesVodafone Class 5akashkr619No ratings yet

- HMRC Bulletin - May 2012Document3 pagesHMRC Bulletin - May 2012esopcentreNo ratings yet

- ResolutionsDocument4 pagesResolutionsRavibabu ManganelluriNo ratings yet

- ITC Balance Sheet PDFDocument1 pageITC Balance Sheet PDFJayesh ChandNo ratings yet

- KPN 2005Document76 pagesKPN 2005cattleyajenNo ratings yet

- Statement of Changes in EquityDocument24 pagesStatement of Changes in EquityChristine SalvadorNo ratings yet

- IIKP - Annual Report 2019 - ENGDocument122 pagesIIKP - Annual Report 2019 - ENGSri Zahara Dewi SNo ratings yet

- Corporate Accounting FraudDocument10 pagesCorporate Accounting FraudUmar IftikharNo ratings yet

- Corp Governance Quiz 1Document12 pagesCorp Governance Quiz 1杰米No ratings yet

- Ambuja Cement Annual Report 2016Document228 pagesAmbuja Cement Annual Report 2016Amit PandeyNo ratings yet

- CONSOLIDATED FS RevisedDocument5 pagesCONSOLIDATED FS Revisedshai santiagoNo ratings yet