Professional Documents

Culture Documents

CD Tan Vs Castro

Uploaded by

Venus OcumenOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CD Tan Vs Castro

Uploaded by

Venus OcumenCopyright:

Available Formats

VENUS S. OCUMEN Castro vs Tan et.al GR No.

168940 Promulgated on November 24, 2009 FACTS OF THE CASE

BSAT4-1

Spouses Ruben and Angelina Tan entered into an agreement denominated as Kasulatan ng Sanglaan ng Lupa at Bahay (Kasulatan) to secure a loan of P30,000.00 they obtained from Isagani at Diosdada Castro. Under the agreement, spouses Tan undertook to pay the mortgage debt within six months with an interest rate of 5 percent per month, compounded monthly. Ruben Tan died on September 1994 and his wife took the responsibility of paying the loan. She failed to pay the loan upon maturity and instead, Angelina offered spouses Castro the principal amount of P30,000.00 plus a portion of the interest. Spouses Castro refused and instead demanded payment of the total accumulated sum of P359,000.00. Spouses Castro caused the extrajudicial foreclosure of the real estate mortgage and the period of the redemption expired without Angelina Tan having redeemed the property, thus the title of the property was consolidated in favour of spouses Castro. Angelina Tan filed a Complaint for Nullification of Mortgage and Foreclosure before Malolos RTC. Tan alleged that the interest rate imposed on the principal amount of P30,000.00 is unconscionable. The RTC ruled in favour of Tan. When the case was elevated to the Court of Appeals, the appellate court affirmed the RTC decision with modification by ruling that plaintiff-appellee Tan may redeem the mortgage property by paying the defendants-appellants spouses Castro the amount of P30,000.00 with interest at 12 percent per annum. Spouses Castro filed a petition to the Supreme Court asking the reversal of the CA ruling arguing that the CA gravely erred when it declared the stipulated interest in the Kasulatan as null as if there was no express stipulation on the compounded interest. ISSUES: 1. Was the imposition of a very high interest rate on a money debt legal, moral and just even though the two parties agreed to it? 2. Can a foreclosure of property due to inability to settle debts because of very high interest legal and valid? HELD: 1. The imposition of an unconscionable rate of interest on a money debt, even if knowingly and voluntarily assumed, is immoral and unjust. It is tantamount to a repugnant spoliation and an iniquitous deprivation of property, repulsive to the common sense of man. It has no support in law, in principles of justice, or in the human conscience nor is there any reason whatsoever which may justify such imposition as righteous and as one that may be sustained within the sphere of public or private morals. 2. One cannot legally claim the foreclosure of a property due to inability to settle debt because of a very high interest rate since the amount demanded as the outstanding loan was overstated. Consequently, it has not been shown that the respondents have failed to pay the correct amount of their outstanding obligation. Accordingly, we declare the registration of the foreclosure sale invalid and cannot vest title over the mortgaged property.

You might also like

- Bank of Commerce vs. ManaloDocument3 pagesBank of Commerce vs. ManaloLe AnnNo ratings yet

- Bagtas vs. PaguioDocument7 pagesBagtas vs. PaguioChrisel Joy Casuga SorianoNo ratings yet

- Supreme Court rules on rescission of real estate contract due to liensDocument13 pagesSupreme Court rules on rescission of real estate contract due to liensthebluesharpieNo ratings yet

- 1 China Banking Corp Vs CADocument4 pages1 China Banking Corp Vs CAy6755No ratings yet

- FBDC v. Yllas LendingDocument2 pagesFBDC v. Yllas LendingIAN ANGELO BUTASLACNo ratings yet

- Bacaling v. Muya Case Summary: Irrevocable Power of Attorney Cannot Be RevokedDocument3 pagesBacaling v. Muya Case Summary: Irrevocable Power of Attorney Cannot Be RevokedJUAN MIGUEL MOZONo ratings yet

- Succession Digest 9-25-17Document23 pagesSuccession Digest 9-25-17Dustin NitroNo ratings yet

- Usufructuary Cannot Evict Long-Time TenantDocument7 pagesUsufructuary Cannot Evict Long-Time Tenantjuan dela cruzNo ratings yet

- Civil Procedure Digested CasesDocument5 pagesCivil Procedure Digested CasesRowena GallegoNo ratings yet

- Will of Marcelo Jocson upheld by Supreme CourtDocument3 pagesWill of Marcelo Jocson upheld by Supreme CourtIvan Montealegre ConchasNo ratings yet

- Case Digest - Credit Transaction2Document11 pagesCase Digest - Credit Transaction2Mecs NidNo ratings yet

- Presumption That Writing Is Truly Dated Prevails In Workmen's Compensation CaseDocument7 pagesPresumption That Writing Is Truly Dated Prevails In Workmen's Compensation CaseJay Mark Albis SantosNo ratings yet

- Moore v. RepublicDocument1 pageMoore v. RepublicQueenie BoadoNo ratings yet

- United Muslim and Christian Urban Poor Association, Inc. V BrycDocument3 pagesUnited Muslim and Christian Urban Poor Association, Inc. V BrycJohn YeungNo ratings yet

- Mercader v. DBPDocument3 pagesMercader v. DBPReina MarieNo ratings yet

- Abella v. CADocument1 pageAbella v. CAKara MolinarNo ratings yet

- Digest-Tan Shuy v. Sps. MulawinDocument1 pageDigest-Tan Shuy v. Sps. MulawinNamiel Maverick D. BalinaNo ratings yet

- Caoile V CA ESCRADocument9 pagesCaoile V CA ESCRAmheritzlynNo ratings yet

- 119 Sumipat V Banga MontemayorDocument2 pages119 Sumipat V Banga MontemayorCelest AtasNo ratings yet

- Estate Settlement Dispute ProbedDocument5 pagesEstate Settlement Dispute ProbedJenNo ratings yet

- CIAC Jurisdiction Over Construction Dispute Under 40 CharactersDocument2 pagesCIAC Jurisdiction Over Construction Dispute Under 40 CharactersValora France Miral AranasNo ratings yet

- Velez vs. Velez, G.R. No. 187987, November 26, 2014Document3 pagesVelez vs. Velez, G.R. No. 187987, November 26, 2014JMXNo ratings yet

- Victory Liner Vs GammadDocument5 pagesVictory Liner Vs GammadCherry BepitelNo ratings yet

- Sps. Kalayaan - DIGESTDocument1 pageSps. Kalayaan - DIGESTAlfonso Miguel DimlaNo ratings yet

- Litonjua Vs L & R CorporationDocument9 pagesLitonjua Vs L & R CorporationMaria GoNo ratings yet

- Credit TransactionsDocument5 pagesCredit TransactionschelseaNo ratings yet

- Case Digest - Defective ContractsDocument2 pagesCase Digest - Defective ContractsVERONICA YVONNE SALVADORNo ratings yet

- Romero Vs CA (250 SCRA 223) - G.R. No. 107207 November 23, 1995Document2 pagesRomero Vs CA (250 SCRA 223) - G.R. No. 107207 November 23, 1995Maria Catherine LebecoNo ratings yet

- VIRGILIO R. ROMERO V CADocument2 pagesVIRGILIO R. ROMERO V CABeya Marie F. AmaroNo ratings yet

- PG 10 #11 Gallar vs. HusainDocument2 pagesPG 10 #11 Gallar vs. HusainHarry Dave Ocampo PagaoaNo ratings yet

- Case 126 - Social Security System Vs Rosanna H. AguasDocument1 pageCase 126 - Social Security System Vs Rosanna H. AguasmastaacaNo ratings yet

- 780 SCRA 53 (2016) - Mendez vs. Sharia District CourtDocument2 pages780 SCRA 53 (2016) - Mendez vs. Sharia District CourtBea CapeNo ratings yet

- Cristobal vs. Court of AppealsDocument1 pageCristobal vs. Court of AppealsDeniel Salvador B. MorilloNo ratings yet

- Equatorial Realty Vs Mayfair TheaterDocument2 pagesEquatorial Realty Vs Mayfair TheaterSaji JimenoNo ratings yet

- Tolentino Vs CADocument2 pagesTolentino Vs CAcheryl talisikNo ratings yet

- KATHLEEN ObliCon Digests Baylon EndDocument14 pagesKATHLEEN ObliCon Digests Baylon EndDatu TahilNo ratings yet

- 265natino V IAC (Mier - Keith Jasper)Document2 pages265natino V IAC (Mier - Keith Jasper)Keith Jasper Mier100% (1)

- Land Dispute DecisionDocument9 pagesLand Dispute DecisionLyra AguilarNo ratings yet

- Chua Tee Dee VS CaDocument2 pagesChua Tee Dee VS CaPaula TorobaNo ratings yet

- 42 Rallos vs. YangoDocument2 pages42 Rallos vs. YangoMichelle Montenegro - AraujoNo ratings yet

- Rudolf Lietz Inc Vs CADocument1 pageRudolf Lietz Inc Vs CAAlleine TupazNo ratings yet

- Court Upholds Annulment of Titles Over Disputed LandDocument3 pagesCourt Upholds Annulment of Titles Over Disputed LandcmptmarissaNo ratings yet

- Administrative Law and Contract Interpretation CasesDocument57 pagesAdministrative Law and Contract Interpretation Casesmonmonmonmon21No ratings yet

- Dayot Vs ShellDocument2 pagesDayot Vs ShellSachuzen23No ratings yet

- CAse Digests (Article 1-73 of FC) - Jammy's PartDocument56 pagesCAse Digests (Article 1-73 of FC) - Jammy's PartJammy Kate100% (2)

- Zafra Vs PeopleDocument3 pagesZafra Vs PeopleRobertNo ratings yet

- Ii. Heirs of San Miguel VS CaDocument1 pageIi. Heirs of San Miguel VS CaphgmbNo ratings yet

- Rule 18 Monzon Vs RelovaDocument2 pagesRule 18 Monzon Vs RelovaManu SalaNo ratings yet

- Court Upholds Reassignment Presumption of RegularityDocument1 pageCourt Upholds Reassignment Presumption of RegularityRandy OchoaNo ratings yet

- Carrascoso Vs CADocument3 pagesCarrascoso Vs CAKayelyn LatNo ratings yet

- Tago vs. Comelec and Limbona G.R. NO. 216158Document3 pagesTago vs. Comelec and Limbona G.R. NO. 216158riverman89No ratings yet

- Union vs. Nestle labor disputeDocument3 pagesUnion vs. Nestle labor disputeAllenMarkLuperaNo ratings yet

- Credit Transaction Cases 2015Document11 pagesCredit Transaction Cases 2015ronhuman14No ratings yet

- City of Manila vs. TeoticoDocument2 pagesCity of Manila vs. TeoticoPia SarconNo ratings yet

- Case Title G.R. NO. Ponente Date DoctrineDocument2 pagesCase Title G.R. NO. Ponente Date Doctrinemark anthony mansueto50% (2)

- Ugalde V YsasiDocument2 pagesUgalde V Ysasiralph_atmosferaNo ratings yet

- SC Reduces Unconscionable Interest Rate in Loan AgreementDocument1 pageSC Reduces Unconscionable Interest Rate in Loan AgreementMikhael OngNo ratings yet

- CASTRO V DE LEON TAN G.R. No. 168940 November 24, 2009Document2 pagesCASTRO V DE LEON TAN G.R. No. 168940 November 24, 2009philamiasNo ratings yet

- The Defendant: 51. Lozano vs. Tan Suico, 23 Phil. 16 FactsDocument12 pagesThe Defendant: 51. Lozano vs. Tan Suico, 23 Phil. 16 FactsJoanna May G CNo ratings yet

- Civil Law B QDocument8 pagesCivil Law B QChampo RadoNo ratings yet

- ch11 Lam2eDocument36 pagesch11 Lam2eVenus OcumenNo ratings yet

- GR 2861 Feb 26 1951Document2 pagesGR 2861 Feb 26 1951Venus OcumenNo ratings yet

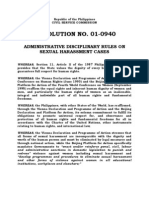

- CSC Ruling On SHDocument21 pagesCSC Ruling On SHVenus OcumenNo ratings yet

- GR 88866 Metrobank S CADocument2 pagesGR 88866 Metrobank S CAVenus OcumenNo ratings yet

- Project FinancingDocument15 pagesProject FinancingAnkush RatnaparkheNo ratings yet

- Professional Associates The Valuation and Muccadam Company of Asif SahuDocument8 pagesProfessional Associates The Valuation and Muccadam Company of Asif Sahuasifsahu100% (1)

- University of East London Fees Policy Academic Session 20167Document30 pagesUniversity of East London Fees Policy Academic Session 20167Masrur Mustavi OmiNo ratings yet

- CBUAE Clarification and Guidelines Manual For Circular No 28 Website VersionDocument9 pagesCBUAE Clarification and Guidelines Manual For Circular No 28 Website VersionAbhishek RungtaNo ratings yet

- Coral - Commitment LetterDocument283 pagesCoral - Commitment LetterMarius AngaraNo ratings yet

- Annotated Bib SS FGFGDocument52 pagesAnnotated Bib SS FGFGshafiqrahimNo ratings yet

- Cebu Cpar Center: Auditing Problems Preweek Lecture Problem No. 1Document18 pagesCebu Cpar Center: Auditing Problems Preweek Lecture Problem No. 1Kelvin Kenneth ValmonteNo ratings yet

- Personal or Household Budgeting.Document11 pagesPersonal or Household Budgeting.Dr Hector C Sikazwe100% (1)

- GABELO V CA Case DigestDocument1 pageGABELO V CA Case DigestMidzmar Kulani50% (2)

- Mortgage Commitment LetterDocument3 pagesMortgage Commitment Letterolboy92No ratings yet

- Rich Vs Paloma - Dissolution Prior Mortgage - Invalid For Lack of Legal Personality No Right of RedemptionDocument2 pagesRich Vs Paloma - Dissolution Prior Mortgage - Invalid For Lack of Legal Personality No Right of RedemptionHershey GabiNo ratings yet

- In Re: MERUELO MADDUX PROPERTIES, INC., 9th Cir. BAP (2013)Document19 pagesIn Re: MERUELO MADDUX PROPERTIES, INC., 9th Cir. BAP (2013)Scribd Government DocsNo ratings yet

- 002 Initial Letter To Lender1Document9 pages002 Initial Letter To Lender1Armond TrakarianNo ratings yet

- HO 2 Installment Sales ActivitiesDocument3 pagesHO 2 Installment Sales ActivitiesddddddaaaaeeeeNo ratings yet

- 17 First Sarmiento Property Holdings vs. PBCom, G.R. No. 202836, June 19, 2018Document3 pages17 First Sarmiento Property Holdings vs. PBCom, G.R. No. 202836, June 19, 2018loschudent100% (1)

- Review of Literature: Chapter-2Document5 pagesReview of Literature: Chapter-2Juan JacksonNo ratings yet

- Bank Loan Heist Threatens Public FundingDocument12 pagesBank Loan Heist Threatens Public FundingSultanaQuader100% (1)

- Fortune Life Insurance Company Vs CoaDocument44 pagesFortune Life Insurance Company Vs CoaLauriz EsquivelNo ratings yet

- Guide To Solicitors' AccountDocument94 pagesGuide To Solicitors' AccountWanee ZailanNo ratings yet

- U.S. Department of Housing and Urban DevelopmentDocument16 pagesU.S. Department of Housing and Urban DevelopmentMichael Seyoum100% (1)

- Real Estate MortgageDocument2 pagesReal Estate MortgageRex Traya100% (1)

- Commissioner of Internal Revenue v. Lake Forest, Inc., 305 F.2d 814, 4th Cir. (1962)Document9 pagesCommissioner of Internal Revenue v. Lake Forest, Inc., 305 F.2d 814, 4th Cir. (1962)Scribd Government DocsNo ratings yet

- Guide To Cashflow 101 TrainingDocument5 pagesGuide To Cashflow 101 TrainingTong Kah Haw100% (2)

- Act No. 3952 (The Bulk Sales Law) PDFDocument2 pagesAct No. 3952 (The Bulk Sales Law) PDFYappi NaniNo ratings yet

- Teal Motor Vs Orient InsuranceDocument2 pagesTeal Motor Vs Orient InsuranceShiena Lou B. Amodia-RabacalNo ratings yet

- NothingDocument4 pagesNothingSofia Louisse C. FernandezNo ratings yet

- Final Insurance Project PDFDocument17 pagesFinal Insurance Project PDFAnand Yadav100% (1)

- Civil Law) Agency) Memory Aid) Made 2002) by Ateneo) 14 PagesDocument14 pagesCivil Law) Agency) Memory Aid) Made 2002) by Ateneo) 14 PagesbubblingbrookNo ratings yet

- Delos Santos Vs VibarDocument2 pagesDelos Santos Vs VibarDeborahAttiwMolitasNo ratings yet

- Agreement Relating To Deposit of Title DeedsDocument2 pagesAgreement Relating To Deposit of Title Deedsjoshstrike21No ratings yet