Professional Documents

Culture Documents

Mutual Fund: Advantages of Mutual Funds

Uploaded by

mercatuzOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mutual Fund: Advantages of Mutual Funds

Uploaded by

mercatuzCopyright:

Available Formats

Mutual fund

Mutual funds may invest in many kinds of securities. The types of securities that a particular fund may invest in are set forth in the fund's prospectus, which describes the fund's investment objective, investment approach and permitted investments. The investment objective describes the type of income that the fund seeks. For example, a "capital appreciation" fund generally looks to earn most of its returns from increases in the prices of the securities it holds, rather than from dividend or interest income. The investment approach describes the criteria that the fund manager uses to select investments for the fund. A mutual fund's investment portfolio is continually monitored by the fund's portfolio manager or managers, who are employed by the fund's manager or sponsor. Advantages of mutual funds Mutual funds have advantages compared to direct investing in individual securities. These include:

Increased diversification Daily liquidity Professional investment management Ability to participate in investments that may be available only to larger investors Service and convenience Government oversight Ease of comparison

Disadvantages of mutual funds Mutual funds have disadvantages as well, which include:

Fees Less control over timing of recognition of gains Less predictable income No opportunity to customize

History The first mutual funds were established in Europe. One researcher credits a Dutch merchant with creating the first mutual fund in 1774. Mutual funds were introduced into the United States in the 1890s. They became popular during the 1920s. These early funds were generally of the closed-end type with a fixed number of shares which often traded at prices above the value of the portfolio. The first open-end mutual fund with redeemable shares was established on March 21, 1924. This fund, the Massachusetts Investors Trust, is now part of the MFS family of funds. However, closed-end funds remained more popular than open-end funds throughout the 1920s. By 1929, open-end funds accounted for only 5% of the industry's $27 billion in total assets.

The first introduction of a mutual fund in India occurred in 1963, when the Government of India launched Unit Trust of India (UTI). Until 1987, UTI enjoyed a monopoly in the Indian mutual fund market. Then a host of other government-controlled Indian financial companies came up with their own funds. These included State Bank of India, Canara Bank, and Punjab National Bank. This market was made open to private players in 1993, as a result of the historic constitutional amendments brought forward by the then Congress-led government under the existing regime of Liberalization, Privatization and Globalization (LPG). The first private sector fund to operate in India was Kothari Pioneer, which later merged with Franklin Templeton. Leading mutual fund complexes At the end of 2010, the top 10 mutual fund complexes in the United States were: 1. Vanguard 2. Fidelity 3. American Funds (Capital Group) 4. PIMCO 5. JPMorgan Chase 6. Franklin Templeton 7. BlackRock 8. Federated 9. T. Rowe Price 10. BNY Mellon Net asset value or NAV A fund's net asset value or NAV equals the current market value of a fund's holdings minus the fund's liabilities (sometimes referred to as "net assets"). It is usually expressed as a per-share amount, computed by dividing by the number of fund shares outstanding. Valuing the securities held in a fund's portfolio is often the most difficult part of calculating net asset value. The fund's board of directors (or board of trustees) oversees security valuation. Turnover Turnover is a measure of the volume of a fund's securities trading. It is expressed as a percentage of net asset value and is normally annualized. Turnover equals the lesser of a fund's purchases or sales during a given period (of no more than a year) divided by average net assets. If the period is less than a year, the turnover figure is annualized. Types of mutual funds There are three basic types of registered investment companies defined in the Investment Company Act of 1940: open-end funds, unit investment trusts, and closed-end funds. Exchange-traded funds are open-end funds or unit investment trusts that trade on an exchange. Open-end funds Open-end mutual funds must be willing to buy back their shares from their investors at the end of every business day at the net asset value computed that day. Most open-end funds also sell

shares to the public every business day; these shares are also priced at net asset value. A professional investment manager oversees the portfolio, buying and selling securities as appropriate. The total investment in the fund will vary based on share purchases, share redemptions and fluctuation in market valuation. There is no legal limit on the number of shares that can be issued. Closed-end funds Closed-end funds generally issue shares to the public only once, when they are created through an initial public offering. Their shares are then listed for trading on a stock exchange. Investors who no longer wish to invest in the fund cannot sell their shares back to the fund (as they can with an open-end fund). Instead, they must sell their shares to another investor in the market; the price they receive may be significantly different from net asset value. It may be at a "premium" to net asset value (meaning that it is higher than net asset value) or, more commonly, at a "discount" to net asset value (meaning that it is lower than net asset value). A professional investment manager oversees the portfolio, buying and selling securities as appropriate. Unit investment trusts Unit investment trusts or UITs issue shares to the public only once, when they are created. Investors can redeem shares directly with the fund (as with an open-end fund) or they may also be able to sell their shares in the market. Unit investment trusts do not have a professional investment manager. Their portfolio of securities is established at the creation of the UIT and does not change. UITs generally have a limited life span, established at creation. Exchange-traded funds A relatively recent innovation, the exchange-traded fund or ETF is often structured as an openend investment company, though ETFs may also be structured as unit investment trusts, partnerships, investments trust, grantor trusts or bonds (as an exchange-traded note). ETFs combine characteristics of both closed-end funds and open-end funds. Like closed-end funds, ETFs are traded throughout the day on a stock exchange at a price determined by the market. However, as with open-end funds, investors normally receive a price that is close to net asset value. To keep the market price close to net asset value, ETFs issue and redeem large blocks of their shares with institutional investors. Most ETFs are index funds.

Questions

1. What is NAV? 2. Which is the first mutual fund in India? 3. What is open-ended and close-ended mutual funds? Source : From Wikipedia, the free encyclopedia Compiled by Varun T K

You might also like

- The Financial Detective CaseDocument6 pagesThe Financial Detective Caseashwini patilNo ratings yet

- Project Report On HDFC Mutual FundsDocument66 pagesProject Report On HDFC Mutual FundsPrince Maurya67% (3)

- Chapter 17Document42 pagesChapter 17hussam100% (2)

- BKM CH 09 Answers W CFAhgigoitDocument10 pagesBKM CH 09 Answers W CFAhgigoitbananpolis100% (11)

- VIKAS Blackbook ProjectDocument12 pagesVIKAS Blackbook Projectansari danish75% (4)

- Introduction to Mutual FundsDocument4 pagesIntroduction to Mutual FundsTinkuNo ratings yet

- Project On MFDocument43 pagesProject On MFAbhi Rajendraprasad100% (1)

- Mutual Fund Guide - Types, Fees & AdvantagesDocument4 pagesMutual Fund Guide - Types, Fees & AdvantagesDhanya ArunNo ratings yet

- Mutual FundsDocument3 pagesMutual FundsKhurram KhanNo ratings yet

- Basics of Mutual FundsDocument26 pagesBasics of Mutual FundsShakeel PashaNo ratings yet

- Mutual FundsDocument7 pagesMutual Fundsjagannath86No ratings yet

- Corporate Law and Governance AssignmentDocument9 pagesCorporate Law and Governance AssignmentSHRAVANTHI.K 20BCO043No ratings yet

- Advantages and disadvantages of mutual fundsDocument4 pagesAdvantages and disadvantages of mutual fundsbhaveshNo ratings yet

- MFS, Etfs, HfsDocument25 pagesMFS, Etfs, HfsAriful Haidar MunnaNo ratings yet

- Investment FundsDocument16 pagesInvestment Fundseunicecisnero9395No ratings yet

- Mutual Funds ChetanDocument16 pagesMutual Funds ChetanDrishty BishtNo ratings yet

- Mutual Funds What Are Mutual Funds?Document18 pagesMutual Funds What Are Mutual Funds?RazzaqeeeNo ratings yet

- Mutual FundsDocument16 pagesMutual Fundsvirenshah_9846No ratings yet

- Information Is An Investor'S Best Toola Guide For InvestorsDocument7 pagesInformation Is An Investor'S Best Toola Guide For InvestorsMarifel SalazarNo ratings yet

- FIN010 Mutual-FundsDocument4 pagesFIN010 Mutual-FundsLanz Mark RelovaNo ratings yet

- Mutual FundsDocument8 pagesMutual FundsaltraxiNo ratings yet

- Mutual FundDocument12 pagesMutual FundyanaNo ratings yet

- Week 11 FinmarDocument5 pagesWeek 11 FinmarJoleen DoniegoNo ratings yet

- Investing in Mutual Funds: Types, Advantages & DisadvantagesDocument13 pagesInvesting in Mutual Funds: Types, Advantages & Disadvantageschandan chNo ratings yet

- What Is A Mutual Fund?Document6 pagesWhat Is A Mutual Fund?vanajaNo ratings yet

- Closed End VS Open End FundsDocument2 pagesClosed End VS Open End Fundspingu_513501No ratings yet

- What Is A Mutual FundDocument5 pagesWhat Is A Mutual FundSHRIYA CHANDANKARNo ratings yet

- Mutual Funds & TypesDocument6 pagesMutual Funds & TypesemrangiftNo ratings yet

- Invest in mutual funds with ease and diversificationDocument6 pagesInvest in mutual funds with ease and diversificationAshwin KumarNo ratings yet

- History and Basics of Mutual FundsDocument16 pagesHistory and Basics of Mutual FundsVivek MurthyNo ratings yet

- History and Basics of Mutual FundsDocument16 pagesHistory and Basics of Mutual FundsVivek MurthyNo ratings yet

- Nive Mutual Fund ProjectDocument16 pagesNive Mutual Fund ProjectVivek MurthyNo ratings yet

- Lect 2Document37 pagesLect 2mahamamir012No ratings yet

- Supply of Capital: Investment FundDocument3 pagesSupply of Capital: Investment FundMahnoor AbbasiNo ratings yet

- Advantages of Mutual FundsDocument11 pagesAdvantages of Mutual FundsMuqthar MaharoofNo ratings yet

- Asset-Management Chapter 5Document5 pagesAsset-Management Chapter 5kaylee dela cruzNo ratings yet

- Mutual Fundss in IndiaDocument15 pagesMutual Fundss in IndiaNaomi KnightNo ratings yet

- Mba Black Book Project On HDFC MFDocument5 pagesMba Black Book Project On HDFC MFPooja SinghNo ratings yet

- Mutual FundDocument4 pagesMutual FundVandita KhudiaNo ratings yet

- Project ReportDocument95 pagesProject ReportsaivasuNo ratings yet

- Mutual Funds & Its TypesDocument5 pagesMutual Funds & Its TypesAadil HanifNo ratings yet

- Mutual Funds: Getting StartedDocument48 pagesMutual Funds: Getting Startedmitesh_ojhaNo ratings yet

- Structure : Securities and Exchange Commission Board of Directors Board of TrusteesDocument8 pagesStructure : Securities and Exchange Commission Board of Directors Board of Trusteestanya tanwarNo ratings yet

- Structure : Securities and Exchange Commission Board of Directors Board of TrusteesDocument17 pagesStructure : Securities and Exchange Commission Board of Directors Board of Trusteestanya tanwarNo ratings yet

- Understanding Capital MarketsDocument15 pagesUnderstanding Capital MarketsSakthirama VadiveluNo ratings yet

- Mutual Funds and Systematic Investment Plans With Their Best Performing FundsDocument7 pagesMutual Funds and Systematic Investment Plans With Their Best Performing FundsTanishka NAHARNo ratings yet

- Invesrment 1Document5 pagesInvesrment 1HaileNo ratings yet

- History of Mutual FundDocument6 pagesHistory of Mutual FundapuoctNo ratings yet

- mutual funds reportDocument8 pagesmutual funds reporti6178717No ratings yet

- An Introduction To Mutual FundsDocument15 pagesAn Introduction To Mutual FundsAman KothariNo ratings yet

- Investor Guide to Mutual Fund TypesDocument34 pagesInvestor Guide to Mutual Fund TypesAmit PasiNo ratings yet

- Preeti (Mutual Fund)Document21 pagesPreeti (Mutual Fund)gawadshrutikaNo ratings yet

- Mutual FundsDocument15 pagesMutual FundsMirchi RiyazNo ratings yet

- Mutual Funds and Other Investment Companies What Are Mutual Funds?Document4 pagesMutual Funds and Other Investment Companies What Are Mutual Funds?RM ValenciaNo ratings yet

- A PROJECT REPORT On Mutual Fund A Safer InvestmentDocument56 pagesA PROJECT REPORT On Mutual Fund A Safer InvestmentBabasab Patil (Karrisatte)100% (1)

- Mutual Fund: Navigation SearchDocument18 pagesMutual Fund: Navigation SearchKr PrajapatNo ratings yet

- Unit 2. Investment Companies and Unit TrustDocument10 pagesUnit 2. Investment Companies and Unit TrustCLIVENo ratings yet

- Financial Institutions: Submitted To: Sharique Ayubi Submitted By: Muzzamil Younus ID: 8782 Date: 9 December 2009Document14 pagesFinancial Institutions: Submitted To: Sharique Ayubi Submitted By: Muzzamil Younus ID: 8782 Date: 9 December 2009Muzzamil YounusNo ratings yet

- Mutual Funds - The Mutual Fund Retirement Plan For Long - Term Wealth BuildingFrom EverandMutual Funds - The Mutual Fund Retirement Plan For Long - Term Wealth BuildingNo ratings yet

- Canadian Mutual Funds Investing for Beginners: A Basic Guide for BeginnersFrom EverandCanadian Mutual Funds Investing for Beginners: A Basic Guide for BeginnersNo ratings yet

- Exchange Traded Funds Sovereign Wealth Funds, Transfer Pricing, & Cyber Crimes: Sovereign Wealth Funds, Transfer Pricing, & Cyber CrimesFrom EverandExchange Traded Funds Sovereign Wealth Funds, Transfer Pricing, & Cyber Crimes: Sovereign Wealth Funds, Transfer Pricing, & Cyber CrimesNo ratings yet

- Australian Managed Funds for Beginners: A Basic Guide for BeginnersFrom EverandAustralian Managed Funds for Beginners: A Basic Guide for BeginnersNo ratings yet

- 68 GaarDocument2 pages68 GaarmercatuzNo ratings yet

- 67.ifrs ConvergenceDocument2 pages67.ifrs ConvergencemercatuzNo ratings yet

- 7.stpi & SezDocument3 pages7.stpi & SezmercatuzNo ratings yet

- 64.role of Chartred Accountants in Financial InstitutionsDocument2 pages64.role of Chartred Accountants in Financial Institutionsmercatuz100% (1)

- 33.tax Planning Under Indirect TaxationsDocument3 pages33.tax Planning Under Indirect TaxationsmercatuzNo ratings yet

- 62.insider TradingDocument5 pages62.insider TradingmercatuzNo ratings yet

- 9.corporate GovernanceDocument3 pages9.corporate GovernancemercatuzNo ratings yet

- 17.role of Tax ConsultantsDocument4 pages17.role of Tax Consultantsmercatuz100% (1)

- Certificate of Deposit: Add-On CdsDocument4 pagesCertificate of Deposit: Add-On CdsmercatuzNo ratings yet

- 8.global WarmingDocument3 pages8.global WarmingmercatuzNo ratings yet

- 65.role of A ConsultantDocument2 pages65.role of A ConsultantmercatuzNo ratings yet

- 66.six SigmaDocument3 pages66.six SigmamercatuzNo ratings yet

- 61.forensic AccountingDocument3 pages61.forensic Accountingmercatuz0% (1)

- 63 KaizenDocument4 pages63 KaizenmercatuzNo ratings yet

- System Audit: Foundations of Information System AuditingDocument4 pagesSystem Audit: Foundations of Information System AuditingmercatuzNo ratings yet

- 6.standards On Quality ControlDocument2 pages6.standards On Quality ControlmercatuzNo ratings yet

- 58.process CostingDocument3 pages58.process CostingmercatuzNo ratings yet

- 60.central Excise Compliance CertificateDocument3 pages60.central Excise Compliance CertificatemercatuzNo ratings yet

- 57.pricing DecisionsDocument3 pages57.pricing DecisionsmercatuzNo ratings yet

- 56.IFRS Vs IASDocument3 pages56.IFRS Vs IASmercatuzNo ratings yet

- 52.analysis For Decision MakingDocument4 pages52.analysis For Decision MakingmercatuzNo ratings yet

- 55.profesional EthicsDocument5 pages55.profesional EthicsmercatuzNo ratings yet

- 5.money LaunderingDocument3 pages5.money LaunderingmercatuzNo ratings yet

- 54.banking Regulation ActDocument5 pages54.banking Regulation ActmercatuzNo ratings yet

- 51.limited Liability PartnershipDocument8 pages51.limited Liability PartnershipmercatuzNo ratings yet

- 46.repo ArrangementsDocument5 pages46.repo ArrangementsmercatuzNo ratings yet

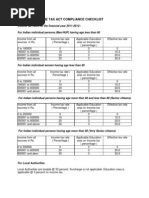

- 53.income Tax Compliance Check ListDocument5 pages53.income Tax Compliance Check ListmercatuzNo ratings yet

- 50.cost Control & Cost ReductionDocument6 pages50.cost Control & Cost ReductionmercatuzNo ratings yet

- 49.transfer PricingDocument4 pages49.transfer PricingmercatuzNo ratings yet

- Due Diligence Review: Purpose of Due-Diligence Review-The Purpose of Due Diligence Review Is To Assist TheDocument4 pagesDue Diligence Review: Purpose of Due-Diligence Review-The Purpose of Due Diligence Review Is To Assist ThemercatuzNo ratings yet

- Kazar Slaven - Chartered Accountants & Insolvency PractitionersDocument14 pagesKazar Slaven - Chartered Accountants & Insolvency PractitionersKazar SlavenNo ratings yet

- Exam in Accounting-FinalsDocument5 pagesExam in Accounting-FinalsIyarna YasraNo ratings yet

- University Malaysia Kelantan (UMK) : Course NameDocument18 pagesUniversity Malaysia Kelantan (UMK) : Course NameshobuzfeniNo ratings yet

- Merger and AcquisitionDocument42 pagesMerger and Acquisitionqari saib100% (1)

- Company Law EssentialsDocument292 pagesCompany Law EssentialsakashkumarNo ratings yet

- Statement of Changes in Equity: Fabm IiDocument12 pagesStatement of Changes in Equity: Fabm IiAlyssa Nikki VersozaNo ratings yet

- Regulatory FrameworkDocument10 pagesRegulatory FrameworkkingjaspeNo ratings yet

- Chap4 (1-15)Document8 pagesChap4 (1-15)Jahanzaib JavaidNo ratings yet

- Pre and Post of Accounting 2Document14 pagesPre and Post of Accounting 2Nancy AtentarNo ratings yet

- IPO's Through Book Building (Procedures and Process)Document30 pagesIPO's Through Book Building (Procedures and Process)joanitasaldanhaNo ratings yet

- Ratio AnalysisDocument79 pagesRatio Analysisanjali dhadde100% (1)

- 06-Earnings-Per-Share Practice Problems Faisal & CODocument10 pages06-Earnings-Per-Share Practice Problems Faisal & COsyed asim shahNo ratings yet

- Global Depositary Receipt - GDRDocument12 pagesGlobal Depositary Receipt - GDRSankesh SatputeNo ratings yet

- 9 Bonus and Right IssueDocument4 pages9 Bonus and Right IssueRohith KumarNo ratings yet

- Market Sounding IPP Procurement For 2016 - R2Document16 pagesMarket Sounding IPP Procurement For 2016 - R2widyo saptotoNo ratings yet

- What Is AccountingDocument3 pagesWhat Is AccountingEmmanuel James SevillaNo ratings yet

- Intac 2Document7 pagesIntac 2Yza GesmundoNo ratings yet

- CA Inter Law Test 1Document6 pagesCA Inter Law Test 1SwAti KiNiNo ratings yet

- Corpo Bar QsDocument37 pagesCorpo Bar QsDee LM100% (1)

- On DirectorsDocument18 pagesOn DirectorsSarthak SinghNo ratings yet

- Fabm 1 FinalDocument16 pagesFabm 1 FinalAlthea Dela Pena100% (1)

- Tutorial Topic 5: Stock Valuation: Page 1 of 2Document2 pagesTutorial Topic 5: Stock Valuation: Page 1 of 2KSNo ratings yet

- Annual Report - Arcotech Ltd. - 2017Document59 pagesAnnual Report - Arcotech Ltd. - 2017Tanmaya SahooNo ratings yet

- Best CFO AwardsDocument2 pagesBest CFO Awardssid.varshneyNo ratings yet

- FIN310 Module 3 Excel AssignmentDocument27 pagesFIN310 Module 3 Excel AssignmentJonathan BurgosNo ratings yet

- HW 4Document4 pagesHW 4Mishalm96No ratings yet

- SFM MTP - May 2018 QuestionDocument6 pagesSFM MTP - May 2018 QuestionMajidNo ratings yet