Professional Documents

Culture Documents

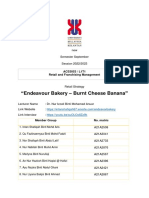

Marketing Strategy

Uploaded by

Praveen KumarOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Marketing Strategy

Uploaded by

Praveen KumarCopyright:

Available Formats

INDUSTRY PROFILE India is one of the largest producers of oilseeds in the world and this sector occupies an important

position in the agricultural economy. Oilseeds and edible oils are two of the most sensitive essential commodities. India grows oilseeds on an area of over 26 million hectares, with productivity of around 1000 kg a hectare. But self reliance in edible oils is not in sight and the country imports almost half of its edible oil requirements. India has a wide range of oilseeds crops grown in its different agro climatic zones. Groundnut, mustard/rapeseed, sesame, safflower, linseed, inversed/castor are the major traditionally cultivated oilseeds. Soya bean and sunflower have also assumed importance in recent years. Coconut is most important amongst the plantation crops. Among the nonconventional oils, rice bran oil and cottonseed oil are the most important. The Indian edible oil industry is composed of some 15,000 oil mills, 600 solvent extraction units, 250 vanaspati units and about 400 refining units. The National council of Applied Economic Research has projected the demand for edible oils under three scenarios on the basis of per capita income growing annually by 4%,5% and 6%.Under the low growth scenario, the demand was to rise to 22.8 million tones ,under medium growth scenario to 25.9 million tones and under high growth scenario to 29.4 million tons in the near future. The edible oil industry is largely dominated by the bulk segment. Unbranded segment accounts for anywhere between 80 and 90% of the total consumption. Imports are taking place in two forms-refined and crude oil. A large part of the crude oil gets sold as unbranded oil. The share of raw oil, refined oil and vanaspati in the total edible oil market is estimated at 35%, 55% and 10% respectively. With growing quality consciousness and plummeting price differences between packaged and non-packaged edible oils, the packaged edible oil sector will capture 50% of the market share in coming years. The packaged branded edible oil industry is growing at 12% annually. Major Players like Marico Industries is the market leader with its two main brands, Sweekar and Saffola, having 15% market share, followed by ITC Agrotechs Sundrop at 13%. Godrej Foods has a market share of 11% and HLLs Flora has 3%. Cargil sells edible oil through Nature Fresh and Gemini brands, Ruchi groups with Ruchi Gold and Mahakosh oil, Adani Wilmer Limited,

owner of Fortune brand, National Diary Development Board's Dhara brand and other small players own rest of the packaged edible oil market.

The Indian vegetable oil economy is the worlds fourth largest after the US, China and Brazil, harvesting about 25 million tons of oilseeds against the world. Since 1995, Indian share in world production of oilseeds has been around 10 percent. Although, India is a major producer of oilseeds, per capita oil consumption in India is only 10.6 kg/annum which is low compared to 12.5 kg/annum in China, 20.8 kg/annum in Japan, 21.3 kg/annum in Brazil and 48.0 kg/annum in USA. Vegetable oil consumption has increased following a rise in household incomes and consumer demand. India imports half of its edible oil requirement, making it the worlds thirdlargest importer of edible oil. The country buys soya oil from Argentina & Brazil and palm oil from Malaysia & Indonesia. Currently, India accounts for 11.2 per cent of vegetable oil import and 9.3 percent of edible oil consumption. India has a wide range of oilseeds crops grown in its different agro climatic zones. Groundnut, mustard/rapeseed, sesame, safflower, linseed, nigerseed / castorseed are the major traditionally cultivated oilseeds. Soyabean and sunflower have also assumed importance in recent years. Groundnut, soyabean and mustard together contribute about 85 percent of the countrys oilseeds production. Coconut is most important amongst the plantation crops. Efforts are being made to grow oil palm in Andhra Pradesh, Karnataka, Tamil Nadu in addition to Kerala and Andaman & Nicobar Islands. Among the non-conventional oils, ricebran oil and cottonseed oil are the most important. In addition, oilseeds of tree and forest origin, which grow mostly in tribal inhabited areas, are also a significant source of oils. Until 2002, the olive oil sector in India was predominantly unorganised. The olive oil industry in India is small and largely people use it more for cosmetic purposes than for cooking. Today Indians are moving to better cooking mediums like Olive oil for health and wellness reasons. Olive Oil has always been placed somewhere between food and medicine and the biggest challenge is to educate Indian consumers on the benefits of olive oil as a cooking medium. Today, the domestic olive oil consumption is seen rising 25% annually.

Key Market Players and Brands: Major Market players: Edible Oils:

-Tech (Secunderabad)

Vanaspathi:

Wipro (Bangalore) Rasoi (Calcutta) Avi Industries (Mumbai) Oil brands: Sundrop

Vanaspathi brands:

Consumption Pattern of Edible Oils in India India is a vast country and inhabitants of several of its regions have developed specific preference for certain oils largely depending upon the oils available in the region. For example, people in the South and West prefer groundnut oil while those in the East and North use mustard/rapeseed oil. Likewise several pockets in the South have a preference for coconut and sesame oil. Inhabitants of northern plain are basically hard fat consumers and therefore, prefer Vanaspati, a term used to denote a partially hydrogenated edible oil mixture. Vanaspati has an important role in our edible oil economy. Its production is about 1.2 million tonnes annually. It has around 10% share of the edible oil market. It has the ability to absorb a heterogeneous variety of oils, which do not generally find direct marketing opportunities because of consumers preference for traditional oils such as groundnut oil, mustard oil, sesame oil etc. For example, newer oils like soyabean, sunflower, ricebran and cottonseed and oils from oilseeds of tree and forest origin had found their way to the edible pool largely through vanaspati route. Of late, things have changed. Through technological means such as refining, bleaching and deodouraisation, all oils have been rendered practically colourless, odourless and tasteless and, therefore, have become easily interchangeable in the kitchen. Newer oils which were not known before have entered the kitchen, like those of cottonseed, sunflower, palm oil or its liquid fraction (palmolein), soyabean and ricebran. These tend to have a strong and distinctive taste preferred by most traditional customers. The share of raw oil, refined oil and vanaspati in the

total edible oil market is estimated at 35%, 55% and 10% respectively. Major Features of Edible Oil Economy There are two major features, which have very significantly contributed to the development of this sector. One was the setting up of the Technology Mission on Oilseeds in 1986. This gave a thrust to Government's efforts for augmenting the production of oilseeds. This is evident by the very impressive increase in the production of oilseeds from about 11.3 million tonnes in 1986-87 to 24.8 million tonnes in 1998-99. There was some setback in 1999-2000 because of the unseasonal rain followed by inclement weather. The production of oilseeds declined to 20.7 million

tonnes in 1999-2000. However, the oilseeds production went up to 27.98 million tones in 200506 and was 24.29 million tonnes during 2006-07 oil year. As per the 3rd advance estimate by Ministry of Agriculture dated 22.4.08 the production of nine major oilseeds is estimated to be about 28.21 million tonnes during 2007-08. The other dominant feature which has had significant impact on the present status of edible oilseeds/oil industry has been the programme of liberalisation under which the Government's economic policy allowing greater freedom to the open market and encourages healthy competition and self regulation rather than protection and control. Controls and regulations have been relaxed resulting in a highly competitive market dominated by both domestic and multinational players.

COMPANY PROFILE Anjali Oils and Foods was born out of the dream of visionary entrepreneur, Mr. K.S.R.Natarajan. He was well aware of the tremendous importance of sesame, or gingelly oil in the culture of South India, and how it is used as a cooking medium, for medicinal purposes in Ayurveda, and for cosmetic use. Realizing the potential importance of this nutritionally rich oil in an increasingly health-conscious society, he founded Nataraj Oil Mills Private Limited in 1994, to provide the best quality gingelly oil to small and large consumers. Mr. Natarajan has emerged as a pioneer in the oil industry, with a strong background of about thirty years in the oil industry. His venture into the packaged oil business paid rich dividends and Anjali carved a niche for itself with its strong brand image. The success of Anjali in the area of edible oils led to the growth of the brand in other related food segments, such as Pickles, Sauces, Ketchups and Jams under the banner of Anjali Foods. Anjali had already become a household name, recognized for its purity and taste, and this was reinforced by wholesome pickles and preserves from the Anjali brand that are an integral part of every meal. Anjali Foods has led to a quantum leap in the Anjali story, by capturing peoples hearts and becoming a popular and sought after brand.

Anjali Oils and Foods products are produced in a fully automated manufacturing plant along the Madurai-Chennai Highway in Tamil Nadu, India that is spread across an area of 5 acres. State-of-the-art machinery, and high quality ingredients ensure quality products adhering to international standards. The products are packed completely untouched by human hands during the entire process, and are thus assured of a longer shelf life. ANJALI PRODUCTS - FEATURES Anjali Gingelly Oil - Drop of Health Sesame, or gingelly, is a seed used as a food ingredient for the last 2000 years. The oil extracted by crushing this seed has been described thus by Charaka, the father of Ayurveda, Of all the oils, sesame oil is the best. The modern view of sesame, or gingelly oil is no different because the sesame seed contains calcium, phosphorus, potassium, Vitamin B and Iron. It has a high and unique protein composition, and high quantities of methionine and tryptophan amino acids. Sesame oil has the finest flavour and a high boiling point, thus less molecular restructuring takes place in sesame oil than in any other seed oil, making it non-carcinogenic. In Korea, it is a major food supplement for children, in the belief that the oil acts as a brain invigorator! Ayurveda has long used sesame oil as a medium for medicines to penetrate the skin through massage. It is also widely used in the treatment of haemorrhoids, skin disorders, anaemia, dysentery, diarrhoea, respiratory as well as menstrual disorders and sinusitis. Most importantly, sesame oil enhances HDL (good cholesterol) and reduces LDL (bad cholesterol). Manufactured with the health-specific Nutri-effect - a Unique Protein Composition, Anjali Sesame Oil is entirely free from Argemone oil and adheres strictly to the ever-changing quality guidelines of the international food products industry. Available in flexi-pouches in measures ranging from 50 gms, 100 gms, 200gms, 500 gms to 1 kg and HDPE cans of 200gms, 500gms, 1kg and 5kg. Anjali meets the varied buying requirements of both home and commercial consumers.

Anjali Sesame or Gingelly Oil comes to you at an attractive price with its rich taste, splendid flavour and peerless quality. Little wonder that this flagship product from Anjali is firmly entrenched in the hearts of millions of healthy and satisfied consumers! Anjali Groundnut Oil Groundnut Oil 100g Food Energy Protein Carbohydrate (total) Dietary fibre Crude fibre Ash GMO Lipids Total fat Saturated fat Monounsaturated fat Polyunsaturated fat Cholesterol Vitamins Vitamin E 25 micrograms 100g 16.5g 52.3g 26.3g 0mg 884kcal 0g 0g 0g 0g 0g NIL

Groundnut (Peanut) oil is a popular cooking medium, especially for stir-fries. It is relatively high in saturated fats, which do not turn into trans fatty acids when heated to normal cooking temperatures. Therefore it is more useful as a cooking medium than oils that are lower

in saturates and higher in omega 3 fatty acids. Peanut Oil has neutral flavour and odour, and does not absorb smells from foods. Anjali Pickles - Salt n Spice The tangy and spicy taste of Indian pickles is richly rendered by Anjali Pickles. Choose from our classic Mango pickle made with the best quality green mangoes and the full-bodied spices that make for an unforgettable taste, or our Lime and Chilli pickles that can satisfy the taste buds of the most discerning customer. Anjali Appalams and Ready-to-fry foods - Clever Crunches Crisply fried accompaniments to lunch and dinner are an important part of the Indian dining experience. Traditional recipes for delicious appalams and vadams, or papads and readyto-fry items from Anjali are specially aimed to please the Indian palate. Savour the flavour Anjali sauces Whether it is Soya sauce giving the full-bodied taste of the best soyabeans, or chilli sauce made from the freshest green chillies, or tomato ketchup made from ripe, red, tomatoes bursting with health, your meal gets an instant lift with the presence of Anjali spicy condiments. Fresh n Fruity Anjali jams The freshest fruits, sourced directly from lush orchards all over India go into Anjali Jams. Our Jams have enhanced nutritional value, not only due to the purity and freshness of the fruit ingredients, but also because of the Calcium, Vitamin A, Glucose and Vitamin B3 added in the processing of the fruit pulp. Freshness, affordability, sheer goodness and taste are the winning ingredients of Anjali Jams.

PRODUCT PROFILE

ANJALI GINGELLY OIL

1 ltr

500 ml

200 ml

100 ml

5 ltr

1 ltr

500 ml

200 ml

100 ml

ANJALI GROUNDNUT OIL

1 ltr

ANJALI PICKLES

Amla

Andhra Avakkai

Capsicum

Citron

Garlic

Ginger

Lime

Cut Mango

Mango Thokku

Mixed Vegetable

Tomato

Vadu Mango

ANJALI APPALAM

Size 1

Size 3

Size 4

QUALITY POLICY

Anjali oil considers quality as one of the principal strategic objectives to guarantee its growth and leadership in the markets in which it operates. The company is committed to respond creatively and competitively to the changing needs and aspirations of the consumers through relentless pursuit of technological excellence, innovation and quality management across their businesses, and offer superior quality products and services that are appropriate to the various price points in the market. The company trains/ provides necessary tools & techniques to its employees as well as is empowering them to ensure broad base compliance of the policy of the organisation at all levels. The company is committed to fulfill its legal and statutory obligations and international standards of product safety and hygiene and will not knowingly sell product that is harmful to consumers or their belongings. It will institute systems and measures to monitor compliance in order to meet its responsibilities to consumers. The company will maintain an open communication channel with its consumers and customers and will carefully monitor the feedback to continuously improve its products and services and set quality standards to fulfill them.

The company is committed to extend its quality standards to its contract manufacturers, key suppliers and service providers and by entering into alliances with them, to jointly improve the quality of its products and services. This policy is applicable to production from its own facilities as well as to production that is outsourced. The company will periodically review this quality policy for its effectiveness and consistency with business objectives.

SCOPE OF THE STUDY In business it is said winning company those that can meet customers needs economically and conveniently and with effective communication. Two key themes of marketing communication are that: Different marketing activities are employed to communicate and deliver value. All marketing activities are coordinated to maximize their joint effects.

In every organization after implementing the communications plan, the communications director must measure the impact of different communications programs on the target audience. Members of the target audience are asked whether they recognize or recall the message, how many times they use the product and what they feel about the product and their current and previous attitudes toward the product and the company. The communicator should also collect behavioral measures of audience response, such as how many people like the product and talked to others about the product. So these studies are helpful to peruse the customers perception toward the product and company. This study clears the image of the product and the company created by the communications programs and its effect can also measure easily.

OBJECTIVES OF THE STUDY To know the marketing feasibility and advertisement strategy for the edible oil brands. To know the consumer preference about edible oil. To study the consumers perception and opinion for the product. To know which criteria consumers follow before they purchase oil. Qualitative and Quantitative analysis of the purchasing behavior of the people. To find out the various marketing communications programes effect on the consumers. To find out which type of programes are more convencing. To study and analyse the consumer behaviour in rural markets.

REVIEW OF LITERATURE

A literature review is a body of text that aims to review the critical points of current knowledge and or methodological approaches on a particular topic. Literature reviews are secondary sources, and as such, do not report any new or original experimental work. A good literature review is characterized by: a logical flow of ideas; current and relevant references with consistent, appropriate referencing style; proper use of terminology; and an unbiased and comprehensive view of the previous research on the topic. My project was related to government stores and company has started concentrating on these stores now but so many studies have been done on FMCG sector, mainly to increase the sale in rural areas. 1.Basu Purba (2004),suggested that the lifestyle of rural consumers is changing. Rural Indian market and the marketing strategy have become the latest marketing buzzword for most of the FMCG majors. She added the strategies of different FMCG companies for capturing rural market like Titans Sonata watches, Coco Colas 200mlbottle, different strategies of HUL and Marico

etc. She takes into consideration the study of National Council for Applied Economic Research (NCAER).According to the NCAER projections, the number of middle and high-income households in rural area is expected to grow from 140 million to 190 million by 2007.In urban India, the same is expected to grow from 65 million to 79 million. Thus, the absolute size of rural India is expected to be double that of urban India.

2.Tognatta Pradeep (2003),suggested that ,the economic growth in India's agricultural sector in last year was over 10%,compared with 8.5%in the industrial sector. This implies a huge market potentiality for the marketer to meet up increasing demand. Factors such as village psyche,strong distribution network and market awareness are few prerequisites for making a dent in the rural markets. The model is of the stolid Anglo-Dutch conglomerate Unilever Group, which has enjoyed a century-long presence in India through its subsidiary Hindustan Lever Ltd. It was Hindustan Lever that several years ago popularized the idea of selling its products in tiny packages. Its sachets of detergent and shampoo are in great demand in Indian villages. Britannia with its low priced Tiger brand biscuits has become some of the success story in rural marketing.

3. Dr. N. Rajendhiran(MBA, PhD)/ Mr. S. Saiganesh(MBA, MA, M.Phil)/ Ms. P. Asha(MBA) Prime Minister Dr. Manmohan Singh recently talked about his vision for rural India: "My vision of rural India is of a modern agrarian, industrial and services economy co-existing side by side, where people can live in well-equipped villages and commute easily to work, be it on the farm or in the non-farm economy. There is much that modern science and technology can do to realise this vision. Rural incomes have to be increased. Rural infrastructure has to be improved. Rural health and education needs have to be met. Employment opportunities have to be created in rural areas." 'Go rural' is the slogan of marketing gurus after analyzing the socio-economic changes in villages. The Rural population is nearly three times the urban, so that Rural consumers have become the prime target market for consumer durable and non-durable products, food, construction, electrical, electronics, automobiles, banks, insurance companies and other sectors besides hundred per cent of agri-input products such as seeds, fertilizers,

pesticides and farm machinery. The Indian rural market today accounts for only about Rs 8 billion of the total ad pie of Rs 120 billion, thus claiming 6.6 per cent of the total share. So clearly there seems to be a long way ahead. Although a lot is spoken about the immense potential of the unexplored rural market, advertisers and companies find it easier to vie for a share of the already divided urban pie. The success of a br and in the Indian rural market is as unpredictable as rain. It has always been difficult to gauge the rural market. Many brands, which should have been successful, have failed miserably. More often than not, people attribute rural market success to luck. Therefore, marketers need to understand the social dynamics and attitude variations within each village though nationally it follows a consistent pattern looking at the challenges and the opportunities which rural markets offer to the marketers it can be said that the future is very promising for those who can understand the dynamics of rural markets and exploit them to their best advantage. A radical change in attitudes of marketers towards the vibrant and burgeoning rural markets is called for, so they can successfully impress on the 230 million rural consumers spread over approximately six hundred thousand villages in rural India. 4. Aithal, K Rajesh (2004), suggested that rural markets are an important and growing market for most products and services including telecom. The characteristics of the market in terms of low and spread out population and limited purchasing power make it a difficult market to capture. The Bottom of the pyramid marketing strategies and the 4 A's model of Availability, Affordability, Acceptability and Awareness provide us with a means of developing appropriate strategies to tackle the marketing issues for marketing telecom services in rural areas. Successful cases like the Grameen Phone in Bangladesh and Smart Communications Inc in Philippines also provide us with some guidelines to tackling the issue. As per my concern of the research, it is a detail study of different FMCG products used by rural consumers. It will provide detail information about consumer preferences towards a good number of FMCG products which is too unique and different from those above researches.

You might also like

- 1 Assess The Management Organization and Technology Issues For UsingDocument1 page1 Assess The Management Organization and Technology Issues For UsingAmit PandeyNo ratings yet

- A Project Report OnDocument64 pagesA Project Report OnsiddhantkarpeNo ratings yet

- Fortune OilDocument12 pagesFortune OilAlok Mahapatra100% (2)

- SB Feed MillsDocument8 pagesSB Feed Millsanum8991100% (1)

- Apple Vs SamsungDocument6 pagesApple Vs SamsungLYDIA PRIYADARSHININo ratings yet

- Pre-Sales Consultant Interview QuestionsDocument89 pagesPre-Sales Consultant Interview QuestionsRahmanShahidNo ratings yet

- Buying Behavior at KOF Oil Project ReportDocument62 pagesBuying Behavior at KOF Oil Project ReportBabasab Patil (Karrisatte)100% (3)

- Fortune vs. Saffola: The Competitive Edge of Adani Wilmar Over MaricoDocument35 pagesFortune vs. Saffola: The Competitive Edge of Adani Wilmar Over Maricosameer_mech11No ratings yet

- A Pragmatic Study On Buyers of Edible OilsDocument36 pagesA Pragmatic Study On Buyers of Edible OilsNeha Motwani100% (3)

- Edible Oil Marketing StrategiesDocument60 pagesEdible Oil Marketing StrategiesVidya Sonawane0% (1)

- N.K Proteins PVT LTDDocument36 pagesN.K Proteins PVT LTDAaf All Facts100% (1)

- A Project On Bail Kohlu Mastured Oil in MarketDocument57 pagesA Project On Bail Kohlu Mastured Oil in Marketrenu356100% (1)

- Rural Marketing by ITCDocument23 pagesRural Marketing by ITCrachitmasaliaNo ratings yet

- Swot Analysis On SundropDocument20 pagesSwot Analysis On SundropGopal Chandra Saha100% (1)

- Project Report: "Study On Lux Beauty Soap"Document51 pagesProject Report: "Study On Lux Beauty Soap"singhbba100% (1)

- Kellogs and MaricoDocument18 pagesKellogs and MaricoDISHA SACHAN Student, Jaipuria LucknowNo ratings yet

- Producer Company Case Study of I of PCL KeralaDocument18 pagesProducer Company Case Study of I of PCL Keralavintosh_pNo ratings yet

- Role of Agriculture Processing in Export Growth of Agricultural ProductsDocument8 pagesRole of Agriculture Processing in Export Growth of Agricultural ProductsAwadhesh YadavNo ratings yet

- Project Report of DMR Marketing LimitedDocument52 pagesProject Report of DMR Marketing LimitedRucha ShahNo ratings yet

- Ramdev Industry Visit Report, B-06, Aniruddh Singh ThakurDocument14 pagesRamdev Industry Visit Report, B-06, Aniruddh Singh ThakurAniruddh Singh ThakurNo ratings yet

- FMCG Companies Specific Distribution Channels PDFDocument5 pagesFMCG Companies Specific Distribution Channels PDFjedNo ratings yet

- Spices Cryo-Grinding UnitDocument7 pagesSpices Cryo-Grinding Unitbenrakesh75No ratings yet

- Indian Tea Industry, Pimr SSSDocument21 pagesIndian Tea Industry, Pimr SSSLodhi Kailash Singh ChouhanNo ratings yet

- Summer Internship Project Mangalore Chemicals and Fertilizers LTD Panambur MangaloreDocument37 pagesSummer Internship Project Mangalore Chemicals and Fertilizers LTD Panambur MangaloreHariprasad bhatNo ratings yet

- Tata Tea vs. HUL Tea - Vashishth & GroupDocument20 pagesTata Tea vs. HUL Tea - Vashishth & GroupNirav Fruitwala50% (2)

- ObjectivesDocument6 pagesObjectivesMegha Sharma100% (1)

- MarachekkuDocument10 pagesMarachekkuRENUSREE ENTERPRISESNo ratings yet

- Company ProfileDocument6 pagesCompany ProfileDimple SukhijaNo ratings yet

- Project Report On Soya Products (Soya Milk, Flavored Milk, Curd & Tofu)Document6 pagesProject Report On Soya Products (Soya Milk, Flavored Milk, Curd & Tofu)EIRI Board of Consultants and PublishersNo ratings yet

- Aastha Nema - Quaker OatsDocument14 pagesAastha Nema - Quaker OatsAastha NemaNo ratings yet

- A Study On The Working of Keo Food Products Pvt. LTD.Document51 pagesA Study On The Working of Keo Food Products Pvt. LTD.jayachandranNo ratings yet

- Working Stress of Women in A Cashew Processing IndustryDocument18 pagesWorking Stress of Women in A Cashew Processing Industryramprasad88100% (1)

- Cold Pressed Edible OilsDocument25 pagesCold Pressed Edible OilsVenki Kanduri100% (1)

- Tata Tea ReportDocument2 pagesTata Tea ReportTarun GuptaNo ratings yet

- Sugarcane JuiceDocument21 pagesSugarcane JuiceOk HqNo ratings yet

- Cold Pressed Edible Oils: Subhashis Das GuptaDocument26 pagesCold Pressed Edible Oils: Subhashis Das GuptasantoshnemadeNo ratings yet

- BikajiDocument18 pagesBikajiRavi RajaniNo ratings yet

- Ruchi Soya - NutrelaDocument16 pagesRuchi Soya - NutrelaRitu KhandelwalNo ratings yet

- Start A Namkeen Factory. Salted Packaged Food Industry-544076 PDFDocument69 pagesStart A Namkeen Factory. Salted Packaged Food Industry-544076 PDFVishal Govind ChakrawarNo ratings yet

- Ramdev FinalDocument13 pagesRamdev FinalChitrang Patel67% (3)

- S-4 ProjectDocument42 pagesS-4 ProjectRityNo ratings yet

- Aloe Vera Farming Is Known To Be A Profitable Business and Over The YearsDocument14 pagesAloe Vera Farming Is Known To Be A Profitable Business and Over The YearsKavish BhandoyNo ratings yet

- Everest MasalaDocument3 pagesEverest MasalaUday Khule0% (2)

- Spices FinalDocument17 pagesSpices FinalSaif KhanNo ratings yet

- FMCG Industry in IndiaDocument31 pagesFMCG Industry in India1987rakesh1987100% (1)

- Tea and Lentil Export Potential of NepalDocument23 pagesTea and Lentil Export Potential of NepalChandan SapkotaNo ratings yet

- An Organization Study OnDocument39 pagesAn Organization Study Onvelmuthusamy100% (2)

- Trend Analysis of Four FMCG Companies in IndiaDocument42 pagesTrend Analysis of Four FMCG Companies in IndiaAbhay Adil100% (3)

- Project Report On Mint Oil Process and FormulaDocument6 pagesProject Report On Mint Oil Process and FormulaEIRI Board of Consultants and PublishersNo ratings yet

- Tea Board of India PDFDocument18 pagesTea Board of India PDFDebasish RazNo ratings yet

- Case Study - The Gall-Fly AttackDocument9 pagesCase Study - The Gall-Fly AttackNetaji DasariNo ratings yet

- AshirwadDocument3 pagesAshirwadShivam SethiNo ratings yet

- HUL Reinvigorates Annapurna: Kissan: Totally Confused?Document4 pagesHUL Reinvigorates Annapurna: Kissan: Totally Confused?Rahul MishraNo ratings yet

- Groundnutdpr 04.08.23Document17 pagesGroundnutdpr 04.08.23TNRTP SALEMNo ratings yet

- PGCBM20 - Group 43 - Marico Case StudyDocument29 pagesPGCBM20 - Group 43 - Marico Case StudyAjay KrishnanNo ratings yet

- Report On Him Shree Foods XXXDocument24 pagesReport On Him Shree Foods XXXparbatiNo ratings yet

- Darshan Patel (MDH Masala IB Assignment)Document10 pagesDarshan Patel (MDH Masala IB Assignment)darshan patelNo ratings yet

- My Food Roller Flour Factory PVT - LTDDocument54 pagesMy Food Roller Flour Factory PVT - LTDSandeep Nair67% (3)

- Hamdard Case StudyDocument11 pagesHamdard Case StudyPooja SinghNo ratings yet

- Ruchi SoyaDocument52 pagesRuchi Soyakhaledawarsi0% (2)

- Horlicks Asha - An Initiative To Target Bottom of The Pyramid MarketDocument6 pagesHorlicks Asha - An Initiative To Target Bottom of The Pyramid Marketmukeshpra007gmailcomNo ratings yet

- Dhanaa Full ProjectDocument34 pagesDhanaa Full ProjectSimon Peter100% (1)

- Sunflower Oil Refinery Project ReportDocument6 pagesSunflower Oil Refinery Project ReportMohamed ShuaibNo ratings yet

- 1121Document89 pages1121Praveen KumarNo ratings yet

- 3 Pages (3 Copies)Document6 pages3 Pages (3 Copies)Praveen KumarNo ratings yet

- FactorDocument1 pageFactorPraveen KumarNo ratings yet

- A Study On Fullerene Graph and Zeolite in Graph TheoryDocument7 pagesA Study On Fullerene Graph and Zeolite in Graph TheoryPraveen KumarNo ratings yet

- AlagarDocument2 pagesAlagarPraveen KumarNo ratings yet

- The Tamilnadu Co-Operative Milk Producers' Federation Ltd. Corporate Office:: Marketing UnitDocument3 pagesThe Tamilnadu Co-Operative Milk Producers' Federation Ltd. Corporate Office:: Marketing UnitPraveen KumarNo ratings yet

- Low Cost Home Made Solar CellDocument8 pagesLow Cost Home Made Solar CellPraveen KumarNo ratings yet

- Kalasalingam University Application Form Available Here If U Got 60% of Mark Spot Admission HereDocument1 pageKalasalingam University Application Form Available Here If U Got 60% of Mark Spot Admission HerePraveen KumarNo ratings yet

- IntroductionDocument68 pagesIntroductionPraveen KumarNo ratings yet

- B 1035 B 1035 B 1035 B 1035 Uec1 Uec1 Uec1 Uec1Document4 pagesB 1035 B 1035 B 1035 B 1035 Uec1 Uec1 Uec1 Uec1Praveen KumarNo ratings yet

- Kalasalingam University Application Form Available Here If U Got 60% of Mark Spot Admission HereDocument1 pageKalasalingam University Application Form Available Here If U Got 60% of Mark Spot Admission HerePraveen KumarNo ratings yet

- Content Management SystemDocument4 pagesContent Management SystemPraveen KumarNo ratings yet

- B 933 Bec 1: Ö Õ Î À Pø Zuà ÷ - Õup (Pîà H÷Uý® SSö ÷ - Õup (Pøí ÂíuspDocument4 pagesB 933 Bec 1: Ö Õ Î À Pø Zuà ÷ - Õup (Pîà H÷Uý® SSö ÷ - Õup (Pøí ÂíuspPraveen KumarNo ratings yet

- Frequency Percent Below 18 19 9.5 19-23 53 26.5 24-28 56 28.0 Above 30 72 36.0 Total 200 100.0Document16 pagesFrequency Percent Below 18 19 9.5 19-23 53 26.5 24-28 56 28.0 Above 30 72 36.0 Total 200 100.0Praveen KumarNo ratings yet

- Features Preferred While Buying Canon PrintergfDocument7 pagesFeatures Preferred While Buying Canon PrintergfPraveen KumarNo ratings yet

- B 1035 Uec 1: Ö Õ Íõuõ ® Pø Zu SS Ö Õx ÷ - Õup (Pøí Mi KPDocument6 pagesB 1035 Uec 1: Ö Õ Íõuõ ® Pø Zu SS Ö Õx ÷ - Õup (Pøí Mi KPPraveen KumarNo ratings yet

- S. No Particular Page No: 1 1 2 System Study 5Document2 pagesS. No Particular Page No: 1 1 2 System Study 5Praveen KumarNo ratings yet

- 1.total and AverageDocument23 pages1.total and AveragePraveen KumarNo ratings yet

- Siva 1Document62 pagesSiva 1Praveen KumarNo ratings yet

- S. No Particular Page No: 1 1 2 System Study 5Document2 pagesS. No Particular Page No: 1 1 2 System Study 5Praveen KumarNo ratings yet

- Initial CharacterizationrggdfgDocument10 pagesInitial CharacterizationrggdfgPraveen KumarNo ratings yet

- CSC775 A3 Final ReportDocument29 pagesCSC775 A3 Final ReportPraveen KumarNo ratings yet

- Lesson TitleDocument4 pagesLesson TitlePraveen KumarNo ratings yet

- 11 Chapter 3Document99 pages11 Chapter 3anon_727416476No ratings yet

- Curriculum Vitae: Maruthupandian.P Maruthu - Sri@yahoo - Co.inDocument5 pagesCurriculum Vitae: Maruthupandian.P Maruthu - Sri@yahoo - Co.inPraveen KumarNo ratings yet

- 19A 2012 Not Tam CSSE-I-2012Document52 pages19A 2012 Not Tam CSSE-I-2012msdhoni007No ratings yet

- Terminal MarketDocument33 pagesTerminal Marketgarvit100% (1)

- Information Management LastDocument41 pagesInformation Management LastNipuna Bandara WeerakoonNo ratings yet

- Managerial Economics AssignmentDocument5 pagesManagerial Economics AssignmentTrisha LionelNo ratings yet

- What Is Direct Selling?Document12 pagesWhat Is Direct Selling?Shantesh SavagaonNo ratings yet

- General ManagementDocument62 pagesGeneral ManagementBhupendra BhangaleNo ratings yet

- The Success of CRMDocument4 pagesThe Success of CRMFoo Shu FongNo ratings yet

- CH 10 E-Commerce Digital Markets, Digital Goods CH 10 E-Commerce Digital Markets, Digital GoodsDocument7 pagesCH 10 E-Commerce Digital Markets, Digital Goods CH 10 E-Commerce Digital Markets, Digital GoodsRidhi BNo ratings yet

- Research Analysis of Food Hub TrendsDocument62 pagesResearch Analysis of Food Hub TrendsPatrickNo ratings yet

- Strategic Paper SampleDocument49 pagesStrategic Paper SampleCrisamor ClarisaNo ratings yet

- Neha Singh: March 2017 - PresentDocument2 pagesNeha Singh: March 2017 - Presentchakradhar kadaliNo ratings yet

- Managing Salesforce Performance: Behavior Versus Outcome MeasuresDocument11 pagesManaging Salesforce Performance: Behavior Versus Outcome MeasuresGaurav GopalNo ratings yet

- Cost Volume Profit AnalysisDocument23 pagesCost Volume Profit AnalysisRoxan Jane Valle EspirituNo ratings yet

- Marketing Strategy Group-8Document21 pagesMarketing Strategy Group-8ZarahJoyceSegoviaNo ratings yet

- Entrep Lesson 3 DLLDocument6 pagesEntrep Lesson 3 DLLMhea Laurence NiereNo ratings yet

- LSCM - Naven KrishnaDocument7 pagesLSCM - Naven KrishnaAishu KrishnanNo ratings yet

- M04MKT-Etihad V6Document53 pagesM04MKT-Etihad V6ytudak100% (1)

- Buy Twitter FollowersDocument9 pagesBuy Twitter FollowersAvery HazelNo ratings yet

- Week2 AssignmentDocument21 pagesWeek2 AssignmentRahul ChawlaNo ratings yet

- Market Analysis of Daikin Air ConditionersDocument51 pagesMarket Analysis of Daikin Air ConditionersShorya Karol67% (3)

- Retail Assignment 1 & 2Document35 pagesRetail Assignment 1 & 2An-nur HazirahNo ratings yet

- How Project Management Could Benefits Your OrganizationDocument7 pagesHow Project Management Could Benefits Your Organizationvikasdawar1174No ratings yet

- Marketing & Distribution Strategies of ACI Logistics LTD PDFDocument48 pagesMarketing & Distribution Strategies of ACI Logistics LTD PDFJn MustakimNo ratings yet

- Business MarketDocument31 pagesBusiness MarketManish GuptaNo ratings yet

- Report - Nilkamal-Bito Storage SystemsDocument55 pagesReport - Nilkamal-Bito Storage Systemsdebendu nag0% (1)

- Gartner ReprintDocument35 pagesGartner Reprintsrini_rNo ratings yet

- Ethical DilemmaDocument3 pagesEthical DilemmaJose Antonio VillarbaNo ratings yet

- The Role of IT-Enabled Supply Chains On The Indian FMCG MarketDocument9 pagesThe Role of IT-Enabled Supply Chains On The Indian FMCG MarketRachit DongreNo ratings yet