Professional Documents

Culture Documents

For Assessment Year - 2011 - 12 TDS Rates Chart Rates of TDS For Major Nature of Payments For The Financial Year 2010-11

Uploaded by

Savoir PenOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

For Assessment Year - 2011 - 12 TDS Rates Chart Rates of TDS For Major Nature of Payments For The Financial Year 2010-11

Uploaded by

Savoir PenCopyright:

Available Formats

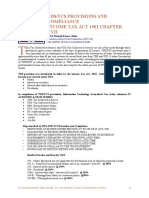

For ASSESSMENT YEAR 2011 - 12 TDS Rates Chart Rates of TDS for major nature of payments for the

e Financial Year 2010-11 Particulars Criteria for Deduction Section Nature of Payment (payment in excess of) upto 30th June 2010 194 A Interest from a Banking Company Interest other than from a Banking Co. 194 B 194 BB Winning from Lotteries Winning from Horse races Contractors, Pay 194 C to Advt /Sub Contr, Payment to Transporter 194 D 194 H 194 I Insurance Commission Commission or Brokerage Rent other than Plant, Mach. & Equip. Rent of Plant , Machinery & Equipments Professional Charges Rs.5,000/- p.a. Rs.2,500/- p.a. Rs.20,000/- per contract or Rs.50,000/- p.a. Rs.5,000/- p.a. Rs.2500/- p.a. Rs.1,20,000/-p.a. Rs.10,000/- p.a. Rs.5,000/- p.a. Rs.30,000/- per contract or Rs.75,000/- p.a. Rs.20,000/- p.a. Rs.5,000/- p.a. Rs.1,80,000/-p.a. 30 30 30 30 Rs.10,000/- p.a. Criteria for Deduction (payment in excess of) w.e.f. 1st July 2010 Rs.10,000/- p.a. Rates from 1.4.10 to 31.03.2011 If the recipient is a Company, Cooperative Society, Firm 10.00 If recipient is an Individual or HUF

10.00

194 A

Rs.5,000/- p.a.

Rs.5,000/- p.a.

10.00

10.00

2*

1*

10 10 10

10 10 10

194 I 194 J 115 O

Rs.1,20,000/-p.a. Rs.20,000/- p.a.

Rs.1,80,000/-p.a. Rs.30,000/- p.a.

2 10

2 10

Dividend other than deemed dividend

16.60875 (15% + SC + E Cess)

For below mentioned payments - If the recipient is a non-resident non-corporate assessee or non-domestic company a) aggregate payments does not exceed 1 Crore TDS + E Cess b) aggregate payments exceed 1 Crore TDS + SC + E Cess 195(a) 195(b) 195(c) 195(d) Income from foreign exchange assets payable to an Indian citizen Income by way of long-term capital gain referred to in sec. 115E Income by way of Short-term capital gains u/s. 111A Income from other long-term capital gains 20 10 15 20

195(e)

Income by way of interest payable by Government/Indian concern on money borrowed or debt incurred by Government or Indian concern in foreign currency Royalty payable by Government or an Indian concern in pursuance of an agreement made by non-resident with the Government or the Indian concern after March 31, 1976, where such royalty is in consideration for the transfer of all or any rights (including the granting of a license) in respect of copyright in any book on a subject referred to in the first proviso to section 115A(1A) to the Indian concern or in respect of computer software referred to in the second proviso to section 115(1A), to a person resident in India Where the agreement is made before June 1, 1997 Where the agreement is made after May 31, 1997 but before June 1, 2005 Where the agreement is made on or after June 1, 2005 Royalty (not being royalty of the nature referred to in (e) sub para) payable by Government or an Indian concern in pursuance of an agreement made by nonresident with the Government or the Indian concern and where such agreement is with an Indian concern, the agreement is approved by the Central Government or where it relates to matter included in the industrial policy, the agreement is in accordance with that policy

20

195(f)

30 20 10

195(g) Where the agreement is made after March 31, 1961 but before April 1, 1976 Where the agreement is made after March 31, 1976 but before June 1, 1997 Where the agreement is made after May 31, 1997 but before June 1, 1997 Where the agreement is made on or after June 1, 2005 Fee for technical services payable by Government or an Indian concern in pursuance of an agreement made by non-resident with the Government or the Indian concern and where such agreement is with an Indian concern, the agreement is approved by the Central Government or where it relates to matter included in the industrial policy, the agreement is in accordance with the policy Where the agreement is made after February 29, 1964 but before April 1, 1976 Where the agreement is made after March 31, 1976 but before June 1, 1997 Where the agreement is made after May 31, 1997 but before June 1, 2005 Where the agreement is made on or after June 1, 2005 195(i) 196A 196B 196C 196D Any other income Income in respect of Units of Non-residents Income and Long-term Capital gain from units of an Off shore fund Income and Long-term Capital Gain from Foreign Currency Bonds or shares of Indian companies Income of Foreign Institutional Investors for Securities

Company 50 Others 30 30 20 10

195(h)

Company 50 Others 30 30 20 10 Company 40 Others 30 20 10 10 20

Surcharge & E Cess - Applicable for Foreign Companies if payment/credit exceeds Rs.1 crore of such companies * No tax is to be deducted in the case the Contractor is in transport business and PAN is quoted by him

No TDS under Sec 193, 194, 194A, 194EE if the recipient makes a declaration in Form No 15G / 15H under the provisions of Sec 197A

Surcharge and Cess is not applicable on tds from 01-04-2009 on any payment made to resident i.e. SC is

applicable only when the recipient is a foreign company & payment exceeds 1 Crore. E Cess is applicable in the cases of TDS from payment of salary to a resident or non-resident and in case of any other sum to a non-resident or a foreign company. If pan not provided by the deductee then rate as per above table or 20% which ever is higher *Interest of late deposit of TDS is proposed to be increased from 12% p.a. to 18% p.a. effective from 1st July 2010. Notes: Amendment to Sec 201: Rate of Interest (per month or part) 1% 1.5% Period for which interest is payable From the date on which tax was deductible to the date on which tax is actually deducted From the date on which tax was actually deducted to the date on which tax is actually paid

1) Due date of payments is as under: a) Credit/Paid in the month of March 30th April b) Any other case On or before 7 days from the end of the month in which deduction is made.

c) TDS certificate to be issued within 1 month from the end of the month in which payment / credit was made Income Tax Challans: Purpose Payment of INCOME-TAX both for companies and non company assessee Deposit of TDS both by companies and non company deductee Securities transaction tax / Wealth tax / Gift tax / Expenditure / other tax / Estate duty / Interest tax / Hotel receipts tax Banking Cash Transaction Tax / Fringe Benefits Tax Income Tax Rates: Male For Income Between 0 to 1,60,000 For Income Between 1,60,001 to 5,00,000 For Income Between 5,00,001 to 8,00,000 For Income above 8,00,001 Surcharge Education Cess Domestic Company Foreign Company Surcharge applicable if exceeds 1 Crore, Domestic 7.5%, Foreign Company 2.5% Female For Income Between 0 to 1,90,000 For Income Between 1,90,001 to 5,00,000 For Income Between 5,00,001 to 8,00,000 For Income above 8,00,001 Senior Citizen For Income Between 0 to 2,40,000 For Income Between 2,40,001 to 5,00,000 For Income Between 5,00,001 to 8,00,000 For Income above 8,00,001 Tax (%) 0 10 20 30 0 3 30 40 Challan No. TNS 280 ITNS 281 ITNS 282 ITNS 283

Capital gains: Covered by STT Asset US-64 Units equity oriented Units others Equity shares covered u/s 10(36) listed Long term 0 0 NA 0 0 NA NA NA NA NA NA Short term 0 15 NA 15 15 NA NA NA NA NA NA Not covered by STT Long term Without indexation 0 10 10 0 10 NA 10 NA 10 20 10 With indexation 0 20 20 0 20 20 20 20 NA NA 20 Short term 0 Normal Normal Normal Normal Normal Normal Normal Normal Normal Normal

Equity shares listed others Equity shares unlisted Preference shares listed Preference shares unlisted Debentures listed Debentures unlisted govt. securities

Advance Tax: to be paid if tax payable is 10000 or more Corporate Assessee On or before Jun 15 On or before Sep 15 On or before Dec 15 On or before Mar 15 MAT: If book profit of a company exceeds 1 Crore, MAT cannot exceed the following (18 Lakhs + Book Profit 1 Crore) + E Cess Rate of MAT is increase to 18% of Book Profits - Tax credit shall be allowed to be carried forward and set off up to 10 Assessment years immediately succeeding the AY in which tax credit becomes allowable. If Book Profit does not exceed 1 Crore IT Domestic Company Foreign Company 18 18 SC E Cess 0.54 0.54 Total 18.54 18.54 If Book Profit exceeds 1 Crore IT 18 18 SC 1.35 0.4 5 E Cess 0.5805 0.5535 Total 19.9305 19.0035 Up to 15% Up to 45% Up to 75% Up to 100% Non-corporate Assessee Up to 30% Up to 60% Up to 100%

Forms to be used for filing Returns: Form 24 - Annual return of "Salaries" under Section 206 Form 26 - Annual return of deduction of tax under section 206 in respect of all payments other than "Salaries" Form 27 - Quarterly Statement of deduction of tax from interest, dividend or any other sum payable to certain persons Form 27E - Annual return of collection of tax under section 206C of Income Tax Act, 1961

Form 24Q - Quarterly statement to be filed within 15 days from the end of the Quarter for tax deducted at source from "Salaries" Form 26Q - Quarterly statement to be filed within 15 days from the end of the Quarter of tax deducted at source in respect of all payments other than "Salaries" Form 27Q - Quarterly statement to be filed within 14 Days from the end of the Quarter for deduction of tax from interest, dividend or any other sum payable to non-residents Form 27EQ - Quarterly statement of collection of tax at source Examples:

1) If TDS is Deducted for the Month of January 2011 then it has to be deposited on or before 7th February 2011 2) If TDS is Deducted for the Month of March 2011 (including TDS on 31st March2011) then it has to be

deposited on or before 30th April 2011. 3) For the TDS on payments other than salary with respect to Quarter I i.e. 1.04.2010 to 30.06.2010:-

4) The Quarterly Statement (Form 26Q/27Q) should be filed on or before 15th July2010 and the

TDS Certificate (Form 16A) should be issued on or before 30th July2010. Sec Nature of Payment Time of Deduction Time of Deposit of TDS Form and Date of Quarterly Return Form No. 24Q, Within 15 Days from the close of Quarter and May 15 for the Quarter ending Mar 31 Time limit for issue of TDS certificate Form 16 to be issued by May 31 following the end of relevant financial year. Form 16A on Quarterly basis within 15 days from the due date of furnishing quarterly TDS statement (Form 26Q/27Q) do

192

Salary

At the time of Payment

Within 7 Days from end of month

193

Interest on Securities

Time of Payment or Credit ,whichever is earlier

do

Form No. 26Q, Within 15 Days from the close of Quarter and May 15 for the Quarter ending Mar 31

194A

Interest other than Interest on Securities Winning from Lotteries or Crossword Puzzles Winning from Horse Races Payment to Contractor or Sub Contractor Insurance Commission Non Resident Sportsmen

Time of Payment or Credit ,whichever is earlier At the time of Payment

do

do

194B

do

do

do

194B B

Do Time of Payment or Credit ,whichever is earlier Do Do

do

do

do

194C

do

do

do

194D 194E

do do

do Form No.27 within 14 days from the end of

do do

or sports associations 194E E National Saving Scheme Equity Linked Saving Scheme At the time of Payment At the time of Payment do

Quarter Form 26, 30June of relevant AY do

194F

do With in 7 Days from end of month of deduction. But if tax is deducted on behalf of Govt. it is to be deposited on the same day without challan. With in 7 days from end of month of deduction. do

do

do

194G

Commission on sale of Lottery Tickets

Time of Payment or Credit ,whichever is earlier

do

do

194H 194 I

Commission Brokerage Rent Fees for Professional and Technical Services Payment to Non Resident

Do Do

do do

do do

194 J

Do

do

do

do

195

Do

do

No Annual Return but statement of TDS to be filed with in 14 days from the end of Quarter

do

Mode of Payment of TDS: Following persons shall be liable to pay TDS electronically i.e. internet banking or debit/credit cards: i) A company ii) A person (other than a company) to whom provisions of section 44AB are applicable

You might also like

- 1040 Exam Prep: Module I: The Form 1040 FormulaFrom Everand1040 Exam Prep: Module I: The Form 1040 FormulaRating: 1 out of 5 stars1/5 (3)

- TDS Rate Chart PDFDocument2 pagesTDS Rate Chart PDFjdhamdeep07No ratings yet

- Introduction To TDS:-: Tax Deducted at SourceDocument3 pagesIntroduction To TDS:-: Tax Deducted at Sourcepadmanabha14No ratings yet

- Tds Rate Chart Fy 2014-15 Ay 2015-16Document26 pagesTds Rate Chart Fy 2014-15 Ay 2015-16shivashankari86No ratings yet

- TDS Rates and ReturnsDocument3 pagesTDS Rates and ReturnsKashishKumarNo ratings yet

- TDS Rate Financial Year 13-14Document10 pagesTDS Rate Financial Year 13-14Heena AgreNo ratings yet

- TDS 3Document16 pagesTDS 3payal AgrawalNo ratings yet

- What Is Tax Deducted at SourceDocument6 pagesWhat Is Tax Deducted at SourcejdonNo ratings yet

- Intro of TdsDocument6 pagesIntro of Tdsshivani singhNo ratings yet

- Module-1: Basic Concepts and DefinitionsDocument35 pagesModule-1: Basic Concepts and Definitions2VX20BA091No ratings yet

- Individual Heads of IncomeDocument5 pagesIndividual Heads of Incomeamitratha77No ratings yet

- TDS On SalariesDocument3 pagesTDS On SalariesSpUnky RohitNo ratings yet

- Tax ChangesDocument7 pagesTax ChangesSujan SanjayNo ratings yet

- Rates of Tax:-: Individual/HUF/AOP/Artificial Juridical PersonDocument8 pagesRates of Tax:-: Individual/HUF/AOP/Artificial Juridical PersonKiran KumarNo ratings yet

- Income Tax Questions and AnswersDocument9 pagesIncome Tax Questions and AnswersHeraldWilsonNo ratings yet

- Individual Paper Income Tax Return 2015Document23 pagesIndividual Paper Income Tax Return 2015marrukhjNo ratings yet

- Tax Deduction at SourceDocument4 pagesTax Deduction at SourcevishalsidankarNo ratings yet

- Tax AmendmentDocument10 pagesTax AmendmentVinay BoradNo ratings yet

- Hari Income Tax Department - Do CXDocument12 pagesHari Income Tax Department - Do CXNelluri Surendhar ChowdaryNo ratings yet

- 3 Income Tax ConceptsDocument37 pages3 Income Tax ConceptsRommel Espinocilla Jr.No ratings yet

- Income Tax in IndiaDocument19 pagesIncome Tax in IndiaConcepts TreeNo ratings yet

- Tax Deduction at SourceDocument5 pagesTax Deduction at SourceSarayu BhardwajNo ratings yet

- Bhubaneswar 08112015 Session I PDFDocument42 pagesBhubaneswar 08112015 Session I PDFsachin NegiNo ratings yet

- Tds Rate Chart Fy 2014-15 Ay 2015-16 Tds Due Dates #SimpletaxindiaDocument11 pagesTds Rate Chart Fy 2014-15 Ay 2015-16 Tds Due Dates #Simpletaxindiashivashankari86No ratings yet

- BIR FormsDocument30 pagesBIR FormsRoma Sabrina GenoguinNo ratings yet

- Income TaxationDocument13 pagesIncome TaxationKyzy LimsiacoNo ratings yet

- Income Tax Note 02Document4 pagesIncome Tax Note 02Hashani Anuttara AbeygunasekaraNo ratings yet

- Lecture Witholding TaxDocument152 pagesLecture Witholding Taxemytherese100% (2)

- FBR IncomeTax Return 2016Document40 pagesFBR IncomeTax Return 2016Muhammad Awais100% (1)

- Income Tax MannualDocument6 pagesIncome Tax MannualMuhammad Ammar KhanNo ratings yet

- Tax Deduction at SourceDocument62 pagesTax Deduction at SourcePallavisweet100% (1)

- WHT New 2020Document7 pagesWHT New 2020MadurikaNo ratings yet

- Articleship Exam QuestionsDocument33 pagesArticleship Exam QuestionsVarshiniNo ratings yet

- 61a38d5c7b74a - INcome Tax and ETA HandwrittenDocument15 pages61a38d5c7b74a - INcome Tax and ETA HandwrittenAnuska ThapaNo ratings yet

- Module 1 E - Filing of ReturnsDocument8 pagesModule 1 E - Filing of Returnsshivani singhNo ratings yet

- Budget 2009: KIA AssociatesDocument16 pagesBudget 2009: KIA Associatesalmas_sshahidNo ratings yet

- Taxation Report Vina MarieDocument12 pagesTaxation Report Vina MarieAnonymous gmDxRbnwONo ratings yet

- Income Tax - Chap 01Document8 pagesIncome Tax - Chap 01ZainioNo ratings yet

- BIR - Invoicing RequirementsDocument17 pagesBIR - Invoicing RequirementsCkey ArNo ratings yet

- BDO Budget Snapshot - 2012-13Document9 pagesBDO Budget Snapshot - 2012-13Pulluri Ravikumar YugandarNo ratings yet

- Synopsis of Budget For Fy 2068-69 Prepared by G. K. Agrawal & Co.Document33 pagesSynopsis of Budget For Fy 2068-69 Prepared by G. K. Agrawal & Co.knmodiNo ratings yet

- Presentation 1Document12 pagesPresentation 1AGNo ratings yet

- Instructions For Filling Out FORM ITR-2Document7 pagesInstructions For Filling Out FORM ITR-2Harminder Singh DhamNo ratings yet

- IncomeTax MaterialDocument91 pagesIncomeTax MaterialSandeep JaiswalNo ratings yet

- Food Corporation of India - 41202411354277Document9 pagesFood Corporation of India - 41202411354277abhimanyu7004No ratings yet

- Tax Deducted at SourceDocument29 pagesTax Deducted at SourceAmbar Pratik MishraNo ratings yet

- Instructions For Filling Out FORM ITR-2: Page 1 of 10Document10 pagesInstructions For Filling Out FORM ITR-2: Page 1 of 10mehtakvijayNo ratings yet

- Tds On Foreign Remittances: Surprises Continued.Document9 pagesTds On Foreign Remittances: Surprises Continued.AdityaNo ratings yet

- Tax Credit Statement (: Instructions For Filling FORM ITR-2Document7 pagesTax Credit Statement (: Instructions For Filling FORM ITR-2Manyam JainiNo ratings yet

- Tax Credit Statement (: Instructions For Filling FORM ITR-2Document6 pagesTax Credit Statement (: Instructions For Filling FORM ITR-2ajey_p1270No ratings yet

- TDS & TCSDocument3 pagesTDS & TCSRajashree DasNo ratings yet

- TDS ElaboratedDocument80 pagesTDS ElaboratedAncyNo ratings yet

- Tax Icsi 2012Document84 pagesTax Icsi 2012Janani ParameswaranNo ratings yet

- Individual Paper Income Tax Return 2016Document39 pagesIndividual Paper Income Tax Return 2016aarizahmadNo ratings yet

- 3.2 Business Profit TaxDocument49 pages3.2 Business Profit TaxBizu AtnafuNo ratings yet

- Tds Rate Chart 13 14Document4 pagesTds Rate Chart 13 14rockyrrNo ratings yet

- Part I: Statutory Update: © The Institute of Chartered Accountants of IndiaDocument4 pagesPart I: Statutory Update: © The Institute of Chartered Accountants of IndiaRamanNo ratings yet

- Introduction To Indian Taxes - A Brief Guide (Updated To June 3, 2003) A. IntroductionDocument9 pagesIntroduction To Indian Taxes - A Brief Guide (Updated To June 3, 2003) A. IntroductionkrunaldedehiyaNo ratings yet

- Budget 2013 - 2014Document11 pagesBudget 2013 - 2014sdfdhgtj894No ratings yet

- Instruction Kit For Eform Chg-1Document22 pagesInstruction Kit For Eform Chg-1Savoir PenNo ratings yet

- Asset and Liability at The End of The Year (Applicable in The Case of Total Income Exceeds Rs.50 Lakh)Document1 pageAsset and Liability at The End of The Year (Applicable in The Case of Total Income Exceeds Rs.50 Lakh)Savoir PenNo ratings yet

- Instruction Kit For Eform Pas-3: (Return of Allotment)Document15 pagesInstruction Kit For Eform Pas-3: (Return of Allotment)Savoir PenNo ratings yet

- Finacle CodesDocument7 pagesFinacle CodesSavoir PenNo ratings yet

- Rights Issue Steps & ProcessDocument4 pagesRights Issue Steps & ProcessSavoir PenNo ratings yet

- Tax DeductionDocument2 pagesTax DeductioncidBookBeeNo ratings yet

- Authorization FirmDocument1 pageAuthorization FirmSavoir PenNo ratings yet

- Annex 1 UndertakingsDocument4 pagesAnnex 1 UndertakingsSavoir PenNo ratings yet

- Notification No.77/2015 (F.no.500/137/2011 FTD I) /so. 2676 (E), Dated 30 9 2015Document34 pagesNotification No.77/2015 (F.no.500/137/2011 FTD I) /so. 2676 (E), Dated 30 9 2015Savoir PenNo ratings yet

- Letter of Consent (For Proprietor)Document1 pageLetter of Consent (For Proprietor)Savoir PenNo ratings yet

- Assessment of Working Capital RequirementsDocument13 pagesAssessment of Working Capital Requirementsamit_kachhwaha100% (2)

- Steps For Company Formation in India: Statements For The Purpose of Filing It With The RegistrarDocument2 pagesSteps For Company Formation in India: Statements For The Purpose of Filing It With The RegistrarSavoir PenNo ratings yet

- Right Issue Resolution of Board MeetingDocument2 pagesRight Issue Resolution of Board MeetingSavoir PenNo ratings yet

- Right Issue Resolution of Board MeetingDocument2 pagesRight Issue Resolution of Board MeetingSavoir PenNo ratings yet

- Solved Problems: OlutionDocument5 pagesSolved Problems: OlutionSavoir PenNo ratings yet

- Diet ChartDocument4 pagesDiet ChartSavoir PenNo ratings yet

- Cma FormatDocument14 pagesCma FormatMahesh ShindeNo ratings yet

- New LLP FormatDocument13 pagesNew LLP FormatSavoir PenNo ratings yet

- Illustration: A B C D E B-D F B 5% GDocument2 pagesIllustration: A B C D E B-D F B 5% GSavoir PenNo ratings yet

- Fmea Aiag Vda First Edition 2019Document254 pagesFmea Aiag Vda First Edition 2019Sabah LoumitiNo ratings yet

- PrpaDocument80 pagesPrpaRaymund Pabalan0% (1)

- Pre Shipment and Post Shipment Finance: BY R.Govindarajan Head-Professional Development Centre-South Zone ChennaiDocument52 pagesPre Shipment and Post Shipment Finance: BY R.Govindarajan Head-Professional Development Centre-South Zone Chennaimithilesh tabhaneNo ratings yet

- Apache 2018 PDFDocument3 pagesApache 2018 PDFOom OomNo ratings yet

- The History of Oil Pipeline RegulationDocument20 pagesThe History of Oil Pipeline Regulationsohail1985No ratings yet

- Strategic Litigation Impacts, Insight From Global ExperienceDocument144 pagesStrategic Litigation Impacts, Insight From Global ExperienceDhanil Al-GhifaryNo ratings yet

- Downloads - Azure Data Services - Módulo 2Document11 pagesDownloads - Azure Data Services - Módulo 2hzumarragaNo ratings yet

- Mathematical Solutions - Part ADocument363 pagesMathematical Solutions - Part ABikash ThapaNo ratings yet

- The Endgame of Treason - Doyle - ThesisDocument237 pagesThe Endgame of Treason - Doyle - Thesisdumezil3729No ratings yet

- E10726 PDFDocument950 pagesE10726 PDFAhmad Zidny Azis TanjungNo ratings yet

- Lungi Dal Caro Bene by Giuseppe Sarti Sheet Music For Piano, Bass Voice (Piano-Voice)Document1 pageLungi Dal Caro Bene by Giuseppe Sarti Sheet Music For Piano, Bass Voice (Piano-Voice)Renée LapointeNo ratings yet

- SLB Qhse Standards & B.O.O.K.S - Poster - v03 - enDocument1 pageSLB Qhse Standards & B.O.O.K.S - Poster - v03 - enLuisfelipe Leon chavezNo ratings yet

- Accounts TextbookDocument548 pagesAccounts TextbookChillTrap State70% (10)

- Republic of The Philippines Province of Capiz Municipality of DumaraoDocument2 pagesRepublic of The Philippines Province of Capiz Municipality of DumaraoCHEENY TAMAYO100% (1)

- What Is A Citizen CharterDocument6 pagesWhat Is A Citizen CharterGanesh ShindeNo ratings yet

- Renter Information Rental Information Charge Information: Biswadeep Das Time ChargesDocument1 pageRenter Information Rental Information Charge Information: Biswadeep Das Time ChargesBiswadeep DasNo ratings yet

- Oracle SOA 11.1.1.5.0 Admin GuideDocument698 pagesOracle SOA 11.1.1.5.0 Admin GuideConnie WallNo ratings yet

- MOTION FOR SUMMARY JUDGMENT (Telegram)Document59 pagesMOTION FOR SUMMARY JUDGMENT (Telegram)ForkLogNo ratings yet

- Philippine Health Care Providers, Inc. Vs CIR Case DigestDocument2 pagesPhilippine Health Care Providers, Inc. Vs CIR Case DigestJet jet NuevaNo ratings yet

- Huge Filing Bill WhiteDocument604 pagesHuge Filing Bill WhiteBen SellersNo ratings yet

- Suite in C Major: Jan Antonín LosyDocument10 pagesSuite in C Major: Jan Antonín LosyOzlem100% (1)

- Ontario G1 TEST PracticeDocument9 pagesOntario G1 TEST Practicen_fawwaazNo ratings yet

- CESSWI BROCHURE (September 2020)Document2 pagesCESSWI BROCHURE (September 2020)Ahmad MensaNo ratings yet

- Inspection and Testing RequirementsDocument10 pagesInspection and Testing Requirementsnaoufel1706No ratings yet

- HyiDocument4 pagesHyiSirius BlackNo ratings yet

- 8 Soc - Sec.rep - Ser. 123, Unempl - Ins.rep. CCH 15,667 Alfred Mimms v. Margaret M. Heckler, Secretary of The Department of Health and Human Services, 750 F.2d 180, 2d Cir. (1984)Document8 pages8 Soc - Sec.rep - Ser. 123, Unempl - Ins.rep. CCH 15,667 Alfred Mimms v. Margaret M. Heckler, Secretary of The Department of Health and Human Services, 750 F.2d 180, 2d Cir. (1984)Scribd Government DocsNo ratings yet

- April, 2020 DOM: Customer Number: Billing Month: Tariff/Customer Class: Bill ID: 712282339453Document1 pageApril, 2020 DOM: Customer Number: Billing Month: Tariff/Customer Class: Bill ID: 712282339453maazraza123No ratings yet

- Icici Marketing Strategy of Icici BankDocument68 pagesIcici Marketing Strategy of Icici BankShilpi KumariNo ratings yet

- United States v. David Fields, 39 F.3d 439, 3rd Cir. (1994)Document13 pagesUnited States v. David Fields, 39 F.3d 439, 3rd Cir. (1994)Scribd Government DocsNo ratings yet

- Thermal Physics Assignment 2013Document10 pagesThermal Physics Assignment 2013asdsadNo ratings yet