Professional Documents

Culture Documents

Bruce & Darlene Schwichtenberg 2009 Property Tax Statement

Uploaded by

CarverCountyMNOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bruce & Darlene Schwichtenberg 2009 Property Tax Statement

Uploaded by

CarverCountyMNCopyright:

Available Formats

For the following online services visit our website at: www.co.carver.mn.

us1 Pay your taxes online 1 Sign up for our Tax Payment Reminder 1

YOUR PROPERTY TAX VALUES & CLASSIFICATIONS Taxes Payable Year: 2008 2009

Estimated Market Value: New Improvements or Expired Exclusions*: Taxable Market Value: Property Class: 150,000 150,000

Property ID#: R 04.0010200 Taxpayer ID#: 19680 BRUCE R SCHWICHTENBERG & DARLENE R SCHWICHTENBERG 5250 COUNTY ROAD 140 CHASKA MN 55318-9379

150,000

RES. HSTD

150,000

RES. HSTD

Bill#: 907

Desc: Sect-01 Twp-115 Range-024 .98 AC P/O SE1/4 SW1/4 SECT 1 DESC AS COMM AT SE

CORN SW1/4 SECT 1 TH S87*W ALONG S LINE SW1/4 275' TO PT OF BEG TH CONT S87*

Property 5250 COUNTY ROAD 140 Address: CHASKA MN 55318-9379

Taxes Payable Year: 1. Use this amount on Form M1PR to see if you are eligible for a property tax refund. File by August 15. If this box is checked, you owe delinquent taxes and are not eligible. 2. Use this amount for the special property tax refund on schedule 1 of Form M1PR. Your Property Tax and How It Is Reduced By The State 3. Your property taxes before reduction by state-paid credits 4. Credits paid by the State of MN to reduce your property tax: A. Homestead and Agricultural Market Value Credits B. Other Credits 5. Your property tax after reduction by state-paid credits Property Tax by Jurisdiction 6. County A. CARVER COUNTY B. CO RAIL AUTHORITY 7. City or Town TOWN OF DAHLGREN 8. State General Tax 9. School District 0112 A. Voter Approved Levies B. Other Local Levies 10. Special Taxing Districts A. METRO DISTRICT B. OTHERS C. D. 11. Non-school voter approved referenda levies 12. Total property tax before special assessments Special Assessments on Your Property 13. Special assessments Interest: Principal: 25.00

RECYCLE MGT 25.00

2008

1,351.00

1,588.40 237.40 1,351.00 460.55 .88 114.32 615.52 113.67 16.62 29.44

2009

1,359.00

1,596.40 237.40 1,359.00 468.63 1.28 131.05 554.80 157.14 16.21 29.89

1,351.00 25.00

1,359.00 25.00

14. YOUR TOTAL PROPERTY TAX AND SPECIAL ASSESSMENTS

1,376.00

1,384.00

PAYABLE 2009 2nd HALF PAYMENT STUB

TO AVOID PENALTY PAY ON OR BEFORE: OCTOBER 15

To pay on-line go to www.co.carver.mn.us

The online payment feature is available for a current year tax payment in which penalty has not accrued or has been paid to date. Delinquent payments cannot be paid online. PLEASE INDICATE YOUR ADDRESS CORRECTION ON REVERSE SIDE OF THIS PAYMENT STUB.

Property ID#: R 04.0010200

Bill #: 907 RES. HSTD

692.00 PENALTY:

Taxpayer ID#: 19680 BRUCE R SCHWICHTENBERG & DARLENE R SCHWICHTENBERG 5250 COUNTY ROAD 140 CHASKA MN 55318-9379

OUR RECORDS INDICATE THAT YOUR TAXES ARE BEING PAID BY ESCROW COMPANY CHASE HOME FINANCIAL LLC

Taxes of $50.00 or less must be paid in full. If you pay your taxes late, you will be charged a penalty. See back for details.

Your cancelled check is proof of payment. Please write your Property ID # on your check. Postdated checks are not held. Only official U.S. Postmark determines payment mail date. No receipt sent unless requested and is void until check is honored.

PAYABLE 2009 1st HALF PAYMENT STUB

TO AVOID PENALTY PAY ON OR BEFORE: MAY 15

To pay on-line go to www.co.carver.mn.us

The online payment feature is available for a current year tax payment in which penalty has not accrued or has been paid to date. Delinquent payments cannot be paid online. PLEASE INDICATE YOUR ADDRESS CORRECTION ON REVERSE SIDE OF THIS PAYMENT STUB.

Property ID#: R 04.0010200

Bill #: 907 RES. HSTD

Taxpayer ID#: 19680 BRUCE R SCHWICHTENBERG & DARLENE R SCHWICHTENBERG 5250 COUNTY ROAD 140 CHASKA MN 55318-9379

1,384.00 692.00 PENALTY:

OUR RECORDS INDICATE THAT YOUR TAXES ARE BEING PAID BY ESCROW COMPANY CHASE HOME FINANCIAL LLC

Taxes of $50.00 or less must be paid in full. If you pay your taxes late, you will be charged a penalty. See back for details.

Your cancelled check is proof of payment. Please write your Property ID # on your check. Postdated checks are not held. Only official U.S. Postmark determines payment mail date. No receipt sent unless requested and is void until check is honored.

You might also like

- Verizon Bill 01 18 2020Document28 pagesVerizon Bill 01 18 2020jason56% (9)

- Your Consolidated Statement: Contact UsDocument5 pagesYour Consolidated Statement: Contact UsSAM50% (2)

- Final Account StatementDocument5 pagesFinal Account StatementGuy KulmanNo ratings yet

- Comcast2014 11 03 - BillDocument4 pagesComcast2014 11 03 - BillDarlene MannNo ratings yet

- BKKG&TAX ServicesDocument3 pagesBKKG&TAX ServicesJean Fajardo Badillo100% (1)

- PastBills PDFDocument37 pagesPastBills PDFKhanhNo ratings yet

- Verizon-Bill-12-09-2014 Sprint PDFDocument46 pagesVerizon-Bill-12-09-2014 Sprint PDFSarah Silva0% (1)

- Your Adv Safebalance Banking: Account SummaryDocument6 pagesYour Adv Safebalance Banking: Account SummaryAlex100% (2)

- Att Bill May 2012Document4 pagesAtt Bill May 2012Kim Gardner100% (1)

- Mystmt - 2022 11 09Document5 pagesMystmt - 2022 11 09sylvia100% (2)

- Manage your Verizon Wireless account invoiceDocument20 pagesManage your Verizon Wireless account invoiceLevi Paul OrlickNo ratings yet

- Computerised Accounting Practice Set Using Xero Online Accounting: Australian EditionFrom EverandComputerised Accounting Practice Set Using Xero Online Accounting: Australian EditionNo ratings yet

- LT Bill 46001160003 201512Document2 pagesLT Bill 46001160003 201512Santanu DasNo ratings yet

- Your Business Advantage Relationship Banking: Account SummaryDocument4 pagesYour Business Advantage Relationship Banking: Account SummaryJasmine ONeill50% (2)

- DeKalb Co Sample RE Tax StatementsDocument13 pagesDeKalb Co Sample RE Tax StatementsTucker InitiativeNo ratings yet

- Your Electricity Bill For: Loknath Developers PVTDocument2 pagesYour Electricity Bill For: Loknath Developers PVTRahul NaagNo ratings yet

- LT BILL 48074297001 Mar16Document2 pagesLT BILL 48074297001 Mar16Argon Et CarbonNo ratings yet

- LT Bill 05001185713 201601Document2 pagesLT Bill 05001185713 201601joramNo ratings yet

- 3196 Aberdeen WayDocument2 pages3196 Aberdeen Waycharger1234No ratings yet

- Oct-13Document2 pagesOct-13Vivek MauryaNo ratings yet

- Sep-11Document2 pagesSep-11Binay PradhanNo ratings yet

- Account Id: 2107125505: È Øœã+L7D6Ð0Äœã (50äœã% 50Äœã8?Äœã9S Ê È Øœã+L7D6Ð0Äœã (50äœã% 50Äœã8?Äœã9S ÊDocument1 pageAccount Id: 2107125505: È Øœã+L7D6Ð0Äœã (50äœã% 50Äœã8?Äœã9S Ê È Øœã+L7D6Ð0Äœã (50äœã% 50Äœã8?Äœã9S ÊkhayatNo ratings yet

- LT Bill 48000348869 201602Document2 pagesLT Bill 48000348869 201602प्रतीक प्रकाशNo ratings yet

- Tata Photon bill detailsDocument2 pagesTata Photon bill detailsMukesh BohraNo ratings yet

- Your Reliance Bill: Summary of Current Charges Amount (RS.)Document4 pagesYour Reliance Bill: Summary of Current Charges Amount (RS.)Mohd Farman SajidNo ratings yet

- P ¡Cs¡e : Your Reliance Communications BillDocument2 pagesP ¡Cs¡e : Your Reliance Communications BillKarthick KumarNo ratings yet

- DUPLICATE BILL DETAILS FOR RAVINDER VERMADocument2 pagesDUPLICATE BILL DETAILS FOR RAVINDER VERMAverma_ravinderNo ratings yet

- Your Reliance Communications BillDocument2 pagesYour Reliance Communications BillRajesh UpadhyayNo ratings yet

- Non-Domestic Rates Bill 2018/19: Please Quote On All EnquiriesDocument4 pagesNon-Domestic Rates Bill 2018/19: Please Quote On All Enquiriesautos osmanNo ratings yet

- Pay bill and view charges onlineDocument8 pagesPay bill and view charges onlinepradeep3110850% (1)

- Eastland Center - Loan Prop DetailDocument10 pagesEastland Center - Loan Prop DetailClickon DetroitNo ratings yet

- Residential Electric Service Application: Modesto Irrigation DistrictDocument1 pageResidential Electric Service Application: Modesto Irrigation DistrictstacypaizNo ratings yet

- Report On Research MethodsDocument1 pageReport On Research MethodsAmjid HussainNo ratings yet

- SalesUseTaxSC c-287 - 20131113 PDFDocument5 pagesSalesUseTaxSC c-287 - 20131113 PDFAnonymous uqhSfwUENo ratings yet

- PTCL invoice details and customer billing informationDocument1 pagePTCL invoice details and customer billing informationjohnsilvesterNo ratings yet

- Miami Dade County Real Estate 24 (TODOS)Document12 pagesMiami Dade County Real Estate 24 (TODOS)OmarVargasNo ratings yet

- 2013 10 28 - BillDocument2 pages2013 10 28 - BillDave RodriguezNo ratings yet

- Upw2011augm05 1087000162 936494122Document2 pagesUpw2011augm05 1087000162 936494122Manan SudiNo ratings yet

- Tom MerkertDocument10 pagesTom MerkertMark WilliamsNo ratings yet

- Your Reliance Communications BillDocument2 pagesYour Reliance Communications BillHarry MahajanNo ratings yet

- Account Id: 1946865741: È Øœã+ Y!Wzjäœã"50Äœã&$50Äœã1Iäœã25 Ê È Øœã+ Y!Wzjäœã"50Äœã&$50Äœã1Iäœã25 ÊDocument2 pagesAccount Id: 1946865741: È Øœã+ Y!Wzjäœã"50Äœã&$50Äœã1Iäœã25 Ê È Øœã+ Y!Wzjäœã"50Äœã&$50Äœã1Iäœã25 Ê12343567890No ratings yet

- Summary of Current Charges Amount (RS.) : Bill Enquiries: 3033 7777 or 377Document7 pagesSummary of Current Charges Amount (RS.) : Bill Enquiries: 3033 7777 or 377Ankit ShresthaNo ratings yet

- 2015 Property Tax Statement: Due Date Total DueDocument1 page2015 Property Tax Statement: Due Date Total DueDeron BrownNo ratings yet

- DIDP240660009983Document3 pagesDIDP240660009983kasun89No ratings yet

- Tax Credit Certificate On Supplies: For General Tax Questions Call Our Toll Free 0800117000 or Log Onto URA Web PortalDocument1 pageTax Credit Certificate On Supplies: For General Tax Questions Call Our Toll Free 0800117000 or Log Onto URA Web PortalKUKUPEY INVESTMENTSNo ratings yet

- Photon Bill Upto 2nd NovDocument2 pagesPhoton Bill Upto 2nd NovSunil VyasNo ratings yet

- Rainbow Vistas: Green Hills Road, Moosapet, Hyderabad - 500018Document2 pagesRainbow Vistas: Green Hills Road, Moosapet, Hyderabad - 500018Subbarao AppanabhotlaNo ratings yet

- Bank of America Account StatementDocument7 pagesBank of America Account Statementevaristus221No ratings yet

- 2023 Web Tax Statement: Owner ID: Parcel ID: Sequence: Account #: Owner Interest: Legal DescriptionDocument1 page2023 Web Tax Statement: Owner ID: Parcel ID: Sequence: Account #: Owner Interest: Legal Descriptionp13607091No ratings yet

- BB&T Bank StatementDocument7 pagesBB&T Bank StatementBraeylnn bookerNo ratings yet

- Dl2011novm05 1134415034 906495033Document2 pagesDl2011novm05 1134415034 906495033sumeshkumarsharmaNo ratings yet

- 2022 Property Tax Statement for 405 Flintrock WayDocument1 page2022 Property Tax Statement for 405 Flintrock WayLOUNGE HOMENo ratings yet

- Print Dup BillDocument1 pagePrint Dup BillSyed Nabeel Hassan JafferyNo ratings yet

- Or2011maym17 1030169071 604436840Document2 pagesOr2011maym17 1030169071 604436840santoshkumarpatroNo ratings yet

- Account Id: 2100651131: È Øœã,$Y) Rt0Äœã) 5/Äœã#+5/Äœãigäœãjqøê È Øœã,$Y) Rt0Äœã) 5/Äœã#+5/ÄœãigäœãjqøêDocument2 pagesAccount Id: 2100651131: È Øœã,$Y) Rt0Äœã) 5/Äœã#+5/Äœãigäœãjqøê È Øœã,$Y) Rt0Äœã) 5/Äœã#+5/ÄœãigäœãjqøêkmillatNo ratings yet

- Tata Indicom bill details for account 203598844Document2 pagesTata Indicom bill details for account 203598844mirzashahezadaNo ratings yet

- 1069 NE 39th Ave Offer Instruction PKGDocument26 pages1069 NE 39th Ave Offer Instruction PKGMahoo RENo ratings yet

- BillDocument4 pagesBilldeepakbshettyNo ratings yet

- Summary of Current Charges Amount (RS.) : Bill Enquiries: 3033 7777 or 377Document6 pagesSummary of Current Charges Amount (RS.) : Bill Enquiries: 3033 7777 or 377Prashant SinghNo ratings yet

- eStmt_2023-10-31Document4 pageseStmt_2023-10-31ellamaekitchensNo ratings yet

- Schwichtenberg OAH ComplaintDocument3 pagesSchwichtenberg OAH ComplaintCarverCountyMNNo ratings yet

- Bruce Schwichtenberg OAH Complaint 8/1/2012Document6 pagesBruce Schwichtenberg OAH Complaint 8/1/2012CarverCountyMNNo ratings yet

- Carver County Board of Adjustment Packet March 2009Document16 pagesCarver County Board of Adjustment Packet March 2009CarverCountyMNNo ratings yet

- Carver County Board of Adjustment March 2009Document4 pagesCarver County Board of Adjustment March 2009CarverCountyMNNo ratings yet

- Bruce Schwichtenberg Foreclosure NoticesDocument1 pageBruce Schwichtenberg Foreclosure NoticesCarverCountyMNNo ratings yet

- Bruce Schwichtenberg Bankruptcy 1990 BKY-4-90-2793Document19 pagesBruce Schwichtenberg Bankruptcy 1990 BKY-4-90-2793CarverCountyMNNo ratings yet

- Press Release - CARVER COUNTY WINS SEPTIC LAWSUIT Decemeber 2008Document2 pagesPress Release - CARVER COUNTY WINS SEPTIC LAWSUIT Decemeber 2008CarverCountyMNNo ratings yet

- Bruce Schwichtenberg James Keeler LetterDocument1 pageBruce Schwichtenberg James Keeler LetterCarverCountyMNNo ratings yet

- Bruce Schwichtenberg Election ResultsDocument1 pageBruce Schwichtenberg Election ResultsCarverCountyMNNo ratings yet

- Bruce Schwichtenberg in His Own WordsDocument4 pagesBruce Schwichtenberg in His Own WordsCarverCountyMNNo ratings yet

- State of Minnesota Ex Rel Bruce R. SchwichtenbergDocument12 pagesState of Minnesota Ex Rel Bruce R. SchwichtenbergCarverCountyMNNo ratings yet

- Oxford City Council Notice of Council Tax For 2019/20Document2 pagesOxford City Council Notice of Council Tax For 2019/20Judith DallossoNo ratings yet

- Residence & Scope of Total IncomeDocument17 pagesResidence & Scope of Total IncomeSatyam Kumar AryaNo ratings yet

- RFQ For WTP & ESR DESIGN - 6 MLD - 20.12.2020Document1 pageRFQ For WTP & ESR DESIGN - 6 MLD - 20.12.2020abhishek5810No ratings yet

- CTA Orders Partial VAT Refund for Export CorporationDocument10 pagesCTA Orders Partial VAT Refund for Export Corporationsamaral bentesinkoNo ratings yet

- BSA Assignment AnswerDocument7 pagesBSA Assignment AnswerjayNo ratings yet

- Residential StatusDocument4 pagesResidential StatusTauseef AzharNo ratings yet

- U.S. Individual Income Tax Return: Filing StatusDocument2 pagesU.S. Individual Income Tax Return: Filing Statusboayoung.0820No ratings yet

- Case 2 QuestionsDocument3 pagesCase 2 QuestionsIqra AliNo ratings yet

- RECISSIONDocument12 pagesRECISSIONj weiss100% (10)

- CBDT Notification Software Purchase TDSDocument1 pageCBDT Notification Software Purchase TDSdeepakaggarwalcaNo ratings yet

- CIR v. T Shuttle ServicesDocument14 pagesCIR v. T Shuttle ServicesArrianne ObiasNo ratings yet

- CTA upholds prescription of EWT, WTC assessments for 2005Document1 pageCTA upholds prescription of EWT, WTC assessments for 2005John Kenneth Jacinto0% (1)

- INCOME TAXATION TAX 411Document45 pagesINCOME TAXATION TAX 411Phearl Anjeyllie PilotonNo ratings yet

- Final Exam RIPHDocument4 pagesFinal Exam RIPHJane AlmanzorNo ratings yet

- A Theoretical Analysis On Tax Auditing-Tax Compliance Determinants and Bomb Crater EffectDocument23 pagesA Theoretical Analysis On Tax Auditing-Tax Compliance Determinants and Bomb Crater EffectmeisyafitriNo ratings yet

- Commissioner of Customs VDocument16 pagesCommissioner of Customs VJefferson NunezaNo ratings yet

- Formal Letter of Demand: Republic of The Philippines Department of Finance Bureau of Internal RevenueDocument3 pagesFormal Letter of Demand: Republic of The Philippines Department of Finance Bureau of Internal RevenueDominic Dela VegaNo ratings yet

- CIR v. Vda de PrietoDocument3 pagesCIR v. Vda de Prietoevelyn b t.No ratings yet

- Estate Tax Changes Under TRAIN Law SimplifiedDocument4 pagesEstate Tax Changes Under TRAIN Law SimplifiedMargz CafifgeNo ratings yet

- AUDITING AND TAXATION KEY TERMSDocument7 pagesAUDITING AND TAXATION KEY TERMSKadam KartikeshNo ratings yet

- City of Manila vs. Coca Cola BottlersDocument2 pagesCity of Manila vs. Coca Cola BottlersMyla RodrigoNo ratings yet

- Pay Bill of Gazzetted OfficerDocument1 pagePay Bill of Gazzetted OfficerHeadmasterGSECTNo ratings yet

- ENG 5 Academic Paper: Republic Act No. 10963 Tax Reform For Acceleration and Inclusion (TRAIN) To Sustainable Near-Term GrowthDocument4 pagesENG 5 Academic Paper: Republic Act No. 10963 Tax Reform For Acceleration and Inclusion (TRAIN) To Sustainable Near-Term GrowthRey Joyce AbuelNo ratings yet

- Business Taxation MaterialDocument18 pagesBusiness Taxation MaterialKhushboo ParikhNo ratings yet

- Benguet Corp Vs CBAA Case DigestDocument2 pagesBenguet Corp Vs CBAA Case DigestVincent Adrian GeptyNo ratings yet

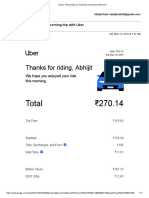

- Your Saturday morning trips with UberDocument11 pagesYour Saturday morning trips with UberabhijitrathiNo ratings yet

- Income Taxation Chapter 1Document5 pagesIncome Taxation Chapter 1Princess Ivy PenaflorNo ratings yet

- Ahmirah Ali Weekly Stub 1Document1 pageAhmirah Ali Weekly Stub 1Lillian AwtNo ratings yet

- W-2 Tax FormDocument7 pagesW-2 Tax FormMaria HowellNo ratings yet

- Reagan Vs CIRDocument1 pageReagan Vs CIRemmaniago08No ratings yet