Professional Documents

Culture Documents

Bussiness Case Review

Uploaded by

QisthiDaisyOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bussiness Case Review

Uploaded by

QisthiDaisyCopyright:

Available Formats

Hanil Bank v. PT.

Bank Negara Indonesia (Persero)

I.

Background of Case

PT. Kadeco Electronics Indonesia (Kadeco ) applied to BNI to issue a letter of credit for benefit of Sung Jun Electronics Co. Ltd. (Sung Jun). BNI issued L/C (Letter of Credit) but misspelled the name of the beneficiary as Sung Jin Electronics Co. Ltd. The beneficiary did not request amendment of the L/C to change the name of the beneficiary. Hanil purchased the L/C and the document submitted by Sun Jun. Later, BNI rejected the documents tendered by Hanil and refused to pay under the L/C based on 4 reasons, namely: the different name of beneficiary under the L/C; the packing list did not show the content required by L/C; fails to comply with the export quality; the bill of lading should be ocean bill of lading. Hanil brought the case to the New York State court. Hanil as the plaintiff and BNI as the defendant. II. Issues

1. If the issuing bank is responsible? 2. If the advising bank is responsible? 3. Who should be responsible in this matter? III. Rules

Uniform Customs and Practice for Documentary Credits (1993 Revision) International Chamber of Commerce Publication No. 500 (the UCP)

Beyene v. Irving Trust Co. Mutual Export Corp. v. Westpac Banking Corp.

IV.

Analysis

1. If the issuing bank is responsible? The issuing bank in this case is BNI who issued letter of credit. The issuing bank is in breach of contract and breach of Uniform Customs and Practice for Documentary Credits (1993 Revision) International Chamber of Commerce Publication No. 500 (the UCP) concerning unjust enrichment and breach of implied covenant of good faith and fair dealing. The issuing bank is responsible under the reasons improper documents, the issuing bank is under the obligation to honor the draft on a credit is independent of the performance underlying the contract. The issuing bank should be in good faith to properly check the letter of credit that had been issued. The misspelled of beneficiary name is crucial that it effected the reimbursement of payment could not be made, so the error was made by issuing bank. The payment of letter of credit should be made in accordance to a proper document. Thus the issuing bank should recover any damages that resulted from refusal of payment. The issuing bank should in good faith in conducting the business, that should consider other document that prove the typographical error may render the amendment of letter of credit. Thus, the issuing bank should properly check other document and in this case the issuing bank should check other document of delivery of goods which had been given to the issuing parties to receive the payment. The refusal of payment is neglected the essence of fair dealing in business on how the exception of term should be applied as in this matter only typological error in one sentence, therefore the payment should be made. 2. If the advising bank is responsible? The issuing bank refer to obligation under Uniform Customs and Practice for Documentary Credits (1993 Revision) International Chamber of Commerce Publication No. 500 (the UCP) . the duty of the issuing bank to pay upon the submission document which appear on their face to conform to the terms and conditions of letter of credit is absolute, the advising bank should consider the condition of letter of credit, the name of beneficiary is important to make payment, and this standard is absolute. The advising bank rely on the good faith basis if the facts available is the letter of credit which in different name of beneficiary. The beneficiary is the best position to determine whether a letter of credit meets the needs of the underlying commercial transaction.

The issuing bank refer to the case Beyene v. Irving Trust Co. and Mutual Export Corp. v. Westpac Banking Corp. that the misspelled of beneficiary name under the letter of credit could be a proper basis to refuse the payment of letter of credit. The document to payments should be held if there is a properly identify the beneficiary of the letter of credit. fairness of commercial transaction should be function of the reasonable expectation. Even if it is obvious from the examination of the letter of credit and the document that different in the beneficiarys name result from the typographical error, the error does not justify to dishonor the letter of credit itself. Thus, the advising bank should be responsible and the payment for typological error of the beneficiary name cannot be conducted.

3. Who should be responsible in this matter? In this case, the plaintiff was affected by the mistyping conducted by the defendant who has the he obligation to issue the letter of credit. The document concerning the name of beneficiary should be properly examined by the defendant as the issuing bank, however the plaintiff did not check the beneficiary name thus the different name of beneficiary in the letter of credit resulted the plaintiff has no right to claim any damages and payment. The court only can rely in the actual basis of the document available. The fulfillment of standard banking practice is significantly affect the payment that need to go through the operating procedure. The only test applicable in this matter is whether the plaintiff has sufficiently checks document for an issuing banks, whether an experienced and knowledgeable document checker would find the document checker would find that the documents are in compliance.

V.

Conclusion

The issuance of payment for letter of credit should have a proper document. The essential matter is concerning the beneficiary name stipulates should be correct, if it is not correct or there is a typological error the payment of letter of credit possible to be refused because it need to conform with term and condition of letter of credit is absolute in which the document of issue payment

should under the same beneficiary name. in this case, the issuing bank is held not liable to refuse the payment considered different name in the letter of credit and the document issue by the advising bank.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The UN Dispute Settlement Mechanism Reinforce The Rule of LawDocument5 pagesThe UN Dispute Settlement Mechanism Reinforce The Rule of LawQisthiDaisyNo ratings yet

- Comparative Studies Civil ProDocument8 pagesComparative Studies Civil ProQisthiDaisyNo ratings yet

- Comparative Studies Civil ProDocument8 pagesComparative Studies Civil ProQisthiDaisyNo ratings yet

- Juridical Evaluation On Aceh - FULL PAPERDocument9 pagesJuridical Evaluation On Aceh - FULL PAPERQisthiDaisyNo ratings yet

- Course Book Intl Envo LawDocument6 pagesCourse Book Intl Envo LawQisthiDaisyNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Rsbsa-8 7 2015 PDFDocument4 pagesRsbsa-8 7 2015 PDFRonalene Garbin100% (1)

- A More Expensive Cuppa: Nestle (Malaysia)Document8 pagesA More Expensive Cuppa: Nestle (Malaysia)bijueNo ratings yet

- Personal ID: MD-2071, CHISINAU STR. ALBA-IULIA 75/22b, Ap. 22Document1 pagePersonal ID: MD-2071, CHISINAU STR. ALBA-IULIA 75/22b, Ap. 22Bargan DoinițaNo ratings yet

- PDFDocument7 pagesPDFClaytonNo ratings yet

- HDFC Bank Credit Cards GSTIN: 33AAACH2702H2Z6 HSN Code - 9971Document1 pageHDFC Bank Credit Cards GSTIN: 33AAACH2702H2Z6 HSN Code - 9971Hardik RavalNo ratings yet

- Shippers Letter of InstructionDocument2 pagesShippers Letter of InstructionWilliam LooNo ratings yet

- Standar Pemasangan Sticker Mesin ATM BCA 2021Document20 pagesStandar Pemasangan Sticker Mesin ATM BCA 2021MA FayyadhNo ratings yet

- Star Two vs. Paper CityDocument2 pagesStar Two vs. Paper CityJewel Ivy Balabag DumapiasNo ratings yet

- Abenson Summer Exclusives - Promo Mechanics PDFDocument2 pagesAbenson Summer Exclusives - Promo Mechanics PDFBon Alexis GuatatoNo ratings yet

- Bank of Namibia Act 15 of 1997Document22 pagesBank of Namibia Act 15 of 1997André Le RouxNo ratings yet

- From Import Import From Import From Import Try From Import Except PassDocument2 pagesFrom Import Import From Import From Import Try From Import Except PassriteshNo ratings yet

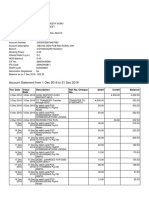

- Account Statement From 1 Dec 2016 To 31 Dec 2016: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument2 pagesAccount Statement From 1 Dec 2016 To 31 Dec 2016: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceENDLURI DEEPAK KUMARNo ratings yet

- Fms Project-Microfinance in IndiaDocument25 pagesFms Project-Microfinance in Indiaashu181186No ratings yet

- Nov Paper11 2010Document20 pagesNov Paper11 2010Aung Zaw HtweNo ratings yet

- T24 Islamic Banking User Guide: Wakala MusawamaDocument30 pagesT24 Islamic Banking User Guide: Wakala MusawamaSathya KumarNo ratings yet

- Liability Insurance.Document62 pagesLiability Insurance.pankajgupta80% (5)

- PradipchowdhuryDocument2 pagesPradipchowdhurybiswa chakrabortyNo ratings yet

- NAFSCOB-Branch OperationsDocument379 pagesNAFSCOB-Branch OperationsAshoak VarmaNo ratings yet

- Bills of ExchangeDocument16 pagesBills of ExchangeswayamNo ratings yet

- Tendering ProcessDocument36 pagesTendering ProcessChris Opuba100% (1)

- IRDA Syllabus for Insurance Broker ExamDocument8 pagesIRDA Syllabus for Insurance Broker Examreena mathurNo ratings yet

- New Microsoft PowerPoint PresentationDocument48 pagesNew Microsoft PowerPoint PresentationIryne Kim PalatanNo ratings yet

- Intermediate Accounting 3 PDFDocument86 pagesIntermediate Accounting 3 PDFChelsy SantosNo ratings yet

- Who is Sta. Lucia Land and their Sotogrande Condotel projectDocument44 pagesWho is Sta. Lucia Land and their Sotogrande Condotel projectRustle JimmiesNo ratings yet

- Case 4 - Wellfleet Bank (Patacsil)Document6 pagesCase 4 - Wellfleet Bank (Patacsil)Davy PatsNo ratings yet

- Certificate PDFDocument28 pagesCertificate PDFRecordTrac - City of OaklandNo ratings yet

- CPA Board Examinations QuestionsDocument14 pagesCPA Board Examinations QuestionsJeane BongalanNo ratings yet

- Fundamental of Banking MarathiDocument256 pagesFundamental of Banking MarathisunilNo ratings yet

- Pershing Sqaure CP ActivismDocument31 pagesPershing Sqaure CP ActivismMichael BenzingerNo ratings yet

- Investor investment patternsDocument4 pagesInvestor investment patternsSaiKumarSeelamNo ratings yet