Professional Documents

Culture Documents

25 Yr Old - Fast Track

Uploaded by

Rajeswari SenguptaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

25 Yr Old - Fast Track

Uploaded by

Rajeswari SenguptaCopyright:

Available Formats

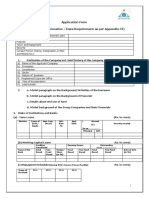

Max New York Life Fast Track PlanTM

Unit Linked Insurance Plan

UIN No:104L067V01

Policy/Proposal No:[_________________]

Date of Illustration : Jun 27, 2012 1:41:33 AM

IN THIS POLICY, THE INVESTMENT RISK IN THE INVESTMENT PORTFOLIO IS BORNE BY THE POLICYHOLDER

Personal Details

Product Features

Proposer

Age of Proposer

30 Years

Life Insured

Investment Options

Policy Term (Years)

20 Years

Growth Fund

0%

Premium Paying Term

10 Years

Growth Super Fund

0%

Premium Paying Mode

Annual

Balanced Fund

100%

Age of Life Insured at inception of

Policy

30 Years

Modal Premium

Rs 2,00,000.00

Conservative Fund

0%

Gender of Life Insured

Male

Annualised Target Premium

Rs 2,00,000.00

Money Market Fund

0%

State

Other

Sum Assured of Base Policy

Rs 20,00,000.00

Secure Fund

0%

Systematic Transfer Plan

No

DD Rider Sum Assured, if Opted

PAB Rider Sum Assured, if Opted

Gross Yield

10 %

Net Yield (This includes service tax & all charges) *

7.92 %

Net Yield (This excludes service tax, mortality, morbidity, rider and guaranteed benefit charges) *

8.42 %

Net Reduction in Yield (This excludes service tax & mortality, morbidity, rider and guaranteed benefit charges)

1.58 %

Service Tax including Cess

12.36 %

* The yields shown above do not take partial withdrawals into consideration.

Signature of Agent/Specified Person/Principal officer:___________________________________________

Policy Holders Signature:___________________________________________

This is only an Illustrative document. The Benefits if guaranteed, are clearly marked so. For variable benefits, investment growth rates of 6% and 10% are used as an illustration.

MAX NEW YORK LIFE INSURANCE CO. LTD, 11th Floor, DLF Square, Jacaranda Marg, DLF City, Phase II, Gurgaon 122 002

Page 1 of 4

YEARLY ILLUSTRATIVE DETAILS

(This shall form a part of the policy document)

The following provides year-by-year statements of various charges along with performance of the fund expected over the duration of the policy with assumed rate of return as mentioned:

All cash flows are in Rs

General Details

Policy

Year

Premium Details

Age of life

Assured Annualize

d Target

premium

Top-up

Premium

Charges & Service Tax Details

Premium

Allocation

charge

Amount

Policy

Available Administr Guarantee

for

ation

Charge

Investmen Charge

t (out of

premium)

Risk

Charges

Fund

Managem

ent

Charge

Scenario 1 (Gross Yield :- 10% pa)

Other

Charges

Total

Charges

Service

Tax

Fund

Value

before

FMC

Fund

Value

(EOY)

Partial

Death

Withdraw Guarantee Surrender Benefit(E

al (EOY) d Loyalty

Value

OY)

Additions (EOY) ***

to fund (if

any)

Maturity

Benefit

Commissi

ons

/Brokerag

e if

payable **

30

2,00,000

8,000

1,92,000

1,500

3,215

2,168

14,882

1,900

2,04,421

2,01,925

1,95,925

22,01,925

11,900

31

2,00,000

8,000

1,92,000

1,575

3,217

4,493

17,285

2,263

4,26,328

4,21,153

4,16,153

24,21,153

2,000

32

2,00,000

8,000

1,92,000

1,654

3,277

7,017

19,948

2,663

6,67,186

6,59,104

6,55,104

26,59,104

2,000

33

2,00,000

8,000

1,92,000

1,736

3,367

9,757

22,860

3,100

9,28,588

9,17,351

9,15,351

29,17,351

2,000

34

2,00,000

8,000

1,92,000

1,823

3,491

12,730

26,044

3,577

12,12,258

11,97,596

11,97,596

31,97,596

2,000

35

2,00,000

8,000

1,92,000

1,914

3,649

15,957

29,520

4,097

15,20,068

15,01,691

15,01,691

35,01,691

2,000

36

2,00,000

8,000

1,92,000

2,010

3,839

19,458

33,306

4,663

18,54,055

18,31,646

18,31,646

38,31,646

2,000

37

2,00,000

8,000

1,92,000

2,111

4,061

23,256

37,427

5,279

22,16,429

21,89,645

21,89,645

41,89,645

2,000

38

2,00,000

8,000

1,92,000

2,216

4,317

27,377

41,910

5,949

26,09,591

25,78,060

25,78,060

45,78,060

2,000

10

39

2,00,000

8,000

1,92,000

2,327

4,835

31,847

47,009

6,705

30,35,874

29,99,196

29,99,196

50,99,196

2,000

11

40

2,443

5,230

34,495

42,168

6,181

32,88,270

32,48,543

32,48,543

53,48,543

12

41

2,566

5,637

37,363

45,566

6,681

35,61,779

35,18,748

35,18,748

56,18,748

13

42

2,694

5,996

40,472

49,162

7,213

38,58,269

38,11,658

38,11,658

59,11,658

14

43

2,828

6,383

43,843

53,054

7,789

41,79,680

41,29,187

41,29,187

62,29,187

15

44

2,970

6,865

47,496

57,331

8,420

45,28,037

44,73,337

44,73,337

65,73,337

16

45

3,118

7,449

51,455

62,023

9,111

49,05,532

48,46,272

48,46,272

69,46,272

17

46

3,274

8,138

55,745

67,157

9,867

53,14,542

52,50,341

52,50,341

73,50,341

18

47

3,438

8,932

60,393

72,763

10,690

57,57,647

56,88,093

56,88,093

77,88,093

19

48

3,610

9,829

65,428

78,867

11,586

62,37,652

61,62,300

61,62,300

82,62,300

20

49

3,790

10,828

70,882

85,501

12,559

67,57,604

66,75,970

66,75,970

87,75,970

66,75,970

** Please refer to the following notes:

--The actual amount of commission paid to the agent may be lower or higher than the depicted value as the actual payout is dependent on factors such as total business procured and policy renewability.

--TDS is deducted from Commission/ brokerage payable to the agent / broker on this policy.

--Offering or accepting a rebate is prohibited under Section 41 of the Insurance Act, 1938 and is a punishable offense.

Signature of Agent/Specified Person/Principal officer:___________________________________________

Policy Holders Signature:___________________________________________

This is only an Illustrative document. The Benefits if guaranteed, are clearly marked so. For variable benefits, investment growth rates of 6% and 10% are used as an illustration.

MAX NEW YORK LIFE INSURANCE CO. LTD, 11th Floor, DLF Square, Jacaranda Marg, DLF City, Phase II, Gurgaon 122 002

Page 2 of 4

All cash flows are in Rs

General Details

Policy

Year

Premium Details

Age of life

Assured Annualize

d Target

premium

Top-up

Premium

Charges & Service Tax Details

Premium

Allocation

charge

Amount

Policy

Available Administr Guarantee

for

ation

Charge

Investmen Charge

t (out of

premium)

Risk

Charges

Fund

Managem

ent

Charge

Scenario 2 (Gross Yield :- 6% pa)

Other

Charges

Total

Charges

Service

Tax

Fund

Value

before

FMC

Fund

Value

(EOY)

Partial

Death

Withdraw Guarantee Surrender Benefit(E

al (EOY) d Loyalty

Value

OY)

Additions (EOY) ***

to fund (if

any)

Maturity

Benefit

Commissi

ons

/Brokerag

e if

payable **

30

2,00,000

8,000

1,92,000

1,500

3,215

2,124

14,839

1,894

1,96,938

1,94,491

1,88,491

21,94,491

11,900

31

2,00,000

8,000

1,92,000

1,575

3,217

4,319

17,111

2,236

4,02,941

3,97,967

3,92,967

23,97,967

2,000

32

2,00,000

8,000

1,92,000

1,654

3,277

6,615

19,545

2,602

6,18,393

6,10,774

6,06,774

26,10,774

2,000

33

2,00,000

8,000

1,92,000

1,736

3,367

9,016

22,119

2,987

8,43,694

8,33,310

8,31,310

28,33,310

2,000

34

2,00,000

8,000

1,92,000

1,823

3,491

11,526

24,840

3,394

10,79,259

10,65,985

10,65,985

30,65,985

2,000

35

2,00,000

8,000

1,92,000

1,914

3,649

14,151

27,714

3,823

13,25,523

13,09,226

13,09,226

33,09,226

2,000

36

2,00,000

8,000

1,92,000

2,010

3,839

16,895

30,743

4,274

15,82,943

15,63,485

15,63,485

35,63,485

2,000

37

2,00,000

8,000

1,92,000

2,111

4,061

19,763

33,934

4,749

18,51,994

18,29,234

18,29,234

38,29,234

2,000

38

2,00,000

8,000

1,92,000

2,216

4,317

22,760

37,293

5,249

21,33,175

21,06,963

21,06,963

41,06,963

2,000

10

39

2,00,000

8,000

1,92,000

2,327

4,835

25,891

41,052

5,801

24,26,741

23,96,923

23,96,923

44,96,923

2,000

11

40

2,443

5,230

27,004

34,677

5,045

25,31,000

24,99,899

24,99,899

45,99,899

12

41

2,566

5,637

28,163

36,365

5,286

26,39,504

26,07,070

26,07,070

47,07,070

13

42

2,694

5,996

29,369

38,059

5,529

27,52,502

27,18,678

27,18,678

48,18,678

14

43

2,828

6,383

30,625

39,837

5,784

28,70,163

28,34,892

28,34,892

49,34,892

15

44

2,970

6,865

31,933

41,768

6,060

29,92,585

29,55,808

29,55,808

50,55,808

16

45

3,118

7,449

33,293

43,861

6,356

31,19,865

30,81,522

30,81,522

51,81,522

17

46

3,274

8,138

34,706

46,119

6,675

32,52,098

32,12,127

32,12,127

53,12,127

18

47

3,438

8,932

36,174

48,544

7,016

33,89,383

33,47,722

33,47,722

54,47,722

19

48

3,610

9,829

37,697

51,136

7,379

35,31,827

34,88,411

34,88,411

55,88,411

20

49

3,790

10,828

39,277

53,896

7,765

36,79,540

36,34,304

36,34,304

57,34,304

36,34,304

EOY - End of Year

***The Policyholder may surrender/discontinuance the policy at any time after inception of the policy. However, surrender value would only be payable on completion of five years from the inception.

Signature of Agent/Specified Person/Principal officer:___________________________________________

Policy Holders Signature:___________________________________________

This is only an Illustrative document. The Benefits if guaranteed, are clearly marked so. For variable benefits, investment growth rates of 6% and 10% are used as an illustration.

MAX NEW YORK LIFE INSURANCE CO. LTD, 11th Floor, DLF Square, Jacaranda Marg, DLF City, Phase II, Gurgaon 122 002

Page 3 of 4

Important Notes:

Section A

-- Max New York Life Insurance Company is the name of the Company and Max New York Life Fast Track PlanTM is the name of the Unit Linked Life Insurance Policy and does not in any way indicate the future prospects or returns of the said Plan.

-- This is only an illustrative document. It does not purport to be a contract of insurance and does not in any way create any rights and/or obligations. Some of the benefits are guaranteed and some benefits are variable with returns based on the future

performance of your insurer carrying on life insurance business. If your policy offers guaranteed returns then these will be clearly marked "guaranteed" in the illustration table on this page. If your policy offers variable returns then the illustrations on this

page will show two different rates of assumed future investment returns. These assumed rates of return are not guaranteed and they are not the upper or lower limits of what you might get back, as the value of your policy is dependent on a number of

factors including future investment performance.

-- Unit Linked Life Insurance products are different from traditional insurance products and are subject to risk factors mentioned in the policy document.

-- The Premiums paid in unit-linked life insurance policies are subject to investment risks associated with capital markets and the NAVs of the units may go up or down based on the performance of the fund and factors influencing the capital market. The

insured is responsible for his or her decisions.

-- Past performance of the investment funds do not indicate the future performance of the same. There are no guaranteed or assured returns.

-- Policy benefits are payable provided all premiums are paid, when they are due. The illustrative benefits above assume that all premiums that are due will be paid on the due dates.

-- Service Tax and Education Cess would be levied as per applicable laws and would be to the account of the policyholder.

-- You may be entitled to certain tax benefits on your premiums and benefits. Please note all the tax benefits are subject to tax laws prevailing at the time of payment of premium or receipt of benefits by you.

Section B

-- Risk charges include sum at risk charges, where sum at risk is equal to total of Base Sum Assured.

-- Rider Charges, if any, will be included in Risk Charges.

-- There are no other charges in this product.

-- Surrender and Maturity Benefits are inclusive of Partial Withdrawals, if any.

I _____________________________________________________________________________________ (Name), having received the information with respect to the above, have understood the above statement before entering into the contract.

Signature of Agent/Corporate Agent/Specified Person/Broker:

Policy Holders Signature:

Name and ID:

Policy Holders Name:

Place:

Date:

Date:

Company Seal:

2010.1.2.8.6.57.05agency13012000000112932 1000000001000000 10000018001000000 0

Page 4 of 4

You might also like

- Premium 25000Document3 pagesPremium 25000psatya432No ratings yet

- Need For Every ExpensesDocument5 pagesNeed For Every ExpensesJagannath DasNo ratings yet

- HDFC Life Click 2 Invest - Ulip - GJ - IllustrationDocument3 pagesHDFC Life Click 2 Invest - Ulip - GJ - IllustrationYashpal SinghNo ratings yet

- IDBI Federal Incomesurance Endowment and Money Back Plan - Benefit IllustrationDocument3 pagesIDBI Federal Incomesurance Endowment and Money Back Plan - Benefit IllustrationVipul KhandelwalNo ratings yet

- HDFC Life Super Savings Plan (SPL) IllustrationDocument2 pagesHDFC Life Super Savings Plan (SPL) IllustrationBrandon WarrenNo ratings yet

- IllustrationForm S000000502723Document1 pageIllustrationForm S000000502723anand_guruwarNo ratings yet

- HDFC Life ProGrowth Plus IllustrationDocument3 pagesHDFC Life ProGrowth Plus IllustrationBullish Guy100% (1)

- Variable Life Insurance Proposal: 0PROP.07.4Document4 pagesVariable Life Insurance Proposal: 0PROP.07.4Ahmad Israfil PiliNo ratings yet

- Smart Wealth Builder - Form 274 - Corporate Website PDFDocument36 pagesSmart Wealth Builder - Form 274 - Corporate Website PDFSai Deva AkkipalliNo ratings yet

- ICICI Benefit IllustrationDocument4 pagesICICI Benefit Illustrationudupiganesh3069No ratings yet

- HDFC LifeDocument1 pageHDFC LifefacebookorkutNo ratings yet

- IllustrationDocument3 pagesIllustrationDevender Singh RautelaNo ratings yet

- Vidya DharDocument2 pagesVidya DharKatie PerryNo ratings yet

- Mr. Basit HassanDocument4 pagesMr. Basit HassanBasit Hassan QureshiNo ratings yet

- Customer's Declaration: Assessment of Suitability and Appropriateness For Sale of Third Party ProductsDocument17 pagesCustomer's Declaration: Assessment of Suitability and Appropriateness For Sale of Third Party ProductsKavya NageshNo ratings yet

- Illustration of GSIPDocument3 pagesIllustration of GSIPAjinkya ChalkeNo ratings yet

- HDFC Life Sanchay (SPL) IllustrationDocument2 pagesHDFC Life Sanchay (SPL) IllustrationAnkur Mittal100% (1)

- Illustration PDFDocument0 pagesIllustration PDFbpshuNo ratings yet

- rm4800 550kDocument28 pagesrm4800 550kDwayne OngNo ratings yet

- HDFC Children's Gift Fund - Savings Plan - : Nature of Scheme Inception Date Option/PlanDocument5 pagesHDFC Children's Gift Fund - Savings Plan - : Nature of Scheme Inception Date Option/Plansandeepkumar404No ratings yet

- ValueResearchFundcard BirlaSunLifeIncomePlus 2013jul17Document6 pagesValueResearchFundcard BirlaSunLifeIncomePlus 2013jul17Chiman RaoNo ratings yet

- MR Majed: Insurance & Investment ConsultantDocument5 pagesMR Majed: Insurance & Investment Consultantmajidv2003No ratings yet

- Whole Life Surance Savings Plan 116414681443669413Document2 pagesWhole Life Surance Savings Plan 116414681443669413msneha1No ratings yet

- HDFC Life Sampoorn Samridhi Insurance Plan (SPL) IllustrationDocument0 pagesHDFC Life Sampoorn Samridhi Insurance Plan (SPL) IllustrationAakash MazumderNo ratings yet

- Shriram Transport Finance Company LTD: Fixed DepositDocument3 pagesShriram Transport Finance Company LTD: Fixed DepositjkamraNo ratings yet

- NTUC Wealth SolitaireDocument36 pagesNTUC Wealth SolitaireGaryNo ratings yet

- ValueResearchFundcard SBIMagnumIncome 2013jul17Document6 pagesValueResearchFundcard SBIMagnumIncome 2013jul17Chiman RaoNo ratings yet

- Gsip For 15 YrsDocument3 pagesGsip For 15 YrsJoni SanchezNo ratings yet

- 500-1542314 08 05 2013 FundTransactionNoticeDocument2 pages500-1542314 08 05 2013 FundTransactionNoticeAjay Krishna DevulapalliNo ratings yet

- ENDOWMENT PLAN - (Table No. 14) Benefit Illustration: Guaranteed Surrender ValueDocument3 pagesENDOWMENT PLAN - (Table No. 14) Benefit Illustration: Guaranteed Surrender ValueGBKNo ratings yet

- Reliance's Guaranteed Money Back PlanDocument2 pagesReliance's Guaranteed Money Back PlantrskaranNo ratings yet

- IFrame ServletDocument8 pagesIFrame ServletHansaraj ParidaNo ratings yet

- Illustration For Your HDFC Life Click 2 Protect PlusDocument2 pagesIllustration For Your HDFC Life Click 2 Protect Plus0001212vivekchauhanNo ratings yet

- Term PlanDocument4 pagesTerm PlanKaushaljm PatelNo ratings yet

- SmartElite19072022 8468161Document3 pagesSmartElite19072022 8468161manishNo ratings yet

- Reating Lif: Child Protection Money Back PlanDocument2 pagesReating Lif: Child Protection Money Back PlanSanjay Ku AgrawalNo ratings yet

- LifeXL PDFDocument6 pagesLifeXL PDFJoydeep Kar0% (1)

- L&T Infra BondsDocument6 pagesL&T Infra BondsPramod MoreNo ratings yet

- Illustration For Your HDFC Life Click 2 Protect PlusDocument1 pageIllustration For Your HDFC Life Click 2 Protect Plus0001212vivekchauhanNo ratings yet

- Jeevan VriddhiDocument4 pagesJeevan VriddhihemukariaNo ratings yet

- Money Back 20 Years Insurance Policy by Lic: Plan ParametersDocument3 pagesMoney Back 20 Years Insurance Policy by Lic: Plan ParametersTwinkle PahujaNo ratings yet

- EFU Life Assurance Ltd. Illustration of Benefits For 'Prosperity For Life' Prepared For: Mr. ARSHAD ALIDocument3 pagesEFU Life Assurance Ltd. Illustration of Benefits For 'Prosperity For Life' Prepared For: Mr. ARSHAD ALIMonyee SindhuNo ratings yet

- Security Analysis 1 To 30 ConsolidatedDocument151 pagesSecurity Analysis 1 To 30 ConsolidatedPRACHI DASNo ratings yet

- Illustration PDFDocument3 pagesIllustration PDFrahulNo ratings yet

- Investor Presentation Q3 FY2012-13 (15-January-2013) PDFDocument33 pagesInvestor Presentation Q3 FY2012-13 (15-January-2013) PDFRohit ShawNo ratings yet

- Lakshya Plus v1Document10 pagesLakshya Plus v1Mahadevan VenkatesanNo ratings yet

- KFD U39Document3 pagesKFD U39mniarunNo ratings yet

- Portfolio Management: Different Types of Secured Investments Plan, and Types of AnalysisDocument22 pagesPortfolio Management: Different Types of Secured Investments Plan, and Types of AnalysisAnkita ModiNo ratings yet

- Insurance Ia 2Document6 pagesInsurance Ia 2Vikrant SinghNo ratings yet

- IRDA Registration No. 133 CIN No: U66010MH2006PLC165288: Part A Forwarding LetterDocument27 pagesIRDA Registration No. 133 CIN No: U66010MH2006PLC165288: Part A Forwarding LetterChandan KeshriNo ratings yet

- Value Research: FundcardDocument6 pagesValue Research: FundcardAbhishek SinhaNo ratings yet

- QT Nil P 0281201412122056697Document18 pagesQT Nil P 0281201412122056697Sarath KumarNo ratings yet

- E-Term Policy DocumentDocument23 pagesE-Term Policy DocumentpraveenNo ratings yet

- IndiaFirst Life Guaranteed Singgle Premiolicy DocumentDocument20 pagesIndiaFirst Life Guaranteed Singgle Premiolicy DocumentPraveen MishraNo ratings yet

- HDFC Life YoungStar Super Premium (SPL) IllustrationDocument0 pagesHDFC Life YoungStar Super Premium (SPL) IllustrationAnkur MittalNo ratings yet

- E-Term Plus Policy DocumentDocument25 pagesE-Term Plus Policy DocumentsrikanthNo ratings yet

- Miss Soo QTNDocument41 pagesMiss Soo QTNHong Siong ShinNo ratings yet

- Life Insurance: Summary of Your Inforced Policies With Income As of 17 Jul 2021 Toh Qin-Zhen (Zhuo Qinzhen)Document1 pageLife Insurance: Summary of Your Inforced Policies With Income As of 17 Jul 2021 Toh Qin-Zhen (Zhuo Qinzhen)Toh Qin-ZhenNo ratings yet

- Management of Life Insurance CompaniesDocument55 pagesManagement of Life Insurance CompanieshmtjnNo ratings yet

- Miscellaneous Nondepository Credit Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Nondepository Credit Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- NASDAQDocument4 pagesNASDAQNeha KrishnaniNo ratings yet

- Kinnevik Broker Report Apr-15Document118 pagesKinnevik Broker Report Apr-15Daniel ChngNo ratings yet

- A Handbook On Derivatives PDFDocument35 pagesA Handbook On Derivatives PDFAccamumbai Acca Coaching50% (2)

- Essentials of Investments (BKM 5 Ed.) Answers To Selected Problems - Lecture 6Document3 pagesEssentials of Investments (BKM 5 Ed.) Answers To Selected Problems - Lecture 6Kunal KumudNo ratings yet

- Money and Banking SyllabusDocument6 pagesMoney and Banking Syllabusscevola09No ratings yet

- A Project Report On: A Study On Consumer Satisfaction of Payzapp Wallet With Refrence To City BhindDocument51 pagesA Project Report On: A Study On Consumer Satisfaction of Payzapp Wallet With Refrence To City Bhindnikhil jNo ratings yet

- Loan Application FormDocument9 pagesLoan Application FormrohitNo ratings yet

- Course Outline PDFDocument5 pagesCourse Outline PDFMuhammad AsadNo ratings yet

- JPMAC2006-NC1 Schedule D To The Master ISDA AgreementDocument38 pagesJPMAC2006-NC1 Schedule D To The Master ISDA Agreement83jjmackNo ratings yet

- California Apostile Info and HelpDocument3 pagesCalifornia Apostile Info and HelpDiana0% (1)

- Kinds of Companies Under Companies ActDocument3 pagesKinds of Companies Under Companies ActSoumo DasNo ratings yet

- FISDocument10 pagesFISapi-3739522No ratings yet

- The Accompanying Notes Are An Integral Part of The Financial StatementsDocument7 pagesThe Accompanying Notes Are An Integral Part of The Financial Statementsravibhartia1978No ratings yet

- Project WorkDocument16 pagesProject WorkMaheshNo ratings yet

- A Summer Training Project Report ON "Cash Flow Management of BSNL"Document51 pagesA Summer Training Project Report ON "Cash Flow Management of BSNL"Neha VidhaniNo ratings yet

- FIN 420 Chapter 9 (Long Term Financing)Document17 pagesFIN 420 Chapter 9 (Long Term Financing)Halim NordinNo ratings yet

- Aggregation, Set Off and Carry Forward of IncomeDocument27 pagesAggregation, Set Off and Carry Forward of IncomeTomy MathewNo ratings yet

- Tax 2 Reviewer LectureDocument12 pagesTax 2 Reviewer LectureHazel Rocafort TitularNo ratings yet

- Amazon in Emerging Markets Preview - PDFDocument1 pageAmazon in Emerging Markets Preview - PDFghaniaNo ratings yet

- ExercisesDocument3 pagesExercisesrhumblineNo ratings yet

- Inbound Delivery ProcessDocument5 pagesInbound Delivery ProcessDar Pinsor50% (2)

- ICICI Direct - Research ReportDocument4 pagesICICI Direct - Research ReportMudit KediaNo ratings yet

- T3TSL - Syndicated Loans - R14Document283 pagesT3TSL - Syndicated Loans - R14tayutaNo ratings yet

- LOLES Gregory AffidavitDocument9 pagesLOLES Gregory AffidavitHelen BennettNo ratings yet

- Overview of Accumulate / Distribute AlgorithmDocument2 pagesOverview of Accumulate / Distribute AlgorithmRonitSingNo ratings yet

- Social and Business Ethics1Document10 pagesSocial and Business Ethics1SjNo ratings yet

- Problem 7-1 Multiple Choice (PAS 32)Document3 pagesProblem 7-1 Multiple Choice (PAS 32)Mobi Dela CruzNo ratings yet

- 21 09 21 Tastytrade ResearchDocument5 pages21 09 21 Tastytrade ResearchtrungNo ratings yet

- Chap 024Document37 pagesChap 024nobNo ratings yet

- Financial MArkets Module 1 NCFMDocument92 pagesFinancial MArkets Module 1 NCFMChetan Sharma100% (21)