Professional Documents

Culture Documents

Introduction of Bank: Banks

Uploaded by

Kunal NagOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Introduction of Bank: Banks

Uploaded by

Kunal NagCopyright:

Available Formats

INSURANCE AND BANKING

INTRODUCTION OF BANK

In the modern age, banks are the important part of man's economic life. As we know that Finance is the life blood of the organization, banks help in providing funds to the economy. Finance is the lifeblood and controlling nerve centre of business and banks arrange right amount of finance at right time. Banks are essential for the fast Economic Development of the nation. Bank is a financial institution which deals with other people's money. Banks provide number of services to its customers as well as to economic activities. It also helps in strengthening the

commercial activities as well as domestic processes. Bank is one of the most important aids to trade. Banks accept deposits, grant loans, make payment of bills, rent, etc on behalf of its customers.

INSURANCE AND BANKING

INSURANCE AND BANKING

INTRODUCTION OF INSAURANCE

In today's world we hardly come across anyone who is not familiar with the term insurance. Our life is uncertain, we do not have any idea what will happen in our future. But insurance has become one of the great ways to secure our future. Getting the right introduction to insurance is important so as to get more familiar with the term. Well, you get started the right way here.

Insurance is a risk management technique primarily used

to hedge against the risk of a contingent, uncertain loss that may be suffered by those individuals or entities who have an insurable interest in scarce resources, by transferring the possibility of this loss from one interested person, persons, or entity to another. All policies of insurance in India are regulated by IRDA The idea of insurance is very simple. It can simply be defined as an instrument used for managing the possible risks of

INSURANCE AND BANKING

the future. Throughout our life we may face many kinds of risks such as failing health, financial losses, accidents and even fatalities. Insurance addresses all these uncertainties on financial terms. So one should understand the importance of insurance in their life. With us, you will get to know all the types of insurance plus the benefits. In the last few decades we have seen numerous changes in the insurance industry since the need for insurance is more evident now than earlier. People's spending patterns are changing and more & more resources are needed for immediate consumption.

INSURANCE AND BANKING

DEFINITION OF INSURANCE

Insurance is a financial arrangement that re-distributes the cost of unexpected losses.

Insurance is a device to protect against risk on a provision against inevitable (unavoidable) contingencies or a cooperation device of spreading risk

INSURANCE AND BANKING

DEFINITION OF BANKING 1. According to Dr.H.L.Hart.

"A banker is one who, in the ordinary course of his business, honours cheques drawn upon him by persons from and for whom he receives money on current account."

2. According to SAYERS.

"Banks are institutions whose debts usually referred to as "bank deposits"-are commonly

accepted in final settlement of other people's debt."

INSURANCE AND BANKING

Types of Life Insurance Policies

Endowment Policy: This policy is for fixed period. Payment of premium is done for a fixed period. Compensation amount is paid on the maturity of period or on the death of the insured. Whole Life Policy: This policy is a life insurance policy that remains in force for the insureds whole life and requires (in most cases) premiums to be paid every year into the policy.

With Or Without Profit Policy: In case of with profit policy the premium is increased and the person insured will be entitled in the share of the profit of company

7

INSURANCE AND BANKING

and will be given to insured along with the amount of policy insured. In case of without profit policy the premium is normal and the person insured will be entitled only to the amount of policy and no such bonuses or profit. Joint Life Policy: Joint life policy is a life insurance policy for 2 persons in this 2 persons are

insured together and the amount of policy is paid to other person on the death of each of the persons insured.

Annuity Policy: An annuity is a contract between you and an insurance company. In return for your payment, the insurance company agrees to provide either a regular stream of income or a lump sum pay-out at some future time

8

INSURANCE AND BANKING

Janta Policy: This policy is made for the welfare of the people. This policy is given o the people up to the age of 45 years. There is door to door collection in janta policy. Convertible Whole Life Policy: This is a whole life policy which can be converted to endowment policy in case if person insured is not able to pay the premium of the policy. Money Back Policy: In this policy the compensation amount is not paid at once to the insured it is paid in installments to the insured Jeevan Sathi Policy: This policy is same as insurance taken for two where people insurance joint is

where

INSURANCE AND BANKING

compensation amount is paid at the death of one person and then the policy continues and again the amount is paid at the maturity of the policy

NEEDS AND IMPORTANCE OF INSURANCE

Risk sharing: Insurance companies help in the risk sharing of

insured person for the particular period of time or till death.

Co-operative device: Insurance Company pays the compensation

to the insured from the collective premiums of all the persons insured with the company this function is known is co-operative device.

Savings: It is a mode of saving the money for future as insured

gets compensation on maturity, maturity is savings done by him through the years by way of paying regular premiums.

10

INSURANCE AND BANKING

Capital formation:

Insurance assuages the businessmen from

security investments. This is done by paying small amount of premium against larger risks and dubiety.

Economic development: Insurance provides an opportunity to

develop to those larger industries which have more risks in their setting up.

Providing protection: The elementary purpose of insurance is to

allow security against future risk, accidents and uncertainty.

Insurance is in reality a protective cover against economic loss, by apportioning the risk with others.

Prevention of loss: Insurance warns individuals and businessmen

to embrace appropriate device to prevent unfortunate aftermaths of risk by observing safety instructions; installation of automatic

sparkler or alarm systems, etc.

Certainty: Insurance is a device, which assists in changing

uncertainty to certainty.

11

INSURANCE AND BANKING

PRINCIPLES:1. The Principle of Utmost Good Faith is a very basic and first primary principle of insurance. According to this principle, the insurance contract must be signed by both parties (i.e. insurer and insured) in an absolute good faith or belief or trust. 2. The principle of insurable interest states that the person getting insured must have insurable interest in the object of insurance. A person has an insurable interest when the physical existence of the insured object gives him some gain but its non-existence will give him a loss. In simple words, the insured person must suffer some financial loss by the damage of the insured object. 3. Indemnity means security, protection and compensation given against damage, loss or injury. According to the principle of indemnity, an insurance contract is signed only for getting protection against unpredicted financial losses arising due to future uncertainties. Insurance contract is not made

12

INSURANCE AND BANKING

for making profit else its sole purpose is to give compensation in case of any damage or loss. In an insurance contract, the amount of compensations paid is in proportion to the incurred losses. The amount of compensations is limited to the amount assured or the actual losses, whichever is less. The compensation must not be less or more than the actual damage. Compensation is not paid if the specified loss does not happen due to a particular reason during a specific time period. Thus, insurance is only for giving protection against losses and not for making profit. However, in case of life insurance, the principle of indemnity does not apply because the value of human life cannot be measured in terms of money. 4. Subrogation means substituting one creditor for another. According to the principle of subrogation, when the insured is compensated for the losses due to damage to his insured property, then the ownership right of such property shifts to the insurer.

13

INSURANCE AND BANKING

This principle is applicable only when the damaged property has any value after the event causing the damage. The insurer can benefit out of subrogation rights only to the extent of the amount he has paid to the insured as compensation.

14

INSURANCE AND BANKING

ECONOMIC GROWTH OF INSURANCE

The period immediately after nationalization affected the business because of lack of experienced and trained staff. In the year 1957, the situation was difficult as the common man was

affected because of the rise in the cost of living index.

Agriculture was also affected by the famine condition. In these circumstances, LICs performance during that period was reasonably good. After this period LIC over the years made commendable progress from a new business of Rs 3.2808 billion. The sum assured are done 0.932 million policies procured in India. During the period of 16 months between 1st September 1956 to 31st December 1957.

15

INSURANCE AND BANKING

LIC had made tremendous progress particularly after 1974-75 the premium income for the first year of policy increased from rs.85.67 crores in 1974-75 to Rs 4071.73 crores in 1998-99 and an annual growth rate of 32 %. The renewal premium has also increased from Rs 411.71 crores in 74-75 to Rs 1771.22 crores in 98-99 with the growth rate of 31%, this indicated that LIC had done a good job LIC progressed to a business of Rs 1927.8 billions the sum assured in 2001-2002. The one year premium received during 2001-2002 reached Rs 99.6 billion from Rs130.6 millions in a 16 month period ending 31th December 1957

16

INSURANCE AND BANKING

INTRODUCTION OF MAX NEWYORK

Max New York Life Insurance Company Ltd. is a joint venture

between Max India Limited, one of India's leading multi-business corporations and New York Life International, the international arm of New York Life. The company has positioned itself on the quality platform. In line with its vision to be the most admired life insurance

company in India, it has developed a strong corporate governance

model based on the values of excellence, honesty, knowledge, caring, integrity and teamwork. Incorporated in 2000, Max New York Life started commercial operation in April 2001. In line with its values of financial

responsibility, Max New York Life has adopted sensible financial practices to ensure safety of policyholder's funds. The Company's paid up capital as on 31st August, 2010 is Rs 1,973crore.

Max

New

York

Life

has

multi-channel

distribution a lot of

spread emphasis

across the country.

The Company places

17

INSURANCE AND BANKING

on four and

its

selection -

process screening, The control model

for

agent

advisors, test, are

which career trained

comprises seminar in-house is the

stages final

psychometric agent advisors

interview.

to ensure optimal first time such a

on quality of has of been put

training. in

This for

place

Rural

marketing

insurance.

Max New York Life offers a suite of flexible products. It now has 21 products covering both life and health insurance and 8 riders that can be to customized choose the to over 800 combinations fits their 7

enabling need.

customers this,

policy offers

that 6

best

Besides

the

company

products

and

riders in group insurance business

18

INSURANCE AND BANKING

Founder Mr. Analjit Singh

Mr. Analjit Singh is the Founder & Chairman of Max India Limited, Chairman of Max New York Life Insurance Company Limited; Max Healthcare Institute Limited and Max Bupa Health Insurance

Company Limited. He has been the driving force behind the Max India Groups sustained growth and success since the mid 80s. A self made entrepreneur, Mr. Analjit Singh has been leading the charge of reinventing and restructuring the Max India Group with a vision to be amongst Indias most admired companies for Service Excellence.

19

INSURANCE AND BANKING

Max India Ltd:

Max India Limited is a multi-business corporate, driven by the spirit of enterprise people and service oriented and focused on businesses. The

Companys vision is to be one of Indias most admired corporate for Service Excellence. Besides max newyork india ltd. Deals in the businesses like: Max

New York Life, Max Healthcare, Max Bupa Health Insurance Limited, Products Max Neeman Medical International, Max Speciality

New York Life LLC:

New York Life Insurance Company is a Fortune 100 company founded in 1845, is the largest mutual life insurance company in the United States and one of the largest life insurers in the world. The mission of New York Life is to maintain its superior 'financial strength', hold on to the highest standards of 'integrity' and display 'humanity' by treating its customers, agents and employees with kindness, consideration and respect.

20

INSURANCE AND BANKING

New York Life is one of the largest and strongest life insurance companies in the world .As a leader in the insurance industry, New York Life continues to bring to its operations new management concepts, advanced technologies, new distribution and training

systems and innovative insurance products. MAX NEWYORK LIFE INSAURANCE: Incorporated in 2000, Max New York Life started commercial ltd.(domestic operation in April company) and 2001. max India life

newyork

(international company) started a new business (max newyork life insurance) in collaboration

21

INSURANCE AND BANKING

PROMOTERS Max New York Life Insurance Company Ltd. is a joint venture between New York Life, a Fortune 100 company and Max India Limited, one of India's leading multi-business corporations. Since its inception in 2000, the organization has progressed and positioned

itself on the quality platform. In line with its vision to be the most admired life insurance company in India, it has developed a strong corporate governance model based on the core values of

excellence, honesty, knowledge, caring, integrity and teamwork. The strategy is to establish itself as a trusted life insurance service provider through a quality approach to business.

22

INSURANCE AND BANKING

FEATURES

First company to provide free look period of 15 days to the customer. This was later made mandatory by the regulator

First company to start toll free line for agent services First and the only life insurance company in India to implement Lean methodology of service excellence in service industry

First

life

insurance

company

in

India

to

provide

various

services to the agents and customers over phone

First Indian life insurance company to start service center at the regional level

First life insurance company in India to receive ISO 9001:2000 certification

First life insurance Company to be awarded CII-EXIM Bank commendation certificate for Strong Commitment to Excel.

23

INSURANCE AND BANKING

24

INSURANCE AND BANKING

PLANS AND POLICIES

Retirement Plans

Let your golden years be the most precious of your life, full of freedom and choice. A time to pursue your hobbies, travel and enjoy the good life. You will never miss your salary cheque or be constrained by rising inflation. Even as you work hard to make a better today, it is up to you to create a superior tomorrow. If you want to sustain your current lifestyle even after you stop working, make that money work for you. Our Retirement Plans will keep you comfortable and content, and let you live the life you deserve.

25

INSURANCE AND BANKING

LIFE PARTNER PLUS PLAN

In your journey through life, you will need to take care of changing needs like asset creation, investing for retirement, childrens

education and marriage and so on. At Max New York Life, we understand your desire to take care of these needs and your financial planning and investment. That is why we have introduced Max New York Lifes Life Partner Plus Plan (Limited Pay

Endowment to Age 75), a life insurance plan that offers you protection for life, cash bonuses, and multiple options to utilize these cash bonuses to meet all your individual requirements.

26

INSURANCE AND BANKING

27

INSURANCE AND BANKING

CHILD PLANS Max New York Life's College Plan,

College education is the most critical juncture of your childs life; its the first time that your child moves out from the sheltered school life into the real world. It is most important that this college education experience is the very best for your child as it will be the defining phase that will shape their future. Therefore it is essential that you start planning for your childs professional education at the earliest, The best time to start planning is during the age group of 0-8 years as it gives you the maximum time period to be able to build a sizeable quantity till your child reaches

college-going age i.e. 18 years.

28

INSURANCE AND BANKING

Max New York Life's Shiksha Plus II,

We understand this desire that every parent has for their child. Therefore, our child plan is designed specifically to ensure that your child not only gets the best of education but also can explore and develop his/her hidden talent.

Max New York Life Shiksha Plus II is a 360 degree child plan that provides for over all development of your child in all the

circumstances.

29

INSURANCE AND BANKING

Max New York Life Line Healthy Family Plus Why Healthy Family

The core of any happy family is a healthy family. However, demanding lifestyles, high stress levels and weakening

environmental conditions are increasing the probability of diseases and as a consequence, treatment for the same. The need of the hour is for a plan that not only takes care of your health, but also takes care of your family. Taking care of this need Max New York Life presents Life Line Healthy Family- the Most comprehensive Health Insurance Plan.

30

INSURANCE AND BANKING

TAX BENEFIT

The average life span of an individual has increased in India due to better health conditions, awareness about ones well being and improved Medical facilities. At the same time, the medical costs of treatment and surgery have increased a lot. It is a well-known fact that one can save tax up to Rs. 1 lakh of the Income Tax Act, 1961 As per section 80D of the Act, a deduction can be claimed by an individual in respect of the medical insurance premium paid up to Rs. 15,000 for himself and his spouse and dependent children. Consider the following example: If any persons salary is 5 lac than if he is taking the policy of 1 lac from insurance company.than that person will get the tax bebefit from the government. I.e SALARY-TAXABLE INCOME-PREMIUM OF INSURANCE POLICY RS 500000-RS100000-135000= RS335000/-

31

INSURANCE AND BANKING

Now after calculations that person has to pay the tax on is rs 33500.and the rest of amount will be exempted.

Future Plans

The global life insurance major is bullish in favour of India over China in its international business plans. The companys vision is to become Indias most admired life insurance company.

32

INSURANCE AND BANKING

Taking advantage of the freedom given to expand, MNYL now proposes to push its business to second-rung towns. MNYL is also planning bancassurance tie-ups for expanding its network. MNYL has projected a capital requirement of over US$ 22 million every year for the next three to four years. The cumulative investment required to grow the business till FY 200708 is to the tune of US$ 133144 million. Of this, the joint venture partners would invest US$ 76.6 million. MNYL plans to raise its stake in MNYL after Budget 2004 announced allowing a hike in foreign partners holdings from 26 per cent to 49 per cent.

33

INSURANCE AND BANKING

WHY ANYONE GO FOR MAX NEW YORK LIFE

Max New York life is the only company in India which is the collaboration of max India ltd and New York LLC. This is the first company to receive ISO certification. The strategy of this company is to be the most admirable life insurance company in India. The functioning of this company is better than the other companys .this Company works according to divisional structure. This company is divided into three departments which ensure smooth functioning and better quality services provided to the customers. This company provides the service as per the needs and

requirements of the customer. The charges are very nominal and provide high quality services.

34

INSURANCE AND BANKING

35

INSURANCE AND BANKING

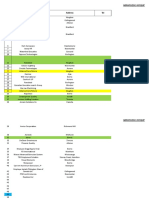

FUNCTIONING OF MAX NEW YORK LIFE In every branch of mnyl there are normally 3 departments Operational departments Sales department Training department

1. Operational department: Operational department of MNYL plays a very important role. In this department, the day to day operation of MNYL is carried on. The working of this department is to login the applied form, checking the required documents, delivering it to the main branch.

2. Sales department: As the name suggest this department is related with the selling process. There are various heads working in these

36

INSURANCE AND BANKING

departments. In the first level there is a branch manager who manages the overall working of Branch.

Second level consists of assistant branch manager who assist the branch manager in managing the functions of the branch.

Third level consists of agency development manager. These adms works for the development of the agents. ADMs helps in solving the problems of agents and guide them for the proper functioning of the firm.

Forth level consists of agent advisers these are the people who directly approach the customers and advice them in

taking the proper polices once the person applies for the policy the insurance agent helps them in submitting documents. the required

37

INSURANCE AND BANKING

3. Training department: In training department there are various trainers giving training to untrained staff which in future act agents and advisor. In every branch there are 2 trainers.

DEPARTMENTS

OPERATION DEPARTMENT

SALES DEPARTMENT

TRAINING DEPARTMENT

COMPUTER OPERATORS

BRANCH MANAGER

TRAINERS

ASSISTANT BRANCH MANAGER

AGENT DEVELOPEMENT MANAGER

AGENT ADVISORS

38

INSURANCE AND BANKING

PROCEDURE FOR TAKING LIFE INSAURANCE

Choice

Proposal Form

Proof Of Age

Medical Examination

Verification Of Proposal Form

Acceptance Of Proposal

Issue Of Policy

Payment Of Premium

39

INSURANCE AND BANKING

PROCEDURE FOR SETTLEMENT OF CLAIM

PROOF OF DEATH

The proof of death has to be presented to LIC it the policy has become due, because to the death of insured. A certificate given by the doctor who has given treatment to the insured before his death or the certificate issued by the municipality cans satisfactory proof of death. Death certificate is out of question in the case of survival of policy holder.

PROOF OF LEGAL TITLE

The person who is claiming the amount of policy has to give the proof of his title. If the nominee is mentioned in the policy, he can claim the amount easily. If such information is not given in the policy, the person has to prove his legal title and has to submit succession certificate to the LIC.

PROOF OF AGE

40

INSURANCE AND BANKING

Proof of age is necessary if the age of the assured was not admitted earlier i.e., at the time of taking out policy. Such certification can be obtained from the municipal authorities easily.

MAKING PAYMENT

If the insurance company is satisfied with all the documentary proofs. The amount of claim will be paid. It is always paid by a crossed cheque. If the policy holder is alive, the claim is settled quickly as limited formalities are required to be completed.

AWARDS

Outlook Money survey ranked MNYL No.1 in Slow, Medium and Quick fund categories

Awarded the Gallup Great Work Place Award 2009 CII Exim Bank Commendation Certificate for Business

Excellence 2008 & 2009

Recognized as a Super brand, 2009 - 2010. Golden Peacock Award for Innovation 2008

41

INSURANCE AND BANKING

Among the top 25 companies to work for in India, according to Business world 2003 Great Workplaces of India

Among the top five most respected insurance companies in India as per Business world 2004 & 2006 survey

Among top 3 in Asia Life Insurance Company of the Year Award 2007 instituted by Asia Insurance Review

Received the Amity Corporate Excellence Award 2007 Max New York Life bags the Asia Insurance Industry

Innovation of the Year Award 2009.

Conclusion

Insurance, today, have become integral part of our society as well as of our nation. Insurance play a vital role in stabilizing the economic activities of the country.

42

INSURANCE AND BANKING

Thus, from above statements we all can conclude that Insurance are very important part our lives as well as for the fast economic growth of every country.

Insurance are in existence since 18th century. We can say that Insurance are as old as our civilization. Insurance today perform various and innumerable functions which has benefited human life. Thus, Insurance are useful in mans economics as well as personal life.

43

INSURANCE AND BANKING

BIBLIOGRAPHY

NEWS PAPERS

1. ECONOMIC TIMES 2. HINDUSTAN TIMES 3. MUMBAI MIRROR

WEB SITES WWW.WIKIPEDIA.COM WWW.MAXNEWYORKLIFE.COM

44

INSURANCE AND BANKING

45

You might also like

- Insurance Chapter IntroductionDocument63 pagesInsurance Chapter IntroductionMadhushreeNo ratings yet

- Account Project Ration AnalyicesDocument36 pagesAccount Project Ration AnalyicesSagar ZineNo ratings yet

- Project On Insurence MajorDocument81 pagesProject On Insurence MajordarshansinghwaraichNo ratings yet

- Banking and Insurance ElementsDocument11 pagesBanking and Insurance ElementsNisarg ShahNo ratings yet

- Insurance Regulatory Environment & Risk ImportanceDocument38 pagesInsurance Regulatory Environment & Risk ImportanceAnuska JayswalNo ratings yet

- Life Insurance Industry in IndiaDocument10 pagesLife Insurance Industry in Indiapriya tiwariNo ratings yet

- A Report On Insurance Industry of NepalDocument7 pagesA Report On Insurance Industry of NepaldeepNo ratings yet

- LIC's mission, vision and objectivesDocument11 pagesLIC's mission, vision and objectivesPradeep Kumar V PradiNo ratings yet

- Consumer Awareness Regarding PNB MetlifeDocument51 pagesConsumer Awareness Regarding PNB MetlifeKirti Jindal100% (1)

- Summer Training Report: in Partial Fulfillment of The Requirements For The Award of The Degree ofDocument74 pagesSummer Training Report: in Partial Fulfillment of The Requirements For The Award of The Degree ofrahul19myNo ratings yet

- Insurance & Risk Management JUNE 2022Document11 pagesInsurance & Risk Management JUNE 2022Rajni KumariNo ratings yet

- Final DraftDocument71 pagesFinal DraftPayal RaghorteNo ratings yet

- Insurance FundamentalsDocument24 pagesInsurance FundamentalsKarthick KumarNo ratings yet

- Executive Summary: The Fact That The India Is The Emerging Market Is Throwing A Lot of CompetitionDocument11 pagesExecutive Summary: The Fact That The India Is The Emerging Market Is Throwing A Lot of CompetitionBibin PoNo ratings yet

- Table & ContentDocument43 pagesTable & Contentsweety coolNo ratings yet

- Analysis of Indian Insurance Industry with Focus on ICICI PrudentialDocument68 pagesAnalysis of Indian Insurance Industry with Focus on ICICI PrudentialNiharika MathurNo ratings yet

- Icici Bank Project ReportDocument68 pagesIcici Bank Project ReportNeeraj PurohitNo ratings yet

- Apollo MunichDocument52 pagesApollo MunichSumit ManglaniNo ratings yet

- Summer Project ReportDocument58 pagesSummer Project ReportRamchandra ChotaliaNo ratings yet

- Aka SH Bang ADocument63 pagesAka SH Bang AakashbangaNo ratings yet

- Hum ADocument119 pagesHum Ajyoti8mishra100% (2)

- UNIT 1 InsuranceDocument9 pagesUNIT 1 InsuranceHarleenNo ratings yet

- Project Report ON: University of MumbaiDocument55 pagesProject Report ON: University of MumbaiNayak SandeshNo ratings yet

- Life Insurance Kotak Mahindra Group Old MutualDocument16 pagesLife Insurance Kotak Mahindra Group Old MutualKanchan khedaskerNo ratings yet

- Unit Iii BoirmDocument58 pagesUnit Iii Boirmmtechvlsitd labNo ratings yet

- LIC Study Objectives and MethodologyDocument60 pagesLIC Study Objectives and MethodologypiudiNo ratings yet

- Rupee Maker ProjectDocument48 pagesRupee Maker ProjectPrince PanwarNo ratings yet

- Life Insurance ExplainedDocument49 pagesLife Insurance ExplainedSumit JoshiNo ratings yet

- Understanding Insurance Industry in IndiaDocument51 pagesUnderstanding Insurance Industry in IndiaAnkur SheelNo ratings yet

- Insurance MGT NotesDocument36 pagesInsurance MGT NotesHONEY AGRAWALNo ratings yet

- Life Insurance in India - 1Document7 pagesLife Insurance in India - 1Himansu S MNo ratings yet

- Chapter 1 - Introduction to Life Insurance ConceptsDocument44 pagesChapter 1 - Introduction to Life Insurance ConceptsmadhuriNo ratings yet

- Market Analysis of Icici Prudential and Other Insurance-Companies (MARKAT)Document68 pagesMarket Analysis of Icici Prudential and Other Insurance-Companies (MARKAT)NationalinstituteDsnrNo ratings yet

- Iom Concept of InsuranceDocument4 pagesIom Concept of Insuranceowuor PeterNo ratings yet

- Advantages of Insurance: Security, Risk Spreading, Capital Formation & MoreDocument6 pagesAdvantages of Insurance: Security, Risk Spreading, Capital Formation & MoreSanthosh KumarNo ratings yet

- Meaning of InsuranceDocument7 pagesMeaning of InsuranceSannidhi MukeshNo ratings yet

- Insurance Sales Associate PDFDocument97 pagesInsurance Sales Associate PDFIrfan MasoodiNo ratings yet

- 1.1 Review of Insurance Company in NepalDocument25 pages1.1 Review of Insurance Company in NepalKumar Dhungel100% (2)

- Insurance AssgnmntDocument25 pagesInsurance AssgnmntTahsin SanjidaNo ratings yet

- Executive SummaryDocument25 pagesExecutive SummaryRitika MahenNo ratings yet

- Privatistion of Insurance Final DraftDocument61 pagesPrivatistion of Insurance Final DraftPankaj VyasNo ratings yet

- 3-Financial Services - Non Banking Products-Part 2Document47 pages3-Financial Services - Non Banking Products-Part 2Kirti GiyamalaniNo ratings yet

- Life Insurance ProjectDocument11 pagesLife Insurance ProjectDarshana MathurNo ratings yet

- Introduction to Insurance PrefaceDocument55 pagesIntroduction to Insurance PrefaceShivansh OhriNo ratings yet

- Consumer Perceptions and Buying Behaviour Towards Life InsuranceDocument28 pagesConsumer Perceptions and Buying Behaviour Towards Life InsuranceMayank MahajanNo ratings yet

- Banking and InsuranceDocument20 pagesBanking and Insurancebeena antuNo ratings yet

- Summary Sheet - Insurance Lyst7304Document19 pagesSummary Sheet - Insurance Lyst7304smriti kumariNo ratings yet

- Summer Internship: Project ReportDocument22 pagesSummer Internship: Project ReportVaibhav GuptaNo ratings yet

- Child Insurance PlanDocument72 pagesChild Insurance PlanAnvesh Pulishetty -BNo ratings yet

- Project On Insurance - Business Studies Project Class 11Document1 pageProject On Insurance - Business Studies Project Class 11chawariyasameer55No ratings yet

- Insurance Project 1172407) VarDocument54 pagesInsurance Project 1172407) VarVarinder SinghNo ratings yet

- Insurance Principles, Types and Industry in IndiaDocument10 pagesInsurance Principles, Types and Industry in IndiaAroop PalNo ratings yet

- State Life InsuraceDocument167 pagesState Life Insuracetyrose88No ratings yet

- Introduction Finacila ManagementDocument48 pagesIntroduction Finacila ManagementSagar ZineNo ratings yet

- Insurance Company in BD Term PaperDocument19 pagesInsurance Company in BD Term PaperHabibur RahmanNo ratings yet

- Functions of InsuranceDocument26 pagesFunctions of InsurancenikschopraNo ratings yet

- Introduction To Insurance IndustryDocument38 pagesIntroduction To Insurance Industryakshata_mudur4726No ratings yet

- CaDocument37 pagesCaKunal NagNo ratings yet

- Solar Energy Science ProjectsDocument16 pagesSolar Energy Science ProjectsalemmarNo ratings yet

- WaterDocument25 pagesWaterPulkit AgarwalNo ratings yet

- History of International TradeDocument14 pagesHistory of International TradeKunal NagNo ratings yet

- Ajanta Final EditingDocument34 pagesAjanta Final EditingKunal NagNo ratings yet

- CaDocument37 pagesCaKunal NagNo ratings yet

- Import DocumentsDocument17 pagesImport DocumentsKunal NagNo ratings yet

- Recession in U.S.ADocument27 pagesRecession in U.S.AKunal NagNo ratings yet

- The Crystallization of The City:: The First Urban TransformationDocument27 pagesThe Crystallization of The City:: The First Urban TransformationCzari Muñoz100% (1)

- Application Log Sheet - TanvirDocument22 pagesApplication Log Sheet - TanvirlitonNo ratings yet

- Puzzles and RiddlesDocument4 pagesPuzzles and RiddlesPercy Jason BustamanteNo ratings yet

- Discrete Choice Models: William Greene Stern School of Business New York UniversityDocument24 pagesDiscrete Choice Models: William Greene Stern School of Business New York Universitymmorvin89No ratings yet

- Solutions Provider: Imagepilot Aero DRDocument8 pagesSolutions Provider: Imagepilot Aero DRTaha ObedNo ratings yet

- Grades 1 To 12 Daily Lesson Log: Mu2Tx-Ivd-F-2 A2Pr-Ivd Pe2Pf-Iv-Ah-2 H2Is-Ivj-19Document7 pagesGrades 1 To 12 Daily Lesson Log: Mu2Tx-Ivd-F-2 A2Pr-Ivd Pe2Pf-Iv-Ah-2 H2Is-Ivj-19Chris Abaniel TorresNo ratings yet

- Certi - Audited by Another AuditorDocument10 pagesCerti - Audited by Another AuditorKathNo ratings yet

- Eni Oso S 68Document2 pagesEni Oso S 68gourave daipuriaNo ratings yet

- Nike VS AdidasDocument67 pagesNike VS AdidasNitesh Agrawal100% (2)

- Lab Manual 11 Infrared SpectrosDocument5 pagesLab Manual 11 Infrared SpectrosLuca Selva CampobassoNo ratings yet

- Ohe Mast Fixing Arrangement On Pier Cap at Bridge No:46 For New Proposed Double LineDocument1 pageOhe Mast Fixing Arrangement On Pier Cap at Bridge No:46 For New Proposed Double LineRVNLPKG6B VBL-GTLMNo ratings yet

- Coaching For PerformanceDocument23 pagesCoaching For PerformanceKonie LappinNo ratings yet

- Catalogo PrincipalDocument89 pagesCatalogo PrincipalJavierfox98100% (1)

- Netflix PrivacyDocument9 pagesNetflix PrivacyAdam SypniewskiNo ratings yet

- Specific TL ActivitiesDocument2 pagesSpecific TL ActivitiesTeresa Pajarón LacaveNo ratings yet

- JD785A CellAdvisor Base Station Analyzer Spectrum, Cable & Antenna, Power MeterDocument16 pagesJD785A CellAdvisor Base Station Analyzer Spectrum, Cable & Antenna, Power MeterYousuf_AlqeisiNo ratings yet

- BS (AI DS CySec Curriculum 2020)Document97 pagesBS (AI DS CySec Curriculum 2020)Kinza ShakeelNo ratings yet

- Earth Science Quiz on Seasons, Movements and StructureDocument4 pagesEarth Science Quiz on Seasons, Movements and StructureRBS RISSNo ratings yet

- Mac 113Document93 pagesMac 113Chidera DanielNo ratings yet

- Prefabrication & Precasting: Systems, Components, AdvantagesDocument47 pagesPrefabrication & Precasting: Systems, Components, AdvantagesDurgesh SinghNo ratings yet

- Guide to Writing Effective MemorandumsDocument13 pagesGuide to Writing Effective MemorandumsHaseeb RazaNo ratings yet

- Edexcel Coursework Authentication FormDocument6 pagesEdexcel Coursework Authentication Formvepybakek1t3100% (2)

- Technical Specification: Iso/Iec Ts 22237-4Document9 pagesTechnical Specification: Iso/Iec Ts 22237-4joaferaNo ratings yet

- Manual de Partes Compresor SANDEMDocument25 pagesManual de Partes Compresor SANDEMLuis Panti EkNo ratings yet

- Diver Tech Manual PDFDocument246 pagesDiver Tech Manual PDFChowdhury FatemaNo ratings yet

- HMWSSB Presentation PDFDocument52 pagesHMWSSB Presentation PDFJagadeesh PrakashNo ratings yet

- 5v0-21.19.prepaway - Premium.exam.60q: Number: 5V0-21.19 Passing Score: 800 Time Limit: 120 Min File Version: 1.1Document23 pages5v0-21.19.prepaway - Premium.exam.60q: Number: 5V0-21.19 Passing Score: 800 Time Limit: 120 Min File Version: 1.1Chaima MedhioubNo ratings yet

- Dr. P. K. Jain's PublicationsDocument8 pagesDr. P. K. Jain's PublicationsSeshanNo ratings yet

- Blood Pressure Levels For Boys by Age and Height PercentileDocument4 pagesBlood Pressure Levels For Boys by Age and Height PercentileNuzla EmiraNo ratings yet

- Marketing With Your Unique BlueprintDocument41 pagesMarketing With Your Unique Blueprintjorge antezana75% (8)