Professional Documents

Culture Documents

Price Theory Study Questions Set#4

Uploaded by

Daniel Andrew SunOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Price Theory Study Questions Set#4

Uploaded by

Daniel Andrew SunCopyright:

Available Formats

Price Theory Study Questions set#4 MONOPOLY AND RELATED DISCUSSIONS 1.

Consider the following inverse demand curve faced by a monopolist: P= 100 -Q. a. Find the marginal revenue curve for the monopolist. b. At what quantity is total revenue maximized? c. If MC and AC are constant at $20, then what is the profit-maximizing output for a monopoly? What is the monopoly price?monopoly profit? d. How would your answer to part (c) change if a $10 per unit tax was imposed on the monopolist? Is the monopolist able to pass on all of the tax to consumers? Explain. e. What would be the P and Q in a competitive industry? f. Find consumer and producer surplus for a competitive industry and a monopoly. How do they compare? 2. True or false, explain. a. A monopolist can sell all that it wants at whatever price it wants. b. A monopolist necessarily makes a positive economic profit. c. The quantity at which TR is maximized is greater than the quantity at which total profit is maximized. d. a change in fixed costs does not change the quantity at which monopoly profit is maximized in the short run. e. A operates on the inelastic segment of its demand curve. (Use graph to explain.) 3. A movie studio pays its star actors 10% of total revenue. Who has the incentive to charge the highest price for a movie ticket---the studio or the stars? Explain. 4. A price-discriminating monopolist faces the following inverse demand functions: In Market One it is P1 = 20-Q1 where P1 is the price charged in Market 1 and Q1 is the quantity demanded in Market one. In Market Two it is P2 = 15-1.5Q2 where P2 is the price charged in Market 2 and Q2 is the quantity demanded in Market Two. Marginal cost is constant at $5. Find the profit-maximizing quantity and price charged in each market. Calculate profit in each market and joint profit. What would this firms price, quantity and profit be if it were constrained to charge the same price to all consumers? Show this outcome on a graph. 5. question deleted 6. Consider the following inverse demand function: P = 10 Q. Marginal cost is constant at $2. a. Find the TR and MR functions under perfect-price discrimination. What is profit-maximizing quantity? What is profit? b. The perfect-price discrimination outcome can be attained by an all-or-nothing packaging scheme. Explain how. 7. question deleted 8. a. What conditions make price discrimination possible? b. A monopoly can sell its good in the US, where the elasticity of demand is -2, and in South Korea, where the elasticity of demand is -4. Its marginal cost is $10. At what price does the monopoly sell its good in each country if resales are not possible?

ANSWERS 1. a. First, multiply each side of the inverse demand function by Q. This gives us the TR function: TR= PQ = 100Q - Q2. Next, take the derivative with respect to Q to get the MR function: dTR/dQ = MR = 100-2Q. (or you can use the rule that for any linear demand curve P = a bQ the marginal revenue curve is MR = a 2bQ. ) b. TR is maximized when MR equals zero. Therefore, set the MR function equal to zero and solve for Q: MR = 100-2Q = 0. This gives us Q = 50.

c. Set MR equal to MC and solve for Q: 100-2Q = 20 which gives us Q = 40. To find price, plug Q=40 into the inverse demand function and solve for P. P = 100-40= $60. Profit= (P-AC)(Q)=(60-20)(40)= $1,600. d. MC = $20 + excise tax = $30. Follow the same steps as in part (c ) to get: Q=35,P=$65, and profit of $1,225. No, the monopolist is not able to pass on ALL of the tax. Price increases by $5 which is less than the $10/unit tax. e. In a competitive economy, P = MC (that is, competitive output occurs where the MC curve crosses the demand curve). To find, competitive quantity, set the inverse demand function equal to MC and solve for Q. So 100-Q = 20 which gives us Q = 80. P =MC = 20. f. Competitive Industry Monopoly Change Consumer Surplus 0.5(100-20)(80)=$3,200 0.5(100-60)(40)=$800 -$2,400 Producer Surplus 0 (60-20)(40)=$1,600 +$1,600 Social Total $3,200 $2,400 -$800 Monopoly leads to a deadweight loss of $800. 2a. False. A monopolist faces a downward-slopping demand curve. Hence, an increase in price means a drop in quantity sold. 2b. False. If the short-run AC curve lies everywhere above the demand curve, then the monopolist will incur losses. (NOTE: If the AC curve lies everywhere above the demand curve, the monopolist may still be able to make a positive profit by engaging in perfect-price discrimination). 2c. This is true as long as MC is positive. Profits are maximized at the quantity where MR=MC, and if MC is greater than zero, then so must MR>0. On the other hand, TR is maximized at the quantity where MR=0. This quantity is necessarily greater than the profit-maximizing quantity (as long as MC>0). 2d. True. a change in fixed costs does not change MC and therefore does not change the Q at which MR equals MC. 2e. False. A monopolist operates on the elastic segment ( e >1) of its demand curve. The elastic segment of its demand curve corresponds to MR > 0, and since profits are maximized at MR = MC and MC > 0 it follows that MR > 0 at the quantity the monopolist produces. If the monopolist was operating in the region of MR < 0 (that is, where e < 1), then it could increase TR by raising price. As it raises price, quantity demanded falls and therefore TC falls (firm is producing fewer units). With TR rising and TC falling then profit must be rising. 3. The movie stars would want to maximize TR since their payments equal 0.1TR, whereas the studio desires to maximize profit. The quantity at which TR is maximized is greater than the quantity at which profit is maximized (see 2c), and therefore the price would be lower at this TR-maximizing Q. 4. The firm maximizes profit by producing where MR =MC in EACH market. First, find the MR function for each market: TR1=20Q1-Q12 which gives us MR1 = 20-2Q1. For market two: TR2=15Q2-1.5Q22 which gives us MR2 = 15-3Q2. Second, set MR equal to MC and solve for quantities. Market One: 20-2Q1 = 5 which gives us Q1 = 7.5, and Market Two: 15-3Q2 = 5, which gives us Q2= 3.33. Third, plugging these quantities into the demand function gives us prices. P1 = 20-7.5 = $12.5 and P2 = 15-1.5(3.33)= $10. 1= (12.5-5)(7.5) = $56.25. 2=(10-5)(3.33) = $16.67. joint = $56.25+$16.67=$72.92. First, we need to find the market demand curve by horizontally adding the individual demand curves. To do this we must solve for quantity for each buyer: Q1=20-P and Q2 = 10-2/3P. Next, Q = Q1+ Q2 =(20-P)+(10-2/3P)=30-(5/3)P. After doing this, we re-solve for P so that P = 18-(3/5)Q. This allows us to write the market MR equation as MR = 18-(6/5)Q. (NOTE: Given the constraint that the price must be the same for both groups of buyers, you CANNOT get the market MR curve be horizontally summing the individual MR curvesdoing this implicitly assumes that the MR in each market will be the same at the profit-maximizing solution. But this would not be true if the price is the same in each market. That is why you must first derive the market demand curve and then get the MR curve from that.) Second, set MR = MC and solve for Q. 18-(6/5)Q=5, and so Q 10.833. Third, Plug Q = 10.833 into market demand curve to get price. P =18-(3/5)(10.833) $11.50. Fourth, find profit. Profit = (11.50-5)(10.833) = $70.42. 5. answer deleted

6.a. Under perfect price discrimination, total revenue equals the entire under the demand curve up to the quantity sold, so TR = 10-Q dQ = 10Q 0.5Q2 . MR = dTR/dQ = 10 Q. Setting MR = MC 10 Q = 2, or Q =8. Profit is TR TC = 10(8) 0.5(8)2 (2)(8) = $32. b. Require the consumer to purchase the good in a package of 8 units or not at all. The all-or-nothing price equals average revenue at a quantity of 8 units AR = 10 0.5Q = 10- 0.5(8) = $6. So the price of a package of 8 units is $6*8= $48. Profit = $48 - $16 = $32. 7. answer deleted 8. a. First, the firm must have some degree of market power, b. Resale of the good must be difficult, and c. The firm must be able to identify (or the consumers have to implicitly identify themselves) the different groups of buyers that it wants to price discriminate against. b. PUS = MC/[1+ (1/eUS)] = $10/[0.5] = $20 and PSK = $10/[0.80] = $13.33 $/unit 2e. With MC > 0, then MR>0 by profit maximization (MR =MC). absolute value of e > 1 e = 1 e < 1 D MR Quantity

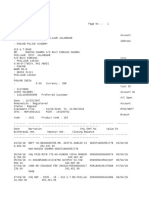

Question 4 :Same price to all consumers. $20 P=20-Q (for P>$15) $15 P=18-(3/5)Q (for P<$15) $12 P=$11.50 Dmkt. $10 $5 MRmkt MR=18-(6/5)Q MC

10.833

Note: Because there is a kink in the market demand curve, there will be a discontinuity in the market MR curve.

$ per unit 10

Question 6. Perfect Price Discrimination

Pall-or-nothing = $6

$2 D = MR 8

MC AR Q

You might also like

- Mathematical Formulas for Economics and Business: A Simple IntroductionFrom EverandMathematical Formulas for Economics and Business: A Simple IntroductionRating: 4 out of 5 stars4/5 (4)

- Economics 370 Microeconomic Theory Problem Set 6 Answer KeyDocument3 pagesEconomics 370 Microeconomic Theory Problem Set 6 Answer KeyHM TohaNo ratings yet

- End-Of-Chapter Answers Chapter 10 PDFDocument13 pagesEnd-Of-Chapter Answers Chapter 10 PDFSiphoNo ratings yet

- Solution - Numericals Market Structure PDFDocument4 pagesSolution - Numericals Market Structure PDFpiyush kumarNo ratings yet

- Solution-BECO575-Worksheet 3 (8 And10 - Market Structures) PDFDocument10 pagesSolution-BECO575-Worksheet 3 (8 And10 - Market Structures) PDFSara HalabiNo ratings yet

- q1222 EconnnDocument6 pagesq1222 EconnnSina TempioraryNo ratings yet

- Chapter 10 Monopoly and MonopsonyDocument13 pagesChapter 10 Monopoly and MonopsonynebiyuNo ratings yet

- Chapter 10: Market Power: Monopoly and Monopsony: P MC 1 + 1 EDocument5 pagesChapter 10: Market Power: Monopoly and Monopsony: P MC 1 + 1 EKalyan SaikiaNo ratings yet

- Managerial Economics Michael Baye Chapter 8 AnswersDocument6 pagesManagerial Economics Michael Baye Chapter 8 Answersneeebbbsy8980% (10)

- Extra Session-Numerical Problems With CalculusDocument42 pagesExtra Session-Numerical Problems With CalculusAnit DattaNo ratings yet

- Profit Maximization: B-Pure MonopolyDocument11 pagesProfit Maximization: B-Pure MonopolyChadi AboukrrroumNo ratings yet

- Chapter 8: Answers To Questions and Problems: Managerial Economics and Business Strategy, 5eDocument5 pagesChapter 8: Answers To Questions and Problems: Managerial Economics and Business Strategy, 5eadityaintouch100% (1)

- AAEC 3315 Agricultural Price Theory: Price and Output Under MonopolyDocument25 pagesAAEC 3315 Agricultural Price Theory: Price and Output Under MonopolyRakesh KumarNo ratings yet

- T Note 8 MonopolyDocument7 pagesT Note 8 MonopolyBella NovitasariNo ratings yet

- Tutorial 8 - SchemeDocument7 pagesTutorial 8 - SchemeTeo ShengNo ratings yet

- Solution Manual Chap 8Document5 pagesSolution Manual Chap 8sshahar2No ratings yet

- Managerial Economics Assignment Biruk TesfaDocument13 pagesManagerial Economics Assignment Biruk TesfaBirukee ManNo ratings yet

- Remedial Class Qs 2Document4 pagesRemedial Class Qs 2Shekhar SinghNo ratings yet

- HUL 212 Problem Set 2 2018Document2 pagesHUL 212 Problem Set 2 2018Kshitij BansalNo ratings yet

- Practice Questions - Session 11-12Document5 pagesPractice Questions - Session 11-12Akansha Singh100% (1)

- Assignment 8Document8 pagesAssignment 8eric stevanusNo ratings yet

- Engineering Economics Monopoly NumericsDocument53 pagesEngineering Economics Monopoly Numericsalisha27No ratings yet

- Monopoly MarketDocument29 pagesMonopoly MarketSanjay .. SanjuNo ratings yet

- Homework 6 AnswersDocument6 pagesHomework 6 AnswersSophia SeoNo ratings yet

- Microecon Cheat Sheet - FinalDocument3 pagesMicroecon Cheat Sheet - FinalDananana100100% (3)

- NAME - : BRIEFLY Explain How You Would Solve It. Keep The Explanation Brief and To TheDocument5 pagesNAME - : BRIEFLY Explain How You Would Solve It. Keep The Explanation Brief and To TheAlicia KimNo ratings yet

- Answers To Summer 2010 Perfect Competition QuestionsDocument7 pagesAnswers To Summer 2010 Perfect Competition QuestionsNikhil Darak100% (1)

- Econ 2001 Midsemester Marathon: EquationsDocument3 pagesEcon 2001 Midsemester Marathon: Equationssandrae brownNo ratings yet

- Imperfectly Competitive Markets: Imperfect Heterogenous Not All Price TakersDocument19 pagesImperfectly Competitive Markets: Imperfect Heterogenous Not All Price TakersRomit BanerjeeNo ratings yet

- ADDITIONAL EXERCISES - PS5.text PDFDocument10 pagesADDITIONAL EXERCISES - PS5.text PDFfedericodtNo ratings yet

- BECO575-Extra Problems 3 (CH 7, 8,9&10 - Market Structures)Document12 pagesBECO575-Extra Problems 3 (CH 7, 8,9&10 - Market Structures)Jamal Ezzi100% (1)

- Class 7 Monopoly and MonopsonyDocument10 pagesClass 7 Monopoly and MonopsonyNaida Diamond ČajićNo ratings yet

- Eco 301 QuestionsDocument16 pagesEco 301 QuestionsSamuel Ato-MensahNo ratings yet

- Topic 8 - Firms in Competitive Markets PDFDocument32 pagesTopic 8 - Firms in Competitive Markets PDF郑伟权No ratings yet

- BECO575-Worksheet 3 (CH 7, 8 And10 - Market Structures)Document11 pagesBECO575-Worksheet 3 (CH 7, 8 And10 - Market Structures)Sara HalabiNo ratings yet

- Chapter Onemonopoly MonopolyDocument16 pagesChapter Onemonopoly Monopolyvillaarbaminch0% (1)

- Econ203 Lab 081Document36 pagesEcon203 Lab 081api-235832666No ratings yet

- Workshop 4 Perfect Competition Solutions-2Document15 pagesWorkshop 4 Perfect Competition Solutions-2GiovanniNico33No ratings yet

- EconDocument4 pagesEconKianna SabalaNo ratings yet

- Profit MaximiisationDocument28 pagesProfit MaximiisationnagamuniNo ratings yet

- ECONOMICS Problem SetDocument8 pagesECONOMICS Problem SetnbvnvnvNo ratings yet

- Monopoly: I. What Is A Monopoly Market?Document6 pagesMonopoly: I. What Is A Monopoly Market?Asaa mjakaNo ratings yet

- ME (2023) Answer Keys (Problem Set-8) .Document8 pagesME (2023) Answer Keys (Problem Set-8) .p23vakulsNo ratings yet

- Problem Set 7Document1 pageProblem Set 7Shubham VishwakarmaNo ratings yet

- Optimal Decisions Using Marginal AnalysisDocument9 pagesOptimal Decisions Using Marginal AnalysisMsKhan0078No ratings yet

- MS 602 - Topic 6 - Revision QuestionsDocument6 pagesMS 602 - Topic 6 - Revision QuestionsPETRONo ratings yet

- Block 7 Monopoly Lecture TutorialDocument24 pagesBlock 7 Monopoly Lecture Tutorialshakti preeyaNo ratings yet

- Micro II RVUDocument35 pagesMicro II RVUhailu abera haileNo ratings yet

- Answerstosummer2010perfectcompetitionquestions PDFDocument7 pagesAnswerstosummer2010perfectcompetitionquestions PDFMohammad Javed QuraishiNo ratings yet

- Week 2 SolutionsDocument6 pagesWeek 2 SolutionsAnton BochkovNo ratings yet

- Microeconomics SampleDocument4 pagesMicroeconomics SampleSaumyaKumarGautamNo ratings yet

- CH 10Document21 pagesCH 10Shomu BanerjeeNo ratings yet

- Types of Market StructureDocument16 pagesTypes of Market StructureCatarina CoelhoNo ratings yet

- Micro Ch14 PresentationDocument36 pagesMicro Ch14 PresentationGayle AbayaNo ratings yet

- Microeconomics Exam 3 Practice - Chapter 10 16 18Document19 pagesMicroeconomics Exam 3 Practice - Chapter 10 16 18Love Rabbyt100% (1)

- Homework 8: Monopolistic Competition/Oligopoly (To Be Handed in On Thursday 15Document2 pagesHomework 8: Monopolistic Competition/Oligopoly (To Be Handed in On Thursday 15anirbanmbeNo ratings yet

- Managerial Economics and Business Strategy 8th Edition Baye Solutions ManualDocument6 pagesManagerial Economics and Business Strategy 8th Edition Baye Solutions Manualoutscoutumbellar.2e8na100% (27)

- Chapter 6 Eco120Document32 pagesChapter 6 Eco120Alyaa ZfrhNo ratings yet

- The Process of Capitalist Production as a Whole (Capital Vol. III)From EverandThe Process of Capitalist Production as a Whole (Capital Vol. III)No ratings yet

- HW3Document4 pagesHW3Daniel Andrew SunNo ratings yet

- CS10 TA Syllabus - MondaysDocument2 pagesCS10 TA Syllabus - MondaysDaniel Andrew SunNo ratings yet

- Solutions CH 15Document14 pagesSolutions CH 15Daniel Andrew SunNo ratings yet

- Math ReviewDocument8 pagesMath ReviewDaniel Andrew SunNo ratings yet

- LinalgDocument6 pagesLinalgDaniel Andrew SunNo ratings yet

- Midterm PracticeDocument4 pagesMidterm PracticeDaniel Andrew SunNo ratings yet

- Wind Song Kotaro OshioDocument3 pagesWind Song Kotaro Oshiodcde2004100% (1)

- The Venture Capital Funds in India 11Document15 pagesThe Venture Capital Funds in India 11SanjayBhatia100% (1)

- Gisella Cindy 115180047 JADocument32 pagesGisella Cindy 115180047 JAYuyun AnitaNo ratings yet

- Tan VS CirDocument3 pagesTan VS CirJani MisterioNo ratings yet

- The Inland Water Transport of Bangladesh and I2Document3 pagesThe Inland Water Transport of Bangladesh and I2Syed Mubashir Ali H ShahNo ratings yet

- Retail Cloud Service 2613359Document128 pagesRetail Cloud Service 2613359AryanNo ratings yet

- CFA二级 财务报表 习题 PDFDocument272 pagesCFA二级 财务报表 习题 PDFNGOC NHINo ratings yet

- Rich Dad, Poor Dad Summary at WikiSummaries, Free Book SummariesDocument12 pagesRich Dad, Poor Dad Summary at WikiSummaries, Free Book SummariesKristian100% (1)

- Type YZ - FLO - 251123Document5 pagesType YZ - FLO - 251123Oky Arnol SunjayaNo ratings yet

- GPNR 2019-20 Notice and Directors ReportDocument9 pagesGPNR 2019-20 Notice and Directors ReportChethanNo ratings yet

- Social Security CalculatorDocument20 pagesSocial Security CalculatorHamood HabibiNo ratings yet

- NAICS 611430 - Professional and Management Development TrainingDocument5 pagesNAICS 611430 - Professional and Management Development Trainingaarr7qdgreNo ratings yet

- Dodla Dairy Limited: #8-2-293/82/A, Plot No.270-Q, Road No.10-C, Jubilee Hills Hyderabad-500033Document1 pageDodla Dairy Limited: #8-2-293/82/A, Plot No.270-Q, Road No.10-C, Jubilee Hills Hyderabad-500033yamanura hNo ratings yet

- Beyond Borders Global Biotechnology Report 2011Document104 pagesBeyond Borders Global Biotechnology Report 2011asri.isbahaniNo ratings yet

- MOA and AOA MSDocument2 pagesMOA and AOA MSMALAVIKA SINGHNo ratings yet

- PDCS Minor Project BBA III Sem Morning Evening Final 1Document38 pagesPDCS Minor Project BBA III Sem Morning Evening Final 1ANKIT MAANNo ratings yet

- Weekly Learning Activity Sheet Solomon P. Lozada National High SchoolDocument15 pagesWeekly Learning Activity Sheet Solomon P. Lozada National High SchoolRutchelNo ratings yet

- Accounting Activity 4Document2 pagesAccounting Activity 4Audrey Janae SorianoNo ratings yet

- Impact 2020 Agenda-C667Document3 pagesImpact 2020 Agenda-C667Edwards TranNo ratings yet

- Our Plan For Prosperity - Excerpts From The PPP/C Manifesto 2020-2025Document8 pagesOur Plan For Prosperity - Excerpts From The PPP/C Manifesto 2020-2025People's Progressive Party86% (14)

- Madfund NotesDocument14 pagesMadfund NotesJoshua KhoNo ratings yet

- Yenieli CVDocument2 pagesYenieli CVumNo ratings yet

- Why Public Policies Fail in PakistanDocument5 pagesWhy Public Policies Fail in PakistanbenishNo ratings yet

- Constantinides 2006Document33 pagesConstantinides 2006Cristian ReyesNo ratings yet

- Enron Company ScandalDocument16 pagesEnron Company ScandalAbaynesh ShiferawNo ratings yet

- CRM DimensionsDocument12 pagesCRM DimensionsetdboubidiNo ratings yet

- 1538139921616Document6 pages1538139921616Hena SharmaNo ratings yet

- Cost Accounting, 14e, Chapter 4 SolutionsDocument39 pagesCost Accounting, 14e, Chapter 4 Solutionsmisterwaterr80% (15)

- Tutorial AnswerDocument14 pagesTutorial AnswerJia Mun LewNo ratings yet

- 10 Axioms of FinManDocument1 page10 Axioms of FinManNylan NylanNo ratings yet

- BCM 2104 - Intermediate Accounting I - October 2013Document12 pagesBCM 2104 - Intermediate Accounting I - October 2013Behind SeriesNo ratings yet