Professional Documents

Culture Documents

Kotak Mahindra

Uploaded by

FarhanOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Kotak Mahindra

Uploaded by

FarhanCopyright:

Available Formats

Kotak Mahindra Life Insurance Ltd.

1.1 COMPANY PROFILE

NAME OF THE COMPANY

KOTAK MAHENDRA AND OLD MUTUAL LIFE INSURANCE

ADDRESS OF COMPANY

5TH FLOOR, REMBRANDT BUILDING, OPP ASSOCIATED PETROL PUMP, C.G.ROAD, ELLISBRIDGE, AHMEDABAD - 380 006.

PHONE NO.

(079) 66315000-4

FAX

(079) 66315009

College of Computer and Management Studies, Vadu.

Kotak Mahindra Life Insurance Ltd.

1.2 LIST OF THE DIRECTORS

Uday Kotak Hasan Askari Gaurang Shah Shivaji Dam Paul Hanratty Bryce Johns Dipak Gupta Pallavi Shroff S. S. Thakur Vineet Nayyar Chairman Vice-Chairman Managing Director Independent Director Additional Director Alternate Director to Hasan Askari Director Independent Director Independent Director Independent Director

College of Computer and Management Studies, Vadu.

Kotak Mahindra Life Insurance Ltd.

1.3 MANAGEMENT TEAM

Mr. Gaurang Shah (Managing Director)

Mr. Gaurang Shah is the Managing Director of Kotak Mahindra Old Mutual Life Insurance Limited. Mr. Gaurang Shah is a Chartered Accountant and a Cost and Works Accountant. He has also done his Company Secretary ship from the Institute of Company Secretaries of India. Mr. Gaurang Shah has been with the Kotak Group for the past eight years where he has held different positions of great responsibility and juggled multiple tasks effectively. His cumulative experience, primarily in financial services, stands at over 21 years, several of those in building the retail finance business. At Kotak Life Insurance, Mr. Shah will focus on developing new lines of businesses and leveraging the company's existing competencies and network to steer Kotak Life Insurance on its ongoing growth path with even greater thrust. Mr. Shah has a commendable expertise in managing a large number of employees. Mr. Shah has been previously associated with Kotak Mahindra Primus since its inception and has contributed towards its growth to become a Rs.2000 Cr plus business. Before coming to Kotak Life Insurance, Gaurang Shah was Group Head of Retail Assets for Kotak Mahindra Bank. The Retail Assets include commercial vehicles, personal loans, structured products, car loans and loans against shares.

College of Computer and Management Studies, Vadu.

Kotak Mahindra Life Insurance Ltd. Mr. Pankaj Desai (Executive Director, Sales & Distribution)

As the Executive Director at Kotak Life Insurance, Mr. Pankaj Desai is responsible for Sales, Training, Distribution and Channel Marketing. A Chartered Accountant by qualification, Pankaj comes with a very rich and diverse experience in the Banking and Finance sectors. Pankaj joined the Kotak Group in 1999 as Vice President Kotak Mahindra Finance Ltd. and since then has juggled many responsibilities within the Group. Prior to joining Kotak Life Insurance, he was heading the Retail Assets business at Kotak Mahindra Bank Ltd. where he was responsible for verticals like Car Finance, Personal Loans, Home Finance and Business Banking. Mr. Desai is passionate about reading and traveling.

College of Computer and Management Studies, Vadu.

Kotak Mahindra Life Insurance Ltd.

Mr. G Murlidhar (Chief Financial Officer)

Mr. Murlidhar is a Chief Financial Officer and Company Secretary of Kotak Life Insurance. Mr. Murlidhar is an associate member of the Institute of Chartered Accountants of India, an associate member of the Institute Of Company Secretaries of India, and graduate member of the Institute of Cost & Works Accountants of India. Mr. Murlidhar possesses over 20year work experience and has earlier worked with National Dairy Development Board (NDDB), MDS Switchgear Limited and Nicholas Piramal India Limited and Ion Exchange Ltd. Prior to Kotak Life Insurance; he held the position of VP-Finance at Gujarat Glass Ltd. As Chief Financial Officer at Kotak Life Insurance, he oversees all aspects of Finance including Operations, Regulatory, Internal Control, Finance, Accounts and Treasury.

College of Computer and Management Studies, Vadu.

Kotak Mahindra Life Insurance Ltd.

1.4 HISTORY

Almost 4,500 years ago, in the ancient land of Babylonia, traders used to bear risk of the caravan trade by giving loans that had to be later repaid with interest when the goods arrived safely. In 2100 BC, the Code of Hammurabi granted legal status to the practice. That, perhaps, was how insurance made its beginning. Life insurance had its origins in ancient Rome, where citizens formed burial clubs that would meet the funeral expenses of its members as well as help survivors by making some payments. As European civilization progressed, its social institutions and welfare practices also got more and more refined. With the discovery of new lands, sea routes and the consequent growth in trade, medieval guilds took it upon themselves to protect their member traders from loss on account of fire, shipwrecks and the like. Since most of the trade took place by sea, there was also the fear of pirates. So these guilds even offered ransom for members held captive by pirates. Burial expenses and support in times of sickness and poverty were other services offered. Essentially, all these revolved around the concept of insurance or risk coverage. That's how old these concepts are, really. In 1347, in Genoa, European maritime nations entered into the earliest known insurance contract and decided to accept marine insurance as a practice.

The first step...

College of Computer and Management Studies, Vadu. 6

Kotak Mahindra Life Insurance Ltd.

Insurance as we know it today owes its existence to 17th century England. In fact, it began taking shape in 1688 at a rather interesting place called Lloyd's Coffee House in London, where merchants, ship-owners and underwriters met to discuss and transact business. By the end of the 18th century, Lloyd's had brewed enough business to become one of the first modern insurance companies.

Insurance and Myth...

Back to the 17th century. In 1693, astronomer Edmond Halley constructed the first mortality table to provide a link between the life insurance premium and the average life spans based on statistical laws of mortality and compound interest. In 1756, Joseph Dodson reworked the table, linking premium rate to age.

Enter companies...

The first stock companies to get into the business of insurance were chartered in England in 1720. The year 1735 saw the birth of the first insurance company in the American colonies in Charleston, SC. In 1759, the Presbyterian Synod of Philadelphia sponsored the first life insurance corporation in America for the benefit of ministers and their dependents. However, it was after 1840 that life insurance really took off in a big way. The trigger: reducing opposition from religious groups.

The growing years...

The 19th century saw huge developments in the field of insurance, with newer products being devised to meet the growing needs of urbanization and industrialization. In 1835, the infamous New York fire drew people's attention to the need to provide for sudden and large losses. Two years later, Massachusetts became the first state to require College of Computer and Management Studies, Vadu. 7

Kotak Mahindra Life Insurance Ltd. companies by law to maintain such reserves. The great Chicago fire of 1871 further emphasized how fires can cause huge losses in densely populated modern cities. The practice of reinsurance, wherein the risks are spread among several companies, was devised specifically for such situations. There were more offshoots of the process of industrialization. In 1897, the British government passed the Workmen's Compensation Act, which made it mandatory for a company to insure its employees against industrial accidents. With the advent of the automobile, public liability insurance, this first made its appearance in the 1880s, gained importance and acceptance. In the 19th century, many societies were founded to insure the life and health of their members, while fraternal orders provided low-cost, members-only insurance. Even today, such fraternal orders continue to provide insurance coverage to members as do most labor organizations. Many employers sponsor group insurance policies for their employees, providing not just life insurance, but sickness and accident benefits and old-age pensions. Employees contribute a certain percentage of the premium for these policies.

In India...

Insurance in India can be traced back to the Vedas. For instance, yogakshema, the name of Life Insurance Corporation of India's corporate headquarters, is derived from the Rig Veda. The term suggests that a form of "community insurance" was prevalent around 1000 BC and practiced by the Aryans.

Burial societies of the kind found in ancient Rome were formed in the Buddhist period to help families build houses, protect widows and children.

College of Computer and Management Studies, Vadu.

Kotak Mahindra Life Insurance Ltd.

Bombay Mutual Assurance Society, the first Indian life assurance society, was formed in 1870. Other companies like Oriental, Bharat and Empire of India were also set up in the 1870-90s. It was during the swadeshi movement in the early 20th century that insurance witnessed a big boom in India with several more companies being set up. As these companies grew, the government began to exercise control on them. The Insurance Act was passed in 1912, followed by a detailed and amended Insurance Act of 1938 that looked into investments, expenditure and management of these companies' funds. By the mid-1950s, there were around 170 insurance companies and 80 provident fund societies in the country's life insurance scene. However, in the absence of regulatory systems, scams and irregularities were almost a way of life at most of these companies.As a result, the government decided nationalize the life assurance business in India. The Life Insurance Corporation of India was set up in 1956 to take over around 250 life companies. For years thereafter, insurance remained a monopoly of the public sector. It was only after seven years of deliberation and debate - after the RN Malhotra Committee report of 1994 became the first serious document calling for the re-opening up of the insurance sector to private players -- that the sector was finally opened up to private players in 2001. The Insurance Regulatory & Development Authority, an autonomous insurance regulator set up in 2000, has extensive powers to oversee the insurance business and regulate in a manner that will safeguard the interests of the insured.

1.5 MYTH BUSTERS

Myth 1: Insurance is for tax saving

There's always this rush to buy insurance policies towards the end of the financial year, College of Computer and Management Studies, Vadu. 9

Kotak Mahindra Life Insurance Ltd. making one wonder if the tax-saving purpose of life insurance has not overshadowed its other roles. Yes, the tax benefits associated with life insurance policies do help make the investment more attractive. The Public Provident Fund also offers the 20% tax rebate under section 88 of the Income Tax Act, 1961, as do small saving schemes like post office deposits and national savings certificates. You may also avail of Tax benefits under section 80CCC with certain plans. And there are other investment options that give you higher returns than insurance. But these don't offer you security, the risk cover that helps you overcome the uncertainties of life. The primary function of life insurance is to cover you against financial losses arising out of sudden death or disability. It also offers returns and tax savings. Life insurance, as an instrument, is hence a good marriage of risk cover, returns and tax benefits.

Myth 2: Insurance does not give good returns

Insurance is different from routine investment options. A fixed deposit or even a National Savings Certificate may apparently fetch more returns than a life insurance policy. But that's not a fair straight-line comparison. If monetary returns are evaluated in isolation, a fixed deposit (FD) offering 9.5% might look very good in this depressed market. But insurance offers other benefits along with returns. Look at security for instance. If you invest in an FD and happen to die, your nominee can claim only the amount of the FD. If you live, you will get back the sum of the FD with the desired interest. Compare this to a life insurance policy. For a sum of Rs 5,000 invested in a FD, you would get the same amount at the end of the year whereas for a small insurance premium of say Rs 5,000 per annum, you could buy yourself a cover of around Rs 50,000 to Rs 2 lacs depending on your age and type of policy. If you happen to die during the tenure of the

College of Computer and Management Studies, Vadu.

10

Kotak Mahindra Life Insurance Ltd. policy, your family members would get Rs 50,000 to Rs 2 lakh as a benefit. In case you live, you will get back the entire sum assured with maybe a decent return. Evaluate the two options. For a small "notional loss" in returns, you are running the risk of leaving your loved ones uncared for if something happened to you. On the other hand, with an insurance policy, peace of mind will never be an issue. Thats something money can seldom buy.

1.6 DIRECTORS REPORT

DIVIDEND

Since your Company is in the initial stages of its business and there is an overall deficit for the year under review, the Directors do not recommend any dividend for the year.

College of Computer and Management Studies, Vadu.

11

Kotak Mahindra Life Insurance Ltd.

CAPITAL

Your Company strongly believes the need for investing for sustainable growth. Your Directors, however, believe the need of maintaining the highest level of efficiency in usage of this capital. During the year under review, the Authorized Share Capital of your Company has increased from Rs. 350 crores to Rs. 525 crores. While the Paid-up Share Capital of your Company has increased from Rs. 330 crores to Rs. 480 crores. Your Company is amongst the top quartile companies in the industry in terms of Premium to Capital ratio a measure of capital efficiency for the industry.

1.7 INDUSTRY SCENARIO

Insurance industry continues to grow at a brisk pace. The share of the private player in the overall Industry has grown significantly. During the year, the industry has witnessed deeper penetration and has been able to expand into the rural areas. It is expected that high economic growth and changing demographics will ensure industrys continuing growth path in near future.

College of Computer and Management Studies, Vadu.

12

Kotak Mahindra Life Insurance Ltd.

1.8 SIZE OF THE UNIT

Your Company strongly believes the need for investing for sustainable growth. Your Directors, however, believe the need of maintaining the highest level of efficiency in usage of this capital. During the year under review, the Authorized Share Capital of your Company has increased from Rs. 350 crores to Rs. 525 crores. While the Paid-up Share Capital of your Company has increased from Rs. 330 crores to Rs. 480 crores. Your

College of Computer and Management Studies, Vadu.

13

Kotak Mahindra Life Insurance Ltd. Company is amongst the top quartile companies in the industry in terms of Premium to Capital ratio a measure of capital efficiency for the industry.

2.1 RANGE OF PRODUCTS

INDIVIDUAL

Kotak Long Life Secure Plus Kotak Long Life Wealth Plus College of Computer and Management Studies, Vadu. 14

Kotak Mahindra Life Insurance Ltd.

Kotak Smart Advantage Kotak Eternal Life Plans Kotak Platinum Advantage Plan Kotak Head Start Child Plans Kotak Sukhi Jeevan Plan Kotak Privileged Assurance Plan Kotak Term / Preferred Term Plan Kotak Money Back Plan Kotak Child Advantage Plan Kotak Endowment Plan Kotak Capital Multiplier Plan Kotak Retirement Income Plan Kotak Retirement Income Plan (Unit-linked) Kotak Safe Investment Plan II Kotak Flexi Plan

College of Computer and Management Studies, Vadu.

15

Kotak Mahindra Life Insurance Ltd. Kotak Easy Growth Plan Kotak Premium Return Plan Riders

GROUP

Employee Benefits Kotak Term Group plan Kotak Credit-Term Group plan Kotak Complete Cover Group plan Kotak Gratuity Group plan Kotak Superannuation Group plan

RURAL

Kotak Gramin Bima Yojana

2.2 TYPES OF INSURANCE POLICIES

1. Term Insurance Policy 2. Whole Life Policy College of Computer and Management Studies, Vadu. 16

Kotak Mahindra Life Insurance Ltd.

3. Endowment Policy 4. Money Back Policy 5. Annuities and Pensions Most of the products offered by Indian life insurers are developed and structured around these "basic" policies and are usually an extension or a combination of these policies. So, what are these policies and how do they differ from each other?

TERM INSURANCE POLICY

A term insurance policy is a pure risk cover for a specified period of time. What

this means is that the sum assured is payable only if the policyholder dies within the

College of Computer and Management Studies, Vadu.

17

Kotak Mahindra Life Insurance Ltd. policy term. For instance, if a person buys Rs 2 lakh policy for 15-years, his family is entitled to the money if he dies within that 15-year period.

What if he survives the 15-year period? Well, then he is not entitled to any

payment; the insurance company keeps the entire premium paid during the 15-year period.

So, there is no element of savings or investment in such a policy. It is a 100 per cent

risk cover. It simply means that a person pays a certain premium to protect his family against his sudden death. He forfeits the amount if he outlives the period of the policy. This explains why the Term Insurance Policy comes at the lowest cost.

WHOLE LIFE POLICY

College of Computer and Management Studies, Vadu.

18

Kotak Mahindra Life Insurance Ltd.

As the name suggests, a Whole Life Policy is an insurance cover against death,

irrespective of when it happens.

Under this plan, the policyholder pays regular premiums until his death, following

which the money is handed over to his family. This policy, however, fails to address the additional needs of the insured during his post-retirement years. It doesn't take into account a person's increasing needs either. While the insured buys the policy at a young age, his requirements increase over time. By the time he dies, the value of the sum assured is too low to meet his family's needs. As a result of these drawbacks, insurance firms now offer either a modified Whole Life Policy or combine in with another type of policy.

ENDOWMENT POLICY

College of Computer and Management Studies, Vadu.

19

Kotak Mahindra Life Insurance Ltd. Combining risk cover with financial savings, endowment policies is the most popular policies in the world of life insurance.

In an Endowment Policy, the sum assured is payable even if the insured survives the

policy term.

If the insured dies during the tenure of the policy, the insurance firm has to pay the

sum assured just as any other pure risk cover.

A pure endowment policy is also a form of financial saving, whereby if the person

covered remains alive beyond the tenure of the policy, he gets back the sum assured with some other investment benefits. In addition to the basic policy, insurers offer various benefits such as double endowment and marriage/ education endowment plans. The cost of such a policy is slightly higher but worth its value.

MONEY BACK POLICY

College of Computer and Management Studies, Vadu.

20

Kotak Mahindra Life Insurance Ltd.

These policies are structured to provide sums required as anticipated expenses

(marriage, education, etc) over a stipulated period of time. With inflation becoming a big issue, companies have realized that sometimes the money value of the policy is eroded. That is why with-profit policies are also being introduced to offset some of the losses incurred on account of inflation.

A portion of the sum assured is payable at regular intervals. On survival the

remainder of the sum assured is payable.

In case of death, the full sum assured is payable to the insured. The premium is payable for a particular period of time.

ANNUITY AND PENSION

College of Computer and Management Studies, Vadu.

21

Kotak Mahindra Life Insurance Ltd. In an annuity, the insurer agrees to pay the insured a stipulated sum of money periodically. The purpose of an annuity is to protect against risk as well as provide money in the form of pension at regular intervals. Over the years, insurers have added various features to basic insurance policies in order to address specific needs of a cross section of people

PRODUCTS

College of Computer and Management Studies, Vadu.

22

Kotak Mahindra Life Insurance Ltd.

Your Company has developed a competitive product basket offering some of the industrys most innovative products. Your Company relentlessly pursued the customer need approach in line with its philosophy that the ever changing needs of todays customers require continuous innovation and development of newer products. During the year, your Company strengthened its product portfolio by introducing 4 new plans. The non-ULIP offering was bolstered with the introduction of two new plans, Kotak Eternal Life plans and Kotak Surakshit Jeevan. Eternal Life, a traditional whole life plan led our entry into the whole life segment. Surakshit Jeevan is a reversionary bonus insurance-cum-investment plan offering simple and affordable insurance to semi-urban customers. During the year, the Company also launched two new ULIP plans. Kotak Platinum Advantage is a market linked insurance plan that offers great choice and tremendous flexibility to our customers. The benefits of guarantee, growth and protection are combined in one single plan and are primarily targeted at the high net worth segment. Your Company also saw the launch of Kotak Smart Advantage, a plan with 100% premium allocation and guaranteed returns on the first year premium. The introduction of the new Opportunities Fund strengthened our Fund offering. The Opportunities Fund is aimed at providing high returns by exposure to mid-cap segment.

3.1 HUMAN RESOURCES

College of Computer and Management Studies, Vadu. 23

Kotak Mahindra Life Insurance Ltd.

There has been a significant increase in the number of employees to support our expansion plans. As of 31st March, 2008, the number of employees was 4,677 compared to 3,220 employees as at the end of last year. Your Company believes its employees are going to shape its future and it is imperative to introduce methods that will mould employees growth paths. The Talent Management and Organizational Capability cell has been set up with the objective of creating the right environment to nurture talent and assure superior performance of our personnel. On technology side, with a view to automate operational activities, speed up delivery, make access to the human capital information easy and reduce the requirement of paperwork, the first phase of Oracle Human Resources Management System (HRMS) has been implemented, with second and third phases in the pipeline.

3.2 COMPLIANCE AND INTERNAL CONTROL

College of Computer and Management Studies, Vadu. 24

Kotak Mahindra Life Insurance Ltd.

The Compliance function counsels other functions within the Company on the dynamic regulatory framework associated with a new and growing industry. Your Company believes in proactive compliance to ensure that our practices are best in the industry. The Compliance processes of your Company are complimented by independent audit conducted across various functions. As a part of good Corporate Governance, the Audit Committee reviews the findings of the internal auditors who report directly to the Audit Committee. The Company has an Anti-Money Laundering (AML) policy in place and has implemented specialized AML software.

3.3 CAREERS

College of Computer and Management Studies, Vadu. 25

Kotak Mahindra Life Insurance Ltd.

Kotak Mahindra Old Mutual Life Insurance Ltd., a company offering Life Insurance products, is one of Indias premier & growing insurance companies employing over 1000 people, across various offices in India. We aim to achieve a balance between what our people want as individuals and what the organization expects of them. The most talented people choose to join and stay with us because we offer them opportunities to: Deliver the best - working with the most talented colleagues. Rapidly build skills, knowledge and experience. Work in a challenging environment that constantly demands them to operate at the edge of their ability. Be recognized and rewarded for their achievement by accelerated career paths and differentiated rewards. Be a good corporate citizen.

RECRUIT AND RETAIN THE BEST

College of Computer and Management Studies, Vadu. 26

Kotak Mahindra Life Insurance Ltd.

At Kotak Life Insurance, we understand that our client servicing depends upon our people. That makes our people our greatest asset. To encourage our people excel, we encourage an open door policy across all levels and our people's contribution on a wide range of office matters from client service to professional. Opportunities to provide input empower us all to grow both professionally and personally. The company encourages training within the work environment, while providing staff with every opportunity to 'up skill' and advance their career prospects.

BENEFITS TO THE EMPLOYEES

College of Computer and Management Studies, Vadu. 27

Kotak Mahindra Life Insurance Ltd.

GRATUITY

In accordance with Payment of Gratuity Act, 1972 the Company provides for gratuity, a defined benefit retirement plan covering all employees. The plan provides a lump sum payment to vested employees at retirement or termination of employment based on the respective employees salary and the years of employment with the Company subject to maximum of Rs. 3.50 lacs per employee. The gratuity benefit is provided through unfunded plan and annual contributions are charged to profit and loss account. Under the scheme, the settlement obligation remains with the Company.

PROVIDENT FUND

In accordance with Indian regulations, employees of the Company are entitled to receive benefits under the provident fund, a defined contribution plan, in which, both the employee and the Company contribute monthly at a determined rate. These contributions are made to a recognized provident and administered by a Board of Trustees. The employee contributes 12% of his or her basic salary and the Company contributes an equal amount. The investments of the funds are made according to rules prescribed by the Government of India. The companys contribution for the year amounts to Rs. 72,178 (2007-41,303).

ACCUMULATED COMPENSATED ABSENCES

The Company accrues the liability for compensated absences based on the actuarial valuation as at the balance sheet conducted by an independent actuary.

4.1 BUSINESS AND DISTRIBUTION CHANNELS

College of Computer and Management Studies, Vadu.

28

Kotak Mahindra Life Insurance Ltd.

The business of the Company is broadly divided into three major channels. 1. TIED AGENCY 2. ALTERNATIVE CHANNELS 3. GROUP INSURANCE Let us discuss the above mentioned business and distribution channels in details.

1. TIED AGENCY

College of Computer and Management Studies, Vadu. 29

Kotak Mahindra Life Insurance Ltd.

Your Company believes that insurance is a unique instrument that forms a vital part of a customers financial planning, hence it is crucial to dispense the right advice to a customer during purchase. Your Company has continually invested in creating and maintaining a well-recruited, professionally-trained and well monitored life advisor force that is capable of recommending suitable solutions to customers. A sizeable life advisor force being critical in scaling up business, your Company has kept significant focus in this area and the Companys life advisor force now stands at over 34,000. Your Company continued to maintain stringent standards for the life advisors we partner with, requiring a depth of expertise and highly ethical behavior. To meet this objective, your Company continues to invest heavily on training. Till 31st March, 2008, your Company has 92 trainers and has 58 Insurance Regulatory and Development Authority (IRDA) certified training centers. Your Company also continues to leverage from a vast network of IRDA certified private training institutes, spread across the country. Your Company is proud to mention that 2 life advisors qualified for Top of the Table Honors; 20 life advisors qualified for Court of the Table Honors and 192 life advisors qualified for the prestigious Million Dollar Round Table an indication that our agency force is making a mark within the industry.

2. ALTERNATE CHANNELS

College of Computer and Management Studies, Vadu.

30

Kotak Mahindra Life Insurance Ltd. Your Company has concentrated significantly on building up the Alternate Channels of distribution through Bank assurance, Corporate Agents, Brokers and Referral arrangements. This has shaped the business considerably in terms of bringing efficiencies into the distribution framework. It is expected that the alternate distribution channels will generate a larger and substantially cost effective business. Further, your Company continued to leverage its strong relationships with Kotak Mahindra Bank Limited, which form a significant part of the Alternate business. Your Company will continue to benefit from the fast expanding network of Kotak Mahindra Bank. Kotak Securities and other companies of Kotak group are also expected to contribute significantly to the growth. As on 31st March, 2008, your Company has 235 corporate agents and 143 empanelled brokers.

3. GROUP INSURANCE

College of Computer and Management Studies, Vadu.

31

Kotak Mahindra Life Insurance Ltd. Insurance to groups in the form of Term Insurance, Credit Insurance, Gratuity and Superannuation Schemes is sold through your Companys own employee force. Your Company managed to leverage the relationship within the Kotak Group which helped in generating significant business in this segment. At the end of the year under review, 269 (2007-195) customer relationship were acquired. Your Company generated a premium income of Rs. 132 crores (2007 Rs. 69 crores) from its group insurance business achieving a growth of 92%.

4.2 BRANCH NETWORK

College of Computer and Management Studies, Vadu.

32

Kotak Mahindra Life Insurance Ltd. As a player in a fast-expanding industry, your Company has always believed that increase in both value and scale is the imperative. With a substantially augmented footprint in the last year, your Company is a significant player poised to shape industry dynamics in much geography. Your Company has doubled its branch presence during the year to150 locations across 109 cities. The location of the branches will help your Company cater better to the middle class and affluent population. During the expansion, the Company focused aggressively on Tier II cities offering favorable business potential and the opportunity to reach out to rural areas.

4.3 BRAND

College of Computer and Management Studies, Vadu.

33

Kotak Mahindra Life Insurance Ltd. During the year, your Company strengthened the brand promise of Zindagi se ek kadam aagey by reaching out to a wider base of potential consumers through various initiatives. Your Company also chose to support the newly launched Kotak Smart Advantage Plan with a multi-media campaign in the last quarter. Your brand has now got a strong recall in the top 10 towns and five focus states of Gujarat, Kerala, Punjab, Haryana and Maharashtra. Recognizing the need to reach the customer at meaningful occasions, a special emphasis was given to festival participations across the country. Additionally, by becoming the first advertiser on the high-impact, in-tunnel medium on Delhi Metro, your Company was regarded as a pioneer. As per AC Nielsen ORG MARGs January 2008 survey, your Companys total brand awareness scores have moved up from 69% in January 2007 to 75%.

4.4 RURAL AND SOCIAL SECTORS

College of Computer and Management Studies, Vadu.

34

Kotak Mahindra Life Insurance Ltd. During the year, the Companys distribution was extended to Tier - II cities and rural areas. 72,477 policies (Previous year 30,677) were written in the rural sector representing 23.10 % (Previous year 18.57%) of the total policies. This is against the regulatory requirement as per the IRDA (Obligations of Insurers to Rural and Social Sectors) Regulations, 2002, of 18% of the total policies written in the financial year from the rural sector. Outperforming the regulatory requirement of covering 25,000 social lives, your Company covered 30,476 lives (Previous year 71,299 lives) during the financial year under review.

5.1 FINANCIAL RESULTS

College of Computer and Management Studies, Vadu.

35

Kotak Mahindra Life Insurance Ltd. Your Company continues to demonstrate a consistent, value-based growth in a fast growing industry. The summarized results of operation of the Company are as follows: (Rs. Crore) PARTICULARS New Business Premium Adjusted New Business Premium Total Premium Profit/Loss after tax Number of Policyholders New Business Sum Assured Bonus to Policyholders Transfer from Shareholders to Policyholders account Transfer from Policyholders to Shareholders Account Your Directors have declared an addition to the Policyholders Accumulation Account to give a return of 7% (2007 7%) to participating life policyholders and 8% (2007 7%) to annuity participating policyholders for the year ended 31st March, 2008. A reversionary bonus of 2% (2007 2%) has been declared on traditional products. The transfer from the Shareholders Account to the Policyholders Account during the current year was to finance the expense over-runs and increased solvency requirements due to growth in business. Transfers from the Policyholders Account to Shareholders Account are the surplus in the Non-Participating Policyholders Account and 10% of the amount distributed to the Participating Policyholders. YEAR ENDING MARCH 2008 1,107 1,052 1,691 72 14 33,102 14 109 19 YEAR ENDING MARCH 2007 615 573 972 58 10 20,163 10 118 1

5.2 CAPITAL

Your Company strongly believes the need for investing for sustainable growth. Your Directors, however, believe the need of maintaining the highest level of efficiency in usage of this capital. During the year under review, the Authorized Share Capital of your Company has increased from Rs. 350 crores to Rs. 525 crores. While the Paid-up Share

College of Computer and Management Studies, Vadu.

36

Kotak Mahindra Life Insurance Ltd. Capital of your Company has increased from Rs. 330 crores to Rs. 480 crores. Your Company is amongst the top quartile companies in the industry in terms of Premium to Capital ratio a measure of capital efficiency for the industry.

5.3 INVESTMENTS

Your Company manages its investments within the overall framework laid out by the Investment Committee. The Company has implemented systems to help in analysis of investment portfolio, which acts as an enabler to the front-end Investment team in asset allocation and stock selection. Further, the Company has well staffed Investment team College of Computer and Management Studies, Vadu. 37

Kotak Mahindra Life Insurance Ltd. which has been structured into front office, mid office and back office for effective function and independent checks to constantly monitor investment performance and analysis.

5.4 AUDITORS

1. M/s. Maheshwari & Associates, Chartered Accountants 2. M/s. M. P. Chitale & Co., College of Computer and Management Studies, Vadu. 38

Kotak Mahindra Life Insurance Ltd. Chartered Accountants The Joint Auditors of your Company hold office until the conclusion of the ensuing Annual General Meeting of the Company.

5.5 MANAGEMENT REPORT

Pursuant to the provisions of Regulation 3 of the Insurance Regulatory and Development Authority (Preparation of Financial Statements and Auditors Report of Insurance Companies) Regulations, 2002, the Management Report forms a part of the financial statements. College of Computer and Management Studies, Vadu. 39

Kotak Mahindra Life Insurance Ltd.

5.6 DIVIDEND

Since your Company is in the initial stages of its business and there is an overall deficit or the year under review, the Directors do not recommend any dividend for the year.

5.7 STATUTORY INFORMATION

During the period under review, your Company has not accepted any deposits from the public. The information required under Section 217(2A) of the Companies Act, 1956, read with the Companies (Particulars of Employees) Rules, 1975, is enclosed herewith.

College of Computer and Management Studies, Vadu.

40

Kotak Mahindra Life Insurance Ltd.

During the year ended 31st March, 2008, expenditure in foreign exchange amounted to Rs.54 lacs. Other particulars prescribed under the Companies (Disclosure of Particulars in the Report of Board of Directors) Rules, 1988, are not applicable, since your Company is not a manufacturing Company.

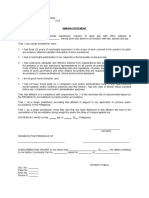

5.8 DIRECTORS RESPONSIBILITY STATEMENT

Based on representations from the Management, your Directors state, in pursuance of Section 217(2AA) of the Companies Act, 1956, that:

College of Computer and Management Studies, Vadu.

41

Kotak Mahindra Life Insurance Ltd. 1. Your Company has, in the preparation of the annual accounts for the year ended 31st March, 2008, followed the applicable accounting standards along-with proper explanations relating to material departures, if any; 2. The Directors have selected such accounting policies and applied them consistently and made judgments and estimates that are reasonable and prudent, so as to give a true and fair view of the state of affairs of your Company as at 31st March, 2008, of the surplus in the Revenue Account and the loss in the Profit and Loss Account of your Company for the financial year ended 31st March, 2008; 3. The Directors have taken proper and sufficient care to the best of their knowledge and ability, for the maintenance of adequate accounting records in accordance with the provisions of the Act, for safeguarding the assets of your Company and for preventing and detecting fraud and other irregularities; 4. The Directors have prepared the annual accounts on a going concern basis.

5.9 BALANCE SHEET AS ON 31ST MARCH, 2008

PARTICULARS SOURCES OF FUNDS Shareholders fund Share Capital College of Computer and Management Studies, Vadu. SCHEDULE 5 AMOUNT (Rs.) 4,802,732 42

Kotak Mahindra Life Insurance Ltd. Reserve and Surplus Sub-total Policy Liabilities Participating Non-participating Annuities Participating Annuities Unit-Linked Non-Participating 6 520,363 5,323,095 3,910,750 596,745 317,596 16,948 479,066

Unit-Linked Non-Participating Insurance Reseerves Participating Non-participating Annuities Participating Annuities Unit-Linked Non-Participating

36,964

Unit-Linked Non-Participating Linked Liabilities Fair Value Change Total Provision for Linked Liabilities Sub-total Funds for future appropriation linked liabilities Others TOTAL

22,974,368 410,951 22,563,417 27,921,486 531,010 1,009 33,776,600

APPLICATION OF FUNDS Investments Shareholders 8 8A 8B 9 10 11 12 13 14 1,312,978 5,704,368 23,094,427 56,252 425,603 1,535,633 661,880 2,197,513 2,282,473 118,890 Policyholders Assets held to cover linked liabilities Loans Fixed Assets Current Assets Cash and Bank Balances Advances and Other Assets Sub-total (A) Current Liabilities Provisions

College of Computer and Management Studies, Vadu.

43

Kotak Mahindra Life Insurance Ltd. Sub-total (B) Net Current Assets (C) = (A) - (B) Miscellaneous Expenditure Debit Balance in Profit and :Loss Account TOTAL 2,401,363 203,850 --------3,386,822 33,776,600

5.10 AUDITORS REPORT

To the Members of Kotak Mahindra Old Mutual Life Insurance Limited 1. We have audited the attached Balance Sheet of Kotak Mahindra Old Mutual Life Insurance Limited (the Company) as at March 31, 2008, the related Revenue Account, the Profit & Loss Account and the Receipts and Payments Account for the year ended on that date annexed thereto, which we have signed under reference to this report. These financial statements are the responsibility of the management of the Company. Our responsibility is to express an opinion on these financial statements based on our audit. 2. We conducted our audit in accordance with auditing standards generally accepted in India. These standards require that we plan and perform the audit to obtain reasonable assurance as to whether the financial statements are free of material

College of Computer and Management Studies, Vadu.

44

Kotak Mahindra Life Insurance Ltd. misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion. 3. We report that: (a) We have obtained all the information and explanations, which to the best of our knowledge and belief were necessary for the purposes of the audit and have found them to be satisfactory (b) In our opinion and to the best of our information and according to

the explanations given to us, proper books of account as required by law have been maintained by the Company, so far as appears from our examination of those books; (c) As the Companys financial accounting system is centralized, no returns for the purposes of our audit are prepared at the branches of the Company; (d) The Balance Sheet, the Revenue Account, the Profit and Loss

Account and the Receipts and Payments Account referred to in this report are in agreement with the books of account; (e) The actuarial valuation of policyholders liabilities other than

provision for linked liabilities is the responsibility of the Companys Appointed Actuary (the Appointed Actuary). The actuarial valuation of these liabilities as at March 31, 2008 has been duly certified by the Appointed Actuary and in his opinion, the assumptions for such valuation are in accordance with the guidelines and norms issued by the Insurance Regulatory Development Authority (IRDA) and the Institute of Actuaries of India in concurrence with IRDA. We have relied upon Appointed Actuarys certificate in this regard for forming our opinion on the financial statements of the Company;

College of Computer and Management Studies, Vadu.

45

Kotak Mahindra Life Insurance Ltd.

(f)

On the basis of written representations received from the Directors

of the Company, as on March 31, 2008 and taken on record by the Board of Directors, none of the Directors is disqualified as on March 31, 2008 from being appointed as a Director in terms of clause (g) of sub-section (1) of Section 274 of the Companies Act, 1956. 4. In our opinion and to the best of our information and according to the explanations given to us, we further report that: (a) The Investments have been valued in accordance with the provisions

of the Insurance Act, 1938, the Insurance Regulatory and Development Authority (Preparation of Financial Statements and Auditors Report of Insurance Companies) Regulations, 2002, (the Regulations) and/or orders / directions issued by IRDA in this behalf; (b) The accounting policies selected by the Company are appropriate and are in compliance with the applicable Accounting Standards referred to under sub-section (3C) of Section 211 of the Companies Act, 1956 and with the accounting principles as prescribed in the Regulations and orders / directions issued by IRDA in this behalf; (c) The Balance Sheet, the Revenue Account, the Profit and Loss

Account and the Receipts and Payments Account referred to in this report are in compliance with the applicable accounting standards referred to under subsection(3C) of Section 211 of the Companies Act, 1956; and (d) The Balance Sheet, the Revenue Account, the Profit and Loss

Account and the Receipts and Payments Account together with the notes thereon and attached thereto are prepared in accordance with the requirements of the Regulations, the Insurance Act, 1938, the Insurance Regulatory and Development Authority Act, 1999 and the Companies Act, 1956, to the extent applicable and in

College of Computer and Management Studies, Vadu.

46

Kotak Mahindra Life Insurance Ltd. the manner so required and give a true and fair view in conformity with applicable accounting principles generally accepted in India: i. ii. date; iii. date; and iv. in the case of the Receipts and Payments Account, of the receipts and payments for the year ended on that date. in the case of Profit and Loss account, of the loss for the year ended on that in the case of the Balance Sheet, of the state of affairs of the Company as at March 31, 2008; in the case of Revenue Account, of the net surplus for the year ended on that

5. Further, on the basis of our examination of books and records of the Company and according to the information and explanations given to us, we certify to the best of our knowledge and belief that: (a) We have reviewed the Management Report attached to the financial

statements for the year ended March 31, 2008, and have found no apparent mistake or material inconsistencies with the financial statements; (b) Based on management representations and compliance certificates noted by

the Risk Management and Audit Committee, nothing has come to our attention which causes us to believe that the Company has not complied with the terms and conditions of registration stipulated by IRDA.

College of Computer and Management Studies, Vadu.

47

Kotak Mahindra Life Insurance Ltd.

SWOT ANANLYSIS

STRENGTHS

Good financial condition of the firm in current situation Talented and efficient manpower Good grip on the market share. Capable to tackle the competition in the current market

WEAKNESS

Lack of enough advertisement.

College of Computer and Management Studies, Vadu.

48

Kotak Mahindra Life Insurance Ltd. The firm is not enough capable to be in this kind of market situation & in such a competition. The firm puts lot of burden of targets for the agents which demotivates them and hence demoralize them to work.

OPPORTUNITIES

The firm can grab the opportunity of current situation when all the firms are getting dissolved due to the world level recession and can try to maintain its level and raise the scope. The firm may also take decisions to collaborate with other poor firms so that the competition can be reduced and the growth can be raised. As the economy is growing in a way of development most of the people now a days prefer to go for private firms rather than govt. institutions so the firm may get opportunity to attract those prospects.

THREATS

College of Computer and Management Studies, Vadu.

49

Kotak Mahindra Life Insurance Ltd. Financial crisis is the one of the most challenging problems for all the financial institutions Market is not stable at present it is continuously going downwards which creates lack of trust in the mind of people towards the private financial institutes.

FINDINGS AND SUGGESTIONS

FINDINGS

The firm has good reputation in the market The firm has talented and efficient manpower with it. The firm has various policies for various classes of people. There is lack of advertisement by the firm. It is capable to compete with other firms The target set up by the firm are very high.

College of Computer and Management Studies, Vadu.

50

Kotak Mahindra Life Insurance Ltd.

SUGGESTIONS

The firm should increase it advertisement as there is lack of advertisement by the firm to tackle competition with other firms. Set the targets by taking in mind a proper standard which should not be large nor be short.

CONCLUSION

After undertaking this industrial training, I can conclude that such industrial training help the student in matching theoretical knowledge with its practical implementation. As far as the firm KOTAL LIFE INSURANCE is concerned, I can say that it has good market value in India & Across the world.

College of Computer and Management Studies, Vadu.

51

Kotak Mahindra Life Insurance Ltd.

BIBLIOGRAPHY

WEB-SITE 1. www.google.com 2. www.mykotaklife.com 3. www.khoj.com

BOOKS NAME 1. Marketing Management by Philip Kottler 2. Human Resource Management By K. Ashwatthapa College of Computer and Management Studies, Vadu. 52

You might also like

- Requesting For To Activate Internet BankingDocument1 pageRequesting For To Activate Internet BankingFarhanNo ratings yet

- Requesting For Changing Mobile NumberDocument1 pageRequesting For Changing Mobile NumberFarhanNo ratings yet

- Requesting For A New ATM CardDocument1 pageRequesting For A New ATM CardFarhanNo ratings yet

- Requesting For Speed BreakerSpeed BreakerDocument1 pageRequesting For Speed BreakerSpeed BreakerFarhanNo ratings yet

- Icici PrudentialDocument73 pagesIcici PrudentialFarhanNo ratings yet

- The Six Pack AbDocument35 pagesThe Six Pack AbFarhanNo ratings yet

- Material of Disaster Mgt.Document10 pagesMaterial of Disaster Mgt.FarhanNo ratings yet

- Promact PlasticDocument61 pagesPromact PlasticFarhanNo ratings yet

- Jecson MachinaryDocument4 pagesJecson MachinaryFarhanNo ratings yet

- R T C LTDDocument32 pagesR T C LTDFarhanNo ratings yet

- Patidar CottonDocument57 pagesPatidar CottonFarhanNo ratings yet

- Italian TilesDocument60 pagesItalian TilesFarhanNo ratings yet

- Jekson Machinery PVT LTDDocument49 pagesJekson Machinery PVT LTDFarhanNo ratings yet

- Horizons Lamkraft PVT - LTDDocument42 pagesHorizons Lamkraft PVT - LTDFarhanNo ratings yet

- Gujarat Appolo IndustryDocument68 pagesGujarat Appolo IndustryFarhanNo ratings yet

- L&TDocument50 pagesL&TFarhanNo ratings yet

- Kalptru PowerDocument72 pagesKalptru PowerFarhanNo ratings yet

- Super Crop SafeDocument44 pagesSuper Crop SafeFarhanNo ratings yet

- Ahmedabad District Co-Operative Milk Producers'Document44 pagesAhmedabad District Co-Operative Milk Producers'Farhan100% (1)

- Jai Electrical ProjectDocument64 pagesJai Electrical ProjectFarhanNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- BOA Accreditation Sworn StatementDocument1 pageBOA Accreditation Sworn StatementJanetNo ratings yet

- SAP PublicDocument148 pagesSAP PublicMarek Rzepka100% (2)

- Fundamentals of AccountingDocument512 pagesFundamentals of AccountingCalmguy Chaitu91% (35)

- GR 10 Test Posting To Ledger From CashDocument10 pagesGR 10 Test Posting To Ledger From CashStars2323No ratings yet

- Basics of Accounting For MBA HRDocument19 pagesBasics of Accounting For MBA HRKundan JhaNo ratings yet

- Dobbs Ferry PTSA Unit BylawsDocument12 pagesDobbs Ferry PTSA Unit BylawsJennifer KupershlakNo ratings yet

- Strategic Audit NotesDocument3 pagesStrategic Audit Noteswords of Ace.No ratings yet

- Alzou Bi 2016Document22 pagesAlzou Bi 2016Denny PutriNo ratings yet

- Lecture Guide No. 2 AE19.ChuaDocument5 pagesLecture Guide No. 2 AE19.ChuaJonellNo ratings yet

- Strategy Mapping ToolDocument15 pagesStrategy Mapping ToolXuan Hung100% (2)

- FABM-1 - Module 1 - Intro To AccountingDocument13 pagesFABM-1 - Module 1 - Intro To AccountingKJ Jones100% (26)

- The PPSAS and The Revised Chart of Accounts: Tools To Enhance Accountability and Transparency in Financial ReportingDocument98 pagesThe PPSAS and The Revised Chart of Accounts: Tools To Enhance Accountability and Transparency in Financial ReportingJhopel Casagnap EmanNo ratings yet

- Behre Dolbear Feasibility Studies SOQDocument14 pagesBehre Dolbear Feasibility Studies SOQKhishigbayar PurevdavgaNo ratings yet

- Auditing Set 2Document7 pagesAuditing Set 2cleophacerevivalNo ratings yet

- Henri Case StudyDocument2 pagesHenri Case StudyMaria100% (1)

- Bid Documents PDFDocument133 pagesBid Documents PDFCaitlin Elise O. CornelNo ratings yet

- CA Final - Paper 3 - CH - 3 - RISK ASSESSMENT AND INTERNAL CONTROLDocument30 pagesCA Final - Paper 3 - CH - 3 - RISK ASSESSMENT AND INTERNAL CONTROLLathaNo ratings yet

- PSQCS, Framework, Psas, Papss, Psres, Psaes, PsrssDocument3 pagesPSQCS, Framework, Psas, Papss, Psres, Psaes, PsrssChristine Joyce FajardoNo ratings yet

- MDI Graduation Booklet October 2015 Updated Aslani BioDocument20 pagesMDI Graduation Booklet October 2015 Updated Aslani BioAli MraniNo ratings yet

- Spip-W-3 - 26 09 19Document243 pagesSpip-W-3 - 26 09 19Anonymous 98sE6VNo ratings yet

- Cma - UsaDocument10 pagesCma - UsaswarnaletslearnNo ratings yet

- The Shareholders: DR Safdar A ButtDocument23 pagesThe Shareholders: DR Safdar A ButtAhsanNo ratings yet

- DTI, SEC, BSP and BOI RequirementsDocument22 pagesDTI, SEC, BSP and BOI Requirementsni_kai2001No ratings yet

- DMR 70 MSCC Application Form For ExaminationDocument2 pagesDMR 70 MSCC Application Form For Examinationsanda anaNo ratings yet

- Pratiksha PatelDocument2 pagesPratiksha PatelAlison NorrisNo ratings yet

- Irfan Malik 01Document2 pagesIrfan Malik 01Irfan AliNo ratings yet

- CHAPTER 3 - Organizational Ethics: Lesson OverviewDocument22 pagesCHAPTER 3 - Organizational Ethics: Lesson OverviewTrúc NguyễnNo ratings yet

- Charles P. Jones and Gerald R. Jensen, Investments: Analysis and Management, 13th Edition, John Wiley & SonsDocument21 pagesCharles P. Jones and Gerald R. Jensen, Investments: Analysis and Management, 13th Edition, John Wiley & SonsAnnisa AdriannaNo ratings yet

- Coco Life Audited Financial Statement 2014Document95 pagesCoco Life Audited Financial Statement 2014Angel PortosaNo ratings yet

- Financial Accounting An Integrated Approach (7th Edition) 2019Document737 pagesFinancial Accounting An Integrated Approach (7th Edition) 2019Helen T100% (6)