Professional Documents

Culture Documents

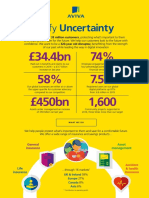

Infographic of Aviva Real Retirement Report Summer 2012

Uploaded by

Aviva GroupCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Infographic of Aviva Real Retirement Report Summer 2012

Uploaded by

Aviva GroupCopyright:

Available Formats

Finances of the Report The Real Retirement

Summer 2012 typical modern

Over-55s income tracking - June 2012

family

What forms of support did your final employer provide when approaching retirement?

1,361

All

1,359

55 64s

1,390

65 74s

1,318

Over 75s

12%

9%

10%

Percentage of over-55s who survive on less than 500 per month

Workshops/Seminars on retirement finances

Benefit statements

Ability to reduce working hours or work flexi-time

9%

7%

9%

5%

12%

2010 Summer

11%

2011 Summer

10%

2012 Summer

Offer to extend my working life

Counselling / advice on how to adjust to retirement

Written literature on the financial issues surrounding retirement

A dedicated member of staff to talk to about these issues

Top monthly income sources for over 55s

Employer pension 39%

68%

of employees want employers to help them as they approach retirement

Investments/savings 27%

Employees top requests are:

Personal pension 34% Over-55s have typically been with their last employer for State pension 62% Wages/other earned income 32% Benefits inc. unemployment 17% Spouses pension 22%

35% 35% 21%

financial workshops retirement literature a list of recommended financial advisers

16 years

Typical savings pots of the over-55s - June 2012

Debt by type of formal borrowing

Hire Purchase Credit Cards Personal Loans

2,802 6,544

26,085 15,756 9,373

55-64 65-74

3,470 12,998

Storecards

All over 55s Over 75

Overdraft

Doorstep lenders

766

Debt of those with a mortgage 1,564 223,958 87,500

East

846

395,098 70,000

London

208,398 82,292

East Midlands

191,518 51,786

West Midlands

So what does this tell us?

1. Take the lead in securing advice With 64% of employers offering no additional or tailored support for employees approaching retirement, you cant just rely on your workplace for help planning your later life finances. 2. Consider part-tirement Some employers are happy to offer you assistance with planning your exit from work so consider whether you might want to work part-time or work beyond the traditional retirement age. 3. Look at the wider implications of stopping work While retiring will mean a drop in income for most people, there are other implications. Will you lose your private medical insurance and therefore do you need to take out a private policy? 4. What borrowing do you have? Entering retirement with significant debts, even if you have assets, is not ideal. Consider how you can use your assets to reduce your debts and therefore your monthly outgoings.

167,411 77,500

North East

178,779 47,794

North West

191,827 43,056

Scotland

316,827 78,040

South East

281,327 70,000

South West House Price

191,389 37,500

Wales Mortgage

165,402 45,833

Yorkshire

236,474 63,555

UK

In a rapidly changing world it makes sense to make the most of your retirement; to understand what you have, the options available and ensure you maximise your assets.

To find out how Aviva can help

visit www.aviva.co.uk/retirement

106000692 07/2012 Aviva plc

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- 2018 CFA Level 2 Mock Exam MorningDocument40 pages2018 CFA Level 2 Mock Exam MorningElsiiieNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Common Law Distress On Third PartiesDocument7 pagesCommon Law Distress On Third Partiesnorris1234No ratings yet

- Cash Flow Statements PDFDocument101 pagesCash Flow Statements PDFSubbu ..100% (1)

- Document ManagementDocument55 pagesDocument Managementrtarak100% (1)

- Notes # 2 - Fundamentals of Real Estate Management PDFDocument3 pagesNotes # 2 - Fundamentals of Real Estate Management PDFGessel Xan Lopez100% (2)

- Auditor Appointment Letter FormatDocument2 pagesAuditor Appointment Letter Formateva100% (3)

- Veneracion v. Mancilla (2006)Document2 pagesVeneracion v. Mancilla (2006)Andre Philippe RamosNo ratings yet

- Aviva 2018 Key Metrics InfographicDocument1 pageAviva 2018 Key Metrics InfographicAviva GroupNo ratings yet

- Aviva 2018 Interim Results AnnouncementDocument10 pagesAviva 2018 Interim Results AnnouncementAviva GroupNo ratings yet

- Aviva PLC 2016 Results InfographicDocument2 pagesAviva PLC 2016 Results InfographicAviva GroupNo ratings yet

- Aviva HY16 Results Summary - InfographicDocument1 pageAviva HY16 Results Summary - InfographicAviva GroupNo ratings yet

- Aviva 2017 Interim Results AnnouncementDocument131 pagesAviva 2017 Interim Results AnnouncementAviva GroupNo ratings yet

- Aviva PLC 2016 Interims Results AnnouncementDocument127 pagesAviva PLC 2016 Interims Results AnnouncementAviva GroupNo ratings yet

- Aviva 2017 Interim Results Analyst PresentationDocument64 pagesAviva 2017 Interim Results Analyst PresentationAviva GroupNo ratings yet

- Aviva PLC - at A Glance March 2018Document2 pagesAviva PLC - at A Glance March 2018Aviva GroupNo ratings yet

- 2017 Preliminary Results AnnouncementDocument143 pages2017 Preliminary Results AnnouncementAviva GroupNo ratings yet

- Enabling Europe To Compete in The Global World of FinTechDocument2 pagesEnabling Europe To Compete in The Global World of FinTechAviva GroupNo ratings yet

- Aviva PLC 2016 ResultsDocument71 pagesAviva PLC 2016 ResultsAviva GroupNo ratings yet

- Aviva PLC Capital Markets DayDocument2 pagesAviva PLC Capital Markets DayAviva GroupNo ratings yet

- Mark Wilson Aviva PLC 2016 Half Year Results Interview TranscriptDocument4 pagesMark Wilson Aviva PLC 2016 Half Year Results Interview TranscriptAviva GroupNo ratings yet

- Aviva 2015 Full Year Results TranscriptDocument3 pagesAviva 2015 Full Year Results TranscriptAviva GroupNo ratings yet

- What Are We in Business For? Being A Good AncestorDocument22 pagesWhat Are We in Business For? Being A Good AncestorAviva GroupNo ratings yet

- Aviva 2015 Preliminary AnnouncementDocument10 pagesAviva 2015 Preliminary AnnouncementAviva GroupNo ratings yet

- Aviva at A Glance InfographicDocument2 pagesAviva at A Glance InfographicAviva GroupNo ratings yet

- Aviva 2015 Results InfographicDocument1 pageAviva 2015 Results InfographicAviva GroupNo ratings yet

- 2015 Half Year Results Interview With Group CEO Mark WilsonDocument4 pages2015 Half Year Results Interview With Group CEO Mark WilsonAviva GroupNo ratings yet

- Aviva Q1 IMS 2015 PDFDocument17 pagesAviva Q1 IMS 2015 PDFAviva GroupNo ratings yet

- Aviva Half Year 2015 AnnouncementDocument163 pagesAviva Half Year 2015 AnnouncementAviva GroupNo ratings yet

- Aviva 2014 Results PresentationDocument26 pagesAviva 2014 Results PresentationAviva GroupNo ratings yet

- Aviva Half Year 2015 Analyst PresentationDocument30 pagesAviva Half Year 2015 Analyst PresentationAviva GroupNo ratings yet

- Aviva Q1 IMS 2015 PDFDocument17 pagesAviva Q1 IMS 2015 PDFAviva GroupNo ratings yet

- Aviva PLC 2014 Preliminary Results AnnouncementDocument9 pagesAviva PLC 2014 Preliminary Results AnnouncementAviva GroupNo ratings yet

- Inflation Drop Gives Over-55s An Extra 1,032 A Year in Disposable Income As Essential Costs FallDocument5 pagesInflation Drop Gives Over-55s An Extra 1,032 A Year in Disposable Income As Essential Costs FallAviva GroupNo ratings yet

- Aviva: Whiplash Costs 2.5bn Per Year, Adding 93 To Motor PremiumsDocument4 pagesAviva: Whiplash Costs 2.5bn Per Year, Adding 93 To Motor PremiumsAviva GroupNo ratings yet

- 2014 Full Year Results Film Transcript - Interview With Group CEO Mark WilsonDocument7 pages2014 Full Year Results Film Transcript - Interview With Group CEO Mark WilsonAviva GroupNo ratings yet

- CDP Revised Toolkit Jun 09Document100 pagesCDP Revised Toolkit Jun 09kittu1216No ratings yet

- Typing Book by Vivaan SharmaDocument52 pagesTyping Book by Vivaan SharmaSanjay Rai100% (1)

- Business TransactionsDocument6 pagesBusiness TransactionsMarlyn Joy Yacon100% (1)

- Fresh Schedule 2021 (Online)Document280 pagesFresh Schedule 2021 (Online)Rumah Sakit khusus ibu dan anak annisa banjarmasinNo ratings yet

- Joint Venture in Insurance Company in IndiaDocument37 pagesJoint Venture in Insurance Company in IndiaSEMNo ratings yet

- Patrick Morgan: HighlightsDocument1 pagePatrick Morgan: HighlightsGhazni ProvinceNo ratings yet

- Invoice #100 for Project or Service DescriptionDocument1 pageInvoice #100 for Project or Service DescriptionsonetNo ratings yet

- The Journal of Performance Measurement Table of ContentsDocument12 pagesThe Journal of Performance Measurement Table of ContentsEttore TruccoNo ratings yet

- Salient Features of The Companies Act, 2013Document6 pagesSalient Features of The Companies Act, 2013SuduNo ratings yet

- Jharkhand Govt Gazette Regarding Stipend For LawyersDocument6 pagesJharkhand Govt Gazette Regarding Stipend For LawyersLatest Laws TeamNo ratings yet

- Accounting and FinanceDocument5 pagesAccounting and FinanceHtoo Wai Lin AungNo ratings yet

- Technopreneurship in Small Medium EnterprisegrouptwoDocument50 pagesTechnopreneurship in Small Medium EnterprisegrouptwoKurt Martine LacraNo ratings yet

- Aptivaa Model ManagementDocument18 pagesAptivaa Model Managementikhan809No ratings yet

- 1st PB-TADocument12 pages1st PB-TAGlenn Patrick de LeonNo ratings yet

- Engineering CodeDocument217 pagesEngineering CodeSudeepSMenasinakaiNo ratings yet

- Gram Yojana (Gram Priya) 10 Years Rural Postal Life Insurance Age at Entry Yrs Annual Rs Halfyearly Rs Quarterly Rs Monthly Age at Entry YrsDocument2 pagesGram Yojana (Gram Priya) 10 Years Rural Postal Life Insurance Age at Entry Yrs Annual Rs Halfyearly Rs Quarterly Rs Monthly Age at Entry YrsPriya Ranjan KumarNo ratings yet

- Saral Gyan Stocks Past Performance 050113Document13 pagesSaral Gyan Stocks Past Performance 050113saptarshidas21No ratings yet

- Palais Royal Vol-4 PDFDocument100 pagesPalais Royal Vol-4 PDFrahul kakapuriNo ratings yet

- CRC-ACE REVIEW SCHOOL PA1 SECOND PRE-BOARD EXAMSDocument6 pagesCRC-ACE REVIEW SCHOOL PA1 SECOND PRE-BOARD EXAMSRovern Keith Oro CuencaNo ratings yet

- Essentials of a Contract - Formation, Validity, Performance & DischargeDocument25 pagesEssentials of a Contract - Formation, Validity, Performance & Dischargesjkushwaha21100% (1)

- Bikash 4Document16 pagesBikash 4Bikash Kumar NayakNo ratings yet

- Wealth X Family Wealth Transfer ReportDocument28 pagesWealth X Family Wealth Transfer ReportStuff NewsroomNo ratings yet