Professional Documents

Culture Documents

Presentation On Negotiable Student

Uploaded by

nikskagalwalaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Presentation On Negotiable Student

Uploaded by

nikskagalwalaCopyright:

Available Formats

B.

Law

Negotiable Instruments Act (1881)

Prepared by:

Harshal Naik (28) Vivek Naik(29) Dixita Patel(37) Sanjay Patel(43) Sumit Sharma(55)

Submitted to:

Prof. Lalit Tank

Agenda of the Presentation

Negotiable Instrument & its types Holder & Holder in due course Dishonour of Negotiable Instrument Discharge of Negotiable Instrument

B.Law

What is a negotiable instrument?

Negotiable means transferable from one person to another person. The consideration is essential for transferability. Instrument means a written document creating a right in favour of any person. A written document which is transferable from one person to another person, and

creates a right in favor of any person.

B.Law

According to Negotiable Instrument Act 1881:(Section 13)

A negotiable instrument means a promissory note, bill of exchange or a Cheque payable either to order or bearer.

Examples of Negotiable instrument

- Promissory Note - Bill of exchange, - Cheque, - Bearer debentures, - Government Promissory notes, etc.

4

B.Law

PROMISSORY NOTE

A Promissory note is an instrument in writing (not being a bank note or currency note), containing an unconditional undertaking, signed by the maker, to pay on demand or at a fixed or determinable future time, a certain sum of money only to, or to the order of, a certain person, or to the bearer of instrument.

B.Law

Parties to Promissory Note

MAKER:

The person who makes a promissory note called maker. i.e. debtor.

PAYEE:

The person with whom the promise to pay is made is called payee. i.e. the creditor.

ESSENTIALS OF PROMISSORY NOTE:

In Writing Clear Promise to Pay Promise must be unconditional

B.Law

Conti

Signature by the maker Payment period Certain sum of money Certain payee

Other legal formalities:

It shall be properly and clearly written. Date should be mentioned. Amount should be stated both in words &figures. It should be properly stamped.

7

B.Law

Bills of Exchange

A Bill of exchange is an Instrument in writing containing an unconditional order, signed by the marker, directing a certain person, to pay on demand or at a fixed or determinable future time a certain sum of money only to or to the order of, a certain person or to the bearer of instrument." (Negotiable Instrument Act 1881.[Section 5]

B.Law

Parties to Bills of Exchange

DRAWER The person who makes the bill is called Drawer. DRAWEE The person who is directed to pay is called drawee. PAYEE The person to whom the payments to be made is called payee.

9

B.Law

Essential features of Bills of Exchange

In Writing Clear Order to pay The Order must be Unconditional Signature by Drawer Payment Period Certain sum of Money Certain payee Other legal formalities: It shall be properly and clearly written. Date should be mentioned. Amount should be stated both in words &figures. It should be properly stamped.

10

B.Law

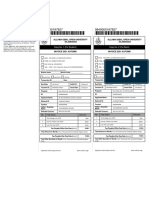

CHEQUE

In simple term: A written order of a depositor upon a banker to pay the designed party Or bearer a specific sum of money on demand. A Cheque is a bill of exchange drawn on a specified banker and not expressed to be payable otherwise than on demand. (ACCORDING TO NEGOTIABLE INSTRUMENT ACT 1881.[Section 6])

11

B.Law

PARTIES OF CHEQUE

Drawer:

The person who draws the cheque is called drawer.

Drawee

The bank on which the Cheque is drawn is known as drawee.

Payee

The Person to whom the Cheque is made payable is known as payee.

12

B.Law

ESSENTIAL FEATURES

In Writing Clear Order to pay The order must be Unconditional Signature by Drawer Payment Period Maker must be Account Holder Drawn on Specified Bank Must be on Prescribed Performa Payment in Money Only Date

13

B.Law

Conti

Other Legal Formalities:

It shall be properly and clearly written

Date should be mentioned. Amount should be stated both in words &figures

14

B.Law

Holder (Sec. 8)

The holder of a promissory note. bill of exchange or Cheque means any person entitled in his own name

The possession thereof, and To receive or recover the amount due thereon from the parties thereto.

The holder is the person so entitled at the time of such loss or destruction.

15

B.Law

Holder in due course (Sec. 9)

Any person Is a Holder in due course' if he fulfils the following conditions : For consideration. he became: The possessor of the negotiable instrument If payable to bearer. or The payee or indorsee thereof. If payable to order. That he became the holder of the Instrument before Us maturity. If the instrument is taken after It is due. the person taking It has. as against the other parties, only the rights of his immediate transferor.

16

A holder of a negotiable instrument will not be a holder in due course if He has obtained the instrument by gift or for an unlawful consideration or by some illegal method ; or He has obtained the instrument after its maturity; or He has not obtained the instrument bonafide.

B.Law

17

Special Privileges of a Holder in Due Course

B.Law

Inchoate stamped instrument Liability of prior parties Fictitious payee Negotiable instrument without consideration Conditional delivery Instrument cleansed of all dejects Instrument obtained by unlawful means or for unlawful Every holder is a holder in due course. Estoppels against denying original validity of instrument Estoppel against denying capacity of payee to indorse. Indorses not permitted to deny the capacity of prior prates

18

B.Law

LIABILITY OF PARTIES

Liability of drawer Liability of drawer of Cheque to negotiable instruments Liability of maker of note and acceptor of bill Liability of indorses

19

DISHONOUR OF A NEGOTIABLE INSTRUMENT

B.Law

May be dishonored by non-acceptance or by non-payment. A promissory note and Cheque are dishonored by non-payment only. When a negotiable instrument is dishonored, the holder must give a notice of Dishonour to all the prior parties in order to make them liable on the instrument. If he fails to do so, except in cases when notice of Dishonour may be excused, he forfeits his right of action against the prior parties entitled to the notice of Dishonour (Sec. 93).

20

B.Law

Dishonour by non-acceptance (Sec. 91)

Reason for dishonoured:

If the drawee does not accept the bill within forty-eight hours from the time of presentation though it is duly presented for acceptance. If there are several drawee and all of them do not accept. When presentment for acceptance is excused and the bill is not accepted. When the drawee is incompetent to contract. When the drawee gives a qualified acceptance. When the drawee is a fictitious person or after reasonable search cannot be found.

21

B.Law

Dishonoured by non-payment (Sec. 92)

When the maker of the note, acceptor of the bill or drawee of the Cheque makes default in payment upon being duly required to pay the same. (Sec.92). An instrument is also dishonoured by nonpayment when presentment for payment is excused and the instrument when overdue remains unpaid (Sec. 76).

22

B.Law

NOTICE OF DISHONOUR

When a negotiable instrument is dishonoured either by non-acceptance or by non-payment, the holder of the instrument or some party to it who is liable thereon, must give a notice of Dishonour to all the prior parties whom he wants to makes liable on the instrument. If he does not give notice, except in cases when notice of dishonour may be excused, all the prior parties liable thereon are discharged of their liability (Sec. 93).

23

Rules for giving notice of dishonour (Sec. 106)

B.Law

If the holder and the party entitled to notice of dishonour carry on business or live in different cities, the notice must be dispatched by the next post or on the day next after the day of honour.

If these parties carry on business or live in the same place, the notice must be dispatched in time to reach its destination on the day next after the day of dishonour.

24

B.Law

Duties of the holder upon dishonour

Notice of dishonour Noting and protesting Suit for money

25

B.Law

Instrument acquired after notice of dishonour

NOTING AND PROTESTING: NOTING:

Noting means the recording of the fact of dishonour by a Notary Public upon the instrument, or upon a paper attached thereto or partly upon each within a reasonable time after dishonour(sec.99,)

Contains of Noting:

The fact of dishonour The date of dishonour The reason, if any assigned for such dishonour. If the instrument has not been expressly dishonoured the reason why the holder treats it as dishonoured ; and The notarys charges (Sec. 99,).

26

B.Law

Protest

When a promissory note or bill of exchange has been dishonoured by non-acceptance or non-payment. The holder may, within a reasonable time. Cause such dishonour to be noted and certified by a Notary Public Such certificate is called a protest (sec. 100)

Contents of PROTEST:

The instrument or a literal transcript of the instrument. The name of the person whom and against whom the instrument has been protested. The fact of, and reason for, dishonour. The place and time of dishonour. The signature of Notary Public.

27

B.Law

Advantage of protest

It affords an authentic evidence of dishonour to the drawer and indorsers. In a suit upon an instrument which has been dishonoured, the court shall, on proof of the protest, presume the fact of dishonour, unless and until such fact is disproved.

28

B.Law

Discharge of an Instruments

Modes of discharge of an instrument :

By payment in due course. By party primarily liable becoming holder. By express waiver. By cancellation By discharge as a simple contract.

29

B.Law

Discharge of Party or Parties

By payment By cancellation By release By allowing drawee more than forty-eight hours BY non-presentment of Cheque Cheque payable to order Draft drawn by one branch on another Parties not consenting discharged by qualified acceptance By material alteration Discharge by payment of altered instrument

30

B.Law

31

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- How To Start A BusinessDocument30 pagesHow To Start A BusinessTermDefined80% (5)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Emerging Trends in Insurance SectorDocument90 pagesEmerging Trends in Insurance Sectorvahid80% (20)

- Ast TX 901 Fringe Benefits Tax (Batch 22)Document6 pagesAst TX 901 Fringe Benefits Tax (Batch 22)Shining LightNo ratings yet

- Mutual FundDocument18 pagesMutual FundAnkit Chhabra100% (2)

- Mock Test AnswersDocument19 pagesMock Test Answerstoll_meNo ratings yet

- FM 8 Module 2 Multinational Financial ManagementDocument35 pagesFM 8 Module 2 Multinational Financial ManagementJasper Mortos VillanuevaNo ratings yet

- March 2019Document4 pagesMarch 2019sagar manghwaniNo ratings yet

- Quantitative Analysis-I: (For Contemporary Decision Making)Document1 pageQuantitative Analysis-I: (For Contemporary Decision Making)nikskagalwalaNo ratings yet

- Concept Methods Analysis InterpretationDocument13 pagesConcept Methods Analysis InterpretationnikskagalwalaNo ratings yet

- Personal Selling-Meaning, Features & TheoriesDocument35 pagesPersonal Selling-Meaning, Features & TheoriesShivali GambhirNo ratings yet

- PGDFME - Semester Wise Subject List (2013-14)Document1 pagePGDFME - Semester Wise Subject List (2013-14)nikskagalwalaNo ratings yet

- PGDFME - Notification (2013-14)Document2 pagesPGDFME - Notification (2013-14)nikskagalwalaNo ratings yet

- Work Place Factor Affecting Employees Performance:: Role Congruity Defined ProcessDocument3 pagesWork Place Factor Affecting Employees Performance:: Role Congruity Defined ProcessnikskagalwalaNo ratings yet

- MBA/MCA Admissions 2013 - TENTATIVE KEY DATES: /print Out of Online ResultDocument1 pageMBA/MCA Admissions 2013 - TENTATIVE KEY DATES: /print Out of Online ResultnikskagalwalaNo ratings yet

- MBA/MCA Admissions 2013 - TENTATIVE KEY DATES: /print Out of Online ResultDocument1 pageMBA/MCA Admissions 2013 - TENTATIVE KEY DATES: /print Out of Online ResultnikskagalwalaNo ratings yet

- GirlDocument5 pagesGirlnikskagalwalaNo ratings yet

- QuestionnaireDocument3 pagesQuestionnairenikskagalwalaNo ratings yet

- Import Import Import Import Import Import Import: / Servlet Implementation Class MydocDocument4 pagesImport Import Import Import Import Import Import: / Servlet Implementation Class MydocnikskagalwalaNo ratings yet

- A Presentation On Recent Example of Joint Venture and AcquisitionDocument20 pagesA Presentation On Recent Example of Joint Venture and AcquisitionnikskagalwalaNo ratings yet

- CH 8Document29 pagesCH 8nikskagalwalaNo ratings yet

- A Study On Investment Pattern of General Public in Mutual Fund (Focus On Mutual Fund)Document20 pagesA Study On Investment Pattern of General Public in Mutual Fund (Focus On Mutual Fund)nikskagalwalaNo ratings yet

- Roadblocks and Barriers To CommunicationDocument12 pagesRoadblocks and Barriers To CommunicationnikskagalwalaNo ratings yet

- CH 14Document14 pagesCH 14nikskagalwalaNo ratings yet

- Assignment Book of New Enterprise and Innovation Management: Admin (Type The Document Subtitle)Document5 pagesAssignment Book of New Enterprise and Innovation Management: Admin (Type The Document Subtitle)nikskagalwalaNo ratings yet

- Identify The PersonalitiesDocument28 pagesIdentify The PersonalitiesnikskagalwalaNo ratings yet

- Venture CapitalistDocument21 pagesVenture CapitalistnikskagalwalaNo ratings yet

- IB QuestionnaireDocument8 pagesIB QuestionnaireWasi Akhtar33% (3)

- Presentation 1Document14 pagesPresentation 1nikskagalwalaNo ratings yet

- The Indian Contract Act, 1872, m1Document112 pagesThe Indian Contract Act, 1872, m1nikskagalwalaNo ratings yet

- The Indian Contract Act 1872Document47 pagesThe Indian Contract Act 1872Dilfaraz KalawatNo ratings yet

- Previous Questions - PercentagesDocument2 pagesPrevious Questions - Percentagessonu khanNo ratings yet

- Genmath LoansDocument22 pagesGenmath LoansninjarkNo ratings yet

- Modi Bats For Unlocking Economy, Cms Divided: He Conomic ImesDocument12 pagesModi Bats For Unlocking Economy, Cms Divided: He Conomic ImesyodofNo ratings yet

- Quarter 3 Module Entrepreneurship 10Document7 pagesQuarter 3 Module Entrepreneurship 10Jowel BernabeNo ratings yet

- Summary PBI Regulation in Regard To The Reporting of Offshore BorrowingDocument3 pagesSummary PBI Regulation in Regard To The Reporting of Offshore BorrowingAditya NuramaliaNo ratings yet

- Worksheet 4.1 Introducing Bank ReconciliationDocument4 pagesWorksheet 4.1 Introducing Bank ReconciliationHan Nwe Oo100% (1)

- Problem 1-1: Problem 1-2 Cash and Cash EquivalentsDocument14 pagesProblem 1-1: Problem 1-2 Cash and Cash EquivalentsAcissejNo ratings yet

- Takeover and AcquisitionsDocument42 pagesTakeover and Acquisitionsparasjain100% (1)

- Meezan Bank AccountsDocument17 pagesMeezan Bank AccountsHamza AkbarNo ratings yet

- E-Commerce MCQ 2nd Sem by Anu OjhaDocument3 pagesE-Commerce MCQ 2nd Sem by Anu OjhaNikhil PimpareNo ratings yet

- International BusinessDocument7 pagesInternational BusinessAarnav BengeriNo ratings yet

- ENTREP - Simple Bookkeeping & Income StatementDocument56 pagesENTREP - Simple Bookkeeping & Income StatementMaydilyn M. Gultiano100% (1)

- Chapter 3 The Machinery of Government MMLSDocument32 pagesChapter 3 The Machinery of Government MMLSpremsuwaatiiNo ratings yet

- DCM Shriram BS 2022Document202 pagesDCM Shriram BS 2022Puneet367No ratings yet

- Important : Allama Iqbal Open University Islamabad Allama Iqbal Open University IslamabadDocument1 pageImportant : Allama Iqbal Open University Islamabad Allama Iqbal Open University IslamabadMuhammad Sohail0% (1)

- IGCSE Economics - Monetary Policy - Handout PDFDocument7 pagesIGCSE Economics - Monetary Policy - Handout PDFdenny_sitorusNo ratings yet

- 5 6332319680358777015Document6 pages5 6332319680358777015Hitin100% (1)

- SL Order For Reduce SlippageDocument4 pagesSL Order For Reduce SlippageVIPUL SAININo ratings yet

- 3 ReceivablesDocument13 pages3 Receivablesjoneth.duenasNo ratings yet

- Long-Term Construction Contracts & FranchiseDocument6 pagesLong-Term Construction Contracts & FranchiseBryan ReyesNo ratings yet

- ACCT 10001: Accounting Reports & Analysis Lecture 2 Illustration: ARA Galleries Pty LTDDocument5 pagesACCT 10001: Accounting Reports & Analysis Lecture 2 Illustration: ARA Galleries Pty LTDBáchHợpNo ratings yet

- Course by Course Evaluation Report: U.S. Equivalence: Grade AverageDocument2 pagesCourse by Course Evaluation Report: U.S. Equivalence: Grade AverageBhageshwar ChaudharyNo ratings yet

- Adms 4551 PDFDocument50 pagesAdms 4551 PDFjorNo ratings yet

- AFAR 3 (Test Questions)Document4 pagesAFAR 3 (Test Questions)Lalaine BeatrizNo ratings yet