Professional Documents

Culture Documents

03 07 08

Uploaded by

Fabien BonnassieOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

03 07 08

Uploaded by

Fabien BonnassieCopyright:

Available Formats

DENIS ILYIN, Senior Vice-President for Strategy & Commercial Moscow, Russia 18.06.

08

Development of Cargo Aircraft Market in Russia

next

World Air Freight Market Will Grow 6.2% Year Through 2025

RTKs, billions 800 History Forecast

High Base Low

Average annual growth 2005-2025 High Base Low 7.1% 6.2% 5.4%

600

400 5.3% growth per year 200

1995

2000

2005

2010

2015

2020

2025

Source: Boeing Commercial Airplanes, World Air Cargo Forecast

previous

next

Average World Air Cargo Freight growth, 6.2%

Domestic China Intra-Asia

Asia-North America Europe-Asia

Latin America-North America Latin America-Europe Europe-North America Europe-Africa Intra-Europe Europe-Middle East North America Russia

Average Growth in %

0% 2% 4% 6% 8% 10% 12%

Source: Boeing Commercial Airplanes, World Air Cargo Forecast

previous

next

Air Cargo Market for non ramp aircraft Scheduled Services 1879 Aircraft ~98,5%$78,8 billion

DC-10, MD-11

Total volume in 2007 ~ $80 billion 190 billion tons / kilometer 41 mln tons

Air Cargo Market for ramp aircraft Charter Services 479 AC ~1,4% $1 billion

-76

A-300-330 -12 -124-100 C-130

-96

B-747

-204

311 AC 747F $30 billion per year (2007) ~ 38% market share

28 AC An-124-100 $771 mln per year (2007) ~ 70% market share

Market Growth Forecast (2020): - On Non ramp Aircraft 6%-6,2% (according to Boeing, Airbus, IATA)

- On Ramp Aircraft 8%-10% (according to Volga-Dnepr Groups forecast)

previous

next

Scheduled cargo operations market (2007)

Ramp aircraft operations market 2007

$80 billion

Russian civil aviation 1,4 % European countries 24%

$1 billion

Russian civil aviation 74 %

Asian and Pacific Region countries 1,4 %

other countries 7,6 % Ukraine and other countries 26%

USA 31%

By 2020 Russian transport aviation development strategy specifies: 1. Increase in dominant position of ramp aircraft cargo operations (from 74% up to 90%). Already now Russian cargo air carriers play the role of international military-cargo airlines. With all that US, European and UNO show the growing need in the services of Russian ramp aircraft air carriers. Expansion on the market of general cargo transportation and share growth on this market (from 1% up to 10%) .

2.

previous

next

2008

100 tons; 16; 11% 10tons; 91; 63%

2020

10 tons; 28; 21% 100 tons; 55; 39%

An-124 Il-76

30-100 tons; 15; 10%

An-124

Charter Services

Il-76

10-30 Tons; 28; 16% Medium 10-30 Tons; 12; 9% 30-100 tons; 41; 31%

Current Ramp Cargo Fleet (150 aircraft)

Ramp Cargo Fleet Forecast (136 aircraft)

Total Number of Aircraft in use 171

Scheduled Services

10 tons; 3; 14%

212 Total Number of Aircraft required 207

10 tons; 8; 11%

100 tons; 20; 27%

10-30 tons; 3; 14%

100 tons; 12; 16%

747F B 747

100 tons; 12; 57%

30-100 tons; 1; 16% 10 tons; 8; 11%

100 tons; 25; 32%

30-100 tons; 19; 26%

747F

B 747

10-30 Tons; tons; 30-100 5; 24%

10-30 Tons; 24; 36%

6; 29%

Current Non Ramp Cargo Fleet (21 aircraft) Source: Volga-Dnepr Group Forecast

30-100 tons; 19; 25% Non Ramp Cargo Fleet Forecast (92 aircraft)

10-30 tons; 24; 32%

previous

next

Other Countries 98,7%

2004

Russia 1,3%

Other Countries 98,6%

2007

Russia 1,4%

Total volume $55 billion

Total volume

$80 billion

Other Countries 92,0%

2015

Other Countries 84,0%

Total volume

$105 billion

previous

Russia 8,0%

Market volume

$160 billion

2030

Russia 16,0% next

DC-10, MD-11

USA

Canada

USA

Canada

B-747, 777

Europe

Moscow

Khabarovsk Krasnoyarsk

Europe Moscow

St.Petersburg

Khabarovsk Krasnoyarsk

China Middle East, Africa India Singapore India

China

Singapore

Moscow natural geographical hub connecting Europe to Middle East, Indian Subcontinent and South-East Asia

Krasnoyarsk natural geographical hub connecting USA, Europe & Canada to China, Japan and South-East Asia

previous

next

HOU ORD NYC

YYC LAX

Moscow

Krasnoyarsk

AMS LHR FRA MIL LED MOW TLV KJA SHA NBO BJS DEL SIN UUS NGO

NRT

HKG

KUL

B 747-8F

previous

next

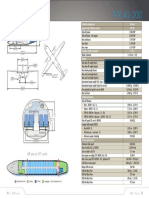

Total Aircraft 2

Aircraft Type 2 x Boeing 747-200 (VP-BIA, BIB)

Delivery/Retirement Schedule April 2004, July 2005

Current Status Retired in 2007-2008

3

4 6 5 6 8 7 8-12

1 x Boeing 747-300SF (VP-BIC)

1 x Boeing 747-200F (VP-BID) 2 x Boeing 747-200F (VP-BII, BIJ) 2 x Boeing 747-200F (VP-BIA) Boeing 747- 400ERF (VP-BIG) Boeing 747-400ERF Boeing 747-200 (VP-BIB) Boeing 747-8

October 2005

June 2006 (NCA) March 2007 (NCA) September 2007 October 2007 (Boeing) February & April 2008 (Boeing) March 2008 2010-2013 (Boeing)

In Service

In Service In Service Retired in 2007 In Service In Service Retired in 2008 On Order

previous

next

10

Boeing 747-8F

Boeing 747 8F Boeing 747-400 ERF 2 x Boeing 747-200 1 x Boeing 747 -400 ERF

+5

+5

2020

+2

2010-13

Boeing 747-200

+3

2008

Boeing 747-200

Boeing 747-200

+1

2007

Boeing 747-200

-1

Boeing 747-200

+1

2006

-1

2005

2004

previous

next

11

Cities with population more than 1mln people

Regions of significant economic growth

S. Petersburg Moscow Rostov on Don Nizhny Novgorod

Kazan Ufa

Chelyabinsk

Yekaterinburg Omsk Novosibirsk Krasnoyarsk

Source: Ministry of Economic of RF Federal State Statistics Service

Samara

previous

next

12

-204

AirBridgeCargo Hubs ABC Schedule Service Air Feeder Service

B-737, 757, 767 Road Feeder Service

A320F, A330F

ST. PETERSBURG (LED)

MOSCOW (SVO)

Oil & Gas Exploration fields

YUZHNOSAKHALINSK (UUS)

KRASNOYARSK (KJA)

KHABAROVSK (KHV)

previous

next nex

13

While Boeing 747 freighters offer capacity on long haul international routes, regional aircraft will complement transcontinental services with local distribution capabilities. Tupolev 204C has been selected as the middle range aircraft type to serve Russian domestic markets from ABC hubs in Moscow and Krasnoyarsk. In June 2007, two planes of this type have been ordered with AVIASTAR-SP (Ulyanovsk, Russia), and 3 more are in plans until 2010

Aircraft 1-2 3-5

Aircraft Type Tupolev-204C Tupolev-204C

Delivery Schedule 2009 Quarter 1 Until 2010

Status In production On Option

previous

next

previous

exit

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Heathrow Egll Stand Allocation Guide 2 0 PDFDocument4 pagesHeathrow Egll Stand Allocation Guide 2 0 PDFDesmond NgNo ratings yet

- CBT TEST ANSWERSDocument1 pageCBT TEST ANSWERSGirish SreeneebusNo ratings yet

- Aircraft CompanyDocument2 pagesAircraft CompanyBobbyD.ResjaNo ratings yet

- A320-27-1247 R0 - Config 001Document85 pagesA320-27-1247 R0 - Config 001Edson Carvalho100% (1)

- ETOPSDocument199 pagesETOPSFaiz JamadarNo ratings yet

- DVB Overview of Commercial Aircraft 2017-2018Document96 pagesDVB Overview of Commercial Aircraft 2017-2018Bayu Panji BaskoroNo ratings yet

- A318/A319/A320/A321: Service BulletinDocument129 pagesA318/A319/A320/A321: Service BulletinPradeep K sNo ratings yet

- MPD A320 Rev.46 Oct 14 2019Document1,546 pagesMPD A320 Rev.46 Oct 14 2019Adhitya Ramadhan100% (2)

- Atr42 300 BrochureDocument1 pageAtr42 300 BrochureAnonymous lfjo09d2OsNo ratings yet

- Aercap - Fleetsheet 4Q 2022Document2 pagesAercap - Fleetsheet 4Q 2022Neo PauloNo ratings yet

- D10 - A320 Family Customer Presentation Programme - FM1302305 - v1Document7 pagesD10 - A320 Family Customer Presentation Programme - FM1302305 - v1IDINAHNo ratings yet

- China Report CN Web 2016 A01Document66 pagesChina Report CN Web 2016 A01Yiliang CuiNo ratings yet

- Canadian Forces CC-137 Detailed ListDocument1 pageCanadian Forces CC-137 Detailed ListПриходько РомаNo ratings yet

- Controller Assy-Side StickDocument1 pageController Assy-Side StickAhmed El MahdyNo ratings yet

- A318/A319/A320/A321: Service BulletinDocument128 pagesA318/A319/A320/A321: Service BulletinPradeep K sNo ratings yet

- HISTORY of Air BusDocument1 pageHISTORY of Air BusImran FarmanNo ratings yet

- Airborne Fuel Pump 2Document1 pageAirborne Fuel Pump 2Luis Martinez GerdingNo ratings yet

- 737 NG - System Diagram BookDocument95 pages737 NG - System Diagram Booktung phung van93% (14)

- OEM Backlog Evolution and Impact of Covid-19Document3 pagesOEM Backlog Evolution and Impact of Covid-19Arya PrihutamaNo ratings yet

- Bite Test PDFDocument3 pagesBite Test PDFbillyNo ratings yet

- 004 BADA 3 7 Revision SummaryDocument38 pages004 BADA 3 7 Revision Summaryy.komurcu921No ratings yet

- A318/A319/A320/A321: Service BulletinDocument53 pagesA318/A319/A320/A321: Service BulletinGuy Ulrich DouoguiNo ratings yet

- GOW - A318 - A319 - A320 - A321 - AMM - 01-Feb-2020 - 11-25-55-910-001-A - Record The Weight of The ElevatorDocument8 pagesGOW - A318 - A319 - A320 - A321 - AMM - 01-Feb-2020 - 11-25-55-910-001-A - Record The Weight of The ElevatornaziaNo ratings yet

- Embraer E190-E2 SpecDocument2 pagesEmbraer E190-E2 SpecNaili Bourhane Aboudou RahimeNo ratings yet

- Q300 enDocument2 pagesQ300 enhenry_aero100% (2)

- Embraer Legacy 600Document4 pagesEmbraer Legacy 600Anish Shakya0% (1)

- Delta Aircraft Fleet SpecsDocument2 pagesDelta Aircraft Fleet SpecsseguinsNo ratings yet

- 2012-US Majors - All AircraftDocument888 pages2012-US Majors - All Aircraftma28navNo ratings yet

- MPD A320 PDFDocument1,634 pagesMPD A320 PDFGabriel Santos100% (2)

- Yellow Electric Pump: Job Card Package Title: HIM - A318/A319/A320/ A321 Tail Number - MSN - FSN ALL ContinousDocument4 pagesYellow Electric Pump: Job Card Package Title: HIM - A318/A319/A320/ A321 Tail Number - MSN - FSN ALL ContinousSuman BajracharyaNo ratings yet