Professional Documents

Culture Documents

CH 06

Uploaded by

sumihosaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CH 06

Uploaded by

sumihosaCopyright:

Available Formats

6-1

Chapter 6

Charles P. Jones, Investments: Analysis and

Management,

Tenth Edition, John Wiley & Sons

Prepared by

G.D. Koppenhaver, Iowa State University

Measuring Returns and

Risk

6-2

Asset Valuation

Function of both return and risk

At the center of security analysis

How should realized return and risk be

measured?

The realized risk-return tradeoff is based on

the past

The expected risk-return tradeoff is

uncertain and may not occur

6-3

Return Components

Returns consist of two elements:

Periodic cash flows such as interest or

dividends (income return)

Yield measures relate income return to a price

for the security

Price appreciation or depreciation (capital

gain or loss)

The change in price of the asset

Total Return =Yield +Price Change

6-4

Financial Risk

Tied to debt financing

Liquidity Risk

Marketability with-out

sale prices

Exchange Rate Risk

Country Risk

Political stability

Risk Sources

Interest Rate Risk

Affects income return

Market Risk

Overall market effects

Inflation Risk

Purchasing power

variability

Business Risk

6-5

Risk Types

Two general types:

Systematic (general) risk

Pervasive, affecting all securities, cannot be

avoided

Interest rate or market or inflation risks

Nonsystematic (specific) risk

Unique characteristics specific to issuer

Total Risk = General Risk + Specific

Risk

6-6

P

) P (P CF

TR

B

B E t

+

=

Measuring Returns

For comparing performance over time or

across different securities

Total Return is a percentage relating all cash

flows received during a given time period,

denoted CFt +(PE - PB), to the start of period

price, PB

6-7

Measuring Returns

Total Return can be either positive or

negative

When cumulating or compounding, negative

returns are problem

A Return Relative solves the problem

because it is always positive

TR

P

P CF

RR

B

E t

+ =

+

= 1

6-8

)

n

TR )...( TR )( TR ( WI + + + 1

2

1

1

1

0

Measuring Returns

To measure the level of wealth created

by an investment rather than the

change in wealth, need to cumulate

returns over time

Cumulative Wealth Index, CWI

n

, over n

periods =

6-9

rr. of For.Cu Begin Val.

. f For.Curr End Val. o

RR 1

(

Measuring International Returns

International returns include any

realized exchange rate changes

If foreign currency depreciates, returns

lower in domestic currency terms

Total Return in domestic currency =

6-10

n

X

X

=

Measures Describing a

Return Series

TR, RR, and CWI are useful for a given,

single time period

W hat about summarizing returns over

several time periods?

Arithmetic mean, or simply mean,

6-11

Arithmetic Versus Geometric

Arithmetic mean does not measure the

compound growth rate over time

Does not capture the realized change in

wealth over multiple periods

Does capture typical return in a single

period

Geometric mean reflects compound,

cumulative returns over more than one

period

6-12

Defined as the n-th root of the product

of n return relatives minus one or G =

Difference between Geometric mean

and Arithmetic mean depends on the

variability of returns, s

| | ) TR )...( TR )( TR (

/n

n

1 1 1 1

1

2 1

+ + +

( ) s X G

2

2

2

1 1 + ~ +

Geometric Mean

6-13

( )

( )

CPI

TR

TR

IA

1

1

1

+

+

=

Adjusting Returns for Inflation

Returns measures are not adjusted for

inflation

Purchasing power of investment may

change over time

Consumer Price Index (CPI) is possible

measure of inflation

6-14

n

X X

s

/ 2 1

2

1

|

|

.

|

\

|

=

Measuring Risk

Risk is the chance that the actual

outcome is different than the expected

outcome

Standard Deviation measures the

deviation of returns from the mean

6-15

Risk Premiums

Premium is additional return earned or

expected for additional risk

Calculated for any two asset classes

Equity risk premium is the difference

between stock and risk-free returns

Bond horizon premium is the difference

between long- and short-term

government securities

6-16

Equity Risk Premium, ERP, =

Bond Horizon Premium, BHP, =

( )

RF

CS

TR

1

1

1

+

+

TB

TR

GB

TR

1

1

1

+

+

Risk Premiums

6-17

The Risk-Return Record

Since 1920, cumulative wealth indexes

show stock returns dominate bond

returns

Stock standard deviations also exceed bond

standard deviations

Annual geometric mean return for the

S&P 500 is 10.3% with standard

deviation of 19.7%

6-18

Copyright 2006 John Wiley & Sons, Inc. All rights

reserved. Reproduction or translation of this work

beyond that permitted in Section 117 of the 1976 United

states Copyright Act without the express written

permission of the copyright owner is unlawful. Request

for further information should be addressed to the

Permissions department, John Wiley & Sons, Inc. The

purchaser may make back-up copies for his/her own use

only and not for distribution or resale. The Publisher

assumes no responsibility for errors, omissions, or

damages, caused by the use of these programs or from

the use of the information contained herein.

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- CH 09Document29 pagesCH 09sumihosaNo ratings yet

- CH 09Document29 pagesCH 09sumihosaNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Market StructureDocument16 pagesMarket StructureRD Suarez100% (2)

- CH 14Document20 pagesCH 14sumihosaNo ratings yet

- "Energy Demand in Rural Ethiopia From A Household Perspective: A Panel Data Analysis," by Dawit Diriba GutaDocument20 pages"Energy Demand in Rural Ethiopia From A Household Perspective: A Panel Data Analysis," by Dawit Diriba GutaThe International Research Center for Energy and Economic Development (ICEED)100% (1)

- CH 17Document22 pagesCH 17sumihosaNo ratings yet

- CH 22Document19 pagesCH 22sumihosaNo ratings yet

- CH 19Document23 pagesCH 19sumihosaNo ratings yet

- CH 20Document22 pagesCH 20sumihosaNo ratings yet

- CH 18Document19 pagesCH 18sumihosaNo ratings yet

- CH 21Document20 pagesCH 21sumihosaNo ratings yet

- CH 10Document25 pagesCH 10sumihosaNo ratings yet

- CH 16Document20 pagesCH 16sumihosaNo ratings yet

- CH 12Document23 pagesCH 12sumihosaNo ratings yet

- CH 13Document20 pagesCH 13sumihosaNo ratings yet

- CH 10Document25 pagesCH 10sumihosaNo ratings yet

- CH 15Document24 pagesCH 15sumihosaNo ratings yet

- CH 11Document14 pagesCH 11sumihosaNo ratings yet

- Jones ch01Document9 pagesJones ch01sumihosa0% (1)

- Selecting and Optimal PortfolioDocument16 pagesSelecting and Optimal PortfoliosumihosaNo ratings yet

- Investing in Mutual Funds and EtfsDocument16 pagesInvesting in Mutual Funds and EtfssumihosaNo ratings yet

- CH 04Document16 pagesCH 04sumihosa100% (2)

- What To Know About Trading SecuritiesDocument16 pagesWhat To Know About Trading SecuritiessumihosaNo ratings yet

- CH 12Document23 pagesCH 12sumihosaNo ratings yet

- CH 11Document14 pagesCH 11sumihosaNo ratings yet

- Financial Assets Available To InvestorsDocument22 pagesFinancial Assets Available To InvestorssumihosaNo ratings yet

- Diversification and Portfolio TheoryDocument20 pagesDiversification and Portfolio TheorysumihosaNo ratings yet

- Selecting and Optimal PortfolioDocument16 pagesSelecting and Optimal PortfoliosumihosaNo ratings yet

- Diversification and Portfolio TheoryDocument20 pagesDiversification and Portfolio TheorysumihosaNo ratings yet

- What To Know About Trading SecuritiesDocument16 pagesWhat To Know About Trading SecuritiessumihosaNo ratings yet

- CH 06Document18 pagesCH 06sumihosa100% (1)

- FinGame 5.0 Participants Ch03Document24 pagesFinGame 5.0 Participants Ch03Martin VazquezNo ratings yet

- Session 3Document32 pagesSession 3vidhiNo ratings yet

- Chapter 3 ElasticitiesDocument30 pagesChapter 3 ElasticitiesMandeep KaurNo ratings yet

- Unemployment in PakistanDocument14 pagesUnemployment in PakistanmadihasaleemsNo ratings yet

- MCQ CapitalrationingDocument2 pagesMCQ Capitalrationingvirendra kumarNo ratings yet

- Inventec Case StudyDocument3 pagesInventec Case StudyMonica TrieuNo ratings yet

- Econ 3803a Ayoo w20Document4 pagesEcon 3803a Ayoo w20Omotara YusufNo ratings yet

- Fiscal Policy and Endogenous GrowthDocument33 pagesFiscal Policy and Endogenous GrowthNicolas BaroneNo ratings yet

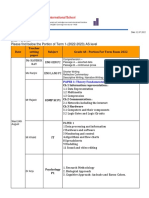

- Dear Parents, Please Find Below The Portion of Term 1 - (2022-2023) AS LevelDocument5 pagesDear Parents, Please Find Below The Portion of Term 1 - (2022-2023) AS LevelPrayrit JainNo ratings yet

- Cost of CapitalDocument33 pagesCost of CapitalIamByker BwoeNo ratings yet

- Chapter 25 - Merger & AcquisitionDocument42 pagesChapter 25 - Merger & AcquisitionmeidianizaNo ratings yet

- HW 4Document7 pagesHW 4doug119No ratings yet

- Russell Sage Foundation Spring 2013 CatalogDocument44 pagesRussell Sage Foundation Spring 2013 CatalogRussell Sage FoundationNo ratings yet

- Assignment Investment ManagementDocument15 pagesAssignment Investment Managementmkay azizNo ratings yet

- A-Level Economics SyllabusDocument21 pagesA-Level Economics SyllabusyeohjjNo ratings yet

- P6 - Anprod - Total Productivity ModelDocument17 pagesP6 - Anprod - Total Productivity ModelNicko Nur RakhmaddianNo ratings yet

- Difference Between Job Costing and Process CostingDocument2 pagesDifference Between Job Costing and Process CostingJayceelyn OlavarioNo ratings yet

- Thesis On Public PolicyDocument6 pagesThesis On Public Policyqrikaiiig100% (2)

- The Leontief Production Function As Limiting Case of The CES - Csontos and Subhash (1992)Document4 pagesThe Leontief Production Function As Limiting Case of The CES - Csontos and Subhash (1992)OmarAndredelaSotaNo ratings yet

- Strategy PickerDocument16 pagesStrategy PickerJose ShawNo ratings yet

- Popper's Situational Analysis and Contemporary Sociology - Hedström, Swedberg, Udéhn 1998Document26 pagesPopper's Situational Analysis and Contemporary Sociology - Hedström, Swedberg, Udéhn 1998Anders FernstedtNo ratings yet

- Managerial Economics Reviewer.Document49 pagesManagerial Economics Reviewer.Jay PonsaranNo ratings yet

- Economic Theory by ShumPeterDocument16 pagesEconomic Theory by ShumPeterPalak AhujaNo ratings yet

- BB 107 Supplementary Exam Summer 2020 Q (Set A) (Online)Document6 pagesBB 107 Supplementary Exam Summer 2020 Q (Set A) (Online)Brewell CoNo ratings yet

- Acc49 KLIBEL6 Acc 49 Ayu-Purnama D49Document8 pagesAcc49 KLIBEL6 Acc 49 Ayu-Purnama D49riniNo ratings yet

- EurowindowDocument11 pagesEurowindowThanh Tam VuNo ratings yet

- Introduction To Operations Management: Random Fluctuations Monitor Output Adjustment Needed?Document11 pagesIntroduction To Operations Management: Random Fluctuations Monitor Output Adjustment Needed?Shweta Yadav100% (1)

- M&e Module 4Document15 pagesM&e Module 4Vignesh Lio100% (1)