Professional Documents

Culture Documents

Checking Account and Debit Card Simulation

Uploaded by

Sandra_ZimmermanOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Checking Account and Debit Card Simulation

Uploaded by

Sandra_ZimmermanCopyright:

Available Formats

2.7.3.

G1

September 14 B Day Panther Time is 5B)

Quiz on Being a Wise Consumer Road Map & Budget Interims 9/28 I need your missing work Todays lesson is on check writing, filling out a deposit ticket, understanding the many types of bank transactions, endorsing the back of a check, and completing a check register

Family Economics & Financial Education May 2006 Get Ready to Take Charge of Your Finances Checking Account & Debit Card Simulation Slide 1 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

Checking Account & Debit Card Simulation

Understanding Checking Accounts and Debit Card Transactions

2.7.3.G1

What is a Checking Account?

Common financial service used by many consumers Funds are easily accessed

Check ATM (automated teller machine) Debit card Telephone Internet

Services and fees vary depending upon the financial institution

Family Economics & Financial Education May 2006 Get Ready to Take Charge of Your Finances Checking Account & Debit Card Simulation Slide 3 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2.7.3.G1

Why Do People Use Checking Accounts?

Reduces the need to carry large amounts of cash Convenience useful for paying bills Spending Plan Tool

Keeps a record of where money is spent

Safety using checks is safer than carrying cash

Family Economics & Financial Education May 2006 Get Ready to Take Charge of Your Finances Checking Account & Debit Card Simulation Slide 4 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2.7.3.G1

What is a Check?

Used at the time of purchase as the form of payment Piece of paper pre-printed with the account holders:

Name Address Financial institution Identification numbers

Family Economics & Financial Education May 2006 Get Ready to Take Charge of Your Finances Checking Account & Debit Card Simulation Slide 5 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2.7.3.G1

Bouncing a Check

Check written for an amount over the current balance held in the account

Bounces due to insufficient funds, or not enough money in the account to cover the check written

A fee will be charged to the account holder Harm future opportunities for credit

Family Economics & Financial Education May 2006 Get Ready to Take Charge of Your Finances Checking Account & Debit Card Simulation Slide 6 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2.7.3.G1

Other Checking Components

Checking Account Register

Place to immediately record all monetary transactions for a checking account

Written checks, ATM withdrawals, debit card purchases, deposits and additional bank fees

Checkbook

Contains the checks and the register to track monetary transactions

Family Economics & Financial Education May 2006 Get Ready to Take Charge of Your Finances Checking Account & Debit Card Simulation Slide 7 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2.7.3.G1

ATM

Automated teller machine, or a cash machine Can be used to withdraw cash and make deposits Additional fees may be assessed if the ATM used is not provided by the financial institution sponsoring the card

Family Economics & Financial Education May 2006 Get Ready to Take Charge of Your Finances Checking Account & Debit Card Simulation Slide 8 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2.7.3.G1

Debit Card

Plastic card that looks like a credit card Electronically connected to a bank account Money is automatically taken from the bank account when purchases are made Requires a PIN (personal identification number)

Confirms the user is authorized to access the account

Family Economics & Financial Education May 2006 Get Ready to Take Charge of Your Finances Checking Account & Debit Card Simulation Slide 9 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2.7.3.G1

To Use A Debit Card

Swipe it through the store machine or put into an ATM Enter the PIN Complete transaction

Family Economics & Financial Education May 2006 Get Ready to Take Charge of Your Finances Checking Account & Debit Card Simulation Slide 10 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2.7.3.G1

Pros and Cons - Debit Cards

Pros

Cons

Convenient Small Can be used like a credit card Allows a person to carry less cash Does not allow overspending

Can lose track of balance if transactions are not written down Opens checking account up to credit fraud Others can gain access to the account if the card is lost and PIN is known

Family Economics & Financial Education May 2006 Get Ready to Take Charge of Your Finances Checking Account & Debit Card Simulation Slide 11 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2.7.3.G1

Endorsing a Check

Endorsement

Signature on the back of a check to approve it to be deposited or cashed A check must be endorsed to be deposited

Blank Restrictive Special

Three types

Family Economics & Financial Education May 2006 Get Ready to Take Charge of Your Finances Checking Account & Debit Card Simulation Slide 12 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2.7.3.G1

Blank Endorsement

Receiver of the check signs his/her name Anyone can cash or deposit the check after has been signed

Family Economics & Financial Education May 2006 Get Ready to Take Charge of Your Finances Checking Account & Debit Card Simulation Slide 13 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2.7.3.G1

Restrictive Endorsement

More secure than blank endorsement Receiver writes for deposit only and account number above his/her signature

Allows the check to only be deposited

Family Economics & Financial Education May 2006 Get Ready to Take Charge of Your Finances Checking Account & Debit Card Simulation Slide 14 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2.7.3.G1

Special Endorsement

Receiver signs and writes pay to the order of (fill in persons name) Allows the check to be transferred to a second party

Also known as a two-party check

Family Economics & Financial Education May 2006 Get Ready to Take Charge of Your Finances Checking Account & Debit Card Simulation Slide 15 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2.7.3.G1

Worksheet Answers

Blank

Endorse Here Endorse Here

Restrictive

X

Students Signature

Students Signature

For Deposit OnlyAcct. # 987654321

Special

Endorse Here

Students Signature

Pay to the Order of Jonathon Smith

Family Economics & Financial Education May 2006 Get Ready to Take Charge of Your Finances Checking Account & Debit Card Simulation Slide 16 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2.7.3.G1

Making a Deposit

Deposit slip

Contains the account holders account number and allows money (cash or check) to be deposited into the correct account Located in the back of the checkbook

Complete a deposit slip to make a deposit Deposited amount must be recorded in the checking account register to keep the balance current Deposits can be made at an ATM or with a bank teller

Family Economics & Financial Education May 2006 Get Ready to Take Charge of Your Finances Checking Account & Debit Card Simulation Slide 17 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2.7.3.G1

Completing a Deposit Slip

Date

The date the deposit is being made

Family Economics & Financial Education May 2006 Get Ready to Take Charge of Your Finances Checking Account & Debit Card Simulation Slide 18 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2.7.3.G1

Completing a Deposit Slip

Signature Line

Sign this line to receive cash back

Family Economics & Financial Education May 2006 Get Ready to Take Charge of Your Finances Checking Account & Debit Card Simulation Slide 19 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2.7.3.G1

Completing a Deposit Slip

Cash

The total amount of cash being deposited

Family Economics & Financial Education May 2006 Get Ready to Take Charge of Your Finances Checking Account & Debit Card Simulation Slide 20 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2.7.3.G1

Completing a Deposit Slip

Checks

List each check individually

CASH

Dollars Cents

List Singly Identify each check on the deposit slip by abbreviating the name of the check writer Piggly Wiggly #5678

CHECKS

Family Economics & Financial Education May 2006 Get Ready to Take Charge of Your Finances Checking Account & Debit Card Simulation Slide 21 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona Total From Other Side

154 01

2.7.3.G1

Completing a Deposit Slip

Checks

If more checks are being deposited than number of spaces on the front, use the back List each check Add the total, enter it on the front

Family Economics & Financial Education May 2006 Get Ready to Take Charge of Your Finances Checking Account & Debit Card Simulation Slide 22 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2.7.3.G1

Completing a Deposit Slip

Total from Other Side

The total amount from all checks listed on the back

Family Economics & Financial Education May 2006 Get Ready to Take Charge of Your Finances Checking Account & Debit Card Simulation Slide 23 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2.7.3.G1

Completing a Deposit Slip

Subtotal

The total amount of cash and checks

Family Economics & Financial Education May 2006 Get Ready to Take Charge of Your Finances Checking Account & Debit Card Simulation Slide 24 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2.7.3.G1

Completing a Deposit Slip

Less Cash Received

The amount of cash back being received This amount is not deposited into account

Family Economics & Financial Education May 2006 Get Ready to Take Charge of Your Finances Checking Account & Debit Card Simulation Slide 25 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2.7.3.G1

Completing a Deposit Slip

Net Deposit

The amount being deposited into the account To calculate the amount, subtract the cash received from the subtotal

Family Economics & Financial Education May 2006 Get Ready to Take Charge of Your Finances Checking Account & Debit Card Simulation Slide 26 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2.7.3.G1

Worksheet Answer

Family Economics & Financial Education May 2006 Get Ready to Take Charge of Your Finances Checking Account & Debit Card Simulation Slide 27 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2.7.3.G1

Writing a Check

To pay for items using a checking account

A check is given as a form of payment Must be completed and given to the person or business Name and address of account holder Name and address of financial institution Check number Identification numbers (account, routing)

Pre-printed items on a check

Family Economics & Financial Education May 2006 Get Ready to Take Charge of Your Finances Checking Account & Debit Card Simulation Slide 28 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2.7.3.G1

Writing a Check

Personal Information

Account holders name and address May include a phone number, not required DO NOT list a social security number for safety reasons

Family Economics & Financial Education May 2006 Get Ready to Take Charge of Your Finances Checking Account & Debit Card Simulation Slide 29 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2.7.3.G1

Writing a Check

Check Number

Numbers used to identify checks Printed chronologically

Family Economics & Financial Education May 2006 Get Ready to Take Charge of Your Finances Checking Account & Debit Card Simulation Slide 30 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2.7.3.G1

Writing a Check

Date

The date the check is written

Family Economics & Financial Education May 2006 Get Ready to Take Charge of Your Finances Checking Account & Debit Card Simulation Slide 31 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2.7.3.G1

Writing a Check

Pay to the Order of

The name of the person or business to whom the check is being written

Family Economics & Financial Education May 2006 Get Ready to Take Charge of Your Finances Checking Account & Debit Card Simulation Slide 32 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2.7.3.G1

Writing a Check

Amount of the Check in Numerals

The amount of the check written numerically in the box Write the cents smaller and underline Write the numbers directly next the dollar sign to prevent someone else from adding numbers to change the amount

Family Economics & Financial Education May 2006 Get Ready to Take Charge of Your Finances Checking Account & Debit Card Simulation Slide 33 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2.7.3.G1

Writing a Check

Amount of the Check in Words

The amount of the check written in words on the second line Start at the far left of the line, write the amount in words, followed by and, and the amount of cents over 100; draw a line from the end of the words to the word dollars

Family Economics & Financial Education May 2006 Get Ready to Take Charge of Your Finances Checking Account & Debit Card Simulation Slide 34 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2.7.3.G1

Writing a Check

Memo

Space used to identify the reason for writing a check; optional Good place to write information requested by a company when paying a bill, generally the account number

Family Economics & Financial Education May 2006 Get Ready to Take Charge of Your Finances Checking Account & Debit Card Simulation Slide 35 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2.7.3.G1

Writing a Check

Signature

The account holders signature agreeing to the transaction

Family Economics & Financial Education May 2006 Get Ready to Take Charge of Your Finances Checking Account & Debit Card Simulation Slide 36 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2.7.3.G1

Writing a Check

Identification Numbers

First - routing numbers to identify the accounts financial institution Second - account number Third - check number

Family Economics & Financial Education May 2006 Get Ready to Take Charge of Your Finances Checking Account & Debit Card Simulation Slide 37 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2.7.3.G1

Worksheet Answers

Family Economics & Financial Education May 2006 Get Ready to Take Charge of Your Finances Checking Account & Debit Card Simulation Slide 38 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2.7.3.G1

Worksheet Answers

Family Economics & Financial Education May 2006 Get Ready to Take Charge of Your Finances Checking Account & Debit Card Simulation Slide 39 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2.7.3.G1

Check 21

Check Clearing for the 21st Century Act (Check 21)

When a check is written, the money is automatically withdrawn from a bank account Makes bouncing checks difficult

Family Economics & Financial Education May 2006 Get Ready to Take Charge of Your Finances Checking Account & Debit Card Simulation Slide 40 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2.7.3.G1

Debit Card

Account NumberLinks all purchases made with the card to a designated bank account Expiration Date The debit card is valid and may be used until this date Cardholders Name The cardholders full name is written out and displayed. Magnetic Strip When the debit card is swiped, the magnetic strip automatically withdraws funds from the cardholders account.

Family Economics & Financial Education May 2006 Get Ready to Take Charge of Your Finances Checking Account & Debit Card Simulation Slide 41 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2.7.3.G1

Debit Card

Authorized Signature Sign in the signature box on the back of the debit card to authorize payments

Should also write, See ID in the signature box Ensures the person using the card is authorized to do so

Verification NumberThis three digit code is located on the back of the card in the signature area

Help ensure the card is in the cardholders possession when making purchases Prevents unauthorized use

Family Economics & Financial Education May 2006 Get Ready to Take Charge of Your Finances Checking Account & Debit Card Simulation Slide 42 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2.7.3.G1

Checking Account Register

Place to record all monetary transactions for a checking account

Deposits,

checks, ATM use, debit card purchases, additional bank fees

Used to keep a running balance of the account Remember

Record every transaction!

Family Economics & Financial Education May 2006 Get Ready to Take Charge of Your Finances Checking Account & Debit Card Simulation Slide 43 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2.7.3.G1

Check Register

Date

The date the check was written or transaction was made

Family Economics & Financial Education May 2006 Get Ready to Take Charge of Your Finances Checking Account & Debit Card Simulation Slide 44 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2.7.3.G1

Check Register

Number

The number of the written check; if a debit card or ATM was used, write DC or ATM

Family Economics & Financial Education May 2006 Get Ready to Take Charge of Your Finances Checking Account & Debit Card Simulation Slide 45 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2.7.3.G1

Check Register

Description of Transaction

The person/business the check was written to or where the debit card was used Gray line can be used to write the memo

Family Economics & Financial Education May 2006 Get Ready to Take Charge of Your Finances Checking Account & Debit Card Simulation Slide 46 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2.7.3.G1

Check Register

Payment/Debit(-)

Amount of the transaction Deducted from the balance

Family Economics & Financial Education May 2006 Get Ready to Take Charge of Your Finances Checking Account & Debit Card Simulation Slide 47 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2.7.3.G1

Check Register

Deposit/Credit(+)

Amount of the transaction Added to the balance

Family Economics & Financial Education May 2006 Get Ready to Take Charge of Your Finances Checking Account & Debit Card Simulation Slide 48 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2.7.3.G1

Check Register

A box used to track whether the check has cleared on the monthly bank statement when reconciling at the end of each month

Family Economics & Financial Education May 2006 Get Ready to Take Charge of Your Finances Checking Account & Debit Card Simulation Slide 49 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2.7.3.G1

Check Register

Fee (if any)

Any extra fees charged to the account Listed on the bank statement

Family Economics & Financial Education May 2006 Get Ready to Take Charge of Your Finances Checking Account & Debit Card Simulation Slide 50 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2.7.3.G1

Check Register

Balance

The running total of the checking account Calculated by adding or subtracting each transaction Keep this updated

Family Economics & Financial Education May 2006 Get Ready to Take Charge of Your Finances Checking Account & Debit Card Simulation Slide 51 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2.7.3.G1

Monthly Bank Statement

Lists each monetary transaction and the current account balance for a specified time period Includes:

Dates Identification for each transaction (number or type, date, amount) Transaction amounts for withdrawals and/or deposits Interest earned (if applicable) Fees or charges (if applicable)

Family Economics & Financial Education May 2006 Get Ready to Take Charge of Your Finances Checking Account & Debit Card Simulation Slide 52 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2.7.3.G1

Monthly Bank Statement

Lists each transaction and current account balance

Deposits Checks Debit Card transactions ATM transactions Additional fees

Family Economics & Financial Education May 2006 Get Ready to Take Charge of Your Finances Checking Account & Debit Card Simulation Slide 53 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2.7.3.G1

Reconciling a Checking Account

Reconcile

Balance the checkbook register each month to the balance shown on the statement

Do this every month to ensure the correct balance in the checkbook

Knowing the correct balance can help to avoid bouncing checks

Family Economics & Financial Education May 2006 Get Ready to Take Charge of Your Finances Checking Account & Debit Card Simulation Slide 54 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2.7.3.G1

Steps for Reconciling

View the monthly bank statement and check register

Family Economics & Financial Education May 2006 Get Ready to Take Charge of Your Finances Checking Account & Debit Card Simulation Slide 55 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2.7.3.G1

Place a check mark in the T column for all transactions that have been cleared and are shown on the bank statement

Family Economics & Financial Education May 2006 Get Ready to Take Charge of Your Finances Checking Account & Debit Card Simulation Slide 56 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2.7.3.G1

Determine the current account balance from the bank statement

Family Economics & Financial Education May 2006 Get Ready to Take Charge of Your Finances Checking Account & Debit Card Simulation Slide 57 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2.7.3.G1

Add any outstanding deposits transactions that have not cleared the bank

Calculate the Subtotal

Family Economics & Financial Education May 2006 Get Ready to Take Charge of Your Finances Checking Account & Debit Card Simulation Slide 58 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2.7.3.G1

Subtract any outstanding withdrawals and calculate

Compare the total with the checkbook register. If the totals are different, double check the math and make sure all service fees and bank charges are recorded in the check register.

Family Economics & Financial Education May 2006 Get Ready to Take Charge of Your Finances Checking Account & Debit Card Simulation Slide 59 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2.7.3.G1

Checking Account Safety

If a checkbook, ATM, and/or debit card becomes lost or stolen

Immediately report it to the financial institution File a report with the police Financial institutions generally do not hold the account holder liable for any fraudulent charges

Reported lost/stolen checkbook:

Family Economics & Financial Education May 2006 Get Ready to Take Charge of Your Finances Checking Account & Debit Card Simulation Slide 60 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2.7.3.G1

Safety continued

Reported lost/stolen ATM/debit card:

Within 2 business days

Cardholder is only liable for $50.00

Longer than 2 business days

Could be liable for up to $500.00

May not charge the account holder anything if the correct steps were taken to report the lost/stolen card

Varies depending upon the financial institution

Family Economics & Financial Education May 2006 Get Ready to Take Charge of Your Finances Checking Account & Debit Card Simulation Slide 61 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2.7.3.G1

Questions?

Family Economics & Financial Education May 2006 Get Ready to Take Charge of Your Finances Checking Account & Debit Card Simulation Slide 62 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

You might also like

- Checking Account Simulation Power Point Presentation FEFEDocument77 pagesChecking Account Simulation Power Point Presentation FEFEfletcher8No ratings yet

- Health Insurance Forms 1Document1 pageHealth Insurance Forms 1api-453439542No ratings yet

- Oakland Domain Awareness Center - Invoice Binder Scan 11-06-13 (May 2013) 76pgsDocument76 pagesOakland Domain Awareness Center - Invoice Binder Scan 11-06-13 (May 2013) 76pgsoccupyoaklandNo ratings yet

- Healthy Apps Us New VarDocument9 pagesHealthy Apps Us New VarJESUS DELGADONo ratings yet

- Numbers Sheet Name Numbers Table Name Excel Worksheet Name: Bank Info For Agency Reg ExampleDocument5 pagesNumbers Sheet Name Numbers Table Name Excel Worksheet Name: Bank Info For Agency Reg ExampleIskandar DormanNo ratings yet

- TSYS Bank Request Change Document-101Document1 pageTSYS Bank Request Change Document-101Keller Brown JnrNo ratings yet

- Methods of Payment - AIU PDFDocument2 pagesMethods of Payment - AIU PDFMasiko MosesNo ratings yet

- IDirect Deposit ScanDocument2 pagesIDirect Deposit ScanSteven Hill0% (1)

- Credit Card ClientsDocument943 pagesCredit Card ClientsMamadou SowNo ratings yet

- GD Credit Application 2012 PDFDocument1 pageGD Credit Application 2012 PDFSergiSerranoNo ratings yet

- Capital One - 000214-006Document2 pagesCapital One - 000214-006Cristian ViverosNo ratings yet

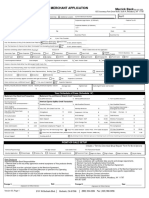

- Merchant Application Merrick Bank: Your Schedule of Fees (Schedule 'A')Document11 pagesMerchant Application Merrick Bank: Your Schedule of Fees (Schedule 'A')Alejandro DuinNo ratings yet

- 2008 Mark and Stephanie Madoff Foundation 990Document60 pages2008 Mark and Stephanie Madoff Foundation 990jpeppardNo ratings yet

- FazaDocument5 pagesFazaZacarias and Ana De JesusNo ratings yet

- Rubio Party CardDocument76 pagesRubio Party CardandrewperezdcNo ratings yet

- Checking Account PDFDocument7 pagesChecking Account PDFVigNeshNo ratings yet

- Cardholder Request FormDocument1 pageCardholder Request FormMarissa Gallenero-CalabinesNo ratings yet

- Bank of America Online Statement 1Document1 pageBank of America Online Statement 1Wells Wally100% (1)

- Including The Long Form Fee Disclosure ("List of All Fees.")Document9 pagesIncluding The Long Form Fee Disclosure ("List of All Fees.")Shamara LoganNo ratings yet

- Rewarding Excellence Visa Prepaid Card FaqsDocument4 pagesRewarding Excellence Visa Prepaid Card FaqsjudahNo ratings yet

- Esteban Alexander Ramirez Mongui: Palisades ParkDocument3 pagesEsteban Alexander Ramirez Mongui: Palisades ParkJose Antonio Valero AtuestaNo ratings yet

- Bank of AmericaDocument14 pagesBank of AmericagisellaolsenNo ratings yet

- Employee Credit Card Authorization FormDocument2 pagesEmployee Credit Card Authorization FormLiza wongNo ratings yet

- AZ Argan Ventures LTDDocument20 pagesAZ Argan Ventures LTDBarangaySanLuisNo ratings yet

- Wells Fargo DocumentDocument6 pagesWells Fargo DocumentJc R100% (1)

- Nma Merchant ApplicationDocument5 pagesNma Merchant Applicationapi-257017808No ratings yet

- Virtual - Checkbook SimulationDocument34 pagesVirtual - Checkbook SimulationSteven HillNo ratings yet

- Credit OneDocument2 pagesCredit OneS100% (1)

- Minority Depository Institutions (Mdis) December 31, 2020Document3 pagesMinority Depository Institutions (Mdis) December 31, 2020Mark LeeNo ratings yet

- American Express Travel PDFDocument4 pagesAmerican Express Travel PDFfooNo ratings yet

- Thanks For Shopping With Us!: Your Receipt From BitrefillDocument2 pagesThanks For Shopping With Us!: Your Receipt From BitrefillCristhian SalazarNo ratings yet

- Your Credit Report: Fill Out A Form Pick The Reports You WantDocument20 pagesYour Credit Report: Fill Out A Form Pick The Reports You Wantwhat is thisNo ratings yet

- Ach Autharization FormDocument2 pagesAch Autharization FormAlexander Weir-WitmerNo ratings yet

- Enhanced Consumer Credit Report 2019Document5 pagesEnhanced Consumer Credit Report 2019Sumedh BangNo ratings yet

- Training Manual For National E-Government Procurement System of NepalDocument38 pagesTraining Manual For National E-Government Procurement System of NepalRanjan Raj KoiralaNo ratings yet

- Sara Barz - TransUnion Personal Credit Report - 20141116 PDFDocument14 pagesSara Barz - TransUnion Personal Credit Report - 20141116 PDFSaraBarz50% (2)

- Bank Direct DepositDocument1 pageBank Direct DepositRainy R WilkersonNo ratings yet

- Alex ScanDocument5 pagesAlex ScanAlex BeckmanNo ratings yet

- ADocument2 pagesAMahdy MohamedNo ratings yet

- Credit CardDocument6 pagesCredit CardAnup SrivastavaNo ratings yet

- Regina R Ross-1ab65dfcfca54a7 PDFDocument21 pagesRegina R Ross-1ab65dfcfca54a7 PDFGlenn ColemanNo ratings yet

- Visa Credit Card Generator For Data TestingDocument1 pageVisa Credit Card Generator For Data Testingadam errouissiNo ratings yet

- W-2 Wage and Tax Statement: Statutory Employee Retirement Plan Third-Party Sick PayDocument1 pageW-2 Wage and Tax Statement: Statutory Employee Retirement Plan Third-Party Sick Paychsudheer291985No ratings yet

- Detailed Statement: Neft-Ani Integrated Services LTDDocument3 pagesDetailed Statement: Neft-Ani Integrated Services LTDRohit raagNo ratings yet

- VAC Form New FeesDocument3 pagesVAC Form New FeesLiano GuerraNo ratings yet

- Authorization For Credit Card Transactions: U.S. Citizenship and Immigration ServicesDocument1 pageAuthorization For Credit Card Transactions: U.S. Citizenship and Immigration ServicesShelly LiuNo ratings yet

- Direct Debit: Electronic Funds Transfer AgreementDocument2 pagesDirect Debit: Electronic Funds Transfer Agreementsputnik3000_100% (1)

- PWR - Carrier PacketDocument3 pagesPWR - Carrier Packetmeda590No ratings yet

- Current & Recent Credit Card Signup BonusesDocument31 pagesCurrent & Recent Credit Card Signup BonusesRakib SikderNo ratings yet

- Credit Card Authorization Form-Rev 082508Document1 pageCredit Card Authorization Form-Rev 082508Pierre YouriNo ratings yet

- CC Authorization TemplateDocument1 pageCC Authorization TemplateAlfonso Joel V. GonzalesNo ratings yet

- Printing H - FORMFLOW - SF3107.FRPDocument10 pagesPrinting H - FORMFLOW - SF3107.FRPKeller Brown JnrNo ratings yet

- EG-ACH Direct Credit Payment Advice ReportDocument1 pageEG-ACH Direct Credit Payment Advice ReportAlbert FaragNo ratings yet

- Death Mom Dad SSN 136125787Document629 pagesDeath Mom Dad SSN 136125787Joseph Matthias ZaoNo ratings yet

- BOA StatementDocument3 pagesBOA Statementstanjh2012No ratings yet

- Oakland County Candidates and Ballot Issues, Nov. 3, 2015, ElectionDocument16 pagesOakland County Candidates and Ballot Issues, Nov. 3, 2015, ElectionBeth DalbeyNo ratings yet

- PRR 3873 Os Checks W AddrDocument22 pagesPRR 3873 Os Checks W AddrRecordTrac - City of OaklandNo ratings yet

- Broadcast ApplicationDocument1 pageBroadcast Applicationmikeinverizon84No ratings yet

- TitleMax E-Commerce CreditDocument30 pagesTitleMax E-Commerce Creditklassiq100% (1)

- Take Charge of CreditcardsDocument10 pagesTake Charge of CreditcardsSandra_ZimmermanNo ratings yet

- Unit 1: The Nature of TechnologyDocument36 pagesUnit 1: The Nature of TechnologySandra_ZimmermanNo ratings yet

- Warm Up (8/27: - List Two Facts You Already Know About Credit CardsDocument10 pagesWarm Up (8/27: - List Two Facts You Already Know About Credit CardsSandra_ZimmermanNo ratings yet

- CH 02Document44 pagesCH 02Sandra_ZimmermanNo ratings yet

- Comparison ShoppingDocument18 pagesComparison ShoppingSandra_ZimmermanNo ratings yet

- Goals GaloreDocument15 pagesGoals GaloreSandra_ZimmermanNo ratings yet

- Comparison ShoppingDocument18 pagesComparison ShoppingSandra_ZimmermanNo ratings yet

- Checking Account and Debit Card SimulationDocument61 pagesChecking Account and Debit Card SimulationSandra_ZimmermanNo ratings yet

- Exploring Values, Needs & WantsDocument9 pagesExploring Values, Needs & WantsSandra_ZimmermanNo ratings yet

- Does Money Grow On TreesDocument23 pagesDoes Money Grow On TreesSandra_ZimmermanNo ratings yet

- Exploring Values, Needs & WantsDocument9 pagesExploring Values, Needs & WantsSandra_ZimmermanNo ratings yet

- Goals GaloreDocument13 pagesGoals GaloreSandra_ZimmermanNo ratings yet

- Exploring Values, Needs & WantsDocument9 pagesExploring Values, Needs & WantsSandra_ZimmermanNo ratings yet

- Oracle Fusion TaxDocument43 pagesOracle Fusion Taxneeraj pandey60% (5)

- Tugas 7 Akuntansi BiayaDocument7 pagesTugas 7 Akuntansi BiayaekokoessNo ratings yet

- Search EnginesDocument43 pagesSearch EnginesSrinivas Kumar KoradaNo ratings yet

- Confidential Memo To Dlevant 112507Document5 pagesConfidential Memo To Dlevant 112507The Oregonian100% (1)

- Trading Riot Auction Market Theory - Understanding of Market andDocument13 pagesTrading Riot Auction Market Theory - Understanding of Market andJ100% (2)

- The British Money MarketDocument2 pagesThe British Money MarketAshis karmakarNo ratings yet

- Master Thesis 2021: Aakash Mishra URN 2021-M-10081997Document48 pagesMaster Thesis 2021: Aakash Mishra URN 2021-M-10081997Akash MishraNo ratings yet

- Bankrupcy and Insolvancy LawDocument64 pagesBankrupcy and Insolvancy LawmuhumuzaNo ratings yet

- Audit of The Capital Acquisition and Repayment CycleDocument20 pagesAudit of The Capital Acquisition and Repayment Cycleputri retno100% (1)

- Account FINAL Project With FRNT PageDocument25 pagesAccount FINAL Project With FRNT PageMovies downloadNo ratings yet

- Ch1 FundamentalsDocument45 pagesCh1 FundamentalsFebri RahadiNo ratings yet

- MODULE 3 - Extinguishment of ObligationsDocument8 pagesMODULE 3 - Extinguishment of ObligationsALYSSA LEIGH VILLAREALNo ratings yet

- Ceres Gardening Company Graded QuestionsDocument4 pagesCeres Gardening Company Graded QuestionsSai KumarNo ratings yet

- Subsidy Scheme For Coffee ProcessingDocument4 pagesSubsidy Scheme For Coffee ProcessingPankaj SharmaNo ratings yet

- LTCCDocument16 pagesLTCCandzie09876No ratings yet

- ACCELERATING Entrepreneurship in Africa: Understanding Africa's Challenges To Creating Opportunity Driven Entrepreneurship - Omidyar Network in Partnership With Monitor GroupDocument48 pagesACCELERATING Entrepreneurship in Africa: Understanding Africa's Challenges To Creating Opportunity Driven Entrepreneurship - Omidyar Network in Partnership With Monitor GroupCraft AfrikaNo ratings yet

- Itr Fy 22-23Document6 pagesItr Fy 22-23Omkar kaleNo ratings yet

- What Is A Zero-Coupon Treasury Bond: Guarantees The SecurityDocument7 pagesWhat Is A Zero-Coupon Treasury Bond: Guarantees The Security88arjNo ratings yet

- Introduction To Agricultural AccountingDocument54 pagesIntroduction To Agricultural AccountingManal ElkhoshkhanyNo ratings yet

- On KajariaDocument16 pagesOn KajariaPOORVICHIBNo ratings yet

- IAS 1 Presentation of Financial StatementsDocument12 pagesIAS 1 Presentation of Financial StatementsIFRS is easyNo ratings yet

- Session 5 - Compensation and BenefitsDocument17 pagesSession 5 - Compensation and BenefitsyashNo ratings yet

- Bar Questions Civil Law 2006-2018Document34 pagesBar Questions Civil Law 2006-2018Ruth Hazel GalangNo ratings yet

- Objective of Financial Market RegulationDocument5 pagesObjective of Financial Market RegulationmoonaafreenNo ratings yet

- BDO-EPCI vs. JAPRL DevelopmentDocument1 pageBDO-EPCI vs. JAPRL DevelopmentHannah SyNo ratings yet

- Final Answer KeyDocument13 pagesFinal Answer Keysiva prasadNo ratings yet

- MKC006910 PDFDocument1 pageMKC006910 PDFShylesh RaveendranNo ratings yet

- 1651 20eDocument51 pages1651 20esafrazahamedNo ratings yet

- Apparel Roi CalculatorDocument3 pagesApparel Roi CalculatorRezza AdityaNo ratings yet

- Prepared by M Suresh Kumar, Chief Manager Faculty, SBILD HYDERABADDocument29 pagesPrepared by M Suresh Kumar, Chief Manager Faculty, SBILD HYDERABADBino JosephNo ratings yet