Professional Documents

Culture Documents

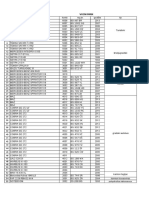

Ibm Spss

Uploaded by

Neha SharmaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ibm Spss

Uploaded by

Neha SharmaCopyright:

Available Formats

This estimate is based on OECD analysis of data for international M&A activity up to 26 November 2009.

The fall is largely due to the 60% decline in value of cross-border merger and acquisitions (M&A) by firms based in the OECD area, from over USD 1 trillion in 2008 to USD 454 billion in 2009. However, it was also due to the first sharp declines in M&A activity into and from major emerging economies: international M&A activity by firms based in Brazil, China, India, Indonesia, Russia, and South Africa fell by 62% to USD 46 billion in 2009 from USD 121 billion in 2008. M&A activity into these countries is forecast to decline by almost 40% this year to just over USD 80 billion from just under USD 140 billlion in 2008. These latest international investment estimates suggest that total foreign direct investment into the 30 OECD countries will fall to USD 600 billion in 2009 from a 2008 total of USD 1.02 trillion.

Notification on:30.07.2009 Success full completion on: January 27, 2010 In April 2009, Oracle announced plans to purchase Sun Microsystems. This acquisition, worth an estimated $1.5 billion in additional revenue and for a total estimated purchase price of $7.4 billion. What makes this acquisition is the ability for Oracle to reticence Java and Solaris. Java is one of the most widespread cross platform computer programs, and the implications of Oracle ownership are immense.

On September 3, 2009, the European Commission announced that it would not immediately approve the deal, but would instead perform a second round of investigation, focusing on the implications of Oracle's control of MySQL. On October 20, 2009, Sun filed with the U.S. Securities and Exchange Commission (SEC) its intention to cut 3,000 jobs globally over next 12 months, citing losses caused by delays in the acquisition process. On November 6, Sun announced 25% total revenue decrease, due to "economic downturn, the uncertainty associated with proposed acquisition by Oracle. On January 21, 2010, EU Competition Commissioner Neelie Kroes announced unconditional approval of the deal. On January 27, 2010, Oracle announced that it had completed its acquisition of Sun Microsystems, making Sun a wholly owned subsidiary of Oracle.

Oracle acquired Sun common stock for $9.50 per share in cash. Oracle also gets some virtualization technologies with the Sun buy. Oracle took out its No. 1 threat by buying Sun

Oracle owned two key Sun software assets: Java and Solaris. Java is one of the computer industrys best-known brands and most widely deployed technologies, and it is the most important software Oracle has ever acquired. Oracle Fusion Middleware, Oracles fastest growing business, is built on top of Suns Java language and software.

On 8 jul 2009 IBM (NYSE: IBM ) and SPSS Inc. (Nasdaq: SPSS ) announced that the two companies have entered into a definitive merger agreement for IBM to acquire SPSS, a publicly-held company headquartered in Chicago SPSS shares rose $14.36 to close at $49.45 at 4 p.m. on the Nasdaq Stock Market. IBM shares fell 0.4% to $117.28 on the New York Stock Exchange.

On 2 oct 2009, IBM acquired SPSS Inc. an all cash transaction at a price of $50/share, resulting in a total cash consideration in the merger of approximately $1.2 billion IBM's $50-a-share all-cash offer represents a 42% premium to SPSS's closing price.

IBM sees potential applications for SPSS tools in helping financial services companies retain customers, preventing crime and picking the optimal site for a new store or factory. IBM was expanding its focus on businessanalytics technology and services to meet a growing client need to cut costs.

Pfizer is a American multinational pharmaceutical corporation headquartered in New York City, and with its research headquarters in Groton,United States. It is the world's largest pharmaceutical company by revenues Wyeth, formerly one of the companies owned by American Home Products Corporation (AHP), was a pharmaceutical company. The company was based in Madison, New Jersey, USA. They were known for manufacturing the over the-counter (OTC) The Companys major divisions include Wyeth Pharmaceuticals, Wyeth Consumer Healthcare and Fort Dodge Animal Health.

In January 2009, the US based Pfizer; the world's largest pharmaceutical company announced that it would acquire Wyeth, another leading pharmaceutical company based in the US, by paying US$ 68 billion in stock and cash.

With the patent expiry nearing of Lipitor and no probable block busters in pipeline, Pfizer faced risk of loosing huge part of its revenues once Lipitor is available for generic competition. Pfizer strategy to expand its product line and diversify its sources of revenue led it to acquire Wyeth.

Wyeth, on other hand, had patent expiry issues around the same time as Pfizer had. Pfizer Inc. acquired Wyeth in a cash and stock merger. Pursuant to the terms of the merger, Wyeth holders received 0.985 of a share of Pfizer Inc. common stock and $33.00, without interest for every 1 share of Wyeth common stock they own. The deal was financed through a combination of cash, debt and stock. Pfizer will borrow $22.5 billion from a consortium of banks, four of which recently received federal bailout money: Goldman Sachs, J.P. Morgan, Citi and Bank of America.

Chrysler LLC is an American vehicle producer that has been producing vehicles ever since the year 1925 and from the year 1914 below the Dodge name. From the year 1998 to the year 2007, Chrysler and its subordinates were component of the DaimlerChrysler (at the present known as Daimler AG) of German foundation.

FIAT Group is traditionally one of the big 6 car makers in Europe and the dominator of the Italian market. It controls nearly all Italian car brands existed today, i.e. Lancia, Alfa Romeo, Ferrari and Maserati. The fortune of FIAT is declining since the 1970s. The enhanced free trade within EU and competition from Korean and Japanese cars ate into its domestic market share.

In 2009 US carmaker Chrysler and Italian carmaker Fiat merged to create world's sixth largest global auto giant. Fiat took 35% stake in the No 3 American carmaker Chrysler in exchange for Fiat's platforms for its fuel-efficient, small and medium-sized compact cars, which will fill a gap in Chrysler's range of models. Fiat in turn would gain access to American auto plants and service centers as well as the reintroduction of several of their models back into America.

Fiat like Chrysler was also in a terrible state after a failed merger with General Motors, but is now on its road to recovery.

integration of Fiat and Chrysler is nearly complete and some analysts now say it could become a model for trans-Atlantic cooperation in the auto industry. The company is launching new joint models the first is the new Dodge Dart, a compact with the chassis and technology of an Alfa Romeo.

Thus we know that Management focus and dedication to change are critical elements of many successful megers.

BY : AKSHI GUPTA DEEPU DUBEY MAITRI RASTOGI NEHA SHARMA

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Car Remapping Price ListDocument2,429 pagesCar Remapping Price ListJavod AkobirovNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Vehicle Lifecycle Costs Analysis: Sponsored byDocument32 pagesVehicle Lifecycle Costs Analysis: Sponsored byJairo Iván SánchezNo ratings yet

- Introduction To MercedesDocument31 pagesIntroduction To MercedesShubham Prasad100% (1)

- PDCB - GC RFQ PDFDocument272 pagesPDCB - GC RFQ PDFAlexandru Simion CosmaNo ratings yet

- Mercedes Vs BMWDocument19 pagesMercedes Vs BMWdev_dbcNo ratings yet

- Presentation MercDocument11 pagesPresentation Mercavdeep anandNo ratings yet

- PM Mercedes Benz IAA NFZ 2012 enDocument138 pagesPM Mercedes Benz IAA NFZ 2012 enrusuclaudiuionutNo ratings yet

- Odometer Correction For W168 A-Class, W202 C-Class, W140 S-Class, W210 E-Class, W461 G-Class, W208 CLK, W220 S-Class, W163 MLDocument3 pagesOdometer Correction For W168 A-Class, W202 C-Class, W140 S-Class, W210 E-Class, W461 G-Class, W208 CLK, W220 S-Class, W163 MLJame Eduardo100% (3)

- Mercedes Uputstvo (English)Document2 pagesMercedes Uputstvo (English)aleksandarsbgNo ratings yet

- IHRM Assessment 1 Greenway Case StudyDocument4 pagesIHRM Assessment 1 Greenway Case StudyNguyễn Duy Thuỳ DươngNo ratings yet

- MB Pricelist June 2021Document5 pagesMB Pricelist June 2021ariNo ratings yet

- Mercedes Retail CatalogDocument3 pagesMercedes Retail Catalogpanda910No ratings yet

- Case Study - Indian Luxury Car MarketDocument5 pagesCase Study - Indian Luxury Car MarketSatyam GambhirNo ratings yet

- Marketing Project Bharat BenzDocument24 pagesMarketing Project Bharat BenzSoumya Siddharth Rout64% (11)

- Case Study ChryslerDocument10 pagesCase Study ChryslerShatesh Kumar ChandrahasanNo ratings yet

- WO 2016 + UNLIMITED KeysDocument7 pagesWO 2016 + UNLIMITED Keysroney.w.lNo ratings yet

- Cross-Border Alliance As A Strategic Business Imperative: Diversity ManagementDocument14 pagesCross-Border Alliance As A Strategic Business Imperative: Diversity ManagementAiza AyazNo ratings yet

- DaimlerDocument4 pagesDaimlerjojee2k6No ratings yet

- Conti TechDocument91 pagesConti Techalx100% (1)

- Fiat Swot AnalysisDocument2 pagesFiat Swot AnalysisVlè KaNo ratings yet

- Daimler Chrysler Strategy AnalysisDocument19 pagesDaimler Chrysler Strategy AnalysisNaveen RaajNo ratings yet

- Normativ 2Document16 pagesNormativ 2Aleksa TrifkovićNo ratings yet

- Daimler Ir Annual Report 2020 Incl Combined Management Report Daimler AgDocument267 pagesDaimler Ir Annual Report 2020 Incl Combined Management Report Daimler AgSaba MasoodNo ratings yet

- Daimler-Chrysler Merger Creates Global Auto GiantDocument23 pagesDaimler-Chrysler Merger Creates Global Auto GiantAnand Narayan Singh100% (1)

- Wurth KeysDocument4 pagesWurth KeysDaniel IonuţNo ratings yet

- Mercedes Portugal ReportDocument15 pagesMercedes Portugal ReportRazvan Paul CovaliuNo ratings yet

- REcent Developments in NY Practice ALLDocument206 pagesREcent Developments in NY Practice ALLMISSTY1027No ratings yet

- Баумустер Об'єм двигуна (см³) Потужність, к.с. / Нм Витрати палива (л/100 км) Макс. швидкість (км/год) Розгін 0-100 (км/год) Вартість автомобіля DDP Київ*, EURO A-classDocument5 pagesБаумустер Об'єм двигуна (см³) Потужність, к.с. / Нм Витрати палива (л/100 км) Макс. швидкість (км/год) Розгін 0-100 (км/год) Вартість автомобіля DDP Київ*, EURO A-classHorn BlowerNo ratings yet

- Concept of Green ManagementDocument9 pagesConcept of Green ManagementN AvinashNo ratings yet