Professional Documents

Culture Documents

FDI / Foreign Direct Investment

Uploaded by

SeHrawat Nishu NiShaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FDI / Foreign Direct Investment

Uploaded by

SeHrawat Nishu NiShaCopyright:

Available Formats

FDI / Foreign Direct Investment:

FDI stands for Foreign Direct Investment, a component of a country's national financial accounts. Foreign direct investment is investment of foreign assets into domestic structures, equipment, and organizations.

This

does not include foreign investments in stock markets. Instead, FDI refers more specifically to the investment of foreign assets into domestic goods and services.

FDIs can be classified as;

Inward FDI and Outward FDI, depending on the direction of flow of money. Inward FDI occurs when foreign capital is invested in local resources. The factors propelling the growth of inward FDI include tax breaks, low interest rates and grants. Outward FDI, also referred to as "direct investment abroad", is backed by the government against all associated risk.

Benefit of Foreign Direct Investment

One of the advantages of foreign direct investment is that it helps in the economic development of the particular country where the investment is being made. This is especially applicable for developing economies. During the 1990s, foreign direct investment was one of the major external sources of financing for most countries that were growing economically

Foreign Direct Investment National Policy

Central

Level Policies:The central level policies governing various strategic factors affecting business- investment, land acquisition, electricity provide a conducing environment for business environment.

The policies have been aligned over the years with an objective to thrust India on the path of economic growth by attracting foreign and indigenous investment and assisting such investments through a positive business environment inclusive convenience in investment norms, tax reforms, power reforms, port development etc. Some of the key policies have been discussed below:-

Foreign Direct Investment Policy Salient Features

FDI up to 100% is allowed under the automatic route in all activities / sectors except the following which will require approval of the Government: . Activities / items that require an Industrial License . Proposals in which the foreign collaborator has a previous / existing venture / tie up in India in the same or allied field

. All proposals relating to acquisition of shares in an existing Indian company by a foreign / NRI investor. . All proposals falling outside notified sectoral policy / caps or under sectors in which FDI is not permitted.

FDI in areas of special economic activity

Special Economic Zones:- 100% FDI is permitted under automatic route for setting up of Special Economic Zone Export Oriented Units EOUs:-Export Oriented Units Industrial Park:- 100% FDI is permitted under automatic route for setting up of Industrial Park

Software Technology Park Units:the applicant should seek separate approval of the FIPB(Foreign investment promotion board)

The New Consolidated Foreign Direct Investment Policy 2011

Every developing economy today is so called FDI hungry. Commenting on the new policy, commerce and industry minister Anand Sharma said, The Circular 1 of 2011 is a part of ongoing efforts of procedure simplification and FDI rationalization which will go a long way in inspiring \investor confidence.

Analyzing the statistics as to FDI in India makes us to arrive at a conclusion that it was only after 2007 FDI has shown a steady increase in India. During 20092010 FDI in India showed a whopping increase mainly due to grave recession in other parts of the globe but recent decline from April to May really was perturbing

Thus the Indian government has made scores of changes to the FDI policy to attract more foreign direct investment amidst 25% decline in FDI during the eleven month period between AprilFebruary 2010-11 to 18.3 billion.

The main features of the new consolidate FDI Policy

Foreign Institutional Investor Investment:- An FII may invest in the capital of an Indian company either under the FDI Scheme/Policy or the Portfolio Investment Scheme. Hundred Percent FDI in some area of Farm Sector:- The new FDI Policy allow 100 per cent FDI in development and production of seeds and planting material,

floriculture, horticulture, and cultivation of vegetables and mushrooms under controlled conditions. Similarly, the tea sector has also been brought under the 100 per cent FDI norm.

Liberalization of policy for non-cash capital contributions:

The existing policy FDI provided for conversion of only ECB/lump-sum fee/Royalty into equity The Government has now decided to permit issue of equity, with prior approval, in the following cases, subject to stipulated conditions:-

Import of capital goods/ machinery/ equipment Pre-operative/ pre-incorporation expenses

Pricing of convertible instrument

earlier provided that The pricing of the capital instruments should be decided/determined upfront at the time of issue of the instruments and will not be change but now the price can be change. That is a very flexible change in FDI Policy.

Removal of the condition of prior approval in case of existing joint ventures/ technical collaborations in the same field:

earlier Circular of FDI provided that FDI would be subject to the Existing Venture/ tie-up conditions as stated in sub-clauses of Clause basically stating that where a non-resident investor has an existing joint venture/ technology transfer/ trademark agreement,

as on January 12, 2005, new proposals in the same field for investment/technology transfer/technology collaboration/trademark agreement would have to be under the Government approval route through FIPB/ Project Approval Board

the Government while releasing the FDI Circular 1 of 2011 has in its press release stated that it has decided to abolish this condition. The press release further states that It is expected that this measure will promote the competitiveness of India as an investment destination and be instrumental in attracting higher levels of FDI and technology inflows into the country.

Globalization

the act or process of globalizing : the state of being globalized; especially : the development of an increasingly integrated global economy marked especially by free trade, free flow of capital, and the tapping of cheaper foreign labor markets

Globalization has tremendously affected world in various different aspects :

1. Industrial- it has provided the surface to the production market with an enhanced access to a wide variety of foreign products and therefore globalization has increased large number of customers for itself. 2. Financial- Globalization has opened the way to procure external financing opportunities to the borrowers.

3. Economic- the freedom of exchange of goods and capitals tells us that the markets are interrelated and any kind of economic collapse in one country could be managed by others. 4. Political- the United States has come up with the supreme power in the era of globalization as it has strong and wealthy economy. Also in the recent decade the Peoples Republic of China has skilled with great economic growth.

5. Informational- flow of information from one part of the globe to another and even to the remote locations, through satellites, wireless communication or through internet. 6. Competition- globalization has given birth to tremendous competition and has made the market an open place to excel with skills and quality. Cultural- Cross-cultural contacts are the result of globalization.

Social- due to globalization the social network of people is widening and people are able to understand each other in a better way howsoever distant geographically they may be. Technical- Any kind of technological advances can be communicated to other parts of the world and thus feedback to further enhance it can be procured.

You might also like

- Foreign Direct Investment (FDI) Refers To Foreign Capital That Is Invested To Enhance The Production Capacity of The EconomyDocument9 pagesForeign Direct Investment (FDI) Refers To Foreign Capital That Is Invested To Enhance The Production Capacity of The EconomyKeerti VasaNo ratings yet

- Foreign Direct Investment in India: Posted in Labels: ESSAY, Indian Economy - 5:43 AMDocument3 pagesForeign Direct Investment in India: Posted in Labels: ESSAY, Indian Economy - 5:43 AMSahil ShahNo ratings yet

- FDI in India Case Study WalmartDocument32 pagesFDI in India Case Study WalmartDhawal Khandelwal33% (3)

- Foreign Direct InvestmentDocument13 pagesForeign Direct InvestmentGaurav GuptaNo ratings yet

- IEBDocument25 pagesIEBAnkit Kumar SinhaNo ratings yet

- Or An Investor Located Outside Its BordersDocument6 pagesOr An Investor Located Outside Its BordersIrshita TarafdarNo ratings yet

- Prepared by Faculty: S. S. PaudelDocument43 pagesPrepared by Faculty: S. S. PaudelRojan JoshiNo ratings yet

- Fdi & Fii Impact On Indian Economy: A Project Report OnDocument62 pagesFdi & Fii Impact On Indian Economy: A Project Report OnHamza ShaikhNo ratings yet

- FDI in IndiaDocument3 pagesFDI in IndiaNaveen DsouzaNo ratings yet

- FDI in India Case Study WalmartDocument32 pagesFDI in India Case Study WalmartSaad KhanNo ratings yet

- Foreign Direct Investment (Fdi) : Nature and ScopeDocument4 pagesForeign Direct Investment (Fdi) : Nature and ScopeMaithili DicholkarNo ratings yet

- Assignment Merggers and AcquisitionDocument13 pagesAssignment Merggers and AcquisitiondhandeyhemaniNo ratings yet

- Y y y y y y y y y y y y y y y yDocument32 pagesY y y y y y y y y y y y y y y ychandra4145No ratings yet

- International InvestmentDocument16 pagesInternational Investmentmisty_nairNo ratings yet

- FDI, Foreign Direct InvestmentDocument20 pagesFDI, Foreign Direct InvestmentBhargesh VedNo ratings yet

- FDI in IndiaDocument20 pagesFDI in IndiaSnoi MindaNo ratings yet

- The Impact of FDIDocument7 pagesThe Impact of FDIArham KothariNo ratings yet

- What Is Foreign Direct Investment (FDI) ?Document6 pagesWhat Is Foreign Direct Investment (FDI) ?kqb54qwkm4No ratings yet

- FDIDocument9 pagesFDIPankaj ChetryNo ratings yet

- Foreign Direct InvestmentDocument8 pagesForeign Direct InvestmentpratikpawarNo ratings yet

- Factors Influencing FDI 1. Political FactorsDocument4 pagesFactors Influencing FDI 1. Political FactorsAiman KhalilNo ratings yet

- Impact of Fdi in India - Annai MathammalDocument7 pagesImpact of Fdi in India - Annai MathammalSubakarthi KarthiNo ratings yet

- Term Paper On FII & FDIDocument25 pagesTerm Paper On FII & FDIamin pattaniNo ratings yet

- A Study On Foreign Direct Investment Specialization (Repaired)Document65 pagesA Study On Foreign Direct Investment Specialization (Repaired)yatinNo ratings yet

- Mod 4 BeDocument25 pagesMod 4 BePratha JainNo ratings yet

- Economics ProjectDocument7 pagesEconomics ProjectelizaroyNo ratings yet

- Types of Foreign Direct Investment: An OverviewDocument12 pagesTypes of Foreign Direct Investment: An OverviewSeema KinhaNo ratings yet

- Afghanistan's Investment Opportunities and ChallengesDocument42 pagesAfghanistan's Investment Opportunities and ChallengesSudeep ChinnabathiniNo ratings yet

- SM Project .FinalDocument40 pagesSM Project .Finalaniketbhosale_012No ratings yet

- Chapter 6 - FOREIGN DIRECT INVESTMENTDocument13 pagesChapter 6 - FOREIGN DIRECT INVESTMENTAriel A. YusonNo ratings yet

- IntroductionDocument3 pagesIntroductionbhamidipati_bNo ratings yet

- Corporate Governance SystemDocument16 pagesCorporate Governance SystemRajib RoyNo ratings yet

- Enhancing FDI Flows to Nepal during Global RecessionDocument21 pagesEnhancing FDI Flows to Nepal during Global RecessionIsmith PokhrelNo ratings yet

- FDI Policy in India After 2002Document10 pagesFDI Policy in India After 2002Ashish YadavNo ratings yet

- FDIDocument4 pagesFDIramesh sNo ratings yet

- Significance: Study of Fdi in IndiaDocument73 pagesSignificance: Study of Fdi in Indiatarun41100% (1)

- Foreign Direct Investment and Its Growth in IndiaDocument75 pagesForeign Direct Investment and Its Growth in IndiaRohit SoniNo ratings yet

- Project Report On FDI in RetailDocument52 pagesProject Report On FDI in Retailprasenjitbiswas4515No ratings yet

- Buisnes EnvioDocument18 pagesBuisnes EnvioAparna A D NairNo ratings yet

- Business Environment Unit 2 PDFDocument14 pagesBusiness Environment Unit 2 PDFHarsh BusaNo ratings yet

- K.E.S. Shroff College of Arts & CommerceDocument19 pagesK.E.S. Shroff College of Arts & CommerceNirali AntaniNo ratings yet

- Difference Between FDI and FIIDocument3 pagesDifference Between FDI and FIIBhavdeep SinghNo ratings yet

- Module 4 If NotesDocument31 pagesModule 4 If Notesanon_433140562No ratings yet

- SYBFM Equity Market II Session I Ver 1.2Document84 pagesSYBFM Equity Market II Session I Ver 1.211SujeetNo ratings yet

- FDI Slsabela TrainiDocument7 pagesFDI Slsabela TrainiSalsabela Mahmoud Yousef AlturaniNo ratings yet

- Project Report Fdi FinalDocument68 pagesProject Report Fdi FinalKarann ValechaNo ratings yet

- SYBFM Equity Market II Session I Ver 1.1Document80 pagesSYBFM Equity Market II Session I Ver 1.111SujeetNo ratings yet

- Globalization and FDI in India: An AnalysisDocument34 pagesGlobalization and FDI in India: An AnalysisAnonymous qFWInco8cNo ratings yet

- FDI Guide to Foreign Direct InvestmentDocument9 pagesFDI Guide to Foreign Direct InvestmentVinitmhatre143No ratings yet

- Foreign Direct InvestmentDocument4 pagesForeign Direct InvestmentRajiv RanjanNo ratings yet

- FDI and FII Impact on Indian Economy | SaahilDocument26 pagesFDI and FII Impact on Indian Economy | SaahilpparijaNo ratings yet

- Project 1Document71 pagesProject 1vipulNo ratings yet

- Bep 5Document12 pagesBep 5Kajal singhNo ratings yet

- Term Paper On FII FDIDocument25 pagesTerm Paper On FII FDINisharg ZaveriNo ratings yet

- Introduction of FdiDocument5 pagesIntroduction of Fdijalpashingala1231707No ratings yet

- Foreign Direct Investment in IndiaDocument75 pagesForeign Direct Investment in IndiavijaysuperindiaNo ratings yet

- International InvestmentDocument27 pagesInternational InvestmentYash Dave100% (1)

- What Is The Full Form of FDIDocument8 pagesWhat Is The Full Form of FDIvmktptNo ratings yet

- Nisha PresentaionDocument21 pagesNisha PresentaionSeHrawat Nishu NiShaNo ratings yet

- HR PracticesDocument21 pagesHR PracticesSeHrawat Nishu NiShaNo ratings yet

- Grivence Handling 1Document56 pagesGrivence Handling 1manyasinghNo ratings yet

- Standing Orders1Document29 pagesStanding Orders1SeHrawat Nishu NiShaNo ratings yet

- ND THDocument12 pagesND THSeHrawat Nishu NiShaNo ratings yet

- Project Employee Training DevelopmentDocument15 pagesProject Employee Training DevelopmentHimanshu KshatriyaNo ratings yet

- Project Employee Training DevelopmentDocument15 pagesProject Employee Training DevelopmentHimanshu KshatriyaNo ratings yet

- PPTDocument22 pagesPPTSeHrawat Nishu NiShaNo ratings yet

- Training and DevelopmentDocument74 pagesTraining and DevelopmentSeHrawat Nishu NiShaNo ratings yet

- Ethical Decision Making Process: BY: Pooja SharmaDocument20 pagesEthical Decision Making Process: BY: Pooja SharmaSeHrawat Nishu NiShaNo ratings yet

- Directional Policy MatrixDocument8 pagesDirectional Policy MatrixSeHrawat Nishu NiSha100% (1)

- The of Among and Businesses in Multiple - A Specific, Such As A or That Engages in Among Multiple CountriesDocument41 pagesThe of Among and Businesses in Multiple - A Specific, Such As A or That Engages in Among Multiple CountriesSeHrawat Nishu NiShaNo ratings yet

- Pooja ProjectDocument69 pagesPooja ProjectMayank SwarnkarNo ratings yet

- Industrial Relations PerspectivesDocument8 pagesIndustrial Relations PerspectivesAdityaNo ratings yet

- Nisha ManagementDocument26 pagesNisha ManagementSeHrawat Nishu NiShaNo ratings yet

- GlobalizationDocument21 pagesGlobalizationSeHrawat Nishu NiShaNo ratings yet

- Stress Mgt.Document151 pagesStress Mgt.SeHrawat Nishu NiShaNo ratings yet

- Managing Diversity Within and Across CulturesDocument22 pagesManaging Diversity Within and Across CulturesSeHrawat Nishu NiShaNo ratings yet

- Weber'S Theory of LocationDocument30 pagesWeber'S Theory of LocationSeHrawat Nishu NiShaNo ratings yet

- 5 Series LLC Strategies EbookDocument11 pages5 Series LLC Strategies EbookjuniormintsNo ratings yet

- Financial Education For School Children: An Initiative of SEBI & NISMDocument51 pagesFinancial Education For School Children: An Initiative of SEBI & NISMshree4545No ratings yet

- Specialists Control Over Market Openings and Closings by Richard NeyDocument3 pagesSpecialists Control Over Market Openings and Closings by Richard NeyaddqdaddqdNo ratings yet

- A Value Investment Strategy That Combines Security Selection and Market Timing SignalsDocument16 pagesA Value Investment Strategy That Combines Security Selection and Market Timing SignalsVarun KumarNo ratings yet

- Derivatives Mba ProjectDocument74 pagesDerivatives Mba ProjectPooja163No ratings yet

- Hero Moto Corp Financial Analysis 2012Document10 pagesHero Moto Corp Financial Analysis 2012Amar NegiNo ratings yet

- FinMan Report On FS Analysis RATIODocument31 pagesFinMan Report On FS Analysis RATIOMara LacsamanaNo ratings yet

- Winning Formula EbookDocument21 pagesWinning Formula EbookHunter Gale100% (2)

- Common Size AnalysisDocument25 pagesCommon Size AnalysisYoura DeAi0% (1)

- Nike ProjectDocument15 pagesNike ProjectCicko CokaNo ratings yet

- Trading Webinar Topics Covering Nifty Basics, Technical Analysis, Stock SelectionDocument139 pagesTrading Webinar Topics Covering Nifty Basics, Technical Analysis, Stock SelectionRajeshKancharla100% (1)

- FAQ On Cordros Money Market FundDocument3 pagesFAQ On Cordros Money Market FundOnaderu Oluwagbenga EnochNo ratings yet

- Tata Steel PPT On Investment DecisionDocument13 pagesTata Steel PPT On Investment DecisionhittimishraNo ratings yet

- Summary Accounting For InvestmentsDocument2 pagesSummary Accounting For InvestmentsJohn Rashid HebainaNo ratings yet

- FM Unit1.Document166 pagesFM Unit1.shaik masoodNo ratings yet

- Debt RestructureDocument2 pagesDebt RestructureJeffrey CincoNo ratings yet

- AnswersDocument9 pagesAnswersSandip AgarwalNo ratings yet

- Segment ReportingDocument4 pagesSegment ReportingAlex FungNo ratings yet

- Chapter 17Document29 pagesChapter 17Saroni YanthanNo ratings yet

- Philippine Capital MarketsDocument12 pagesPhilippine Capital MarketsGee-Chelle Mariexris AlbelleraNo ratings yet

- Sunanda Jha & Dinabandhu BagDocument4 pagesSunanda Jha & Dinabandhu Bagdinabandhu_bagNo ratings yet

- Joseph E. Granville, ObituaryDocument4 pagesJoseph E. Granville, ObituaryObituaries_GNo ratings yet

- Beaver W 1968 The Information Content of Annual Earnings AnnouncementsDocument15 pagesBeaver W 1968 The Information Content of Annual Earnings AnnouncementsYuvendren LingamNo ratings yet

- DSIJ3123Document68 pagesDSIJ3123Navin ChandarNo ratings yet

- Of Profit or Loss and Other Comprehensive Income: Consolidated StatementDocument11 pagesOf Profit or Loss and Other Comprehensive Income: Consolidated Statementaslanalan0101No ratings yet

- Equity-Based Islamic Bonds Public PrivateDocument34 pagesEquity-Based Islamic Bonds Public PrivateSiti HasnahNo ratings yet

- Pre-Test 6 SolutionsDocument3 pagesPre-Test 6 SolutionsBLACKPINKLisaRoseJisooJennieNo ratings yet

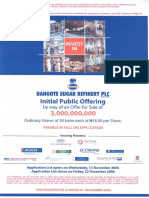

- Dangote Sugar Offer SummaryDocument79 pagesDangote Sugar Offer SummaryBilly LeeNo ratings yet

- Questus Global Capital Markets On GXGDocument3 pagesQuestus Global Capital Markets On GXGlcdcomplaintNo ratings yet

- Future Option AnlysisDocument18 pagesFuture Option AnlysisAdarsh ChhajedNo ratings yet