Professional Documents

Culture Documents

Working Capital Management

Uploaded by

Pratik SukhaniOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Working Capital Management

Uploaded by

Pratik SukhaniCopyright:

Available Formats

A PRESENTATION ON

Working Capital is the amount of Capital that a Business has available to meet the day-to-day cash requirements of its operations Working Capital is the difference between resources in cash or readily convertible into cash (Current Assets) and organizational commitments for which cash will soon be required (Current Liabilities) It refers to the amount of Current Assets that exceeds Current Liabilities (i.e. CA - CL) Working Capital refers to that part of the firms Capital, which is required for Financing Short-Term or Current Assets such as Cash, Marketable Securities, Debtors and Inventories. Working Capital is also known as Revolving or Circulating Capital or Short-Term Capital

Gross Concept: It means Current Assets. This is knows as Quantitative aspect of Working Capital (Focus is on (i) Optimum Investment in Current Assets and (ii) Financing of Current Assets) Net Concept: It means difference between Currents Assets & Current Liabilities. This is knows as Qualitative aspect of Working Capital (Focus is on (i) Liquidity Position of the Firm and (ii) WC Amount that can be financed by Permanent sources of Funds)

Start with Cash Buy Raw Materials from Cash Raw materials are proceeded with Work In Progress and then Finished Goods Finished goods are the sold which become Debtors to the firm and then these debtors are converted in Cash for which again Raw Materials are bought This cycle continuous.

Nature of Business/Industry; Size of Business/Scale of Operations; Growth prospects Business Cycle; Manufacturing Cycle; Operating Cycle & Rapidity of Turnover; Operating Efficiency; Profit Margin; Profit Appropriation Depreciation Policy; Taxation Policy; Dividend Policy and Government Regulations

Conventional Method: Matching of Cash Inflows & Outflows. This method ignores Time Value of Money Operating Cycle Method: Debtors + Stock (RM/WIP/FG) - Creditors. This method takes into Account length of Time which is required to convert cash into resources, resources to final product, final product to Debtors and Debtors to Cash again. Cash Cost Technique: Working Capital forecast is done on Cost Basis (i.e. taking P&L items into account) Balance Sheet Method: Working Capital forecast is done on various Assets & Liabilities (i.e. taking B/S items into account)

Working Capital Management is concerned with the problems that arise in attempting to manage the Current Assets, Current Liabilities and the interrelationship that exists between them Working Capital Management means the deployment of current assets and current liabilities efficiently so as to maximize short-term liquidity Working capital management entails short term decisions - generally, relating to the next one year period - which are "reversible" Two Steps involved in the Working Capital Management: (i) Forecasting the Amount of Working Capital (ii) Determining the Sources of Working Capital

Working Capital is the Life Blood of the Business Fixed Assets (Long Term Assets) can be purchased on Lease/Hire Purchase but Current Assets cannot be Liquidity V/s Profitability

Deciding Optimum Level of Investment in various WC Assets Decide Optimal Mix of Short Term and Long Term Capital Decide Appropriate means of Short Term Financing

Forecasting the Amount of Working Capital Determining the Sources of Working Capital

Management of Inventory Management of Receivables/Debtors Management of Cash Management of Payables/Creditors

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Vault GuideDocument414 pagesVault Guidethum_liangNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Deed of Conditional Sale House and Lot DraftDocument3 pagesDeed of Conditional Sale House and Lot DraftJanmari G. FajardoNo ratings yet

- Itr-3 Coi - F.Y 2021-22 - Ayush BhosleDocument6 pagesItr-3 Coi - F.Y 2021-22 - Ayush Bhosledarshil thakkerNo ratings yet

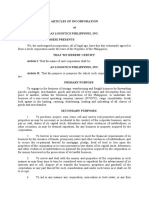

- Articles of IncorporationDocument4 pagesArticles of IncorporationRuel FernandezNo ratings yet

- Doa TradeDocument17 pagesDoa TradeEduardo WitonoNo ratings yet

- Financial Accounting P 1 Quiz 3 KeyDocument6 pagesFinancial Accounting P 1 Quiz 3 KeyJei CincoNo ratings yet

- Goods and Services Tax (GST) in IndiaDocument30 pagesGoods and Services Tax (GST) in IndiarupalNo ratings yet

- Updates in Financial Reporting StandardsDocument24 pagesUpdates in Financial Reporting Standardsloyd smithNo ratings yet

- 2 - Example Business PlanDocument14 pages2 - Example Business Planmuftahmail721No ratings yet

- History of Writing ImplementsDocument20 pagesHistory of Writing ImplementsPratik SukhaniNo ratings yet

- Research Methodology PVR Vs CineMaxDocument47 pagesResearch Methodology PVR Vs CineMaxSiddharth Vachhiyat100% (1)

- Street Food-WpDocument4 pagesStreet Food-WpPratik SukhaniNo ratings yet

- History of Writing ImplementsDocument20 pagesHistory of Writing ImplementsPratik SukhaniNo ratings yet

- Project On GingerDocument51 pagesProject On GingerPratik SukhaniNo ratings yet

- Top 50 B-SchoolsDocument22 pagesTop 50 B-SchoolsPratik SukhaniNo ratings yet

- On Kingfisher AirwaysDocument22 pagesOn Kingfisher AirwaysPratik Sukhani100% (5)

- Research MethodologyDocument47 pagesResearch MethodologyPratik SukhaniNo ratings yet

- Donor's Tax QuizDocument2 pagesDonor's Tax Quizsujulove foreverNo ratings yet

- CPA Exam Questions on FASB Conceptual FrameworkDocument26 pagesCPA Exam Questions on FASB Conceptual FrameworkTerry GuNo ratings yet

- Risk Identification and Mitigation StrategiesDocument5 pagesRisk Identification and Mitigation StrategiesnishthaNo ratings yet

- Financial Management Chapter 1Document11 pagesFinancial Management Chapter 1Ruiz, CherryjaneNo ratings yet

- The Companies Act, 1956 Company Limited by Shares: G. H. Raisoni Sports and Cultural FoundationDocument8 pagesThe Companies Act, 1956 Company Limited by Shares: G. H. Raisoni Sports and Cultural FoundationanilNo ratings yet

- Types of CapitalDocument24 pagesTypes of CapitalAnkita N VyasNo ratings yet

- Solution 1Document5 pagesSolution 1frq qqrNo ratings yet

- UnileverDocument5 pagesUnileverKevin PratamaNo ratings yet

- ACCT203 LeaseDocument4 pagesACCT203 LeaseSweet Emme100% (1)

- Sesi 13 - 17dec20 - Completing The AuditDocument40 pagesSesi 13 - 17dec20 - Completing The Auditstevany rutina sohNo ratings yet

- Hexaware TechnologiesDocument2 pagesHexaware Technologieshsolanke21No ratings yet

- Negen Capital: (Portfolio Management Service)Document5 pagesNegen Capital: (Portfolio Management Service)Sumit SagarNo ratings yet

- Dawood Habib GroupDocument3 pagesDawood Habib GroupShuja HussainNo ratings yet

- LATAM Airlines Group 20F AsFiledDocument394 pagesLATAM Airlines Group 20F AsFiledDTNo ratings yet

- Risk Management Strategies G2 - 20.3 (Final)Document4 pagesRisk Management Strategies G2 - 20.3 (Final)Phuong Anh NguyenNo ratings yet

- Dissolution and Incorporation of a PartnershipDocument26 pagesDissolution and Incorporation of a PartnershipJohn LouiseNo ratings yet

- Transfer Tax Quiz QuestionsDocument5 pagesTransfer Tax Quiz QuestionsKyasiah Mae AragonesNo ratings yet

- A Generation of Sociopaths - Reference MaterialDocument30 pagesA Generation of Sociopaths - Reference MaterialWei LeeNo ratings yet

- Study of Retail Banking Services of HDFC Bank With Reference To Customer SatisfactionDocument89 pagesStudy of Retail Banking Services of HDFC Bank With Reference To Customer SatisfactionPriya GuptaNo ratings yet

- L2 Certificate in Bookkeeping and Accounting PDFDocument26 pagesL2 Certificate in Bookkeeping and Accounting PDFKhin Zaw HtweNo ratings yet

- Anand RathiDocument3 pagesAnand RathiShilpa EdarNo ratings yet