Professional Documents

Culture Documents

Commercial & Shipping Law

Uploaded by

Thavasi Nadar0 ratings0% found this document useful (0 votes)

38 views9 pagesgood

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentgood

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

38 views9 pagesCommercial & Shipping Law

Uploaded by

Thavasi Nadargood

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 9

The INLAND Vessels Act

THE INLAND VESSELS ACT, 1917 Went through 15 amendments from 1920 to 2007. Consists of 8 Chapters. INLAND Water means any LAKE, Canal, River or any navigable water within a state. Any area of tidal water deemed to be the inland water as defined by the central govt under section 70 water declared by the central govt to be smooth and partially smooth waters under clause (41) of section 3 of the Merchant Shipping Act 1958.

INDIAN BILLS OF LADING ACT 1856

1) Rights under bills of lading to vest in consignee of endorsee.-Every consignee of goods named in a bill of lading, and every endorsee of a bill of lading to whom the property in the goods therein mentioned shall pass, upon or by reason of such consignment or endorsement shall have transferred to and vested in him all rights of suit, and be subject to the same liabilities in respect of such goods as if the contract contained in the bill of lading had been made with himself. 2) Not to affect right of stoppage in transitu of claims for freight.-Nothing herein contained shall prejudice or affect any right of stoppage in transitu, 2[ or any right to claim freight against the original shipper or owner, or any liability of the consignee or endorsee by reason or in consequence of his being such consignee or endorsee, or of his receipt of the goods by reason or in consequence of such consignment or endorsement.

INDIAN BILLS OF LADING ACT 1856

3) Bill of lading in hands of consignee, ect., conclusive evidence of the shipment as against master, etc.-- Every bill of lading in the hands of a consignee or endorsee for valuable consideration, representing goods to have been shipped on board a vessel, shall be conclusive evidence of such shipment as against the master or other person signing the same, notwithstanding that such goods or some part thereof may not have been so shipped, unless such holder of the bill of lading shall have had actual notice at the time of receiving the same that the goods had not in fact been laden on board: Provided that the master or other person so signing may exonerate himself in respect of such misrepresentation, by showing that it was caused without any default on his part, and wholly by the fraud of the shipper, or of the holder, or some person under whom the holder claims.

INDIA Lighthouse Act-1927

In accordance with the Gazette Notification dated 06.09.2000, issued by the Ministry of Surface Transport (Department of Shipping), Ships engaged in International Trade arriving at or departing from any Indian Port are required to pay light-dues @ Rs. 8/- per ton. Section 13 of the Light House Act, 1927 empowers the Proper Officer of Customs to recover the light-dues. As per Section 10 (2) of the Act, the light-dues paid by a Ship are valid for 30 days. For Ascertainment of Tonnage Section 12(1) of the Light House Act, 1927 states that For the purpose of levy of light-dues, the tonnage of a ship or sailing vessel shall be reckoned as under the Merchant Shipping Act, 1958 for dues payable on a ships tonnage including the tonnage of any space added under the said Act to the tonnage of ships by reason of such space being utilized for carrying cargo.

INDIA Lighthouse Act-1927

As per the prevailing practice, it is noticed that Ship Agents pay light-dues on the NRT (Net Register Tonnage) of the ship. There is voluminous traffic of containers on Ships and it is noticed that Ships carry containers in holds as well as on the deck. In terms of Section 12 (1) of the Light House Act, 1927, Ships that utilize the open space upon deck for carrying containers or any other cargo including the cargo at any other space utilized in addition to NRT shall pay light-dues for all such spaces utilized for carrying cargo.

INDIA Lighthouse Act-1927

Tonnage of such spaces, not included in the computation of Net Tonnage, so utilized for carrying cargo shall be determined and added to the Ships. Net Tonnage for the levy of light-dues. If the volume of such utilized spaces is determined in cubic meters it shall be divided by 2.83 for arriving at the Tonnage figure and in case the volumetric capacity is in cubic feet it shall be divided by 100 to arrive, at the Tonnage figure In case of General cargo or any other cargo carried as Deck Cargo or Cargo carried in spaces not included in NRT of the Ship, the volumetric capacity and tonnage of such spaces declared by the Owner or Master of the Ship shall normally be accepted by the Customs. For this purpose the Owner or the Master of the Ship shall provide documentation with sufficient information to confirm the admeasurements.

INDIA Lighthouse Act-1927

Besides other documents, Deck Cargo declaration is provided along with the APPLICATION FOR ENTRY INWARD by the Ship Agents to the Customs Boarding Officer. Hereafter, the Deck Cargo Declaration shall give details of the number of container, sizes, inner volumetric capacity of the containers and computed Tonnage for the purpose of assessment of light-dues. The same applied to the Ships leaving the port. The Ships shall also provide cubic capacity as well as Tonnage of the General Cargo or any other cargo carried as Deck Cargo under the Deck Cargo Declaration. The Master of the Ship shall also provide information of any additional spaces other than NRT that is utilized for carrying cargo. The owner or the Master of the Ships shall as well pay the difference in light-dues arising within the period of 30 days on the Ships arrival at or departure from any Port in India by reason of the Ship utilizing excess Tonnage as Deck Cargo and/or utilizing any other space other than NRT for carrying cargo.

INDIA Lighthouse Act-1927

The owner, Masters of the Ships and Ship Agents hall therefore, ensure that such Ships which utilize the open spaces on the upper deck for carrying containerized cargo or any other cargo or utilize the open spaces, which are not included in the NRT are liable to pay light-dues for such volume of space in addition to the light-dues they have been hitherto paying only against the NRT of the Ship. It is a statutory requirement in terms of the Light House Act, 1927 read with the Merchant Shipping Act, 1958 and the Rules framed thereunder. In terms of Section 14 of the Light House Act, 1927 and Section 42 of the Customs Act, 1962, no port Clearance will be granted until the amount of all light-dues have been paid.

INDIA Lighthouse Act-1927

The owner, Masters of the Ships and Ship Agents hall therefore, ensure that such Ships which utilize the open spaces on the upper deck for carrying containerized cargo or any other cargo or utilize the open spaces, which are not included in the NRT are liable to pay light-dues for such volume of space in addition to the light-dues they have been hitherto paying only against the NRT of the Ship. It is a statutory requirement in terms of the Light House Act, 1927 read with the Merchant Shipping Act, 1958 and the Rules framed thereunder. In terms of Section 14 of the Light House Act, 1927 and Section 42 of the Customs Act, 1962, no port Clearance will be granted until the amount of all light-dues have been paid.

You might also like

- Law of Carriage by Land, Sea and AirDocument35 pagesLaw of Carriage by Land, Sea and Airafifa_afrinNo ratings yet

- V.Meku RFKK Fudksckj) Hilewg: NotificationDocument21 pagesV.Meku RFKK Fudksckj) Hilewg: NotificationKausik DattaNo ratings yet

- Ibl Cia 1Document29 pagesIbl Cia 1abraNo ratings yet

- Carriage of Goods by Sea Act COGSADocument25 pagesCarriage of Goods by Sea Act COGSAAna Carmela DomingoNo ratings yet

- Luzon Stevedoring Corporation Vs CTADocument2 pagesLuzon Stevedoring Corporation Vs CTARobertNo ratings yet

- International Tonnage ConventionDocument31 pagesInternational Tonnage ConventionMahdi Bordbar100% (1)

- Chennai Port VRCDocument24 pagesChennai Port VRCRaj KumarNo ratings yet

- Scale of RatesDocument97 pagesScale of Ratesjoes1988No ratings yet

- MC 110Document5 pagesMC 110Rachel Erica Guillero BuesingNo ratings yet

- Chai Sutta Bar Supply Chain/ Logistics Management Task-6: Destination Country 20' Container 40' ContainerDocument9 pagesChai Sutta Bar Supply Chain/ Logistics Management Task-6: Destination Country 20' Container 40' ContainerAkanksha PatelNo ratings yet

- Mi - Unit 1Document15 pagesMi - Unit 1jNo ratings yet

- 附录一NYPE 46Document35 pages附录一NYPE 46张为国国际法兴趣小组(2023)No ratings yet

- Carriage of Goods by Sea Act, 1925Document8 pagesCarriage of Goods by Sea Act, 1925AQSULTANNo ratings yet

- Charter For The Period of A Voyage: Form No. 6Document4 pagesCharter For The Period of A Voyage: Form No. 6Sudeep SharmaNo ratings yet

- Carriage of Goods by Sea Act (COGSA) ExplainedDocument25 pagesCarriage of Goods by Sea Act (COGSA) ExplainedRuth Caranguian100% (1)

- Jawaharlal Nehru Port Trust: Gazette No.137 Dated 19.05.2014Document25 pagesJawaharlal Nehru Port Trust: Gazette No.137 Dated 19.05.2014acnt4scribdNo ratings yet

- Court Rules Against Customs Berthing Fees at Private PortDocument7 pagesCourt Rules Against Customs Berthing Fees at Private PortJay-r Tumamak50% (2)

- The Indian Carriage of Goods by Sea ActDocument33 pagesThe Indian Carriage of Goods by Sea Actharshit_jindal_1No ratings yet

- 1 ( ) The Words "Including The Delegates Representing His Majesty" Omitted by The Repealing and Amending Act (LII of 1964)Document12 pages1 ( ) The Words "Including The Delegates Representing His Majesty" Omitted by The Repealing and Amending Act (LII of 1964)amaan ahmedNo ratings yet

- Petitioner Vs Vs Respondent Hausermann, Cohn & Fisher Acting Attorney-General HarveyDocument14 pagesPetitioner Vs Vs Respondent Hausermann, Cohn & Fisher Acting Attorney-General HarveyHans Henly GomezNo ratings yet

- Commissioner of Customs v. ReluniaDocument5 pagesCommissioner of Customs v. ReluniaCarissa CruzNo ratings yet

- 1 digestCOMMISSIONER OF CUSTOMS V COURT OF TAX APPEALS GR 48886 88Document3 pages1 digestCOMMISSIONER OF CUSTOMS V COURT OF TAX APPEALS GR 48886 88Bayombong FireStation Nueva VizcayaNo ratings yet

- (Day 62) (Final) The Indian Carriage of Goods by Sea Act, 1925Document6 pages(Day 62) (Final) The Indian Carriage of Goods by Sea Act, 1925Deb DasNo ratings yet

- Luzon Stevedoring Corporation vs. Court of Tax Appeals and The Commissioner of Internal RevenueDocument2 pagesLuzon Stevedoring Corporation vs. Court of Tax Appeals and The Commissioner of Internal RevenueChiiBiiNo ratings yet

- Jalan Udyog. Edited.Document8 pagesJalan Udyog. Edited.SAURABH SUNNYNo ratings yet

- Luzon Stevedoring Corporation Tax Exemption CaseDocument1 pageLuzon Stevedoring Corporation Tax Exemption CasetemporiariNo ratings yet

- R.A. 9295Document8 pagesR.A. 9295Anonymous zDh9ksnNo ratings yet

- Pondicherry Landing and Shipping Fees Act 1971Document9 pagesPondicherry Landing and Shipping Fees Act 1971Latest Laws TeamNo ratings yet

- 30-GD Commissioner of Customs v. CTA, 224 SCRA 665,671 (1993)Document2 pages30-GD Commissioner of Customs v. CTA, 224 SCRA 665,671 (1993)kenedy saetNo ratings yet

- Commissioner of Customs Vs CTA DigestDocument3 pagesCommissioner of Customs Vs CTA DigestRomarie AbrazaldoNo ratings yet

- Module 3 INTRODUCTION TO SEA CARRIAGE & CARRIAGE OF GOODSDocument51 pagesModule 3 INTRODUCTION TO SEA CARRIAGE & CARRIAGE OF GOODSRam SinghNo ratings yet

- Study Guide #3Document6 pagesStudy Guide #3Shinji NishikawaNo ratings yet

- The Voyage Charterparty Rules in This Scenario: A Brief Overview of Owner's Description of The VesselDocument9 pagesThe Voyage Charterparty Rules in This Scenario: A Brief Overview of Owner's Description of The VesselAhmer AslamNo ratings yet

- Chapter 04Document31 pagesChapter 04Ram SskNo ratings yet

- Commissioner of Customs vs. Lt. Col. Relunia, 105 Phil. 875, No. L-11860 May 29, 1959Document11 pagesCommissioner of Customs vs. Lt. Col. Relunia, 105 Phil. 875, No. L-11860 May 29, 1959Alexiss Mace JuradoNo ratings yet

- Maritime CodeDocument45 pagesMaritime CodeSV PRNo ratings yet

- Maritime Law EssentialsDocument121 pagesMaritime Law EssentialsSharmaine Alisa Basinang100% (1)

- Legal Implications of Mis Delivery and Non-Delivery of Cargo Under The Indian Law and The Hague Visby and Hamburg Rules.Document12 pagesLegal Implications of Mis Delivery and Non-Delivery of Cargo Under The Indian Law and The Hague Visby and Hamburg Rules.Ross DennyNo ratings yet

- S.1 Short Title of Commencement: Kolkata Port Trust Scale of Rates Gazette No.65 Dated 26.02.2014 GeneralDocument42 pagesS.1 Short Title of Commencement: Kolkata Port Trust Scale of Rates Gazette No.65 Dated 26.02.2014 GeneralAbhishek KumarNo ratings yet

- United States Lines vs. Comm. of CustomsDocument2 pagesUnited States Lines vs. Comm. of CustomsRhea CalabinesNo ratings yet

- Ship MortgageDocument6 pagesShip MortgageSSNo ratings yet

- Luzon Stevedoring Corp. V CTA 163 SCRA 647Document2 pagesLuzon Stevedoring Corp. V CTA 163 SCRA 647Kyle DionisioNo ratings yet

- Gemı OlmaDocument23 pagesGemı OlmacptmehmetkaptanNo ratings yet

- Indian Carriage of Goods by Sea ActDocument8 pagesIndian Carriage of Goods by Sea ActRajat ThakurNo ratings yet

- Boat Rules, 1953Document7 pagesBoat Rules, 1953mfuzee_jlsNo ratings yet

- Commissioner of Customs vs. ReluniaDocument5 pagesCommissioner of Customs vs. Reluniaelna ocampoNo ratings yet

- Kandla Port Trust Scale of Rates Chapter 1 DefinitionsDocument30 pagesKandla Port Trust Scale of Rates Chapter 1 DefinitionsAbhishek KumarNo ratings yet

- Annex - Visakhapatnam Port Trust Scale of Rates Section 1 1.1. Definitions - GeneralDocument31 pagesAnnex - Visakhapatnam Port Trust Scale of Rates Section 1 1.1. Definitions - GeneralMohd IqbalNo ratings yet

- SOM TopicsDocument23 pagesSOM TopicsPagan jatarNo ratings yet

- Deendayal Port PDFDocument33 pagesDeendayal Port PDFbinary786No ratings yet

- C.A. No. 65Document6 pagesC.A. No. 65Angelo M. MañalacNo ratings yet

- Luzon Stevedoring Corp vs. CTADocument2 pagesLuzon Stevedoring Corp vs. CTAmaximum jicaNo ratings yet

- Tan Chiong Sian Vs InchaustiDocument5 pagesTan Chiong Sian Vs Inchaustithornapple25100% (1)

- Registrations of Indian ShipsDocument5 pagesRegistrations of Indian ShipsCAPT PARTHASARATHY VASANTHNo ratings yet

- Charter PartyDocument6 pagesCharter PartyHuong Nguyen Dinh100% (1)

- Transportation and Public Utilities Law - Finals NotesDocument45 pagesTransportation and Public Utilities Law - Finals NotesylaineNo ratings yet

- Reviewer AdmiraltyDocument8 pagesReviewer AdmiraltyRadel LlagasNo ratings yet

- De Rama Bill of Lading MarlawDocument5 pagesDe Rama Bill of Lading MarlawMark Alvin CuyaNo ratings yet

- Shipping Practice - With a Consideration of the Law Relating TheretoFrom EverandShipping Practice - With a Consideration of the Law Relating TheretoNo ratings yet

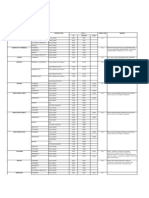

- CCAI THC Tariff Updated As On 17 Oct 12Document6 pagesCCAI THC Tariff Updated As On 17 Oct 12Thavasi NadarNo ratings yet

- 15.02.2013 Customer Letter - IN Local and Detention ChargesDocument2 pages15.02.2013 Customer Letter - IN Local and Detention ChargesThavasi NadarNo ratings yet

- India ocean freight rates container typesDocument2 pagesIndia ocean freight rates container typesThavasi NadarNo ratings yet

- BondDocument2 pagesBondThavasi NadarNo ratings yet

- VesselScheduleRouteResults 20131115230635Document2 pagesVesselScheduleRouteResults 20131115230635Thavasi NadarNo ratings yet

- Export THC LDocument0 pagesExport THC LThavasi NadarNo ratings yet

- Do 0354Document1 pageDo 0354Thavasi NadarNo ratings yet

- ANL ScheduleDocument3 pagesANL ScheduleThavasi NadarNo ratings yet

- Type of Business Authorized Signatory For The LetterDocument1 pageType of Business Authorized Signatory For The LetterThavasi NadarNo ratings yet

- Cma CGM SchedulesDocument34 pagesCma CGM SchedulesThavasi NadarNo ratings yet

- BondDocument2 pagesBondThavasi NadarNo ratings yet

- Final Deakin UniversityDocument24 pagesFinal Deakin UniversityThavasi NadarNo ratings yet

- AssignmentDocument3 pagesAssignmentThavasi NadarNo ratings yet

- Anil Mbi LCLDocument24 pagesAnil Mbi LCLThavasi NadarNo ratings yet

- Final Deakin UniversityDocument24 pagesFinal Deakin UniversityThavasi NadarNo ratings yet

- NOC LetterDocument1 pageNOC LetterThavasi NadarNo ratings yet

- MSCSchedule INNSA USNYCDocument1 pageMSCSchedule INNSA USNYCThavasi NadarNo ratings yet

- Tony Fernandez 1 PDFDocument4 pagesTony Fernandez 1 PDFThavasi NadarNo ratings yet

- CMA-CGM import docsDocument3 pagesCMA-CGM import docsThavasi NadarNo ratings yet

- NOC LetterDocument1 pageNOC LetterThavasi NadarNo ratings yet

- AssignmentDocument1 pageAssignmentThavasi NadarNo ratings yet

- India: India Export Surcharge Table: THC/LDocument0 pagesIndia: India Export Surcharge Table: THC/LThavasi NadarNo ratings yet

- Tony Fernandez 1 PDFDocument4 pagesTony Fernandez 1 PDFThavasi NadarNo ratings yet

- Safmarine Surrender LetterDocument1 pageSafmarine Surrender LetterThavasi Nadar100% (1)

- THC Applied 1st Aug ZimDocument2 pagesTHC Applied 1st Aug ZimThavasi NadarNo ratings yet

- Avatar The Last Airbender Wii Bleach Shatterd Blade Wii Bully Scholar Ship Edition Wii Csi Hard Evidence Wii or PC Gi Joe Rise of Cobra Wii Wwe SVR 2008 2009 2011Document1 pageAvatar The Last Airbender Wii Bleach Shatterd Blade Wii Bully Scholar Ship Edition Wii Csi Hard Evidence Wii or PC Gi Joe Rise of Cobra Wii Wwe SVR 2008 2009 2011Thavasi NadarNo ratings yet

- Indian Oil Corporation LimitedDocument2 pagesIndian Oil Corporation LimitedThavasi NadarNo ratings yet

- Ifact Maintenance Details - Softline Home FashonsDocument1 pageIfact Maintenance Details - Softline Home FashonsThavasi NadarNo ratings yet

- Safmarine Surrender LetterDocument1 pageSafmarine Surrender LetterThavasi Nadar100% (1)

- Ifact Maintenance Details - Pt. Kewalram IndonesiaDocument1 pageIfact Maintenance Details - Pt. Kewalram IndonesiaThavasi NadarNo ratings yet