Professional Documents

Culture Documents

FFM 910

Uploaded by

Harry Satria PutraOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FFM 910

Uploaded by

Harry Satria PutraCopyright:

Available Formats

10 - 1

CHAPTER 10

The Cost of Capital

Cost of capital components Accounting for flotation costs WACC Adjusting cost of capital for risk Estimating project risk

Copyright 2001 by Harcourt, Inc. All rights reserved.

10 - 2

What types of capital do firms use?

Debt Preferred stock Common equity: Retained earnings New common stock

Copyright 2001 by Harcourt, Inc.

All rights reserved.

10 - 3

Should we focus on before-tax or after-tax capital costs?

Stockholders focus on A-T CFs. Therefore, we should focus on A-T capital costs, i.e., use A-T costs in WACC. Only kd needs adjustment.

Copyright 2001 by Harcourt, Inc.

All rights reserved.

10 - 4

Should we focus on historical (embedded) costs or new (marginal) costs?

The cost of capital is used primarily to make decisions that involve raising new capital. So, focus on todays marginal costs (for WACC).

Copyright 2001 by Harcourt, Inc.

All rights reserved.

10 - 5

A 15-year, 12% semiannual bond sells for $1,153.72. Whats kd?

0 i=? 1 60 2 30

...

60 60 + 1,000

-1,153.72

INPUTS OUTPUT

30

N I/YR

-1153.72 60

PV PMT

1000

FV

5.0% x 2 = kd = 10%

All rights reserved.

Copyright 2001 by Harcourt, Inc.

10 - 6

Component Cost of Debt

Interest is tax deductible, so kd AT = kd BT(1 T) = 10%(1 0.40) = 6%. Use nominal rate. Flotation costs small. Ignore.

Copyright 2001 by Harcourt, Inc. All rights reserved.

10 - 7

Whats the cost of preferred stock? Pp = $111.10; 10%Q; Par = $100. Use this formula:

Dp $10 kp 0.090 9.0%. Pp $111.10

Copyright 2001 by Harcourt, Inc.

All rights reserved.

10 - 8

Picture of Preferred Stock

0 -111.1

kp = ?

1 2.50

...

2.50

2.50

DQ $2.50 $111.10 = = . kPer kPer

$2.50 kPer = = 2.25%; $111.10 kp(Nom) = 2.25%(4) = 9%.

Copyright 2001 by Harcourt, Inc. All rights reserved.

10 - 9

Note: Preferred dividends are not tax deductible, so no tax adjustment. Just kp. Nominal kp is used. Our calculation ignores flotation costs.

Copyright 2001 by Harcourt, Inc.

All rights reserved.

10 - 10

Is preferred stock more or less risky to investors than debt? More risky; company not required to pay preferred dividend. However, firms try to pay preferred dividend. Otherwise, (1) cannot pay common dividend, (2) difficult to raise additional funds, (3) preferred stockholders may gain control of firm.

Copyright 2001 by Harcourt, Inc. All rights reserved.

10 - 11

Why is yield on preferred lower than kd? Corporations own most preferred stock, because 70% of preferred dividends are nontaxable to corporations. Therefore, preferred often has a lower B-T yield than the B-T yield on debt. The A-T yield to an investor, and the A-T cost to the issuer, are higher on preferred than on debt. Consistent with higher risk of preferred.

Copyright 2001 by Harcourt, Inc. All rights reserved.

10 - 12

Example: kp = 9% kd = 10% T = 40% kp, AT = kp kp (1 0.7)(T) = 9% 9%(0.3)(0.4) = kd, AT = 10% 10%(0.4) =

7.92%.

6.00%.

A-T Risk Premium on Preferred = 1.92%.

Copyright 2001 by Harcourt, Inc.

All rights reserved.

10 - 13

Why is there a cost for retained earnings? Earnings can be reinvested or paid out as dividends. Investors could buy other securities, earn a return. Thus, there is an opportunity cost if earnings are retained.

Copyright 2001 by Harcourt, Inc. All rights reserved.

10 - 14

Opportunity cost: The return stockholders could earn on alternative investments of equal risk. They could buy similar stocks and earn ks, or company could repurchase its own stock and earn ks. So, ks is the cost of retained earnings.

Copyright 2001 by Harcourt, Inc. All rights reserved.

10 - 15

Three ways to determine cost of common equity, ks:

1. CAPM: ks = kRF + (kM kRF)b.

2. DCF: ks = D1/P0 + g.

3. Own-Bond-Yield-Plus-Risk Premium: ks = kd + RP.

Copyright 2001 by Harcourt, Inc.

All rights reserved.

10 - 16

Whats the cost of common equity based on the CAPM? kRF = 7%, RPM = 6%, b = 1.2.

ks = kRF + (kM kRF )b. = 7.0% + (6.0%)1.2 = 14.2%.

Copyright 2001 by Harcourt, Inc.

All rights reserved.

10 - 17

Whats the DCF cost of common equity, ks? Given: D0 = $4.19; P0 = $50; g = 5%.

D1 D0(1 + g) ks = +g= +g P0 P0

$4.19(1.05) = + 0.05 $50 = 0.088 + 0.05 = 13.8%.

Copyright 2001 by Harcourt, Inc. All rights reserved.

10 - 18

Suppose the company has been earning 15% on equity (ROE = 15%) and retaining 35% (dividend payout = 65%), and this situation is expected to continue. Whats the expected future g?

Copyright 2001 by Harcourt, Inc.

All rights reserved.

10 - 19

Retention growth rate:

g = (1 Payout)(ROE) = 0.35(15%) = 5.25%. Here (1 Payout) = Fraction retained. Close to g = 5% given earlier. Think of bank account paying 10% with payout = 100%, payout = 0%, and payout = 50%. Whats g?

Copyright 2001 by Harcourt, Inc. All rights reserved.

10 - 20

Could DCF methodology be applied if g is not constant?

YES, nonconstant g stocks are expected to have constant g at some point, generally in 5 to 10 years. But calculations get complicated.

Copyright 2001 by Harcourt, Inc. All rights reserved.

10 - 21

Find ks using the own-bond-yield-plusrisk-premium method. (kd = 10%, RP = 4%.)

ks = kd + RP

= 10.0% + 4.0% = 14.0% This RP CAPM RP. Produces ballpark estimate of ks. Useful check.

Copyright 2001 by Harcourt, Inc. All rights reserved.

10 - 22

Whats a reasonable final estimate of ks? Method CAPM Estimate 14.2%

DCF

kd + RP

13.8%

14.0%

Average

Copyright 2001 by Harcourt, Inc.

14.0%

All rights reserved.

10 - 23

Why is the cost of retained earnings cheaper than the cost of issuing new common stock? 1. When a company issues new common stock they also have to pay flotation costs to the underwriter. 2. Issuing new common stock may send a negative signal to the capital markets, which may depress stock price.

Copyright 2001 by Harcourt, Inc. All rights reserved.

10 - 24

Two approaches that can be used to account for flotation costs:

Include the flotation costs as part of the projects up-front cost. This reduces the projects estimated return. Adjust the cost of capital to include flotation costs. This is most commonly done by incorporating flotation costs in the DCF model.

Copyright 2001 by Harcourt, Inc. All rights reserved.

10 - 25

New common, F = 15%:

D0 (1 g) ke g P0 (1 F)

$4.191.05 5 .0 % $501 0.15 $4.40 5.0% 15.4%. $42.50

Copyright 2001 by Harcourt, Inc. All rights reserved.

10 - 26

Comments about flotation costs: Flotation costs depend on the risk of the firm and the type of capital being raised. The flotation costs are highest for common equity. However, since most firms issue equity infrequently, the per-project cost is fairly small. We will frequently ignore flotation costs when calculating the WACC.

Copyright 2001 by Harcourt, Inc. All rights reserved.

10 - 27

Whats the firms WACC (ignoring flotation costs)?

WACC = wdkd(1 T) + wpkp + wcks

= 0.3(10%)(0.6) + 0.1(9%) + 0.6(14%) = 1.8% + 0.9% + 8.4% = 11.1%.

Copyright 2001 by Harcourt, Inc.

All rights reserved.

10 - 28

What factors influence a companys composite WACC? Market conditions. The firms capital structure and dividend policy. The firms investment policy. Firms with riskier projects generally have a higher WACC.

Copyright 2001 by Harcourt, Inc. All rights reserved.

10 - 29

WACC Estimates for Some Large U. S. Corporations, Nov. 1999

Company Intel General Electric Motorola Coca-Cola Walt Disney AT&T Wal-Mart Exxon H. J. Heinz BellSouth

Copyright 2001 by Harcourt, Inc.

WACC 12.9% 11.9 11.3 11.2 10.0 9.8 9.8 8.8 8.5 8.2

All rights reserved.

10 - 30

Should the company use the composite WACC as the hurdle rate for each of its projects? NO! The composite WACC reflects the risk of an average project undertaken by the firm. Therefore, the WACC only represents the hurdle rate for a typical project with average risk. Different projects have different risks. The projects WACC should be adjusted to reflect the projects risk.

Copyright 2001 by Harcourt, Inc. All rights reserved.

10 - 31

Risk and the Cost of Capital

Rate of Return (%)

Acceptance Region W ACC 12.0 10.5 10.0 9.5 8.0 L A B H Rejection Region

Risk L

Risk A

Risk H

Risk

Copyright 2001 by Harcourt, Inc.

All rights reserved.

10 - 32

Divisional Cost of Capital

Rate of Return (%)

13.0 Division Hs WACC WACC

11.0 10.0 9.0 7.0 Project L Composite WACC for Firm A

Project H

Division Ls WACC

RiskL

Risk Average

RiskH

Risk

Copyright 2001 by Harcourt, Inc.

All rights reserved.

10 - 33

What are the three types of project risk?

Stand-alone risk Corporate risk Market risk

Copyright 2001 by Harcourt, Inc.

All rights reserved.

10 - 34

How is each type of risk used? Market risk is theoretically best in most situations. However, creditors, customers, suppliers, and employees are more affected by corporate risk. Therefore, corporate risk is also relevant.

Copyright 2001 by Harcourt, Inc. All rights reserved.

10 - 35

What procedures are used to determine the risk-adjusted cost of capital for a particular project or division? Subjective adjustments to the firms composite WACC. Attempt to estimate what the cost of capital would be if the project/division were a stand-alone firm. This requires estimating the projects beta.

Copyright 2001 by Harcourt, Inc. All rights reserved.

10 - 36

Methods for Estimating a Projects Beta

1. Pure play. Find several publicly traded companies exclusively in projects business. Use average of their betas as proxy for projects beta. Hard to find such companies.

Copyright 2001 by Harcourt, Inc. All rights reserved.

10 - 37

2. Accounting beta. Run regression between projects ROA and S&P index ROA. Accounting betas are correlated (0.5 0.6) with market betas. But normally cant get data on new projects ROAs before the capital budgeting decision has been made.

Copyright 2001 by Harcourt, Inc.

All rights reserved.

10 - 38

Find the divisions market risk and cost of capital based on the CAPM, given these inputs: Target debt ratio = 40%. kd = 12%. kRF = 7%. Tax rate = 40%. betaDivision = 1.7. Market risk premium = 6%.

Copyright 2001 by Harcourt, Inc. All rights reserved.

10 - 39

Beta = 1.7, so division has more market risk than average. Divisions required return on equity:

ks = kRF + (kM kRF)bDiv. = 7% + (6%)1.7 = 17.2%.

WACCDiv. = wdkd(1 T) + wcks = 0.4(12%)(0.6) + 0.6(17.2%) = 13.2%.

Copyright 2001 by Harcourt, Inc. All rights reserved.

10 - 40

How does the divisions market risk compare with the firms overall market risk? Division WACC = 13.2% versus company WACC = 11.1%. Indicates that the divisions market risk is greater than firms average project. Typical projects within this division would be accepted if their returns are above 13.2%.

Copyright 2001 by Harcourt, Inc. All rights reserved.

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Basics of Stocks and Stock MarketsDocument13 pagesBasics of Stocks and Stock MarketsPraveen R VNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Audit of EquityDocument76 pagesAudit of Equitydar •No ratings yet

- R D V Stock Preferred of ValueDocument42 pagesR D V Stock Preferred of ValueJesper N. Qvist100% (4)

- MC With Answers Partnership Operation CorporationDocument19 pagesMC With Answers Partnership Operation CorporationASHLEY ROLAINE VICENTENo ratings yet

- Investment in Associate-HandoutDocument9 pagesInvestment in Associate-HandoutPhoeza Espinosa VillanuevaNo ratings yet

- DocxDocument32 pagesDocxDaniella Zapata Montemayor100% (1)

- FQ 001 Sharehoders - Equity and Retained EarningsDocument4 pagesFQ 001 Sharehoders - Equity and Retained Earningsmarygraceomac83% (6)

- Sports Betting Rules: Applicability of These RulesDocument30 pagesSports Betting Rules: Applicability of These RulesWisnu WijayaNo ratings yet

- Pemanfaatan e Commerce Dalam Dunia BisnisDocument18 pagesPemanfaatan e Commerce Dalam Dunia BisnisHarry Satria Putra100% (1)

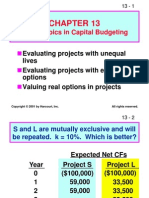

- Other Topics in Capital BudgetingDocument24 pagesOther Topics in Capital BudgetingHarry Satria PutraNo ratings yet

- The Basics of Capital Budgeting: Should We Build This Plant?Document42 pagesThe Basics of Capital Budgeting: Should We Build This Plant?Harry Satria PutraNo ratings yet

- MFRD - LaliteshDocument35 pagesMFRD - LaliteshRajivVyasNo ratings yet

- Fundamentals of Advanced Accounting 8th Edition Hoyle Test Bank 1Document60 pagesFundamentals of Advanced Accounting 8th Edition Hoyle Test Bank 1audra100% (41)

- SFM MaterialDocument42 pagesSFM MaterialPSBALARAMNo ratings yet

- Corporation Code of The Philippines-CODALSDocument47 pagesCorporation Code of The Philippines-CODALSKadzNituraNo ratings yet

- Requirement of The Finance May Be Classified Into Two PartsDocument5 pagesRequirement of The Finance May Be Classified Into Two Partssarin khorozianNo ratings yet

- FM ReportingDocument45 pagesFM ReportingOliwa OrdanezaNo ratings yet

- MAS Mockboard ExaminationDocument8 pagesMAS Mockboard ExaminationAngelica EstolatanNo ratings yet

- MFRS132 Financial InstrumentsDocument49 pagesMFRS132 Financial InstrumentsAin YanieNo ratings yet

- Finsas: Financial Statement Analysis SpreadsheetDocument25 pagesFinsas: Financial Statement Analysis SpreadsheetDharm Veer RathoreNo ratings yet

- Q1-Module 2-Week 2-Financial Institutions, Instrument and Market Flow of FundsDocument27 pagesQ1-Module 2-Week 2-Financial Institutions, Instrument and Market Flow of FundsJusie ApiladoNo ratings yet

- Chapter 12 ProblemsDocument40 pagesChapter 12 ProblemsInciaNo ratings yet

- Module 1 MaterialDocument308 pagesModule 1 Materialmusinguzi francisNo ratings yet

- Interim Order Cum Show Cause Notice in The Matter of DGR Farms & Leisures Ltd.Document15 pagesInterim Order Cum Show Cause Notice in The Matter of DGR Farms & Leisures Ltd.Shyam SunderNo ratings yet

- Frequently Asked QuestionsDocument15 pagesFrequently Asked QuestionsJunelyn T. EllaNo ratings yet

- Final AssignmentDocument10 pagesFinal AssignmentRuthNo ratings yet

- Chapter 6.valuation of SDocument48 pagesChapter 6.valuation of SPark CảiNo ratings yet

- Chapter 008 Stock Valuation: Aacsb Topic: Analytic SECTION: 8.1 Topic: Stock Value Type: ProblemsDocument23 pagesChapter 008 Stock Valuation: Aacsb Topic: Analytic SECTION: 8.1 Topic: Stock Value Type: Problemsdarling assylaNo ratings yet

- Section B Answer Question 1 and Not More Than One Further Question From This Section. Question 1Document3 pagesSection B Answer Question 1 and Not More Than One Further Question From This Section. Question 1Kəmalə AslanzadəNo ratings yet

- Australian Sharemarket: TablesDocument20 pagesAustralian Sharemarket: TablesallegreNo ratings yet

- Acc501 Quiz FileDocument19 pagesAcc501 Quiz Filedaredevil18050% (2)

- Corporate Finance Fundamentals - Course PresentationDocument83 pagesCorporate Finance Fundamentals - Course PresentationMinhaj HussainNo ratings yet

- Accounting ResearchDocument10 pagesAccounting ResearchDave AlereNo ratings yet

- Shareholders' Equity: Prof. Haezel Lagonera, Cpa, CTT, MbaDocument20 pagesShareholders' Equity: Prof. Haezel Lagonera, Cpa, CTT, MbaAndrea BaldonadoNo ratings yet