Professional Documents

Culture Documents

6 TRB DelayWorkshop Hansen

Uploaded by

Ace MonyoOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

6 TRB DelayWorkshop Hansen

Uploaded by

Ace MonyoCopyright:

Available Formats

1

Total Delay Impact Study

Mark Hansen, Thea Graham, Bo Zou,

Chieh-Yu Hsao et. al

TRB

January 11, 2009

2

Outline

Motivation

Goals and Scope

Results to Date

3

Impact of Aviation on the U.S. Economy

Aviation accounts for

11 million aviation-related jobs

$1.2 trillion in economic activity

5.6 Percent Contribution to Gross

Domestic Product

Adds $61 Billion to the U.S. Trade

Balance

The Aviation Industry contributes to the U.S. Economy and International Trade

4

Questions to be Addressed

What are the ripple effects?

Quality of life

Economic productivity

Global economic position

Transportation choice

Societal costs?

Environmental consequences

from uncontained delay?

5

Project Deliverables

Estimate the total cost of airline delay on the

economy and society

Direct costs including passenger and air carriers

Indirect costs, i.e. economic productivity, lost wages, etc.

Tertiary costs including societal and quality of life costs

Estimate the impact of aviation infrastructure

investment on US economic productivity

Final Report January 2010

6

Approach

2007 as case study year

Quantify flight delays and related

metrics

Quantify passenger delays

Assess economic impact

Costs to airlines and passengers

Costs to other sectors

Firm-level case studies

Adaptation cast studies

7

Results to Date

Impact of flight delays on

passenger route demand

Impact of flight delays on airline

costs

8

Impact of Delays on Passenger

Route Demand

9

Introduction

The model

Predicts aggregate link flows from flows in particular city-pair

markets

Deals with demand generation and demand assignment in a

single model (consistent with random utility theory), and quantifies

induced air travel

Models both multiple routes and multiple airports within regions

Capture patterns of correlations among alternatives

Answer empirical questions

How is air service demand affected by causal factors, such as fare

and delay?

What are the welfare impacts of different scenarios, including

different levels of congestion and scheduled flight time?

10

The Demand Model

Model city-pair demand generation and its assignment

among airports and routes

City A City B

H1

H2

O1

O2

O3

D1

D2

Origin airport

Connecting airport

Destination airport

Travel by other

modes, or non-

travel

11

Estimation Results

NL3B model is the preferred model

Routes between two cities (within a

nest) are correlated

A route is

more likely to be substituted by another

route of the same O-D airport pair than the

routes of the other O-D airport pairs

least likely to be substituted by the non-air

alternative

Most coefficients are significant and

have expected signs

Non-

Air

O1

D1

NL3B

O1

D2

O1

H1

D1

O1

H2

D1

O1

H2

D2

O1

H3

D2

Air

OD Airport

Variable NL3B

-OLS

NL3B

-IV

Fare (hundreds of 2004 dollars) -0.160

***

-1.546

***

[0.005] [0.206]

ln(Frequency)Direct

(flights per quarter)

1.337

***

1.240

***

[0.016] [0.029]

ln(Max frequency of two segments)

Connecting (flights per quarter)

0.440

***

0.627

***

[0.009] [0.030]

ln(Min frequency of two segments)

Connecting (flights per quarter)

0.822

***

0.957

***

[0.007] [0.023]

Scheduled flight timeDirect

(minutes)

-0.019

***

-0.004

[0.000] [0.002]

Scheduled flight time Connecting

(minutes)

-0.019

***

-0.006

**

[0.000] [0.002]

Dummy for direct routes

(=1, if direct route)

3.874

***

6.066

***

[0.141] [0.397]

Positive hub arrival delay

t-1

(minutes per flight)

-0.002

**

-0.006

***

[0.001] [0.002]

Positive hub arrival delay

t-4

(minutes per flight)

-0.002

**

-0.007

***

[0.001] [0.002]

Inclusive value of level 3

(parameter=

a p

/ )

0.937

***

0.664

***

[0.011] [0.014]

Inclusive value of level 2

(parameter=

m a

/ )

0.711

***

0.795

***

[0.009] [0.010]

Inclusive value of level 2 *market

distance

-0.008

***

-0.012

***

[0.001] [0.001]

Market distance (hundreds of miles)

0.018

***

-0.024

***

[0.005] [0.005]

ln(market distance) 1.888

***

1.575

***

[0.048] [0.046]

Per capita personal income of market

(thousands of 2004 dollars)

0.015

***

0.038

***

[0.003] [0.003]

Constant (level 1) -17.316

***

-16.229

***

[0.116] [0.102]

12

System Delay Experiment:

Hub Delay

The delay of the 30 hub airports reduce by 100%

Changes in traffic (from NL3B-IV):

Connecting routes: +6.6 million trips

Direct routes: -1.9 million trips

All air routes: +4.7million trips

13

System Delay Experiment

Impacts on LADC Market

The delay of the 30 hub airports reduce by 100%

LA DC

ORD

ATL

+23,093

+6,437 (10.4%)

+6,941(15.4%)

+3,501(4.5%)

Other Hubs: +11,673(6.4%)

-12,985 (3.4%)

LAX

ONT

SNA

BUR

LGB

PSP

DEN

DFW

PHX

+3,884 (5.1%)

+3,643 (5.7%)

DCA

IAD

BWI

+9,472(1.6%)

+8,309(6.1%)

+3,770(5.1%)

+1,367(5.2%)

+786(5.1%)

-611(1.2%)

+1,605(0.6%)

+12,501(6.0%)

+8,987(2.0%)

14

System Delay Experiment:

Schedule Padding

Calculated from individual flight data: ASQP (2004)

For each route-quarter,

Padding time=

Average scheduled flight time -

20

th

percentile of actual gate to gate time

Scenarios for schedule padding,

New scheduled flight time

=Average scheduled flight time - padding time

= 20

th

percentile of actual gate to gate time

15

Welfare Analysis

User benefits approximated by the rule of

is calculated from and fare elasticity of

market demand

ly. respective ts, improvemen with the and ut witho

market a of traffic the are Q and

ly; respective ts, improvemen with the and ut witho

market a of fare the are and where,

2 / ) )( (

1 0

1 0

1 0 1 0

m m

m m

m

m m m m

Q

P P

Q Q P P

+

1

m

P

1

Q

m

16

Welfare Analysis

Scenarios

Net Changes

in Traffic

(Million

Trips)

Total User

Benefits

(Billion

Dollars)

Benefits per

User

($)

(1) Hub Delay

-100%

4.71 0.74 2.48

(2) No Schedule

Padding

7.62 1.17 3.87

(3) Both(1)

and(2)

12.60 1.98 6.44

17

Impact of Delays on Airline

Costs

18

Approaches to Estimating

Cost of Delays to Airlines

Cost Factor

Block-hr DOC (Schumer report)

Block-hr Total Cost (Schumer)

Airline/Airport/ANSP Surveys

(Cook)

Econometric

Economic Cost Function

Unit Cost Change Model

(Discussed here)

19

Unit Cost Change Model

Panel data

9 major airlines

17 years (90-07)

Use changes of cost and influencing

factors

Dependent Variable: % Change in

Operating Cost per ASM

Independent Variables (% or absolute)

Change in delay (using different metrics)

Change in other factors (e.g. costs)

it it it it

c | | | + A + A + = A ) factor other ( y_factor) punctualit ( * ) ost unit_opr_c (

2 1 0

20

Punctuality Factors

Arrival delay

Departure delay

In this study use difference in minutes

between scheduled

and actual arrival/departure time

On-time percentage

a flight is considered on-time when it

arrives less than 15

minutes after its published arrival time

Cancellation rate

21

Metric 1&2: dep./arr. delay

Dependent variable Independent variables Parameter estimates

(t-statistics)

R

2

Percent_cost_change Dep_delay_change

CCI_change

0.007296(3.15)

0.001771(2.98)

0.1281

Dep_delay_change

Percent_CCI_change

0.007759(3.35)

0.2046(2.68)

0.1186

Percent_dep_delay_change

CCI_change

0.0552(2.87)

0.001261(2.67)

0.1187

Percent_dep_delay_change

Percent_CCI_change

0.0586(3.05)

0.1782(2.29)

0.1078

arr_delay_change

CCI_change

0.007429(3.03)

0.001930(3.27)

0.1239

arr_delay_change

Percent_CCI_change

0.007675(3.11)

0.2182(2.86)

0.1097

Percent_arr_delay_change

CCI_change

0.0831(2.94)

0.001928(3.26)

0.1211

Percent_arr_delay_change

Percent_CCI_change

0.0851(2.99)

0.2155(2.81)

0.1057

22

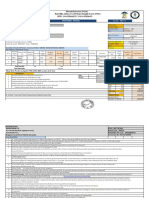

Estimating total delay cost

Our

Estimation

ATA (2007) Schumer (2008)

Cost Factor

Approach

Cost Factor

Approach

Total Cost Approach

Measure of

Delay

A

Arrival delay

> 15 min

C D A B C D

Total

Airline-side

Delay Cost

(billion $)

8.82/9.10

(10.9/11.3)

8.09 3.6 6.1 12.2 21.7 19.1 23.4

delay / cost/cost) (

1

A A = |

( ) ) ASM Total ( * ]

1

1 [ * ) cost unit current ( cost delay total

) delay arr. avg. ( *

1

|

e

=

A: Difference in minutes between scheduled and actual arrival time. Early arrivals set to 0.

B: Actual elapse time-5

th

percentile of observed elapse time for given segment in a given month.

C: Delay leaving the gate +delay during taxi (relative to FAA nominal taxi times) + (airborne delay relative to smaller

of flight plan and block time minus nominal taxi times).

D: Delay leaving the gate +delay during taxi (relative to FAA nominal taxi times) + (airborne delay relative to 5

th

percentile of observed airborne time for given segment in a given month).

23

Estimating marginal delay cost

at a system level

Diseconomies of scale: airlines would suffer more for

marginal increase of delay when delay is at a higher level

24

Estimating avg. delay cost

($/min)

delay / cost/cost) (

1

A A = |

( ) ) capacity seat avg ( * ) length stage avg ( * )

$

( * cost/min delay

1

ASM

| =

Our approach

ATA,

2007

Barnett et

al. 2001

Cook et

al. 2004

ITA, 2000

9 airlines

System-

wide

Delay cost

for airlines

($/min)

87.6/90.5 81.7/84.4 60.46 51.70 60.4 78.5

market-dominant airlines tend to suffer more from

delays than do carriers of relatively small size

25

Summary of Cost Estimates

Approach Metrics

System-wide

cost

Our approach

Model 5/6 Arrival delay type A 8.8/9.1

Model 13~16 On-time percentage 8.0/8.2/9.2/9.5

Model 19/23 Cancellation 2.4/2.7*

ATA (2007) Cost factor based

Arrival delay > 15

min

6.9**

Schumer (2008)

Cost factor based

Arrival delay type C 3.6

Arrival delay type D 6.1

Total cost based

Arrival delay type A 12.2

Arrival delay type B 21.7

Arrival delay type C 19.1

Arrival delay type D 23.4

Cancellation cost

Our estimate of system-wide delay cost is in the range of $ 8-9.5 billion.

If cancellation is taken into account, total cost reaches $10.5-12 billion.

26

Future work

Airline/Aircraft type cost data

Additional explanatory variables

Other punctuality metrics

Variance of delay

Long delays

Diversion

Incorporating buffer delay

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- MT0690 - Abhishek - Check UpDocument1 pageMT0690 - Abhishek - Check UpAbhishek KhandelwalNo ratings yet

- Celtic Knot Fingerless GlovesDocument3 pagesCeltic Knot Fingerless GlovesNguyễn Thu ThuỷNo ratings yet

- Accounting Vouchers in TallyDocument2 pagesAccounting Vouchers in TallyAbracadabraGoonerLincol'otu0% (2)

- QHAVLDocument5 pagesQHAVLAce MonyoNo ratings yet

- CSS Part IIDocument26 pagesCSS Part IIAce MonyoNo ratings yet

- Prg111 ExamDocument1 pagePrg111 ExamAce MonyoNo ratings yet

- Basic Flowchart and It's FunctionDocument9 pagesBasic Flowchart and It's FunctionJoey Slipknot JordisonNo ratings yet

- prg111 ExamDocument1 pageprg111 ExamAce MonyoNo ratings yet

- Excel Training Guide PDFDocument13 pagesExcel Training Guide PDFMoiz IsmailNo ratings yet

- Movie ListDocument1 pageMovie ListAce MonyoNo ratings yet

- prg111 ExamDocument1 pageprg111 ExamAce MonyoNo ratings yet

- Apply Programming Skills in C LanguageDocument71 pagesApply Programming Skills in C LanguageJeffrey Abadesa Esmundo50% (2)

- Excel Training Guide PDFDocument13 pagesExcel Training Guide PDFMoiz IsmailNo ratings yet

- Patrick ResumeDocument1 pagePatrick ResumeAce MonyoNo ratings yet

- RESUME Danilo Plaganas career objectiveDocument2 pagesRESUME Danilo Plaganas career objectiveAce MonyoNo ratings yet

- Patrick ResumeDocument1 pagePatrick ResumeAce MonyoNo ratings yet

- 20140101-20140527 Gun Gear To GoDocument1 page20140101-20140527 Gun Gear To GoAce MonyoNo ratings yet

- File Systems: 6.1 Files 6.2 Directories 6.3 File System Implementation 6.4 Example File SystemsDocument46 pagesFile Systems: 6.1 Files 6.2 Directories 6.3 File System Implementation 6.4 Example File Systemsmaged abbassNo ratings yet

- Display Author Information in Google Search ResultsDocument6 pagesDisplay Author Information in Google Search ResultsAce MonyoNo ratings yet

- How Java WorksDocument17 pagesHow Java WorksAce MonyoNo ratings yet

- 6 TRB DelayWorkshop HansenDocument26 pages6 TRB DelayWorkshop HansenAce MonyoNo ratings yet

- CSS Part IIDocument26 pagesCSS Part IIAce MonyoNo ratings yet

- TXN Date Value Date Description Ref No./Cheque No. Branch Code Debit Credit BalanceDocument25 pagesTXN Date Value Date Description Ref No./Cheque No. Branch Code Debit Credit Balancenetcity143No ratings yet

- Full Download Intermediate Accounting 2nd Edition Gordon Solutions ManualDocument35 pagesFull Download Intermediate Accounting 2nd Edition Gordon Solutions Manualashero2eford100% (47)

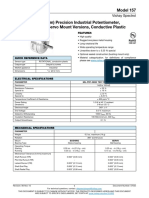

- Model 157: Vishay SpectrolDocument4 pagesModel 157: Vishay SpectrolJulio Vazquez MorenoNo ratings yet

- 17112-Daljeet - Thethi - Abc Assignment No 2Document7 pages17112-Daljeet - Thethi - Abc Assignment No 2Daljeet ThethiNo ratings yet

- PC 16 Works Account - 1Document13 pagesPC 16 Works Account - 1MukeshNo ratings yet

- Oligopoly Strategic BehaviorDocument3 pagesOligopoly Strategic Behaviorswaroop666100% (1)

- Modyul #8Document16 pagesModyul #8Kakeru Llorente DcNo ratings yet

- XBRL Financial Statements Duly Authenticated As Per Section 134 (Including BoardDocument196 pagesXBRL Financial Statements Duly Authenticated As Per Section 134 (Including BoardDSddsNo ratings yet

- PI 012 - R1 L&T INNOVATION CAMPUS dt.17.04.2023Document2 pagesPI 012 - R1 L&T INNOVATION CAMPUS dt.17.04.2023Jayshree RAJU NAIKNo ratings yet

- Organization Assignment List (Ics 203) : Utah COVID-19 Unified Response 4/24/2020 0800 - 4/25/2020 0800Document2 pagesOrganization Assignment List (Ics 203) : Utah COVID-19 Unified Response 4/24/2020 0800 - 4/25/2020 0800Alyssa RobertsNo ratings yet

- Super Health Cntr-Model-01Document1 pageSuper Health Cntr-Model-01Jennylou DingalNo ratings yet

- Challenges facing NGOs in IndiaDocument9 pagesChallenges facing NGOs in IndiaAshutosh PrasharNo ratings yet

- Verify Servant/Tenant DetailsDocument1 pageVerify Servant/Tenant DetailsRavi ShekharNo ratings yet

- Chief Accountant with 8+ years experience seeks new opportunityDocument1 pageChief Accountant with 8+ years experience seeks new opportunityNGỌC NGUYỄNNo ratings yet

- What Is Customer Lifetime Value (CLV) and How Do You Measure It?Document8 pagesWhat Is Customer Lifetime Value (CLV) and How Do You Measure It?darshan jainNo ratings yet

- Diagram 1.1: (Book of Original Entry) Office Equipment XXXX Cash XXXX Accounts Payable XXXXDocument14 pagesDiagram 1.1: (Book of Original Entry) Office Equipment XXXX Cash XXXX Accounts Payable XXXXEfi of the IsleNo ratings yet

- Labsii 202 Bara 2009Document82 pagesLabsii 202 Bara 2009siraj liki100% (5)

- Bank Reconciliation Statements 5: This Chapter Covers..Document18 pagesBank Reconciliation Statements 5: This Chapter Covers..amal joy0% (1)

- Solved Given The Following Nonlinear Curve Answer The Following Questions A atDocument1 pageSolved Given The Following Nonlinear Curve Answer The Following Questions A atM Bilal SaleemNo ratings yet

- Furniture ManufacturerDocument9 pagesFurniture ManufacturerUniversal PrideNo ratings yet

- Durkopp Adler Manuel - 265Document104 pagesDurkopp Adler Manuel - 265Leon SintorresNo ratings yet

- Uts Inggris 3Document2 pagesUts Inggris 3Mukti UtamiNo ratings yet

- Vol 2 SampleDocument20 pagesVol 2 Sampleअहम् ब्रह्मास्मिNo ratings yet

- Apgvb Insurance Consent LetterDocument1 pageApgvb Insurance Consent LetterMahesh PasupuletiNo ratings yet

- Curriculum Vitae: Deepak Kumar MittalDocument3 pagesCurriculum Vitae: Deepak Kumar MittalThe Cultural CommitteeNo ratings yet

- Issue of Shares QuestionsDocument5 pagesIssue of Shares Questionsgson52310No ratings yet

- Strategic Trade Theory and Neoclassical Theory - How The World Sees... Shinkenhuis2017Document19 pagesStrategic Trade Theory and Neoclassical Theory - How The World Sees... Shinkenhuis2017Mohamed AbdisalanNo ratings yet