Professional Documents

Culture Documents

Fiscal Policy

Uploaded by

prabhatrc4235Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fiscal Policy

Uploaded by

prabhatrc4235Copyright:

Available Formats

It means the use of taxation and public expenditure by the govt. for stabilisation or growth.

The word fisc means state treasury and fiscal policy refers to policy concerning the use of state treasury or the govt. finances to achieve the macroeconomic goals.

By fiscal policy we refers to govt. actions affecting its receipts and expenditure which we ordinarily taken as measured by the govt.s receipts, its surplus or deficit. Culberston A policy under which the govt. uses its expenditure and revenue programmes to produce desirable effects and avoid undesirable effects on the national income, production and employment. Arthur Smithies Changes in taxes & expenditures which aim at short run goals of full employment & price level stability. Otto Eckstein

To maintain and achieve full employment To stabilise price level To stabilise growth rate of an economy To maintain equilibrium in the BoP To promote economic development of underdeveloped countries.

Fiscal policy through variations in govt. expenditure and taxation profoundly affects national income, employment, output & prices. An increase in public expenditure during depression adds to the aggregate demand and leads to a large increase in income via the multiplier process; while reduction in taxes has the effect of raising disposable income thereby increasing consumption & investment expenditure of the people. The govt. can control deflationary & inflationary pressures in the economy by a judicious combination of expenditure and taxation programmes.

Compensatory Fiscal Policy: It aims at continuously

compensating the economy against chronic tendencies towards inflation and deflation by manipulating public expenditures and taxes. When there are inflationary tendencies, the govt. should reduce its expenditures by having surplus budget and raising taxes in order to stabilise the economy. On the other hand when there are deflationary tendencies in the economy, the govt. should increase its expenditures through deficit budgeting and reduction in taxes.

Compensatory fiscal policy has two approaches:

Built-in Stabilisers

Discretionary fiscal policy

Built-in Stabilisers It involves the automatic adjustment of the expenditures and taxes in relation to cyclical upswings and downswings within the economy without delicerate action on the part of the govt. This technique is called as automatic stabilisation Various automatic stabilisers are corporate profit tax, income tax, excise taxes, and unemployment insurance and unemployment relief payments.

Merits of Built-in Stabilisers

It serves as cushion for private purchasing power,

when it falls and lessen the hardships on the people during deflationary period. They prevent national income and consumption spending from falling at low level There are automatic budgetary changes in this device and the delay in taking administrative decisions is avoided. Automatic stabilisers minimise the errors of wrong forecasting and timing of fiscal measures They integrate short-run and long run fiscal policy

Limitations of Built-in Stabilisers

The effectiveness depends on the elasticity of tax

receipts, the level of taxes and flexibility of public expenditures. The greater the elasticity of tax receipts, the greater will be the effectiveness in controlling inflationary & deflationary tendencies. With low level of taxes even a high elasticity of tax receipts would not be very significant as an automatic stabiliser doing a down swing. It keeps silence about the stabilising influence of local bodies, state govt. and the pvt. sector economy. They cant eliminate business cycle.

It requires deliberate change in the budget by such actions as changing tax rates or govt. expenditures or both. It may take three forms

Changing taxes with govt. expenditures constant. Changing govt. expenditures with taxes constant. Variations in both expenditures and taxes simultaneously.

The first method is more effective in controlling inflation, the second method is more useful in controlling deflationary tendencies and third is more effective and superior to the other two methods in controlling inflationary and deflationary tendencies.

Limitations of Discretionary Fiscal Policy:

Accurate forecasting is essential to judge the stage of

cycle. There are delays in proper timing of public spending. In fact it is subject to three time lags

Decision lag: time reqd to study the problem and taking the decision Execution lag: it involves expenditure which is to be allocated for the execution of the programme. Certain public work projects are so cumbersome that it is not possible to accelerate or slow them down.

Budgetary policy exercises control over size and relationship of govt. receipts and expenditures. Budget Deficit Fiscal Policy during Depression:

When govt. expenditure exceeds receipts.

C is the consumption function C+I+G represents consumption, investment and Govt. expenditure before budget. Suppose govt. expenditure G is injected to the economy, that will lead to upward shift of total spending function C+I+G1. Income increases from OY to OY1, the new equilibrium position is now E1. Increase in income YY1=EA=E1A is greater than govt expenditure E1B= G. BA represents increase in consumption.

450

Expenditure

C+I+G1 E1 B A C+I+G C

Y1 Income

Budget deficit may also be secured by reduction in taxes and without govt. spending. Reduction in taxes tends to leave larger disposable income and thus stimulates increase in aggregate demand output, income & employment. Suppose tax is reduced by ET, the consumption function will shifts upward to C1. Income will increase from OY to OY1. However, reduction in tax may be saved and not spent on consumption. To safeguard this govt. should reduce tax with increase in govt. expenditures.

450

Consumption

C1 E1 T C

Y1 Income

Occurs when govt. revenues exceeds expenditures. It is followed to control inflationary pressures. It may be through

Increase in taxation Reduction in govt. expenditures Both of the above

There may be budget surplus without govt. spending when taxes are raised. Enhanced taxes reduce the disposable income and encourage reduction in consumption expenditure. The result is fall in aggregate demand, output income and employment.

C is the consumption function before the imposition of the tax. Suppose a tax equal to ET is introduced. The consumption function shifts downward to C1. The new equilibrium position is E1. So income falls from OY to OY1.

450

Consumption

C E T C1

E1

Y1

Y Income

Here, increase in taxes and in govt. expenditure are of an equal amount. This has the impact of increasing net national income. This is because reduction in consumption resulting from the tax is not equal to the govt. expenditure.

C is the consumption function before the imposition of the tax with income OY0. Suppose a tax equal to AG is imposed. The consumption function shifts downward to C1. Now govt. expenditure of GE amount is injected into the economy which is equal to the tax yield AG. The new govt. expenditure line is C1+G which determines OY income at point E. Increase in income Y0Y=tax yield AG = increase in govt. expenditure GE.

450 E Consumption & Govt. Expenditure C1 + G C A G C1

Y0 Income

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Southern Luzon Drug Corporation vs. Department of SocialDocument115 pagesSouthern Luzon Drug Corporation vs. Department of SocialAbombNo ratings yet

- Credit ManagementDocument7 pagesCredit Managementprabhatrc4235100% (1)

- Sample Motion Re House Arrest ApprovalDocument6 pagesSample Motion Re House Arrest ApprovalBen Kanani100% (1)

- Motion To Set For Collusion Hearing SAMPLEDocument4 pagesMotion To Set For Collusion Hearing SAMPLEAnnaliza Garcia Esperanza100% (3)

- Importance of Managerial EconomicsDocument5 pagesImportance of Managerial Economicsprabhatrc4235100% (2)

- Social, Economic, Technological & Competitive ForcesDocument20 pagesSocial, Economic, Technological & Competitive Forcesprabhatrc423533% (3)

- Fundamentals of Marketing Management: by Prabhat Ranjan Choudhury, Sr. Lecturer, B.J.B (A) College, BhubaneswarDocument53 pagesFundamentals of Marketing Management: by Prabhat Ranjan Choudhury, Sr. Lecturer, B.J.B (A) College, Bhubaneswarprabhatrc4235No ratings yet

- RRP NCIP Rules of ProcedureDocument27 pagesRRP NCIP Rules of ProcedurePhoebe HidalgoNo ratings yet

- Antonio Vs RD Makati CityDocument2 pagesAntonio Vs RD Makati CitytynajoydelossantosNo ratings yet

- FranchisingDocument13 pagesFranchisingprabhatrc4235100% (2)

- Presentation On Juvenile DelinquencyDocument17 pagesPresentation On Juvenile DelinquencyAnonymous sSh4Eb3KZONo ratings yet

- In The Court of District & Sessions Judge, Rajkot Bail Application No. 106 of 2019Document4 pagesIn The Court of District & Sessions Judge, Rajkot Bail Application No. 106 of 2019Deep HiraniNo ratings yet

- Caribbean Studies Past QuestionsDocument10 pagesCaribbean Studies Past QuestionsNashae Betton RobertsNo ratings yet

- People Vs RelovaDocument2 pagesPeople Vs Relovaminri721No ratings yet

- Feminism Theory Lesson Plan: I. ObjectivesDocument7 pagesFeminism Theory Lesson Plan: I. ObjectivesKristel100% (1)

- Bhu' M M M C C 2016: Team Code-OdDocument34 pagesBhu' M M M C C 2016: Team Code-Odaryan100% (1)

- PLTDT V City of DavaoDocument2 pagesPLTDT V City of DavaoPablo Jan Marc FilioNo ratings yet

- Merciales v. CA DigestDocument2 pagesMerciales v. CA DigestKaren PanisalesNo ratings yet

- Laws of Production-Law of Variable ProportionDocument15 pagesLaws of Production-Law of Variable Proportionprabhatrc4235No ratings yet

- Role of Managerial EconomistDocument7 pagesRole of Managerial Economistprabhatrc4235No ratings yet

- Retail Franchising: The Word "Franchise" Is of Anglo-French Derivation - From Franc, Meaning FreeDocument17 pagesRetail Franchising: The Word "Franchise" Is of Anglo-French Derivation - From Franc, Meaning Freeprabhatrc4235No ratings yet

- Supply AnalysisDocument12 pagesSupply Analysisprabhatrc4235No ratings yet

- FTA, Customs Union, Common MarketsDocument5 pagesFTA, Customs Union, Common Marketsprabhatrc4235No ratings yet

- Production AnalysisDocument16 pagesProduction Analysisprabhatrc4235No ratings yet

- Wpi & CpiDocument18 pagesWpi & Cpiprabhatrc4235No ratings yet

- Market StructureDocument16 pagesMarket Structureprabhatrc4235No ratings yet

- It Is Designed To Cater To The Needs of The End CustomerDocument9 pagesIt Is Designed To Cater To The Needs of The End Customerprabhatrc4235No ratings yet

- Role of It in SCMDocument11 pagesRole of It in SCMprabhatrc4235No ratings yet

- Challenges & Opportunities For EntrepreneursDocument13 pagesChallenges & Opportunities For Entrepreneursprabhatrc4235No ratings yet

- Void Or: Inexistent ContractsDocument20 pagesVoid Or: Inexistent ContractsRichard LamagnaNo ratings yet

- M10 Krug8283 08 SG C10Document6 pagesM10 Krug8283 08 SG C10Chisei MeadowNo ratings yet

- Montgomery Bus Boycott - Student ExampleDocument6 pagesMontgomery Bus Boycott - Student Exampleapi-452950488No ratings yet

- Machiavelli NotesDocument3 pagesMachiavelli Notessusan_sant_1No ratings yet

- Central University of South Bihar: Max Weber: Three Types of Legitimate RuleDocument9 pagesCentral University of South Bihar: Max Weber: Three Types of Legitimate Rulerahul rajNo ratings yet

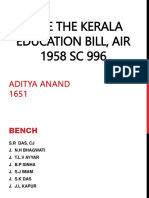

- In Re The Kerala Education Bill, Air 1958 SC 996: Aditya Anand 1651Document11 pagesIn Re The Kerala Education Bill, Air 1958 SC 996: Aditya Anand 1651Aditya AnandNo ratings yet

- Lokayata: Journal of Positive Philosophy, Vol - III, No.01 (March 2013)Document118 pagesLokayata: Journal of Positive Philosophy, Vol - III, No.01 (March 2013)The Positive PhilosopherNo ratings yet

- Juris On - Change of Date (Formal Amendment)Document4 pagesJuris On - Change of Date (Formal Amendment)Leogen TomultoNo ratings yet

- Salient Features of Indian ConstitutionDocument2 pagesSalient Features of Indian ConstitutionSiddharth MohananNo ratings yet

- Illinois V Nationwide Title Consent Decree 12 13Document9 pagesIllinois V Nationwide Title Consent Decree 12 13Wonderland ExplorerNo ratings yet

- Spivak - Righting WrongsDocument59 pagesSpivak - Righting WrongsAtreyee GuptaNo ratings yet

- Near v. MinesotaDocument1 pageNear v. MinesotaMark Genesis RojasNo ratings yet

- Labour Law Relations South African ViewDocument11 pagesLabour Law Relations South African ViewQuizziesZANo ratings yet

- Compassionate Appnt - Not Below Under J.A. - JudgementDocument6 pagesCompassionate Appnt - Not Below Under J.A. - JudgementThowheedh Mahamoodh0% (1)

- ACLU LTR Re LAPD BWV Policy (4-28-2015)Document5 pagesACLU LTR Re LAPD BWV Policy (4-28-2015)Matthew FeeneyNo ratings yet

- Cod BailDocument2 pagesCod Bailcustodial facilityNo ratings yet

- "It May Seem Strange": Strategic Exclusions in Lincoln's Second InauguralDocument21 pages"It May Seem Strange": Strategic Exclusions in Lincoln's Second InauguralScott SmithNo ratings yet