Professional Documents

Culture Documents

Wachovia Securities Databook

Uploaded by

anshulsahibOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Wachovia Securities Databook

Uploaded by

anshulsahibCopyright:

Available Formats

Wachovia Securities Databook

Corporate & Investment Banking Product Expertise

Corporate & Investment Banking Product Expertise

Proactively Delivering Ideas and Capital at Every Stage of a Clients Life Cycle

The chart below and descriptions on the following pages detail some of the core Corporate & Investment Banking products, which allow Wachovia to provide comprehensive solutions to its clients. Private Equity Groups Financial Sponsors Group Growing Companies Corporate Finance

Consistent Corporate & Investment Banking Coverage

Mergers & Acquisitions Sellside and Buyside Advisory Strategic Advisory Takeover Defense Fairness Opinions

Private Equity Principal Investments

Public Equity IPOs and Follow-On Offerings

Debt Products High Yield Investment Grade Loan Syndications Bank Debt Debt Private Placements Asset-Based Lending

Structured Products Derivatives Currency Products Securitization Leasing

Equity Private Placements Agented Transactions Access to Private Equity and Venture Capital Communities

Block Trades Convertibles Research Access to Institutional Investors

Share Repurchase Programs

3 | Wachovia Securities Corporate & Investment Banking

Corporate & Investment Banking Product Expertise

Equity Capital Markets Expertise

Market Position

Research Team of 40 Senior Analysts covering approximately 500 companies in 10 industry sectors Unique research philosophy Franchise approach to coverage vs. II model 60% of stocks with market cap less than $3B 28% of S&P 500 covered Trading Over $250 million in capital for client liquidity 2003 OTC volumes up 68% from 2000 2003 Listed volumes up 180% from 2000 Institutional Sales 50 senior salespeople with an average of 15 years experience U.S. and European coverage of over 600 key institutional investors Extensive IPO, follow-on, and block trade experience with traditional and expedited transactions

Ranked 10th in equity underwriting YTD 2004 Completed 53 deals YTD 2004 raising over $1.5 billion in capital Retail Distribution The Wachovia and Prudential combined retail brokerage organization became effective July 1, 2003 Creates 3rd largest retail brokerage firm in the U.S. with over $537 billion in client assets Over 12,000 registered reps in 48 states and Washington, D.C.

4 | Wachovia Securities Corporate & Investment Banking

Corporate & Investment Banking Product Expertise

Equity Linked Products Expertise

Market Position

Convertible Securities Convertible Origination, Sales & Trading Dedicated Convertible Research capabilities; Leading provider of Convertible Securities Research to Institutional clients Convertible Arbitrage Equity Derivatives Listed Options and Exchange Traded Fund (ETF) Sales & Trading OTC Marketing and Trading Structured Products, Equity Linked CDs and Listed Securities Equity Finance Equity and Fixed Income financing capabilities for Corporate and Institutional clients Total Return Swaps, Variance Swaps, Credit Default Swaps and other customized structures

Convertible Securities Lead and c0-managed 41 offerings LTM 2004, raising $12.7B Ranked 9th in Domestic Equity Linked origination Top ranked trader by Autex Data Services: (1Q) > #3 in Convertible Coupon Bonds > #3 in Convertible Zero-Coupon Bonds > #4 in Mandatory Convertibles > #7 in Convertible Preferreds Equity Derivatives Rapidly growing top 10 provider of listed option and ETF sales, trading and research Leading provider of customized options and structured equity linked products on US single stocks and equity indices to institutional, corporate and private clients Over $5 billion in OTC options transactions in 2003 Over $500 million Market Power CDs issued in 2003 Equity Finance Active Stock Lending book in excess of $7 billion Total Return Swap balances in excess of $3 billion

5 | Wachovia Securities Corporate & Investment Banking

Corporate & Investment Banking Product Expertise

Preferred Stock Expertise

Market Leader in Retail Transactions Top 3 in number of book running leads in 1H 2004 Participation in 2/3 of all 1H deals Longstanding sales relationships with over 600 key institutional investors 3rd Largest Retail Brokerage Firms in the Country Over $569 billion in assets under management and over 11,600 registered representatives Extensive retail distribution with 3,300 offices in 48 states and Washington, D.C. Double-digit market share percentage in half of the Top 50 most affluent markets

Rank 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

1H 2004 Preferred League Table Apportioned Credit to Bookrunning Lead Manager No. of Volume Institution Deals ($ MM) Citigroup 21 $2,364.6 Morgan Stanley 16 2,195.5 Wachovia Securities 14 843.9 Merrill Lynch & Co 12 1,351.8 Lehman Brothers 8 894.8 Bear Stearns & Co Inc 6 421.7 UBS 5 422.1 Friedman Billings Ramsey & Co Inc 4 230.8 AG Edwards & Sons Inc 3 199.5 Goldman Sachs & Co 3 85.0 RBC Capital Markets 3 50.7 Credit Suisse First Boston 2 81.3 ABN Amro Bank NV 1 600.0 Cohen & Steers Capital Advisors LLC 1 118.5 Bank of America 1 35.0

Source: Bloomberg LP

6 | Wachovia Securities Corporate & Investment Banking

Corporate & Investment Banking Product Expertise

Wachovia Capital Partners Expertise

Investment Profile

Principal investing group of Wachovia Corporation Founded in 1988 as First Union Capital Partners Invested $2.5 billion in over 200 companies since inception Responsible for all direct mezzanine and equity investments as well as third party fund investments

Transaction types Leveraged buyouts Recapitalizations Corporate divestitures Acquisition capital Growth capital for established businesses Special situations Flexible role Control/lead investor Co-investor Mezzanine Specific industry groups Business services Energy Financial services Growth industrial Healthcare Media and communications

Significant, flexible capital provider Current portfolio approximately $800 million in 60 companies Targeting $250 to $400 million of capital invested per year ($10 -$50 million per investment) Experienced professionals 20 investment professionals Headquartered in Charlotte with an office in New York City

7 | Wachovia Securities Corporate & Investment Banking

Corporate & Investment Banking Product Expertise

Mergers & Acquisitions Expertise

Over 40 professionals focused on providing a full array of strategic advisory services to Wachovias client base in targeted industry sectors.

Industry-focused M&A bankers aligned with corporate and financial sponsor coverage officers to add value to priority relationships.

Strong M&A franchise with proven track record of superior idea generation, transaction execution, and uncompromising integrity.

Completed over 410 engagements since 1996, involving a broad range of sellside, buyside, hostile takeover, special committee, fairness opinion, and strategic advisory assignments. A leading M&A advisor for transactions $100 million to $1 billion+ in size.

M&A capabilities and deal flow enhanced by resources of one of the largest full-service financial institutions in the United States.

Strong industry expertise through investment banking with coverage efforts across 10 major sectors. Valuable senior level relationships with domestic and international corporate clients.

Deep knowledge of capital markets through leading institutional presence in loan syndications, high yield, and equity origination and trading.

Extensive geographic footprint through commercial banking and retail brokerage network.

8 | Wachovia Securities Corporate & Investment Banking

Corporate & Investment Banking Product Expertise

Corporate Finance Expertise

Aligning our corporate and investment banking teams by industry enables us to provide critical insights and strategic solutions for our clients needs.

Corporate Finance Origination Groups Financial Institutions Healthcare Media & Communications Real Estate Technology Consumer & Retail Defense & Aerospace Energy & Power Industrial Growth IT & Business Services

Public Equity Convertible Securities

Mergers & Acquisitions Private Placements

High Yield Debt

Loan Syndications

Investment Grade Debt Wealth Management

Asset Based Lending Cash Management

Derivatives

Asset Securitization

Capital Management

9 | Wachovia Securities Corporate & Investment Banking

Corporate & Investment Banking Product Expertise

Corporate Finance Expertise (contd)

Consumer & Retail

Sectors of Coverage Food & Beverage Manufacturing & Distribution Home Furnishings & Household Products Restaurants Specialty Retailing Apparel

A market leader in equity underwriting, with over 70 transactions completed in the last 10 years. Leading mergers and acquisitions advisor with over 84 transactions closed since 1996. Over $30 billion of fixed income dollars in the public and private market for our clients since 1995. Over $9 billion in credits commitments to the Consumer Products and Retail sectors. Industry drivers: Continued consolidation, market expansion and cost minimization.

Defense & Aerospace

Sectors of Coverage Defense Aerospace Homeland Security & Defense

Leader in defense industry financing and advisory services. One of the most active mergers and acquisitions advisors for medium-size growing companies, completing over 33 M&A transactions since 1999. Over $1 billion in capital committed to more than 135 defense and aerospace companies worldwide. Leader in cross-border M&A advisory. Industry drivers: Increased defense budgets, turbulent airline environment, shifts in government procurement policies and cost pressures.

10 | Wachovia Securities Corporate & Investment Banking

Corporate & Investment Banking Product Expertise

Corporate Finance Expertise (contd)

Energy & Power

Sectors of Coverage Exploration & Production Oilfield Services Processing & Gathering Transportation & Distribution Integrated Gas & Electric Utilities Retail Propane Distributors

Significant balance sheet support for clients more than $8 billion committed to public and private companies. Raised more than $5.1 billion in proceeds for public clients through 15 common or preferred equity offerings. Demonstrated commitment to the MLP sector by providing more debt capital to MLPs than any other investment bank. Over 35 dedicated industry experts located in Houston, Charlotte, New York and Atlanta. Managing Directors average 20 years of experience. Industry drivers: Volatile commodity prices and a dynamic regulatory environment.

Financial Institutions

Sectors of Coverage Asset Managers Banks & Depository Institutions Insurance

Lead managed deals in equity, converts, high grade debt, and ABS represent a significant percentage of the groups revenues. Significant leverage of Wachovias position as 3rd largest retail brokerage platform. Significant balance sheet support for clients more than $11 billion committed to public and private companies. Dedicated team of over 30 Corporate Finance and M&A professionals. Industry drivers: Consolidation, historically low interest rate environment and heightened regulatory scrutiny.

Specialty Finance

11 | Wachovia Securities Corporate & Investment Banking

Corporate & Investment Banking Product Expertise

Corporate Finance Expertise (contd)

Healthcare

Sectors of Coverage Biotechnology Healthcare Services Medical Technology Specialty Pharmaceuticals

Significant balance sheet support for our clients more than $4 billion committed to public and private healthcare companies. Ranked #3 for number of healthcare domestic lead transactions in 1H 2004. 16 deals in for a total volume of $3.3 billion. Raised more than $2.8 billion in proceeds for clients through 25 common stock offerings, preferred equity offerings and private placements since 1999. More than 30 dedicated industry experts located in Charlotte, New York, Baltimore, Boston and Richmond. Managing Directors average 15 years of experience. Industry drivers: A rapid level of consolidation and growth as a result of government and private sector efforts to decrease cost and increase access.

Industrial Growth

Sectors of Coverage Automotive/Transportation Building materials

Dedicated and experienced team: 34 Corporate Finance and M&A professionals. Demonstrated Expertise. Over $14 billion committed capital to sector. Leading M&A advisor to middle-market Industrial Products companies. Industry drivers: Recognition that companies must expand, modernize or partner with other firms to achieve scale, acquire technological capabilities and develop proprietary, value-added products.

Capital goods

Electrical/Electronics Chemicals Metals and mining Forest products/packaging

12 | Wachovia Securities Corporate & Investment Banking

Corporate & Investment Banking Product Expertise

Corporate Finance Expertise (contd)

IT & Business Services

Sectors of Coverage Business Communications Outsourcing Business Services Electronic Processing HR Outsourcing IT Services & Consulting

Extensive and targeted industry knowledge and relationships. Over 21 bankers dedicated to the sector Managing Directors and Directors average 20 years of experience. Over $5.0 billion of capital committed to IT & Business Services companies. Raised over $6.8 billion in proceeds for clients through 13 equity offerings since 2002 -- a top 3 underwriter in the IT Services & Consulting sector since 1999. Industry drivers: Growth trends should continue as the service industry adopts strategic outsourcing, continues to consolidate and applies/manages new technology.

Media & Communications

Sectors of Coverage TV and Radio Broadcasting Publishing Cable Content & Distribution Diversified Media & Entertainment Wireline and Wireless Communications

Balance Sheet Support Wachovia has more than $5.2 billion committed to public and private companies in this sector. Executed 62 capital markets transactions for 46 clients, raising over $35 billion of capital, in 2003. Wachovia is a leading underwriter of both bank capital and high yield debt in the sector. Over 50 dedicated industry and product experts focused on the sector -Managing Directors average over 12 years of sector banking experience. Industry drivers: Merger and LBO activity in the sector is heating up, and companies are taking advantage of increased access to the capital markets.

13 | Wachovia Securities Corporate & Investment Banking

Corporate & Investment Banking Product Expertise

Corporate Finance Expertise (contd)

Real Estate

Sectors of Coverage Multifamily Office Retail Industrial Net lease/specialty storage Health care Hospitality

Experienced banking team with over $18 billion of advisory transaction experience. Senior bankers have executed approximately $900 million of private placements within the past 24 months. The #3 underwriter of public common equity for REITs in 1H 2004. The #3 underwriter of investment grade debt for REITs in 1H 2004. Significant balance sheet support for real estate clients over 58 corporate lending relationships to REITs and REOCs. Industry drivers: The securitization of real estate has fundamentally changed the way real estate assets and companies are valued and financed.

Technology

Sectors of Coverage Software Equipment Semiconductors

Dedicated technology industry experts located in San Francisco, Baltimore, Charlotte and New York. Executed over 90 technology related public equity offerings in excess of $24 billion since 1999. Arranged more than $1.6 billion in technology-related private placements since 2000 Invested over $250 million directly into technology-related companies since 1999 Industry drivers: Sector consolidation/convergence and evolving technology.

14 | Wachovia Securities Corporate & Investment Banking

Corporate & Investment Banking Product Expertise

Loan Syndications Expertise

Origination / Execution Pitch and structure agented/lead arranged senior debt transactions

Loan Syndications - Domestic Lead Arranger First Half 2004 (by number of deals) Rank 1 2 3 4 5 6 7 7 9 10 11 12 13 14 15 15 17 17 19 20 21 21 23 24 25 26 26 28 29 30 Bank Holding Company Bank of America JP Morgan Wachovia Securities Citigroup BANK ONE Corporation Credit Suisse First Boston PNC Bank Wells Fargo & Company Deutsche Bank ABN AMRO Bank N.V. General Electric Capital Corporation Bank of New York Company Goldman Sachs & Company U.S. Bancorp BNP Paribas SunTrust Bank UBS AG KeyBank National City Corporation Scotia Capital Harris Nesbitt Merrill Lynch & Company Lehman Brothers Antares Capital Corporation Morgan Stanley Barclays Bank Plc Union Bank of California CIBC World Markets Ableco Finance/ Dymas Capital Bear Stearns Companies Number of Deals 470 303 185 170 159 82 73 73 58 52 48 41 35 32 31 31 30 30 29 25 23 23 22 21 19 18 18 16 13 12 Volume $128,301,323,253 196,929,560,717 36,822,191,187 90,070,491,671 32,593,640,514 19,932,693,262 3,602,011,000 10,321,231,672 19,060,967,705 5,673,074,137 4,597,383,431 8,763,120,685 6,957,318,921 3,484,100,000 5,458,700,000 6,303,658,846 4,688,714,000 2,514,090,147 2,428,750,000 5,769,456,686 2,795,906,500 2,406,759,250 3,332,116,514 1,154,250,000 5,984,629,150 8,109,700,000 2,366,500,000 3,073,287,102 705,500,000 1,863,955,000 Market Share 21% 13% 8% 7% 7% 4% 3% 3% 3% 2% 2% 2% 2% 1% 1% 1% 1% 1% 1% 1% 1% 1% 1% 1% 1% 1% 1% 1% 1% 1%

Industry focused underwriting of agented and distribution risk senior debt opportunities from a credit and risk/return perspective

Syndicate / Research Provide market perspective on structure, pricing and syndication strategies to enhance origination efforts Sales & Trading Distribution of all Wachovia-originated facilities

Par loan trading desk: market-maker in lead arranged and broader market transactions

Source: Loan Pricing Corporation - League Tables.

15 | Wachovia Securities Corporate & Investment Banking

Corporate & Investment Banking Product Expertise

High Yield Expertise

Superior Execution

Since 1996: > No lead deals priced outside of price talk > No failed or pulled transactions > #1 aftermarket performance in 2003

High Yield League Table Full Credit to Each Manager - Domestic Deals 1H 2004 No. of Deals 76 71 68 67 61 48 44 41 30 30 26 26 24 23 19 Volume (in millions) $26,282 24,413 21,362 23,690 18,814 15,460 12,215 11,024 8,378 8,210 3,771 7,071 9,048 10,925 6,620

Rank 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

Institution Banc of America JP Morgan CSFB Citigroup Deutsche Bank Lehman Brothers Wachovia Securities UBS Warburg Bear Stearns Merrill Lynch Jefferies Goldman Sachs Scotia Capital Morgan Stanley BNP Paribas

Over $1 billion of capital committed to trading desk Significant momentum Served as lead or co-manager in 20% of deals completed in 2002 and 2003 Book-runner for 12 issuances in the first half of 2004 raising $1.9 billion in proceeds

16 | Wachovia Securities Corporate & Investment Banking

Corporate & Investment Banking Product Expertise

High Grade Debt Expertise

Syndicate and Corporate & Investment Banking Top 10 in Book Running Leads in 1H 2004 Increased lead managed market share by 65% in a market down 35% 25 dedicated Corporate & Investment Banking and syndicate specialists Sales Over 85 institutional salespeople in Charlotte and other regional sales offices 3rd largest retail distribution network with over 11,600 registered representatives in more than 3,300 locations Trading 53 institutional and 38 retail trading professionals $750MM - $1.5 billion in secondary trading inventory Analytics & Research Credit research focused on industry reports and issuer profiles Economic analysts dedicated to covering both domestic and international markets

1H 2004 League Tables All HG Corporates -- Public and 144a Book Runner Full to Book Runner (Equal if Joint) Citigroup JP Morgan Credit Suisse First Boston Merrill Lynch & Co Inc Lehman Brothers Goldman Sachs & Co Morgan Stanley Banc of America Securities LLC Deutsche Bank AG Wachovia Corp UBS Barclays Capital BNP Paribas SA ABN AMRO HSBC Holdings PLC BANK ONE Corp Bear Stearns & Co Inc Keefe Bruyette & Woods Inc RBC Capital Markets KeyCorp/ McDonald Investments Nomura Jefferies & Co Inc Calyon Santander Central Hispano Inv. ING

Source: Thomson Financial.

Proceeds Amount + Overallotment Sold Mkt. Number of This Market (US$ Mil) Rank Share Issues $63,574.2 $44,226.8 $26,327.9 $20,624.4 $26,917.0 $25,264.8 $28,627.7 $16,621.3 $10,699.6 $7,042.7 $12,029.6 $3,923.6 $2,984.8 $4,606.2 $7,113.5 $1,637.9 $1,796.6 $581.0 $511.6 $439.4 $999.7 $276.1 $241.8 $198.4 $198.3 1 2 3 4 5 6 7 8 9 10 10 12 13 14 15 16 17 18 19 20 21 22 23 24 25 20.4 14.2 8.4 6.6 8.6 8.1 9.2 5.3 3.4 2.3 3.9 1.3 1.0 1.5 2.3 .5 .6 .2 .2 .1 .3 .1 .1 .1 .1 266 234 150 96 94 93 80 80 55 43 43 32 29 24 20 14 11 7 4 4 2 2 1 1 1

17 | Wachovia Securities Corporate & Investment Banking

Corporate & Investment Banking Product Expertise

Debt Private Placements Expertise

Origination Ranked 5th in the 2003 league tables for number of issues, raising more than $1.3 billion in proceeds through 19 issues Ranked third in floating rate issuance, serving as lead or co-agent on six transactions Complete integration with public and 144A debt platforms Leading secondary private placement capability, trading more than $2.5 billion in private placements Distribution Over 75 institutional salespeople in Charlotte, New York, and Chicago, maintaining close relationships with over 50 traditional private placement lenders Demonstrated track record in selling to cross over and new entrants to the private placement market

Debt Private Placement Floating Rate League Table Calendar 2003 Rank 1 2 3 4 5 6 7 8 9 10 Agent Bank of America Bank One Wachovia Securities SPP Capital JP Morgan Lehman Citibank Fleet Barclays Merrill $ Volume 982,500 612,500 511,500 200,000 170,000 65,000 50,000 20,000 15,000 10,000 Market % Deals 37.3% 9 23.2% 4 19.4% 6 7.6% 3 6.4% 2 2.5% 1 1.9% 1 0.8% 1 0.6% 1 0.4% 1

Source: Private Placement Monitor.

2003 Traditional Private Placements (Full Credit to Lead, Equal Credit to Joint) Proceeds ($MMs) 9,179.5 7,798.2 3,016.3 2,647.6 3,616.3 1,346.4 2,767.0 2,672.0 2,308.3 2,347.9 1,053.5 787.0 995.0 617.1 45,667.3 Market share % 20.1 17.1 6.6 5.8 7.9 2.9 6.1 5.9 5.1 5.1 2.3 1.7 2.2 1.4

Product Capabilities Senior debt, both secured and unsecured Synthetic leases Credit tenant leases Investment and non-investment grade transactions

Rank Manager 1 Bank of America 2 RBS Securities 3 Banc One 4 JP Morgan T5 Barclays Capital T5 Wachovia Securities T6 Merrill Lynch T6 Deutsche Bank AG T6 Citigroup T7 ABN AMRO T7 SunTrust Bank 8 Lehman 9 HSBC Securities 10 ING Industry Total

Source: Thomson Financial

# Issues 97 31 27 24 19 19 16 16 16 15 15 7 6 2 301

18 | Wachovia Securities Corporate & Investment Banking

Corporate & Investment Banking Product Expertise

Private Portfolio Management

Agency Management Establish Wachovia Securities as a market leader in quality execution for its clients and investors on an ongoing basis Proactively manage the senior debt product for agented/lead arranged transactions > Assist coverage and origination & execution efforts in negotiating and closing new transactions with clients and investors > Interact with clients, investors and Wachovia product specialists to provide timely service and customized solutions > Provide industry focused active portfolio management, both monitoring and identifying risk migration as well as recommending risk mitigation actions, such as re-negotiation, sales, purchasing protection, etc. Provide portfolio reporting to senior management and interact with regulators for Shared National Credit and focused reviews Credit Management Proactively manage the senior debt product to position Corporate Finance for future lead roles with clients and to provide continuous monitoring of portfolio risk including: > Underwriting of strategic participation transactions based on comprehensive internal due diligence > Active portfolio management via monitoring and identifying risk migration as well as recommending risk mitigation actions, such as re-negotiation, sales, purchasing protection, etc. > Required servicing and interaction with regulators for focused reviews > Portfolio reporting

19 | Wachovia Securities Corporate & Investment Banking

Corporate & Investment Banking Product Expertise

Public Portfolio Management (PPM)

Mission - To reduce the earnings volatility of the Strategic Loan Portfolio due to non-systematic risk resulting from industry and company concentrations and by offsetting P&L losses through the generation of mark-to-market gains and the reduction of annual capital costs through industry and company diversification. Additionally, enhance the entire Fixed Income platform through distribution of Credit Portfolio Managements (CPM) proprietary sector and credit views and through generation of value-added investment ideas. Accomplished Through.

Producing proprietary credit research on names within PPMs investment universe including Balancing Portfolio positions and credits, liquid Strategic Portfolio companies, and select industry comparables. Research utilized to establish proprietary internal valuation opinions and support other Fixed Income constituents. Building and actively managing a portfolio of loans, bonds, credit derivatives, and index positions that are in line with the Model Portfolio objectives and which meet, or exceed, defined benchmarks (i.e. P&L, Total Return). Monitoring secondary market trading levels and industry fundamentals in order to identify, evaluate, and recommend transactions to support the Balancing Portfolio as well as the Bond and Relative Value Portfolios. Actively managing the liquid and semi-liquid portions of the Strategic Portfolio and executing hedges based on evolving sector views, expected credit migration, relative value opportunities, and credit capital concentration.

20 | Wachovia Securities Corporate & Investment Banking

Corporate & Investment Banking Product Expertise

Structured Products Expertise

Market Position

Comprehensive asset backed and structured finance capabilities: Underwriting of public and private assetbacked securities New issue and secondary market sales and trading Asset-backed commercial paper (CP) funding Hedging/risk management Synthetic leases, sale lease-back transactions and structured tax products including installments sales and like-kind exchanges Structured Products Services (ranked #1 commercial mortgage backed securities (CMBS) master servicer in 1999, 2001, and 2002) Assets securitized include, among others: Collateralized Debt Obligation funds (CDOs) Commercial loans and leases Commercial real estate Consumer loans and leases Emerging assets/Future flow Mortgages/Home equity loans Small Business Administration (SBA) loans Trade receivables

In 2003, we maintained a strong leadership position within our focus areas in emerging assets: First in small business loan asset-backed securities (ABS) First in middle market commercial loan securitization First in number of CDOs issued First in equipment securitization from 1997-2003 Third in 144A, Ninth in public auto ABS Fourth for CMBS Fourth in domestic real estate investment trust (REIT) arrangement Warehouse transactions are primarily funded in the Variable Funding Capital Corporation conduit facility. As of June 30, 2004 the conduit contained 56 transactions which represented $9.9 billion of commitments and $5.7 billion outstanding

21 | Wachovia Securities Corporate & Investment Banking

Corporate & Investment Banking Product Expertise

Capital Finance

Wachovia Asset Based Lending: Ranked #1 by Volume for 2Q 2004 and #1 by number of deals for 1H 2004 Wachovia Capital Finance Group: > Asset-based lending presence since 1972 > Total commitments in excess of $3.9 billion > Active relationships with over 190 clients nationwide > Staff of 153 professionals > Based out of Atlanta with other main offices in Charlotte and Philadelphia Congress Financial Corporation: > Began more than 50 years ago as a family owned business; owned by CoreStates for 30 years and integrated into Asset Based Lending in 1988 > Staff of 375 employees > Total commitments of $16 billion and approximately 500 clients > Based out of New York, with offices throughout the U.S., Canada, and the UK

Leasing:

3rd largest bank owned leasing company in U.S. 8th largest leasing company in U.S. $14 billion in lease receivables Projected to complete more than $2.5 billion in equipment cost by FYE 2004 Awarded Deal of the Year by Asset Finance International: 1997, 1999, 2000, 2001 & 2002

Asset Backed Conduit Program: As of March 15, 2004, ranked 4th in Trade Receivable Commitments 3rd in net Trade Receivable Transactions for the period February 15, 2000 to March 15, 2004 Lead or Sole Agent on Eighty-two percent of transactions Transactions are primarily funded in the Blue Ridge conduit facility. As of June 30, 2004 the conduit contained 52 transactions which represented $6.9 billion of commitments and $3.7 billion outstanding

22 | Wachovia Securities Corporate & Investment Banking

Corporate & Investment Banking Product Expertise

Global Rates - Interest Rate Products Expertise

Leading Capabilities

A dedicated group of over 140 professionals, consisting of Corporate Derivative Marketing, Institutional Sales and Trading, and Municipal Products Each team of specialists assists our customers in meeting needs including hedging strategies, information, and overall liquidity in the interest rate markets As one of the major market makers across Wall Street, products available to our clients through the Interest Rate Products group include derivatives such as swaps and options on various interest rate securities, as well as cash products such as Treasuries and mortgage backed securities Wachovia is currently one of the largest derivative providers in the U.S. and continues to grow this business at a rapid pace

Highly qualified team with years of experience in the interest rate markets Focus on tailored strategies designed to meet individual client needs Strong reputation for providing unparalleled structuring and consulting on taxable and taxexempt interest rate risk Employ industry-focused client coverage to provide unique and valuable insights into market information and flows Leading provider of liquidity and aggressive pricing to clients across all products and markets

As of 31 December 2003

23 | Wachovia Securities Corporate & Investment Banking

Corporate & Investment Banking Product Expertise

Global Rates - Non-Dollar Products Expertise

Offers a full range of products and services designed to help companies and investors move money across borders seamlessly and manage the risks of investing or transacting in a foreign currency 24 hours a day Seasoned team of more than 50 professionals in Charlotte, New York, and London, combines expertise in currency and fixed income markets, derivative products, and financial instrument accounting Serving over 6,000 customers worldwide including corporations, institutions, and individuals

Global Rates Commodity Derivatives Expertise

An experienced team of Marketers and Traders with prestigious backgrounds in the Energy markets simultaneously bring market share and the highest level of quantitative and analytical ability Wachovias deep Energy and Power client base creates an uncommon ability for Wachovia to interact with both producers and consumers to provide very competitive pricing The most recent addition to Global Rates, the commodity derivatives business brings a profitable market and even greater depth to Wachovias already vast array of product capabilities

As of 30 June 2004

24 | Wachovia Securities Corporate & Investment Banking

Corporate & Investment Banking Product Expertise

International Expertise

Wachovia is a a major player in the world of international banking, providing a full range of services to financial institutions, corporations and government entities around the world

A Global Leader

1st in third party trade processing 1st in SWIFT-based message type 700 (trade) series 3rd in Eximbank insurance program usage 4th in U.S. trade volume (letters of credit) 7th in CHIPS payment traffic

32 representative offices throughout Europe, Asia and Latin America 6 international processing centers in New York, Philadelphia, Charlotte, Winston Salem, Miami and Los Angeles 5 Branches in Hong Kong, Tokyo, Taipei, Seoul and London Foreign exchange desks in London and Charlotte 7,000+ relationships in more than 130 countries, served by a team of over 1,000 professionals

A Pioneer in Global Banking

First to develop international cash letter First to develop export bills collection product First to enable companies to perform letter of credit transactions on the Internet Founding participant of CHIPS and SWIFT

25 | Wachovia Securities Corporate & Investment Banking

Corporate & Investment Banking Product Expertise

Treasury Services Expertise

Size & Strength 2nd largest U.S. cash management bank 9 of 10 key products rank in the top three Nationally acclaimed for responsive customer service and operational excellence Product Depth 24/7 access via multiple channels, including Web, wireless and PC E-commerce, image technology Single account for interstate deposit and transaction activity Industry Specialization Officers focus on specific industries: Retail, Healthcare, Communications, Real Estate, Insurance and Government Industry-specific Advisory Boards Value-added expertise to address unique business challenges

A History of Innovation Controlled Disbursement (72) Image-based processing for wholesale lockbox (78) Customer Advisory Boards (92) Fraud Management Reporting (93) Web-based Reporting (96) Awarded Patent for Image Technology (99) E-Billing (99) Wireless Treasury Services (00)

26 | Wachovia Securities Corporate & Investment Banking

Analyst Career Opportunities

Analyst Career Opportunities

Analyst Career Opportunities

Wachovia Securities is looking to hire over 140 analysts for the class of 2005 to work across a range of analyst positions, below are the positions posted on your campus:

Investment Banking: The Investment Banking Analyst and the Fixed Income Origination Analyst are the primary analytical support for Corporate and Investment Banking origination in a coverage group. Analysts may also work in a product group, supporting underwriting, deal execution and transaction management, ongoing portfolio surveillance and risk management activities. Groups hiring under this posting will include Corporate Finance, Mergers&Acquisitions/Financial Sponsors, Leveraged Finance, Investment Grade Debt, and Structured Products. Sales & Trading: Analysts working in Sales and Trading will interact closely with salespeople and traders dealing with both domestic and international clients and markets. Groups hiring under this posting will include Global Rates. Portfolio Management & Research: Portfolio Management units support Wachovias origination efforts by interacting directly with clients and coverage officers, communicating company and industry expertise, and performing client underwriting functions on agented and non-agented loan transactions. Groups hiring under this posting will include Public Portfolio Management and Private Portfolio Management.

28 | Wachovia Securities Corporate & Investment Banking

Analyst Career Opportunities

Investment Banking Corporate Finance

Group Overview

The Corporate Finance Group is the primary origination arm of Wachovia Securities, working closely with all product groups to originate and execute various investment banking products, including equity, high yield, M&A, leveraged finance, convertible debt, etc.

Bankers within Corporate Finance are assigned to a specific industry group and maintain active dialog with their priority clients in those sectors.

Perform valuation and credit analysis through leveraged buyout, discounted cash flow, merger, comparable public company and comparable transaction models. Create and edit pitchbooks used in the origination of investment banking transactions. Participate in due diligence, drafting sessions and preparing offering memoranda and management presentations primarily for equity, high yield and M&A transactions.

Analyst Responsibilities

29 | Wachovia Securities Corporate & Investment Banking

Analyst Career Opportunities

Investment Banking Mergers & Acquisitions/Financial Sponsors

Group Overview

The M&A/Financial Sponsors Group is responsible for transaction execution of buyside, sellside, and advisory assignments in a variety of industries, as well as relationship management for key financial sponsor clients.

>

Senior bankers within M&A are aligned with Corporate Finance industry groups and are responsible for maintaining an active M&A dialogue with clients in their respective sectors.

Analysts in M&A are generalists and work on transactions in a broad range of industries.

>

Analyst Responsibilities

Creation of detailed financial models used for valuation (DCF, LBO, merger plans, accretion/dilution, comparable company, and comparable transaction analyses). Research and preparation of industry analyses, buyers lists, and acquisition opportunities. Preparation of marketing documents, including pitch materials, confidential offering memoranda, management presentations, fairness opinions, and board presentations. Support of the relationship management efforts of Financial Sponsors Group coverage officers through the development of value-added ideas, preparation of marketing presentations, and execution of M&A and financing opportunities.

30 | Wachovia Securities Corporate & Investment Banking

Analyst Career Opportunities

Fixed Income Credit Products Leveraged Finance and Investment Grade Debt

Group Overview

Credit Products includes leveraged finance, investment grade, portfolio management and special situations groups. The groups specialize in the origination, sales and trading of various products including corporate and high yield bonds, syndicated loans, municipal and money market securities.

The Leveraged Finance Group is responsible for structuring, underwriting and syndicating the senior and high yield debt products for clients in all industry groups and for clients who do not maintain an investment grade credit rating.

The Investment Grade Debt Group is responsible for structuring, underwriting and syndicating bonds, bank debt and preferred stock for investment grade-rated clients. Perform valuation and credit analysis through leveraged buyout, discounted cash flow, and merger models. Assist in the creation of pitches, proposals, and marketing materials as well as offering memoranda, lender, rating agency and roadshow materials for debt offerings. Research comparable transactions and perform relative value analysis to determine pricing for loans and securities.

Analyst Responsibilities

Participate in client meetings, due diligence visits and other client interactions.

31 | Wachovia Securities Corporate & Investment Banking

Analyst Career Opportunities

Fixed Income Credit Products Private Portfolio Management

Group Overview

The Credit Products Private Portfolio Management teams have responsibility for the borrowing/credit relationships of the corporate banking clients. The Credit Products Private Portfolio Management team includes the Agency Management and Credit Management units.

In their role, the Private Portfolio Management units interact directly with these clients, monitor the changing risk trends of individual client relationships, routinely assess the evolving mix of loans in the portfolio, and actively manage the diversity and return of the assets held in the portfolio.

Perform valuation and credit analysis through leveraged buyout, discounted cash flow, and merger models. Research comparable transactions and perform relative value analysis to determine pricing for securities. Protect balance sheet and quality of assets via monitoring of loan book for risk migration and recommending risk mitigating actions, such as re-negotiation, sales, purchasing credit default swaps, etc. Collaborate with corporate finance and other units to help identify value-added customized solutions for existing clients. Participate in client meetings, due diligence visits and other client interactions. Prepare primary assessments of and recommendations on client borrowing requests.

Analyst Responsibilities

32 | Wachovia Securities Corporate & Investment Banking

Analyst Career Opportunities

Fixed Income Credit Products Public Portfolio Management

Group Overview

The Public Portfolio Management group is tasked with reducing the earnings volatility of the Strategic Loan Portfolio and enhancing the entire Fixed Income platform through dissemination of Credit Portfolio Managements (CPM) proprietary sector and credit views and through the generation of value-added investment ideas.

>

Industry Analysts are aligned by industry groups and are responsible for reshaping the Strategic Portfolio through reducing company and industry concentrations and generating mark-to-market gains and net interest/premium income to offset losses in the Strategic Portfolio. Industry Analysts are also responsible for developing, publishing, and sharing company and sector credit views with other FID groups. Analysts will provide analytical support to Industry Analysts and Team Leaders across multiple industries assisting in the generation of buy-side research and portfolio trade ideas.

>

Analyst Responsibilities

Assist in providing industry and company specific fundamental and valuation analysis within assigned sectors including developing an understanding of and monitoring industry drivers and characteristics. Assist in maintaining proprietary databases including the monitoring of trading levels on bonds, credit derivatives, and loans and industry and company-specific credit curves. Facilitate reporting requirements of the group and assist with special projects.

33 | Wachovia Securities Corporate & Investment Banking

Analyst Career Opportunities

Fixed Income Structured Products

Group Overview

Structured Products is a group of over 600 professionals engaged in origination, asset management, sales and trading of structured products in business units that specialize in commercial mortgage backed securities, residential mortgage and consumer ABS, commercial ABS, and CDOs. Across various Structured Products groups, Analysts will have the opportunity to participate in various stages of a transaction origination, execution, and ongoing deal and portfolio management for both public and private bond issuances and also for transactions structured for the groups owned portfolio. Groups hiring within Structured Products include Real Estate Capital Markets (RECM), Structured Asset Finance (SAF), Residential Mortgage and Consumer ABS, and Structured Credit Products (SCP). Assist in underwriting, deal execution, and portfolio management activities. Participate in client meetings, due diligence and other client interactions. Perform analysis of various ABS assets. Assist in the creation of pitches, proposals, and marketing materials as well as sales materials and transaction documentation. Gain understanding of fixed income markets and interact with sales, trading and research professionals.

Analyst Responsibilities

Analysts will have the opportunity to acquire Series 7 and Series 63 licenses.

34 | Wachovia Securities Corporate & Investment Banking

Analyst Career Opportunities

Fixed Income Global Rates

Group Overview Interest Rate Products: > Specialized marketing teams focus on meeting the needs of institutional, corporate, commercial, and municipal clients with experienced professionals in each of these unique disciplines. > Traders devise and implement relative value strategies that are responsive to changing market conditions, and provide consistent and aggressive pricing to our customers. Non-Dollar Products: > Takes consultative approach to solve the global risk management needs of clients including global debt strategy, foreign interest rate management, and currency hedging. > Provide liquidity and counsel related to all currencies and economies across the globe. Commodity Derivatives: > Marketers address the needs of all clients exposed to Commodity price volatility by analyzing and understanding the impact of changing geopolitical and macro economic conditions, and provide innovative and responsive risk management solutions. > Traders utilize sophisticated quantitative techniques to manage uniquely volatile Commodity environment, and deliver consistently well priced derivative products to our clients. Analyst Responsibilities

Support marketers and traders by: > Structuring and executing client transactions. > Preparing marketing materials including pitch books, analytical graphs, and capital structure analyses. > Coordinating with Relationship Managers and Credit Officers to facilitate the closing of transactions. > Providing market data and pricing indications on a daily basis to clients. > Analyzing market conditions and data to provide clients with accurate information and trade ideas.

35 | Wachovia Securities Corporate & Investment Banking

Analyst Career Opportunities

After The Analyst Program

Following the conclusion of the program, analysts have pursued a variety of career options, including corporate clients and the following representative private equity firms and graduate schools:

Private Equity Groups Advent International Apollo Management Bruckman, Rosser, Sherrill Carousel Capital Centre Partners Management Code Hennessy & Simmons Cornerstone Equity Investors Evercore Partners GTCR Golder Rauner JP Morgan Partners J.H. Whitney Quad-C Olympus Partners Saunders Karp & Megrue Thayer Capital Partners The Blackstone Group The Carlyle Group Thomas Weisel Capital Partners Wachovia Capital Partners William Blair Capital Partners Graduate Schools Dartmouth College - Tuck Duke University - Fuqua Harvard Business School Harvard Law School Northwestern University - Kellogg Stanford Graduate School of Business University of Chicago Graduate School of Business University of North Carolina - Kenan Flagler University of Pennsylvania - Wharton Yale Law School University of Virginia - Darden

In addition, certain Wachovia business units offer longer-term positions with potential opportunities for promotion and assumption of additional roles and responsibilities.

36 | Wachovia Securities Corporate & Investment Banking

Why Wachovia Securities?

Why Wachovia Securities?

The Analyst Experience

Wall Street experience. Small deal teams result in immediate responsibility. Allows for direct access to senior bankers. Allows for direct and frequent client interaction. Allows analysts to take on immediate and significant responsibility. Middle market client base provides more interaction with senior-level decision makers. Comprehensive financial services platform provides variety of career opportunities in multiple locations. Senior bankers actively support efforts to develop career opportunities at conclusion of analyst program. Intensive training program.

38 | Wachovia Securities Corporate & Investment Banking

Why Wachovia Securities?

What This Means For You

The Analyst Program will expose you to a broad range of responsibilities, a diverse mix of financial products, and an excellent opportunity to increase the depth of your understanding of the financial markets. As an Analyst, you will be conducting research, participating in strategic planning, assisting in the execution of advisory services, participating in debt finance structuring and monitoring, attending client meetings/due diligence visits and gaining exposure to key executives and senior bankers. You will work as part of a team with others, including very accessible senior level bankers. These positions require a high level of personal motivation, strong interpersonal communication skills and sound analytical thinking. As an Analyst at Wachovia, you will be able to take on a high level of responsibility and will be able to have a great deal of access to the client and will be highly involved in your transactions. Candidates must be comfortable working independently and as part of a team, have proven academic performance and be willing to take on significant responsibility for meeting stringent deadlines and high quality standards. All Analysts participate in a comprehensive six-week training program before beginning work in their business units. The majority of Analyst positions are located in Charlotte, NC, with limited opportunities in Atlanta, Baltimore, Houston, Los Angeles, New York, Philadelphia, Richmond and San Francisco.

39 | Wachovia Securities Corporate & Investment Banking

Recruiting Process

Recruiting Process

ON CAMPUS INTERVIEWS

SELECTION OF FINAL CANDIDATES

SUPER SATURDAY

Charlotte, North Carolina Friday: Saturday: Follow-up: Presentation & Dinner Series of 6 or 8 interviews with a debrief at the end Extension of final offers

41 | Wachovia Securities Corporate & Investment Banking

Recruiting Process Investment Banking

Investment Banking On Campus Interview

Corporate Finance/M&A Super Saturday

Possible Placement in: Corporate Finance Industry Groups: Healthcare IT & Business Services Media & Communications Real Estate Defense & Aerospace International Consumer & Retail Financial Institutions Strategic Advisory Energy & Power Industrial Growth Technology & Mergers & Acquisitions/Financial Sponsors Group

Origination Super Saturday

Possible Placement in: Real Estate Corporate Finance Structured Credit Products Structured Asset Finance Residential Mortgage & Consumer Leveraged Finance Public Finance Syndicate

42 | Wachovia Securities Corporate & Investment Banking

Recruiting Process Sales & Trading

Sales & Trading On Campus Interview

Sales & Trading Super Saturday Possible Placement in: Corporate Derivatives

Non Dollar Products Institutional Rates Municipal Derivatives Energy High Yield Sales & Trading Public Portfolio Management

Debt Capital Markets Credit Default Swaps Trading Sales Emerging Markets Trading Swing Factor

43 | Wachovia Securities Corporate & Investment Banking

Recruiting Process Portfolio Management & Research

Portfolio Management & Research On Campus Interview

Portfolio Management Super Saturday

Possible Placement in: Public Portfolio Management Agency Management Credit Management Research

44 | Wachovia Securities Corporate & Investment Banking

You might also like

- PrinciplesofFinance WEBDocument643 pagesPrinciplesofFinance WEBGLADYS JAMES100% (2)

- Lehman Brothers Private Equity Partners Investor Presentation13Mar2009Document40 pagesLehman Brothers Private Equity Partners Investor Presentation13Mar2009SiddhantNo ratings yet

- How I Trade With Only The 2-Period RSIDocument5 pagesHow I Trade With Only The 2-Period RSImhudzz50% (2)

- UBS M&A PitchbookDocument19 pagesUBS M&A Pitchbookspuiszis100% (2)

- Goldman Sachs Presentation To Credit Suisse Financial Services ConferenceDocument10 pagesGoldman Sachs Presentation To Credit Suisse Financial Services ConferenceGravity The NewtonsNo ratings yet

- Investment Banking - SMG 211Document32 pagesInvestment Banking - SMG 211Hesham Abd-AlrahmanNo ratings yet

- Ecm & DCMDocument114 pagesEcm & DCMYuqingNo ratings yet

- High Yield Bond Basics USDocument4 pagesHigh Yield Bond Basics USJDNo ratings yet

- RBC Nov 2013Document90 pagesRBC Nov 2013theredcornerNo ratings yet

- 107 16 BIWS Financial Statements ValuationDocument50 pages107 16 BIWS Financial Statements ValuationFarhan ShafiqueNo ratings yet

- Carrying Out Due Diligence On Private Equity FundsDocument5 pagesCarrying Out Due Diligence On Private Equity FundsHariharan Sivaramakrishnan100% (1)

- Devos FinancialDocument80 pagesDevos FinancialThe Washington PostNo ratings yet

- Chapter 11 Leveraged Buyout Structures and ValuationDocument27 pagesChapter 11 Leveraged Buyout Structures and ValuationanubhavhinduNo ratings yet

- Lecture 16: Overview of Private Equity: FNCE 751Document50 pagesLecture 16: Overview of Private Equity: FNCE 751jkkkkkkkkkretretretrNo ratings yet

- Avid Cost of Venture Debt With Warrants and Net Interest TemplateDocument13 pagesAvid Cost of Venture Debt With Warrants and Net Interest TemplateSeemaNo ratings yet

- Buyouts: Success for Owners, Management, PEGs, ESOPs and Mergers and AcquisitionsFrom EverandBuyouts: Success for Owners, Management, PEGs, ESOPs and Mergers and AcquisitionsNo ratings yet

- Debt For Equity SwapsDocument7 pagesDebt For Equity SwapsSergiu HaritonNo ratings yet

- UBS Technology M&A: Discussion of Current Industry TrendsDocument19 pagesUBS Technology M&A: Discussion of Current Industry TrendsEmanuil SirakovNo ratings yet

- Global Oil & Gas Primer - Credit Suisse First Boston (2002)Document156 pagesGlobal Oil & Gas Primer - Credit Suisse First Boston (2002)JcoveNo ratings yet

- TTS - LBO PrimerDocument5 pagesTTS - LBO PrimerKrystleNo ratings yet

- Investor PresDocument24 pagesInvestor PresHungreo411No ratings yet

- Valuation & Case AnalysisDocument38 pagesValuation & Case AnalysisShaheen RahmanNo ratings yet

- How To Create Investment Banking Pitch BooksDocument7 pagesHow To Create Investment Banking Pitch BooksRaviShankarDuggiralaNo ratings yet

- Private Equity, LBO & Hedge Funds (Bocconi University)Document14 pagesPrivate Equity, LBO & Hedge Funds (Bocconi University)ah02618No ratings yet

- IBIG 03 03 Your Own DealsDocument17 pagesIBIG 03 03 Your Own DealsіфвпаіNo ratings yet

- Piper Jaffray - US LBO MarketDocument40 pagesPiper Jaffray - US LBO MarketYoon kookNo ratings yet

- Mergers and Acquisitions - A Beginner's GuideDocument8 pagesMergers and Acquisitions - A Beginner's GuideFforward1605No ratings yet

- LBO TutorialDocument8 pagesLBO Tutorialissam chleuhNo ratings yet

- Investing in the High Yield Municipal Market: How to Profit from the Current Municipal Credit Crisis and Earn Attractive Tax-Exempt Interest IncomeFrom EverandInvesting in the High Yield Municipal Market: How to Profit from the Current Municipal Credit Crisis and Earn Attractive Tax-Exempt Interest IncomeNo ratings yet

- PitchBook SampleDocument8 pagesPitchBook SampleMopis100% (1)

- Framing Global DealsDocument35 pagesFraming Global DealsLeonel KongaNo ratings yet

- The Financial Advisor M&A Guidebook: Best Practices, Tools, and Resources for Technology Integration and BeyondFrom EverandThe Financial Advisor M&A Guidebook: Best Practices, Tools, and Resources for Technology Integration and BeyondNo ratings yet

- LevLoan PrimerDocument45 pagesLevLoan PrimerLesterNo ratings yet

- Excel Shortcuts For ValuationDocument13 pagesExcel Shortcuts For ValuationsmithNo ratings yet

- Role of The Sell SideDocument8 pagesRole of The Sell SideHoward AndersonNo ratings yet

- Banker BlueprintDocument58 pagesBanker BlueprintGeorge TheocharisNo ratings yet

- Investment Banking Interview Questions and Overview 2Document9 pagesInvestment Banking Interview Questions and Overview 2Rohan SaxenaNo ratings yet

- Aladdin Synthetic CDO II, Offering MemorandumDocument216 pagesAladdin Synthetic CDO II, Offering Memorandumthe_akinitiNo ratings yet

- Discussion Materials, Dated May 20, 2010, of Goldman SachsDocument29 pagesDiscussion Materials, Dated May 20, 2010, of Goldman Sachsmayorlad100% (1)

- M&a PpaDocument41 pagesM&a PpaAnna LinNo ratings yet

- Behind the Curve: An Analysis of the Investment Behavior of Private Equity FundsFrom EverandBehind the Curve: An Analysis of the Investment Behavior of Private Equity FundsNo ratings yet

- 50 AAPL Buyside PitchbookDocument22 pages50 AAPL Buyside PitchbookZefi KtsiNo ratings yet

- Venture Debt Presentation 022609Document17 pagesVenture Debt Presentation 022609ttunguzNo ratings yet

- Distressed Investing Man 08Document25 pagesDistressed Investing Man 08Alexandre DeneuvilleNo ratings yet

- Company Analysis and ValuationDocument13 pagesCompany Analysis and ValuationAsif Abdullah KhanNo ratings yet

- The Handbook for Investment Committee Members: How to Make Prudent Investments for Your OrganizationFrom EverandThe Handbook for Investment Committee Members: How to Make Prudent Investments for Your OrganizationNo ratings yet

- Investment Policy Statement ExampleDocument12 pagesInvestment Policy Statement ExampleCheeseong LimNo ratings yet

- Lazard - Analyst Recruitment Process For WebsiteDocument3 pagesLazard - Analyst Recruitment Process For WebsiteAndor JákobNo ratings yet

- How To Set Up A KPI Dashboard For Your Pre-Seed and Seed Stage Startup - Alex IskoldDocument12 pagesHow To Set Up A KPI Dashboard For Your Pre-Seed and Seed Stage Startup - Alex IskoldLindsey SantosNo ratings yet

- SP-Distressed Company ValuationDocument18 pagesSP-Distressed Company ValuationfreahoooNo ratings yet

- MoelisDocument24 pagesMoelisBakshi V100% (1)

- The Rise of The Leveraged LoanDocument7 pagesThe Rise of The Leveraged LoanTanit PaochindaNo ratings yet

- Venture Debt QsDocument1 pageVenture Debt QsLenny LiNo ratings yet

- Black Derman Toy ModelDocument4 pagesBlack Derman Toy ModelLore-Anne A. CadsawanNo ratings yet

- Annual Report GMDocument290 pagesAnnual Report GMclemynceNo ratings yet

- Financial AccountingDocument471 pagesFinancial AccountingJasiz Philipe Ombugu80% (10)

- Active Alpha: A Portfolio Approach to Selecting and Managing Alternative InvestmentsFrom EverandActive Alpha: A Portfolio Approach to Selecting and Managing Alternative InvestmentsNo ratings yet

- m339d Lecture Fourteen Binomial Option Pricing One Period PDFDocument9 pagesm339d Lecture Fourteen Binomial Option Pricing One Period PDFPriyanka ChampatiNo ratings yet

- A Study On Investor Perception Towards Mutual FundsDocument68 pagesA Study On Investor Perception Towards Mutual FundsTom Salunkhe0% (1)

- VFC Meeting 8.31 Discussion Materials PDFDocument31 pagesVFC Meeting 8.31 Discussion Materials PDFhadhdhagshNo ratings yet

- Kevin Buyn - Denali Investors Columbia Business School 2009Document36 pagesKevin Buyn - Denali Investors Columbia Business School 2009g4nz0No ratings yet

- Conseco: Restructuring An Insurance Giant With A Subprime Lending ArmDocument28 pagesConseco: Restructuring An Insurance Giant With A Subprime Lending ArmSarah WooNo ratings yet

- Wealth & Asset ManagementDocument17 pagesWealth & Asset ManagementVishnuSimmhaAgnisagarNo ratings yet

- Ibig 04 08Document45 pagesIbig 04 08Russell KimNo ratings yet

- Precedent Transaction AnalysisDocument6 pagesPrecedent Transaction AnalysisJack JacintoNo ratings yet

- Elevator Pitch DraftDocument2 pagesElevator Pitch DraftJack JacintoNo ratings yet

- Vault-Finance Practice GuideDocument126 pagesVault-Finance Practice Guidesarthak.ladNo ratings yet

- Private Equity Unchained: Strategy Insights for the Institutional InvestorFrom EverandPrivate Equity Unchained: Strategy Insights for the Institutional InvestorNo ratings yet

- The 64 Trillion Dollar Question Convergence in Asset ManagementDocument7 pagesThe 64 Trillion Dollar Question Convergence in Asset ManagementanshulsahibNo ratings yet

- Good Medical Practice - English 0914Document36 pagesGood Medical Practice - English 0914Mina RaghebNo ratings yet

- APPG Women in Parliament Report 2014Document48 pagesAPPG Women in Parliament Report 2014anshulsahibNo ratings yet

- Cost Lisbon Treaty British Business RDocument20 pagesCost Lisbon Treaty British Business RanshulsahibNo ratings yet

- Health and Social Care Bill MythsDocument6 pagesHealth and Social Care Bill MythsanshulsahibNo ratings yet

- Bipolar Disorder (Nice)Document5 pagesBipolar Disorder (Nice)anshulsahibNo ratings yet

- Seminar Paper On KIIFBDocument4 pagesSeminar Paper On KIIFBAthiraNo ratings yet

- #22 Revaluation & Impairment (Notes For 6206)Document5 pages#22 Revaluation & Impairment (Notes For 6206)Claudine DuhapaNo ratings yet

- Special Laws in Transporation (B) : Atty. Vivencio F. Abaño - 8Document2 pagesSpecial Laws in Transporation (B) : Atty. Vivencio F. Abaño - 8PiaTinioNo ratings yet

- Tybaf Black Book TopicDocument7 pagesTybaf Black Book Topicmahekpurohit1800No ratings yet

- ECO466 FIN521 Final SolutionDocument8 pagesECO466 FIN521 Final SolutionjonNo ratings yet

- About DubaiDocument27 pagesAbout DubaiUdit DattaNo ratings yet

- AshlarDocument21 pagesAshlarTarun BamolaNo ratings yet

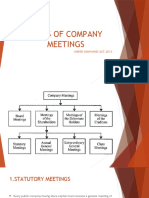

- Company Meetings NavinDocument12 pagesCompany Meetings NavinNavin SureshNo ratings yet

- Financial Management For Decision Makers Canadian 2nd Edition Atrill Solutions ManualDocument35 pagesFinancial Management For Decision Makers Canadian 2nd Edition Atrill Solutions Manualalmiraelysia3n4y8100% (26)

- Transfer of Property Act Notes 1Document17 pagesTransfer of Property Act Notes 1arunaNo ratings yet

- VA23 OutputDocument2 pagesVA23 Outputtushar2001No ratings yet

- Hand-Out 4 - ABC and Support Cost AllocationDocument2 pagesHand-Out 4 - ABC and Support Cost AllocationJerric CristobalNo ratings yet

- Solution Manual For Financial Reporting, Financial Statement Analysis and Valuation, 9th Edition, James M. Wahlen, Stephen P. Baginski Mark BradshawDocument42 pagesSolution Manual For Financial Reporting, Financial Statement Analysis and Valuation, 9th Edition, James M. Wahlen, Stephen P. Baginski Mark Bradshawbrandonfowler12031998mgj100% (43)

- Classifying Investment: According To Its Type, Features, Advantage and DisadvantageDocument14 pagesClassifying Investment: According To Its Type, Features, Advantage and DisadvantageOlivia VallejoNo ratings yet

- Gitman 4e Ch. 2 SPR - SolDocument8 pagesGitman 4e Ch. 2 SPR - SolDaniel Joseph SitoyNo ratings yet

- Euler and Milstein DiscretizationDocument8 pagesEuler and Milstein Discretizationmeko1986100% (1)

- Chapter 10 - Connect PlusDocument18 pagesChapter 10 - Connect Plushampi67% (3)

- United States Court of Appeals, First CircuitDocument11 pagesUnited States Court of Appeals, First CircuitScribd Government DocsNo ratings yet

- FRA Auditors' ReportDocument16 pagesFRA Auditors' ReportRafiullah MangalNo ratings yet

- JPM US Market Intelligence Morning Briefing Futs HigherDocument25 pagesJPM US Market Intelligence Morning Briefing Futs HigherLuanNo ratings yet

- FINC600 Homework Template Week 3 Jan2013Document16 pagesFINC600 Homework Template Week 3 Jan2013joeNo ratings yet