Professional Documents

Culture Documents

Union Budget 2013-14

Uploaded by

Ashima AggarwalCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Union Budget 2013-14

Uploaded by

Ashima AggarwalCopyright:

Available Formats

Union Budget 2013-14: A Recipe for Economic Recovery?

State of the Economy Not a rosy scenario

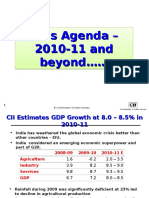

Key Indicators GDP Growth Rate (%) Savings Rate (as % GDP)* Industrial Growth (IIP %) Inflation (Overall) (%) Inflation (Food articles) (%) Inflation (Food products) (%) Fiscal Deficit (as % GDP) Current Account Balance/GDP(%)** 2010-11 9.3 34 8.2 9.6 15.6 3.73 4.8 -2.8 2011-12 6.2 30.8 2.9 8.9 7.3 7.12 5.7 -4.2 2012-13 5 (6.1 to 6.7) 0.7 (Apr-Dec) 7.6 (Apr-Dec) 9.36 (Apr-Nov) 8.07 (Apr-Nov) 5.1 (4.8) -4.6 (Apr-Jan)

* The share of financial savings has been coming down as against physical savings. Reasons are low GDP growth, high inflation leading to falling real income, low returns from stock mkt., higher volatility in stock mkt. ** High CAD is due to rising cost of oil import (due to rupee depreciation); rising gold and coal imports; and falling domestic savings leading to increased financing of domestic investment via external borrowing. Source: Economic Survey (2012-13) & Instructor's own calculations

Approach Prescribed in Economic Survey (2012-13)

Problem Low economic growth Solutions Shift national spending from consumption (read high fiscal deficit) to investment. [Note: Consumption-led growth was pursued during global meltdown in 2008-09] Remove the bottlenecks to investment, especially infrastructure (like inter-ministerial tangles of clearances and procedural norms) Make efforts to reduce the cost of funds Removal of restrictions on FDI in legal and accountancy services and transport sector Labour mkt. reforms Introduce inflation-indexed bonds and other attractive financial saving opportunities Attract savings towards productive assets such as infrastructure and equity mkts.

Falling savings rate

Problem High Inflation

High fiscal deficit

Current account deficit

Solutions Remove supply side bottlenecks [Significant part of inflation getting generated becoz. of poor supply responses] Control demand via tight monetary policy Disfavor higher tax rates for the rich/increase in marginal tax rates. Higher tax rates encourage tax evasion & discourage taxable activities Widen the tax base Cut subsidies on petroleum products and fertilizers Better targeting and reduced leakages in subsidy delivery

Address delays in obtaining environmental clearances, land acquisitions and rehabilitation for increasing domestic coal output thereby reducing coal imports. Control gold imports Increase domestic savings leading to falling external borrowing.

Budget at a Glance (in Rs. Crore)

S. No. 1 2. 3. 4 Components Revenue Receipts Tax Revenue (net to centre) Non-Tax Revenue Capital Receipts 4A. Recoveries of Loans 4B. Other Receipts 4C. Borrowings and Other liabilities Total Receipts (1+4) Non-Plan Expenditure 6A. On Revenue Account 6B. On Capital Account Plan Expenditure 7A. On Revenue Account 7B. On Capital Account Total Expenditure (6+7) Revenue Expenditure (6A + 7A) Capital Expenditure (6B + 7B) Revenue Deficit (9-1) Fiscal Deficit {8-(1+4A+4B)} 2011-2012 (A) 751437 629765 121672 552928 18850 18088 515990 1304365 891990 812049 79941 412375 333737 78639 1304365 1145785 158580 394348 515990 2012-2013 (RE) 871828 742115 129713 558998 14073 24000 520925 1430825 1001638 919699 81939 429187 343373 85814 1430825 1263072 167753 391245 520925 204251 266970 2013-2014 (BE) 1056331 884078 172252 608967 10654 55814 542499 1665297 1109975 992908 117067 555322 443260 112062 1665297 1436169 229129 379838 542499 171814 205182

5 6

8 9 10 11 12 13

Primary Deficit (12-Interest Payments) 242840 Effective Revenue Deficit (11-Grants for 14 creation of capital assets) 261766 Note: A- Actuals; RE - Revised Estimates; BE - Budget Estimates

Budget at a Glance (% Change over previous year) S. No. Components 2012-2013 (RE) 1 Revenue Receipts 16.02 2. Tax Revenue (net to centre) 17.84 3. Non-Tax Revenue 6.61 4 Capital Receipts 1.10 4A. Recoveries of Loans -25.34 4B. Other Receipts 32.68 4C. Borrowings and Other liabilities 0.96 5 Total Receipts (1+4) 9.70 6 Non-Plan Expenditure 12.29 6A. On Revenue Account 13.26 6B. On Capital Account 2.50 7 Plan Expenditure 4.08 7A. On Revenue Account 2.89 7B. On Capital Account 9.12 8 Total Expenditure (6+7) 9.70 9 Revenue Expenditure (6A + 7A) 10.24 10 Capital Expenditure (6B + 7B) 5.78 11 Revenue Deficit (9-1) -0.79 12 Fiscal Deficit {8-(1+4A+4B)} 0.96 13 Primary Deficit (12-Interest Payments) -15.89 Effective Revenue Deficit (11-Grants for creation of 14 capital assets) 1.99

2013-2014 (BE) 21.16 19.13 32.79 8.94 -24.29 132.56 4.14 16.39 10.82 7.96 42.87 29.39 29.09 30.59 16.39 13.70 36.59 -2.92 4.14 -15.88 -23.14

Budget Proposals - Agriculture

Rs 7 lakh crore target fixed for agri. credit for 2013-14 compared to Rs 5.75 lakh crore in the current year. Eastern states (consisting of Bihar, Jharkand, Odisha and West Bengal) get Rs 1,000 crore allocation for improving agricultural production. Rs 500 crore allocated for programme on crop diversification Rs. 5,000 crore for NABARD for agri storage facilities Godowns to be constructed with help of panchayats Proposal for setting up of a National Livestock Mission with a funding of Rs. 307 crore. The Mission will pay attention to animal nutrition by increasing the availability of feed and fodder.

Rs.200 crore for conversion of innovation into practical use.

An institute for agricultural biotechnology will be set up in Ranchi, Jharkhand

Funds for a National Institute of Biotic Stress Management at Raipur

Budget Proposals - Industry

Tax

No change in peak custom, excise rates 5-10% surcharge on domestic companies whose taxable income exceeds Rs 10 crore Commodities transaction tax levied on non-agriculture commodities futures contracts at 0.1% GAAR norms to be introduced from April 1, 2016

Expenditure

Significant increase in the allocation for JNNURM (Rs 14,873 crore in 2013 14 against Rs 7,880 crore in the current fiscal) New ports in West Bengal and Andhra Pradesh Package of measures for textile industry

Rs. 14,000 crore will be provided to public sector banks for capital infusion in 2013-14

SIDBIs refinancing facility to MSMEs to be doubled to Rs 10,000 crore IIFC, in partnership with ADB will help infrastructure companies to access bond market to tap long term funds.

Nearly Rs. 56,000 Cr. is targeted to be mobilized through disinvestment

Budget Proposals Industry (Expenditure contd.)

Benefits or preferences enjoyed by MSME to continue up to three years after they grow out of this category Two new industrial corridor projects [Bangalore-Chennai and Bangalore-Mumbai]. Seven new smart cities will be set up Regulator to give boost to road projects

Standing Council of Experts in Ministry of Finance to examine transaction cost of doing business in India

Incubators set up by companies in academic institutions will qualify for Corporate Social Responsibility (CSR) activities

Budget Proposals - Common People (incl. tax payers)

Tax

No review of income tax slabs. Only tax credit of Rs. 2,000 for income upto Rs. 5 lakh. A surcharge of 10% for taxable incomes above Rs. 1 crore. Service tax restaurants on all A/C

Expenditure

Direct Benefit Transfer Scheme to be rolled out throughout the country during the term of UPA govt. Rs 10,000 crore to the expected cost of the National Food Security Bill/Act Rs. 1000 crore corpus fund to ensure safety of women in public places Grant of Rs. 100 crore each for some universities (AMU, BHU, TISS) and more budgetary allocation for Space, Energy and Technology.

More taxes and duties on SUVs, imported cars, mobile phones, cigarettes

Duty-free limits for passengers to bring jewellery raised to Rs 50000 for men and Rs 1 lakh for women

Budget Proposals Common People (Expenditure contd.)

17% increase in allocation for HRD Ministry. The Ministry will get Rs. 65,867 crore 24.3 % hike in expenditure for health care both rural and urban health mission All flagship programmes adequately funded. PSBs have promised more ATMs in their branch areas by 2014 Insurance companies can now open branches in Tier 2 cities and below without prior approval All towns of India with a population of 10000 or more will have an LIC branch and one other public sector insurance company.

Budget Proposals Common People (Expenditure contd.) First-time buyers of affordable homes will get an additional deduction of interest of Rs. 1 lakh for home loans up to Rs. 25 lakh

Proposal to establish exclusive women bank

Rs 532 crore to make post offices part of core banking

Medical colleges in six more AIIMSlike institutions to start functioning this year; Rs 1650 crore allocated for the purpose.

Budget Proposals Others

Proposal to launch Inflation Indexed Bonds or Inflation Indexed National Security Certificates to protect savings from inflation

TDS of 1% on the transaction/sale of all immovable properties except agricultural land, which exceeds Rs. 50 lakh in value

Question to guide Budget Discussion

Can Union Budget 2013-14 resolve the present challenges low growth & savings, high fiscal deficit, high inflation, high current account deficit, low investor confidence facing Indian economy?

Discussion Groups Section C

Government Roll Nos. FPM 10-Q & 12-S, 165, 125, 174, 130, 148, 152 Opposition Roll Nos. FPM 11-S, 164, 171, 128, 121, 155, 141 Industry Roll Nos. 139,170,169,161,179,173,145,142, 157

Farmers Roll Nos. FPM 9-Q, 172, 129, 147, 154

Common people Roll Nos. 127, 133, 131, 168, 167, 160, 159, 124, 149, 151, 150, 162

Discussion Groups Section E Government Roll Nos. 274, 278, 296, 295, 290 Opposition Roll Nos. 248, 255, 246, 273, 257

Industry Roll Nos. 285, 297, 241, 263, 264

Farmers Roll Nos. 266, 281, 265, 280, 260

Common people Roll Nos. 250, 340, 242, 267, 271, 269, 289

Discussion Groups Section F

Government Roll Nos. 334, 310, 308, 306, 349, 344, 335, 350, 299, 323, 324, 314

Opposition Roll Nos. 317, 316, 315, 307, 346, 347, 352, 325, 326, 329, 331

Industry Roll Nos. 343, 301, 300, 302, 305, 332 Farmers Roll Nos. 309, 349, 348, 337, 338, 342, 322

Common people Roll Nos. 318, 339, 354, 298, 303, 320, 327, 328

You might also like

- Union Budget 2010-2011: Presented byDocument44 pagesUnion Budget 2010-2011: Presented bynishantmeNo ratings yet

- Grant Thornton Analaysis-Budget 2013-14Document39 pagesGrant Thornton Analaysis-Budget 2013-14Kazmi Uzair SultanNo ratings yet

- Union Budget 2010-2011: Symphony of Fiscal Consolidation and Continued GrowthDocument7 pagesUnion Budget 2010-2011: Symphony of Fiscal Consolidation and Continued GrowthChand AnsariNo ratings yet

- Crux 3.0 - 01Document12 pagesCrux 3.0 - 01Neeraj GargNo ratings yet

- LA Presentation FinalDocument29 pagesLA Presentation FinalMadhu Mohan BhukyaNo ratings yet

- Interim Budget 2014 15Document12 pagesInterim Budget 2014 15Pratik KitlekarNo ratings yet

- Presented By: Komal Maurya Neeraj Singh Galgotias Business SchoolDocument35 pagesPresented By: Komal Maurya Neeraj Singh Galgotias Business SchoolNishant RaghuwanshiNo ratings yet

- Union Budget 2013-14: Key Takeout's From The BudgetDocument4 pagesUnion Budget 2013-14: Key Takeout's From The BudgetFeedback Business Consulting Services Pvt. Ltd.No ratings yet

- Budget Presentation FY17Document39 pagesBudget Presentation FY17gautamNo ratings yet

- Krishna Swaroop Ayush Srivastava Sheeba Singh Nikhil Suyesh Arya Vikram SrivastavaDocument20 pagesKrishna Swaroop Ayush Srivastava Sheeba Singh Nikhil Suyesh Arya Vikram SrivastavaSheeba Singh RanaNo ratings yet

- DPNC Budget 2014 15 HighlightsDocument40 pagesDPNC Budget 2014 15 HighlightsSandeep GuptaNo ratings yet

- Union Budget 2010Document31 pagesUnion Budget 2010gauravmangalNo ratings yet

- Budget at A Glance 2011-12Document3 pagesBudget at A Glance 2011-12Ram Pratap SinghNo ratings yet

- 4th March 2010 Finance + BudgetDocument41 pages4th March 2010 Finance + BudgetNeha GargNo ratings yet

- The Highlights of The Union Budget 2013-14 Are As FollowsDocument2 pagesThe Highlights of The Union Budget 2013-14 Are As FollowsarchenigmaNo ratings yet

- Budget 2012 Highlights SummaryDocument11 pagesBudget 2012 Highlights SummaryMilan MeeraNo ratings yet

- CII's AgendaDocument31 pagesCII's AgendaPremkumarJittaNo ratings yet

- Union Budget 2012-13 Key HighlightsDocument14 pagesUnion Budget 2012-13 Key Highlightssandeep25011990No ratings yet

- Union Budget 2019-20 Key Highlights and Market ImpactDocument26 pagesUnion Budget 2019-20 Key Highlights and Market ImpactSunil SaharanNo ratings yet

- Union Budget 2019 - 2020Document26 pagesUnion Budget 2019 - 2020Sunil SaharanNo ratings yet

- Highlights of Union Budget 2019-20Document26 pagesHighlights of Union Budget 2019-20Sunil SaharanNo ratings yet

- Financial Digest Apr11Document56 pagesFinancial Digest Apr11Nandha KumarNo ratings yet

- Union Budget 2010-11 HighlightsDocument5 pagesUnion Budget 2010-11 HighlightsbinucharlesNo ratings yet

- Economicsurvey2009 10budget2010 11 100331100850 Phpapp02Document47 pagesEconomicsurvey2009 10budget2010 11 100331100850 Phpapp02sudiptasaha2KNo ratings yet

- Union Budget: Pragmatic Prudent Populist : Banking & FinancialsDocument6 pagesUnion Budget: Pragmatic Prudent Populist : Banking & FinancialsVikrant MalhotraNo ratings yet

- Budget 2010-2011Document20 pagesBudget 2010-2011Simi SolunkeNo ratings yet

- Group Members:-Jejoy Fernandes Sachin Lohar Siddhesh Mali Siddhesh Shinde Vishesh Rane Amol Jadhav Shekar HandeDocument26 pagesGroup Members:-Jejoy Fernandes Sachin Lohar Siddhesh Mali Siddhesh Shinde Vishesh Rane Amol Jadhav Shekar HandeVishesh V. RaneNo ratings yet

- Background: Infrastructure DevelopmentDocument5 pagesBackground: Infrastructure DevelopmentvishwanathNo ratings yet

- Budget 1Document30 pagesBudget 1Karishma SarodeNo ratings yet

- Budget 2013 PDFDocument6 pagesBudget 2013 PDFNitin NamdeoNo ratings yet

- Budget 2012 13 HighlightsDocument66 pagesBudget 2012 13 HighlightsvickyvikashsinhaNo ratings yet

- Budget 2010-11: by Karan Singh, MBA (General) Section - ADocument32 pagesBudget 2010-11: by Karan Singh, MBA (General) Section - AscherrercuteNo ratings yet

- Weekly News Updates and Special TopicsDocument25 pagesWeekly News Updates and Special TopicsPhysics UniverseNo ratings yet

- Policy Governing MSMEDocument16 pagesPolicy Governing MSMEarupkumaradhikaryNo ratings yet

- Background: GDP Wholesale Price Index Fiscal DeficitDocument5 pagesBackground: GDP Wholesale Price Index Fiscal Deficitdhimant_123No ratings yet

- Economic Survey & Union Budget 2017-18 - Imp Question and AnswersDocument25 pagesEconomic Survey & Union Budget 2017-18 - Imp Question and AnswersArti GroverNo ratings yet

- Mou System: SPS Solanki AGM (CP)Document82 pagesMou System: SPS Solanki AGM (CP)SamNo ratings yet

- Analysis On Union Budget 2011Document7 pagesAnalysis On Union Budget 2011Dnyaneshwar BhadaneNo ratings yet

- Union Budget 2013 14 FinalDocument32 pagesUnion Budget 2013 14 FinalAdarsh KambojNo ratings yet

- Sop-G 8 PresentsDocument24 pagesSop-G 8 PresentsHimesh V NairNo ratings yet

- Balancing Fiscal Consolidation With Growth: Uncertainty Over GAARDocument42 pagesBalancing Fiscal Consolidation With Growth: Uncertainty Over GAARChinmay ShirsatNo ratings yet

- Highlights Union Budget 2012Document4 pagesHighlights Union Budget 2012Debanjan DebNo ratings yet

- Key Features of Budget 2010-2011: Higher Standards............ Making A Difference For YouDocument20 pagesKey Features of Budget 2010-2011: Higher Standards............ Making A Difference For YousheetalmoreyNo ratings yet

- UnionBudget2015 16Document27 pagesUnionBudget2015 16Subhajit SarkarNo ratings yet

- Budget AuroDocument38 pagesBudget AuroSrihari PatelNo ratings yet

- The Following Are Some of The Key Highlights On Union Budget 2010-2011Document2 pagesThe Following Are Some of The Key Highlights On Union Budget 2010-2011ajithtv3No ratings yet

- Budget 2011Document4 pagesBudget 2011viv_nitjNo ratings yet

- India Union Budget Fy14Document33 pagesIndia Union Budget Fy14Akshay VetalNo ratings yet

- Union Budget 2011: Presented by Vidhi Sharma Jimit Pathak Richa SharmaDocument31 pagesUnion Budget 2011: Presented by Vidhi Sharma Jimit Pathak Richa Sharmarajchaurasia143No ratings yet

- Highlights Union Budget 2012Document4 pagesHighlights Union Budget 2012Satish JapadiyaNo ratings yet

- Presentation On Economic Survey Final 2014-15 FinalDocument87 pagesPresentation On Economic Survey Final 2014-15 FinaltrvthecoolguyNo ratings yet

- India Union Budget 2013 PWC Analysis BookletDocument40 pagesIndia Union Budget 2013 PWC Analysis BookletsuchjazzNo ratings yet

- Budget Analysis 2010-2011 Highlights Key Changes for Taxpayers, Businesses & EconomyDocument52 pagesBudget Analysis 2010-2011 Highlights Key Changes for Taxpayers, Businesses & EconomySahil ShahaNo ratings yet

- Finance Minister Pranab Mukherjee On Friday Presented The Union Budget 2012-13 in Lok SabhaDocument3 pagesFinance Minister Pranab Mukherjee On Friday Presented The Union Budget 2012-13 in Lok Sabhajuhi201023No ratings yet

- Indian Economy and Trends January 2013Document29 pagesIndian Economy and Trends January 2013Anand PrasadNo ratings yet

- UNION BUDGET 2013-14 KEY HIGHLIGHTSDocument34 pagesUNION BUDGET 2013-14 KEY HIGHLIGHTSSantosh SinghNo ratings yet

- Union Budget 2012-13 Review: Ansaf PMDocument21 pagesUnion Budget 2012-13 Review: Ansaf PMAnsaf MohdNo ratings yet

- Budget 2010-11Document23 pagesBudget 2010-11RochelleIshanNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- RM1Document20 pagesRM1Ashima AggarwalNo ratings yet

- Module 5 - Forecasting Demand ComponentsDocument13 pagesModule 5 - Forecasting Demand ComponentsAshima AggarwalNo ratings yet

- Entrepreneurship and New Ventures Case Analysis: C K RanganathanDocument2 pagesEntrepreneurship and New Ventures Case Analysis: C K RanganathanAshima AggarwalNo ratings yet

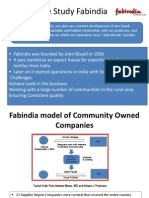

- Case Study FabindiaDocument4 pagesCase Study FabindiaAshima AggarwalNo ratings yet

- Forecasting: © 2007 Pearson EducationDocument27 pagesForecasting: © 2007 Pearson EducationAshima AggarwalNo ratings yet

- CB QuestionnaireDocument2 pagesCB QuestionnaireAshima AggarwalNo ratings yet

- BalancedscorecardDocument1 pageBalancedscorecardRoHan ChaudryNo ratings yet

- Table of Content - Indian Hotel Industry-November 11Document8 pagesTable of Content - Indian Hotel Industry-November 11Ashima AggarwalNo ratings yet

- Hospitality Insights From The Indian Ceo DeskDocument28 pagesHospitality Insights From The Indian Ceo DeskShivani PandeyNo ratings yet

- Commercializing Kunst 1600-NoteDocument5 pagesCommercializing Kunst 1600-Noteprakhar singh100% (2)

- BHEL Project On RecruitmentDocument130 pagesBHEL Project On Recruitmentumanggg100% (7)

- TimelineDocument1 pageTimelineAshima AggarwalNo ratings yet

- Commercializing Kunst 1600-NoteDocument5 pagesCommercializing Kunst 1600-Noteprakhar singh100% (2)

- Starbucks-Delivering Customer ServiceDocument5 pagesStarbucks-Delivering Customer Serviceldavis722No ratings yet

- FactoringDocument6 pagesFactoringNitin SinghalNo ratings yet

- LearningDocument2 pagesLearningAshima AggarwalNo ratings yet

- FactoringDocument6 pagesFactoringNitin SinghalNo ratings yet

- Byod 111220173907 Phpapp02Document27 pagesByod 111220173907 Phpapp02Ashima AggarwalNo ratings yet

- Case - Preparation Questions 2013Document3 pagesCase - Preparation Questions 2013Ashima AggarwalNo ratings yet

- 234a 06 06RealOptionsDocument19 pages234a 06 06RealOptionsAshima AggarwalNo ratings yet

- OM II - Class 6Document21 pagesOM II - Class 6Ashima AggarwalNo ratings yet

- Indian EconomyDocument5 pagesIndian EconomyAshima AggarwalNo ratings yet

- MM Case StudyDocument15 pagesMM Case StudyAshima AggarwalNo ratings yet

- Handoff StrategiesDocument35 pagesHandoff StrategiesAshima Aggarwal0% (2)

- 9772 Economics Pre-U Final SyllabusDocument26 pages9772 Economics Pre-U Final SyllabusDavidOSARaphaelReeceNo ratings yet

- Maldives - Country Assistance Program EvaluationDocument123 pagesMaldives - Country Assistance Program EvaluationIndependent Evaluation at Asian Development BankNo ratings yet

- Empowering Indonesia Report 2023pdfDocument67 pagesEmpowering Indonesia Report 2023pdfAndre YPNo ratings yet

- STS NEW Module 3 Human FlourishingDocument23 pagesSTS NEW Module 3 Human FlourishingJetro PelobelloNo ratings yet

- Chapter 11Document10 pagesChapter 11I change my name For no reasonNo ratings yet

- Ministry of Public Infrastructure & Land Transport (PI Division)Document64 pagesMinistry of Public Infrastructure & Land Transport (PI Division)Bhavish RamroopNo ratings yet

- Materials Management 2Document7 pagesMaterials Management 2Thapaa LilaNo ratings yet

- Lupon National Comprehensive High School 2nd Summative Organization and Management TestDocument4 pagesLupon National Comprehensive High School 2nd Summative Organization and Management TestDo FernanNo ratings yet

- Devcom 202Document209 pagesDevcom 202Den Santiago100% (2)

- RAM 2019 PressMetal Rationale (Final)Document26 pagesRAM 2019 PressMetal Rationale (Final)Joshua LimNo ratings yet

- 4 - Macroeconomics Board Exam Syllabus Part 1 Final PDFDocument53 pages4 - Macroeconomics Board Exam Syllabus Part 1 Final PDFastra_per_asperaNo ratings yet

- Unlocking Cities: The Impact of Ridesharing Across IndiaDocument44 pagesUnlocking Cities: The Impact of Ridesharing Across IndiaLearning EngineerNo ratings yet

- EY Library Mining Metals Investment Guide 2019 2020 PDFDocument92 pagesEY Library Mining Metals Investment Guide 2019 2020 PDFCesar PeiranoNo ratings yet

- A Territorial Approach To The SDGs in Viken, NorwayDocument83 pagesA Territorial Approach To The SDGs in Viken, NorwayAna NichitusNo ratings yet

- IB Economics SL Paper 1 Question Bank - TYCHRDocument25 pagesIB Economics SL Paper 1 Question Bank - TYCHRansirwayneNo ratings yet

- CFA Institute Research Challenge: Whirlpool of India LimitedDocument54 pagesCFA Institute Research Challenge: Whirlpool of India LimitedShashaNo ratings yet

- Ubs GlobalDocument24 pagesUbs GlobalJoOANANo ratings yet

- 2019 Zambia Insurance Industry ReportDocument40 pages2019 Zambia Insurance Industry ReportWakari MastaNo ratings yet

- Enotesofm Com2convertedpdfnotesinternationalbusiness 100330064505 Phpapp01Document291 pagesEnotesofm Com2convertedpdfnotesinternationalbusiness 100330064505 Phpapp01Hari GovindNo ratings yet

- Asahi Group - 2014 Annual ReportDocument64 pagesAsahi Group - 2014 Annual Reportvic2clarionNo ratings yet

- Ap-50-97 Road in The Community Part 2 Towards Better Practice PDFDocument378 pagesAp-50-97 Road in The Community Part 2 Towards Better Practice PDFuntung CahyadiNo ratings yet

- Hodge, D. Woodley & Thomas EssayDocument5 pagesHodge, D. Woodley & Thomas EssayJamal HodgeNo ratings yet

- Investec Global Aircraft Fund Information MemorandumDocument88 pagesInvestec Global Aircraft Fund Information MemorandumTamil Books100% (1)

- Urbanisation and Urban Transport Scenario in IndiaDocument55 pagesUrbanisation and Urban Transport Scenario in IndiaDhrubajyoti DattaNo ratings yet

- Business English ReaderDocument90 pagesBusiness English ReaderFaridaKuttykhodjaevaNo ratings yet

- Dairy Sept 09 ReportDocument140 pagesDairy Sept 09 Reportranisushma1986No ratings yet

- Business Plan To Establish Construction Machinery in EthiopiaDocument26 pagesBusiness Plan To Establish Construction Machinery in EthiopiaSamwoven100% (2)

- Ameresco - Final ReportDocument15 pagesAmeresco - Final ReportRobert FellingerNo ratings yet

- Agrani BankDocument28 pagesAgrani BankSh1r1nNo ratings yet

- Review of LiteratureDocument36 pagesReview of Literaturesanosh mohanNo ratings yet